So, how was it?

Was it everything that you expected and more?

Did you accomplish everything on your checklist? Did you manage to do even more than you had anticipated?

I’m speaking, of course, about your summer, now that it’s over. And while some people might fight me on the “over” part, I just think it’s time to be realistic.

If you own, manage, or physically possess children, and they walked across the threshold of a school this week, then I find it hard to argue that summer lasts until September 22nd.

If you took the kids to any of Brooks Farm, Pingle’s Farm, or Downey Farm over the long weekend, then you absolutely admitted that summer is over. And if you have any future plans to meet your girlfriends (and their husbands and kids…) at one of these establishments next weekend, or the week after, then I think your admission is on full display.

The moment that you set foot on a farm in September, it’s NASA-level proof that summer is in the rear-view mirror.

I can already see it.

It’s a Sunday morning. You meet some friends in the parking lot while others find you by the petting zoo or the corn maze. Some have coffee in a Tim’s cup while others come prepared with a Yeti. Some push strollers while others hip-carry the children; more than one of which are too old to still be carried. The men are all on their phones, checking NFL scores. Some have money on the games while others are hoping their fantasy football teams can eke out a victory in Week 1 or recover from a tough loss in Week 2.

Yeah, the fantasy football draft….back in August. Remember summer?

Sure, sure, you still golf in September. You’re one of those. But it doesn’t make it summer.

And some of you still golf in October! The die-hards are out there with two layers of clothing on, battling the wind, and constantly wiping their noses in mid-November. But that says nothing about the summer timeline. It just means that you and I are different beings.

Being the uncreative, robotic, stubborn, inflexible, and predictable man that I am, my last round of golf was on August 31st. Years from now, the world’s brightest minds will still remain bewildered by my physical and psychological inability to golf in September, but it simply can’t be done. The score of 86 that I carded at Shawneeki G.C. on Saturday of the long weekend will bookend my 2024 nicely.

I played three rounds of golf with my brother this summer, including that last round on Shawneeki over the weekend, and that’s incredible considering that we haven’t played a round of golf together since 2008.

That’s evidence that the world might have started spinning the other way. Or, it’s simply a function of what happens when children reach their teen years and suddenly parents have more time on their hands to pursue individual pursuits. But little-bro got started way earlier than I did, so I have many, many years on my hands before I can start building model ships inside a glass bottle with tiny tools, and hopefully, if there’s a God, with the use of a monocle…

For now, I will have to settle for this “temporary” hobby of blogging, which is in its eighteenth year.

Lemme-see, lemme-see, what-oh-what could we be talking about in the first week of September?

Well, if you live in my world, you’re probably either wondering whether Isiah Pacheco has the ability to be a Top-5 running back in the National Football League, or, you’re wondering what in the world the fall real estate market will look like in Toronto.

So as much as I would love to write 7,000 words about the benefits of auction draft formats versus classic serpentine drafts that we all grew up with, I think I’ll switch gears to real estate now.

After all, this is becoming a bit of a pattern. Case in point, this post from 364 days ago…

September 5th, 2023: “Top Ten: Burning Questions For The Fall Market!”

For the record, I wrote the top ten points in today’s blog before the introduction, so the similarity between last fall’s points and this year’s points is coincidental.

But doesn’t it further underscore the point that the conversations that we have in real estate these days have shifted away from actual houses and neighbourhoods, and more toward economic fundamentals? You’ll read more about this in further sections, trust me.

But for now, let me get to the most important questions in our fall, 2024 real estate market, as I see them today…

1) What’s happening with interest rates?

Have you had enough of this topic yet?

Yes? No? Maybe, so?

At the risk of being repetitive, which is twice as likely if you happen to listen to my podcasts or read last year’s fall blog post, I think this topic is going to dominate not just conversations pertaining to real estate this fall, but all conversations in the media, at the dinner table, or at the proverbial water cooler at your office.

Remember when “talking about real estate” used to mean asking your neighbours if they felt the Johnsons would be able to sell their semi-detached house in time for the end of the school year?

Remember when real estate “discussions” were about the pros and cons of staying in the condominium for another 2-3 years versus buying a freehold today?

