I used to describe myself as “anti-developer.”

Not anti-develompent, but rather anti-developer.

I have a long history, both on Toronto Realty Blog, and in practice, complaining about condominium developers in the province of Ontario and how they operate.

It started essentially when I started my career; as soon as I saw how the deck is stacked so firmly against the consumer, and how developers have learned to take advantage of the Condominium Act, and I began writing about it in 2007 when I started 2007.

Whether it was delays, cancellations, this thing called “economic viability,” the “occupancy” period, or developers simply canceling projects and re-selling them at a higher price, I abhored how developers operated in this city.

I still do, to some extent.

But it’s the legislation that’s allowed them to do the things that I don’t like, and while I started clamouring for updates or even a re-write to the Condominium Act of 1998, nobody really cared.

It wasn’t until two or three years ago that politicians started to complain about all the condo cancellations, but by then it was too late.

This is the system that we have and it’s not going to change.

Developers pre-sell condominiums, to be built at a future date, and when enough of the units are sold, a bank will provide financing for the construction. It’s never going to work any other way.

And in order to allow these developers to put the time, effort, and resources into these projects, developers must possess the ability to cancel a project, years down the line, rather than be “forced” to build a condo at a massive loss.

That’s how commerce works, right?

Not according to some. Many seem to confuse the public sector and the private sector, like one Torontonian who recently wrote a letter to the Globe & Mail suggesting that – wait for this one – the MLS real estate service should be turned into a public utility where everybody can list their properties for free.

Cool story, Hansel.

In any event, my thoughts and opinions on developers and developments over the last few years haven’t changed, but the conversation surely has.

I’ve said all that I have to say about the pre-construction condominium industry.

If you want to pay $1,800 per square foot for your “investment” when you can buy comparable resale today for $1,000 per square foot, be my guest.

If developers are allowed to deliberately delay the transition from “occupancy” to “registration,” so they can pre-sell Phase II of their project next door, go for it. The Condominium Act allows it, and I’ve never sold a pre-construction condo to a client, so I will sleep just fine at night.

But the conversations I’ve been having over the last couple of years have less to do with pre-construction prices and less to do with the process of seeing a condominium through from pre-sale to completion, and more to do with the cost to construct.

More specifically, I have started to repeat versions of this mantra:

Before you blame “greedy developers” for high condominium prices, take a look at how your government is taxing development.

Sure, I’m a fiscal conservative. That’s obvious. My thoughts and opinions are likely shaped by my place in this world, as is the case for just about everybody.

But it doesn’t make the above any less true.

Back in August, I was quoted in this Toronto Star article:

“Why Toronto Wants More Family-Sized Condos. Here’s Why What’s Being Built Just Doesn’t Work.”

Toronto Star

August 23rd, 2024

I had several quotes, but it’s this one that seemed to cause an issue:

There’s a legitimate question as to whether private developers can reasonably be expected to deliver true family-sized units that people can afford, Fleming notes.

“You can’t fix the price otherwise we’re no longer in a free, capitalistic society. Twenty-nine per cent of the cost of the new condo is taxes. It’s the government driving up costs, not greedy developers.”

A few days after the article ran, I received an email from somebody who said he had worked for the municipal government, specifically with development charges. He questioned why I went on the record in this article and challenged me to answer why there’s a problem with current development fees if the value of real estate and land have increased so much during the same period.

I didn’t engage because, well, I didn’t see the point. He won’t convince me; I won’t convince him. So why bother?

But I truly don’t believe that the general public has any idea just how much of the cost of a new unit of housing is through taxation.

The City of Toronto has been living off the real estate market for twenty years. Whether it’s development charges, land transfer tax, or a massive increase in property taxes as the city has doubled in size, the city has paid its bills via revenue attached in one way or another to real estate.

We’ve been in a self-described “housing crisis” for years now, but the crisis is getting far worse – or is about to, as the number of completions is plummeting.

Connect the dots.

- In 2018, the Ontario government set a goal to build 1.5 Million units of housing by 2031.

