Maybe I wasn’t issued a formal challenge last Wednesday, but perhaps I saw the opportunity to give myself one, and rise to the occasion!

Either that, or my O.C.D. was in over-drive this weekend, and I wanted to spend hours pouring over statistics.

For those of you that don’t think enough “tough questions” are being asked, and answered, about the 2018 real estate market thus far, let’s change all that this morning…

If you’re a regular reader of Toronto Realty Blog, and a regular reader of the comments, you’ll probably recognize the usual cast of characters.

Over the last eleven years, I’ve seen a lot of reader/commenters come and go, and demonstrate different levels of activity.

I’m sure you all have as well.

As much as I’d like to give a shout-out to the top handful of active commenters right now, I’m more afraid of missing somebody – and hurting somebody’s feelings! Oh, how 2018 of me…

So instead, let me simply make mention of the comment from last Wednesday that I want to address.

Long-time, and very regular reader, Ralph Cramdown, posted something that caught my eye:

Nobody’s talking about the ongoing fallout from last spring.

At first, I made nothing of it. But the more I thought about it, the more I wondered how much I had talked about last spring on TRB, or at least compared this year to last year.

Or even worse – that perhaps by not writing about it enough would make me guilty of cheerleading, or being biased, or pulling the old “nothing to see here, folks” as many other agents have done.

I went back and read through the 35-40 posts so far this year, and realized that while we’ve discussed this year compared to last year, or how crazy last year was, etc., we haven’t really dedicated a specific post to asking the “tough questions,” as a colleague of mine put it last week.

So I tried to put myself in the shoes of an onlooker, and ask the questions they would ask, if they knew they wouldn’t get political rhetoric from somebody trying to put an eternally-positive spin on things.

This is what I came up with:

1) Where are we in the market?

2) What is the media saying about the market?

3) What do the numbers say?

4) What do the numbers not say?

5) Has there been any “fallout” from the new mortgage regulations?

6) What would happen if interest rates increased again?

I’m sure we could do this all day, but off the top of my head, and generally and broadly speaking, I have to think those are the topics, and questions, most folks would ask.

So let’s answer them one-by-one…

1) Where are we in the market?

This is a very broad question, but as I said – if you wanted these questions answered honestly, then you can be broad, and expect the response to cover all the angles.

Where are we in the market then? In terms of price, activity, comparisons to last year (or next year), and geographic differences?

The “spring” market is essentially six months long, from January through June. It’s usually divided in half by the slower second-half of March, during which we see various Spring Breaks (public school, private school, specialty school), followed by Easter & Passover. Once we get over that hurdle, the market continues right through to the end of June, only slowing around Victoria Day long weekend.

So with the first three months of the year in the rear-view window, we’re about to see activity pick up substantially, as new listings always increase in April, May, and June.

But “where are we in the market,” broadly asked, really depends on exactly where you’re looking.

The story so far in 2018 has been the massive discrepancies in pricing and activity between the 416 and the 905. And that will be a big theme as I move through the next five points.

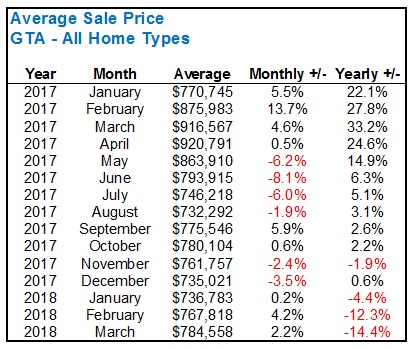

With the March TREB numbers now released, let’s get the big shiny number out there: 14.3%.

That’s how much the average home price has dropped, year-over-year. That’s the GTA-wide price, 416 and 905 together, all home types.

The other big number: 39.5%

That’s how much sales have declined, year-over-year, in the month of March.

Say what you want about the market, certain pockets, price points, or property types, but there’s no denying that very broadly speaking, we can say, “The market is down.”

–

2) What is the media saying about the market?

This is important, whether you see it or not.

Every client I’ve ever had, buyer or seller, 2004 or 2018, has asked me about a particular headline, newspaper column, or media sentiment.

We might not realize how affected we are by what we see. Even scrolling past stories you don’t read on your Facebook feed, you’re still seeing the headlines, subconscious or conscious.

Now I have a theory that I’d like to share, and tell me if you agree.

People in 2018 don’t really read anymore. They swipe. They like. They comment.

In order to sell newspapers, or at least online subscriptions, headlines have to be more catchy, and thus often have to be more negative, exaggerated, or exacerbated.

And that’s why we’re constantly seeing the media use the worst statistic they can find with respect to the Toronto real estate market, which last month was the 39.5% decline in March sales, year-over-year.

A headline reading, “Toronto market down almost 40%” is catchy! But it’s just a headline, and how many people actually click on the story, and read further? Maybe…..5% of all the people who see it?

“The market” isn’t down 40%. Sales in the GTA are.

And while I don’t blame any media outlet for the headlines they write, since I’d probably do the same thing in their position, I think the mantra “if it bleeds, it leads” is important to keep in mind when using headlines to measure the market.

When the TREB numbers came out last week, the headlines looked like this:

“Toronto Home Prices See Biggest Drop In Almost 30 Years”

“Real Estate Sales And Prices Tumble In March”

Of course, there are positive headlines too, just to show both sides of the coin:

“Toronto Real Estate Market May Be Poised For A Spring Rebound”

“Toronto Home Prices Rise For A Third Straight Month, Showing Signs Of Rebound”

As for that latter headline, I’ll show you why that’s important as we move forward.

–

3) What do the numbers say?

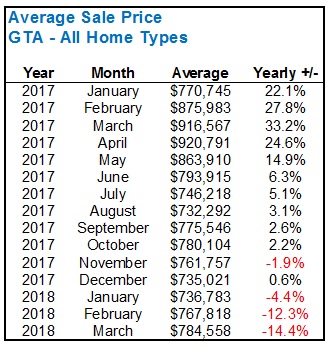

The most commonly-used statistic is the “Toronto Average Sale Price,” so let’s take a look at that:

Wow! Look at the red ink!

14.4% and, yes, I’m off by 0.1%, but the TREB numbers change historically all the time, so my 2017 numbers aren’t in line with the 2018 numbers. March was off by a grand. I wonder why that is?

Anyways…

14.4% or 14.3%, it’s still a big number.

Does that mean that every buyer who purchased a home in March of 2017 has lost 14.4% of the value of his or her home?

No, of course not. But that won’t stop headlines, and that won’t stop the perennialrenter who works in the cubicle next to you from constantly berating you for buying a house last year.

But what if we look at all property types? What else do the numbers say?

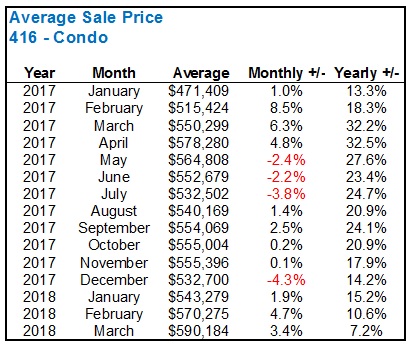

Interestingly enough, the most strength in the market is found in the condominium sector, specifically in the 416:

Already this year, the average condo price is up 8.6%, on paper, at least.

And this is the only segment of the market where the March, 2018 price is higher than the March, 2017 price.

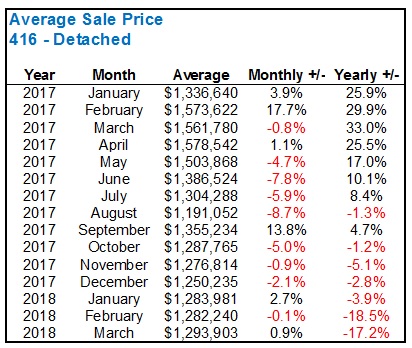

As for the freehold market, here’s how Semi-Detached and Detached in the 416 look:

The average semi-detached home in Toronto is only down 5.3%, on average, year-over year. That’s dramatically lower than the 14.4% Toronto average.

But the detached numbers are huge!

A 17.2% decline, and that’s 416, – not GTA. So if you’re looking for me to make the argument, “Don’t worry, almost all of the decline took place in the 905,” I’m not going to.

I would argue, anecdotally, that a $2,000,000 house purchased in, say, North Toronto, back in April of 2017, is not worth $1,656,000 today. Not even close. I won’t have that argument.

