If you’re a fan of the “folksy intro,” then be prepared for disappointment today!

Because we’ve got a lot to get through and I don’t want to waste any time.

Let’s pick up right where we left off on Monday and get to my third “burning question” for the upcoming fall real estate market…

3) What in the world is happening with inventory?

When you think of the number “twenty thousand,” what comes to mind?

Maybe the science fiction adventure novel by Jules Verne, titled “20,000 Leagues Under the Sea.”

If you’re a sports junkie, maybe you know that only two NBA players produced career rebound totals of over 20,000? Kudos to you if their names come to mind without the help of Google…

In a real estate context, I’ve always had this number stand out in my mind when it comes to inventory.

We talk a lot on TRB about new listings, but we very rarely talk about active listings.

New listings are simply the total number of properties listed in a given month.

Active listings are the number of properties listed for sale on the last day of a given month.

In different markets, you might lean on one metric rather than the other. And in different markets, these metrics could hold varying levels of significance or even comparative value.

For example, you would think that active listings will always be higher than new listings. But in a red-hot market where inventory is absorbed faster, you could see fewer active listings at month’s end than the number of new listings that came out that month, meaning properties that were listed in prior months were selling too.

Simply put, 20,000 active listings is a lot.

Today, it’s a lot. I don’t mean to contradict or confuse, but I want to set the stage for a point that I’m going to make later.

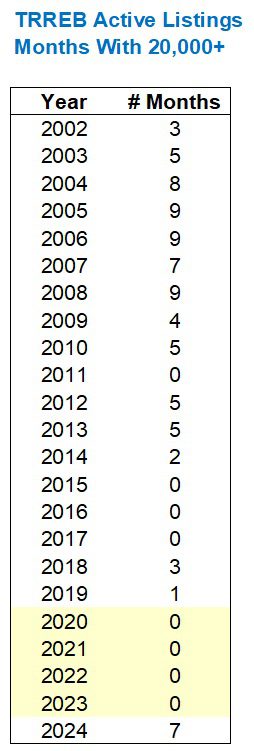

Here’s a chart that I have designed specifically to prove an initial point:

This is the fun thing about numbers; you can make them say anything.

Right now, I want the numbers to scream, “Oh my, 20,000 listings is a lot!”

This chart does exactly that.

Much has been made so far in 2025 about “inventory levels” and for good reason. The number of active listings has simply never been higher and the above chart introduces us to when all this began.

There were 20,017 active listings at the end of May, 2019, and we didn’t see that threshold topped again for five full years! It wasn’t until the 21,760 active listings were recorded in May of 2024 that we returned to this level of inventory.

As you can see from the above chart, the pace continued throughout 2024. From May through November, we saw 20,000+ active listings every month.

But that was nothing compared to what happened in 2025.

Coming into 2025, the record for most active listings in a single month was 27,373 in September of 2008.

We peaked in 2024 with 25,612 in September, so not really approaching the record from 2008.

Active listings declined to 24,481 in October of 2024, then to 21,818 in November, and finished in December with 15,393.

By March of 2025, we had surpassed the 20,000 threshold with 23,462.

But in April, we witnessed a new record: 27,386.

This beat out the previous record from September of 2008, but the market wasn’t finished yet!

In fact, a new-new record was set in May with 30,964, and a new-new-new record the following month in June with a whopping 31,603.

Here are the top-ten months this millennium for active listings:

As you can see, the top-four places on the list are all held by months in 2025.

In a few days’ time, we’ll have the TRREB data for the month of August, and I have no doubt that the figure for active listings last month will appear on the above list. We might not see it over 30,000, but we’ll certainly see it on this list.

All this is to say that inventory has never been higher in Toronto.

We came into this discussion talking about 20,000 active listings being a lot, so what can we say about 30,000 active listings?

It’s a lot. And the media only really caught on to this by mid-spring.

Having said that, I’d like to rewind a wee bit and provide some more context.

Remember when I said there’s a point I would come back to later?

Remember when I said that the first chart in this section was deliberately designed to capture 2020 through 2024?

What if we trace that chart back to 2002?

