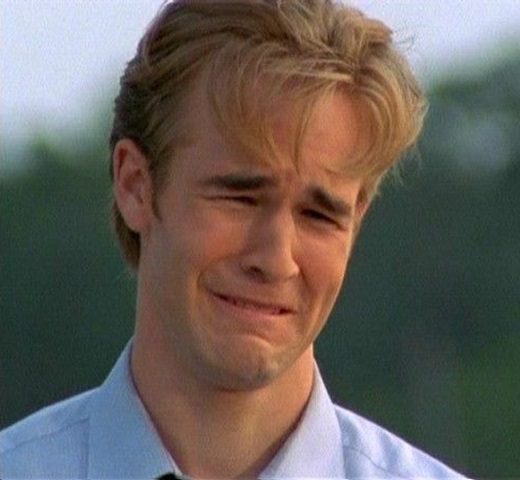

I am. My wife tells me all the time, but I think she’s referring to something else…

Let’s talk about price sensitivity, specifically as it pertains to interest rates, and how a changing mortgage market affects some real estate buyers, and not others…

Yeah, seriously. My wife tells me constantly, “You’re too sensitive!” It’s like I’m the woman, and she’s the man. But how am I supposed to react when she says, “Can you please move your gigantic bobblehead out of the way – I can’t see the TV!”

That’s love…

I was chatting with my mortgage broker the other day about interest rates; where they’ve been, where they’re headed, etc.

Talk to guys in their late 40’s and early 50’s, and they’ll laugh when we complain about interest rates.

No, I’m not old enough to remember interest rates when they were at 22%. But that also means I’m not old enough to remember the miserable synthesizer-enduced music produced during the same time period, as well as the hair, the jeans, and Little House On The Prarie…

Sometimes, you just have to put things into context. Complaining about your 3.39%, five-year fixed rate is a really selfish act, given that rates were as high as 22% in the early 1980’s, or as high as 5.99% as recent as 2007.

And then sometimes, you just don’t care what rates were thirty years ago, because it has absolutely, positively, nothing to do with the discussion of affordability today.

But just for fun, I’d like to demonstrate what life would be like in today’s real estate market, if rates were 22%.

Okay?

First, we have the young, entry-level condo buyer, who buys a place in King West for $350,000, with a 10% down payment, on a 25-year amortization. His monthly mortgage payments are $5,577.93, of which approximately $32 is principal, and $5,524 is interest during the first year.

Second, we have the established, 30-something couple, who buys a house in Bloor West Village for $800,000, with a 20% down payment, on a 30-year amorization. Their monthly mortgage payment is $11,250.58, of which approximately $24 is principal, and $11,227 is interest during the first year.

If that 30-something couple paid 22% interest for the entire course of their 30-year loan, they would pay $4,210,207 for that $800,000 house.

But that’s ridiculous, right?

Stories like that are only read about in textbooks, and talked about in the parking lot of a golf course as some old-timer pats you on the shoulder and calls you “Junior”?

Well, 22% interest rates did happen, although clearly not for a 30-year period. That’s just crazy!

But even crazier, are the borrowers today who spend their time dwelling on the fact that their mortgage broker got them a rate that was 3-basis points higher than what their friend got from his bank. THREE BASIS POINTS, people!

Or crazier than that, are the would-be property-buyers who are fretting over a 20-basis-point jump in interest rates.

That’s crazy, right?

Or is it?

I guess the answer is different for everybody, and it all depends on your price sensitivity.

Here’s where the market bulls and the market bears show their true colors. As the saying goes, “You can make numbers say anything you want,” so I think I’ll do exactly that right now.

I’m going to use the same numbers, and argue both sides of the coin.

Parameters:

Purchase Price: $350,000

Down Payment: $35,000

Interest Rates: 2.89% versus 3.39%, 25-year amortization

Market BULLS and real estate pushers would say:

“Are you really going to change your life’s course for a paltry 50-basis points?

The difference in your mortgage payment equates to $18.81 per week. Really? A twenty-bone? That’s one cab ride from your condo to King West!”

Market BEARS and real estate averse people would say:

“A jump from a rate of 2.89% to a rate of 3.39% represents a 17% increase in the amount you’re being charged to borrow.

You’re paying an additional $81.47 per month in your mortgage, which represents a bump of 5.4% in your largest expenditure. That’s almost $1,000 per year, which at your age, and with your income, could take you months to save.

If you own this condo for five years, you’ll pay almost $8,000 more in interest due to that higher rate.”

.

As I said, you can argue this either way.

It all depends on you price sensitivity, and each individual has to decide for his or herself just how flexible their budget is.

