I had a really tough time coming up with a title for today’s blog.

Saying what I really wanted to say would have been a mouthful. Well, the title already is a bit of a mouthful, so let me say it would been even longer had I said everything I wanted to.

Case in point:

Condos are shrinking in size.

People don’t like the smaller condos.

Young people don’t like smaller condos.

Real estate is expensive.

And so forth.

Put this all together and we see the theme and question in today’s blog post: are these smaller condos showing us just how smart today’s younger condo buyers are or just how entitled they feel to not be “forced” to live in one?

And before you accuse me of gaslighting “youngsters” out there, just wait until I get to some very choice quotes from a 21-year-old who did an interview with the Globe & Mail and showed us exactly how entitled some young people can be.

But first, a history lesson is necessary…

The oldest purpose-built condominiums in Toronto’s downtown core date back to the 1970’s and 1980’s. Yes, that’s how new our city truly is. We’re really only two generations into downtown living in a so-called “world class city.”

At the time, condos were built for living. They were built for life.

Consider a building like 25 George Street which was built in 1989. This building is primarily comprised of what we would call “huge” units, by today’s standards. With only 9-storeys and 40 units, most of these are 2,000 – 3,000 square feet in size and were intended to replace houses for people who wanted a different style of living.

Go back in time even further – to 1976. That’s when 33 Habour Square was built, and while this condominium gets absolutely zero love in 2024, this was all the rage before you and I were born. It was basically a community inside a building, with all the amenities that you’d expect to find outside, contained within the walls of a 45-storey building with 536 units.

The idea of “building condos for families” may have began in Toronto in the late-1970’s, but somewhere along the way, this ceased to be the objective.

Have we ever wondered why that is?

I mean, price, obviously.

The so-called “families” can’t afford $1,400 per square foot for their 3,000 square foot house in the sky.

But when did we stop building condos like 25 George Street? And why?

I started my career in real estate in 2004 and at the time, a “small, one-bedroom condo” was thought to be around 600 square feet.

I’m sure you’re familiar with the term “shoebox in the sky,” right?

Well, back in 2004, people would use that term to describe 600 square feet. In fact, I remember one of the first ‘leads’ I was ever given as an agent was from the daughter of a colleague’s long-time client, and she balked at the idea of living in a “tuna can in the sky” that was 650 square feet.

Today, we’re routinely seeing condo floor plans under 300 square feet.

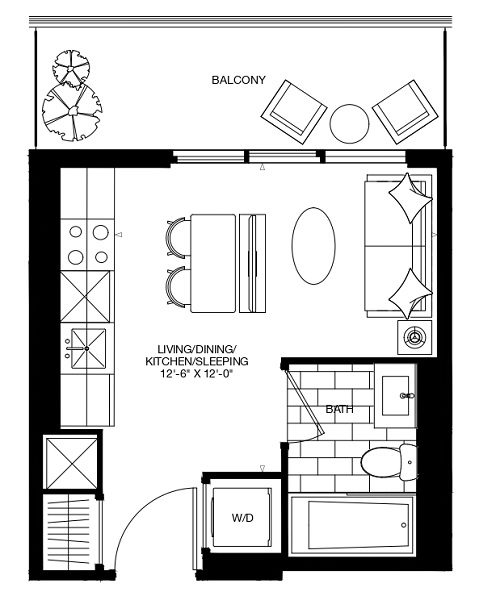

Here’s one in particular:

263 Square Feet

“The Goode” – Distillery District

By Graywood Developments

This is crazy, right?

But this isn’t the “shoebox in the sky” that people complained about in 2004.

This is less than half of the shoebox, as it was, in 2004.

I purchased my first condo in 2005 and it was a 575 square foot floor plan which I felt was more than ample. At 25-years-old, I didn’t need a “chef’s kitchen.” I was already spoiled to have a dishwasher, which was something I never had in university, and a stacked washer/dryer was an absolute luxury compared to the days of using a shared coin-operated machine in the dirty basement of a low-rise building in Hamilton, Ontario…

Back then, the average price per square foot of a condominium in downtown Toronto might have been $450.

At the same time, pre-construction condominium prices were even lower (we’ve discussed why at great length…) and as resale prices began to rise, so too did the price of pre-construction units.

There are all kinds of statistics floating around about the percentage of pre-construction condominium buyers who are investors.

