So, how was your summer?

Mine was great. And now it’s over…

Sometime around mid-July, I told my wife, “This summer is going by really fast! We’re going to be carving pumpkins before you know it!”

I do this to her all the time and she hates it.

“Live in the now,” she tells me. But if I did that, I would lose my best friend in the whole world: anxiety.

And you just know that when we finally do sit down on the back deck in October and get out a magic marker, a knife, and a spoon to attack those pumpkins, I’m going to lean over to my wife and say, “See? I told you summer would fly by and it would be Halloween in the blink of an eye!”

Oh, she’ll love that.

She always teases, “You have this uncanny ability to predict that the future will in fact happen – in the future.”

Well, I also have this uncanny relationship with time; it can’t be stopped or controlled, and that bothers me.

So alas, the summer was fleeting from the very moment that it started, but we packed in as much as we could. Two trips up to cottages (one family, one friend), a return to Deerhurst for the first time since 2019, more parks, play centres, and attractions than I can count, plus the C.N.E and Buskerfest over the long weekend.

I hung up my golf clubs last week. It’s time to relax the body and focus on running in the fall. It’s a great time for it. There’s nothing quite like a long run, late on a Sunday morning, then coming home in time for NFL games at 1:00pm.

Truth be told: I don’t like the fall.

I’m a summer guy, and part of the reason I’m so focused on the fact that summer will end and the fall will be here is that it’s a defense mechanism to help cope with the end of my favourite season and the start of my most hated one.

But as sad as this is to say, I always enjoy the start of the fall real estate market, and that helps me get back into things.

I need routine in my life. I need schedules. I thrive when there’s an established order of things.

The summer is great but it’s slower in real estate, and I really find my groove when we’re busy.

Lucky for me, things are about to get very busy.

We have about ten listings in the queue for the coming weeks, and there are plenty more on the way once people find their bearings in the fall, and others purchase and then go to sell.

We have both holdover buyers from the spring/summer who will be active again, as well as new buyers who just started their search mere days ago.

Whether or not we see inventory this fall for those buyers remains the question. In fact, it will end up being one of my “Burning Questions” as you’ll soon see below.

So as is often the case here on TRB, let’s look at the upcoming market cycle and discuss what will undoubtedly be the top stories…

1) What will happen with interest rates?

How in the world can this be the top story?

Shouldn’t home prices be atop our list?

Maybe.

Perhaps we could call this 1 and 1A, but home prices do depend on interest rates, and since prices have been relatively flat of late, and interest rates have been jumping, it’s a much sexier topic!

Although there have been ten interest rate increases since early-2022, more are rumoured to be on the way.

But it’s not just the interest rate itself that’s newsworthy, but rather whether the Bank of Canada “will or won’t” raise rates. Honestly, the discussion and attention paid to this is exhausting. It’s like talking about whether Ross and Rachael “will or won’t” get together on Friends in the late-1990’s. Those that know, know…

We’re also discussing whether the bank of Canada should raise rates, as well as all the reasons why they shouldn’t.

All told, I think interest rates have become the hottest topic in finance or real estate in this country in 2023, and I don’t expect that to change.

But to fully comprehend the interest rate environment we’re currently in, one has to look at multiple charts based on multiple timelines.

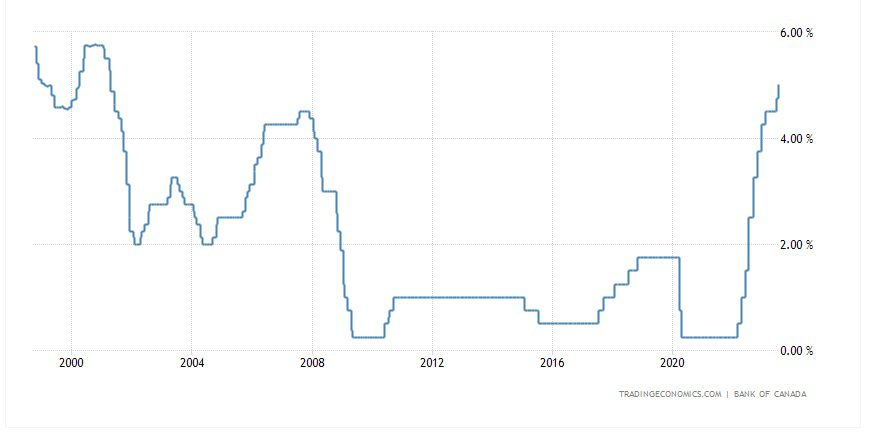

Here’s a five-year chart of Canada’s key interest rate:

One might conclude, “Rates are extremely high.”