A Gross Debt Service ratio (or GDS) is the percentage of the borrower’s income that is needed to pay all required monthly housing costs (mortgage payments, property taxes, heat and 50% of condo fees). This number typically hovers around 32%, or 39% for insured mortgages (ie. those with less than 20% down, insured by CMHC).

So let’s look at this example again, and determine how much rates have to increase to really have an affect.

Assume that Johnny makes $59,000 per year.

He’s looking at this condo – $350,000, with 10% down, on a 25-year amortization, that has $365/month condo fees, and $1,828.50 property taxes.

With a 5-year, fixed mortgage rate of 2.89%, his monthly mortgage payment is $1494.00. Adding in 50% of the $365/month for maintenance fees, and the $152.38/month for taxes, his all-in cost for GDS purposes is $1828.28.

That’s a GDS of 37.2%, and thus he falls within the acceptable range for mortgage purposes.

With a 5-year, fixed mortgage rate of 3.39%, his monthly mortgage payment is $1,575.47. Now, all-in cost for GDS purposes is $1910.35.

That’s a GDS of 38.8%, and thus he still falls within the acceptable range for mortgage purposes. Yes, that’s cutting it close under the 39% ceiling, but I made these numbers work that way for a reason.

The point is that a “whopping” 50-basis-point increase still keeps a potential buyer’s mortgage pre-approval intact, and we’re working with entry-level buyers here. The higher category buyers would likely have less price sensitivity.

Last week, I talked about the “entitlement generation,” and how a lot of (not all, as some of my readers were quick to point out) today’s youth aren’t quite in touch with the true value of a dollar, or how far a dollar goes, or what life is like when your parents aren’t subsidizing it.

By the same token, you could say that today’s mortgage borrowers are also severely entitled, since so much of the current buyer pool feels hard-done-by that they missed out on 2.89%, 5-year, fixed-rate mortgages, and now have to endure the hardship of 3.39%.

Come on!

Put this in context!

How low is 3.39%? It’s insanely low!

And you know what? If rates go up another 50 BPS in the next year, as many people suspect, then deal with your awful, miserable, unfair 3.89% rate. It’s still insanely low.

When rates get over 5.0%, if that happens, then we can have this conversation again.

Wait, let’s not wait. Let’s have it NOW!

Using the same example above, let’s see what the monthly carrying cost of Johnny’s condo is at 5.0%.

The mortgage payment increases to $1,853.06, so the all-in cost for GDS purposes is now $2,187.94.

That means the GDS ratio is now 44.5%, and Johnny will no longer qualify for his mortgage.

But from 2.89%, where rates were a few months back, to 5.0%, in our ficticious example, is almost DOUBLING rates. We’re a long way from that.

Market bears – feel free to tear this blog post apart. I probably won’t disagree that low interest rates have been propping up the market, and that house prices WILL decrease in the future if/when rates increase.

But as for the idea of price sensitivity, I have a hard time believing that most buyers would feel affected by an increase in rates from 2.89% to 3.39%.

Tell me if you think I’m wrong, but just be gentle.

After all, I’m a bit sensitive…

Julie

at 7:44 am

I think that if you’re so close to the edge that a 50 point jump would matter, you probably can’t afford the property!

JG

at 3:21 pm

In my experience the bulk of mortgage holders are all qualifying on a thin edge.

I stressed test a clients approval for her to make her realize just how close on the edge she is. It really shook her, as was my intention.

Now she has increased her payment and will utilize prepayment options over the next 5yrs in prepapration for rates that may not be as low today at her renewal.

And to the comment of 3x ones income, is spot on. It averages 5x-6x the household income, wheres in the past it was 3x at best.

Im not sure if I’m a Bull or a Bear but I do believe in a little preparation and realistic view of what may happen in the future.

Julia

at 7:57 pm

What role do you think bankers/brokers play in convincing people that they can afford what they really can’t? I know that our CIBC banker spent hours trying to convince us to spend way more than we felt comfortable spending in our last house hunt. We really couldn’t believe how much they were willing/trying to lend us…we couldn’t figure how it would work unless we planned on mainly eating hot dogs and Kraft dinner and not having any kind of life outside of work!!

Gerry

at 2:14 am

What role do they play? bwahahaha…what role do YOU play is the real question. You’re the meal ticket. The score. The number on the board that generates a commission. They don’t care what happens to you once you sign the dotted line. Their job is to maximize the value of the loan to you, it is not to care whether or not you can actually afford it, or have to eat KD etc.

