Looking for a feature photo to post in today’s blog led me to a serious realization: I haven’t travelled through Canada nearly enough.

I haven’t been to Vancouver since 1987. I was seven years old, and I went skiing with my father and sister at Whistler.

I haven’t been to Quebec since 2008. I was twenty-eight years old, and I went skiing with my buddies at Mont Tremblant.

I have never been to Alberta. That’s really sad.

I’ve never been to the East Coast. That’s quite sad too.

In fact, I have never been to Alberta, Saskatchewan, Manitoba, New Brunswick, Nova Scotia, Newfoundland & Labradour, Prince Edward Island, Yukon Territory, Northwest Territoy, or Nunavut.

I suppose it would have been more efficient to simply say that I’ve only left my home province to visit B.C. and Quebec, but I guess naming every other province was a good way for me to show myself what I’m missing.

When I think of visiting other places throughout the country, my evaluation criteria are based on stereotypes.

If I’m going out east, it’s for seafood. I’m allergic to shellfish, so it might not be the best reason to hit Nova Scotia.

If I’m going to the prairies, it’s for the Stampede. I’ve spent a lot of time in Wyoming over the years, so I’ve seen more than a few rodeos.

If I’m going to the West Coast, it’s to ski. I grew up skiing, but haven’t been on a hill since 2011. And I haven’t taught my kids yet, so that’s either the reason to go skiing, or the reason not to.

If I’m going to the Yukon, it’s simply to visit the people who lambasted me in my infamous blog from February of 2022: “Pack Your Bags: We’re Moving To The Yukon!” Oh man, I haven’t read those comments in three years! I forgot how bad they were…

I’ve been to thirty-two of the fifty states in the United States of America, but I haven’t been to Calgary.

Get out your cheese grater, and take this maple leaf tattoo off my back!

Over the years here on Toronto Realty Blog, we’ve taken numerous looks at the prices across the country, examining probably every metric there is.

One year, five years, ten years, twenty years.

Appreciation, depreciation.

Provinces, cities.

And just about everything in between.

I feel as though now is as good a time as any for a refresher.

Why now?

Well, it’s the intersection of a few different thoughts in my mind:

-We’re halfway through the fall market

-We’re over three years past our real estate “peak”

-We’ve seen interest rates come down from 5.00% to 2.50%

-Affordability has improved

-Consumer confidence has not improved

-We’re coming up to five years since COVID began

All said, I’m wondering what the following market measure would show us:

How does the home price index look, year-over-year?

It’s simple. One year.

September of 2024 versus September of 2025; how have prices moved in cities and provinces across the country?

Fair warning, folks: this might contradict a lot of your expectations. It certainly did for me!

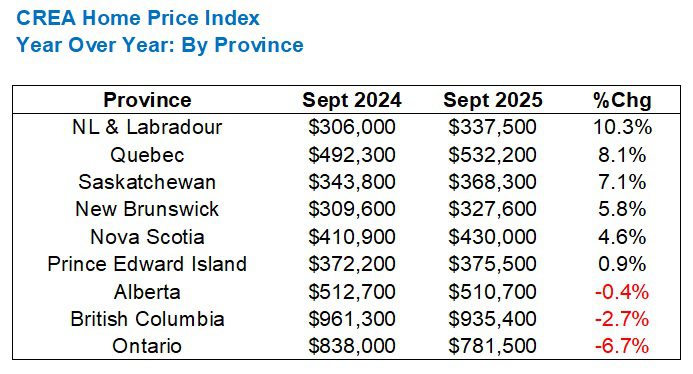

Using the CREA HPI, which is not an average home sale price, but rather an index that more accurately gauges home price levels and trends, while removing both volatility and seasonality, I want to look at how prices have moved in a mere twelve months.

First up, let’s look at the provinces, while keeping in mind that CREA does not provide data for Manitoba, Yukon, NWT, or Nunavut:

Like I said, the results contradict what many of us would have thought.

Raise your hand if you expected to see Newfoundland & Labrador atop the list of market appreciation?

Any hands?

Maybe, maybe not.

But furthermore, raise your hand if you expected to see Ontario at the bottom of this list.

With the benefit of hindsight, I believe several of you have your hands raised.

But I would also question who would have predicted that six of nine provinces would see an increase in the HPI? We’re constantly hearing about how poorly the Canadian real estate market is performing, so doesn’t this come as a surprise?

Last, but not least, who would have thought that British Columbia would be outperforming Ontario by such a wide margin, let alone at all? A modest 2.7% decline in the HPI is seemingly insignificant for the province of British Columbia when you’re holding that up against a whopping 6.7% decline here in Ontario.