Or one might suggest, “Something crazy happened in this market.”

Both might be true, but both might be false, based on how we see this on a relative basis.

Here’s a 25-year chart:

Looking at this chart, one might conclude, “Rates were really low from 2009 through 2020.”

That’s a very different sentiment than what one might express looking at the first chart.

It’s all about perspective, and our parents can refer us to a period of time when interest rates were over 20%.

There are three more interest rate announcements scheduled for 2023:

September 6th

October 25th

December 6th

“Will they, or won’t they,” has been discussed since the last rate hike in July, and for while, it looked like they wouldn’t.

Then, it seemed they would.

Now, we’re not so sure again.

Last week, we learned that the Canadian economy actually contracted, with GDP declining at an annualized rate of 0.2%.

The contraction was a massive surprise, but it was even worse when you consider that the Bank of Canada predicted a 1.5% increase.

It shows that even the Bank of Canada has no idea what to expect in this economy, and it might show that it’s time to stop quantitative tightening.

Here’s a good read:

“Canada’s Economy Unexpectedly Contracts In Second Quarter”

The Globe & Mail

September 1st, 2023

From the article:

A portion of the slowdown is the result of idiosyncratic factors. Numerous industries were affected by wildfires in June, including mining, rail transportation, oil and gas extraction, and accommodation, particularly RV parks and campgrounds. In April, a strike by federal government workers weighed on public-sector economic activity.

That said, there were plenty of signs of a more generalized slowdown in Q2, after a strong first quarter. The contraction was led by a 2.1-per-cent drop in housing investment, which included an 8.2-per-cent fall in new construction and a 4.3-per-cent pullback in renovations. Statscan said these declines coincided with the Bank of Canada’s resumption of monetary policy tightening in June, after a five-month pause.

Household spending also slowed in the quarter, growing 0.1 per cent compared with 1.2 per cent in the previous quarter. Shoppers balked at new passenger cars, furniture and outdoor recreation gear. This was offset by a bump in spending on new trucks, vans and SUVs, which are coming to market after an improvement in auto supply chains.

The fallout from the economic contraction seems to be a consensus among “experts” that the Bank of Canada won’t increase rates in September.

We saw a lot of headlines like this one last month:

“Economists See Bank of Canada Holding On Rates After Surprise GDP Contraction”

Canadian Press

September 1st, 2023

Then again, we’re less than one month from reading headlines like this:

“Canada’s Inflation Rate Ticks Up To 3.3% In July, Raising Odds Of September Rate Hike”

The Globe & Mail

August 15th, 2023

So which is it?

Are interest rates going to rise because of inflation, or are interest rates going to remain because of a contraction in GDP?

Trying to solve that puzzle is like trying to solve a Rubiks’ cube in under 3.3 seconds.

However, some insight from Benjamin Tal might make Ernő Rubik‘s invention seem simpler.

Here’s a great quote from the man, the myth, and the legend in an interview with the Financial Post last week:

“The Bank of Canada will take a recession over inflation any day.”

Alright, so does that settle it?

A contraction in GDP doesn’t mean anything to the Bank of Canada, so long as inflation is above 2%?

Not when we’re seeing things like this in our country:

“B.C. Premier Urges Bank Of Canada To Halt Further Rate Hikes”

Financial Post

September 1st, 2023

Oh, wow.

David Eby wrote a letter to Tiff Macklem, eh?

I don’t think they’re pen pals from camp. I think this is a bit more serious…

Premier Eby is urging the BOC governor to “consider the human impact” of the rate hikes

“People in B.C. are already hurting. In your role as governor, I urge you to consider the full human impact of rate increases and not further increase rates at this time.”

Premier Eby also wrote a letter to Justin Trudeau, and among other things, he said:

“There are other ways for us to achieve cost stability, but they do require diligence and co-ordination. The time is overdue for such an effort. Ahead of September’s rate decisions, I suggest a robust and targeted approach focused on the largest contributors to inflation.”

Mr. Trudeau is already packing his suitcase. This is looking for love in all the wrong places…

One last line from Benajmin Tal before we move on:

“There is no need to raise interest rates. The economy is slowing down, the housing market is slowing down rapidly, even inflation is behaving if you measure it correctly.”

Well, with that said, let’s see what happens on Wednesday…

–

2) Where is the average home price going this fall?

It’s going up.

But up from August, when it was down.

Huh?

Well, it all depends on the narrative you want to create…

The TRREB numbers will likely be released on Tuesday so I don’t have them as I write this, but the August average home price will be down from July substantially.

Will the media run with this? Maybe.