It would look like this:

Like I said: the year 2024 was an outlier and a trend-breaker in terms of active listings.

However, if we look back at what the market used to look like, it seems that 20,000 active listings was the norm.

Everything is about context.

In a post-COVID context, or in a “recent” context, seeing months with over 20,000 active listings is outrageous.

But there was a time, say, from 2004 to 2008, when between 7-9 months each year saw over 20,000 active listings.

These were not poor years in the market. The average home price in Toronto increased every single year.

As with many things in our market, we became spoiled when it came to the rate at which properties sold, the associated absorption rate, and thus the number of active listings in the marketplace, nearing all-time lows became normal.

There’s no arguing that 30,000+ active listings is an unfathomable number, but we also have to take the prior five years in a historical context to see that the increase in inventory is based on all-time low numbers.

I have no doubt that inventory levels in September, October, and November will be between 27,000 – 31,000. But my real burning question is:

Will we see active listings top the 31,603 set in June?

If that’s sensationalizing it too much, then I would ask:

Will we see inventory levels continue to grow?

The answer to this question will affect the upcoming market more than anything else, including the answer to the next burning question…

4) What’s happening with the average home price?

Let’s play a game!

This one is called, “Find examples of where David was wrong.”

Look no further than this feature in 2024 where I said the following about prices:

“I’ve gone on record saying that I think prices will increase in early 2025 and that we could see another massive surge, not unlike 2022.”

Womp Womp!

Of course, I was basing this on the Bank of Canada slashing interest rates, which kinda, sorta, maybe happened, or perhaps didn’t, depending on your target.

As discussed on Monday, the Bank of Canada didn’t provide the “jumbo” cut to the lending rate in September of 2024 like I had expected, and the affordability relief wasn’t delivered until late-2024.

I also didn’t see Trump coming.

I mean, I did. I knew he was going to win the election. We all did.

But I didn’t see his economic battle with the 51st State on the horizon.

I have to believe that this was at least partially responsible for our slow(er) spring real estate market, as consumer confidence plummeted, fear took over, and any life breathed into the market by the Bank of Canada interest rate cuts was soon sucked away by the cloud of uncertainty that still hangs above us.

Another question that I asked in September of 2024:

“Will prices be higher in the Spring of 2025 than in the Spring of 2024?”

The answer, as we all know, is absolutely not.

I realize that there are a lot of market bears out there, some who base their expressions on data and analytics, and some who live in fear and don’t own the house they want. C’est la vie.

But without Donald J. Trump, I really do believe we’d have seen a robust spring market in 2025, one that would have seen the average home price increase.

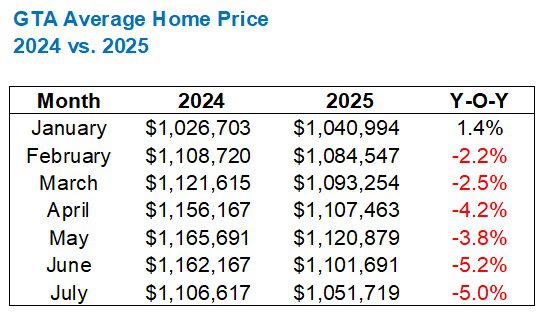

Here’s a look at how 2025 has fared versus 2024:

See how the year started?

It’s only one month, I know. But the year-over-year trend at the start of 2025 was positive, up by a modest 1.4%.

We saw in “Burning Question #2” on Monday that sales in January weren’t the worst of all time like February through May.

But everything changed in February, and as much as I don’t want to give credit to our neighbours south of the border, I see a direct correlation.

The year-over-year gap widened as 2025 progressed.

Here’s the data with a percentage attributed to each month:

It will be very interesting to see what the August data shows, but unfortunately, it won’t be released until after this blog post is written.

We saw a slight reversal of the trend in July, if you will.

If this continues into the fall, could we see a complete reversal?

I’ll do you one better here with yet another burning question:

Can we see the average home price in September, October, or November pull even with the respective price in 2024?

Read the comments on anything I’ve posted on YouTube, and people will say that I need my brain checked. True story. Er, I believe the comment was, “Realtors brains should be studied.”

I don’t think it’s that far-fetched.