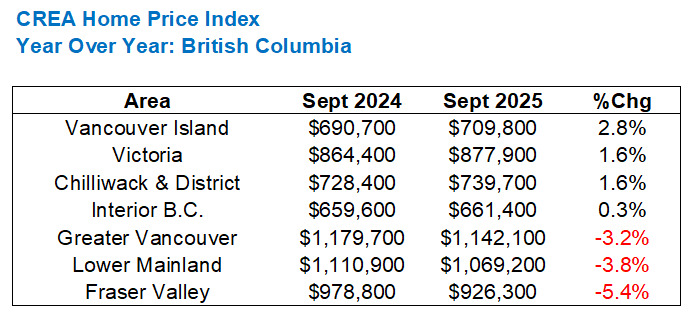

As for where prices are moving in British Columbia and by how much, let’s have a look:

If I can stereotype once again, it would seem the hippies are in the lead out there on Vancouver Island with a decent 2.8% increase, year-over-year. Perhaps there’s just a lot of demand from city-folk who want to head out west and live on an island?

Vancouver is down 3.2% which seems to make sense, given all we hear about the market out there, although Victoria is up 1.6% and those two areas used to run quite equal.

All in all, I think most British Columbians would “accept” a 2.7%, year-over-year decline, considering the incessant news cycle that infers the entire country’s real estate market has gone to hell.

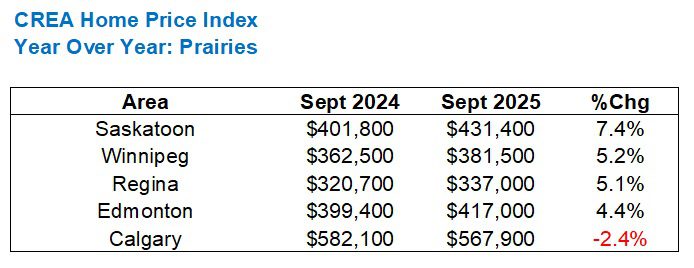

As for cities in Alberta, Saskatchewan, and Manitoba, this also surprised me quite a bit:

Is there demand for houses in Saskatoon?

It would seem so, based on the 7.4% increase in HPI, year-over-year.

Winnipeg too!

Those two cities – Saskatoon and Winnipeg, also typically run hand-in-hand. And as much as I can say that I have zero experience travelling across the country, I do know a guy who moved from Saskatoon to Winnipeg, but kept the house in Saskatoon (along with another thirty “doors” as he calls it, being a real estate investor…).

While you might think that Calgary and Edmonton should run hand-in-hand as well, remember that Calgary saw massive appreciation during the boom of 2022, as speculators from Ontario purchased properties out there, sight-unseen. It seems to reason that Calgary prices would come down at a greater rate than Edmonton, but watch as the gap continues to narrow.

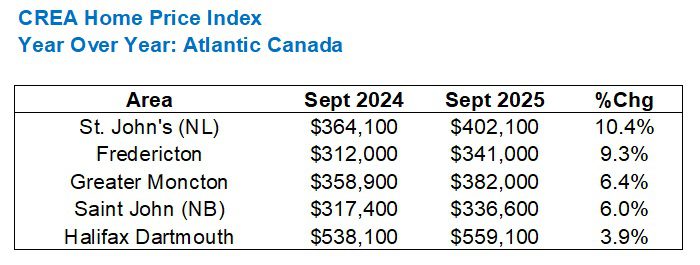

As for Atlantic Canada, here is where I’m experiencing the greatest level of shock:

First and foremost, I had to put (NL) and (NB) in brackets for those of you (including me) who still can’t keep St. John’s and Saint John straight in their mind, despite being raked over the coals with this in public school for years…

Everywhere you look in Atlantic Canada, prices are up.

The trend in many of the cities that we’re examining today seems to say, “Cheaper cities are appreciating at a greater rate,” and the above chart speaks to this. On the whole, these cities are cheaper than most of what’s in British Columbia and Ontario. But as those five cities go, it’s not surprising to see the most expensive (Halifax) with the lowest rate of appreciation.

Wow, St. John’s for the win, eh?

I can hear the fiddle playing all the way over here…

Now, let’s head to Quebec, where you might find a greater deal of shock than I did when looking at Atlantic Canada, but to each, their own…

I’ll be honest: I have absolutely no clue where or what “Mauricie” is. It looks like my friend Maurice spelled his name wrong, but apparently, it’s a beautiful area of Quebec where the HPI is up at double-digit rates over the last year.

These rates of appreciation in Quebec cities are absolutely astounding!

It’s what makes the next chart so incredibly hard to comprehend.