But to print headlines reading, “Toronto Home Prices Drop 8% Last Month” will be misleading, as it always is.

August is a depressed month. The entire summer is a depressed market.

So for comparative purposes, we need to consider that September, October, and November constitutes a “prime” market cycle, and thus compare it to the prime market in the spring.

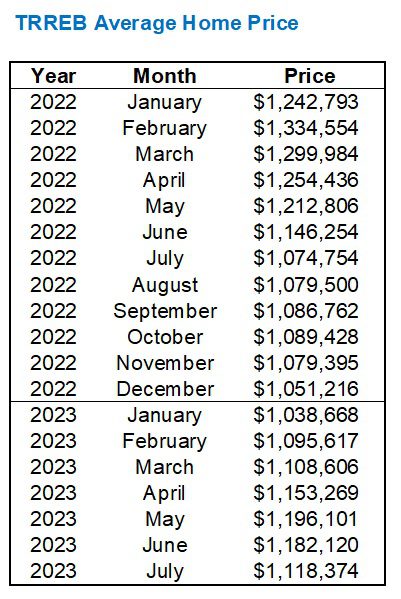

As a refresher, here’s the TRREB average home price since the start of 2022:

We all know the story here.

The peak came in February of 2022, then came ten successive interest rate hikes.

The 2023 market rallied from a low of $1,051,216 in December to a high of $1,196,101 in May, but the market fell off in the summer.

As I said, the August price will likely be lower than July, but we really need to compare apples to apples.

Let’s say that the “peak season” in spring is February, March, April, and May.

Then let’s say that the “peak season” in Fall is September, October, and November.

Now, let’s say that we took an average of the spring and put it up against an average of the fall.

What would that look like?

Something like this:

A lot of data went into this, but what you see is simple.

Over the last ten years, we should come to expect that the average fall price will exceed the average spring price.

The only two instances where it did not was in 2017, when the government intervened in the housing market, and in 2022………….when the government intervened in the housing market.

It’s also worth noting that the whopping 10.0% increase in 2020 is due to the depressed prices in April and May during COVID.

So what should we expect to see this fall?

It depends on whether 2023 falls into the same boat as 2017 and 2023. Are we still able to claim that the government is “intervening in the housing market?” Or is it unfair to extend the 2022 intervention and interest rate hikes into 2023?

In the spring of 2023, we saw the following average home prices:

Average out those months, and it’s $1,138,398.

Given that the average home price in July was $1,118,374, and that I expect August’s price to be below $1,100,000, I don’t think it’s unreasonable at all to assume that the average of September, October, and November to be above $1,138,398.

The real question in my mind is this:

Will the average home price in any of September, October, or November be higher than the $1,196,101 average home price from May?

Forget the averages of averages.

Will we peak this fall?

–

3) What will inventory levels look like this fall?

Good news: inventory was higher in July of 2023 than in July of 2022 or 2021.

Bad news: inventory was lower, by a heckuva-lot, every other month so far this year…

If I’ve said this once, I’ll say it again: if I were selling real estate in the Toronto market they way they do on real estate television shows, then every single one of my buyer-clients would buy a house within weeks of starting their search.

It’s so formulaic, right?

The happy couple, relocating from Valdosta, Georgia, to Santa Fe, New Mexico, have “local Real-a-tor, Randy” show them exactly three houses and they sit on a park bench and weigh the pros and cons of each home before making an offer which is accepted after the seller agrees to fix everything noted in the home inspection, and pay the buyers’ closing costs.

Excuse the run-on sentence, but seeing as these shows are able to cram four months’ worth of work in reality into a twenty-two-minute episode in fantasy, I figured it was fair.

I have about eight active buyer clients at the moment and one has been looking for two years, whereas one has been looking for two days. But in between are a lot of buyers who have been patiently waiting for “the right property,” and many of whom would admit they’ll settle for the “almost-right property” on account of how little inventory there is out there, and has been.

“If we can check eight out of ten boxes, we’ll do it,” goes the adage.

Well, if the Toronto market were a reality real estate show, they would all get 10/10 on their list and they would buy within hours of their plane touching down at Pearson or Billy Bishop…

The story of our 2023 real estate market thus far, believe it or not, hasn’t been about interest rates our housing prices, but rather about inventory – or lack thereof.