I realize there’s a lot of uncertainty in the economy (as I’m writing this, it was just announced that Canadian GDP fell last quarter…), but I see a lot of demand in the market, and I think this could have an effect on prices in the fall market. Maybe not in Saskatoon. Maybe not even in Pickering. But in the Toronto market? Yes, I believe it.

“Delusional” was a word used by one YouTube commenter, but I digress.

I think a lot of people want home prices to decline, but that doesn’t mean they will.

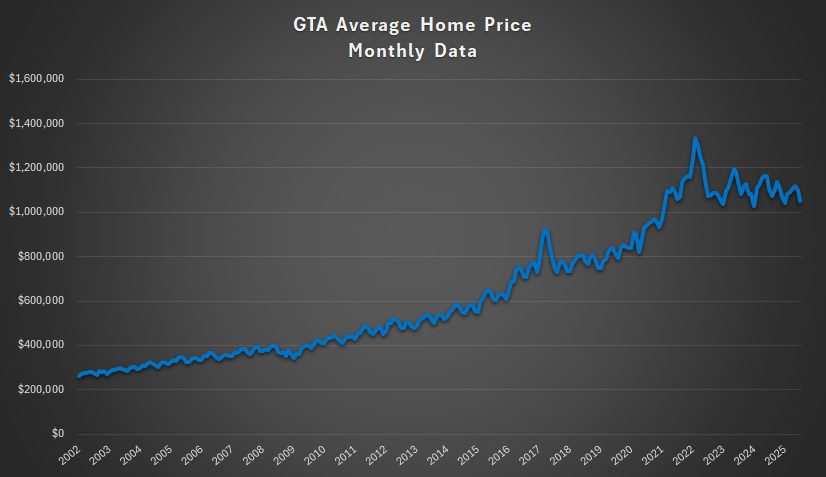

In fact, when I look at the 2017 “peak” and plot it, long-term, against the 2022 “peak,” they look very similar:

Look at this chart and tell me that those peaks don’t look the same.

Now, tell me there’s no way we’ll see the same thing again.

The news cycle out there is brutal, but with potentially three interest rate cuts on the horizon and quality inventory lacking, I see prices rising in 2026, if not this fall.

5) What’s happening with the resale condominium market?

Not much.

Period.

Enough said? Or do you want me to extrapolate a little bit?

Bear in mind, we’re talking about the resale condominium market. We’ll talk about new condominiums in the next section.

In 2024, selling condominiums was a grind. We were consistently seeing a trend of properties sitting on the market for 30 – 50 days before receiving an offer, but we got used to it. We adapted. More importantly, we began telling prospective condo sellers that it was likely going to take six or eight weeks to sell their units, and when you set expectations in advance, there’s a much better understanding of the process.

We sold all but one of our condo listings in 2024, and that was a pretty good result, judging from what colleagues told me about their experiences.

When 2025 began, we assumed the market trend would continue, and we prepared accordingly.

But whether it was failing to learn a “lesson” of sorts from the year before, or whether it was failing to spot a trend, we were caught off guard once again.

The condominium market contracted even more.

Right out of the gates, we noticed that showings were down significantly, and the feedback from buyer agents was always, “My clients are juuuuust starting to look,” or “My guys are reaaaaaally taking their time.”

Sales are down across the board this year, but the condominium market was hit even harder. Not only that, but listings were up, and it was taking even longer for condos to sell.

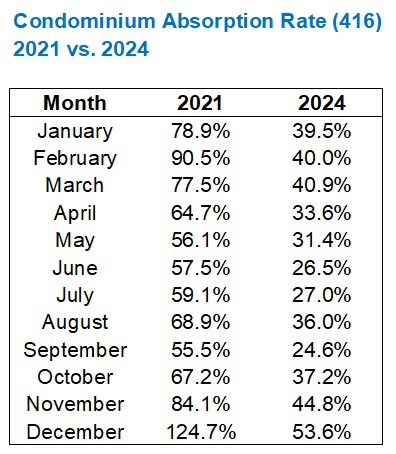

The best way I can describe the condo market over the past couple of years is to look at the absorption rate.

