He must be thinking, “I can’t believe this actually worked.”

All credit is due to Bank of Canada governor, Tiff Macklem, but really? Really?

Maybe he actually did think it would work.

But work this well? I can’t imagine he had that kind of foresight, let alone confidence…

I’m speaking, of course, about inflation.

Last week, during one of those “where were you” moments, we learned that inflation for September checked in at 1.6%.

I was driving in my car listening to News Talk 1010 on AM-radio, which is something you can only do once you reach a certain age, and part of me thought that the 1.6% figure was a mistake.

Perhaps the “6” was an upside-down “9?”

My daughter makes that mistake sometimes when we play “the dice game,” which she made up, and for which she consistently changes the rules to her benefit, but I digress…

The “street” predicted a 1.9% rate of inflation, coming off the month of August where inflation sat at 2.0%.

But 1.6%?

That was shocking! And even Bank of Canada Governor, Tiff Macklem, must have been caught off guard.

History will show that the Bank of Canada might have been reactive rather than proactive when it came to cooling inflation.

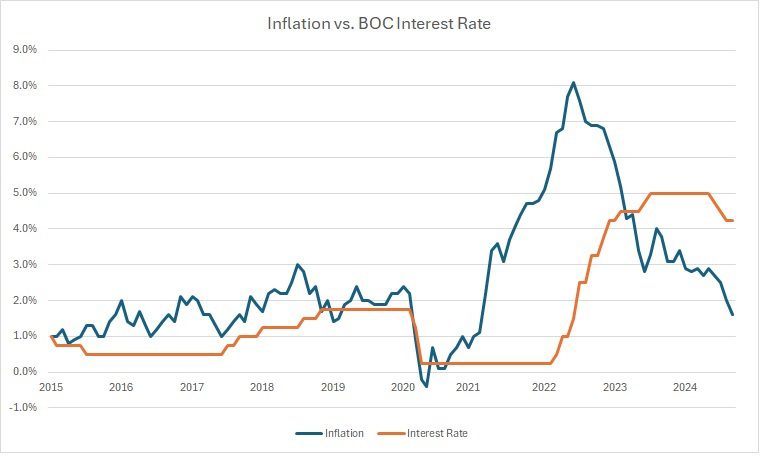

The year 2022 began with inflation figures of 5.1%, 5.7%, and 6.7% respectively in January, February, and March, but it wasn’t until March that the Bank of Canada introduced their first interest rate increase. Inflation continued to rise, peaking at 8.1% in March, before subsiding and finishing 2022 at 6.3%.

As we all know, the Bank of Canada introduced ten interest rate hikes between March of 2022 and July of 2023, and by the end of the rate-hike cycle, inflation had declined to 3.3%.

The hope was that inflation would eventually return to the 2.0% target.

But did anybody see it happening this quickly?

And more importantly, did anybody see inflation declining not just below the 2.0% threshold but to as low as 1.6%?

Here’s our Inflation vs. BOC Interest Rate chart before Wednesday’s announcement:

The Bank of Canada may have been slow in increasing interest rates to curb inflation, but I don’t think they were slow in introducing rate cuts. The first cut came in June when inflation was at 2.7%, and we have to keep in mind that inflation had been ping-ponging between 2.9% and 2.7% from January through June.

Having said that, although the Bank of Canada didn’t “wait too long” to introduce cuts, they have been accused of not cutting “enough” once the cuts began.

Many economists have argued that rates are simply too high for where we are with respect to the Canadian economy, inflation, and unemployment. Benjamin Tal has repeatedly suggested that we “need” to be 2% lower for the sake of the economy.

So was anybody surprised by the 50 basis point cut that we witnessed on Wednesday?

Probably not.

But would you be surprised to see another cut of 50 basis points in December? Because I think that’s coming.