I read in THIS article in December of 2023 that 80% of pre-construction condo buyers are investors, but I might argue that the number is even higher. After all, a true “user” is one who absolutely intends to live in the unit once it’s built, registered, and turned over. I have never thought that this makes up more than ten percent of the buyer pool.

If investors are financing pre-construction condominiums, and if banks won’t loan to developers until 70-80% of units are pre-sold, then it seems to reason these developers need to build the units that will sell the easiest.

That is why a much larger percentage of condominiums being built these days are bachelors or 1-bedroom units.

But why have unit sizes been shrinking for twenty years?

Simple.

Absolute price versus relative price.

I always figured that $500,000 was the ‘breaking point’ for mom-and-pop investors who had no problem investing when pre-construction units were $270,000, or $330,000, or $410,000, but once units started to cost above a “half-million” dollars, the buyer psychology changed a little.

In 2006, let’s say that you could purchase a 575-square-foot, 1-bed, 1-bath, pre-construction condo for $450,000. That’s only $258,750. That’s child’s play!

But when prices began to rise, so too did the cost of these pre-construction condos.

When pre-construction prices hit $800 per square foot, that same 575 square-foot condo was now $460,000, and it was bordering on uncomfortable for those small-time investors, especially when you factor in the “extras,” such as the upgraded finishes, closing costs, and charges passed on by the developers.

So what did developers do?

They started building smaller condos!

Who really “needs” 575 square feet, right? It’s not like the investors are living in the units!

Make that unit 500 square feet at $800 per square foot, and now we’re down to only $400,000 from $460,000. Simple solution!

But what about when pre-construction prices hit $1,000 per square foot? What then?

Well, just shrink that one-bedroom condo down to a 400 square foot model! Then the unit still only costs an investor $400,000!

Do you see where this is going?

Do you understand where all this went?

From 2019 through 2023 when the pre-construction market was on fire, “investors” routinely lined up to pay upwards of $2,000 per square foot for these magic beans, with most downtown projects falling somewhere between $1,400 – $1,700 per square foot.

Imagine my first unit, for a moment, all 575 square feet of it. Now imagine that floor plan in one of these bougie new pre-contsruction projects charging $1,700 per square foot.

That same condo would cost almost a million dollars.

So why not just create floor plans that are around 300 square feet?

At $1,700 per square foot, that’s “only” a $510,0000 investment.

Like I said: it’s absolute price versus relative price.

It is my contention, and I would be tough to convince otherwise, that the reason condominiums have been shrinking in size is not because of a change of tastes, or a change in the way younger people live, or anything of the sort.

It is my contention that the reason condominiums have been shrinking in size is because it makes them cheaper on an absolute basis, and easier for developers to sell to investors.

It’s kind of funny when you think about it: our downtown core isn’t the result of some grand plan by the municipal government, enacted thirty years ago, nor was it overseen by city planners or a bunch of PhD’s in urban and regional planning but rather it was effectively created as a fluke by developers who needed to pre-sell units to investors, otherwise their projects wouldn’t get financed.

Just imagine a developer building a condo like 25 George Street today?

Imagine a building with only 3,000 square foot condos? Who would purchase those in pre-construction? How would a developer get to the 80% threshold to receive financing and the go-ahead from a bank?

Unfortunately, that is how development has worked in Toronto for as long as I’ve been in the business.

I’m not the only one who’s noticed, nor am I the only one who has opined.

A couple of weeks ago, I received a call from a reporter who was working on a story about “family-sized condos,” or rather, the lack thereof.

She referenced a blog post that I wrote seven years ago:

November 8th, 2017: “Should Toronto Be Building More Three-Bedroom Condos For ‘Families?'”

In the blog post, I referenced a 2009 staff report by the City of Toronto that sought to address, “the issue of housing suitable for families with children.”

Here’s that staff report:

October 13th, 2009: Final Report – Official Plan Amendment to Encourage the Development of Units for Households with Children

Since then, condos have continued to shrink in size.

Not only that, the idea that they are somehow “suitable for families with children” has become less realistic.

Here’s the Toronto Star article that ran over the weekend?

“Toronto Wants More Family-Sized Condos. Here’s Why What’s Being Built Doesn’t Work”

Toronto Star

August 23rd, 2024

I was quoted a few times in the article as was your idol, John Pasalis from Realosophy.

Everybody quoted seemed to draw the same conclusion: that developers are not going to build large condos “for families” because there’s no demand…

…at market price, that is.