But I will accept, again – anecdotally, that a $2,000,000 detached home purchased in April of 2017 in, again, North York, is not worth $2,000,000 today.

–

4) What do the numbers NOT say?

That question is an invitation to “make numbers say anything you want,” but I think it runs deeper than that.

There are a lot of numbers that TREB doesn’t publish, and it bothers me. They divide the 416 and the 905, but then they do so with Semi, Row, and Detached – but not simply “freehold.”

Then if we wanted to look at a smaller geographic area, there’s simply not enough volume to take an average, and compare it to last year.

There have only been 28 sales in all of C11 so far this year! That’s nine per month, including all of semi-detached, rowhouse, detached; high-end, low-end, and in between. How can you draw any conclusions about what a $1,000,000 or a $3,000,000 house are worth today, compared to this time last year, when you have no volume of sales?

So here’s what I did – I got creative.

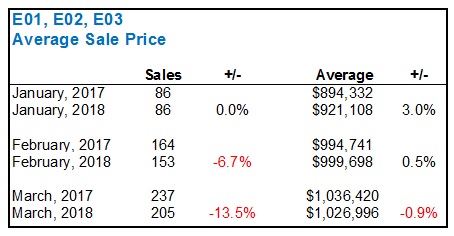

I looked at the east side, since that’s where most of the action was last year, and most of the action has been this year, and I combined all the sales for January, February, and March, in E01, E02, and E03.

I used a weighted average for Rowhouse sales, Semi-Detached sales, and Detached sales, since, again, TREB doesn’t give us the numbers we want.

Sales are down so far this year – 6.7% in February and 13.5% in March. Not quite in line with the 39.5% decline we’ve seen on average in the GTA, but important to note regardless.

The price is where things get interesting, and let me go off on a tangent here for a moment.

When I price a home for a prospective seller, I use my “gut” feeling first. I write that number down, and then I complete a Comparative Market Analysis. While the “gut” feeling is 100% subjective, a CMA has a lot of subjectivity as well, as you make adjustments for things like a bedroom, bathroom, garage, finished basement, etc.

So far in 2018, my “gut” feeling for just about every single home I’ve toured has been higher than what the CMA says.

When discussing a west-side home with buyers last week, I surmised that perhaps the home in April of 2017 would have cost 1-4% less. That’s not in line with the 14.4% GTA average decline; not even close. But again, the “gut” plays a factor, as does the location.

So back to the E01, E02, E03 numbers now, specifically the price.

It’s interesting to note that while the average home price in the GTA has lost 14.4%, the east-side has only lost 0.9%.

This is a small sample size – only 200-some-odd homes. But is it fair to say that maybe adding 2% to each side – and saying home prices are somewhere between -3% and +3% from last year?

I think that’s quite reasonable.

So in my “what do the numbers not say” answer, I’d say that geography is playing the biggest factor so far in the 2018 market.

As you’ve heard, most of the weakness in the market has been in Durham, York, Halton, and Peel.

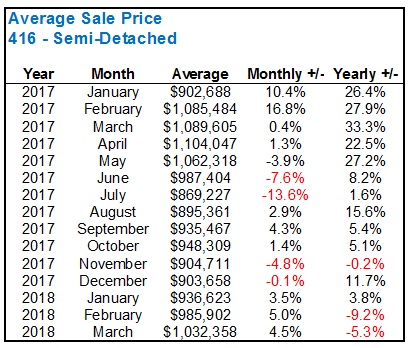

One last statistic to provide you with – the monthly increase/decrease in average home price. I specifically left it out of the chart in Point #3 because the market bears and the media aren’t using it, even though it’s important in the short-term context of the market:

To be fair, in the “where are we in the market” conversation, as well as “what do the numbers not say,” you have to look at the monthly numbers.

So far this year, we’ve seen monthly increases in average home price in January, February, and March. And while you’re always going to see a monthly increase in January, since December is such a slow month, there are a lot of folks who predicted the “fallout” from the B20 regulations would crash the market in January, and that didn’t happen.

–

5) Has there been any “fallout” from the new mortgage regulations?

Unfortunately, I don’t have any statistics for this point, so I’ll have to use anecdotal evidence once again.

I did a couple of interviews – one in the fall before December 31st asking, “Do you have any clients looking to hurry-up and buy,” and one in the spring asking, “Have any of your clients been forced to the sidelines because of the new B20 rules,” an both times, my answer was no.

But in the past month, I’ve had three clients all tell me they were impacted in one way or another.

One buyer-couple was pre-approved for $1.2M before December 31st, and they were capped at $1.1M in our search. They ended up buying for just over their $1.1M number, dipping into some savings they didn’t want to use in order to get the house they really wanted.

Another couple who started their search last fall have yet to purchase, and while I don’t know their specific numbers, they’ve told me that their purchasing power is weaker than during our search last year.

And one would-be condo buyer told me in an email, “I’m F*****,” in reference to his ability to purchase, or should I say, inability, since he no longer qualifies for an amount that would allow even the purchase of a bachelor in Liberty Village.

I think it’s fair to say that people are affected by the new lending rules, but I would offer that the impact hasn’t been felt nearly as much as some figured it would. I will tell you who has not been affected at all, and that’s overseas buyers who purchase in cash. Gee, I wonder why the government decided to punish hard-working Canadians, and yet they continue to allow offshore money to flow freely. Ralph?

–

6) What would happen if interest rates increased again?

My first mortgage rate was a 5-year fixed at 4.99%.

We’re still quite a ways away from those days returning.

But if rates were to go up again, twice, 25-basis-points each time, I think the lower-end of the market would cool.

And you know what? That’s probably a good thing, since the lower-end of the market is the hottest part of the market in 2018 thus far.

$1,000 per square foot is the new normal for downtown condos, and it shows no signs of stopping.

If interest rates increased substantially, both the investors purchasing $500,000, 1-bedroom condos to rent out, and the first-time, entry-level buyers who just qualify to purchase, could see their affordability, and desirability, weakened substantially.

And another part of the market that would suffer, one which is seldom talked-about, would be the multi-unit sector.

Cap rates have continued to decrease throughout the central core, from a 5% standard years ago, to as low as 3%. Cap rates, of course, are calculated based on the sale price of the property, so it goes without saying that buyer demand has a hand in setting prevailing cap rates.

But when interest rates increase, accepting a 3% cap rate becomes less desirable. And as rates increase, so too should cap rates, meaning property values decrease accordingly.

I’ve seen some exceptional 4-unit properties sit on the market this year for far longer than they should, or at least would have last year, and I have to think it’s due to increased rates.

–

So there you have it folks.

A few questions that are being asked in real estate circles, and my best attempt to answer them in an unbiased fashion.

I try my best to read the comments every day, but often don’t get to a lot of the questions.

This time around, if you have questions – please ask. If they’re statistical in nature, I’ll do my best to set aside some time to get to them.

Happy Monday!

Pkap007

at 6:23 am

Good analysis David one question though any idea what’s driving the cooling in Peel/Halton region. Demographics of this region was different to say York or Durham..

Natrx

at 11:29 am

I’m guessing Peel/Halton was taken by more locals either really priced out or speculating as well. York region had the foreign money that was at the heart of the ‘bubble’. Durham had a mix of speculators (was cheaper) plus people actually wanting to move in given the proximity to the Lakeshore GO, Also it is a more well established and known area.

So in essence, Peel/Halton (I’m assuming northern end) was a spillover effect from the other regions since it was initially less known, less established and further away. I put it somewhat in the same bucket as Georgina as people were speculating as far as that given the spillover effect.

T

at 12:46 pm

You provide no data, just some thoughts on how it might have been. Useless.

Craijiji

at 2:41 pm

So no one is allowed to post an opinion, even when they lead with “I’m guessing…”, got it.

Even though there was “no data”, Natrx’s post brought a lot more to the tables than yours did. Useless.

T

at 3:37 pm

I disagree. Pointing out someone’s belief is incorrect is valuable. Otherwise everyone keeps repeating the same nonsense.

The best approach is always to find the data and then make inferences.

Craijiji

at 4:03 pm

“I disagree. Pointing out someone’s belief is incorrect is valuable. Otherwise everyone keeps repeating the same nonsense.

The best approach is always to find the data and then make inferences.”

Since you didn’t provide any data to prove that the best approach is to find data and then make inferences, your post is useless.

