Two stats posts in the same week?

Egad!

Not only that, the January TRREB stats will likely be released on Monday or Tuesday, which means yet another stats post toward the end of next week too.

I guess we need Monday’s post to be something fun and light, just to create the balance?

“Fun and light.” Huh. Not exactly words to describe last year’s condominium market, are they?

It’s hard to believe that only two years ago, we were in a condominium market that was routinely seeing, five, ten, or fifteen offers on run-of-the-mill condos.

I remember one particular condo that I listed for sale on Richmond Street East that was, if I’m being honest, not exactly a jaw-dropper. But what was jaw-dropping was the final tally of showings on the unit, which eventually topped 100.

I think that was the most showings I had ever witnessed on one of my listings before, and while you might think that the “most ever” tag would be applied to an entry-level freehold property, in the end, the record was set by a condo on a busy corner, one city block from a very undesirable section of the city.

But that was then and this is now.

Er, now, for today’s discussion purposes, is 2024, since I want to look back and see how the condominium market finished 2024.

Necessary disclaimer, first and foremost:

We are talking about the resale condominium market. This is not about the pre-construction condo market.

As the regular readers know, I have never sold a pre-construction condo in twenty years. Not one.

I have been writing about the perils of pre-construction condominiums here in TRB since the inception of the site in 2007.

Last year was not a good year for pre-construction condo sales, and for good reason.

It’s hard to convince people – even the most clueless, naive, optimistic, to pay 50% more than fair market value for something that’s not yet built, has no guarantee of being built, and falls within a volatile sector.

Real estate think-tank, Urbanation, gave us some spectacular headlines about pre-construction condo sales in 2024:

February 1st: GTA New Condo Sales Fell To 15-Year Low In 2023

April 22nd: GTHA New Condo Sales Fall 71% Below 10-Year Average

July 18th: Slowest First Half For GTHA New Condo Sales In 27 Years

October 18: GTHA New Condo Sales Fall To Nearly 30-Year Low In Q3-24

So again, it needs to be said: there is a difference between the resale condominium market and the pre-construction condominium market, and in 2024, so many of the major media outlets failed to distinguish between the two.

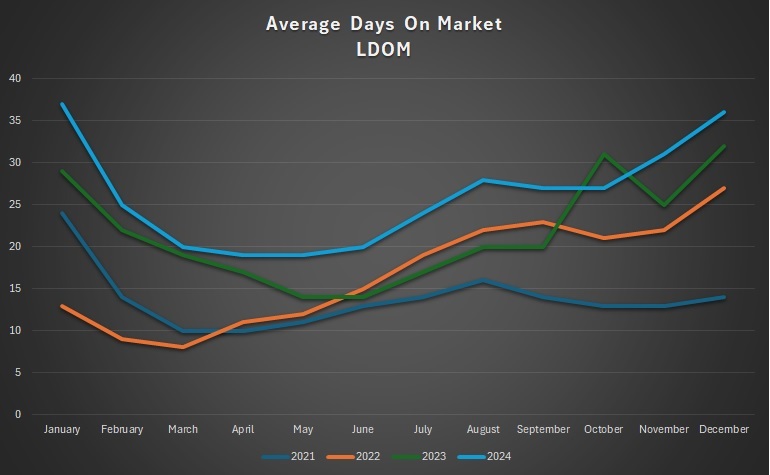

With that out of the way, let’s first talk about the “days on market” statistic as we finished 2024.

Through Q3 of 2024, we had seen listing days on market at a 4-year high in every single month:

As you can see, the spike from October of 2023 meant that one month of 2024 did not set the 4-year high, but overall, I think we can come to a basic conclusion:

Properties took much longer to sell in 2024 than they did in years prior.

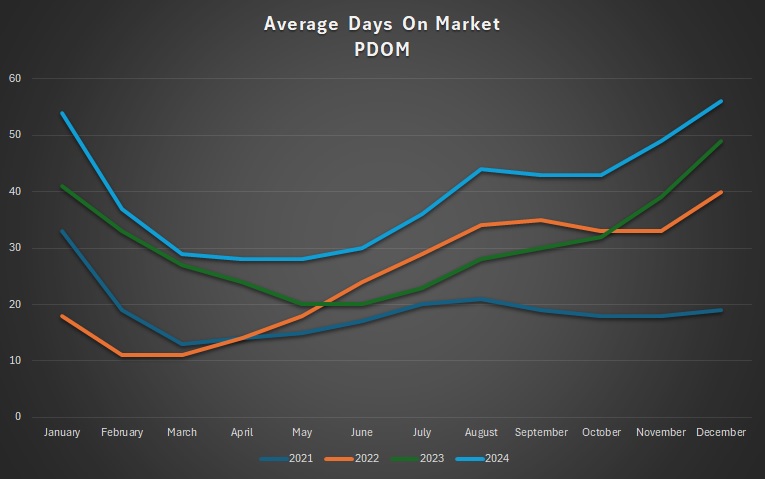

Property days on market, or “PDOM,” which is the total number of days for a property including multiple listings looked very similar last year:

Here we do not see a single-month outlier, as we did in October for LDOM.