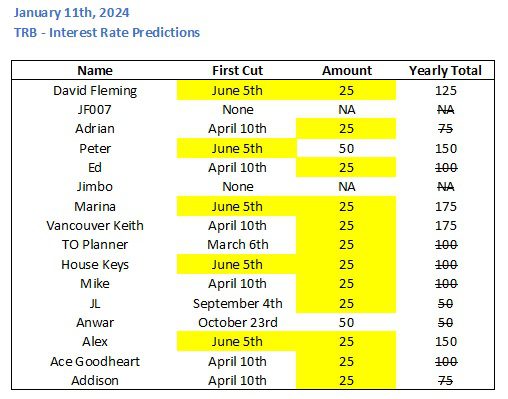

I’d be remiss if I didn’t provide an update on the TRB Interest Rate Prediction Game, because things are getting very interesting…

First and foremost, it needs to be asked: JF007 and Jimbo, what the heck were you guys thinking?

I know that sounds like hindsight talking, but all jokes aside, what was the reasoning behind a 2024 that would see zero interest rate cuts by the Bank of Canada?

I asked the question, but I’ll also try to answer it.

We came into 2024 with third-quarter inflation numbers of 3.1%, 3.1%, and 3.4% respectively in October, November, and December.

If the rate of inflation remained at 3.4% in January, and into February, and so on, I could see a world in which the Bank of Canada doesn’t cut the policy interest rate.

But that didn’t happen.

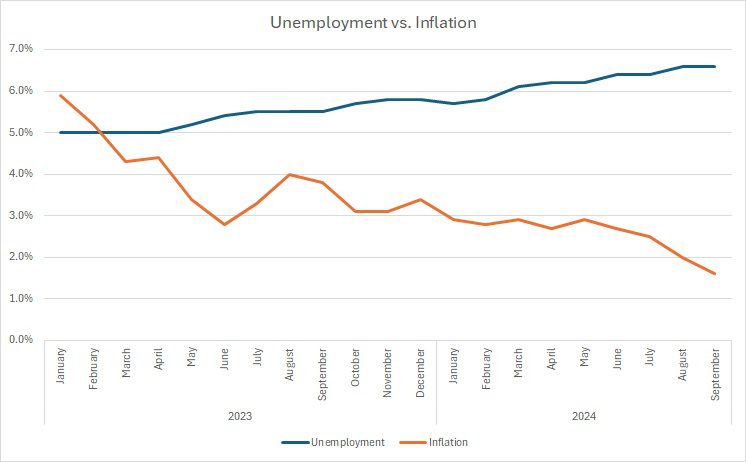

Not only that, but unemployment has risen steadily throughout 2024, and if we go back to the start of 2023 and chart inflation versus unemployment, it would look something like this:

That is a recipe for interest rate cuts!

Two of our contestants predicted zero cuts in 2024.

Two of our contestants predicted fifty basis points in cuts in 2024.

Two of our contestants predicted seventy-five basis points in cuts in 2024.

Three of our contestants predicted one-hundred basis points in cuts in 2024.

All nine of those contestants have proven to be incorrect.

So who does that leave in contention for the contest?

Let me outline three scenarios:

1) No more cuts. We have currently seen a cumulative 125 basis points in cuts, and if it stays this way, then David Fleming is 3/3 in predictions and wins the game.

2) One cut of 25 bps. If we ended up at 150 basis points for the year, then Alex would be 3/3 and would win the game.

3) One cut of 50 bps. If we ended up with 175 basis points for the year, then Marina would be 3/3 and would win the game.

We’ve come a long, long way from that highly-anticipated six-way tie that would have occurred if we only saw 75 bps in cuts this year…

Now, what has the reaction been to the move by the Bank of Canada?

Before we get to that, let’s look back at an article in the Globe & Mail published before the cut:

“The Bank Of Canada Risks Being Behind The Curve. Canada Will Pay For It”

The Globe & Mail

October 22nd, 2024

Yikes.

That sounds bad.

And with a headline like that, who doesn’t want to know more?

From the article:

On Wednesday the Bank of Canada will likely cut interest rates, but a key question is by how much?