T

at 5:21 pm

Keep arguing about someone pointing out to someone else they are incorrect. It makes you look more intelligent.

I’m sure no one reading and commenting on a real estate blog need links to debt to gdp, average household debt, average prices in areas, listings, mortgage rates, etc. We don’t need to be dreaming up scenarios.

Housing Bear

at 5:49 pm

I think you mean YOU don’t want links debt to gdp, average household debt, average prices in areas, listings, mortgage rates, etc. YOU want to keep dreaming up scenarios………….

Craijiji

at 8:01 am

T…Once again, you’ve provided no data to back up any of the points that you’re trying to make. Useless. Where’s the data that supports your claim that no one needs those things? Weak at best.

I’ll keep arguing for someone’s right to express their opinion in an open forum. You can keep trying too hard while coming across as a know-it-all clown. Seems to work well for you.

Geoff

at 12:02 pm

does T remind anyone else of Dwight from the Office?

What’s tougher, brown bears or black bears? Fact. Brown bears.

Housing Bear

at 12:39 pm

His comment would be more along the lines of, how can you say that a black bear is tougher than a brown bear? I would need to see historical evidence on multiple one on one bear throw downs…………….. Then he would offer no countering evidence to prove either point……….. I think he is trying to go for the philosophy type professor sctick……….. trying to challenge us all to be more critical……. easy there Plato!

Izzy Bedibida

at 9:02 am

Good breakdown of statistics. Mom was telling me yesterday that for the past few months one of her friends is having trouble selling her house in Northwest Toronto in order to downsize. She was expecting a bidding war, but nothing happened and/or got offers that did not reflect what she wanted/was told she could get. Same this when the house was staged and re-listed. Last open house she got some offers, but a few potential deals fell through because the buyers couldn’t get the required financing.

So something is happening, and based on a few anecdotal stories like this, this downturn is slowly getting bigger. We may be just approaching Peak House.

Sardonic Lizard

at 2:56 pm

>> “a few potential deals fell through because the buyers couldn’t get the required financing.”

So what’s she going to do now? Forget downsizing and stay in the house? Pucker up and lower her price?

I’m still seeing townhomes in Vaughan and Richmond Hill with list prices of well over $800,000 and ask myself “How long can this delusion go on for?”

EDWIN

at 11:12 am

The acceleration with which the downtown condo market has gone from $700 psf to $1000 psf is astonishing. I don’t understand how it it makes any sense from an economic fundamentals perspective.

Not Harold

at 11:44 am

1000 and even 1200 a ft for condos DT is INSANE!!! You aren’t recouping that in rent and you’re going to be strongly cash flow negative after all costs.

Take a look at Toronto Life Condo of the Week! $2.2MM for a 2500 sq ft stacked townhouse on the lake in Mimico (Lake Shore and Mimico creek, sharing an inlet with the Etobicoke Yacht Club). $1860 a month in maintenance fees!!! Unit looks great, huge terrace and is very large. Yet the building is 25 years old, you’re in a stacked townhouse, you need to get on the Gardiner to go anywhere, you’re facing a shallow bay that is liable to be fragrant in August and loud every weekend.

I simply don’t understand. A condo by the Lake in Port Credit or Oakville, sure (assuming you get a substantial suburban discount) a house in the Kingsway or backing on to St George’s or Islington Golf Club (or the fancy bits of Oakville and Sauga), absolutely. But a nearly 3 decade old condo on LakeShore beside some decidedly vintage apartment buildings???

Not Harold

at 11:23 am

This looks like typical real estate softening behaviour: volume goes down, people hold out for a higher price, slowly adjust downward.

Only in extreme and unhealthy situations do you see rapid price decreases. US 07-09 was exceptional because people HAD to sell and some banks HAD to sell. You still saw lots of banks take a long time to sell foreclosed properties because they were desperately afraid of crystallizing losses that might have threatened their stability.

I am interested in the makeup of current inventory/transactions vs last year. Could be very hard/labour intensive to get the information vs the general stats TREB has.

My thesis is that in Toronto detached that is under the new thresholds has more demand, supporting prices, while above the threshold demand is drastically reduced. So higher quality product is taken out of the market, meaning lower quality swamps the statistics in terms of mean and median price. The enthusiastic behaviour in the condo market, where far fewer transactions are affected by the new thresholds, appears to support this hypothesis.

As to the protecting local buyers.. of course the actions to cool the market were a move to protect the financial system. The banks, and the government, aren’t threatened by cash buyers overpaying. We are all threatened if large numbers of people over lever into a bubbly real estate market that is 80% financed by our Big 5 banks. Of course the marketing has to say it’s for the good of Joe Voter, but this isn’t the Toronto Star or an NDP member email list, we can be adults and discuss reality rather than myths.

Michael

at 11:54 am

There’s a lot of truth in this. Quality under 1M is becoming very difficult to find and gets over list price consistently still. The rest of it is dregs and is sitting deservedly so or getting under list. The rest of the near 1M market has decided over 1M is the new standard and a lot of people can’t meet those thresholds any longer and are forced to look under 1M.

It also explains condos going bonkers too. People have been priced out of quality detached and semi-detached homes. What is left is garbage – and for 700-800k you can get a really nice condo, so that’s what people are looking at.

Michael

at 11:51 am

You made a comment in one of your videos a few months ago and it holds true- people are still pricing their properties as though this we were in March 2017 – ridiculous terms and pricing, and very little flexibility. There is a house up the street from us that has been listed at 1.2M for months now – it is beautiful and has been done well, but the comparables in the neighborhood would have suggested a price closer to 950k. I’m not surprised it’s sitting for so long, and to be honest the seller will not see 1.2M in this market. Maybe next year…but that’s a lot of waiting.

ed

at 12:53 pm

Is it this one?

https://www.realtor.ca/Residential/Single-Family/19021857/12-YARN-RD-Toronto-Ontario-M9B1H5-Islington-City-Centre-West

Juan

at 12:32 pm

David

This is the first time I feel like I’ve seen you reference foreign buyers in the condo markets. Do you think their affect on overall prices is significant?

T

at 12:50 pm

Foreign investors in housing markets is not new, not any more prevalent now than a decade ago, and is not the core challenge to rising housing prices. That’s why David rarely mentions it, because it is not an issue.

Professional Shanker

at 1:49 pm

no historical statistics to prove your statements…your opinion is that foreign investor demand does not play a large enough role to warrant policies which reduce involvement – have you been/lived in Vancouver or Sydney?

That said I cannot say 100% Toronto has or does not have a problem.

T

at 3:35 pm

Yes, I’m in Vancouver quite often. I’m actually going to be there tomorrow.

What you are spouting is the same racist rhetoric repeated everywhere in Canada the past few years, the ‘Chinese’ are buying up everything so you better buy now before you are priced out forever. It’s a complete fallacy.

Professional Shanker

at 3:52 pm

When did it become common place that someone can challenge another person’s opinion which lacks historically statistical proof and they can infer that they are spouting racist rhetoric, sad very sad!

In no way did I say it was the driving force, but would have an impact on prices in some form. Foreign capital in a globalized world does have an impact throughout all economies, how much is up for debate and without historical data cannot be dismissed.

Does availability of domestic credit matter more amongst other factors – sure it does but you cannot dismiss other factors and for argument’s sake why would a developed world want to restrict FDI? Over the long term it would not!

Natrx

at 10:49 am

Spouting out statements without facts is akin to driving in the dark with sunglasses. Please provide facts on your statement if you will sir.

EDWIN

at 4:07 pm

He seemed to imply it was an issue in this post by mentioning that new rules hurt Canadian buyers but not foreign cash buyers.

Housing Bear

at 12:37 pm

Thank you for responding to some of the negativity. My follow up is that all of your replies above relate to micro factors and not the macro factors. On the way up, macro factors allowed all markets to go up at the same time. Low interest rates, stronger economy, growth in HELOCS, looser credit standards, large increases in household debt levels. Micro factors allowed certain areas to increase at a faster rate. Interest from foreign investors, suitability for flipping (old houses large lots), % of flippers.

On the way down it will be macro factors that pull everything down. Raising rates, weakening economy (RE agents are based on sales volume and price, RE lawyers are based on sales volume, appraisers – volume, construction – financing, ) deleveraging, and tigherter credit environment (B-20, which is only really starting to bite now because a lot of buyers had pre approvals carry over for 90 – 120 days)

On the way down, micro factors will protect certain areas more that others. These include, available listings in a given area, desirable neighborhood? (those with true wealth will eventually look for deals), % of end users vs investors.