To put today’s market into context, let’s look at the absorption rate at the condo market “peak” in 2021 and plot this against last year:

It’s a pretty stark contrast.

We were routinely seeing an absorption rate that was half of what it was at the peak.

By definition, anything less than a 50% absorption rate signals a buyer’s market. In reality, I would say that’s a bit high, since we saw a ridiculous seller‘s market through 2021 and three months int the above chart show an absorption rate in the 55-60% range.

Having said that, there’s no debate that absorption rates in the 30% range signal a buyer’s market, let alone the 20% range.

The absorption rate dropped from 40.9% in April to 33.6% in March last year, and that was the start of a very long run of bad statistics! The 24.6% absorption rate in September of 2024 was the lowest I had ever seen.

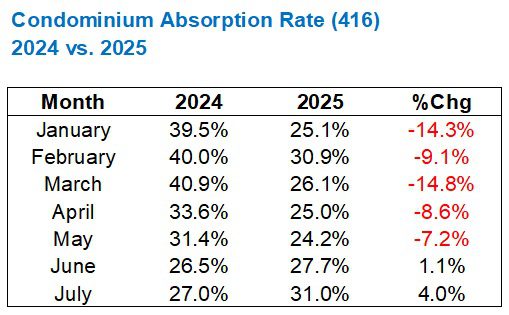

But along came 2025!

January’s absorption rate of 39.5% in 2024 dropped all the way to 25.1% in 2025!

It was about as poor as could be expected.

By the month of May, that 24.6% absorption rate from last September, which I noted was the lowest I had ever seen, was surpassed. May’s absorption rate was 24.2%.

But guess what?

The trend has reversed over the last two months.

One month is an outlier, but two straight months? And at an increasing rate?

Tell me I’m seeing something that isn’t really present, if you want. But I’ll probably tell you the same.

I didn’t set out looking for a trend, let alone one that ‘might’ signal the resale condo market is turning the corner, but I can’t deny its existence.

Specifically, there are two takeaways here:

1) The absorption rate has been lower in 2025 than in 2024, in every month from January through May, but that trend reversed.

2) The year-over-year absorption rate, which is higher in 2025 than in 2024 in both June and July, grew substantially from June to July.

3) The absorption rate is now the highest it’s been all year.

In mid-August, I listed a property for sale not too far from the Rogers Centre.

It was a small, 1-bedroom condo, although not “small” by today’s standards; it was about 550 square feet. Once upon a time, this was small, but with micro-condos being all the rage over the last few years, we might call this a “large small one-bedroom,” if there were such a thing.

In any event, the unit was on the market for about ten days, and then I received an offer.

I paged out the offer to all the agents who had shown the property, and lo and behold, a second offer was registered.

Then a third.

No joke.

Three offers on a Toronto condo? “What year is it?” I asked a stranger on the street…

The condo ended up selling for $10,000 over the list price, and both my seller-client and I were shocked.

I don’t remember the last time I had three offers on a condo listing, but I would assume it was 2022.

This is an isolated incident, no doubt. But the fact that it happened at a time when I was already looking at the above statistics and wondering if the resale condo market had turned a corner is not lost on me.

Nor should it be lost on you, or anybody else, as we move into the fall market…

6) What’s happening with new home construction and government initiatives?

Can I keep this short and sweet?

Doubtful.

As mentioned in a prior blog, I wrote a 4,500-word exposé on the history of pre-construction condos for our annual “INSIGHTS” magazine, and I do intend to publish that on the blog later this month.

I’ve also written several times throughout 2024 and 2025 about how frustrated I am that the media, and associated market bears, fail to distinguish between new condos (ie. pre-construction) and resale condos.

But we’re beyond definitions now, and dare I say that we’re way past the shocking headlines and statistics as well.

For the last eighteen months, we’ve been inundated with headlines like, “New Condo Sales 85% Below 10-Year Average,” or “July New Home Sales Lowest Ever.”

We get it.

Nothing is being sold.

But the long-term implication that people are only now starting to talk about is that nothing is being built.

A few weeks ago, I wrote this blog post:

August 14th, 2025: “Should The Government Intervene In The New ‘New Home Sales’ Market?”

