What’s the difference between a “streak” and a “pattern?”

Is there one?

Does it depend on the context in which we view a consecutive string of similar outcomes?

I’m not a huge basketball fan, but I am a huge sports fan. I’m also a huge fan, as most of you know, of stats.

Combined with an overwhelming case of obsessive-compulsive disorder, I will actually study and memorize statistics for sports in which I have very little interest.

Case in point: tennis.

I don’t watch tennis. I find it to be extremely boring, in the same way that a non-golf fan would find golf boring, or baseball, or basketball, or essentially any other sport which involves repetition.

Tennis is back-and-forth, back-and-forth, point, point, point, game, set, match, boring.

But tennis fans might suggest that a basketball game, which ends up at a 102-101 score, is even worse. Back-and-forth, for two hours, all to come down to a whole lot of time-outs in the last 60 seconds, which take 30 minutes in real-time, so that one team can beat the other by a couple of points.

See what I mean?

I don’t care for tennis, but I do care for the stats!

The Grand Slams! Oh boy, when a grand slam is finished, I immediately run to the laptop to input the winner and runner-up, then update my “All Time” list, as well as a host of others.

That page, along with hundreds of others like it, for other sports that I don’t watch, end up in a book that I print and bind quarterly (waste of paper, so be it), and read in bed at night when I can’t fall asleep………which is every night.

Which men have won all four Grand Slam tennis tournaments?

How about the women?

I know the answers, even though I don’t watch the sport.

The same goes for basketball, which, I’m sorry, I just can’t find interesting. Even the March Madness NCAA tournament has ceased to capture my attention in the last decade.

But when the NBA season is over? You know I update my “All Time Leaders” stats for points, rebounds, assists, steals, games played, et al.

And of course, the “NBA Championship Winners.”

For those of you that know basketball, you know that there was an absolutely unprecedented period in the 1950’s and 1960’s when one team dominated.

There have been dominant teams in every team-sport, as well as individuals in sports like golf, tennis, and cycling! Lance!

But there was absolutely nothing like the Boston Celtics of the late-50’s and 1960’s.

They still hold the record, in the four major sports (hockey, football, baseball, basketball) for the most consecutive championships……..with eight.

Eight? In a row?

That’s insane.

In fact, only the New York Yankees and Montreal Canadiens can claim streaks of five straight championships. And the most consecutive championships in the NFL, is two.

Here’s how the Boston Celtics eight straight championships looked, with the NBA Championship winners in yellow highlight:

Yup, there it is – eight straight from 1959 to 1966.

What an accomplishment, right?

Except that, wait, there’s more.

On this list, there actually thirteen seasons, and the Celtics won eleven championships.

And they also went to the finals ten straight years!

In fact, if you study this list a little longer, you’ll see that you can make five huge claims, depending on what your objective is:

1) Boston won 8-straight from 1959 to 1966.

2) Boston won 9 championships in 10 years, from 1957 to 1966.

3) Boston won 11 in 13 years, from 1957 to 1969.

4) Boston went to the Championship 10 seasons in a row, from 1957 to 1966.

5) Boston went to the Championship 12 times in 13 seasons.

The fact that the Boston Celtics won eight straight championships is incredible.

But is it more impressive that they won 9 times in 10 years?

Or 11 in 13 years?

Is 9/10 more impressive than 11/13?

Is the higher percentage more impressive than the higher total?

I can’t tell you how many times I’ve looked at these dates, teams, and championships, and wondered what’s the most impressive way to explain this period of dominance.

In the end, I think it’s that Boston won 11 times in a 13-year period, and combined with the loss in 1958, they were present at the Championship 12 times in 13 years.

A similar discussion can be had regarding the UCLA Bruins men’s basketball team, which won seven straight championships from 1967 to 1973, but also won in 1964, 1965, and 1975, for a total of 10 times in 12 years.

So what in the world does this have to do with real estate?

I love stats, but I also love streaks.

I will cheer for the favourite in a championship simply because I like dynasties.

And when it comes to the Toronto real estate market, a massive dynasty is coming to an end.

I don’t have stats to support this, but I would gather that the longest “streak” of consecutive years of increase in the average home price in a given city has to be the one we currently find ourselves in.

Twenty-one.

Twenty-one straight years, from 1996 to 2017.

Eat your hearts out, Boston Celtics!