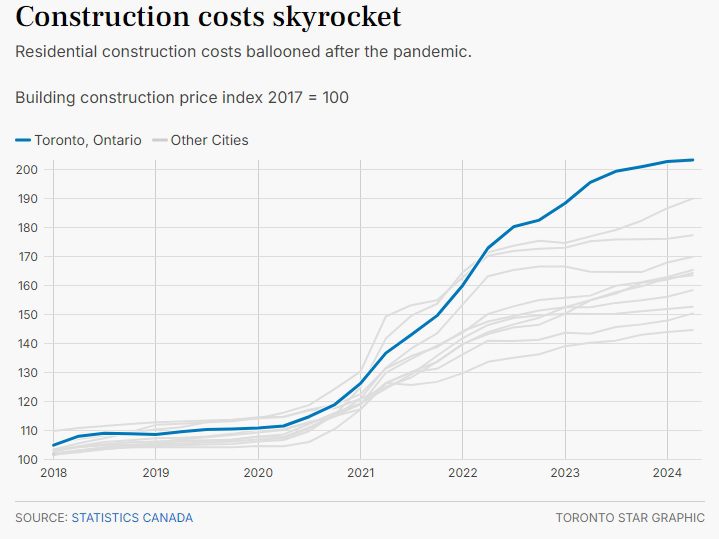

- Since the pandemic, the cost of materials has increased dramatically, as has the cost of labour.

- Interest rates increased.

- Consumer appetite for over-priced pre-construction units plummeted.

- Sales for pre-construction units drop by 72% to a 27-year low.

And now, this article that ran over the weekend:

“More Than 25 Ontario Housing Developers Saw Projects Go Bust This Year — A Higher Number Than The Province Has Seen In Years”

The Toronto Star

September 7th, 2024

But this makes sense, right?

If you connect the dots, that is.

It’s expensive to build condos. So many developers can’t afford to build condos.

But where I have the problem, and have for the last few years, is with respect the amount of taxes that are included in the cost of constructing a new unit of housing.

Sure, it’s not only taxes.

After all, the Toronto Star article above contained this graph:

But the taxes don’t exactly help, right?

So what’s the solution?

The way I see it, we have two basic options:

- Don’t build any new housing. It’s too expensive to pre-sell, and that’s how, unfortunately, out system works.

- Find a way to decrease the overall cost of construction.

With a goal to build 1.5 Million new units of housing by 2031, obviously #1 above isn’t a “plan.”

And with population growth exploding in Canada, and specifically Toronto, the “stick your head in the sand” plan isn’t the way to go.

Can we reduce the cost of materials?

No.

Can we reduce the cost of labour?

No.

Can we force developers to build at a loss?

No.

So is there any solution?

Well, an exceptionally unfavourable solution, in my opinion, would be to see the government give tax breaks to developers.

“Tax breaks” sounds rather vague, but whether it’s development charges, HST, land transfer tax, or something else, eliminating some of the tax built into a new unit of housing is an idea.

Back in August, a press release was issued on behalf of a group of Ontario developers who believe that the “system” of home building is broken. They have come up with some “creative ways” to work with the government to get housing built in this province, and their idea – which we be unpopular with the uninformed, ignorant, capitalist-hating crowd, is for the government to reduce taxes.

Here’s the press release:

Issue: Ontario Developer Coalition Pushes for Tax Breaks

A coalition of Ontario developers has written to three levels of government to ask for a reduction in taxes on new housing, saying it will pass on those savings dollar for dollar to homebuyers. The new group, called the Coalition Against New-Home Taxes, is composed of 18 developers who collectively plan to build 100,000 new housing units over the next 10 years. The coalition wants to see federal and provincial governments remove the harmonized sales tax on all new housing, as they have done for rental housing construction. It would also like the province and the City of Toronto to eliminate the land-transfer tax on new construction homes, and for municipalities to reduce development charges to 2009 rates, adjusted for inflation.

