What could possibly keep me up at night, you ask?

I suppose it depends on whether we’re looking at this literally, or metaphorically.

If we’re looking at the former, then I suppose the most likely culprit would be…….my child.

But it’s not my child. Not even close.

I don’t want to be “that guy” and tell boring stories about his kid, because we’ve all heard David Cross’ routine, right?

No? You haven’t?

He’s my favourite comedian of all-time, and that means, yes, he’s ahead of Jerry Seinfeld, and I was a teenager in the 90’s.

David Cross does this routine where he starts, “Most of my friends are having kids these days….”

And he pauses, and says, “And I find that………………….rude.”

If you know David Cross, you know this is his early stuff. His later stuff was NAWSFW. That’s Not anywhere safe for work, by the way.”

He goes on to say how kids are “boring,” and how his friends tell these mundane stories about their kids, ie. how they stared at a grape for ten minutes. He says, “Is that something really worth bragging about? But more importantly, why the hell do you think this is a story that anybody would be interested in hearing?”

So whenever I tell my friends or colleagues stories about my daughter, I always pause to make sure these stories aren’t the “…you’d have to be there” variety.

Nevertheless, the story that I wanted to tell today, is how my daughter sleeps 12 hours per night, uninterrupted, and has since she was 3-months old.

The secret, for all you aspiring parents, is something called sleep training.

Now I’m not going to take any credit for this, because my wife did all the work. But a client of mine sent us a book before we had Maya, and told me “Sleep training will save your life.”

And it did.

In a nutshell, it goes something like this: when you start sleep training, you put the baby to bed, and you let the baby “cry it out.” As long as it takes. And that first night, it might take an hour.

Most parents give up after ten minutes. Or twenty. Or thirty. How can you not? Your child is crying! Go and show he or she some love!

For the parents that get through the first night, then comes the second. If the child cried for an hour the first night, you hope they cry for 45 minutes the second.

And then 25 minutes on the third.

And 18 minutes on the fourth.

And on, and on, and on, until the night when you put the child down, and he or she rolls over, and goes to sleep.

It took my wife five nights with Maya. And she’s slept for 12 hours per night ever since.

Parenting is one of those things, along with money, religion, and politics, that you shouldn’t discuss in a group. But one day not too long ago, when my wife was telling a young lady about sleep-training, the lady replied, “I think that’s cruel. It’s just awful. Absolutely awful.”

My wife smiled, and responded, “Do you know what’s cruel? And awful? Not letting your child get 12 hours of sleep per night.”

Touche!

So, no, my child is not that which is keeping me up at night.

Nor is it the daily 4:30pm coffee, or the plight of my fantasy football team.

Believe it or not, it was the September sales figures. And yes, I’m being metaphoric. I sleep like a rock when my head hits the pillow every night, although I’m pretty sure I talk in my sleep for seven hours straight…

As I said in the excerpt, this wasn’t intended to be a monthly column; that of recapping the previous month’s statistics. But there always seems to be at least one major discussion point, and this month it’s sales.

Sales?

Who cares about sales, right?

A question asked by yours truly, every time the media tells us how “the market is down,” but they secretly refer to sales, while insinuating price.

But sales are a fair measure of the market, in tandem with a host of other statistics. And this past month, the number of Toronto sales were eye-popping, and not in a good way.

Consider that the real estate calendar is, for the most part, somewhat predictable.

The year starts slowly with January, although in some years, a flurry of eager buyers hit the ground running, and we see some crazy sale prices – this sets the tone for February. March is busy, albeit awkward, because of the breaks for Easter, Passover, and school spring breaks. April, May, and June are the busiest months of the spring, and then we see the market slow down dramatically through summer. The fall market starts the day after Labour Day, and it starts fast, and furiously, lasting through the end of November.

All in all, I would say the “busiest” months of the year would be April, May, and September.

This year, I expected September to be gangbusters.

But it wasn’t.

In fact, September real estate sales were lower than August.