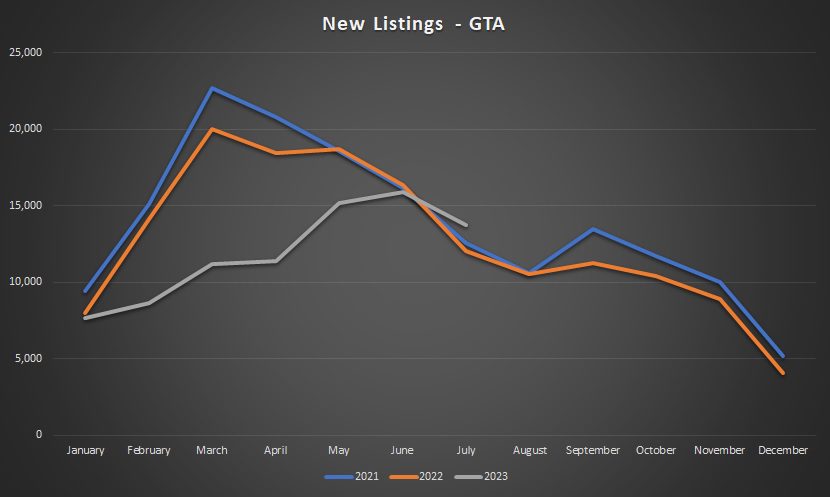

Let me show you one simple chart that will drive this point home and have you asking, “Why haven’t we talked more about this?”

This is the amount of “new listings” coming out each and every month, and the grey line represents 2023.

While it looks as though January starts with the three years aligned, they aren’t.

January of 2021 saw 9,430 new listings and January of 2023 saw 7,688.

That’s a decline of 18.5% which is substantial, only it doesn’t feel like it, since the gap widens astronomically in the spring.

For example, we saw 15,137 new listings in February of 2021 but only 8,637 in February of 2023.

That’s a decline of 42.9%.

And in March, that decline from 2021 levels rose to 50.8%.

What can we do in a market where half the amount of produce is for sale?

Hope and pray, I guess. At least if you’re a buyer…

Amazingly, the effect in 2023 hasn’t been skyrocketing prices. Yes, prices rose in early-2023, but not back to 2022 levels.

So while the number of new listings in Toronto drew even in June and surpassed the 2021 and 2022 levels in July, we have to wonder what it will look like this fall.

–

4) Will we be seeing more “offer dates” this fall, or “offers any time?”

I want you to play real estate agent here, for a moment.

I have a condo townhouse in the west end that’s worth somewhere between $900,000 and $1,000,000.

I know. That’s a huge spread, right?

But the “value” is based on the potential sale price, and the potential sale price really, truly is between those two figures.

It all depends on the staging and marketing, and how the condo looks, plus the pricing strategy, and how the market goes this fall.

So what do we do? How do we price?

Do we list at $989,000 with “offers any time?” Perhaps this will bring in those buyers who don’t want to bid against others in competition on a scheduled offer date.

Or do we list at $779,000 with an “offer date?” Perhaps under-pricing will result in those dummy offers that merely help to push up the bid prices from the serious buyers?

There are pros and cons to each strategy and I continue to dwell on both of them.

I don’t think this condo is actually worth $989,000 or anything close to it.

In fact, the only way to get anything near that price is to list at $799,000 or even $699,000, with an offer date, and work the hell out of agents and buyers who show interest.

But what if the market is sluggish and that doesn’t work? Don’t we want to figure that out ahead of our listing, so we avoid implementing a pricing strategy that’s destined to fail?

Listing at $989,000 when this condo is worth $900,000 is an awful idea, and not only will it take forever to sell, but one or even two price reductions will signal to the buyer pool that this isn’t a good listing, or that it’s having trouble selling, or that the seller has no leverage to negotiate.

But listing at $799,000 with an offer date, then re-listing at $929,000 after that offer date fails, is also a disaster, much like the failed strategy above.

Some listing agents and buyers only consider the upside of the two listing strategies, but it’s crucial to look at the downside as well.

What’s the best-case scenario? What’s the worst-case scenario?

How could things go right? How could things go wrong?

What’s Plan-B in in the list-low, hold-back strategy? What’s Plan-B in the list-high, offers anytime strategy?

Right now, there are a lot of listing agents going through this exercise and a lot of anxious sellers waiting for direction and insight.

But the truth is, we might not know how to list and at what price until we see how the first few listings sell this fall.

I have one particular listing that is coming out at $2,995,000, no matter what happens in the market. But that’s a different property type at a different price point, and it doesn’t matter whether the market is up, down, or sideways.

But my west-end townhouse? That’s another story. We might list at $799,000 with an offer date, or even $699,000 if the market went absolutely bananas, but we might also list at $929,900 or $949,900 if “offer nights” aren’t bearing fruit.