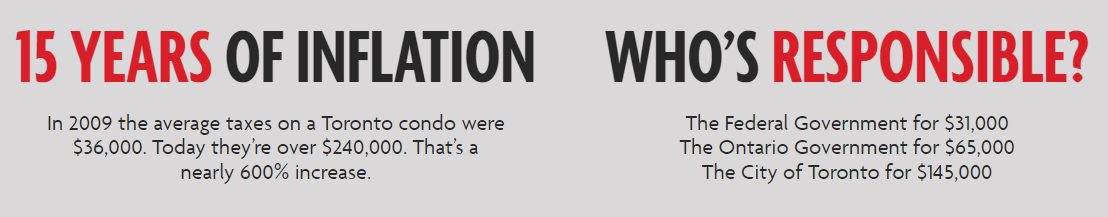

In 2009, taxes accounted for about 12 per cent of the cost of an average condominium in Toronto. Now, taxes account for about 29 per cent for the same home. Development charges have risen 1,200 per cent over the past 15 years. “Now because of higher interest rates, the system has broken,” the coalition said in its letter sent Wednesday to the federal government, the province and the City of Toronto.

Canada and Ontario have taken numerous legislative steps to try to kick-start the construction of housing projects. A combination of soaring home prices over the past decade – especially during the pandemic – and a steep increase in interest rates has stalled many projects. Recently released data from the Canada Mortgage and Housing Corporation show housing starts across Ontario in June are down 44 per cent compared to one year ago. Material and labour costs have also increased significantly in recent years.

“We came to the realization that something’s got to change and we started thinking about creative ways to bring government to the table to have an honest conversation and find solutions together,” Matt Young, president of Republic Developments who is spearheading the coalition, said. “And so we felt that one way to do that would be to sign a pledge that says for every dollar of taxes cut, this group of developers would cut their prices dollar for dollar to ensure that savings are passed on to homebuyers.” He warned that, “housing is unviable today. You can’t sell it low enough to get sales and still make money and if you can’t make money or can’t meet a certain margin, banks won’t finance your projects, which means all projects for the most part are pretty much stalled.”

Municipalities across Ontario are not sold on the proposal from the developer group if it means reducing development charges. The province passed a law in 2022 that cut development charges. The Association of Municipalities of Ontario estimated the changes would leave municipalities with a $10-billion hole over 10 years. The province later walked many of those changes back, but the association says they still represent a $2-billion hole over the same time frame. “The reason that the development charges are going up is for precisely the reasons that the developers have outlined, all of these input costs are going up,” said Lindsay Jones, the association’s director of policy. “The answer cannot just be cutting development charges without a new source of funding to fund infrastructure because with that you’re not going to be able to get more houses built.”

At the time, I didn’t see much media coverage on this.

Here was one article:

“Ontario Developer Coalition Asks Governments For Tax Breaks To Pass On To Homebuyers”

CTV News

August 1st, 2024

But this wasn’t enough, in my opinion.

The people who argue that “greedy developers are ruining the city” and graffiti on Development Application signs are never going to understand, but the people who do realize that we need more housing in Ontario and who do understand the basic tenets of microeconomics should be informed as to just how the three levels of government are impacting the ability – or inability to build new housing.

Just look at this statistic from the press release:

Development charges have risen 1,200 per cent over the past 15 years.

As I have said many times: the City of Toronto has had its mouth attached to the teet of the real estate industry for two decades, and they’ve been sucking like a top-of-the-line Dyson vaccum.

How about this statistic:

In 2009, taxes accounted for about 12 per cent of the cost of an average condominium in Toronto. Now, taxes account for about 29 per cent for the same home.

This is even more incredible when you consider how much materials and labour have increased in the same time period.

Oh, and it’s not like land is any cheaper, right?

Imagine a new $1,000,000 home.

Now, applying the math above, imagine it without any taxes.

It would be $710,000.

I’m hardly arguing in favour of reducing the taxation to zero, but rather I’m proving a point about the “cost of housing” in this city.

My cynical side says that this coalition of developers is going to get hammered, hated, and nobody will give them a voice, but I also think that some folks simply don’t want to admit that what they’re reading is true.

The website www.cantwin.ca is ripe with graphics like this one:

But while this information is completely accurate, it has a sort of right-wing vibe to it that I feel people will use to write it off.

I suppose time will tell.

And while I recognize that my opinion, which is that the government taxes Canadians to death already, and that it will only get worse with successive Liberal governments, is not going to be popular with everybody, my arguments for why real estate is expensive in Toronto isn’t opinion – it’s fact, as evidenced by the statistics here.

