When your “favourites” drop-down menu in Google Chrome is too long to fit on the page, it’s time to clean it up.

Those links to sellers on eBay that you haven’t visited in a while, and the Hotmail account that you never use – as though you can’t just type “hotmail” into the search bar, which probably takes less time than scrolling through your favourites.

It’s time for me to clean out my favourites list, and I’m starting from the most recent.

Every week, I bookmark about 30 newspaper articles, and by the end of the weekend, I make sure they’re all read.

That makes for a lot of late Sunday nights when I should probably be in bed, but any article bookmarked and not read leaves me that much less informed.

I’m sitting here right now with a slew of real estate articles from the past week, and I realized that they’re all about different topics. In fact completely different topics.

Affordable housing, condo-flipping tax cheats, anti-landlord legislation, and first-time-buyer affordability.

So I figured, what could possibly be a better topic on a Friday morning?

Plus, I’m sure by now, you’re tired of hearing about Michael Cohen, Justin Trudeau, and Ariana Grande.

Here are the four articles, excerpts, and my thoughts. But do yourself a favour – read the articles! Even if you do so in bed, on Sunday night…

Globe & Mail, February 26th, 2019

“Affordable Housing Becomes Singular Focus of Toronto’s New Real Estate Czar”

Maybe I’ve been watching too much Narcos on Netflix, but when I see “Czar,” think drugs.

In this case, it’s actually about real estate. But ever since our government decided to start selling weed, I wouldn’t put anything past them…

“CreateTO” is a real estate agency operating at the City of Toronto level, which very few people in Toronto have even heard of. A quick poll of my office shows that 0/6 people know what this agency is.

According to the City of Toronto website:

Launched on January 1, 2018, CreateTO is the City of Toronto’s new real estate agency established to manage the City’s real estate portfolio, develop City buildings and lands for municipal purposes and deliver client focused real estate solutions to City divisions, agencies and corporations

CreateTO is part of the City-wide Real Estate Transformation, which for the first time allows the City to apply a city-wide lens to ensure the effective use of all of the City’s real estate assets.

As a catalyst for city building, CreateTO leverages the City’s real estate to ensure its best use and create new opportunities.

There’s more fluff on the site, but the “City-Wide Real Estate Transformation” link is worth a read. This nugget warrants discussion:

The new agency will be led by a nine-member board of directors, comprised of two Councillors, the Mayor or designate appointed by the Mayor, and six public members, one of whom chairs the Board. The real estate delivery model will be coordinated and aligned through key governance mechanisms.

Right. So in my mind, I see the creation of even more government, which as we know, doesn’t necessarily mean either efficiency, or action.

Nevertheless, the “czar” and CEO of CreateTo has put his money where his mouth is according to the Globe & Mail article:

The new CEO of Toronto’s centralized real estate agency, CreateTO, says success in his new job will be measured by just one yardstick: how much affordable housing the city manages to build.

“It’s the burning platform,” said Brian Johnston, a former Mattamy Homes executive whose appointment was ratified by city council last month. “I think this organization will be measured on its success in that area. And the city will be measured, and the mayor will be measured. I think everybody’s got the message.

The city of Toronto has over 8,400 properties (buildings, parking lots, vacant land) worth $27 Billion, from which CreateTO is looking to complete 40,000 new affordable units in the next 12 years, which was Mayor John Tory’s stated goal last year.

In my opinion, and this is one of the rare times I will applaud any level of government, Brian Johnston is the perfect person to be the CEO of CreateTO. As a former executive of Mattamy Homes, a private company, perhaps he can take his business acumen to the public sector. At the risk of ruffling any feathers here, let me say that I believe the private sector runs any and every industry more efficiently than the public sector. Can we possibly disagree on that? Yes? No?

In order to be successful at squeezing blood from a stone, the CEO of CreateTO needs to be a businessman or woman, and not just another political mouthpiece.

I’m very pleased with this announcement.

CBC News, February 25th, 2019

“First-of-its-Kind Registry In B.C. Targets Under-The-Radar Condo Flippers”

Now here’s an idea!

When it comes to drama and real estate, British Columbia is always at the forefront.

Let’s not forget that it was only three years ago that Globe & Mail reporter, Kathy Tomlinson, shocked the country with her massive expose on Shadow Flipping in the Vancouver real estate market. If you’re new to TRB, or real estate, or both, read that article link!

After the shadow flipping came tax dodging, again exposed by Ms. Tomlinson in the Globe & Mail. The government of British Columbia reacted with investigations, and legislation, but as is always the case, it was after the problems came to light.

Then came conversations about speculation taxes and vacancy taxes, end eventually the government implemented some of these tools, along with the now-famous 15% “Foreign Buyer’s Tax.”