And don’t forget, did your CIBC rep try to sell you ‘mortgage insurance’? You DO know that is a scam, right? That you should just get insured by your own life insurance broker/agent because it is cheaper versus what you would pay through the bank….better check that out. You may have been just used like a kleenex at FanExpo. Why? Why not! They don’t care…

Jackie

at 8:52 am

From the numbers above the buyer will only qualify at 3.39% if they have absolutely no other debt. No credit card debt, no student loans, no car payment.

Huuk

at 9:15 am

When interest rates go UP, Prices will come DOWN. Economics 101.

In your examples, you kept the price the same…which for examples makes sense, but in real life it won’t happen that way.

Buyers, especially condo buyers, will be looking at one price only -> The Monthly Bill.

Geoff

at 10:51 am

‘When interest rates go UP, Prices will come DOWN. Economics 101.”

Is the reverse true? When Interest rates go down, prices go up? Because that did not happen in the United States.

Tallet

at 2:56 pm

Yes. Home prices increased by 50% over the last 4 years in Canada due to decline in interest rates (and continued suppressed rates). Worry about Canada – not the Americans.

KB

at 9:35 am

Any insight into why mortgage lenders use a GDS based on gross income?

Potato

at 1:07 pm

One reason might be that as your income increases so does the percentage taken by taxes. The minimum fixed costs of living (food, transportation, utilities not captured in the GDS) take up so much of a budget. As you make more you can throw proportionately more money at housing if you wish. A fixed percent of gross income translates into a sliding scale of after-tax income with a simple calculation.

Though the real reason is likely that gross income is easier to verify.

Geoff

at 10:17 am

You know whenever people talk about the huge interest rates of the 1980s, they NEVER talk about the simple fact that back then, most homes could be bought on one person’s income at a rate of about 3x ONE person’s income. Now it’s more like 5 or 6X two people’s income. I would gladly trade my $500,000 house at 3% for a house at $250,000 @ 15%. The reasoning is simple: It’s a lot easier for me to make big dents in the $250K debt with prepayments – even small ones – than it is with big prepayments on the $500K.

jeff316

at 11:37 am

This is a very good point.

Joe Q.

at 12:38 pm

This is exactly it — house prices relative to income are much higher now than they were in the 1980s. People also put down larger down-payments and shorter amortizations. Mortgages got paid off on one income.

The biggest risk IMO is the false sense of security people have when it comes to ultra-low rates. 5% is indeed a lot higher than current rates and we won’t go from 3% to 5% overnight. But it is quite conceivable that someone taking on a mortgage today at 3% could renew in five years at much higher rates.

Julie

at 10:26 am

When we bought our first house in 1994, we were thrilled to get a mortgage at 7%. After all, it was only recently that interest rates had dropped below 10%! When we paid off our current mortgage, 3 or 4 years ago, our interest rate was at 1.35% which was just laughable! Now that we’re mortgage free and trying to build up our investments and get retirement income, we wouldn’t mind interest rates going up a bit – hard to make a retirement income with these low rates! :-). That bring said, I do feel badly for young people getting into the market today. Our first house in Toronto was a barely affordable at the time semi detached at Yonge and Lawrence priced in the low $300s. That same 1200 sq ft house is now worth around $800,000 and I just don’t know how most people are supposed to make that work at an entry level.

Joe Q.

at 12:43 pm

Here are some interesting links for those interested in the history of house prices and mortgage rates.

Historical posted 5-year mortgage rates:

http://www.ratehub.ca/5-year-fixed-mortgage-rate-history

House prices relative to disposable income for Ontario cities:

http://theeconomicanalyst.com/content/house-price-and-income-ratios-canadian-cities-part-2

(scroll down for graphs)

jeff316

at 2:57 pm

An interesting analysis would be to compare housing prices by population migration trends and regional economic indicators, to see how much influence (if any) population migration has had on pricing and to assess if any of the increases in core urban areas have been offset by decreases in non-core areas.

Price-to-income comparisons are one of the best tools we have, but are limited given the structural economic changes post 1987 and 1994 and 2008.

Kyle

at 4:00 pm

Totally agree, historical analysis assumes large doses of “all else being equal”. The income distribution has changed dramatically and irreversibly in Toronto over the last decade. In statitical analysis, this results in something called heteroskedasticity, which turns models that once worked into models with the predictive power of a fortune cookie.

