If you ask the folks over at The National Post, they would seem to suggest, “yes.”

An article ran in the Financial Post last week about “Joe Schmo” lenders that I personally felt was a little misleading, since they were talking about the “dangerous” lenders while interviewing people from alternative, albeit “A-lenders” like Street Capital, First National, and MCAP. The latter three are A-lenders, who basically use the same lending criteria as the Big-5 banks; they just don’t have old-lady chequing accounts and security deposit boxes, like the Big-5 banks.

So should we be worried about “Joe Schmo lenders doubling their stake in Canada’s mortgage market,” as the Financial Post article suggests? Or should we be happy that there are options outside of the banking oligopoly?

I am not an expert on this subject.

I do have my opinions on the matter, but as soon as I began discussing this with my mortgage broker, Joe Sammut, I realized I needed him to write this blog, not me.

So I asked Joe very simply, “What do you think about the article?”

He didn’t agree with the content, on the whole, but also the way it was written.

I asked Joe for a “response” to the article, but then just because I know how people think, I proposed five questions to stimulate the conversation that would undoubtedly ensue.

So first, here’s Joe’s response to the Financial Post article:

–

Has Joe Schmo Begun the Wild West in the Field of Secured Lending?

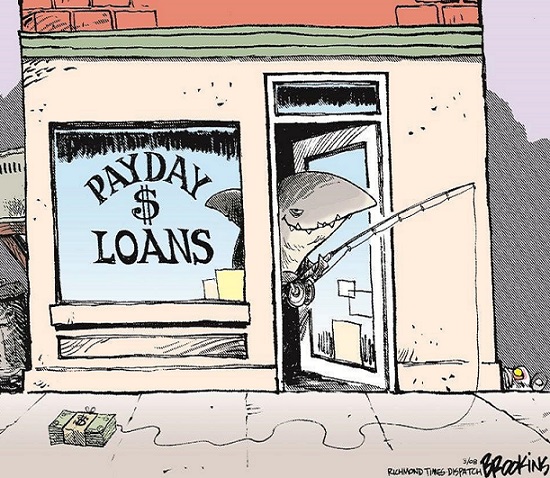

The Financial Post featured an article last Wednesday discussing “Joe Schmo” lenders and the risk they pose to the market. The absence of federal and provincial regulation would, undoubtedly, allow private and alternative lenders to go rogue and gouge clients wherever possible and it’s a scary thought. But what is meant by a “Joe Schmo” lender and how much freedom do these people/institutions have to lend? How much regulation is there prohibiting them from engaging in – for lack of a better word – predatory lending?

We’ll start with the non-traditional bank lenders; institutional lenders that are not the big five banks. In the industry we call them mono-line lenders because they only have the one line, being their mortgage products. The article alludes to a few being First National, Street Capital Group, and MCAP. While there are roughly 35-50 others depending on what province you operate in, we can use these three as perfect examples of mono-line lending and regulation. As it turns out, these three lenders are all considered “A” lenders. They only lend on “A” business meaning the borrower needs decent enough credit, reasonable income to service the mortgage, and low debt levels. They (mono-line lenders) do have programs that think outside the box such as stating incomes for self-employed individuals whose taxable incomes don’t reflect their actual lifestyles for example, but these programs are often niche products and don’t represent the large portion of business that goes to these lenders. This is especially true in my brokerage as we regard most mono-line lenders as “A” business only. One might say that these lenders have similar if not exactly the same risk tolerance as the big five banks when it comes to mortgage lending. But of course, reading that they have books of nearly $200 billion combined can make things seem very scary. The fact is, these lenders which make up a very large portion of the mortgage market are being just as conservative as the big five banks.

So what happens if a client can’t get approved through a bank or a mono-line lender? In that case, there are “B” lenders or what we call “Alt-A” lenders. These lenders typically have a larger appetite for risk and will lend to clients with bruised credit, non-traditional sources of income, or not enough established credit in Canada. With these risks comes higher interest rates. While “A” lenders currently charge around 2.5% for a 5yr term, “B” lenders will typically charge anywhere around 4-7% for a 1yr or 2yr term. The reason for shorter terms is twofold. One, it mitigates the risk taken on by the bank as less time on the loan means less exposure to any market volatility; and two, this type of lending is never seen as a permanent solution, but instead, a temporary solution until we can make the client more appealing to “A” lenders again. It’s worth noting here that this is how any mortgage broker/agent worth their salt should approach “B” lending but this isn’t always the case. The sour apple spoils the bunch unfortunately…

Now, what if a client still carries too much risk for a “B” lender to approve them? That is when a mortgage broker would turn to private lending or in some cases, alternative lending sources. These funds are oftentimes costly and should only ever be used as a temporary solution until the client can either improve their situation or offload the property. Rates in this instance can range anywhere from 7-25% depending on the client’s credit, debt, income, location of their property, etc. Because these lenders are less regulated, there is no saying what a lender might want to charge a client. Having said that, good ol’ fashioned supply and demand still plays a role here. Although one alternative lender may want to charge you 21.1%, another may be willing to lend at 18.5% and another at 12.75%. This competition in the private/alternative market usually brings the pricing down to a fair market rate that is reasonable given the risk of the client.