Nowadays, conversations about real estate are more likely to be about the politics of housing in Canada than they are about whether wood-paneled basement walls will become a trend once again (hint: they won’t).

And here we are, on the eve of another announcement by the Bank of Canada, talking about interest rates. But keep in mind, this is a topic that has been at the forefront of real estate talks since late 2021!

Let me remind you of an article that we discussed in early-2022 and which we’ve come back to a few times:

“Five Charts That Will Define Canadian Real Estate And Housing In 2022”

Macleans

December 23rd, 2021

This was a great article for many reasons, notably that they asked five very different economists for their macroeconomic views in chart form.

It was the first time that I had really stopped to think, “Huh, interest rates really are going up, aren’t they?”

After all, they had to.

Every single economist interviewed in this article offered an opinion on the 2022 economy as if a large uptick in interest rates was simply a given.

For those new to this blog or who have selective amnesia, the Bank of Canada policy rate was sitting at 1.75% at the onset of the 2020 COVID-19 pandemic but was slashed to a mere 0.25% by mid-year.

March 27, 2020 through March 2, 2022, the Bank of Canada policy rate was at 0.25%. That’s simply unsustainable.

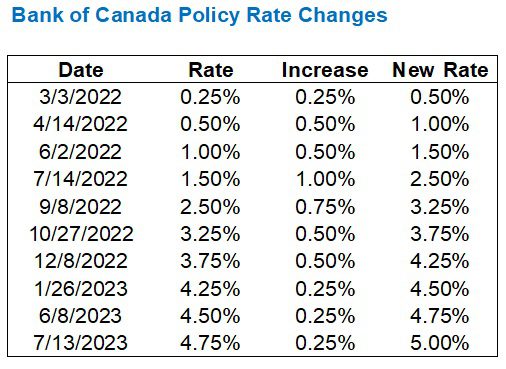

On March 3rd, 2022, the Bank of Canada began an unprecedented series of interest rate increases that brought the rate from 0.25% to 5.00% in sixteen months:

This is ancient history for many of you, but it’s background research for others.

We came into 2024 talking about not if the Bank of Canada would reduce interest rates but rather when, and that question was answered in June with the first cut of 0.25% and the second cut followed in July at the same rate.

What are we going to see on September 4th?

Ask most people and they’ll tell you it’s a 50/50 chance of a 0.25% cut versus a 0.50% cut, but I think those people are just afraid to give a real opinion.

I would think it’s 70/30 for 0.25% versus 0.50%, and I’m basing this on nothing more than my gut.

But then what?

We have another announcement scheduled for October 23rd and then another on December 11th.

I’m operating under the assumption that, between September 4th and December 11th, we’ll see at least fifty basis points in cuts, maybe seventy-five.

Don’t even get me started about the TRG Interest Rate Prediction Game and how it’s come down to blog reader, “House Keys,” versus yours truly…

But the conversation this fall has now turned from “when will rates be cut?” and past “how much will they be cut?” to “how much more will they be cut in 2025?”

Here’s an article from last week:

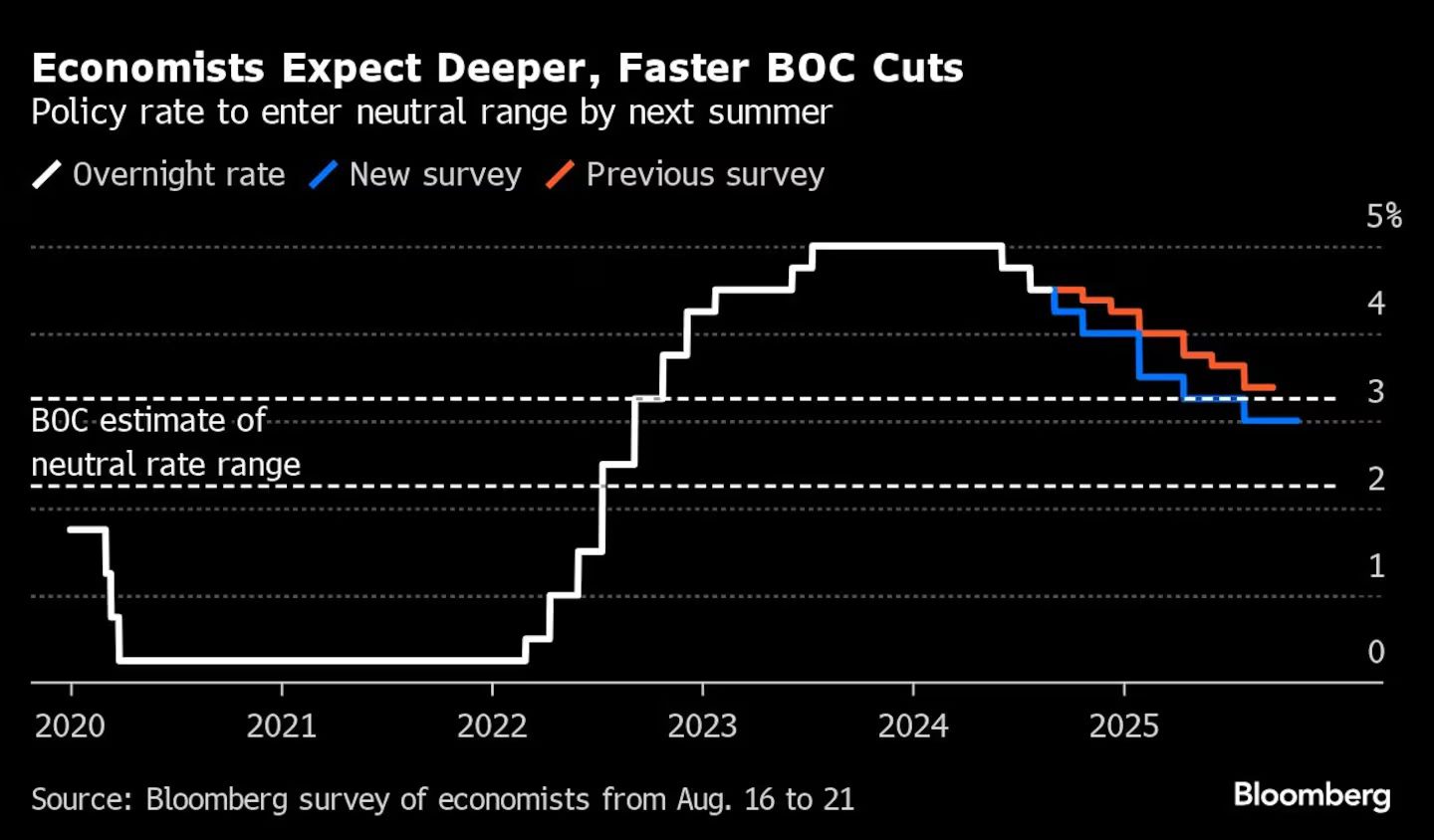

“Bank Of Canada Seen Cutting Rates Deeper, Faster Over Next Year”

BNN Bloomberg

August 26th, 2024

From the article:

Economists are also forecasting faster and deeper cuts to borrowing costs over the next year, and see the central bank reducing the policy rate from the current 4.5% to 3% by next July. In 2026, the overnight rate is expected to average 2.75%, the data show.

The survey results show analysts’ outlook aligning with market expectations for a gradual return to less restrictive monetary policy — traders in overnight swaps are also betting Macklem will deliver more than 150 basis points of easing by next summer. That would bring the bank’s policy stance closer to the so-called neutral rate — where borrowing costs neither stimulate nor restrict economic growth.

Of course, a picture paints a thousand words:

What really strikes me is the “new survey” versus the “previous survey,” because it’s hard evidence that economists truly do “expect deeper, faster cuts.”

Since the interest rate “peak,” I keep asking those in the know, “How long until you think we’ll see a sub-4%, five-year, fixed-rate?”

At first, that question was granted with a long inhale, a sign, and then a slow, “Geeeee, I dunnnnooooo…”

But over time, the answer has become more clear, and the timeline has moved up.