Therein lies the rub, of course.

The root cause of “no suitable condos for families” is the same as the root cause of the shrinking one-bedroom condos in the first place!

Speak of those shrinking condos, I want to now explore the article that ran more than one week ago which contained those elements of “entitlement” as I saw them.

“First-Time Home Buyers Are Shunning Today’s Shrinking Condos”

The Globe & Mail

August 18th, 2024

Now, the “entitlement” isn’t apparent in the title, despite the use of the word “shunning.”

And here’s where I seek to differentiate between intelligence and entitlement.

Why are first-time buyers shunning today’s condos?

Here’s a quote for ya:

Alec Dagenais, 21, is a few years out from being ready to buy his first home, but he already knows he doesn’t want a condo.

Oh, he doesn’t?

And he knows this already at the ripe, old age of twenty-one?

Nice for him!

I assume he eats caviar in a dinner jacket in front of the fireplace every night and takes a helicopter to the office.

But is he, along with others like him, shunning condos because he can afford to buy a detached, four-bedroom home? Or is he shunning condos because he thinks they’re beneath him?

From the article:

He sees some appeal to condo living: It would be less responsibility and, as someone living alone, he doesn’t need a huge amount of space.

But monthly condo fees make the units more expensive than their sale prices suggest, he says. And living in Gatineau, a still-affordable market, a condo is “a lot of the time not meaningfully cheaper,” says Mr. Dagenais, a wealth management associate. “I don’t see the point in going for something inferior, because historically they gain value at a lower rate than single-family homes.”

He’s 21-years-old and he has it all figured out.

He doesn’t see the point in an “inferior” condo.

His first comment, presumably because he’s a wealth manager, is that condos gain value at a lower rate than single-family homes.

Yes, this is true.

But my question remains:

Can you afford a single-family home, and thus you’re passing over condominium living? Or are you simply living in an entitled dream-world where you wouldn’t have to slum it in a condo and you can find an entire house for your collection of pocket squares?

Yikes.

Tell me that I have this wrong, somehow. Tell me this isn’t about entitlement.

Actually, don’t.

Because the next part of the Globe & Mail article explains to us that, unfortunately, it is about entitlement:

There are signs that first-time buyers are souring on condo living. A recent survey of Canadian renters about their home ownership plans by real estate search portal Point2 found that – despite citing high home prices and the down payment as their top challenges to buying – 77 per cent of respondents wanted to buy a single-family home. Just 12 per cent want a condo, a figure that dropped to 8 per cent for respondents aged 18 to 24, and 9 per cent for those over 65.

(I just took a deep breath, for the record)

Okay.

77% of Canadian renters “want to buy a single-family home.”

Why that isn’t 100%, I don’t know, but I digress.

12% of Canadian renters “want to buy a condo.”

Right.

But what the hell does “want” have to do with anything?

May I please draw your attention back to the definition of “wants versus needs” as it pertains to economics?

Only 8% of young renters aged 18-24 want to buy a condo, you say?

Good for them.

They all want houses, you say?

Uh-huh.

This is entitlement at its absolute finest, folks.

And I believe that we, as a society, have created this. We’ve fostered this. We’ve allowed this to happen.

This “gimme, gimme” society that we live in today, where everybody is told (and promised) that they can have everything, has led to a generation of young people who simply aren’t interested in living in condos.

But what’s the alternative?

Where do these people think they’re going to live?

The crazy thing is, there’s a lot of good advice out there right now if people choose to listen.

Rob Carrick, who has been bearish on housing as long as I’ve known him, recently published this:

“It’s Maddening To Say, But Now Might Be A Generational Opportunity To Buy A Home”

The Globe & Mail

August 19th, 2024

Don’t take it from me, since I sell real estate for a living and I’m just a biased cheerleader and all…

I think it goes without saying that none of us want to live in a 263-square-foot condominium. But that’s not representative of the market.

I just finished dealing how I purchased a 575-square-foot condo for $460,000 last month, in a great location, and with an awesome, functional, liveable floor plan.

Leave the 263-square-foot condos alone. Those aren’t for us and they were never intended to be.

But if only 12% of Canadian renters want to buy a condo, and 77% of Canadian renters want to buy a house – and we have 21-year-old “wealth managers” saying that a condominium is beneath them, then I don’t know what the answer is…

Serg

at 8:04 am

Would not these questions be good as intelligence indicators to be included on the interview for the potential tenants for this new condo?