And what about my $1,800,000 house in the Beaches? Should that be listed for $1,499,000 with an offer date? Maybe. But it depends on what the prevailing trend is in the first few weeks of September, as we will likely list at the end of the month.

As crazy as it is to tell your clients, “Determining the listing price is the last thing we do in this process,” it’s actually not crazy. It’s responsible.

What does this mean for buyers?

It means confusion. And it could mean frustration if actual market conditions aren’t lining up with perceived market conditions in the eyes of the seller.

But make no mistake: this will be one of the big stories in September.

Well, that was lengthy!

And we’re only through four “burning questions,” with six more to go.

I’ll trim them down for Thursday. Probably. Maybe… 🙂

Different David

at 8:30 am

I can’t agree with you enough about the listing price. Gone are the days when you underprice it by 15-20% and expect the throng of buyers to give you the market value on offer night.

I think that the key message to sellers is to be patient. Temper your expectations that their house will sell with 10 days, it’s only a question for how much above ask it will go for. They need to stage, market it, and price it effectively. Trust your realtor that they have priced your home accurately, but don’t be static – look to see if prices are falling, and get out in front if necessary (See David’s previous post on grabbing a falling knife).

And please, sell first before buying. You don’t want the stress of owning 2 homes. The worst that happens is that you put your stuff into storage and AirBnB for a few months.

Derek

at 10:24 am

Anyone remember the timing of the post with the last prediction “game” or “contest”? Wonder where things are at?

What’s up with the “government intervention” narrative?

David Fleming

at 6:11 pm

@ Derek

I suppose you could argue there was a difference between the type of government intervention in 2017 and 2022.

In 2017, they didn’t actually DO anything. They just signalled “the end is near.” Muncipal, provincial, and federal leaders walked in lockstep and said, “We need to cool the housing market,” and that was all it took. Yes, the Liberals released some new legislation in Ontario, but it was more to do with renting.

In 2022, they started a run of ten interest rate hikes, which is actually “doing something.”

I don’t know which version is actually “intervening.”

In 2017, they intervened. They saw prices were running quickly and they actually said, “We’re going to to cool the market.” But their actions were few.

In 2022, they didn’t intervene, but rather the Bank of Canada raised rates, and the BOC is supposed to be independant of “government.”

Either way, both were examples of markets running hot and being cooled by external forces.

As for the contest, it was this blog from February:

TRB Reader’s Write: When Will We Peak Again?

https://torontorealtyblog.com/blog/trb-readers-write-when-will-we-peak-again/

We’re nowhere near peaking, so the only qeustion is whether the August TRREB price comes in below the December’s price of $1,038,668, which I don’t think it will…

Derek

at 9:58 am

Re: “intervention narrative”–[stern Marge Simpson noises]

Looks like the prediction game is still unresolved and only about a $44k cushion on the new low question.

Derek

at 10:04 am

At least the BOC held rates this time; Hopefully, things will level off here, at worst.

Vancouver Keith

at 2:45 pm

1. Interest rates. Best to go with what the financial markets expect. At most, one more quarter point increase. More likely increases are done. Factors that drove inflation were temporary in nature – supply chain, shock of the war in the Ukraine, massive increase in government spending. Folk who accumulated a lot of cash from the lockdown – tens of thousands in saved travel costs, dining and entertainment are finally running out of that accumulated surplus. Travel in the summer was a story of fully booked flights all over the place. It’s pent up demand and things will normalize. We are likely already in a technical recession, and the Liberals recently announced a $15 billion spending cut. When the lefties start taking the punch bowl away, the party is truly over.

2. Direction of average home price. Thanks for the monthly price chart. Kick out the highs and the lows, and you have similarity to what the stock market does most of the time. This is a housing market trading sideways, in a relatively tight range. It’s a market waiting for the next catalyst. Peak in the fall is a very real possibility, because the macro economy could get very ugly.

3. Inventory. Let’s do a combination. Inventory falling is going to be quite a trend. Builders and developers have felt the interest rate increases already. Building permit activity is falling. It takes eighteen months for interest rate changes to have the full effect. The governments are running out of liquidity props for the real estate market. The Canadian banks are all setting aside hundreds of millions in upcoming bad loan and mortgage expenses. At renewal time, the century long amortization won’t be permitted. There is an ugly scenario being prepared for by the relatively smartest money in the room.

4. Offer dates vs Offers any time. You’re the expert on that one. Whatever works.

It will be lumpy and exciting in the next eighteen months, with all the disaster scenarios on the table. How many will be realized, stay tuned and wait.

Bal

at 4:27 pm

i believe the Bank of Canada is going to pause tomorrow …don’t think they will increase as the economy and job market start to shake a bit