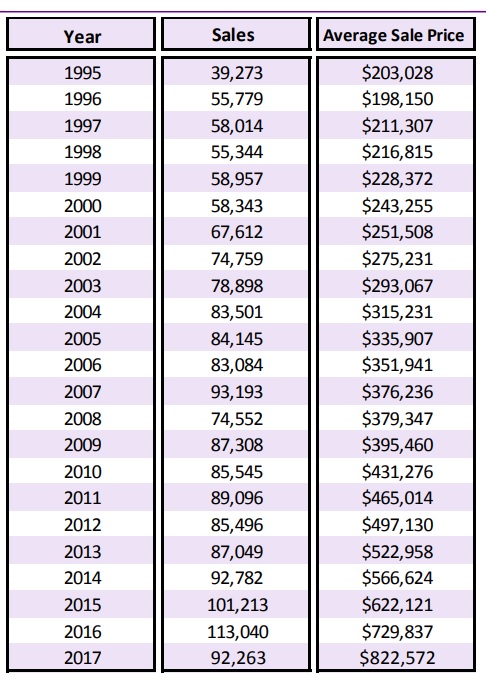

Here’s a look at the average sale price of a Toronto home from 1995 to 2017:

The last time that the average home price in Toronto decreased from one year to the next was from 1995 to 1996.

1996.

Wow.

I was in grade eleven.

Atlanta hosted the summer Olympics.

Friends and Seinfeld were at their height of popularity.

The Toronto Raptors were in their second season of existence.

Connor McDavid, Auston Matthews, and Mitch Marner weren’t born yet.

And “the internet” was still something that only half of your friends had, and most of them couldn’t figure out how to open Netscape Navigator.

Since the Toronto average home price came in at $198,150 in 1996, that average has increased every single year since. And while 2018 isn’t over yet, let me be the first to tell you, in case you didn’t already know, that this “streak” is going to end.

The average home price in Toronto in 2017 was $822,572. And there is absolutely no way that 2018 is going to beat that.

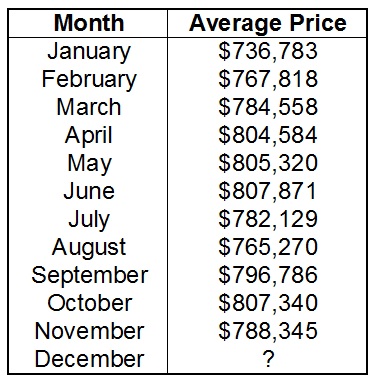

So before I show you why, and how that’s a certainty, let me show you one more chart, just to drive home what an incredible Boston Celtics, UCLA Bruin esque dynasty the Toronto real estate market built:

The bears are going to have a field day with this, but something tells me, so are the bulls.

There’s much to talk about here, whether it’s that 0.8% increase in 2008 that barely kept the streak alive, or the 315% total increase in value through the streak, or perhaps the 17.3% and 12.7%, back-to-back, double-digit increases in 2016 and 2017 that simply made it impossible for 2018 to follow suit.

But let’s keep that $822,572 number in mind, as I show you why the 2018 market won’t keep pace.

Here is the average sale price in Toronto for every month recorded thus far in 2018:

As you can see, even the highest month, which was June, still didn’t beat the overall 2017 average of $822,572. In fact, it was off by 1.8%.

So how can we predict what the overall 2018 average will be?

We could look at the average of all these averages, which is $786,073, but that ignores sales volume.

So I took a weighted-average of all eleven months; the number of sales, times the average sale price, divided by the entire 74,128 sales recorded from January through November.

And that number is $789,319.

December has yet to be recorded, but if history is any indication, it will be lower than November.

So let’s just use that $789,319 number for now.

If 2018 were to finish with $789,319 as the average Toronto home sale price, we would see the end of our twenty-one year streak, and we would also be able to put a number to the decrease, year-over-year: 4.04%.

So what is your spin on this?

Is it the “beginning of the crash?” The one that people were predicting back in 2006, before prices increased 134%, and those prognosticators lost out on a lifetime of tax-free capital gains they will never, ever be able to make back?

Sorry, I couldn’t resist. So much for my attempt to be impartial here, but my experiences weren’t just with statistics and headlines – they were with people. So it is most certainly all the more real to me, as I look back in hindsight.

If this isn’t the beginning of the “crash,” what is it?

Is this a down year?

Is it a return to normal?

Is it the market taking a breather?

Is it much ado about nothing?

If you were an equities trader, and a 38-year-old investor was looking at an RRSP with returns like those above, and there was one year down 4.04%, would it even be a talking point?

Actually, scratch that question. A friend of mine is a wealth manager, and he says that after eleven straight “winning” months, one down month will make the phones ring like crazy, with old men bitching and complaining about the market, predicting doom, and asking if they should move to a cash position. The same goes for one down year, in the context of a 10, 20, or 30 year time horizon.