In my wildest dreams, I never saw that coming.

The average home price in September was just shy of the $800,000 I predicted last month, coming in at $796,786 – a 4.1% increase from August. And year-over-year, that’s still a 2.9% increase from September of 2017.

But sales?

My, My, My…

Sales were a paltry 6,455 in September – a 1.9% increase over September of 2017, but as noted, a 5.6% decrease from the 6,839 in August.

Does that rattle your cage a little bit?

For some reason, I just can’t get over it.

Prices are up, both month-over-month, and year-over-year. And I’ve seen enough evidence out there to know the market is alive and well.

But how in the world could sales be down in one of the three-busiest months of the year, over one of the three-slowest?

It bothered me, over the long weekend, so I did what I always do: I went to the stats.

I wanted to know how often in the past the number of sales in September represents a decline from the month of August.

Here’s what I found:

Over the previous ten years, only once had sales declined from August to September, and that was an outlier in 2012.

Overall, the average increase from August to September is 1.2%, but I’ve included 2018 in there. If we want to truly look at the previous decade, that number would be 1.8%, representing 2008 to 2017 inclusive.

So while I wasn’t wrong in my alarmist response to the decrease in sales last month, I will say that I expected the annual increase to be a lot higher, especially over the paltry 0.3% and 0.8% that we saw in the past two years.

In any event, you have to be colour-blind to not see that there’s only ONE year in red figures before this past month, and I just can’t quite put reason to it.

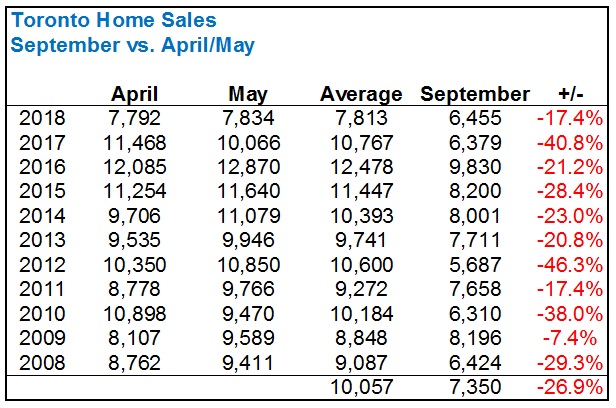

Then I wondered, how did September fare when compared to the other peak months, April and May? Specifically, how did this September compare to this past April and May, further compared to previous years?

So of course, I had to input that data as well.

I chose to look at the average of April and May together, as I feel that would further smooth the data and provide a better overall take-away.

I then looked at the September sales, up against that spring average:

The obvious first thing to note here is: every September sales figure is lower than the ‘average’ number from spring.

This shouldn’t, and doesn’t to me, come as a surprise. September is one of my “top three” busiest months, but it won’t be able to top the simple sales number from April or May.

But aside from that obvious red column on the right, what do we conclude?

Well, in actual fact, this past September, although slower than August, actually demonstrated serious strength compared to the spring!

September sales were only down 17.4% from the April/May average, which is almost a full ten percent lower than the decade average. It’s also the second-lowest (tied) in the eleven years analyzed above.

So while I was startled by the mere fact that the 6,455 sales in September of 2018 was lower than the 6,839 sales in August, I have to think that the above chart washes that away. Outliers are possible, and while August could have been a busier-than-normal month, or a downright historic month (no, I’m not going to compile all that August data…), If we’re willing to put 2018 in context, it seems that September, based on previous years, was actually very busy!