Back in the spring, friends of mine in the mortgage industry felt that we “might” see a 3.99%, five-year, fixed-rate by the end of 2025.

Today, I’m hearing that this could be a reality by March or April of 2025.

So while the topic of interest rates isn’t the sexiest real estate story for the fall of 2024, and while you might argue that’s not even directly about real estate, there’s good reason for all these conversations.

As we move into 2025, any increase in real estate prices will be directly attributed to the Bank of Canada’s monetary policy.

I’ve gone on record saying that I think prices will increase in early 2025 and that we could see another massive surge, not unlike 2022. There are millions of market bears, many of them in denial or simply remaining vengeful about the cost of living, who think that the “crash” has only begun. I’ve seen people describe our market as a “head and shoulders” with the worst yet to come.

But if the story of Fall, 2024 is about interest rates, then there’s a chance the story in the spring or summer of 2025 could be “home prices.”

2) What’s happening with inflation?

Again, not to plug my weekly podcast here, but when I covered this topic in August, I chose the day before the Canadian inflation number for July was going to be released as the day on which I wanted to record my podcast.

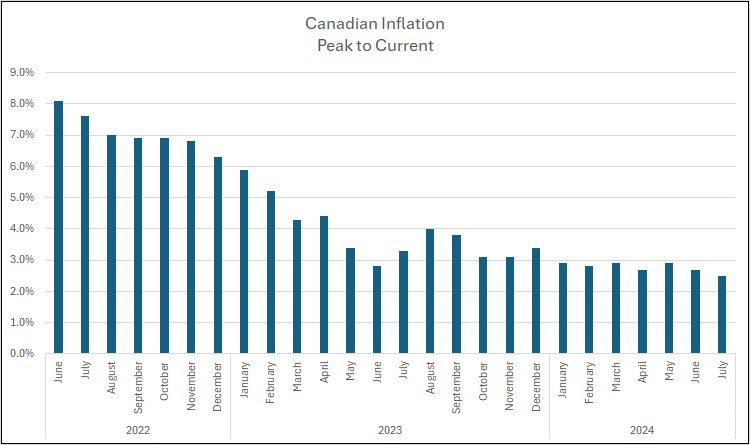

During that podcast, I said that with inflation for June coming in at 2.7%, if we saw even a tenth of a percentage point drop to 2.6% for July, we would start hearing more about interest rate cuts from the Bank of Canada. Then I vaguely referenced, “…and I can’t even imagine what would happen if inflation checked at 2.5%.”

Well, that’s what happened.

And while I can’t believe we’re in a period now when talking about inflation has become the norm, that’s just how our economy and real estate market have changed our thought processes over the last eighteen months.

But look where we’re coming from:

Somewhere out there, an addicted gambler who can’t wait for National Football League action is betting on the rate of inflation. I just know it.

But when inflation hit 8.1% in June of 2022, it was a huge number.

Can you guess: when was the last time that inflation was 8.1% or higher?

Years?

Decades?

How about December of 1982?

That’s when my brother was born.

That’s also when Canadian inflation hit 9.3%, and thus it was the last time that inflation was 8.1% or above.

Forty-two years!

No wonder the alarm bell sounded at the Bank of Canada, and no wonder interest rate hikes begun.

But what does “normal” inflation look like?

Most economists throw out this 2.0% figure, and Bank of Canada governor, Tiff Macklem, has been touting this as the target for as long as these discussions have been going on.