Just a straight blue line above every other line on the chart. That is clear indication of just how long properties took to sell in 2024.

And with PDOM, the contrast is even more stark, since an average of the twelve calendar months for 2021 through 2024 shows as follows:

2024: 39.8 days

2023: 30.5 days

2022: 25.0 days

2021: 18.8 days

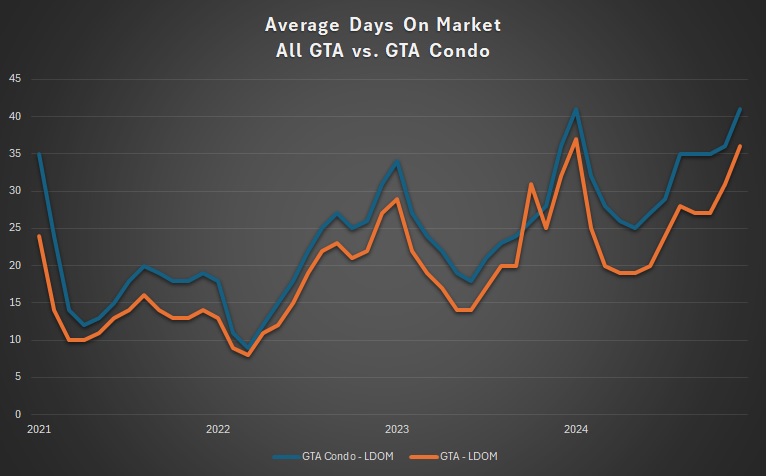

If we compare the DOM for condos versus the overall GTA market, we can see that the gap widened in Q4 before narrowing again to finish the year:

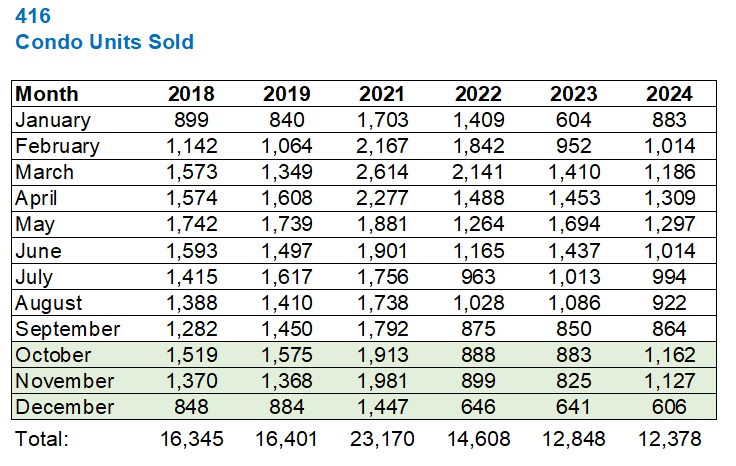

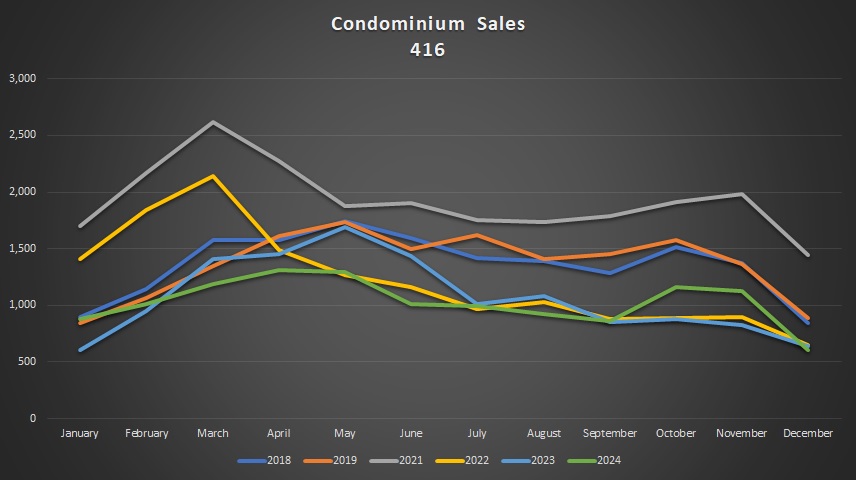

When we start to look at the number of condominium units sold, it’s important to recall the trend from Q3: sales were declining year-over-year.