So while we’re sitting here at December 10th, there are still three weeks left in the month, and a lot of real estate yet to be sold, I think we can all agree on the numbers I have outlined above.

Then why not get a head start on the “I told you so’s” and the predictions, right?

I welcome your thoughts.

Marko

at 6:28 am

Not a bear, and Toronto real estate has been a great investment, but these numbers should be adjusted for inflation… if the theme is winning 🙂

Appraiser

at 7:06 am

TREB stats for November indicated a 3.5% increase in average price year over year. That’s 6 months in a row where prices are ahead of 2017.

Unemployment numbers from Statistics Canada last Friday are at an ALL-TIME low, with the addition of 94,000 mostly full-time jobs.

Sure sign of an imminent real estate crash. Am I right?!

Chris

at 10:11 am

November sales activity lowest since 2012. Active listings above 10 year average. MOI highest since 2012. Average price remains well below peak.

http://creastats.crea.ca/treb/

Unemployment numbers are good news indeed. Will embolden BoC to continue raising rates.

Housing Bear

at 11:12 am

Interest rates have been trending down since the early 1990s. ( Start of last housing bubble correction and bad recession in Ontario)

https://www.google.ca/search?q=BOC+overnight+interest+rate+chart&source=lnms&tbm=isch&sa=X&ved=0ahUKEwiymNWeypXfAhWLo4MKHYhtBSoQ_AUIDygC&biw=1280&bih=610#imgrc=-iI4djOXjil-6M:

1996 as a base year represents the bottom of the last correction where prices were down about 35% on average since the 89/90 peak. (condos were down over 40%) Worth noting that the run up to this bubble was much shorter (although more steep). Prices didn’t recover on inflation adjusted basis until 2010.

Here’s how the bulls and market cheerleaders felt about the market in early 1990.

https://twitter.com/ExtraGuac4Me/status/1071948386792759296

Prices were predicted to rise even if there was a recession because of land shortages, foreign investment, bank of mom and dad, and the long term economic prospects for Ontario……….. sound familiar?

The real estate cycle typical lasts 16-20 years based on data going back to the 1800s. (looks like we beat the average this time…… Go Toronto Go!) Berkshire Hathaway Homeservices ( A Warren Buffet company) even points this out on their web page.

https://berkshirehathawayhs.tomieraines.com/Blog/ID/368/How-Long-Does-a-Sellers-Market-Last-Analyzing-Real-Estate-Cycles

Another nice little check list of what to expect during different stages of the cycle.

https://en.wikipedia.org/wiki/Property_cycle

Chris

at 11:22 am

Yup, typical real estate cycle in the United States was found to be 18 years.

https://www.extension.harvard.edu/inside-extension/how-use-real-estate-trends-predict-next-housing-bubble

Dan de Souza

at 9:55 am

Enjoy reading this blog and love the analysis it presents.

I do have a suggestion.

Chris

at 10:04 am

If we can all agree that December’s average price is very likely to come in below November’s, then Kyle’s prediction of TREB’s average price re-testing $921,000 (which he defined as attaining $900,000) in 2018 will prove to be wrong.

https://torontorealtyblog.com/blog/toronto-newspaper-headlines-tell-whole-story/#comment-80466

As for Toronto real estate’s winning streak, I don’t think anybody can deny that the past 20 years have been very good for this market, particularly in light of the use of leverage and the tax advantages conferred upon principle residences. But that same time-frame (Jan 1996 to Dec 2017) has also been good for equities, with the S&P500 index growing 320% and the NASDAQ climbing 599%. Note that this return doesn’t include dividends.

And yes, people will complain if their RRSP falls 4% in a year. Don’t forget, a couple weeks ago, Appraiser was talking about the “stock market taking a major dump…shhhhhhhhhh!” YTD the S&P500 is down 2.4%.

Kyle

at 10:23 am

TREB prices won’t beat last year’s high this year. Outlying areas and the higher end of the market are still weak, but Central 416 has rebounded nicely and there are many examples of homes that have sold for far more than they could have dreamed of in 2017.

I expect 2019 to beat 2018 and for price increases to continue to rise Y/Y, but at a more moderate pace than we saw in 2016 and 2017.

Chris

at 10:38 am

Perhaps there are some anecdotes such as you are referring to, but the stats are clear, as was your prediction. TREB-wide average price in 2018 did not even come close to re-testing the previous high water mark of $921,000, as you believed it would. It didn’t even manage to surpass $810,000.

So your prediction is that the full-year TREB-wide average price for 2019 will be above that of 2018 (likely to come in at ~$789,000)? If so, we will re-assess come January, 2020.