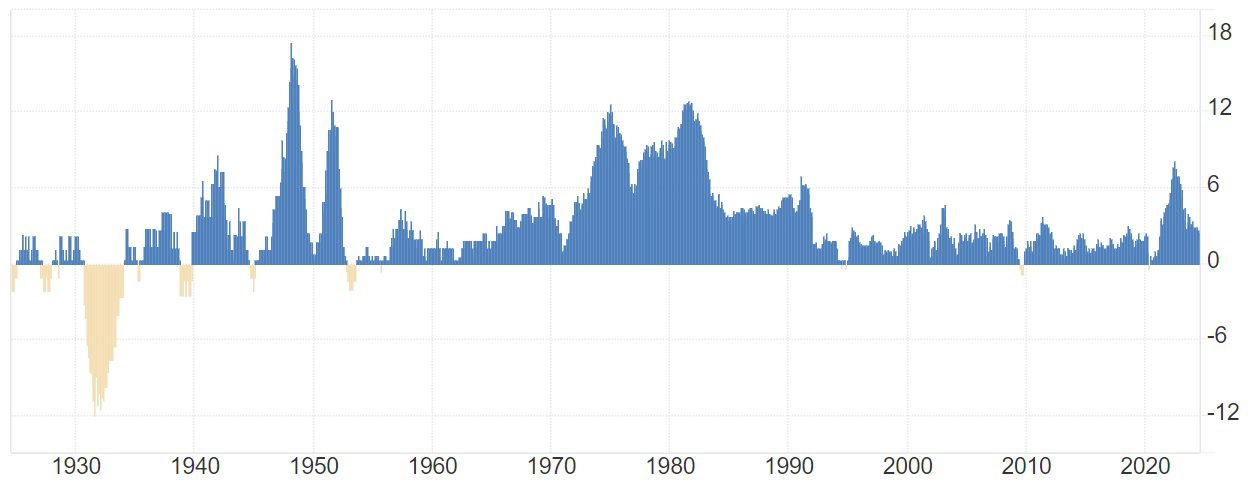

Just for interest’s sake, let’s have a look at all Canadian data to help put things in perspective:

Now perhaps we can put that forty-two-year gap between the 9.3% recorded in December of 1982 and the 8.1% recorded in June of 2024 into perspective?

I obviously wasn’t around in the 1970’s and 1980’s; at least not as anything more than a milk-drinking lad, and clearly I wasn’t in the financial markets.

But look how long it took the Bank of Canada (or perhaps all the world’s central banks) to get inflation under control.

How will 2024, 2025, and 2026 look when we re-run this chart down the line?

I would think that we’ll see a return to sub-3% inflation, and if we consider all the talk in June and July of the “battle against inflation being won,” then maybe it’s time to look forward.

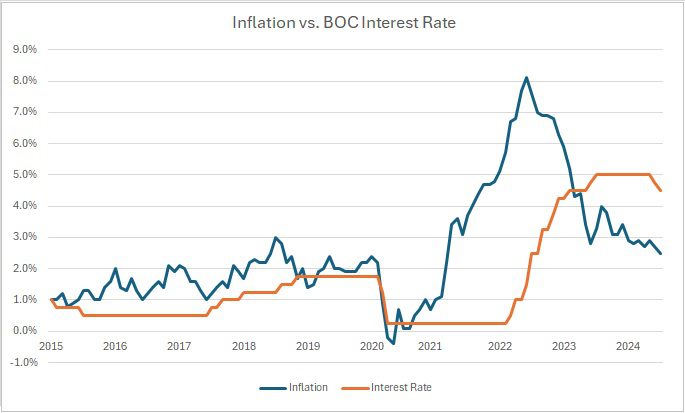

Before I move on, I’d be remiss if I didn’t share a chart that plots our first two discussion points against one another.

Inflation vs. the Bank of Canada Interest Rate:

Is it “normal” to see the policy rate below the rate of inflation?

Economists likely all have their own ideas on this, but if we consider the period from 2015 through 2020, pre-pandemic, it looked as though this was the case.

And if we want to consider the “battle” against inflation, whether it’s been won, and whether it’s time to cut interest rates further, the above chart from 2023 through 2024 shows that perhaps, it is.

While the Bank of Canada was late to respond to the rising inflation with corresponding interest rate hikes, they’ve been slow to respond to declining inflation with corresponding interest rate cuts.

This is by design, of course. The latter, that is. Time will tell whether the former will be called into question.

In any event, I think it’s safe to say that if we see 2.5% inflation continue in August, September, and October, the Bank of Canada’s last announcement on Wednesday, December 11th will likely result in another cut as we move into 2025.

3) What’s happening with the average home price?

Gee, thanks, I thought you’d never ask!

After all, this did top the charts for “burning questions,” proverbial or otherwise, for quite some time.