After seeing 416 condo sales increase on a year-over-year basis in January and February, sales decreased in March, April, May, June, July, and August.

Sales moderately increased in September, but that changed significantly in Q4:

October sales were up 31.6% over 2023, and November sales were up 36.6%.

Sales dipped in December, down 5.5%, but the overall volume in Q4 showed year-over-year strength.

2024 finished with fewer sales than 2023; a decline of 3.7%.

But after seeing 2024 sales essentially trace the bottom of the chart below, sales went “mid-pack” in Q4:

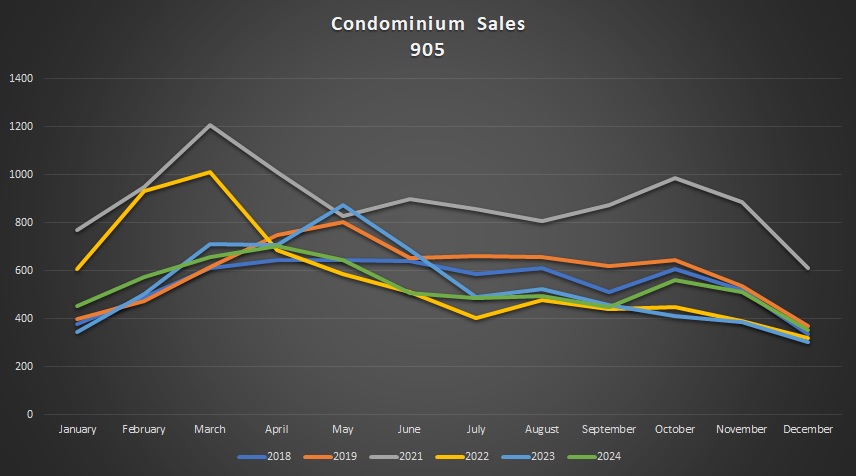

The 905 followed a very similar path to the 416:

October sales were up 35.6%, year-over-year, and November sales were up 32.6%.

But in December, while 416 sales declined, 905 sales increased by 16.8%.

While sales in the 905 did decline on a year-over-year basis, they were only down by 0.1% from 2023.

Looking at the figures on a chart, I think we start to ee that if 2021 was removed, for some reason, the other years would blend together quite seamlessly:

Well, except perhaps for the first three months of 2022.

But overall, June through December, 2018, 2019, 2021, 2023, and 2024 look quite similar.

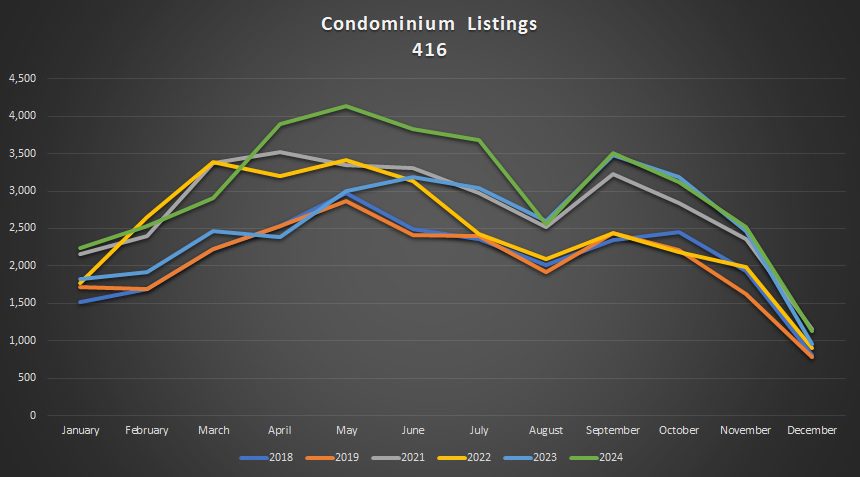

When it comes to inventory, despite all the talk of a massive glut of listings in Q4, the condominium inventory fell more in line than it had in the previous two quarters:

Inventory in Q4 traced 2023 pretty closely as you can see, and both years were well ahead of 2018, 2019, 2021, and 2022.