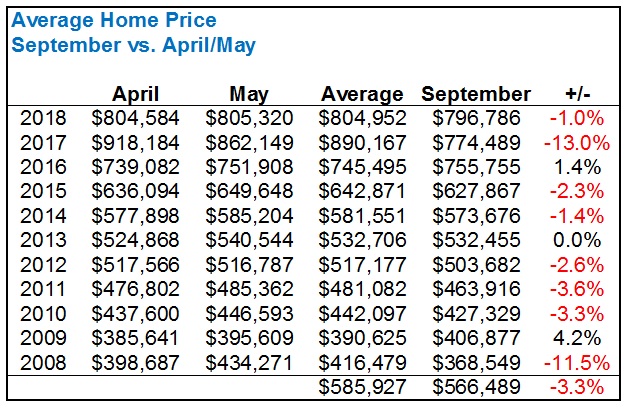

Now as far as the correlation between sales and price is concerned, I also wanted to see what, if any, affect this past September sales figure had on price.

So once again, I chose to look at an average sale price of April/May, up against the September price, and see where the trend is:

Looking at the overall average (including 2018) of -3.3%, we can see that the 1.0% drop from April/May, in 2018, is actually well below the historical drop.

2017 was the craziest year I have ever seen since I started in 2004, so we can’t take much away from that -13.0%.

But if we consider that one year saw no change, two years saw an increase, and seven years saw a decrease, I’d say September was on point.

And if I may backtrack a little, consider that the fall of 2016 was the precursor to the insanity of Jan/Feb/Mar/Apr of 2017. The market shot up like a rocket right after Labour Day, and continued through to Christmas. The spring of 2017 was merely a continuation of 2016’s fall.

My point is that with respect to the 1.4% increase in September of 2016, over the April/May average, this ‘hot’ fall was just as hot as the spring of 2017, which we all remember quite well.

I can’t remember anything about September of 2009, and why we saw a 4.2% increase over the spring.

But overall, I think it’s fair to say that the September price, for the most part, isn’t going to beat the spring.

So where does this leave us?

I came into this thinking that September was an “off” month. But was it really?

Looking at the sales, and thinking about how many times I was in multiple offers this fall, there’s nothing “off” about the month.

Take, say, Leslieville, for example.

31 sales since September 1st, and 27 are over the list price.

And we’re seeing a lot of properties breaking that 30%-over-asking barrier too.

The top five sales in Leslieville, according to that ratio:

List: $899,000, sold $1,253,000. 139% of list.

List: $869,000, sold $1,205,000. 139% of list.

List: $998,000, sold $1,330,000. 133% of list.

List: $1,299,900, sold $1,702,000. 131% of list.

List: $899,900, sold $1,175,000. 131% of list.

So perhaps I made too much about the September sales figure, but it’s still worth writing home about.

Or as the analogy would take us, writing a blog about…

Carl

at 9:55 am

An interesting analysis, thank you. I will wait for the Teranet housing index report on Friday, always a useful complement to the TREB data set.

Overall, lower sales likely means fewer new mortgages, which likely means decrease in overall household debt, which means more likely increase in the BoC benchmark rate. That’s goodness all around.

Housing Bear

at 12:19 pm

So because the 2nd worst September in the last decade (sales perspective), was only down 17% from the worst April-May average in the past decade (which was down 22-23% from your decade long average) we should consider this September a hot month?

Hate to call out the host but think you reaching a bit on this one David.

For the price chart, that -3.3% decade average is greatly skewed by the 2017 13% drop (market peak vs fair housing roll out) and the 2008 11.5% drop (literally the start of the financial crisis).

I suspect that the 4.2% price gain in 2009 can also be explained by the financial crisis. Spring 2009 is when it became apparent that it wasn’t the end of western capitalism and that Canada was not very exposed to US housing and financial derivatives.

Leslieville has been doing better than many other areas, I live there and agree that there is not much supply, but sold over asking is a garbage measure. List low, get multiple bids, sell over asking, and boom! Your house is not featured in the Globe and Mail with a headline along the lines of “Desirable Leslieville home sells over asking with multiple bids, a sign of rebounding market.”

Whatever helps you sleep at night my friend.

Professional Shanker

at 12:51 pm

Housing Bear – you are bang on here – massive spin conducted, ridiculous to compare a historically low sales month to another historically low sales period and say everything is great! What is even worse is to further establish your confirmation bias by drumming up a few low ball ask prices and declaring the market is great, unreal. 99% of the commentary David publishes I can at least understand his perspective but this was the first time I am finding myself shaking my head.