The “big three” topics of conversation in real estate used to be:

Prices, Sales, & Inventory.

All that changed in 2023 after the market slowed, prices declined, and the conversation shifted to:

Interest Rates, Inflation, & Prices.

Don’t fear; I will cover all of these topics by Thursday (this is going to be a two-part blog, in case that wasn’t already obvious…), but to round out our first day back at the office this morning, why don’t we chat about real estate prices?

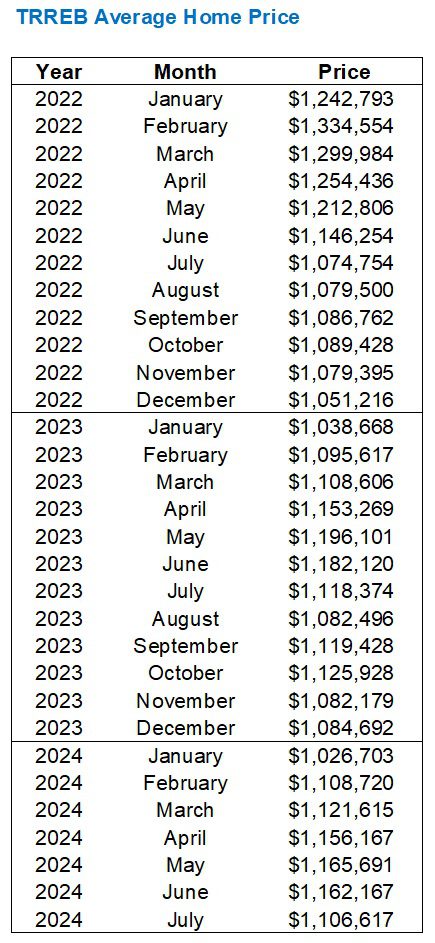

Let’s start with a chart. This will be the first of three that I’m going to use to illustrate a point:

Here we can see that the average home price is:

1) Depressed in July, compared to the market peak in April or May.

2) Significantly up from the start of January of 2023.

3) Significantly down from the chart “peak” in May of 2023.

You can make numbers say anything you want. The same is true of charts or graphs.

In this chart, I could argue that the market is doing quite well over the last 18 months! After all, we saw an average home price of $1,038,668 to start 2023 but we were all the way up to $1,165,691 by spring of 2024!

Sure, the average home price is down year-over-year, but only by 2.5% from May to May.

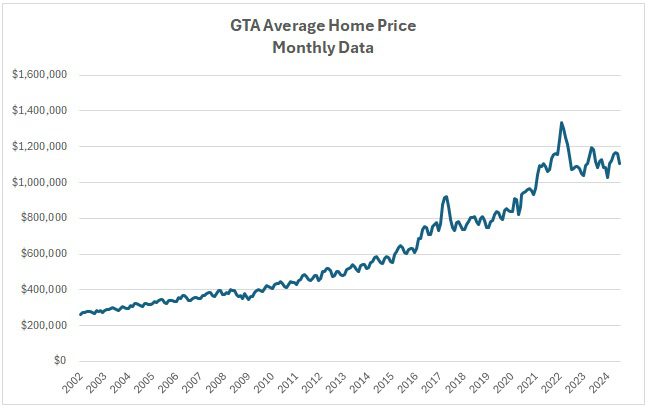

Now look at this chart:

Hopefully, this fits on your screen, or if you’re on your phone, you’re actually looking before scrolling to this text.

But the point is – I’ve used the same data as the first chart, only I went back another twelve months to include 2022.

Now, suddenly the narrative changes.

In fact, the average home price of $1,106,617 in July of 2024 is massively lower than the all-time peak recorded in February of 2022.

On paper, that’s a 17.1% decline, seasonality be damned!

But again, just consider what a third chart could do to the conversation:

Does anybody see the 2008 “correction” displayed on the chart above?

No?

It looked huge back then, trust me. But in the context of a twenty-year cycle, it hardly registers.

I suspect in 2040, the 2017 and 2022 corrections will look identical to how 2008 is displayed above.