For those interested in the actual letter written to the government, here it is:

July 31, 2024

Attention:

The Right Honourable Justin Trudeau, Prime Minister of Canada

The Honourable Chrystia Freeland, Canadian Deputy Prime Minister & Minister of Finance

The Honourable Sean Fraser, Canadian Minister of Housing, Infrastructure and Communities

The Honourable Doug Ford, Premier of Ontario

The Honourable Peter Bethlenfalvy, Ontario Minister of Finance

The Honourable Paul Calandra, Ontario Minister of Municipal Affairs & Housing

Her Worship Olivia Chow, Mayor, City of Toronto

Re: How to immediately reduce the cost of new housing, and our pledge to help you do it.

Dear Prime Minster Trudeau, Deputy Prime Minister Freeland, Minister Fraser, Premier Ford, Minister

Bethlenfalvy, Minister Calandra, and Mayor Chow,

As people who build homes, we the undersigned are concerned about the housing affordability crisis. Housing affordability is the single greatest challenge currently facing our country. We applaud your governments for taking steps to address some of the factors contributing to this crisis, including addressing burdensome approval processes, fast tracking housing enabling infrastructure, and making public lands available for housing. These are important steps, but they will take years to make an impact.

To solve the affordability crisis today, your governments must take bold action to make homes cheaper to build and cheaper to buy.

Collectively, the home builders who have signed this letter have plans to build nearly 100,000 new housing units over the next 10 years. Together, we urge all levels of government to focus on a solution that would materially reduce the cost of new housing today: reducing taxes.

In 2009, taxes accounted for approximately 12% of the cost of an average condo in Toronto for example, or $36,800. Today, combined federal, provincial, and municipal taxes account for 29.2% or over $240,000 in taxes for the same home. These taxes, ultimately paid by homebuyers, exclude hidden additional taxes and duties paid by sub-trades and vendors and passed on to homebuilders. The tax costs per home in real dollars is up nearly 600% in 15 years, with development charges alone increasing nearly 1200%. Now because of higher interest rates, the system has broken. For years, all levels of government have raised revenue off the growing cost of housing. If left uncorrected, high taxes on new homes will put further strain on housing supply in the coming years. This will lead to job losses and will hurt the broader economy. Ultimately, it will make owning a home even harder for Canadians.

Removing taxes on new housing is the single biggest action your governments can take to immediately lower the cost of housing for Canadians. We are keen to be part of this important change.

That’s why we the undersigned pledge that:

For every dollar of tax eliminated by any level of government from the cost of delivering new housing, we will immediately reduce the price of all homes we sell by the amount saved, dollar for dollar.

We are committed to working with all levels of government to help identify the appropriate taxes to cut and are open to any accountability measures to ensure savings are passed on to home buyers. Canada needs a reset in the new housing market. We believe meaningful tax reform is the best way to achieve that.

Sincerely,

Nick

at 6:40 am

I would say I agree in principle with reducing fees but not carte blanche.

This has to be done in a way that gets us the units we want for people to live in.

Specifically I’d say do it based on geography(places the services already are), size of the unit and number of bedrooms/bathrooms.

Giving developers a helping hand to build more micro studios makes no sense, but if we can find a way to bring the cost of family sized units that developers will actually pursue building and selling to end users, thats what I would like to see.

QuietBard

at 9:47 am

I don’t like the whole dollar for dollar angle as now your relying on individual companies to do the right thing and if some companies can gain a competitive advantage they may not drop the price unless the market forces them to.

I’m no economist but I wonder if it were possible to significantly drop the price of real estate wouldnt that also put pressure on wages to stay down. People need to be able to make rent/mortgage payments so if that number went down wouldnt the amount these folks need also be less? Cant we find other ways to generate tax revenue or, gasp, reduce spending?

Or how about introducing a new model where purpose built rental buildings are owned by the government/developer and rented out to the public? Offer them tax incentives or maybe even reduce costs by removing some, gasp, environmental studies and reporting they have to do. Cut some red tape while we are at it? Or we can just accept an eroding standard of living for everyone. Thats not so bad right?