Plain and simply the market is continuing to go through a cooling period which is illustrated by lower sales volumes with the 905 leading the charge. You don’t have to manipulate the data to see that the liquidity of the market is reducing which likely precedes some form of price drop or stagnation – 905 already is experiencing that, will it move to Toronto proper is the question.

Housing Bear

at 2:04 pm

Honestly, the only bullish argument to make is that at least September sales for this year were higher than last despite the fact that we got B-20 and some rate hikes. This however, does not change the fact that September was lower than August.

If you break it down by segment, detached actually did better than I would have expected. Think this is due to the strength in the condo sector over the past year, where buyers with a lot of condo equity can move up the chain. Condo sales have started to slow down fairly rapidly over the past few months, and we have record supply on its way. Still believe when all is said and done that condos will drop a lot more from peak to trough on a percentage basis. Never bet against the credit cycle.

Jennifer

at 1:48 pm

This analysis started off ok. But then it went into the land of, “There are three kinds of lies: lies, damned lies, and statistics.”

Chris

at 2:08 pm

Is this in reference to David’s analysis? Or housing bear’s analysis of that analysis?

Jennifer

at 1:09 pm

David’s.

Chris

at 1:32 pm

Thanks Jennifer, appreciate the clarification. Agreed.

Chris

at 2:07 pm

Bear,

Very well put. I was struck by many of the same thoughts while reading this article. Agree with all of your points. Thanks for articulating them.

Condodweller

at 12:27 pm

Interesting stats. I have a feeling that we are going to see an increasing number of these outliers until one day when we look back we see a trend. My prediction is still that we level off and continue moving forward marking time which is possibly the best outcome except for maybe those who are waiting to buy.

WRT sleep training it’s psych 101 positive/negative reinforcement. Like with anything else in life I don’t like extremes. My take away with my son was that as long as he is clean and fed don’t respond to the crying. However I think you have to be extremely careful with totally ignoring crying as my understanding is that babies cry for three main reasons: 1. they are hungry, 2 they need to be changed and 3. they want attention. The key lies with identifying #3 and ignore the crying then. At such a young age I believe regular feeding is important. So while as a parent you may feel a sense of accomplishment, it might not be the optimal situation for the baby. It may be a smart comeback to say you are not keeping her from sleeping but you may want to ponder whether or not you are keeping her from feeding.

I read in one of the “how to” books that if one totally ignores a baby’s crying he/she will actually die over time. I guess it gives up “crying” for food among other things. Obviously, that’s a theory, hopefully, but something to consider.

I found that sleep training was not just necessary but critical when they start climbing out of their crib.

Jennifer

at 1:55 pm

Ive never heard of “sleep training” up until this generation of new parents. There is just as much counter “science” that says leaving a baby to cry could lead to developmental damage as a result of high cortisol levels or could lead to emotional consequences. To each parent their own.

Mike

at 12:45 pm

Drop in sales have typically been a precursor to a drop in prices. But ever since the market went bonkers (Winter 2017) this hasn’t held true. I wonder why the two metrics seem to have decoupled?

Appraiser

at 1:03 pm

It’s not the stock market, it’s real estate.

Chronically low listing inventory is the main driver of the GTA’s sustained high sale prices. Demand is firm and there is no panic selling taking place, with vendors rushing to sell their homes because they are convinced of an imminent crash.

The only ones convinced of a crash are the perma-bears.

Because…bears.

Professional Shaker

at 1:48 pm

But Demand in 2018 is not showing that it is firm – 2018 sales is one of the lowest in the past decade. Also, what support is there that inventory is chronically low right now? 20,000 units with a demand of roughly 6.5k per month.

That being said at current levels that does not equate to a crash but it also doesn’t support 5%/year prices increase either……

Appraiser

at 2:34 pm

The number of multiple offers alone proves how firm demand is.