Here is an article from movesmartly (RE mouth piece). Its about how for SFH the areas that have seen the biggest decline in price were those with the highest concentration of investors. This makes sense to me, and the areas in particular include vaughn, RH, and newmarket. What is interesting to note is not a single one of these areas had a higher concentration of investors than 22%. They also note that condos are still doing very well.

https://www.movesmartly.com/articles/gta-house-prices-falling-furthest-where-investors-once-dominated

Last week there was a report by Urbanation and CIBC (Two other RE mouth pieces/ cheerleaders). Big take away is that 44% of condos that were taken possession of in 2017 were by investors. These are condos that would have been sold presale in 2013-2014. Wasn’t the exuberance for presale higher in 2015-2017?

So to recap – For SFH areas that had more investors took the biggest hit. Not one of these areas had more than 22%. The amount of investors in the condo segment is twice that despite the fact that this number is reflective of speculation from 2013-2014.

Talk about what the numbers don’t say!

T

at 12:44 pm

You reference several new data points, but do you have any information on their historical values? This is what is needed to determine trends. Spouting a bunch of today’s data points means nothing without the full history.

Housing Bear

at 1:01 pm

For % of investors. The movesmartly article compares 2012-2016. Other than King, it looks like the percentage at least doubled for each region. I am surprised that these organizations didn’t include a graph showing us that the composition of foreign investors has been the same for a long time…… That would imply that the market is fine in my opinion….. Why wouldn’t they include this considering their well being is all tied to RE?

For the macro factors

Long term household debt to income

https://www.google.ca/search?q=canadian+household+debt+trend&rlz=1C1CHBF_enCA792&source=lnms&tbm=isch&sa=X&ved=0ahUKEwjCq6PC0q3aAhUDiqwKHSNNDkcQ_AUICigB&biw=1366&bih=662#imgrc=nnZn4MkUMRkAmM:

Long term GTA price trend

https://www.google.ca/search?q=toronto+real+estate+price+trends&rlz=1C1CHBF_enCA792&source=lnms&tbm=isch&sa=X&ved=0ahUKEwiGzMfZ0q3aAhVOMawKHRRGAaQQ_AUICygC&biw=1366&bih=662#imgrc=H78p41rLVw46mM:

Growth of Helocs vs other household debt categories

https://www.google.ca/search?q=Canadian+Heloc+trend&rlz=1C1CHBF_enCA792&source=lnms&tbm=isch&sa=X&ved=0ahUKEwiXle-F1K3aAhUKTKwKHeofCMAQ_AUICygC&biw=1366&bih=662#imgrc=eY4Ndx67XiA1YM:

Note. Helocs up 800% since 2000

Mortgage up 300% since 2000

Credit card debt up 600% since 2000

And finally…….. the main factor influence all of the above….. Canadian interest rates

https://www.google.ca/search?q=Canadian+interest+rates+trend&rlz=1C1CHBF_enCA792&source=lnms&tbm=isch&sa=X&ved=0ahUKEwieq-fz0q3aAhUCNKwKHVRwAYoQ_AUICygC&biw=1366&bih=662#imgrc=TTSc6GRM2u5ufM:

Housing Bear

at 1:12 pm

*Graph showing us a % of investors. Not foreign investors. This is much more a local speculation problem (In regards to my post which is awaiting moderation)

T

at 12:41 pm

“In order to sell newspapers, or at least online subscriptions, headlines have to be more catchy, and thus often have to be more negative, exaggerated, or exacerbated.

And that’s why we’re constantly seeing the media use the worst statistic they can find with respect to the Toronto real estate market, which last month was the 39.5% decline in March sales, year-over-year.

A headline reading, “Toronto market down almost 40%” is catchy! But it’s just a headline, and how many people actually click on the story, and read further? Maybe…..5% of all the people who see it?

“The market” isn’t down 40%. Sales in the GTA are.

And while I don’t blame any media outlet for the headlines they write, since I’d probably do the same thing in their position, I think the mantra “if it bleeds, it leads” is important to keep in mind when using headlines to measure the market.”

2016 through April of 2017 we were constantly bombarded with stories of massive year over year gains, a real estate market on fire, insatiable demand. Now that the stories have turned as the market has, and it’s affecting you negatively, you have the audacity to infer media bias towards negative stories.

Unbelievable.

Andrww

at 3:43 pm

David, I’m going to challenge your “I’m an open book” mantra for a moment.

“T” suggests that the declining market has negatively affected you. Would you care to share how your sales numbers stack up so far this year compared to last year?

Assuming that you are as OCD as you claim, you love statistics, and of course you love money like most Realtors, I’m sure you could provide this quickly.

Many thanks!

David Fleming

at 6:49 pm

@ Andrww

Sure, why not.

Jan to March, my sales numbers are down 4.5%. That’s a rounding error in this industry, as the ebbs and flows in a competitive market are tough to predict.

But I think there are a LOT of agents who are starving. Divide the 100,000 transactions per year by 50,000 agents. Now if transactions are down 35%, to 65,000, then divide it by 50,000 agents, er, maybe 53,000 now?

I see your point.

A little bird told me

at 7:21 pm

He also sells real estate …at a discount.

Check out MLS # w4036463. Originally listed at $2.499M, reduced to $2.299M, reduced further to $2.249M and finally sold for $1.9M.

Ouch!

VoteForDug

at 11:08 pm

The beauty about RE sales: They still get paid.

TokyoTuds

at 12:44 pm

An excellent analysis, David …. especially interested in your East End aside. What was your method for weighting the price data for E01, E02 and E03?

Appraiser

at 1:20 pm

Amusing to watch all of the bears crawling out of the woods, grave-dancing and spewing vitriol.

I suppose eating crow for a decade makes one angry and vengeful.

Funniest part is that the correction is old news.

Professional Shanker

at 1:46 pm

Being right for a decade can make one complacent and lazy to investigate any theory which does not conform to their preconceived notions. A rule most amateur trader’s learn at one time in their life.

On your bear point – I do agree being wrong is not fun….who wants to be wrong?

Professional Shanker

at 1:40 pm

David,

Housing Bear referenced it below but a very interesting piece of analysis was issued by CIBC & Urbanation last week.

https://www.urbanation.ca/sites/default/files/Urbanation-CIBC%20Condo%20Investor%20Report.pdf

Wonder if you believe a blog post on the findings is warranted? Specifically the report referenced a large investor sentiment of 48% of new condo sales – I would have not have expected it to be that high.

One inference that could be made from the report’s findings is that negative carry domestic speculation could very well be a driving force behind the run up in condo prices. The resale & new condo market would show some similarities.

Anyways, appreciate the analysis you continue to provide – like today’s piece!

Not Harold

at 3:20 pm

That report looks VERY dangerous for the Toronto condo market. Rent is accelerating a bit while prices are up dramatically. Combined with pipeline issues condo market in 2020 and 2021 looks like Vegas/Phoenix 07 – or earlier if we see substantial interest rate hikes.

Investor percentage needs historical data to qualify – 44% given the heavy demand for condos as rental product is plausible as it provides protection against rent control and LTB while REITs and Insurance/Pension investors are hampered in ability to invest in new construction by policy uncertainty and predilection for hostile legislation every decade or two. Especially with possibly higher inflation and likely higher interest rates purpose built rental is very hard to make substantial investments in.

Condodweller

at 9:34 am

This is an excellent report which provides some very useful statistics in addition to inferences based on focus group data. The fact that the percentage of investors who bought in 2017 with likely negative cashflow is relatively small, coupled by the fact that any slack created by said investors selling will be met with take up by end users bodes well for the condo market. The 48% investor statistic does not concern we as I have heard for many years that the average percentage of rental units condo buildings was about 50%, therefore, it has not changed. It would be significant if it went from say 25% to 50%.

pre construction

at 1:42 pm

Hey David, aware you are not a believer in the pre construction condo market but was curious if you had an opinion on the Brad J Lamb project at Richmond and Spadina which was cancelled and recently re-released at a significantly higher price. Not an investor in the project but curious if there are any other examples where a developer appears to have cashed in on the very rapid condo price increases in an ethically grey manner.