Time went on, and more problems arose in British Columbia, with more promises to clean things up by the government.

In 2018, Kathy Tomlinson was back at it again, revealing a money-laundering scheme in B.C., and once again, the government reacted.

So here we are in 2019, and the government of British Columbia has decided to “partner” with developers to compile a database of condo assignors (ie. those who purchase the paper, and eventually flip to other buyers), in order to ensure the assignor/flipper pays taxes.

It’s great.

But it begs the question: why is this only happening now?

As was the case with EVERY single story that Kathy Tomlinson broke over the last three years, the government is always reactive rather than proactive. Perhaps it’s fair to suggest that condo-assignments were a relatively new animal, and it took some time to figure out what was going on, and how to deal with it, but assignments have been around for over a decade. Why is the government only reacting now?

From the article:

The Ministry of Finance says the Condo and Strata Assignment Integrity Register will improve fairness and transparency in property transactions.

Finance Minister Carole James said in a news release that the register will take “real action to moderate the condo market” and is already starting to see results in Metro Vancouver.

Condo developers will be required to securely gather and report the identity and citizenship of anyone completing a contract assignment in a project.

Developers are now required to collect and record assignment information and file a report each quarter, with the first due April 30, covering the period from Jan. 1 to March 31, 2019.

“The B.C. government will use this information to ensure that people who assign condos are paying the appropriate income tax, capital gains and property transfer tax,” the release says.

It’s interesting to note that the NDP government in B.C. released a “30 Point Housing Plan” last year, which clearly trumps the Ontario Liberals’ 16-Point-Plan from 2017, oh, I dunno, I’d say, by about fourteen points…

“The Way To Solve The Rental Crisis: Be Nicer To Landlords”

Why would anyone in their right mind get into the apartment business?

That sub-heading says it all.

And yet despite the logic behind that sentiment, things are only going to get worse for landlords.

Why, well, it’s just the way society is going, in my opinion.

Forgive my political, old-man, Chicken Little tangent here, but look what’s happening south of the border right now. There’s a mad-man in the White House, and all the Democrats had to do in order to take back power in 2020 was not go crazy. Just show up, keep quiet, and wait. And yet what did they do? They went crazy! From January 1st onwards, it’s been 70% tax rates, eliminating all air travel within 10 years, because the world is going to end in 12 years (fact), and my favourite: shaming people who are successful. Elizabeth Warren is Tweeting that Jerry Jones is evil because he purchased a yacht with his own money? America doesn’t like Trump, but they like extreme-socialism even less.

So that’s my rant.

And the takeaway is that it has never been less ‘woke’ to be successful, and it’s never been more frowned upon to have.

So why would the government, at any level, in any jurisdiction, protect landlords that have a second property? That have the means, from hard work, and after-tax dollars, to invest?

They wouldn’t.

And they won’t.

And this article, while making perfect sense, is going to fall on deaf ears. “Being nicer to landlords” is equally as much a fantasy as AOC’s “Green New Deal.” Maybe more, and that’s saying a lot, for those of you who follow U.S. Politics.

Globe & Mail author, William Watson writes:

Why would anyone in their right mind get into the apartment business? Think of the obstacles to making your money back. Restrictive zoning, comprehensive regulation, zealous activists, rent control, high property and income taxes, new proposals to tax wealth, direct competition from subsidized government housing, and so on and so on. Putting up an apartment building isn’t quite as hard as building a pipeline, but it is in the same ballpark.

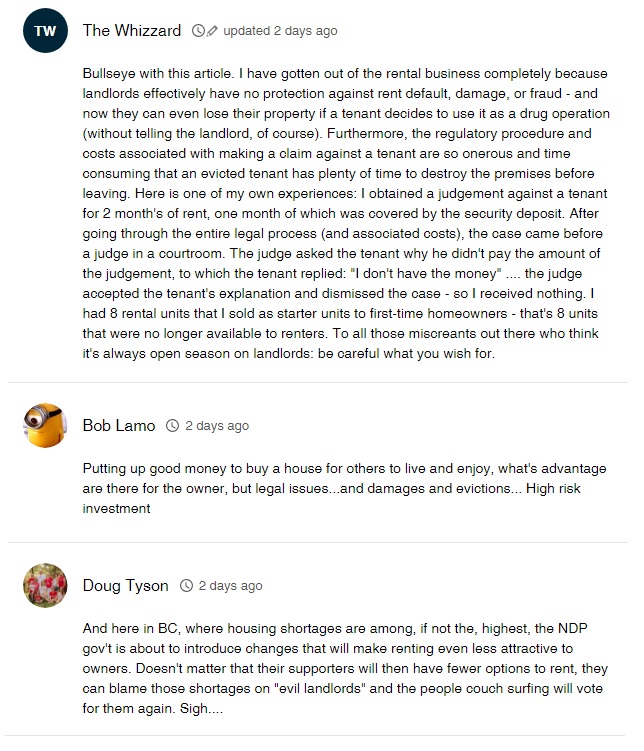

The comments on this were somewhat split, with a handful of people calling this a “propaganda piece,” but most people agreeing.