If there were more good listings there would be more sales.

A balanced market is between 4-6 months of listing inventory. The GTA currently has 2.6 months; and the 416 has 1.9 months of inventory.

The market is still firmly in sellers territory.

To knock prices down for real, there needs to be a sustained period of greater than 6 months worth of listing inventory.

Since real estate prices display nominal rigidity to begin with, I would estimate that at least two years of high inventory are required.

Housing Bear

at 3:47 pm

“The number of multiple offers alone proves how firm demand is.

If there were more good listings there would be more sales.”

So if there were more “good listings” wouldn’t there be fewer multiple offers? If fewer multiple offers, would this alone prove that demand is not firm?………………….. I wouldn’t think so because actual sales would be higher in your example right? I ask because I am trying to understand this market and actual sales are down quite substantially right now, as per David’s numbers above.

While total active listings can be skewed by terminating a listing and relisting at a later month, you are right that we currently do not have the total inventory levels right now to put tremendous downward pressure on prices. But neither did Vancouver at the start of this year. Or New York, Seattle, Sydney and Melbourne this time last year. Guess you could argue that those cities do not have world class neighborhoods like Leslieville. Or maybe its time for those who think they will be selling in the next couple years to get out now while they still can. Any boomers out there dependent on their home equity to fund retirement?

Each rate hike will reduce the amount of demand at every price point. As existing owners start to see their monthly carrying costs going up, we may find that more and more supply starts to come online. Especially when its a 2nd or 3rd property that is more and more money month over month.

I think the ongoing drop in sales is indicative that the only people who are convinced that housing prices can only go up are the perma-bulls.

Because……………. financial illiteracy.

Housing Bear

at 3:55 pm

*losing more and more money month over month

Chris

at 5:04 pm

CREA GTA MOI is above 3.0 for September 2018.

http://creastats.crea.ca/treb/images/treb_chart04_xhi-res.png

Appraiser

at 3:08 pm

At what point should OSFI consider reducing and eventually eliminating the mortgage rate qualifying test.

May I suggest going forward that the stress test percentage be reduced by the same amount as any rise in the BoC overnight rate until the full 2% point penalty is extinguished, if ever.

The program could be adjusted or re-introduced if need be at that point in time.

It would bring more stability into the Canadian market.

The stress test is a national requirement affecting every major lender in every province and territory. Not all real estate markets are super hot or over-priced.

OSFI needs to take their foot off the brake a little bit.

Derek

at 3:26 pm

Why? What problem are you proposing to solve?

Appraiser

at 8:58 am

The problem has already been solved. That’s my point. The number of transactions are down to record lows, any more punishment inflicted upon the market by continuing to enforce the stress test, as is, is just overkill.

Don’t forget, every sustained rise in interest rates increases monthly payments for everyone and removes at least some marginal buyers from the market, all on its own. I see little reason to continue to enforce a full 2% penalty as / if rates rise.

As some wag once wrote, “No more medicine is required doctor, the patient is sufficiently sick.”

Chris

at 9:49 am

OSFI’s mandate is to ensure the strength and stability of the Canadian financial system. It is not to punish, nor promote, the Toronto real estate market. Clearly OSFI felt that the B20 stress test was a prudent measure, in line with their mandate. I wouldn’t expect them to reverse course after only ten months.

Further, are you now implying that B20 is the cause of low sales volume? Weren’t you explaining in a previous post how demand remains firm, and that the low sales volume is only because there are no good listings?

Derek

at 9:57 am

I don’t understand why you believe the market is “sick”. Can you explain?

Also, it is not really a 2% penalty. No mortgage payment is paid based upon the stress test amount. I understood the whole rationale for it is that rates are/will rise. The whole point is that in a rising rate environment, the stress test reduces risk for financial institutions. That is, your suggested reason for stopping it is the reason it exists.

Chris

at 10:02 am

Bingo. Good points, Derek.