Francesca

at 8:38 am

I think the issue that young people feel entitled is that not only is a new micro condo beneath them but also a larger older condo may be too because it doesn’t have the bougie wow factor a newer building does. These kids were raised with the mentality that you can get anything you want because you deserve it just for being you so no wonder they think they deserve the right to own a detached home immediately. Once they see the prices they will come shooting back down to earth unless family money comes in to rescue them. I also see a lot of this being caused by the parents of said 20 years olds talking badly about condo living, that they themselves would never ever move into a condo and be forced to pay maintenance fees etc! When we sold our detached house to downsize into a condo in our mid 40s you should have seen the reaction we got! It was like people thought we were crazy as for some reason in Canada there is this perception that condo living is inferior to any kind of ground level dwelling. In most other places of the world people raise entire generations in condos and apartments and it’s considered perfectly normal but not here. I agree that living in a shoe box may not be the best solution but there are lots of larger alternatives out there if one looks for them at decent prices. Our building is 36 years old and the units go from 950 sq feet to 1450. Plenty of room for singles, couples and families. When our friends who balked at us moving here come visit they are pleasantly surprised at how much space we have and how liveable it actually is!

Adrian

at 10:40 am

You’re bang on that new condos are getting smaller to accommodate this system we have that requires pre-sales for financing. Another issue is that for many years the banks didn’t finance apartment buildings and so few were built. Small investors noted the demand for rental units and bought pre-sale condos to fill the gap in supply.

People usually think it’s a good thing that our banks are conservative in their lending but this is a perfect example of how that conservative lending style has handicapped the market and caused un-intended consequences. I worked at a big 5 bank a few years ago, financing real estate construction. That bank would never finance rental buildings because they just saw them as “unsold condos” and thus very risky. The only reason this is changing now is because CMHC stepped in a few years ago with a product to finance rental development. And given current market conditions banks can’t finance condos since they don’t pencil out. But many banks still won’t finance apartment buildings unless they have insurance from CMHC.

T

at 11:24 am

Internet and social media have changed discourse compared to previous generations. Everything is politicized. We can say rising real estate prices are simple capitalistic supply and demand. They can say government policies such as immigration, greenbelt, development fees. This blog tries to avoid politics when it’s impossible to completely decouple. Other places are talking politics all day long and no longer entertaining to read. There’s no perfect middle ground.

Nick

at 11:50 am

I wouldn’t say entitled. I do think there is a disconnect and lack of understanding of the property ladder these days.

But I also don’t blame them. These micro condos will likely be a volatile segment in the future as every time there is a market slowdown they will be first to lose value.

When I was that age I would have aimed for house too.

Your_Favorite_Tenant

at 4:37 pm

Did you miss the part where he lives in Gatineau? Where you can actually buy a house for less than a starter Toronto condo? Is he wrong that houses appreciate more than condos?

(Also, “21-year-old thinks he has it all figured out but doesn’t” is hardly a shocker. Doesn’t that describe a lot of us at that age?)

I think it would be a mistake to say that because people say they “want” a house they are entitled. The question wasn’t what kind of house can you afford (in the GTA for most that would be “none”) but what do you “want?” I mean, I “want” one of those gorgeous old mansions on Palmerston to divide up into apartments that will pay the mortgage while I live in a renovated owner’s suite on the top floor. What I am actually shopping for is an older 1 bedroom condo.

That said, I do think FTHB may skip over the 300 sq foot condos. At least as long as it is cheaper in terms of cash flow to rent, and you can rent something bigger. The smart move these days is to get into a larger purpose built rent-controlled building while saving up for a down payment, and once you’ve been there a while, it becomes really hard to justify doubling your monthly costs to move into a smaller space.

Izzy_Bedibida

at 3:33 pm

My friend did the math and came out to the same conclusion. To keep her current costs, and not drain her savings, she would end up with a micro condo that would cause tension between her and her cat.