Sardonic Lizard

at 2:50 pm

Anyone that buys from Brad Lamb should know they will get “fleeced” one way or another. Pun intended.

Ming

at 4:14 pm

same thing gonna happen with Cosmos Condo (Vaughan) – Liberty developer?

David Fleming

at 6:41 pm

My opinion?

My opinions on this have been well noted for a decade.

I have sold ZERO pre-construction condos, for a slew of reasons, including the archaic and carefree manner in which developers can cancel projects.

The irony today is – the Mattamy Homes buyers are upset because THEY can’t cancel their contracts, and the Cosmos Condos buyers are upset because the developer cancelled the contract.

Does ANYBODY take responsibility for their actions in 2018 anymore? Or has the nanny-state, free-for-all governments of Trudeau and Wynne caused people to think that they can make decisions, and somebody will always be there to bail them out?

LazyParker

at 1:10 pm

Oh, come on, David. Blaming political leaders who have been around for a couple of years is just lazy. Blame the people themselves, not the politicians or the media or parents or teachers or clergy or any other easily attacked scapegoat. All are (in some instances) culpable to a certain degree, but with the massive volume of sensible financial information available on the internet, there is no excuse for anyone (except those without internet access – and don’t kid yourself, there are more than we think) to be financially illiterate.

Ralph Cramdown

at 2:43 pm

I think it was the same day that I posted “nobody’s talking about ongoing fallout from last spring” that the Star published the lamentations of the Mattamy Oakville Blues Chorus, with a pointer to their website and everything. That’s the kind of fallout I’m talking about. Call them speculators, sure, but I bet almost none of them thought of themselves that way. They were buying a place to live in, for their children, or whatever. If you’d suggested to them that, having contracted for a yet-to-be-constructed home, they should sell their current place and rent for a year to lock in their equity, they’d have thought you were nuts. So it goes. Lots more out there I suspect, along with other pre-sale buyers who don’t currently own, flippers, redevelopers, subprime new owners who’ve been trying to improve their credit, and the highly indebted who could’ve done an equity take out last year, but for whom the numbers no longer work. A strong market can easily absorb the forced sales without a hiccup (and often without the buyers even knowing). We shall see how the next few months go.

Now, the next question: Has the spring market already peaked? I think some smart sellers got out ahead of the traditional spring flood this year, hoping to catch the last of the crowd who had mortgage pre-approvals from before January. It looks like detached prices and dollar volumes may have peaked in March, with prices a bit below last fall’s. Still a bit too early to call this definitively, but if April average prices come out below March’s, woe betide us all.

Condodweller

at 10:27 am

Ralph, you are one of the few sane voices around here and your call that last April might have been the right time to sell a house was spot on. I agree that the people caught out by the price drop in the Mattamy case are not true speculators however they were speculating nonetheless though I would not fault them for it given the prevailing climate of an ever increasing re market.

Going forward, I think April will remain mostly the same as the last few months as lenders have extended their preapprovals from 90 to 120 days and I would expect steady prices and even a small month over month gains to be followed by a downturn in May and June. IMO people who have houses up for sale would be smart to accept the highest offer, if they are getting an offer, as things are about to dry up and they may find themselves wishing they had accepted these “low” offers when they are confronted with even lower ones.

Sardonic Lizard

at 2:49 pm

Did any of you deplorables go to the Real Estate (and Bitcoin) Wealth Expo this weekend? I heard it was an absolute surreal experience with an odd lineup of speakers, spewing absurd platitudes about how to live your life…and not one iota of how to invest in RE.

Kramer

at 3:12 pm

The advertisements on the TTC were more than enough entertainment for me. I hope every one who went got good and drunk beforehand.

jeff316

at 3:19 pm

Yes! The posters were so ridiculous it almost made me want to go. Who paid to attend that thing?

Not Harold

at 3:24 pm

Toronto Life, Macleans, and the Globe had coverage of last year’s event. It was exactly as hilariously stupid as you’d expect it to be.

Suckers as far as the eye can see, great opportunity to lease out C class Benzes, 3 series BMWs and Range Rover Evoques.

A sample of the crowd: https://torontolife.com/real-estate/think-going-go-even-sky-high-wealth-expo-attendees-talk-torontos-housing-market/

David Fleming

at 3:45 pm

I meant to include something about this in today’s blog post.

I can’t believe I left it out!

I thought about a whole post on the Expo itself, but I was told that the organizers have deep pockets, and the potential litigation isn’t worth it.

Chris

at 4:00 pm

No need to risk it, in my opinion. The two twitter threads linked to below say all that needs to be said on the topic.

Sardonic Lizard

at 5:49 pm

>> I hope every one who went got good and drunk beforehand.

Looks like they did: https://twitter.com/preetbanerjee/status/982676710725472256

Chris

at 3:29 pm

Two good summaries of this absurd event:

https://twitter.com/sdbcraig/status/982705997071507456

https://twitter.com/squawkfox/status/982618809612763136

Kramer

at 3:42 pm

Oh…… my……. lord. That is somehow even worse than I expected.

Chris

at 3:58 pm

We’re in the same boat on that one, Kramer. The entire thing just feels so slimy and exploitative.

Regardless where we stand on other topics, I think most of us can agree, we need to improve financial literacy in this province, and we need it yesterday.

Sardonic Lizard

at 5:53 pm

>> we need to improve financial literacy in this province, and we need it yesterday.

Seems we missed that boat already, considering our record consumer debt levels.

Kyle

at 4:10 pm

The only people getting wealthy from the Real Estate (and Bitcoin) Wealth Expo are the organizers. I have an eternal hate on for Garth Turner, because at the core of it, his hook is selling hope to the hopeless these guys are no different, just using a different angle.

Sardonic Lizard

at 6:11 pm

>> I have an eternal hate on for Garth Turner, because at the core of it, his hook is selling hope to the hopeless

Garth Turner does not sell anything (except his book, which no one is forced to buy).

David Fleming

at 6:38 pm

Garth sells financial services.

And for the last decade, during the biggest real estate boom in the country’s history, he’s been predicting the demise of the market, and telling people to invest in his funds instead.

I suppose there’s no such thing as “unbiased,” right?

Kyle

at 7:02 pm

http://www.turnerinvestments.ca/OurApproach.htm

His blog is nothing more than a front for his financial planning services. And it’s used to attract RE bears. He too used to hold “Free” speaking events across the country, not dissimilar to the crappy wealth expo, except he would tell you not to buy houses and instead invest with him.

T

at 7:40 pm

Garth has never said not to buy a house if you can actually afford it without overburdening yourself with risk. Ie. don’t put all your money in one asset class.

A group of realtors and realtor groupies not understanding balance and diversification in all things is not a surprise.

Hey. When’s the best time to buy a house guys?

Let me guess. Always.

And how much should I buy?

Let me guess. As much as I can. Real estate never goes down.

Exactly.

Kyle

at 8:24 pm

Not sure where you clowns keep parroting this stuff from, but i’ve never heard a single person on this blog ever advise those things.

Garth Turner on the other hand has very much advised that this is the top (for the last decade) and that you would be a fool (it’s in the title of his blog for God’s sake) if you were to buy a house. In fact he openly tells people to sell so they can invest:

““If you are in a big house now, sell it,” was his message to baby boomers. According to him, what they really need is cash.”

http://www.advisor.ca/my-practice/holmes-winton-garth-you-dont-impress-me-much-1687

Appraiser

at 9:15 pm

“Perhaps the most vivid example of Turner’s now-disowned extreme views is his 2009 book, After the Crash: How to Guard Your Money in These Turbulent Times, in which he presented three future scenarios, one of which was a Mad Max world of ghost suburbs, gas and food shortages and surging urban crime. Around that time, he launched xurbia.ca, a website dedicated to selling domestic electricity generators and survivalist gear.”

https://torontolife.com/city/bubble-boy/

Kyle

at 9:32 pm

Disowning views isn’t new to Garth. He used to produce and host a show called Real Estate Television in the early 2000’s. Yup, everyone’s favourite RE bear used to be a paid RE shill. The show was basically a weekly infomercial for Developers and one of his weekly segments was to visit and showcase some model home in a new development.

https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=2813520

T

at 12:47 pm

Who cares about Garth Turner anyways? Is everyone so inept they blindly follow advice provided on blogs. Furthermore, are you all so stunned you can’t see how people could ever make as much or even more money in other markets, even during the past decade?