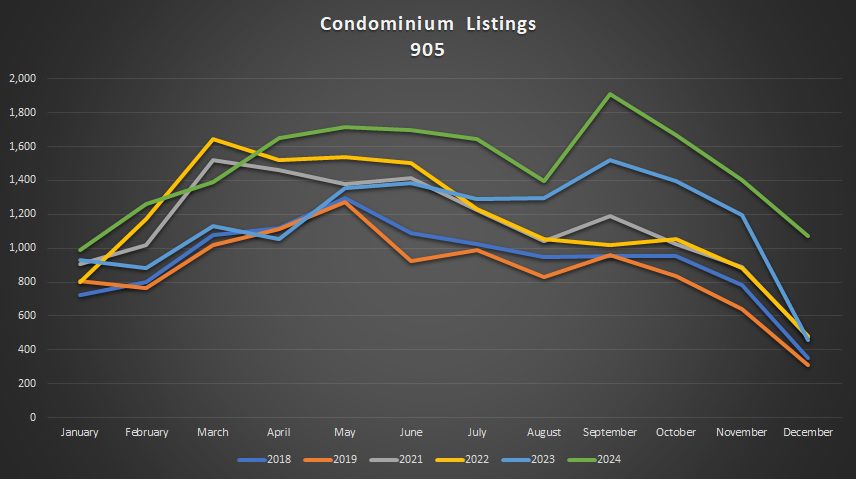

In the 905, the chart looks completely different.

New listings were simply through the roof. There’s no other way to describe this:

The crazy thing is: you would think the absorption rate skyrockets as a result, but as you’ll see shortly, it doesn’t.

So how are all these listings being absorbed by the market?

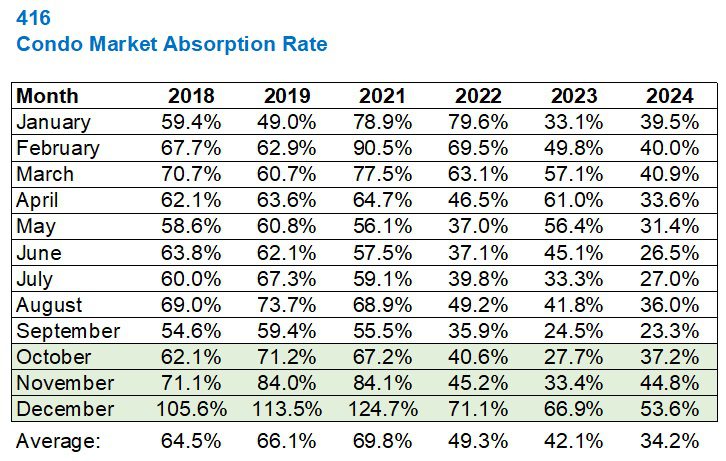

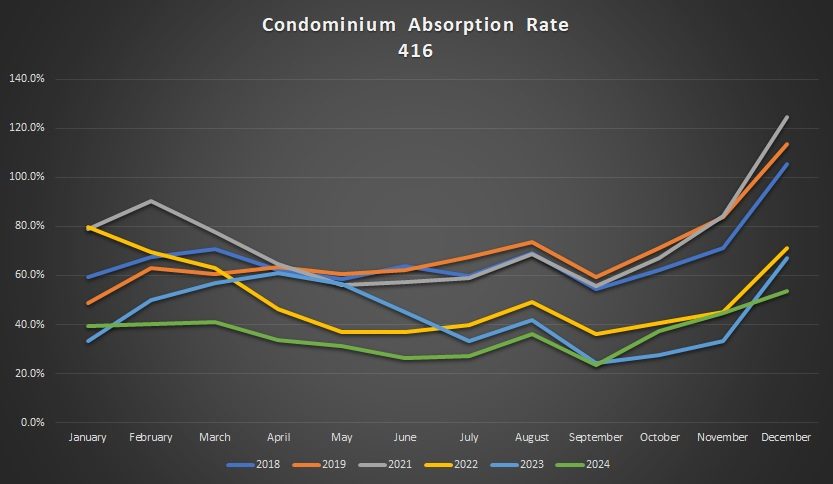

The “absorption rate” in Q4 was still well below the 50% threshold which signals, at least in theory, the difference between a buyer’s market and a seller’s market.

However, after a near-record low rate of 23.3% in September, the absorption rate increased significantly:

Don’t let that 53.6% absorption rate from December fool you into thinking that it was a seller’s market, because it wasn’t.