Jeremy

at 10:15 am

David, awesome blog post today, but I’m curious about one point. Can you elaborate on this:

“my experiences weren’t just with statistics and headlines – they were with people. So it is most certainly all the more real to me, as I look back in hindsight.”

Thank you!

David Fleming

at 11:34 am

@ Jeremy

Many of us like to tell stories, in hindsight, about market bears and their predictions.

But most stories are anecdotal, or nameless and faceless. We know “people out there” predicted a crash, and they were wrong.

But I dealt with actual people, who I remember vividly.

In many of these cases, the people were painfully arrogant, and while I’m not a vindictive person, nor am I the type to take pleasure in the shortcomings and misgivings of others, I do see a sense of irony.

I was completing my real estate license in 2003, and a friend of mine, who was much older, would tell me every single time we met that I was “shooting myself in the head.” He would always talk about the impending real estate crash, and how to get into the industry now was pointless, and self-defeating, since I’d spin my wheels for a few years, fail, then have to enter a new industry all over again. He was a renter, and paid $2,500 for a house on the east side. He continued to rent until 2008, which was when I lost touch with him, but for five years, every Sunday when we would watch football, he would tell me the market was going to crash, I was a fool, everybody was a fool, etc. That was a REAL experience to me. It’s not the same as simply knowing that economists, analysts, authors, and media “have been wrong.” I watched this guy spend $120,000 in rent over those five years, and never change course and buy a house – even though he and his family had massively outgrown the one they were in. He just kept waiting, and waiting, and getting harsher and harsher as the market continued to climb.

When we were looking at selling our family home in 2009, a friend of mine, who’s father made his fortune in real estate, told me, “You should sell it now, then buy it back in a year or two for half of what you paid for it. THEN you could hold it long term.” The suggestion was so asinine, but so arrogant. “You should buy it back in a year for 50% less.” Come on! And his only logic? “My dad says it’s going to happen.”

I can’t tell you how many stories I have like this.

A young British couple in 2011, ready to pull the trigger on a condo at 255 Richmond Street, but instead, “Talked to their stock broker,” who told them to rent instead, and buy into the market in a year or two. “David, you’re too biased to give us a real opinion,” they told me, as though the stock broker wasn’t in the same position, just on the other side. “We’re going to wait for the bubble to burst,” they told me, as though they KNEW it was going to happen, not just THOUGHT it would.

For years and years, I’ve dealt with people who acted as though they had knowledge that nobody else did. And I’m not saying I predicted a 21-year increase, but I was always level-headed, professional, and tried to present pros and cons to both sides. The problem is – most people who were market bears, were so goddam rude about it. Not everybody, and I’m not saying I’m mad at people for picking the wrong side of the coin, but in my experience, the people that decide to pass don’t do so graciously. And then when they’re wrong, they double-down, get ruder, meaner, and provide less evidence for their prediction.

But not everybody goes down with the ship.

A family friend, who I met in 2010, told me the market was going to crash. And in 2011. And in 2012. And then in 2013, he said, “So I bought a condo assignment.” I chuckled, and said, “But I thought the market was going to crash?” He simply said, “Well what do I know? Sometimes your gut, and the facts you’ve hand-selected to justify your position, can’t trump what’s actually happening out there. It’s never too late to right the ship.” His condo is up about 70%, and he’s happy to admit his views on the market were incorrect back at the start of the decade. But not everybody has that humility.

So that’s what I meant with my comment, excuse the long-winded explanation.

Professional Shanker

at 11:59 am

Great points David, bears in late 2000s & early 2010s had their fundamental argument rooted in the basis of interest rates not being cut to historically low levels for a such a long period of time, they essentially got burned by the coordination of central bankers.

Fast forward 10 years later and now the RE bulls are generally rude and laugh and gloat in the face of any continued bear, not you most of the time at least, lol!

The only way out of prolonged reduction in RE prices will be the continued reduction in interest rates – I predict (CAD & US) likely adopt a close to zero nominal interest rate policy in the next 5 years – should be interesting!

Chris

at 11:59 am

Good stories, and fair points. People can get emotional when discussing their investments, particularly real estate. This leads some to be rude, whether taking a bearish or a bullish standpoint. I have been guilty of this myself at times.

As I’ve stated before, at the end of the day, all we’re discussing is the valuation of a certain asset class. At present, I feel it is over-valued. Others will disagree, and feel it is fairly or under-valued. I would hope all of us are able to amend our opinion if/when the facts warrant it, and try our best to prevent the debate descending into rudeness or personal attacks.

Not Harold

at 3:29 pm

One thing that drove bearish sentiment in 05-10 was seeing the behaviour in the US.