The market is now thinking it will be a jumbo half-percentage-point move. This would not be unprecedented as we’ve seen similar-sized cuts in the past. But over this cycle, the cautious Canadian central bank has opted to cut rates by a minute quarter-percentage point in each of its three latest rate decisions. As a result, at 4.25 per cent, the bank’s benchmark interest rate is still well above what most economists and even the Bank of Canada consider neutral – the rate at which the central bank’s monetary policy is neither stimulating nor holding back the economy.

The central bank has been going too slow. An even bigger cut is warranted on Wednesday, and here’s why.

The inflation dragon that most global central banks worried about after pandemic lockdowns ended has already been slain, especially in Canada. Headline inflation was a mere 1.6 per cent in September, below the 2-per-cent midpoint of the Bank of Canada’s target range, while core inflation looks likely to follow soon. In fact, with many prices for consumer goods coming down sharply as global supply chains fully unwind from their pandemic crunch, housing is now the only major component of the Consumer Price Index (CPI) putting upward pressure on overall inflation.

The article was written by the Chief Economist at CoStar Group Canada, and the sentiments seem to be in line with what many other economists are saying as well.

I noted Benjamin Tal previously, but I challenge you to find an economist that has a contrarian viewpoint here. I haven’t seen any economist saying, “We’re making too many cuts, and it’s happening too quickly.”

More from the article:

The bottom line is that with inflation dead, Canada’s economy is in need of sharper interest-rate cuts. To get ahead of the curve, the Bank of Canada should consider even bigger cuts than half a percentage point. This would help to get interest rates back down to neutral levels faster. Front-loading hikes was what happened when the BoC hiked rates by a full percentage point in July, 2022, when it grew fearful of surging global inflation. The same argument could be made in reverse today.

This seemed to echo statements made by Tiff Macklem on Wednesday:

“We took a bigger step today because inflation is now back to the two per cent target and we want to keep it close to the target.”

“With inflation back to two per cent, we want to see growth strengthen. Today’s interest rate decision should contribute to a pickup in demand.”

“Job layoffs have remained modest but business hiring has been weak, which has particularly affected young people and newcomers to Canada. Simply put, the number of workers has increased faster than the number of jobs.”

“High inflation and interest rates have been a heavy burden for Canadians. With inflation now back to target and interest rates continuing to come down, families, businesses and communities should feel some relief.”

But is this enough?

What we’ve seen so far through the three interest rate announcements where cuts were delivered is that Mr. Macklem isn’t going to give us any indication of what lays ahead.

Only hours after the rate cut was announced, I read yet another article in the mainstream media – and from a reputable author, that argued more most be done:

“The Bank Of Canada Must Loosen Monetary Policy At A Faster Pace”

The Globe & Mail

October 23rd, 2024

This article was written by Jeremy Kronick, who is a Vice President and Director at the C.D. Howe Institute, and Steve Ambler, a professor of economics at Universite du Quebec a Montreal.

These are two gentlemen who clearly know a thing or two about economics, but not everybody will want to hear what they have to say – as I’ll show you later on.

But first, this from the article:

As it is, the bank has more work to do with its overnight rate. With inflation falling faster than the policy rate, monetary policy in real terms has become more restrictive since the summer. When the bank cut the overnight rate to 4.25 per cent at its last meeting, inflation was at 2.5 per cent, meaning the real policy rate (adjusted for inflation) was 1.75 per cent. With inflation falling to 1.6 per cent, even at an overnight rate now of 3.75 per cent, the real policy rate, at 2.15 per cent, is actually a bit tighter.

Below-target inflation combined with Canada’s relatively weak economy suggests that the overnight rate target should already be at least at the “neutral rate,” the sweet spot that neither restricts nor stimulates economic growth. The Bank of Canada currently estimates the neutral rate to be in the range of 2.25 per cent to 3.25 per cent.

The C.D. Howe Institute has a lot of insightful folks and I typically agree with their sentiments.

Who could forget this “open letter” to Mayor Olivia Chow from 2023: “Stuck in a Hole, and the Land Transfer Tax isn’t Your Way Out!”

Well, good advice isn’t always taken, and just because a slew of economists believe that the Bank of Canada key lending rate should be lower, doesn’t mean it’s going to be.