In fact, every one of the charts we looked at above makes the following chart hard to comprehend.

Let’s look at the province of Ontario, where twenty-three of twenty-nine cities or towns are in red figures:

Surprise!

And on that note, which of the following came as a greater surprise to you:

1) Price increases in Quebec cities and towns are in double-digit figures

2) Atlantic Canada is on fire

3) British Columbia is ahead of Ontario

4) Ontario is bleeding red numbers

Tough call, and there’s no right or wrong answer here.

I think that much of what we’ve seen today is a factor of how quickly prices moved from 2019 through 20222, as well as how the cost of living can be lower or higher in different parts of the country, and thus why net migration in Ontario is on the decline.

I’ll leave you with this final thought from a publication by the Fraser Institute:

Over the four year period from 2020/21 to 2023/24 (the latest year of available data), 277,299 people migrated to Ontario from other provinces or territories, while 381,725 left Ontario to move to a different province or territory. Put differently, Ontario saw a net loss of 104,426 people to the rest of Canada.

We can further break down this data by age. Looking at working age individuals (15-64 years old), Ontario had a net loss of 80,323 people from 2020/21 to 2023/24. If we zero in further, roughly 39 per cent (40,608 individuals) of the total net loss during those four years were young individuals aged 20-34 years old.

If you’ve moved out of Ontario in the past four years, I’d love to hear from you in the comments section below.

If you’re living in one of the cities or towns mentioned in the above charts, I’d love to hear from you in the comments section below.

Heck, even if you’re living in Ontario and have a perspective to share, I’d love to hear from you too.

Happy Monday, everybody!

Serge

at 11:01 am

It is well known that Ontario bleeds its own population and mostly young professional families. So the question is who are those “eager new buyers”, “sitting on sidelines” and waiting the rates (or development prices) to drop, to “jump into the market”?

Gen Z youth in parents’ basement? Professional class immigrants? Temp workers? Students? Because everybody else already have houses…

The previous guest speaker raised the same question but never answered it, alas…

cyber

at 8:51 am

The 1/3 of of the single 20-34 year old cohort in Toronto who lives with at least one parent… especially if the parent(s) are of the more generous homeowner Boomer variety & open to tapping into HELOC to get their kids into their own properties.

No one likes to buy on the way down and catch a falling knife, but as soon as the market “turns” and seem to be on an upswing from the bottom this cohort will return in spades.

My prediction is that “entry level houses” (e.g. stacked townhouses, semis, 2-bed detached) under $1M will see the most action, as people realize that whatever they buy is more likely to need to be a “forever” (at least 7-10 years) home given market is not as predictably “up only” as it has been in prior twoi decades.

Serge

at 2:30 pm

30% or even 50%.

Well, some people buy exactly on the way down – e.g., David. It could make sense.

There are no stats on how many of those youth have overall income sufficient to pay 4K-6K mortgage even after parents gave them downpayment. Would it be enough to provide, say, 10-15 K purchases of entry-level houses per year?

cyber

at 11:32 am

I mean, 34 year old is hardly “youth”… Plenty of white collar or trades professionals out there making around 100K, and they don’t even need to make that much if house has a basement suite and Mommy and Daddy Dearest are also open to co-signing in addition to providing down-payment. Or even simply co-buying together, eg someone I know is a single tradesperson who bought a small detached with divorced dad, with dad living in the basement apartment.

Also plenty of those “single” 20-34 year olds may in fact have romantic partners who are willing to split a mortgage and finally start “adulting” together

Now will enough of this cohort come out of the woodworks at the first sign of market uptick, to drive the prices up at a noticeable clip? We shall see, possibly not that soon – with all the Trump tariff insanity and Canadian economy headed for a recession anyways (we have been in negative GDP per capita recession for a while already), probably just the teachers, medical professionals, firefighters and the like won’t be worried about losing their jobs to jump into the real estate market, even if parenrs are helping with downpayment.

Serge

at 12:55 pm

I believe that 35 is currently the official cut-off age, no? If so, 34 is youth.

There is stats on downpayment help, it is probably around 30% for 1st time buyers. That I count it.

The cases of co-buying, co-signing seem to be anecdotal.

Not sure about Toronto, but median income for persons 24-35 in Ontario is 60K in 2023, and 90% earn less than 100K in Canada.

Romantic partners? Not sure how banks will review such application. They have to be official.

Landlording? We heard some opinions here…

I wish somebody produced stats exactly how many basement professionals with income over 100K are ready to buy in GTA.

I have not seen for long, what is the percentage of first time buyers now. It was lower than 30% three years ago. But now? I am curious.

So yeah, may be, yes… but it would be good to have some datapoints.