Fortune had a cover story about house flipping in Vegas and Phoenix in August 05. Things were dodgy in housing in 06, some housing funds went bust in 07 and there was a terror crash and then bounce back in August 07, Bear went down in Jan 08, Lehman went down and took everyone with them in Sep 08. Toronto housing took a breather but then kept going, while the fundamentals were scary.

There was emergency stimulus from zero interest rates, but this was expected to be short term – no more than 2-3 years. That’s what previous cycles had looked like. So the expectation was that we’d see a real estate pullback in 2010 or 2011 at the latest.

Plus Toronto and Canadian real estate cycles had recently been rather short – 8 to 10 years.

Anyone betting their own money should be cautious. Bragging about being short and being a total is only something that an analyst on TV should do – you can make serious money for decades by being right once. Taleb about 08 and a few people are still somewhat famous for “calling” 87. TV, books, and speaking gigs requires behaviour that is personally atrocious and intellectually dishonest.

Caution was the wrong pose, and we didn’t see interest rates rise until 2017! There’s aphorisms about markets climbing a wall of worry but the real issue is that whenever we see a trend reverse, whoever is last is going to look obviously stupid. We had absurd behaviour in March 17, but the behaviour in 09 was similarly off the wall compared to 99 – it’s just that instead of being at a 9 or an 11 it was at a 28.

Professional Shanker

at 11:44 am

David – As a historian of statistics, perhaps you can remind your readers what happened the last time the GTA market had it’s first negative year after roughly 20 years of price gains? Rhetorical question I suppose, 1990 it was and for 7 years houses traded hands lower than the previous year (with exception of a small blip in 94). House prices lost 50% of their nominal value – including inflation closer to 65%.

I wonder what the RE industry was saying in the late 80s about the previous 20 years of price gains?

In no means am I saying definitively that prices will fall for 7 years straight – could be longer or maybe this is a 1 year blip and house prices will rise in 2019. What would the stats say when an asset class which utilizes leverage has a losing year, most on this blog won’t like the answer!!

To be clear I benefit in no way shape or form by house prices declining but to disregard statistics prior 1995 is convenient statistically speaking that is!

Chris

at 11:53 am

I get why David picked the years he did, as he’s trying to focus on the winning streak.

But you’re absolutely correct, omission of the last significant correction in the 1990s makes it appear that the real estate cycle is not a cycle so much as a continuous upwards churn. In reality, it seems that the cycle is just rather slow moving (as referenced above, typical USA real estate cycle is 18 years in duration).

Professional Shanker

at 12:01 pm

And here we are, at the top of the mountain/cycle……………wonder what is next statistically speaking?

Chris

at 12:22 pm

My guess would be we’re at the start of Phase III:

“The First Indicator of Trouble – The delineation point between expansion and market hyper supply is marked by the first indicator of trouble in the real estate cycle: an increase in unsold inventory/vacancy.”

We aren’t perfectly aligned with this study’s findings, particularly when it comes to rents, but I suspect some of that is because of the impacts of rent control and short term rental platforms (AirBnB). But it would seem that we are seeing an increase in unsold inventory, as MOI creeps upwards.

However, the timing is difficult to pin down. As Robert Shiller put it in a recent NY Times article:

“It can’t go on forever, of course. But when it will end isn’t knowable. The data can’t tell us when prices will level off, or whether they will plunge catastrophically. All we do know is that prices have been roaring higher at a speed rarely seen in American history.”

https://www.nytimes.com/2018/12/07/business/housing-boom-how-long-can-it-last.html

Professional Shanker

at 12:58 pm

I found this interesting in the context of the US housing market

“In September they were 11 percent higher than at the 2006 peak in nominal terms, and almost as high in real terms. This is not a return to normal, but a market that appears to be rising to a record.”

Seems like they have room for growth, much room!

Joel

at 12:12 pm

Great post! It is great to see that stats of what I think everyone assumed as the year went on. Next year is going to be very interesting to see what happens. I wouldn’t anticipate the average price next year moving more that 2% in either way, but it will help to define what this year is. (Slump, blip, new normal)

Appraiser

at 6:10 am

“Has the 2013 condo market crashed yet? Asking for a friend.”

~Ben Myers, Dec. 7, 2018.

A permanently high plateau

at 11:40 am

The same Ben Myers who spruiked for Fortress?

https://twitter.com/BenRabidoux/status/1055830821758742531

crazyegg

at 5:00 pm

Hi All,

Based on what I have seen and read, I seems that condo prices are on a tear?

Not to add any work to your pile David but me thinks that trending the data by condos only will continue the dynasty…

Regards,

ed…