Housing Bear

at 3:53 pm

The stress test will be removed the second its clear that global interest rates are again on the decline (Keep tabs on the US fed). Until regulators are certain that we are not going to get a 70s/80s style inflation/ interest rate spike. They will keep this in place.

On top of protecting the big banks and would be buyers, it will one day be a good thing for prices believe it or not. Its removal may provide a nice stimulus and establish a floor on prices when this shit actually starts to hit the fan. For example, if enough blood has been let out of the market at that time, its removal may be my queue to jump back in.

Appraiser

at 9:37 am

I’m not proposing immediate removal of the stress test, but rather a gradual reduction of the 2% penalty as / when rates rise.

For example, if rates rise at the next BoC meeting on Oct. 30 by 25 points, then the penalty is reduced from 2% to 1.75%.

Repeat, modify or adjust as necessary over time.

Chris

at 9:59 am

The point of the stress test is to ensure borrowers can handle unforeseen increases in interest rates.

Gradual removal of the stress test would make sense if we knew there was a firm ceiling on interest rates. If/when rates rise by 0.25% at the next BoC meeting, what guarantee do we have that they will not rise by an additional 2.00% over the next few years?

Calling it a penalty is also inaccurate. It is not a punishment, it is a stress test and thus a limit to borrowing. It is no more of a penalty than the spending limit on your credit card.

Housing Bear

at 12:39 pm

I hear what you are saying. I do not personally believe rates will land 2% higher than they are today, some think inflation is about to come back with vengeance, I am not personally in that camp, but Chris is right that its about first making sure that they will not. A tapering could be a good way to go about it once regulators think we are getting close.

One thing I think should never have been included in B-20 is the stress testing of existing home owners on renewal if they wanted to change banks. They have already committed to the debt, why make it harder for them to get a better deal.

Carl

at 11:03 am

OSFI’s main objective is to protect the stability of financial institutions. That’s why the MQR was introduced, not for steering the real estate prices in some desirable direction.

As for the stability of the RE market, it has been quite stable with MQR in place. The prices are up or down only a few percentage points YoY. That’s in marked contrast with the instability in the period before MQR.

Appraiser

at 1:30 pm

Again, problem solved, stability realized, prices down and sales way down as a result of MQR. No reason to continue enforcing the program at full throttle as rates rise.

Perhaps it’s time to consider tapering it off a little.

Condodweller

at 3:48 pm

The problem is not solved. This stress test was put in place to protect consumers from themselves and prevent them from taking on a mortgage they could not afford if rates went up by only 2%.

Remember that we are only what, 1% off the historic bottom. Rates have come up 1% in about a year and 1% more the next is not impossible. It’s very easy to reach that 2% safety net.

The 2% helps in the short term but if rates were to really increase over say the next 5-10 years that would cause real problems not just for mortgagors but the economy in general.

It would not make any sense to remove this little safety net at extremely low rates. I know it may not seem extremely low because we have been here for a number of years now.

Rates in the late 70s went from around 8% to over 20% in the space of less than 10 years. The difference between then and now is that the size of your mortgage back then would have only been around what, maybe $50,000?

A 10% interest rate jump was nasty but still not catastrophic due to the math. Imagine what would happen to your monthly mortgage payment on a $600,000 mortgage if rates went up by just 5%. That would be catastrophic for many people who are taking on these mortgages with no room to spare in their finances.

When you stand back and consider the possibilities I would argue that the 2% is minimal and if anything it should be increased slowly over time.

Carl

at 10:04 pm

Let me repeat, in case it is still not clear: MQR was not introduced to solve some real estate problem that we can now declare solved. It was introduced, not by itself but as part of a whole set of other measures, to protect financial institutions in case of future shocks in RE markets. But of course it is possible that the 2% in the formula may change up or down as the estimates of future risks change.