There was a burning question, only three weeks early…

Over the last several weeks, the media have started to ramp up coverage of a topic that I said would be huge in 2025, and which I think will be even larger in 2026.

Here’s an interesting headline:

“Ontario Homebuilding Is Lagging The Rest Of The Country And That Could Have Dire Consequences”

Financial Post

August 25, 2025

From the article:

Ontario construction costs have grown the most in Canada as land, labour and materials, along with municipal fees, rose rapidly in price.

One sign of trouble is that Ontario municipalities are issuing more building permits than builders are acting on. “This suggests a major bottleneck in projects are costs instead of permit approvals,” he said.

Since large multi-unit projects can take two to three or more years to complete, a slump today threatens future supply.

This plays quite nicely into my next article of choice:

“Canada Not Expected To Meet Housing Target In The Next Decade”

National Post

August 26, 2025

From the article:

Canada needs to build 3.2 million new homes in the next decade to close the housing gap but isn’t on track to do that, the Parliamentary Budget Officer said in a new analysis published on Tuesday.

The report said it expects an average of 227,000 new homes should be completed a year for the next decade. This means the PBO expects about 2.5 million homes to be built over the next 10 years.

But it said Canada needs 3.2 million homes, leaving a gap of almost 700,000 homes between what is currently projected to be built, and what is needed.

Call me a cynic, but I believe that whatever is said to be needed is below what is actually needed.

I don’t want to get into a conversation about immigration, “temporary” workers, and “students,” but suffice it to say, I strongly believe that long-term housing targets have been set way too low.

Here’s another article worth a gander:

“Toronto-Area New Homes Market Flashing Every Possible Warning Light As Industry Sees Worst July On Record”

Toronto Star

August 27, 2025

From the article:

In 1990, there were 4,434 sales from January to July. In 2025, there were 3,007 sales from the same period.

“GTA new home sales in July 2025 extended the severe slowdown the market is currently in the midst of with another record low for the month,” said Edward Jegg, research manager at Altus Group — BILD’s source for new home market data.

“The protracted nature of this market has now surpassed the severe downturn in new home sales during the early 1990s.”

Sales have never been this low in the more than 40 years Altus has been collecting new home sales data.

There were 359 new home sales in July, down 48 per cent from July 2024 — and 82 per cent below the 10-year average, the report said. Historically, new home sales for a typical July in the GTA would be 1,941 units based on the previous 10-year average.

That is what we’ve been reading about for eighteen months.

Phrases like “never been this low” and figures like “82% below the 10-year average.”

All this is to suggest: the government will eventually get involved.

All three levels of government have campaigned on “building more homes,” in every election, over the last several years. The fact that housing sales have plummeted is a tragic irony, but one that will require intervention.

It’s no surprise then to see headlines like this:

“Ontario Could Change How Municipalities Qualify For Housing Fund Amid Market Standstill”

CBC News

August 27, 2025

From the article:

Housing Minister Rob Flack said this week that the Ford government is in talks with municipalities to change the Building Faster Fund at a time when new home construction has slowed and the province faces a “generational housing crisis.”

“We have seen the housing market come to a standstill,” Flack said. “Potential new home buyers have hit the pause button.”

The minister recently promised municipal leaders that the government would sit down with them to discuss the criteria to qualify for the annual fund, something dozens of communities across the province were not able to qualify for last year. Municipalities say basing the qualifying criteria on housing starts, which they don’t control, is unfair and should instead be based on building permit approvals, which are a civic responsibility.

Flack said he’s open to expanded or changed criteria, but the fund must still deliver housing. A spokesperson from Flack’s office said it was too soon to say what those changes may be.

“I want to make sure I say this respectfully … permits are not homes,” Flack said. “Yes, we can issue permits, but we want to see real results.”

Premier Doug Ford appeared to close the door on the municipal request of including building permits as a criteria while speaking at an unrelated news conference Wednesday.

“We’ll sit down and listen [to municipalities], but not based on permits,” he said. “Permits don’t result in homes immediately. They’ll eventually result in homes, but not immediately.”

Oh, yeah.

Get your popcorn ready, folks!

