“If a tree falls in the woods, and nobody is around to hear it, does it make a sound?”

I think the answer is “Yes, but…”

Then you can fill in the rest.

It’s sort of like asking, “If it’s your birthday, and you bought yourself a cake, but you have no friends, and you’re watching the candles burn, alone, is it really celebrating?”

“Yes, but…”

Pick your analogy, if you will. If you must. And for today’s post – you must.

But when I picture the would-be seller, sitting at the kitchen table on “offer night,” all geared up and ready to work, with those HB-II pencils all freshly sharpened and lined up, like that dork in your grade nine math class (that was me, by the way…), I can’t help but think of somebody sitting alone in front of birthday candles.

I mean, even if the tree does make a sound when it falls, nobody is going to hear a damn.

We’re 2 1/2 months into the real estate calendar and for the life of me, I can’t understand why any condo seller is setting an “offer date” right now.

Well, that’s not entirely true. I can understand why; it’s that I don’t agree with the “why.”

The way I see it, there are two reasons why a seller lists a property with an “offer date” in this condo market:

1) The property is something really special, unique, rare, and sought-after.

2) The seller is completely out of ideas and is grasping at straws.

Those two reasons are complete opposites.

That is the story of the 2025 condo market thus far!

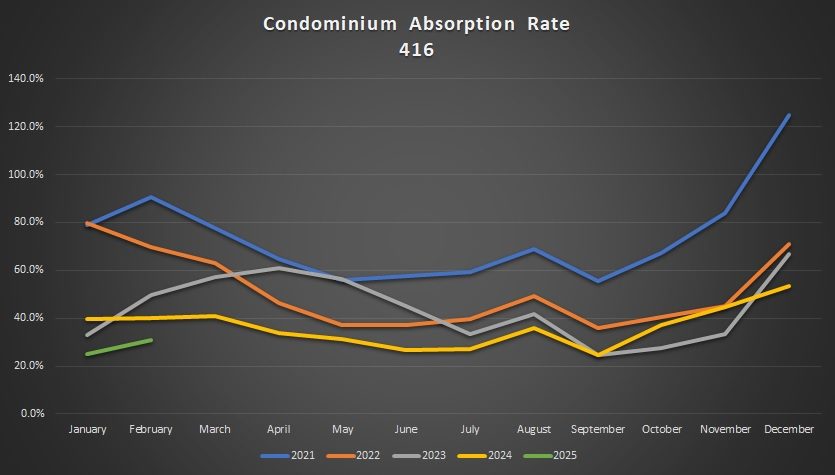

Recall that in early-February, when I reviewed the January TRREB stats with you, I showed you that the absorption rate in the month of January was a paltry 25.1% in the 416 and 25.6% in the 905.

In February, those numbers ticked up modestly to 30.9% and 28.2% respectively, but suffice it to say, the absorption data is still really, really week.

Just look at the five-year chart:

The optimist says, “Our lime green friend is trending up!”

But there’s really no sugar-coating this. Condo buyers are few and far between and we’re looking at historically-low absorption rates.

So when I see somebody setting an “offer date” for a condo, I just don’t understand it.

A few weeks ago, I was in my brokerage meeting and agents were announcing their new listings.

One agent talked about his new downtown condo listing as I focused intently on my game of brickbreaker on my BlackBerry; er, maybe I was playing snake on my Nokia 9800, I can’t quite remember. In any event, my ears perked up when I heard him say, “…..and we’re holding back offers until the following Monday.”

Huh?

What?

Wait, I hear you. I meant….

….huh? WHAT????

I mean, if a tree falls in the woods and all. Right?

Holding back offers on a C- condo in a D- market is a complete and utter waste of time, effort, energy, strategy, and it might actually work against the seller, agent, and listing.

Before we go any further, some of you might be thinking that there is something to be said for “going against the grain,” or how in difficult times, “one must get creative” in an attempt to “make something happen.”

I buy that. Just not in the downtown condo market in March of 2025.

The problem I see is this:

It’s a buyer’s market. Setting an offer date is something that’s done in a seller’s market. Buyers, in a buyers’ market, want to work with sellers who know and act like it’s a buyer’s market. Buyers, in a buyer’s market, aren’t going to work with sellers who act like it’s a seller’s market.