Also, is anyone else annoyed by the letter starting with honourable? While I don’t personally know any of these people. I haven’t seen anything honourable about them. Can I get a duke in front of my name? Duke QuietBard sounds quite dandy.

JF007

at 11:13 am

“As I have said many times: the City of Toronto has had its mouth attached to the teet of the real estate industry for two decades, and they’ve been sucking like a top-of-the-line Dyson vaccum.” –@DavidF i cracked up so hard reading this the dog ran off to hide in his safe space (downstairs powder room) ….the image in my head is too hilarious and too right to be ignored at the same time…frankly development charges as a revenue source is too good to let go by the governments at every level and even if they do they will go on air with grievances about how they are not being supported by levels of govt etc…there surely needs to be a deep dive on the state of finances at the municipal level to see which insatiable pit are these dollars going into if the charges keep increasing, services keep getting reduced and even then cities keep going to province and feds for yet more funds..

Serge

at 12:06 pm

May be this new condo business is a bit passe. Increasingly, new rentals are built. And I reckon, it is not payed by developers. The Gov has billions in housing fund. They give (almost free) money to developers to build. So instead of selling 70% and begging banks for mortgage, the developers take free gov loans and continue to build.

But this is not condos.

There are news on this, but there is no stats on this – how much condo construction business has been diverted into rentals.

Vancouver Keith

at 10:07 pm

The private sector developer is not here to provide affordable housing, they are here to maximise return on invested capital. They don’t have to cut prices, if their costs go down, they will continue to sell at the market price and make as much money as they can. That is what private sector businesses do.

You can reduce the taxes by half, with an aging population and governments running substantial deficits, and you are not left with affordable new housing. You are left with an even bigger fiscal crisis. But tearing down existing affordable housing and building new, even with zero taxes will make the situation for the lower half of median income earner even worse.

Taxes are part of a multifactor disaster of housing costs in this country. A broader analysis is difficult, but more useful. If real estate has grown to 25% of GDP in this country, then you can be assured that governments will tax where the money is showing up. With declining real wages and salaries for 90% of the population in the last several decades, it’s not like income tax revenue can keep up.

Ace Goodheart

at 10:28 am

The sad reality is, taxes must continue to go up. We likely need an HST tax somewhere in the neighbourhood of 20%, just to service the ongoing costs of interest on the Federal Debt (Trudeau and co. more than doubled it since they took office in 2015). The “tax , borrow, borrow some more, and spend, spend, spend” approach to governing will not work in the long term. Eventually the books must balance.

So while it is true that, as we slide down the slippery slope of socialism, everything will get more expensive, the standard of living will go down, and everyone will have less, and have to make do with less, reducing taxes won’t get us out of this hole.

The only way to do that is to reduce government spending, and increase taxes to pay down Trudeau’s massive and ever growing Federal debt load.

Different David

at 3:52 pm

Unfortunately there is never going to be a government with the fortitude or will to do this. Imagine how many articles the Toronto Star is going to publish when PP muses about freezing the hires at the federal public service.

All the government will worry about is paying the interest on the debt. Actually cutting down at it? It would take a miracle of productivity, which is always going to be hampered by the growing public spending…because as soon as there is a hint of prosperity, the grant-suckers will be lined up for their pet projects.

Imagine if PP talked about shutting down entire ministries (Women and Gender Equity comes to mind…). That is the kind of savings we would need to look at to start cutting down the debt. And with so many Canadians who are either employed, or have a close relative/friend employed in the federal service, it would be political suicide.

Vancouver Keith

at 7:30 pm

When Prime Minister Chretien took over from Mulroney back in the nineties, 30% of the federal budget was spent on interest on the debt. Governments take action on difficult problems when they are forced to, not before. We were in surplus in three years. Very painfully, but the job was done.

David Fleming

at 8:57 am

@ Vancouver Keith

How?

How did the government go from debt to surplus?

What new taxes were implemented? What spending was cut?

Vancouver Keith

at 2:18 pm

I can recall a Coles notes version from memory. Taxes were increased. The new GST brought in more than the manufacturers sales. There was a rather clever hidden tax increase strategy brought in, the basic personal exemption that everyone gets on their income taxes was frozen. Normally it increases every year with inflation.