And it depends on who you ask, of course.

What do the folks at the Toronto Star think?

This:

“Too Much, Too Fast? Bank Of Canada Risks A Home Price Runup With Key Rate Cut”

The Toronto Star

October 23rd, 2024

Yes, of course.

The paper seems to be catering to the BlogTO demographic these days; those who want home prices to crumble so that the every-man can own a Rosedale mansion.

I find a tremendous amount of irony in the conflicting headlines.

Globe & Mail: “Loosen monetary policy at a faster pace”

Toronto Star: “Too much, too soon?”

As I said previously, we’re never given any indication from Bank of Canada governor, Tiff Macklem, what’s going to happen next.

That’s okay, however, since the market seems to already know.

Expectations are that we’ll see another 50 basis point cut on December 11th and I don’t know what could happen between now and then that would prevent this.

Is there a chance that we might see only 25 basis points cut?

Sure, I suppose. But a cut is coming, regardless. And the target that most economists have set for mid-2025 is somewhere between 2.75% – 3.25%, with expectations for 2.75% by the end of 2025, worst case.

What does this mean for the real estate market, you might ask?

Well, call me a cheerleader, and that’s fine, but increased affordability and increased consumer confidence aren’t exactly going to cause a decline in home prices, is it?

When the cycle of rate declines began in June, I predicted that we’d see an uptick in both sales and prices in the fall.

That hasn’t exactly proven correct.

The average home price increased modestly in September, over August, by 3.1%.

But sales in September were the second-lowest this millennium and only beat out 2023, when we found ourselves in the same slow fall market.

October “feels” a little bit different, and as I noted on Monday, some of our stale listings started to move. But is this enough to really buck the trend? Are we going to see anything even close to average sales in October?

Coming off a September where we saw 4,996 sales, how much of a month-over-month increase would we need to see in October in order to get back to “average?”

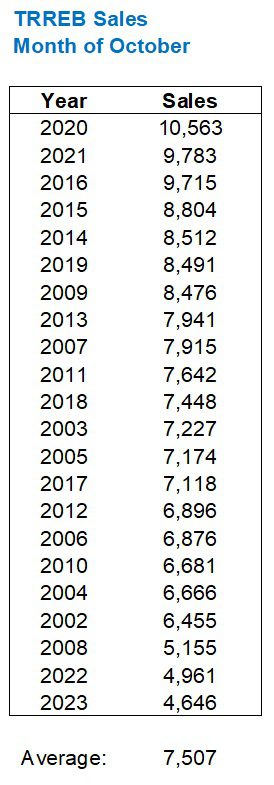

Take a look at this:

Note that the two lowest sales figures are in the two previous years, 2022 and 2023.

The average number of sales in October, from 2002 through 2023, is 7,507.

In order to achieve this, we would need to see a 50.3% increase in sales, month-over-month, from September to October. And that simply isn’t happening.

But prices aren’t going to decline, nor are sales. They might remain flat or might uptick modestly, but one thing has become clear at this point:

The market lags restored affordability.

Even though real estate is more affordable today than it was yesterday, last week, or last month, the market participants have not acted on this – yet.

How long is the lag?

Well, that’s the multi-million-dollar question!

Just as we describe inflation as a “lagging indicator” and note that multiple increases in the key lending rate in the spring of 2022 did not stop inflation from continuing to climb, we have also begun to note that buyers are slow to respond to conditions that are clearly working in their favour.

Consider a would-be buyer who could have purchased a home in the first week of September.

The key lending rate had declined from 5.0% to 4.25%, after 25 basis point cuts in June, July, and August. A variable rate mortgage was sitting somewhere around 5.74%.

This buyer could have purchased a home and closed at the end of October – after the most recent 50 basis point cut, and taken a mortgage with a variable rate somewhere around 5.29%.

That’s still really high, right?

Sure, but we’re in a cycle of interest rate cuts! If you’re buying a home for five, ten, or twenty years, then I would argue, “Why not take it on the chin for a month, or two, or five, in order to win out in the long run?”