Alex

at 5:01 pm

Looking through Ottawa figures I was surprised that their stats were not as good as I expected considering that their market was in better condition to begin with than Toronto. At this stage I presume stress test did make borrowing more difficult or banks are simply too scared to lend. I would say it is a national trend.

Joel

at 7:33 am

Are you calling for/predicting a global economic collapse?

Are you a bear on Toronto housing or the whole economy?

I could definitely see a recession coming, but I don’t have any stats/proof to back it up.

What makes you so certain we are going to see this collapse?

Geoff

at 9:01 am

“I could definitely see a recession coming, but I don’t have any stats/proof to back it up.”

I don’t mean to be overly critical but that’s the basic definition of confirmation bias.

Housing Bear

at 9:54 am

If you are asking me (If not going to address this anyway), I am a huge bear on Toronto housing , and a pretty big one on the whole Canadian economy. They’re are some worrying signs for the global economy, but I believe collapse is too strong of a word.

The route cause of the problems we have in Canada today I believe can be traced back to the Great recession. When the US and Europe were on the brink , their response was reflation. Pump up asset prices back up to the levels that the debts were contracted at. This is why we got QE and record low interest rates. Both of those economies were on the brink of a deflationary spiral and these measures prevented further distress. China, worried about the impact of a slowdown in its two largest export markets, decided to go on an absolute infrastructure building bonanza to keep its economy afloat. For example, in the 3-5 years following the GR, China pored more concrete than the US had in all of the 20th century. Now they have numerous ghost cities, and bridges and roads to nowhere. In fact, about 1/2 to 3/4 (can never fully rely on numbers out of china) of new global debt created since the GR has come from China.

I like appraisers quote above ” No more medicine is required doc, the patient is sufficiently sick”

Canada is a passenger economy, and we got prescribed the same low interest rate medicine that Europe and the US did. We did not have our own QE, but the impact of their QE still resulted in way more liquidity at all banks (way more money to lend out). The result – the medicine has now given us the disease it was meant to prevent in those that actually were sick.

China’s infrastructure binge, drove up the price of commodities which further helped out Canada’s economy. Australia was/is almost in the exact same situation as us, this is why I really like to keep tabs on how Sydney and Melbourne or doing. Their housing bubbles have popped and look llike they are entering the free fall stage. One thing I should point out though is that those alligator wrestling, kangaroo punching idiots actually allowed for adjustable rate/ teaser rate mortgages which have all started to reset. We at least learnt one lesson from the US bubble.

So where is Toronto housing and Canada’s economy at today? Well for the former, we have have record household debt levels, we are at or near record high prices, which now greatly surpass all prudent fundamental measures. Price to rent, price to income, debt service ratio etc. On a lot of these measures we are actually worse off than US households were last decade.

For our economy, FIRE (Finance, insurance, Real estate) makes up 20% of our GDP. 2/3rds of our economy is based on consumption. As debt servicing takes up more and more of our disposable income expect to see a drop in auto sales, new home appliances, restaurants etc…….by the way auto sales were down 7-8% YOY in September.

Not predicting the following;

We sill have commodities, but we have issues getting them to global markets, and if China’s debts come home to roost, expect commodity prices to collapse. If the China debt situation is really bad and caused its own financial crisis than that could be a trigger for a larger global recession. The US, and Europe still have some pretty bad debts, and if something unexpected happened there that could also have some pretty big global consequences. If something bad hit all three of those economies at the same time than that is your global collapse scenario. Not predicting that though, way above my head.

Craig H.

at 8:26 am

Hubris! Not on the market analysis but on the sleep training. Sometimes it works, sometimes it doesn’t – depends on the kid. And (not to scare you)….sometimes it only works for a while. Our first kid slept great and we thought we were the best parents ever. Second kid…not so much.

CB

at 7:56 pm

I was thinking the same thing. One kid slept through the night, her first night home from the hospital. Son didn’t sleep through the night for two and a half years.