A sample of the comments from page one sheds some light on how readers feel:

National Post, February 24th, 2019

“Five Things The Government Could Do To Help Canada’s Stressed Out Home Buyers”

We had this conversation a while back on TRB, discussing what changes the Liberal government, provided they win the next election, are going to make in order to make home ownership in Canada easier.

The five solutions this author has come up with:

1) Allow longer amortizations. Bring back the 30-year, CMHC-insured mortgage that we had before 2012

2) Adjust the stress test. Citing 20% fewer mortgage originations among young Canadians.

3) Bigger first-time home buyer credits. Possibly doubling the credit from $750 to $1,500.

4) Build affordable housing. More government-subsidized housing for low-income earners.

5) Do nothing. Perhaps the most responsible suggestion for those who believe in the free market.

I honestly think we came up with a better list when we discussed this last month, but at least this article gets people thinking.

Not everybody out there reads TRB, and not everybody sits around and ponders (or agressively discusses on a message board…) what the government could do in order to increase housing affordability, and/or whether they should do anything at all.

The comments on the National Post article, however, seemed to all draw connections between higher housing prices, and increased immigration and foreign buyers.

I would add that as point #3 goes, I don’t agree with NDP leader, Jagmeet Singh, and his proposed subsidy for anyone paying more than a third of their income on rent payments. It surmises that people are responsible with their finances, and thus the only people spending more than a third of their income on rent are those that have no choice. But if the former were true, there would be about 100,000,000 less iPhones in circulation today, as well as other consumer goods, but I digress…

I agree that the government should build more affordable housing. Start today. Start yesterday. Just like I say about public transit: start building, and don’t ever stop. We’re never “finished.”

But I would also be in favour of longer amortizations, reducing the stress test from 2.0% to 0.75%, and sure, why not double a tax credit that will have very little effect – $750 to $1,500. I mean, that’s just a new iPhone XR for most people.

Have a great weekend, everybody!

Housing Bear

at 10:10 am

If the goal is to preserve liquidity for older generations like the boomers, or to keep the economy going until the election than I think lowering the stress test and extending amortizations for first time buyers is the play.

If the ultimate goal is to improve affordability for the poor millennials then why not tighten credit further. Wait two years, and see what happens to prices. Loosen credit again, then allow the Mills (and pent up demand) to lead the housing recovery at much lower prices than they are today. The mills will carry way less total dept, the lifetime interest paid to the banks will be much lower and this money can be used for other investments or consumption AND monthly mortgage payments will be lower AKA affordability. Sucks for existing owners, but only if they need to sell in the next 4-8 years…….. but as people on this site have told me, barely anyone will be forced to sell!!!!! RE only goes up long term right? So if you own today, dont worry about the 30% haircut. Be happy that others are getting into the market. You will still be way ahead down the road.

If the goal is financial stability, then keep these measures in place to keep the riskiest borrowers out of the market. When economic gravity really starts to kick in, you can remove them which will act as a form of stimulus and will help to put a floor on how far it drops.

Wha...?

at 10:14 pm

Private sector. Health care. United States. Costliest in the developed world (and far from the best).

Cue the apologists.

Wha...?

at 10:28 pm

“America doesn’t like Trump”?

Where do the 63 million Trump voters live? Timbuktu? Okay, 73 million voted against him, but that still leaves more than 100 million registered voters who didn’t vote at all (i e. chose not to vote against him).

Mxyzptlk

at 10:39 pm

A 70% top income tax rate is “extreme socialism”? Say hello to Dwight “Trotsky” Eisenhower, he of the 91% top rate throughout his entire two-term administration. Even “Red Ronnie” Reagan kept it at 50% until late in his reign.

Get a grip, David.

Chocky

at 11:48 am

Okay, socialism hater, let’s see you burn your OHIP card.

Didn’t think so.

Jimbo

at 9:32 pm

I would burn it if I could get private insurance in Canada.

Not Jimbo

at 8:51 am

Then why do you live here when such a super awesome country is so nearby?

Chocky

at 12:22 pm

Wrong, David. As a recent article in that noted left-wing rag Fortune magazine (“Most Americans Support Increasing Taxes on the Wealthy”) points out, even a poll commissioned by Fox News showed that a good two-thirds of Americans (and more than half of Republicans) support higher taxes on rich(er) people. Agree or disagree, but get your facts straight.

http://fortune.com/2019/02/04/support-for-tax-increase-on-wealthy-americans-poll/