By December, that 5.29% variable rate will likely decline further to around 4.79%.

Then comes January. And February. And so on.

“Yes, David, I know how a calendar works!”

But we’re looking at a period by mid-2025 when a five-year, fixed-rate mortgage will be somewhere between 3.49% – 3.79%.

Not only that, we’re looking at a period by the end of 2025 where the variable rate could be lower than fixed rates.

All this is to say: anybody who is waiting 4-6 months to experience lower rates, at their fingertips, is looking to save a few hundred dollars in interest while paying tens of thousands or hundreds of thousands more on the purchase price.

Let me go on record with this: by April or May of 2024, the GTA average home price, which currently sits at $1,107,921, will be over $1,200,000.

Maybe it’s time for a new prediction game?

London Agent

at 8:18 am

Toronto exceeds 1.2M June 2025

JF007

at 11:20 am

Count me in as well in this prediction.

Sirgruper

at 9:09 am

Surprised you don’t mention the US Fed, and that Canada is way ahead of the US with poorer yields and the effect on the dollar and loss of real purchasing power. Agreed it’s not really a Toronto residential real estate factor, but still is a key reason not to cut too much too soon vs the US.

Adrian

at 11:12 am

I’m betting on increased cuts because of these new immigration targets. Many agree immigration has gotten out of control and healthcare and home building has not been able to keep up. But when the party stops that’s also going to put a big dent in consumption. The economy has barely been growing on a gross basis, when you take away all those extra people I think it will become clear that we’re in a recession and no longer importing consumers to cover that up.

JF007

at 11:19 am

@DavidF did you mean 2025 instead of 2024 below

“Let me go on record with this: by April or May of 2024, the GTA average home price, which currently sits at $1,107,921, will be over $1,200,000.”

As for what i was thinking well i had not anticipated our esteemed PM going hammers and tongs at immigration and especially shut down the international student tap so drastically..that it would lead to reduction in overall demand I feel be it for resources, home and/or rental..

David Fleming

at 2:49 pm

Yes, sorry!

Ace Goodheart

at 1:51 pm

BoC is still playing whack a mole. No foresight at all, just knee jerk reactions to numbers.

I am not a fan of Tiff and never have been. Give me David Dodge, Stephen Poloz. Not fired up around Carney and was glad to see him go (and now he’s back and maybe wants to be PM?).

Tiff is flakey. No insight. Yes, I can see that if inflation is down to 1.6%, you need to cut. But why didn’t you see that coming? 700K per year and you can’t predict that situation ahead of time?

Derek

at 2:22 pm

When prices approached peak in the months leading up to the last peak in February 2022, what were the best available mortgage interest rates? I know I got a 1.66% 5-year fixed in the fall 2020, for example. Thanks Ron! The thinking is that prices will head back in the direction of the peak with the best available rates in the threes? Double the rates from 5 years ago? Why am I always so negative lol

Derek

at 2:27 pm

The taxman cometh:

https://www.thestar.com/real-estate/homeowners-who-regularly-rent-on-airbnb-and-other-sites-must-pay-13-tax-on-property/article_d085d5e0-9166-11ef-a141-73e5557f452e.html

Steve

at 9:16 pm

I think more and more small time landlords will be squeezed out before too long.

Vancouver Keith

at 2:40 pm

It’s worth noting that the current Bank of Canada rate is at 3.75%, and the “neutral rate” that they aspire to (along with 2% inflation and sub 5% unemployment) is 2.75% – a full percentage point lower than today. With inflation blowing through the desired 2% level, and Jerome Powell talking last month about 2% more coming in the next two years, the trend is your friend.

The October U.S. job number is crucial, and if real estate really is 20% of Canada’s GDP then December could be another half point as growth is barely alive in Canada. We’ll keep an eye on jobs and inflation. And what about the 800 pound gorilla in the room, the U.S. election result?

David Fleming

at 2:50 pm

@ Vancouver Keith

I don’t like either candidate.

With 11 days left, is it too late for an independent to run – and win?? 🙂