All of the above are options available to a client assuming their mortgage broker/agent/representative is working in their best interest. But as with any industry, that isn’t always the case. Unfortunately, we’ve seen clients offered rates 5-10% higher than should be expected with fancy mathemagic that makes it next to impossible to calculate exactly how much interest the client would be paying. By law, a lender cannot charge more than 60% APR (Annual Percentage Rate) including all compounding, fees, etc. Anything more than this is considered usury but anything less is fair game in the eyes of the regulators. When your local jewellery buyer or pawn shop offers home loans fast and easy with little documentation, their 18.5% rate compounded monthly plus lending fees, etc. can quickly start to approach that line. This is the type of predatory lending that leaves consumers over-leveraged and threatens the healthy operation of the economy. But are these the guys “doubling the stake in Canada’s mortgage market”?

Now here are my “five questions” and Joe’s answers:

1) What do you say to the somewhat-informed, and/or article “skimmer,” and/or anonymous internet commenter, who offers the generalization, “If you can’t get financing from a Big-5 bank, you shouldn’t get financing, otherwise these alternative lenders are simply allowing non-qualified buyers into the market, and thus artificially propping up the real estate market, and heading us towards a U.S.-style real estate collapse, circa 2008 with their shoddy lending practices?”

I would re-word this question as “What do you say to the skeptic who offers the typical adage “If you can’t get financing from a Big-5, you shouldn’t be getting financing at all. Otherwise These alternative lenders are helping to artificially prop up this crazy real estate market. Aren’t we setting ourselves up similar to the US before the 2008 housing collapse?”

I would say that the fear of a housing collapse is a completely legitimate fear, but the chances of this causing a housing collapse are very slim and any sensationalist media is somewhat misinformed. In our day to day operations, we see perfectly stable clients turned down with the Big-5 because they are tightening their reins. These are not credit-seeking, debt-reliant clients who are irresponsible with money; they are typically clients that can easily afford to service the mortgage but have either non-traditional forms of income (self-employment, commission, overtime hours, international income, etc) or a very reasonable explanation for bruised credit. These clients are put into reasonably priced alternative mortgages as a temporary solution until their situation can be improved. If the risk is too great, however, they don’t even qualify for these loans and instead need to turn to higher risk-tolerant lending such as private funds, MICs (Mortgage Investment Corporations), or smaller alternative lending institutions. It’s worth noting that these types of lending solutions are almost always used to refinance out of bad situations and very, very rarely used as a means of purchasing (and thus falsely propping up the market).

In other words, there are very healthy reasons for a client to seek alternative financing and with the right advisor, it’s a quick and temporary fix. Alternative financing should almost never be used as a means of acquiring real estate if there is no intention of ever qualifying as an “A” client.

2) What is the difference between “Big-5 Banks” and First National, Street Capital, and MCAP?

In terms of overall services, mono-line lenders like First National, Street Capital, MCAP, and many other lenders offer only mortgage products. They don’t typically deal in student loans, saving accounts, unsecured lines of credit, or other banking services. Otherwise, their mortgage products are on par with each other. Most mono-line lenders have mortgage products with similar rates, features, and benefits.

3) If a buyer cannot obtain financing through a Big-5 Bank, are we to simply assume that they can obtain financing through an Alternative-lender, and if so, how would that look?

If a buyer cannot obtain financing through a Big-5 bank, we can oftentimes still obtain an “A” mortgage through a mono-line lender. A decline from a Big-5 bank can sometimes be as simple as the client not having enough of a banking relationship established or having an income that doesn’t quite fit the bank’s “box”.

If, however, the client truly isn’t an “A” client, we would then turn to “B” financing which has somewhat more lax underwriting guidelines and higher rates/fees. This jump from “A” to “B” rates isn’t gigantic but is often significant enough to make unwise decisions like overspending or over-leveraging cost-prohibitive.

4) Two buyers have a $250,000 down payment on an $800,000 house, but they are self-employed, show little income, and thus the Big-5 banks will not provide financing. How is this deal structured with an Alternative lender?