Anyhow, here are some more interesting stats for bulls and bears to interpret as they like. Have fun:

http://www.google.ca/url?sa=t&rct=j&q=toronto%20dwellings&source=web&cd=2&ved=0CC8QFjAB&url=http%3A%2F%2Fwww.toronto.ca%2Fdemographics%2Fpdf%2F2011-census-backgrounder.pdf&ei=OwQdUvqeBuXKyQHNioG4Ag&usg=AFQjCNGjBuTHCnL6UYjR2TqTQrQBWZO1jA&bvm=bv.51156542,d.aWM

jeff316

at 4:46 pm

One of the other things that I’ve always pondered is the applicability of the the shift in average-house-price-to-income ratio.

If the historical average is x3, and the current average is x6 … well…that makes sense to me given the shift from a one-income economy to a two-income economy, particularly in urban areas and super-particularly in Toronto.

The question is, in the event of job loss are you more screwed owing 250 000$ at 11% interest with zero income or owing 500 000$ at 3.5% interest on one income? I don’t know. It might not matter. Honest question.

And, as an aside, I’ve seen that metric framed in terms of gross housing costs, house price, and mortgage-size to gross-income and to take-home income.

(These aren’t bull-bear comments, no agenda here)

Potato

at 11:56 pm

The timescale isn’t right — the shift in price-to-income multiples largely happened over about 10 years, but the shift to a two-income economy didn’t happen nearly that fast. Also, the multiple to family income (which should account for that) has also increased about 60%.

In the event of a job loss, a two-income family might be better off, but they also have two tickets in the “unemployment lottery” so the odds of that outcome happening are higher, with no backup plan if unemployment is longer than temporary (e.g., disability).

Joe Q.

at 10:51 pm

I agree that the income distribution has changed, I’m just not sure how far that goes in explaining current pricing levels. IMO mortgage lending is a far bigger contributor.

Devore

at 10:24 pm

Couple of things to think about on interest rates and price sensitivity.

It is not just about the monthly payment (the last vestige of commissioned salesmen everywhere, no offense David!).

Generally, even in real estate, prices are set at the margins. Ie, it is the marginal buyers who set prices, and what happens to those buyers determines the overall price direction. Of course there are exceptions. Of course, everyone knows “that guy” who bought his million dollar house (or is that million dollar teardown?) with cash, and didn’t even make a dent in his bank account. As incredible as it might seem, unless “that guy” is nearly all buyers, he, and his cohorts, don’t matter. No, really, they don’t.

A “real estate pusher” might say “it’s only $20 bucks more!”, but that’s not the point. It’s actually not $20 more. It is $20 LESS. $20 less that our potential marginal buyer now qualifies to borrow. SOME buyers (maybe even most) can pay $20 more, but the marginal buyer can borrow $20 less.

And as other posters point out, all other things being equal, smaller debt at higher interest rate is preferable over huge debt at tiny interest rate. The small mortgage is much easier to pay off if you make more than the minimum payment. You can try this exercise for yourself, if you don’t believe me. Make an extra $500 payment on a 3% mortgage, and then model an extra $500 payment on an 8% mortgage, where their minimum payments are the same. It’s not even close.

Kyle

at 9:04 am

“Generally, even in real estate, prices are set at the margins. Ie, it is the marginal buyers who set prices, and what happens to those buyers determines the overall price direction”

This may be true for widgets and other more homogenous products, but the way Toronto real estate average price is calculated, it is more affected by the number, dollar value and make up of homes that sold that month (i.e. it is calculated more like an Index, not like a commodity).

Devore

at 10:19 pm

The “index” (or average or median or whatever) is comprised of individual property sales, statistically mangled. Sales mix plays a large role, but you can undo some of the mangling by segmenting the market.

The point is, houses are bought using huge leverage, with the loan amortized over 20+ years, meaning affordability (ie monthly payment) is a significant factor. If affordability is down (interest rates, credit availability, other criteria) that has a direct impact to how much buyers can borrow, and consequently how much they can bid on properties.

Joe Q.

at 11:20 pm

It’s also interesting to look at what borrowers can typically get south of the border — the most common mortgage in the US is a fixed-rate open mortgage with a 30-year term and they currently run a little over 4%. The borrower’s payment is fixed for the entire 30-year period — no interest rate shock risk for the borrower — and the mortgage can be paid off at any time or presumably re-financed to a lower rate.

From what I gather, the typical Canadian mortgage would be classified as a “balloon payment mortgage” in the USA because the loan is not completely amortized over the term of the mortgage. Additionally mortgages with > 80% LTV would not be considered “prime” (definitely not “sub-prime” either, but something more like “Alt-A”)

AsianSensation

at 12:00 pm

Out of the way fat head!!!

young & foolish

at 9:04 am

Higher rates are creeping up, and unless we see significant job/wage growth, RE prices will adjust downwards. The question is by how much?