In fact, it wasn’t a seller’s market at any point in 2024. Not a single month, week, or day.

Q4’s absorption rate was better in 2024 than in 2023, however:

But as I said: 2024 was a buyer’s market, hands down.

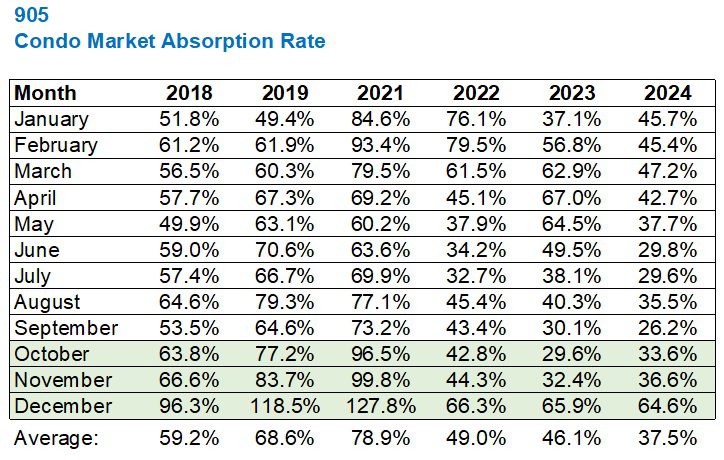

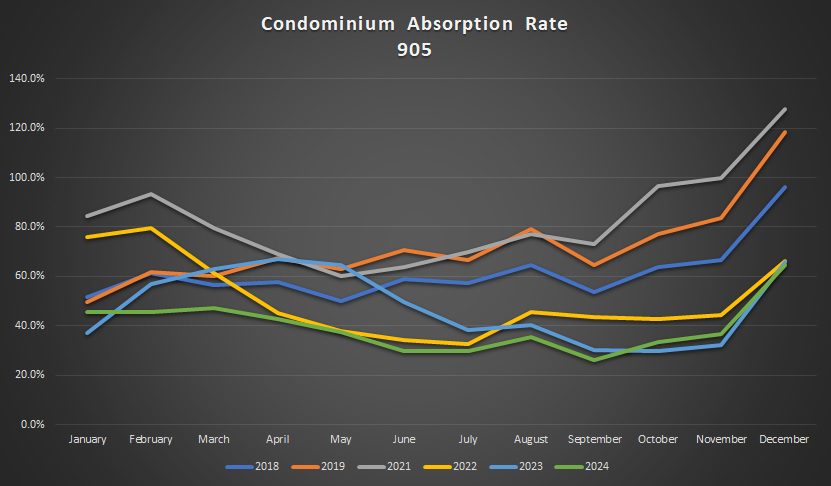

In the 905, the absorption rate was lower than the 416 in both October and November, but surprisingly it was higher in December:

The yearly absorption rate of 37.5% pales in comparison to previous years but is higher than the 34.2% recorded in the 416.

The 905 chart doesn’t look quite as dire as that of the 416:

But wow, 37.5% and 34.2%.

Those numbers are mind-blowing!

Just think about this: the average absorption rate in 2022 was 78.9% in the 905.

That’s more than double what we experienced in 2024.

Alright, so what’s in store for 2025?

Things can only get……….better from here, right?

Let me pass the mic…

Appraiser

at 10:39 am

Prices are remarkably sticky given the significant changes in market conditions, primarily interest rates over the past 2 years.

Despite a relative glut of listings during this period, the average sale price for 2024 was $1,117,600. That is only 6% below the wild-eyed peak of 2022 – which was $1,190,742.

Also it might be best to recall that during the decade from 2014 – 2024 homes prices practically doubled from $566,611 to $1,117,600!

Derek

at 11:17 am

Cold comfort? Prices were sticky in the 90s too. When prices declined every year, year over year, from 89-95, the greatest annual declines were only around -8%. That said, the decline from ’23 – ’24 was essentially meaningless, so who knows.

Steve

at 5:48 pm

Yes …. we are is a sideways market at best ….. this will take time.

Serg

at 12:36 pm

I guess, condo investors, having negative flow, expect about 7% annual price appreciation. Little loss of -6% over 3 years is -30% for their expectations. Only people with deep pockets could continue play a long game.

Serge

at 12:27 pm

It looks like investors left the condo market, and first buyers prefer houses. Downsizing people do not buy one-bedrooms. Share of investors in sales would have clarified it; but TREB probably does not have this statistics. Until inverstors returned, there will be no change.