Contrary to what some might think, these buyers could potentially still qualify for a mortgage with a mono-line lender. The mortgage would still have the same rate, features, and benefits that a bank would offer as well. Sometimes the difference is as simple as a deal making sense but not fitting a cookie cutter mold that most of the Big-5 have.

5) A buyer has a 5% down payment on a $400,000 condo, but shows no income, no credit, and thus the Big-5 banks will not provide financing. How is this deal structured with an Alternative lender?

In this case, this is a fairly high-risk deal. Very few institutions (“A”, “B”, or otherwise) would entertain this transaction which would only leave two viable options. The client would either need to obtain private financing or rely on a “No Questions Asked” lender such as a pawn broker or jewelry store owner. In either case, the risk is so high that I would imagine rates would exceed 30%. It’s difficult to say how high the rate would be as these cases are so rare and are almost intentionally priced to deter this type of behaviour.

Now let me ask you:

Do you think there’s a benefit to opening the lending industry to those outside the Big-5 banks?

Or are you willing to blow this entire conversation out of proportion, and start talking about a U.S.-style housing crisis as a result?

Maybe there’s an opinion somewhere in between, so have your say below…

Joel

at 8:51 am

There is a huge difference between a mono-line lender a B lender and a private lender. The Financial Post article seems to group them all together. Going to a private lender is a last resort, and only comes into play when it makes financial sense. As Joe had mentioned these mortgages are not for purchases, they are for refinances and generally higher interest debt consolidation.

Condodweller

at 9:14 am

I suspect the first question was meant to say do we think there’s a benefit to haveing opened up the lending industry to those outside the Big-5 banks?

There is a definite benefit to alternate lenders especially the mono-line lenders. There are lots of situations where a buyer does not meet the rigid requirements of the big 5 and have no problems paying their mortgage payments. They are also a huge safety net for those who have been preapproved by the big five, subsequently committed to buying i.e. finalized an offer, then at closing, they are asked to pony up an additional 50k or get declined altogether.

There are lots of people in non-standard situations i.e. self employed, contract workers, people working in the US etc. who the big 5 will never lend to but have no problem paying their mortgage.

Mono-line lenders also provide competition to the big 5 resulting in much lower rates for consumers which is always a good thing.

The risk of a US style crash is way overblown, however, there are cracks in the system that could lead to a market downturn. I know of people who have obtained mortgages from the big 5 who lost a job yet the banks still advanced the mortgage. I also know that the big 5 are lending the maximum amount to single people with large incomes. I still say the biggest risk to the market is the group of people who take on the maximum amount they qualify for with large salaries where in case of a job loss they either can’t find a new job, or not with a high enough salary to support paying the mortgage due to fear that they will be priced out of the market if they wait.

I use the balloon analogy. The higher the market goes, the greater the risk. If you put a small amount of air in a balloon you can poke it with a pin and be fine, yet blow it up to the max and it will pop by itself.

MB

at 9:46 am

Fantastic article, David!

Personally I am very happy to see the lending industry opened up beyond the big five banks. There is virtually no difference between monoline lenders and the big five, but it doesn’t stop the big five from spreading fear.

Monoline lenders can offer lower rates because they do not have millions of square feet of retail space to rent.

Edward

at 9:47 am

No mention of Harold the Jewlery Buyer in this article?

Appraiser

at 11:15 am

The rise in “Joe Schmo” lending, (a derogatory and over-sensationalized depiction of the practice), is nothing sudden. It has been very gradual and is a direct result of two main factors. An exit from the non-prime lending space by some of the big boys like TD, who fled that market in 2012, and a continuous tightening of mortgage regulations instituted by OSFI since the financial crisis. All of which has driven otherwise mortgage-worthy clients directly in to the arms of alternative lenders.

Interesting to note that the default rate on mortgages among the alternative lenders is comparable to their more conventional competitors.

Kyle

at 4:41 pm

@ Joe and David, this is an incredibly informative post! Thank you guys.

I’d ordinarily be all for opening up the industry, but after reading this i now have second thoughts. I think there is a lot of misinformation out there from the media and from the advertising campaigns of the various lenders. I suspect that borrowers who get rejected from a bank generally have no clue what their options are and i wonder how many of them are needlessly turning to Alt-A and private lenders to purchase.

RPG

at 6:43 pm

@ Kyle

I think the point here is that the “A” alternate lenders use the same approval criteria as the banks, so it’s not a matter of a borrower getting turned down, but the misinformation out there is that alternate lenders are somehow a notch below the banks.

As Joe said, they’re monolines, meaning they have ONE product, which is mortgages. These aren’t loan sharks, they’re just not banks!

The misinformation among the public is that they ARE a notch below the banks.