Personally, if I see a condo listed for $799,900 “with an offer date,” I’m going to assume that the seller wants something stupid, and/or is overvaluing the condo and underestimating how poor the condo market currently is.

“You catch more flies with honey,” the saying goes. So why not be the listing agent, seller, and property that rolls out the red carpet for buyers instead of the ones who puff out their chests as they sink to the bottom of the sea?

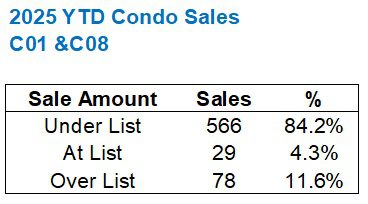

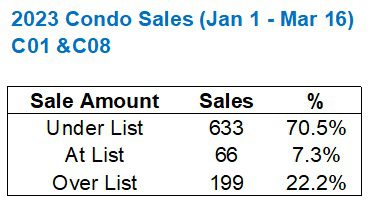

I was very curious about the actual statistics on this so far in 2025, and since I have absolutely no life, I sat down on Sunday afternoon to download an uncanny amount of data.

I looked at every sale so far in 2025 in C01 and C08 (aka “downtown”) and sorted the data by sale-to-list ratio.

The question I wanted to answer was this:

What percentage of condominium sales sold for over the list price?

I would hazard a guess that it’s about 5-8%.

While I maintain that “under-listing” a condo in today’s market and setting an offer date is a poor strategy, that doesn’t mean people aren’t trying it.

Before you ask the question – no, I don’t have stats on “offer date success rates.” That would mean downloading every single unsold and terminated listing and scrolling through the notes to see which had offer dates.

So where does my 5-8% guess land me?

Well, outside the bell curve, it seems…

That’s crazy to me.

11.6% might not sound like a lot, but I have no idea who’s “bidding” on condos in this market.

I don’t understand this:

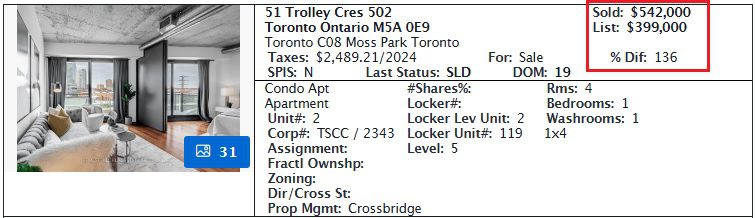

Good on the seller and the listing agent here for selling a junior-one-bedroom condo in a tough market.

But who lined up to bid on this?

Who adhered to the “offer date?”

Look at the days on market: 19.

Who’s waiting 19 days to “bid” on a 400-something square foot condo in this market?

I can’t believe this worked.

But for every attempt at this, how many failed? We don’t have that data, unfortunately, but I would have to think based on emprical evidence, the answer would be “a heck of a lot more than last year, and the year before, and the year before…”

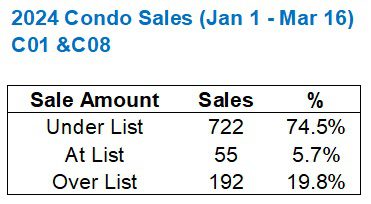

Speaking of which, what about last year?

Here’s the same data set:

Here we see a significantly higher percentage of sales OVER the list price than so far in 2025:

19.8% in 2024 versus 11.6% in 2025

Is that “enough to move the needle?”

I mean, I still can’t believe we’ve seen 11.6% so far in 2025! It’s crazy to me!

But yeah, if we want to ask the question: “Should this change the strategy?” then I would argue it’s a big enough difference to necessitate a change.

A drop from 19.8%, which still isn’t a big number, all the way down to 11.6% would have me asking, again, “Why would anybody list low and hold back offers in this market?”

As for 2023, the figures are even higher:

22.2% versus 19.8%

Not a major uptick but enough once again to show just how many fewer downtown condos are selling for over the list price.