If you thought you’d never see politicians and civil servants crawl to another politician’s door, then you’re going to want an extra-large bag, with extra butter.

You know how I feel about this idea that the government should solve every problem, but this is going to happen whether we like it or not.

Condos and new houses are too expensive to build.

Period.

Developers and builders alike won’t operate at a loss.

Fair.

So eventually, the government is going to get into the business of home building (then we’re all doomed…) and/or we’re going to see a lot of legislation aimed at getting shovels back in the ground and cranes back in the sky.

This fall is going to be ground zero for the next decade of development, or lack thereof…

Folks, if you’ve made it this far….well….then you clearly didn’t want to start your workday. 🙂

But you’re also clearly committed to all things real estate, so thanks for reading.

The January and September blog posts are always extra long because they’re extra special! They represent the start of something new!

Good luck to all real estate market participants this fall, and for the casuals, onlookers, and enthusiasts, enjoy the show

London Agent

at 7:45 am

The only guess I could make for 20,000 rebounds is Shaq

Andrew

at 8:15 am

Wilt Chamberlain for sure.

Dunno about the other.

Graham (the real deal G-funk era)

at 8:43 am

Bill Russell is my guess. Dude was a beast back in the sixties.

Serge

at 8:28 am

I wonder if 20000 active listings in 2009 also were mostly investor condos like in 2025…

Meanwhile, the market already saw it, and survived. So…

QUIETBARD

at 11:32 am

David kinda sorta hints at this but I suspect that in the 2000s rate of sale on homes wasn’t as fast paced as it has been between lets say 2015-2023. If things take longer to sell more inventory can build up. That could also be 1 factor why listings broke 20,000 so many times in the last couple of years. Things aren’t selling crazy fast anymore. This is just conjecture obviously as I don’t recall what the real estate landscape looked like in the 2000s.

Serge

at 4:42 am

That is true, things are not selling crazy. This would be a good idea to complement the build-up numbers but the chart of sales numbers.

Toronto Tom

at 2:31 pm

Great post as always David! One thought about the 20k number – do we expect that as housing supply generally increases each year, that 20k may become a more easily achieved metric? Perhaps we need a more relative measure of active listings vs. new homes or something similar.

Vancouver Keith

at 6:09 pm

When the market runs out of levers (government subsidies, falling interest rates) in a market of mostly declining real incomes, sales volume falls. Prices follow. What is interesting to me is at a time when the market should have properly crashed, it has not. Again the government has intervened in the market to prop it up. While the current market shows some ugly symptoms, the last thirty years simply prove the question is what will the Canadian government do next to stop the market from fully and completely crashing. It is one of the most creative processes in any market, public or private.

Derek

at 8:27 pm

How does one define a proper crash for RE?

Serge

at 4:44 am

I belive it is something like a certain amount of a price drop over certain number of months.

Derek

at 4:14 pm

Yeah, maybe it’s just semantics, but if not “proper crashing”, it certainly seems to be doing something similar (of course, it’s in the rear-view mirror now!!!). What would need to be worse to be a “proper” crash?

https://betterdwelling.com/canadian-real-estate-is-crashing-at-one-of-the-fastest-rates-ever/

Serge

at 11:39 pm

I do not know. Probably, it is a “crush”. To be worse, it needs human horror stories. Like, people en masse losing life savings and homes. Bancruptcies, defaults… “blood on the streets”. How many and what people suffered that the average price went down 24% in three years? I dunno. Ah! Realtors are suffering. Do many regular people care?

Serge

at 11:49 pm

P.S. Ah! Realtors! In reality, (almost) all these 30K listings need representation. It is a listing for every active realtor. They should be as busy as never before… busy-busy. To close the deal, it is another story… But they should be busy, at least! Something on their hands to deal with.

Ace Goodheart

at 8:15 pm

I guess if government really wanted homes to get built, they could get rid of all the foreign buyer bans, and taxes, and fees, and punitive levies, that scare buyers away.

It’s like surrounding a store with barbed wire fence, fining anyone who makes it inside, and then putting massive taxes on everything sold there…

And then complaining that the store closed because there weren’t any customers