But it’s like getting a hot dog from a hot dog cart instead of from a cart that sells hamburgers, falafel, and gyros.

Kyle

at 9:12 am

Sorry you’re right, i meant to say “needlessly turning to B lenders and private lenders to purchase.”

My point is that the monolines aren’t really known to most borrowers unless they happen to be dealing with a mortgage broker. So when someone walks into a bank (typically someone not dealing with a broker) and gets rejected, they often think the only alternative is to pay a tonne of interest to a B lender (whom tend to be better known due to their relentless cheesy advertising campaigns).

I would like to see more monolines going head to head with the banks, but i don’t want to see more B lenders and private lenders.

Clark Blair

at 12:13 pm

Thank you for this informative article. Two points to add:

1. One of the reasons a financial crisis is bad is that governments are forced to bail out banking institutions and their creditors, or face very unpalatable consequences. These mono-line lenders and others (Alt-A, B) are in no way shape or form even remotely of a size or nature that a government would consider bailing them out. For one thing, they do not take deposits from consumers or businesses (which is why they are not “banks”!) If one of these lenders goes bust, a receiver would likely be appointed and just administer the loan book until it runs off naturally over time.

2. the article points out that there is a market in alternative mortgage lending in Canada, and like any market, it responds to supply and demand. A savvy customer should look at multiple alternative mortgage providers to obtain the best price — like you would in any market. it is not the government’s job to regulate or mandate behavior so that customers do not make dumb bargains. Increased regulation will only constrict supply, leading to fewer alternative mortgage providers and ultimately higher pricing of their mortgage products.

Not Harold

at 10:57 am

Street et al aren’t A

I know first hand how they analyze and process their loans (for obvious reasons I won’t explain how or why, but I do) and it is not great. There’s a reason why Street still isn’t a bank, despite years of planning and effort.

Equitable is a bank but… yeah.

While some of their business is A like that also assumes that the information that they are getting is quality. See Home Capital for how that assumption may be… optimistic.

From seeing their systems and operations, I would call them Alt A with quality aspirations. From their actual business approach, how much those aspirations are real vs window dressing for bay street and their funding partners is hard to tell but I would be pessimistic.

There is a huge amount of trouble stored up in the monolines because of a lack of diversification and because of inherent contradictions of their business. If your only business is to write mortgages it’s hard to dial back. Just like how it’s hard for a fund manager to not be invested even if the relevant markets seem over priced and over levered.

I think that they have a place, especially with true A looking for very cookie cutter mortgages until you are a very substantial client. I just think that they should be viewed with extreme skepticism.

Kyle

at 9:15 am

I’d be interested to hear some thoughts on Ottawa’s new mortgage rules from some of the mortgage pros out there. Seems to be a lot of hand wringing about buyers having to qualify at posted rates. But in my (possibly uninformed) mind the posted rates are nothing more than arbitrary rates that the banks post to obfuscate the true rates that mortgages are really being done at. They could all drop their posted rates by 150 bps tomorrow and basically that would nullify these new rules. Am i missing something?

Not Harold

at 1:01 pm

Kyle

Posted rates make it easier to be unclear about pricing and also to not piss of customers. If it’s posted at 4.6 but I did a special deal just for you, which is really going to piss of my manager, and got you 0.5 % off then you’re quite happy with 4.1 (or you might be). If the posted rate is 2.9 and only the best of the best customers truly get 0.5% off but you still get offered 4.1, then you’ll know you’re getting a much higher priced loan because either you are a bad credit risk or the bank thinks they can get away with it.

We’ll see the balance in competitive drivers as to how posted rates move. But no salesman or business ever really wants transparent pricing.

The major issue is if the rules move on to non-cmhc loans. Not much in Toronto qualifies these days except for one bedroom condos, and not even especially large ones.

Kyle

at 1:46 pm

My thoughts exactly. Until now there hasn’t been any reason for banks to set posted rates at anything remotely close to contract rates, hence the current 200+ bp spread on 5 yr fixed, but there will be some serious competitive pressure to lower posted rates now. I think this will be much to the banks’ chagrin for two reasons: 1. As you have pointed out, posted rates are akin to MSRPs on negotiable items, they act as a starting point that leaves lots of profit after negotiation. 2. IRD’s are often based on posted rates, so if they lower posted rates they earn less when people break their mortgages. Will be interesting to watch, but ultimately i don’t see a scenario where banks will be turning away borrowers en masse happening.

Ama

at 4:08 pm

I qualifies for mortgages at big banks but went with First National as the rates were lower and the Big5 would not match. The Big5 were difficult and sent everything thru Toronto for approval. First National’s posted rate is consistently lower and they have great customer service.