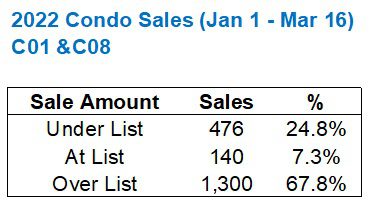

But then if we really wanted to demonstrate just how much things have changed since the “peak,” we would look back one further year.

2022.

Ah, what a crazy year. And even though the market changed significantly in April and remained lukewarm throughout the rest of the year, the first 2 1/2 months show us just how wild things were.

Let’s re-run the same data as above for 2022:

No, that is not a typo.

19.8% and 22.2% in 2024 and 2023, but yes, a ridiculous 67.8% in the same time period in 2022.

It was absolutely absurd.

But we have to remember that back in 2021 and 2022, this was a typical condo sale:

Yep, pretty typical.

I can’t tell you how many listings I had for basic, nothing-special condos that resulted in 15-20 offers.

Having said that, marketing did play a role in this. We pimped the heck out of every listing we had, and back then, buyers were overcome with emotion and the listings that looked the best, sold the best.

But I’d be lying if I said that in 2021 and 2022, even some poorly-presented condos by some less-than-stellar listing agents still received multiple offers.

So put the last four years together and it looks like this:

Now, let’s pretend that you’re a would-be condo seller.

What do you think about the “under-list, hold-back offer” strategy?

If you’re on your seventh listing, then sure, I understand. But if you’re on your seventh listing, you have bigger problems, notably that you’re not accepting current market conditions, otherwise you wouldn’t be on your seventh listing!

As I said at the onset, I understand this “strategy” when it’s a crazy person on their seventh listing and I understand this strategy if you have a renovated hard-loft at 993 Queen Street West with a size and layout that hasn’t been seen on the open market in two years.

But for the rest?

I feel like you’re just alienating the buyer pool.

Setting an offer date for a condo in today’s market is just asking to be left alone on offer night.

But if you like blowing out birthday candles alone, then have at it…

RPG

at 10:53 am

My snake record is untouchable. Thousands of hours logged with that game, riding the TTC in the early 2000’s.

Anon Reader

at 11:07 am

Hey David, this is unrelated to the current blog post but thought you might find it interesting for a future MLS musings post or similar – check out the listing at 275 K. Ave (not sure if we’re allowed to post the actual address) that came out today, vs. the version from 2021. I look at all the new listings daily and this one stuck out to me. The “after” (2025) pictures are so wild vs. the “before” (2021). The colour of the floors, kitchen reno, black bedroom with the wonky plaster….all just pretty crazy. Not to mention listing for 300k more given the market from 2021 to now.

David Fleming

at 11:56 am

@ Anon Reader

I’ve been meaning to comment about what’s “allowed” to be posted nowadays.

I have followed the rules since 2007 when I started this blog. I black out addresses and try to talk about listings without identifying them. But thousands of agents on Tik Tok or Instagram are doing videos with active listings, sale prices, addresses, et al. My argument isn’t “They’re doing it, so I should be able to as well,” but rather I think I’m less fussed today than in the past, as evidenced by my not blacking out the addresses in today’s post.

In any event, the listing you referenced underscores the level of insanity of many sellers out there today. A $300,00 increase over a near-peak price for a house that’s tenanted.

I have a blog post in the queue about this topic. Simply using a series of “average price” metrics, we could easily estimate the value of a home today versus any period in the past. It’s an inexact science, but it’s a starting point. And if the TRREB average home price is down, say, 9.5% since a person purchased in 2021 or 2022, then how could they list a property 15% HIGHER today?

Ace Goodheart

at 3:22 pm

Many folks seem to be trying to unload their pandemic era purchase houses, but they’re not getting anywhere near pandemic era pricing.

Just watched a seller lose 300K selling a 1.7 mil pandemic home for 1.4 mil.

Steve

at 5:38 pm

I don’t think this market (especially for condos) will come back until first time buyers can afford to get in …. and that means lower prices.

Ace Goodheart

at 8:08 pm

There’s a generalized slaughter of pandemic sellers going on right now. Condos were the first to fall. Now we are seeing detached and semi detached and towns suffering the same fate.

The weird thing is, people have the money.

They just aren’t spending it.

It’s almost like a psychological barrier has gone up.