What were you doing in February of 2014?

No. Seriously. I’m asking.

A friend of mine told me this week, “You seem really caught up on age lately.”

I asked him to define “lately” and he paused, pondered, and said, “I mean, maybe the last couple of years, now that I think about it.”

Damn. It’s true what they say. Life does change after 40…

February of 2014 wasn’t that long ago.

Barack Obama was President. Stephen Harper was Prime Minister.

Pharell Williams sang “Happy” and Meghan Trainor taught us “All About That Bass.”

The Olympics were held in Sochi, Russia, but it would take some time for us to learn what an advanced doping system the Russians had implemented!

The Toronto Maple Leafs were led by Phil Kessel, James Van Riemsdyk, Tyler Bozak, Joffrey Lupul, et al, in one of the worst periods for the franchise in my lifetime.

I had only been married for eight months! I was such a pup!

Ten years, eh?

While it’s been said that anxiety is always looking forward, depression is always looking back, and mindfulness is being in the present, I wanted to take a look today at Canadian real estate prices over the last decade.

Why now?

Well, for starters, it’s as good a time as any!

But also because we continue to sit on the precipice of real estate disaster in this country, as our leaders constantly lament housing prices, and yet have not demonstrated anything close to a solution. We have also watched the Canadian population swell from around 35.4 Million in 2014 to close to 40 Million this year. We’ve endured a worldwide pandemic, we’ve witnessed a new “work-from-home movement” that changed how many people live, and we’ve seen a tremendous number of people move out of major cities, only to witness many more move back in.

If you’re an amateur real estate enthusiast, you might also spend time looking at real estate prices outside of Toronto, or even outside of Canada.

You might look at what a house costs in Shinjuku, Tokyo. Or you might look at real estate prices in Nashville, Tennessee.

But how much properties cost is just as important as how much prices have risen.

So today, let’s use the CREA HPI (home price index), which tracks prices in sixty areas, nine of which are provinces, and fifty-one of which are cities or residential areas.

Keep that in mind: 51 cities or areas.

Here are some very preliminary notes about these 51 areas:

-There is no area where the HPI has declined in the last decade.

-The lowest of the fifty-one areas is an increase of 5.2%

-The highest of the fifty-one areas an increase of 220.4%

-35 of the 51 areas saw an increase of 100.0% or more

-The average of the 51 areas is a 109.1% increase

That’s merely for initial context.

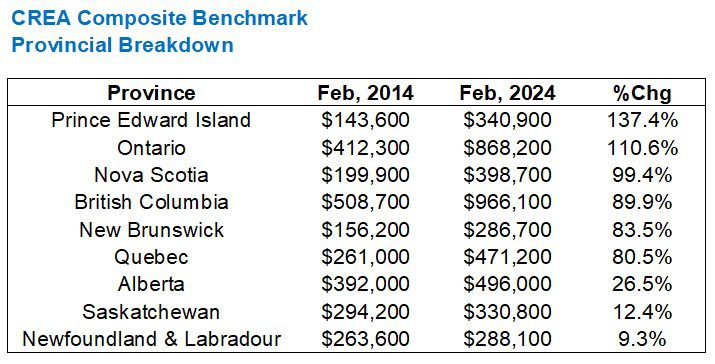

But first, let’s look at the nine provinces:

Interstingly, CREA doesn’t track Manitoba. Don’t ask me why. But CREA also doesn’t track Yukon, Northwest Territories, or Nunavut, and I suppose I understand that.

A first glance at the chart above might have you say, “Yeah, okay, so Ontario and B.C. are in the top four, that makes sense.”

But Prince Edward Island is atop the list? Really?

And Newfoundland & Labradour is at the bottom?

On the one hand, I would be surprised to see an eastern province sitting at an increase of 137.4% while another eastern province sits at a mere 9.3%.

On the other hand, Prince Edward Island is a boon for tourism and second homes. That’s not to say that Newfoundland isn’t, but rather I would think most Canadians looking for vacation homes out east are looking in PEI and Nova Scotia, which happen to be in very close proximity to one-another.

Those less-informed (like myself, on a bad day…) merely assume that “all those provinces out east” are tied together, but one glance at a map shows you that Newfoundland & Labradour is east of the northern-most section of Quebec.

I can see why Newfoundland isn’t getting as much love.

As for Saskatchewan, can we make uninformed assumptions here? Regina. Alright. Saskatoon. Sure. But what else is happening out there? It’s not where you might think real estate prices are skyrocketing, is it?