Off topic, sort of: We are from the US. We just sold our Sarasota, FL house because I saw prices were at 2007 levels, and it had me concerned that we should sell NOW. (And we wanted a condo with reduced maintenance.) The US government is too chaotic, at the top, to maintain a stable economy. We also moved our retirement savings from the US to Toronto.

I’ve just started to think about buying here, but will wait, and continue renting.

Kyle

at 9:08 am

When i look back at what transpired in September, both statistically, and from the activity i’ve seen in the neighbourhoods i follow, my reaction is – Meh. I don’t think it was particularly strong, but certainly no sign of a crash coming. It actually felt somewhat balanced from a flow perspective. Good houses seemed to sell very quickly and for higher than previous year prices, and frankly higher than Spring 2017 prices, while old stale listings (or should i say re-listings) languished. Not a lot of bustle, but it also didn’t feel like there was overwhelming supply or overwhelming demand.

Professional Shanker

at 10:38 am

But David admitted that September should represent a peak month – so meh is not a great sentiment.

Take a peak at the 905 – September was terrible and considering the 905 represents 60% of the total market, it would be foolish to not consider what is happening in the whole GTA market. I don’t really understand the narrative of looking at the Toronto core only in order to draw an inference of the market.

If the GTA continues to bleed due to affordability, etc. does this not have an effect on Toronto core? In a downturn the core city holds up but surely it cannot decouple from its close neighbors.

Kyle

at 1:43 pm

I wasn’t speaking for David, just my own impression. Nothing extraordinary to me about one month’s data. I don’t follow the 905’s at all, but from what i can see in the TREB report is this:

2018 Sales = 3788

2018 Detached = 912,921

2018 S/D = 630,797

2018 Town = 586,731

2018 Condo = 428,360

vs

2017 Sales = 3894

2017 Detached = 905,722

2017 S/D = 661,907

2017 Town = 600,947

2017 Condo = 455,686

In my view this too is Meh. I actually don’t see what’s so terrible about it. I actually don’t understand the narrative of always pointing at the 905’s to find a black lining. The way i see the market working is 416 prices tend to drive 905’s, not the other way around.

FreeMoney

at 5:28 pm

Meh. Agreed. Chill, folks.

Chris

at 10:37 am

OSFI to take further action:

https://business.financialpost.com/personal-finance/mortgages-real-estate/osfi-to-take-new-measures-to-address-equity-based-mortgage-loans

“There have been improvements in the quality of new mortgage loans since the revised B-20 guidelines came into effect this past January, OSFI says, “including higher average credit scores and lower average loan-to-value at mortgage origination.”

But even though OSFI said the new rules “are having the desired effect of helping to keep Canada’s financial system strong and resilient,” the regulator claims more work is needed.

“Although reduced, there continues to be evidence of mortgage approvals that over rely on the equity in the property (at the expense of assessing the borrower’s ability to repay the loan),” the newsletter said. “OSFI will be taking steps to ensure this sort of equity lending ceases.”

Seems you shouldn’t hold your breath waiting on the elimination of the stress test, appraiser.

Condodweller

at 10:52 am

I don’t know if anybody noticed but real estate trusts have been hitting 52 week lows recently. Real estate trusts typically don’t fair well under two conditions: 1. rising interest rates 2. lower real estate prices. Could this be a leading indicator?

Appraiser

at 11:04 am

“The September housing starts report fits with the relative calm and return to normality in sales, market balance and price growth that we are seeing across most of the country this year, in particular Toronto, following speculative excesses in Southern Ontario earlier last year and a moderate correction in response to policy measures earlier this year,”

“Demand continues to be supported by the fastest population growth in 27 years and new millennial-led households.”

Sal Guatieri, senior economist BMO Capital Markets

https://www.cbc.ca/news/business/cmhc-housing-starts-slow-september-1.4855441

Chris

at 11:13 am

Whoops, you cut off the conclusion of Mr. Guatieri’s quote:

“A calmer housing market is just what the doctor ordered, and won’t discourage the Bank of Canada from raising rates on Oct. 24.”