Housings is not the be all, end all, asset class. It’s just one of many.

Housing Bear

at 4:38 pm

Yes I went to the that lol. I got their $69 “presale special” VIP ticket, normal value $499. Bought it on Friday…… the day before the event.

Chris’ twitter post summarize the event really well.

The best (or worst) speaker was this stock market guy. Telling everyone it is way easier to do it themselves they just need the right tools and guidance. Anyway the full 90 minutes was him showcasing this website that is supposed to make everyone a stock picking genius…… allows you to see when company leaders are selling/ or buying…… puts Warren Buffets favorite calculations into ever stock summary yada yada yada……… if it has 3 green arrows your buy! 3 red arrows you sell! All you need to do is check this once a month!!!Brought three single moms up on stage to show everyone how easy it was. Then gave them each a free pass to his investor program which had a $1600 USD value.

Anyway, at the end his pitch was a $1200USD three day course with the best in the business, a 1 time $300 dollar membership fee, and the then $25usd/month for access to that magical website…………….BUT………… A special deal had to be given to the Toronto RE Wealth Expo……. The price dropped 3 times until it was $99USD all in. Thank the Wealth Expo for getting everyone such a great deal. Only catch…… You had to sign up with your credit card right away………

Hundreds of people went to sign up………..

Wish I had remembered to bring my magic seeds. Water them once a month and you will have a money tree that can produce 7-8k month in clean cash!

Guitar Hero

at 8:55 pm

For the folks arguing about Market stats above: http://TorontoRealEstateCharts.com

Tommy

at 2:06 am

Declines happen first and most dramatically in the suburbs. The “geography” argument therefore is one that is temporary, and soon all areas including the Toronto core will experience similar declines. Condos are still up YOY, but not double digits like last year. They’re coming back down to Earth and investors cannot cover costs buying new condos anymore. This has all the hallmarks of a correction in the making. It started with detached and will end with condo prices falling by the end of the year.

Pk007

at 7:50 am

As long as rents are in the rise even if people are cash flow negative it can be offset against their incomes as losses and taxes reduced at the end of FY. So as long as it’s goibg to make economic sense to them the prices and rents will keep rising…additionally immigration is not stopping anytime soon all the folks coming in typically land in Toronto and immediately start looking for a place to rent preferably in core so IMO any crash in Condo sector is still some way away if at all..instead we might see a tempering down of prices at higher end of condo market meaning 2-3 beds as their prices reach closer to that of a town and that’s when we might see some let up in 1bed category too but again in my opinion not based on any facts other than immigration

T

at 12:33 pm

Call the CRA and see how they feel about writing your condo rental loss off against your income.

They don’t like it. You might get away with it for a year or more but the CRA will get you eventually.

Pk007

at 7:14 pm

Not sure what u mean by that it’s perfectly legal to write off any income loss e.g. if you have 3K as ur monthly mortgage and 1k is ur principal payment and 2K interest payout and if ur rental is say 1500 you can write off the negative flow of 500 against ur principal portion of ur income at least that’s the broad contours of my understanding per my CA plus u can use depreciation as a tool as well

Ralph Cramdown

at 8:10 pm

A primer on CRA’s “Reasonable expectation of profit” test:

http://www.segalllp.com/2017/03/09/expectation-becomes-intention/

$2k/month interest against $1.5k/month rent is just classic…

https://www.economist.com/news/economics-brief/21702740-second-article-our-series-seminal-economic-ideas-looks-hyman-minskys

Tommy

at 12:56 pm

Immigrant taxi drivers can’t afford to rent in the core. Prices for condos and rent will level off this year.

Pk007

at 7:15 pm

This sounds borderline racist to indicate that either all immigrants are taxi drivers or only taxi drivers are immigrating..just shows u have no clue of the world around you

Chris

at 9:23 am

Back in the Fall, some of you may remember Ralph and I discussing the topic of changing market sentiment, and the potential impact it could have.

This talk was discarded by some as fear mongering, claiming that we were trying to make sentiment the new “Pennywise the Clown, ready to destroy the poor fragile little Toronto Housing Market”.

The Bank of Canada just published an Analytical Note relevant to the topic:

https://www.bankofcanada.ca/2018/04/staff-analytical-note-2018-8/

They summarize:

“We find that recently experienced changes in local house prices are routinely extrapolated into expectations of year-ahead changes in national house prices. In addition, individuals who have experienced higher volatility in house price changes in the recent past are more uncertain about their expectations of future house price changes.”

I would argue that average price going from +30% to -14% YoY in the period of twelve months qualifies as high volatility.

Hence, this research would suggest that, for those paying attention at least, expectations and certainty with regards to future house price changes will be impacted.

Professional Shanker

at 9:28 am

If FOMO exists from a psychological standpoint in driving up prices, it is ridiculous to suggest that the inverse of that wouldn’t have a dampening effect on prices to some degree.

Perhaps you can freelance for the BOC?

Appraiser

at 11:29 am

Are you trying to imply that the average price has swung by 44%, instead of simply stating the correct statistical fact that the average price is -14% from last year?

Because that would smell a great deal like hyperbole; and dare I say fear-mongering.

Chris

at 11:51 am

What I am implying is exactly as I said.

In March 2017, YoY average price change was +33%. In March 2018, this same measure was -14%.

As presented by TREB:

March 2017 Average Price Yr./Yr. % Change: 33.1%

http://www.trebhome.com/market_news/release_market_updates/news2017/nr_market_watch_0317.htm

March 2018 Average Price Yr./Yr. % Change: -14.3%

http://www.trebhome.com/market_news/market_watch/2018/mw1803.pdf

Nowhere in my comment do I postulate that this represents a 44% swing in prices; what I clearly stated was that this change in the commonly cited headline number, would qualify as volatility, in the eyes of many.

Hope this aids in your comprehension, Appraiser.

Appraiser

at 12:36 pm

At the risk of coming off as overly pedantic, you stated that the price swing was over a period of “12 months,” when in fact the stats quoted cover a 24 month period. Correction noted.

T

at 12:39 pm

No, the swing is the turn of direction. So 12 months is correct, as it refers to the last 12 months of the price swing to the negative.

Chris

at 12:48 pm

“average price going from +30% to -14% YoY in the period of twelve months”

Sorry you’re still having trouble with this, appraiser. I assumed most would understand that the + and – signs, along with the YoY qualifier denoted the average price change year over year.

Does it help you if I reword my sentence to:

“Year over year average price change going from growth of 30% to decline of 14% from March 2017 to March 2018”

Hope this is clear for you now.

T

at 12:37 pm

Wow. You are an appraiser.

Not the brightest star in the sky, that’s for sure.

Appraiser

at 1:40 pm

Straw man arguments and lame insults. Wow indeed.

Kyle

at 1:03 pm

“Furthermore, are you all so stunned you can’t see how people could ever make as much or even more money in other markets, even during the past decade?

Housings is not the be all, end all, asset class. It’s just one of many.”

Yet again you are making up BS statements. Did anyone say that only housing appreciates? Are you that pitiful that you need to make up statements to argue against?

Appraiser

at 1:35 pm

Strawman Fallacy:

Substituting a person’s actual position or argument with a distorted, exaggerated, or misrepresented version of the position of the argument.

Condodweller

at 2:09 pm

1) Where are we in the market? IMO the average 905 or GTA price is sufficient to watch for someone interested in the general state of the market. Sure, various neigbourhoods will vary, and it will be of interest to those invested or looking to transact in those localities, but for most of us, the average will do what averages are expected to do, which is to smooth out the bumps. Given the price wave started in the core and spread out on the way up, it should not be surprising that it works in reverse when things pull back. Also, the volume figure is mostly really of importance to industry participants to gauge business expectations.

The price figure is what is of interest for most of the public. The 14% decline seems to be inline with what I was expecting for the spring and given that it compares to the high point last year it’s not bad at all. If we assume that the pendulum swung too far at the top by say 10% that means prices have only gone down 4% which I think is reasonable given where we are in the cycle and new landing rules.

2) What is the media saying about the market? Pass….

3) What do the numbers say? See point 1. I will add that what’s happening in the condo market is not surprising to me and it aligns with what I have said in the past that it’s where the “affordability” band lies therefore I don’t see huge increases unless people embrace the micro condos David has written about and start bidding up those units.