There were three dollars cut in spending for every new dollar of revenue raised, primarily in transfer payments to the provinces. Old funding formulas for health care and social programs were dropped, and the federal government walked away from previous levels of social program funding. The most aggregious was health care. At one time the feds paid half of provincial health care costs, I believe these days it’s about 15%.

The size of the federal government fell to about 13% of GDP, smallest in my lifetime. I believe under Harper it grew to about 15%, and we are currently around 17 – 18% of GDP (a rather good measure – how big should government be)?

A couple of further revenue notes. I believe Chretien caught some falling interest rates, somewhere between 200 – 300+ basis points. Unemployment fell from 11% when he took over back into single digits, saving a huge EI payout. He also caught a rising tide of resources prices, oil had fallen from $40 per barrel in 1980 down to something in the single digits, and he caught a rising market in most of the commodities – a bigger revenue generator in this country than most like to admit. It was a rocking decade for Alberta.

So the deficit fell from $45 billion (in current dollars) due to Paul Martin and Jean Chretien combining very dramatic actions, leaning on provincial and civic governments to carry more of the burden, yeoman work by Mulroney to reduce the costs of government and bring in the GST, falling interest rates, lower social costs with an improving job market, and a commodities boom. Pretty simple in the end.

Most important was the bond market on Wall Street telling the Canadian people that drastic action was required. People accepted spending cuts and tax increases and didn’t vote the government out. Fiscal progress was dramatic, but provincial finances outside Alberta have never really recovered.

Governments can take big actions, and voters will accept it only when the situation becomes so bad, there is no alternative. 30% of the budget was spent on interest costs, debt to GDP was well over 70%. Unsustainable.

QuietBard

at 10:41 am

Not sure who you are attributing the success to but Brian Mulroney along with Finance Minister Mike Wilson brought the GST into existence to combat the debt. The conservatives were obliterated in that election and Chretien said he pledged to remove the GST. Hilarious isn’t it. The party that did what was right was punished for it. And the other party promised to remove it did not follow through (they recognized how important it was for meaningful positive change. Didnt stop them from blasting Mulroney & Wilson though). Governments dont taken action when they are forced to. Just look around the world for evidence. They take action when people with guts and courage attempt to sincerely do the right thing. Not sure we have any of those at the moment.

https://www.cbc.ca/player/play/video/1.5901559 – “A pledge against the GST”

Ace Goodheart

at 11:44 am

This is exactly correct. Mulroney and Co. brought in the HST, which in effect balanced the books. Debt was paid down and Canada became financially sound once again. This was of course following the reign of Trudeau the senior, who saddled us with massive amounts of Federal debt and put Canada into a debt crisis situation. And now Trudeau the junior has done the same thing (like father, like son…if you don’t believe the rumours that perhaps there was a bit of hanky panky down in Cuba on a family vacation and…..well, we all know the conspiracy theories…..)

PP I believe has the resolve to get the debt situation straightened out. He will not be popular when he does it, and yes we can expect endless news stories about how some special entitled group or other is being torn to shreds by funding cuts, and how terrible that is.

It will be unpleasant but necessary. The other option is Canada gets put on the IMF watchlist for soon-to-be insolvent countries.

David Fleming

at 8:11 pm

Fascinating – thanks to all three of you!

I was in Grade-8 in 1993-94 and we did class projects on the political parties in the election. I remember Jean Chretien saying that he would eliminate GST so I asked my teacher what that meant and she said, “Oh, it’s rubbish!”

I picked the Liberal party for my project because I liked the colour red.

I suspect many people in Canada today do the same.

Except I was 13-years-old at the time and didn’t know any better…

TOPlanner

at 10:05 am

Taxes on new development / development charges pay for infrastructure needed to service new developments. The saying in planning is ‘growth pays for growth’. If you reduce taxes / development charges, how are you going to pay for that infrastructure (pipes, sewers, roads, etc.)? Remove the primary residence capital gains exemption? (:

I do think there could be a tiered system, where for example developments close to transit with fewer parking spaces pay lower development charges to account for less road use.