In any event, all the talk of prices is moot if one doesn’t have a certain perspective in mind.

Will prices be higher in the Fall of 2024 than in the Spring of 2024? Maybe. Maybe not.

Will prices be higher in the Spring of 2025 than in the Spring of 2024? Oh, you had my attention, now you have my interest…

–

Folks, let’s take a break here and come back to the rest of the points on Thursday.

Three today; that leaves seven on Thursday.

Speed round?

Daniel

at 10:58 am

David, I kinda had you pegged as a private member guy, or at least Clublink.

Milk Man

at 3:56 pm

My money would have been on St. George GCC or Islington GC but then again David does have an east-side bias though

David Fleming

at 9:10 am

@ Daniel

I have tracked every round of golf since 2008.

In 2015 and 2016, I played 32 and 26 rounds of golf respectively.

Then came my first child.

In 2017, I played 14 rounds. In 2018, I played 12 rounds.

In 2019, I played 2 rounds.

That’s how it goes.

I only played 13 rounds this year and 9 of those were on vacation.

I don’t have time to belong to a club. But I also don’t think I have the desire. Playing the same club every Sunday? Members – please explain the appeal to me, and I’ll listen.

Sirgruper

at 1:20 pm

But is he the Last Honest Golfer? Plays it were she lies and no mulligans or gimmes? Sorry David but September golf is wonderful.

David Fleming

at 9:06 am

@ Sigruper

“Does Tiger Woods drink a beer on the golf course?”

That’s how I play golf. Everything I do is how a professional golfer would do it, so no, I don’t believe in mulligans.

When I played with my brother on the 31st, we were paired with two random guys. That probably added a couple of strokes to my game. I can’t handle that. It’s why I love golfing alone at 7:00am in Idaho on vacation. In any event, we walked to the first tee and one guy says, “Hey guys, just to let you know, I fucking suck at golf.” I’m like, okay, great, perfect, this will be a fun day. I remember the 10th hole, the guy hit his tee shot into the woods, then tee’d up again and hit that into the woods. Then he swung and missed. Then he piped his drive into the fairway about 280 yards. After an approach shot onto the green, he took two putts and announced, “Yo, bro – that’s my first EVER par!”

My brother whispered in the cart, with a smile, “Nice 12-foot putt to save bogey, Dave, but that guy made par.”

Some would say I’m boring. I don’t drink alcohol on the golf course. I don’t understand guys who pay $200 to “play golf” but just get hammered on the course. I drink Gatorate and water and eat Cliff Bars.

Derek

at 3:06 pm

??The average price for 2008 ($379,080) was higher than for 2007 ($376,236)??

Ace Goodheart

at 8:47 pm

I don’t share David’s rosy view on this subject.

My take on things is that people should not buy, or sell, a piece of real estate in Toronto right now.

If you sell, you are not getting a good price. If you buy, you have still paid too much as prices have further to fall.

I see that the Toronto new build condo market was operating as a ponzi scheme with most buyers having no intention of closing and simply wanting to flip the assignment.

If the only thing that is driving your real estate machine is cheap borrowed money, then you are in trouble. That seems to be the case in Toronto.

Things will get far worse, before they get better.

Rick Michalski P.App ACCI.

at 7:27 am

More chicken little BS from our resident doomer permabear. Rates are dropping like a stone just the way I said they will and prices are already jumping. Spring will easily be up 10 to 15 per cent higher than 2024. Dont you ever get tired of being wrong??

Ace Goodheart

at 2:58 pm

I’ve never been wrong. Maybe this will be the first time?

I don’t think so, but you never know.

A real estate market driven entirely by cheap debt is an unhealthy market. I have yet to meet anyone who can give me any reason, at all, anything, any tidbit of economic wisdom, as to why house and condo prices in the GTA would reach new highs on 2025, other than “interest rates are coming down”.

That seems to be the only argument.

You are basically betting on an asset that cannot be purchased by the vast majority of buyers, without using mountains of cheap debt.

Derek

at 9:42 pm

I imagine some people could afford to take on more house in 2025 than they could carry 5 years ago. But not most people. Most people can probably only afford to carry less house.