JF007

at 6:54 pm

Here is a thought…with all the unsold inventory of small condos and projects not getting off the ground isn’t this the right time for leaders to step in and buy them at say “at cost” and address the rental apartment shortage or something where the builders are incentivized to convert to rental condos…city needs them desperately…

As to want vs need I might have mentioned this in the past..one of the reasons real estate is so pricey in Canada is the fascination of owning single family home here Vs other developed countries..I myself am guilty of the same turns out it’s no bed of roses maintaining a home with a backyard etc etc…

Finally what’s with the ffin Canadian banking system that every say 3,4,5 years one has to renew why is it not the same as US where one can easily get 30 year open mortgages n all my friends have a 3 something mortgage for 30 years and they are set never to worry…

Ace Goodheart

at 10:53 am

I figured I would test the “woke movement’s” fact accuracy this morning by going on zoocasa and searching for available 3 bedroom condos in Toronto.

Wow, there are a lot of them. The median price seems to be around $600,000.00

The most common set up is three bedrooms, a kitchen and a bathroom. Many, many of them had parking spots included in the price.

So while the wokies are out screaming about the housing crisis, you can just go and buy a three bedroom condo in Toronto for 600K and you even get a spot to park your non electric, “ICE” man type climate killing vehicle.

Does anyone even bother to fact check the woke movement anymore? I mean, these people are talking about a yearly “housing fairness levy” to punish home owners for owning and living in their houses, when young folks cannot find a place because there is an old person conspiracy afoot against them.

And yet, when you fact check this, you find……Toronto three bedroom condos a plenty for 600K and under.

Time to fact check the wokies? Or does it even matter anymore?

Adam

at 2:16 pm

If they’re so great, go buy them up and rent them out yourself. Solve the housing situation all by yourself!!

I don’t get why it’s so hard to understand why noone wants to buy sections of the sky for hundreds of thousands of dollars. Whether it’s bachelor or 3 bedroom, a section of sky has no real value, land does.

Phil

at 10:56 am

David, just curious what the market is like for those large condos in older buildings such as 25 George and 33 Harbour Square? Appreciate how tough it is to construct that type of building today, but are the existing units desired? Thanks!

Amanda

at 6:59 pm

I bought a condo and I have a child. People do it. The problem is that maintenance fees are calculated by square footage. So an older condo with a huge floor plan will cost a whole rent payment to maintain. They need to have a tax break on condo maintenance fees if they want to incentivize families to buy them.

My 1000 sq ft condo has been appropriate housing for me and my one child. I have heard that most of the families in my building leave when they have the second baby.

Izzy Bedibida

at 9:34 am

Before entitlement comes in, Lets concider this. Developers are essentially charging Mercedez S Class prices for what is essentially an Hyundai Elantra. With a Mercedez S Class you know what you get. Now imagine Hyundai Charging that price for an Elantra. This is what is happening in the condo market.

Bill

at 9:12 pm

Hey there,

I am a senior (widowed) 4 years old, living in my home. I would like to buy a condo, one bedroom with unsweet and two piece bathrooms, large open concept kitchen/dining and living room, say 1000-1300 square feet. I have looked at several built in the last ten years and they are all very small.

I wouldn’t leave my home to move into these small spaces.

These are my comments

Bill.F.

Caelin

at 6:47 pm

I’m having a hard time following the jump between “I bought my first 575 foot condo at 25 years old in 2005 and it was perfectly fine for me” to “this 21 year old is entitled for not wanting to buy a condo [when the most affordable ones are less than half the size of the one I bought around his age]”.

I feel like maybe this is happening because the article assumes that folks looking to buy condos are likely going to use the purchase as an investment property, in that they might live there for 5 years before reselling and upgrading to something larger?

Maybe this is because you yourself did that with your 575 foot condo? Or you gained the wealth to continue owning and renting it out while you purchased an additional property(ies)? It would help if you also clarified what the 21 year old’s intention is when he is looking to buy property. Because, sure, maybe he has the intention to re-sell and upgrade, but when I read what he says, where my head goes is “He probably wants to make sure that he can grow into the space he’s looking to buy”.

And if not him, then I think that is certainly on the mind of other young people – our objection is less about “I am too good for condo living, period, I need a whole house to myself now”, and more about “if I’m going to put a huge amount of money into a property, I want to know that I can root there”.

I’m 27, and when I look at condos, the one’s I could most comfortably entertain are so insanely small that it feels like an absolute joke paying so much money for it when 1) I can’t comfortably host get togethers, 2) I don’t have much storage space to accumulate belongings, and 3) I certainly could not start a family in one and eventually host my child’s family for visits. It makes me prefer to save my money until I could simply buy the single-family home the 21 year old is referring to.