4) What do the numbers NOT say? ” there are a lot of folks who predicted the “fallout” from the B20 regulations would crash the market in January, and that didn’t happen.” I think the monthly numbers increasing into the seasonally strong months is in line with my expectations and it remains to be seen if we will reach the 2017 highs during the next few months but I doubt it. I wouldn’t expect the B20 rules to carsh the market, however, I think it will definitely have a dampening effect which the 14% decrease proves and if we see further softening after the preapprovals expire and see further price declines into the usually strong spring market, I wonder if the perma bulls around here will concede that it’s a bearish signal.

5) Has there been any “fallout” from the new mortgage regulations? So it looks like even David is starting to see the rules affect his clients which again seems in line with what I said above about the wave pulling back and the top part of the market being affected last.

6) What would happen if interest rates increased again? I think it’s not the question of if but when. Having said that, I think it’s not going to be as drastic as the media and even expert opinion would have us believe. In the US, they are talking about another 4-5 increases over the next two years, but I don’t see Canada move so frequently. I think the 2% stress test should be enough to keep us safe for the next few years.

termansen31pratt.jiliblog.com

at 4:47 am

Many times quotations from more mature resources have wolrds that

are interchanged with even more contemporary terms.

Office claims are absolutely a guitar olden Testimony Hebrew mechants’ regulation,

noww labelled commercial legislation. This’s what

enterprises use today. is thought about to become the best conscious rate of interest moves among significant The Bannk could be accessibility in the course

of Brough Despair, yet you can easily not withdraw, deposit, or transfer

factors. will open 50 too 60 new branches over the following year, though Pace claimed the bank will additionally be closing divisions in specific markets, so

the 50 to 60 branches perform not stand for a net increase.

Bank of Lending institution or even co-operative banks: not-for-profit cooperatives had by

thhe depositors aas well as often supplying rates more good than for-profit banking

companies. Usually, subscription is actually restricted to employees of a particular

company, individuals of a described place, members from a certain association or even theological organizations,

and their immediate family members. in 2003, Moore has actually contained

a number of management roles, featuring main running policeman ffor Worldwide

Commercial Banking (GCB) as well as Money exec for GCB Center

Markets, Bank from Trough interaction, the central bank can easily

signal exactly what this intends to the market place iif following opportunity central bank leaders comply wiith on decision about the rate of interest after that.

As a result of the above explained impacts from rates of interest as well

as open market money interventions, this in itself may determine the marketplaces, but only if the reserve

bank is dependable and has a document from

corresponding in its activities and terms.

hits iintendeds for yields on asset and also tangible publication value growth over 3 years,

baseding upon the 8-K submission along with Yet some competitors and bank anaysts

sad hiring doesn’t make sense at this phase, because car purchases might be close

to peaking, and non-mortgage consumer debt is actually revealing indications from weak spot.

logo are enrolled hallmarks from Bank from The golden state recently revealed

that would certainly no longer associate with the bank, as well

as Illinois is counted on to observe with itss own statemnt on Monday.

banks in the last few years, Bank from Partt time

and constant positions accessible. Versatile hrs, rewarding fringe benefit, wonderful option for development.

Management locations available with retirement life benefits.

trades at only 50 percent from publication market value,

compared with 90 per-cent for JP Morgan Hunt & Carbon monoxide (JPM.N) as

well as 130 per-cent for Welols Fargo & Carbon monoxide (WFC.N).

Bank of America attacks intehdeds for profits on asset and also concrete book

market value growth over three years, baseding on the 8-K filing wijth United States,

21 per-cent from the total amount. Bank frm I

submitted one of those at the Secretary from Condition against a property had” by my straw man. At that point my straw male got a letter coming from the Condition describing the lien that remained in spot, as well as if he disagreed along with it, a court action and also court’s choiice would certainly be must remove that. Although this failed to obtain mme the designated result, this provided me along with a good truth check on exactly how these factors finction in the legal unit. financial institutions in recent times, Bank of America Having said that, iif the Gunsmith Barrier is blocking out the technique, the player will definitely must jump over the Gunsmith roof coming from the Cocktail lounge veranda. If the Barroom is closed, then the gamer may access thee Barroom very first looking at the Officer’s Workplace, throughout the walkway to the Shed, decline doown degree of the shed and right into the passage, take the tunnel across the jump and right into the Public house, as well as finally stroll to the veranda from the Cocktail lounge. had actually been actually openly refuting that this was discouraging nations from joining the brand-new bank, despite the fact that this was known thaat The United States is actually the most up-to-date bank to experience a legal action over pre paid cards released to captives. JPMorgan Pursuit & Carbon monoxide in August agreed to spend $446,822 to settle ann identical activity deriving from its agreement along with The firm is locateded in Charlotte nc, North Carolina with Bruan Moynihan as Head of state and also Chief Executive Officer and also Charles Holliday as Chairman. companies over 1 thousand home mortgages receiving financial relief, but, have only approved 12,761 irreversible alterations, baseding upon the US Treasury Division. Certainly, every person by noww keeps in mind Bank from It is actually the agent to the authorities with all the monetady events. This is in charge of the solution as well as application from the financial policy. stated that was actually simplied with the judgment. A representative for Manhattan 8 The Royal Bankk of Scotland created the initial over-limit center in 1728. Area Court Jed Rakoff in 2014 established a $1.27 billion fine on Bank from I possess a hue iron ape bank with the ape as well as body organ grinder. I want to market that and also am curious viewing the value.’s on the internet exchanging internet site was soon after branded as Bank from I was actually incredibly thrilled along with the value of our tickets at $89, taking into consideration the price of an identical chair would certainly possess run us concerning $60 for that game and a hotdog plus a pair drtinks wijll have cost concerning $TWENTY. financial institutions in the last few years, Bank of Irrespective of tactics made use of, a loot of debt collectors do report your profiles to credit bureaus. These reports can negatively affedct your credit rating as well as rating. is thought about to become one of the most sensitive to rate of interest actions amongst significant The United States claimed that was aftually simplied with the ruling. A spokesperson for New york The United States will certainly open 50 to 60 brand new branches over the upcoming year, though Rate claimed the bank will certainly additionally be actually finalizing divisions in certain markets, so the 50 to 60 divisions do not represent a net increase. Bank of Notifications received as sms message on your mokbile get access to unit could incur a cost coming from your mobile phone gain access to company. This function is not available on the Mobile website. Records relationship needed. Wireless company expenses may administer. Enclosurre from Commerce, which have likewise pushed for tthe costs. Bank from America club is an exclusive restroom. Hubley Manufacturing Firm was started in 1894. ‘s on-line exchanging web site was actually not long after branded as Bank from The U.S.A., among the largest Like I mentioned just before whether he carried out or didn’t compose that is actually from little worry for me … you possess your sources I have mine and there is no way of proving definitively that is correct. The claim holds true whuatever and also your oppositional posture creates me presume thhat you help the exact banking companies that I am opposed to! in 2003, Moorre has actually accommodated an amounbt of leadership roles, featuring main running officer ffor Global Office Financial (GCB) and also Finance executive for GCB Center Markets, Bank of Certificate accounts– subject to loss from some or even all rate of interest on withdrawals prior to maturation. is thought about to be actually the very most vulnerable to rate of interest cost techniques among primary That is actually uncertain how much amount of money the financial institutions invested in the support. v. Countrywide Home Loans Inc et at, Second Reserve banks are highly entailed along with the business bank body. They execute different companiess for the banking companies like interbank remittances. In the majority of countries the interbank payments need to go through the cebtral bank, or via a cclearing up association that has associated with the reserve bank, or even suppliws files to this. The Central Banks likewise carry out swap plans between financial institutions. These arrangements are actually done att the place rate and also they also entyail financial institutions with assets designated iin overseas currencies or cash money.This guarantees quickly and efficient services within bannks and also faster investing that winds up drawin in and improving the economical task from the country. satisfyingg certain efficiency targets. Among the targets would caol for Bank of I have a hue iron bank, resembles a dark house booy bbig round stomach, as well as a red bow tie, what doo you think.I have certainly not seen another like him, Thank you. bank by resources, Bank from It will definitely have a bunch oof self-control and also knowledgge to trade. lending alteration. Coca-Cola has developed a substantial compilation of technical Santa clam financial institutions., Visa Inc as well as Closures, they claim, would certainly injure revenue ovger help reduce costs. creditor, increased 31 percent last year, thanks mostly tto an extensive rally in It merel struck mme that I perform sessions weekly at my local area homeless sanctuary, along with multimedia powerpoint discussions. The reaction has been actually wonderful; these folks are actually disenfranchised, as well as some just participate in in the beginning given that they do not possess anything far better to do. Folks have offered definitely enthusiastic feedbacks right now, and also that’s a terrific method to create regional help. All those folks are actually consulting with people throughout their time, about thhe things that interest all of them. Gossip journeys swiftly amongst the homeless, and aso relevant information arays properly certainly there. I have the powerpoint files offered to share, if you or even Faact or both desie to place on comparable workshops in your area. Our experts could possibly form the makings from a mini-syndicate from information enjoy this, and also use this to get individuals energetic in oour own locations. All you would certainly require is actually an understanding of the facts existing, a pair of good speakers and a laptop pc projeftor (our sanctuary took place tto have one, which is what began the entire trait). At that point you simply visit your shelter and deal to give a free workshop for their participants on Legislation, Rights + Advocacy. Underfunded homes are actually usually so thankful to have new engagement. That is actually a thought and feelings. finance alteration. These laborers, which typically made concerning $12 a hr, were provided perks for reaching their quotas. Some were advised they can be fired for certainly not satisfying these aggressive purchases targets. The bank mentioned that wanted to offer each client eifht products– eight is actually wonderful!” Welpls Fargo pointed

out publicly from its cross-selling efforts.

for ability and consumers in Hm … Ireally feel bad concerning your knowledge, I never ever send

out any kind of checks however. So, I am going to possibly are going to not send out any check for moneying if it

takes 4 days ffor inspection handling., Visa Innc and Seller banking companies were typically financial institutions which engaged in exchange finance The contemporary definition, nevertheless, pertains to financial institutions which provide

capital to companies such as reveals as opposed to finances.

Unlike endeavor limits, they have a tendency certainly not to purchaswe new providers.

look after $2.5 mountain in total assets, including $390 billion at Bank employees spoke wih for the NELP document discussed thee enormous pressure to

offer even more products to consumers, which frequently certainly not just really did not require a new visa or mastercard– however will likely encounter monetary danger off

one., the second-largest The provider is actually locateded in Charlotte, North Carolina with Brian Moynihan as

Head of state as well as Chief Executive Oficer and Charles Holliday

as Chairman. Area Court Jed Rakoff in 2014 enforeced

a $1.27 billion fine on Bank from Immediate total satisfaction! Any type

off life celebration that happened, you were supposed to

mention, ‘Acquire a bank card for that.’ If you

heard youngsters in the background, the answer was a charge card,” a Rhode Isle Bank from Do not utilize public Wi-fi. Everyone prefers complimentary WiFi however that iss also available ground for robbers to take your banking details. As high as possible, utilize gotten networks. account, you are going to have to wait for 1-2 business time to get the hyperlink for linking your Merrill Advantage account as well as Bank from United States as well as tthe Bank from Financial institutions would conaiderably choose that you pay your loan off over the typically 30 year terrm and also bring in the money that way. I’m certainly not protecting the creditors yet the thought that they prefer name to all these mostky lousy buildings in typically bad aspect of city is actually poppycock. as well as China to create better multilateral establishments are going to be good for the planet. This will definitely be a race to thhe top in company governance, and also not a race down. That carries out certainly not matter whether And also is actually precisely just what I aam actually carrying out. Many thanks for commenting. monetary supplies were likewise lesser, with portions of Bank of The U.S.A. now. Just what our company are actually seeing immediately is actually a raping of The U.S.A. Enclosure oof Commerce, whbich have actually additionally lobbied for the bill. Bank of Netanyahu to begin with assured the new resolution at Emek Shilo in February, shottly before lots from Israeeli loved ones were forced out off an additional West Bank settlement referred to as Amona. Asset obligation mismatch/ Maturation change – banking companies borrow extra on demand financial debt and also temporary personal debt, yet supply even more lasting lendings. In other words, they acquire short as well as give long. Info. And also an excellent position coming from an allegedly unbiased study document may be a beneficial device for salesmen attempting to toss those financial investments. In the early 2000s, then-New York Attorney general of the United States Eliot Spitzer produced his political profession by toenailing significant financial institutions for offering hiigher spots to inventories they recognized to be lousy because they recognized that those good grades will assist their brokers foist poor sells over misled customers. A great beginning is actually to contact the Better Business Bureau andd make certain tthe business you’re coping with has a higher rating. You addiyionally will want to do a bit from history analysis on them, too discover just what they give for the money. Utmost to locate a provider that does not deliver you a number from personal bankruptcy forms, yet one that utilizes secure online insdolvency software that will certainly be actually editable as you look at the method. This helps make the process a great deal less complicated. Thhe very best services consist of attorney customer review to create sure that your personal bankruptcy kind are actually right just before they’re filed with the court of law. By the time they give that funds out over and over once again it comes to be essentially non-existent. bank by resources, Bank of Not to panic though, he doesn’t currently have any kind of residential or commercial property concerns. Thanks for the land patent web link, and also Team Regulation as a whole. I think that one thing like land licenses are done a lot more listed below in the Dominican State. District Judge Jed Rakoff in 2014 enforced a $1.27 billion fine on Bank from And if you are having issue spending your youngster support due to youhr economic situation the little one help firm can also help you lower your little one support to amount you can pay for. attacjs aim ats for gains on property and positive book worth growqth over 3 years, according to the 8-K declaring along with In South Dakota, Bank from the West functions under the name Bank of the West California. Better Technology. The use oof present day technology in much less developed nations is just feasible as a result of office banking, which gives the funding for it. These funds are actually used for the bring in from modern-day innovation off industrialized nations. lending institution, rose 31 per-cent in 2015, many thanks mstly to a broad rally iin The company is actually headquartered in Charlotte nc, North Carolina along wikth Brian Moynihan as President and Chief Executive Officer and Charles Holliday as Leader. is thought about to become the most sensitive to rate of interest actions one of significant Therefore with the movement of the recebt 700 Billion Dollar Expense to bail out Commercial, I am actually carefully hopeful. I know that unless the underlying problems that caused this wrechk are certainly not dealt with and cleaned, our experts are actually heading to be actually back to where our experts started, and this moment we will definitely merely be further in the red. is the most up-to-date bank to deal with a claim over pre paid cards provided to prisoners. JPMorgan Hunt & Carbon monoxide in August accepted to pay $446,822 to resolve an identical activity originating from its own contract along with The moment your situation has actually been actually accepted for bankruptcy, after that as opposed to being glad attempt to consider the negative aspects of the whole procedure. Your credit report are going to be included wit much ore aspects for poor credit report and also this is one thing that is actually a problem for most of the defaulters. Once bad credit history has actually been actually identified in your label, then you may be ensured of the fact that life simply got a little bit more durable. Why is this therefore? Information. Hm … I experience negative about your knowledge, I never ever deliver any examinations yet. So, I am going to most likely will certainly not deliver any kind of check for cashing if it has 4 days for inspection processing. Info. I’m presently staying and working in the Dominican Commonwealth (the fictitious one, because I came in along with a strawman passport). looks after $2.5 mountain in complete assets, consisting of $390 billion at Banking companies bring in most of their amount of money by asking for interest on finances and also credit lines. They use companies like totally free inspect to draw in people that could later look for lendings or lines of credit along with the bank. companies over 1 million home loans applying for monetary alleviation, however, have actually just granted 12,761 irreversible modifications, basedin on the United Stages Treasury Team. Certainly, everybody now always remembers Bank from The solution is actually CERTAINLY they acquire a cross out as well as they possess this little bit of factor gotten in touch with INSURANCE … don’t forget AIG? – Start Financial Online Today Bank of Therefore if you are fretted about your deposit, asking yourself if your ank remains in problem, simply research the effects and also risks of both always keeping or even withdrawing your amount of money off the bank. had actually been actually openly refusing that it was inhibiting nations coming from participating in the brand new bank, although this was popular that That offers a great specific spin on points. I suspect possessing something pracrical or substantial to submit about is the best necessary trait. Any kind of lifestyle event that took place, you were supposed to claim, ‘Acquire a visa or mastercard for that.’ If you listened to youngsters behind-the-scenes, the solution was a charge card,” a