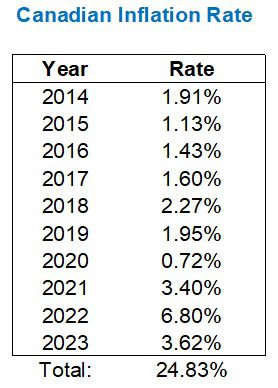

What did surprise me was seeing Alberta at a mere 26.5% increase over ten years. We all know that the province, jobs, and real estate prices revolve heavily around the health of the oil industry, which has had its ups and downs over a decade. But if we adjusted for inflation, how would this look?

Um, let me do that…

These rates are added and not compounded, but you get the idea.

Adjusted for inflation, it would seem that real estate prices are more affordable in Alberta than they are today.

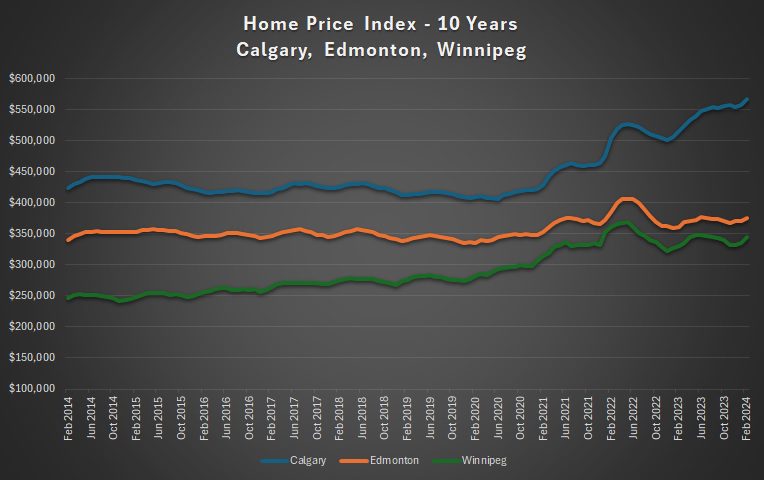

However, if we look at major Canadian cities out west, say, Calgary, Edmonton, and Winnipeg, what would you expect to see?

Here’s the fun part – the conclusion that you might draw from looking at a graph versus a chart could be different. It certainly was for me.

Here’s the graph:

Prices in these cities more-or-less moved in tandem from 2014 through 2018, but whereas Winnipeg saw an increase in 2018 and 2019, Calgary saw a decline.

However, if you look at prices from 2023 onward, you can see that Calgary is trending upwards while Edmonton and Winnipeg are more or less flat.

To me, it look like Calgary saw the largest gain.

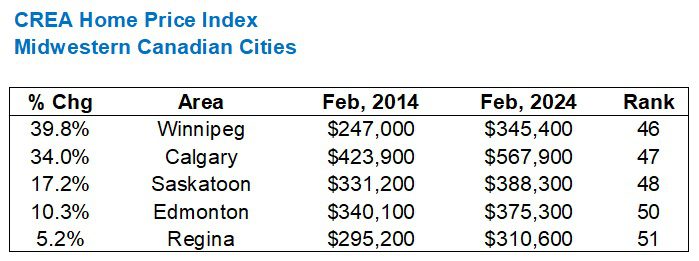

But here’s how the prices actually play out, and let’s add in Saskatchewan just for fun:

Winnipeg trumps Calgary, although not by much.

Calgary has seen a renaissance in the past 18 months, but prices in Winnipeg were so low to begin with that the slow-and-steady climb looks unspectacular on a graph, but is actually quite substantial in practice.

Of course, none of these numbers are “substantial” in the context of the fifty-one areas that CREA tracks.

The last column there – Rank – refers to the area’s rank out of fifty-one.

Regina is dead last at 5.2%, and yes, that’s the mystery city that I noted above in our preliminary notes.

But isn’t it fascinating that these five areas make up 5/6 of the lowest of the fifty-one areas tracked?

Which one is missing from that data set? #49?

Well, let’s look at cities out east now…

There’s #49, in case you were wondering.

St. John’s, Newfoundland. Not to be confused with St. John or Saint John, New Brunswick.

But what’s so interesting to note here is that #49 on the list is a city that’s only seen a 10.6% increase in the Home Price Index in the last ten years, but a mere five places up on that list, at #44, is a city that’s seen its HPI increase by 66.7%.

That shows you just how few of the fifty-one cities that we monitor have seen an increase in HPI of less than 60-70% in the last decade.

So what’s at the top of this list?

Is it cities in British Columbia, you’re asking? That must be it, right? All that west-coast money?

Well, yes and no…

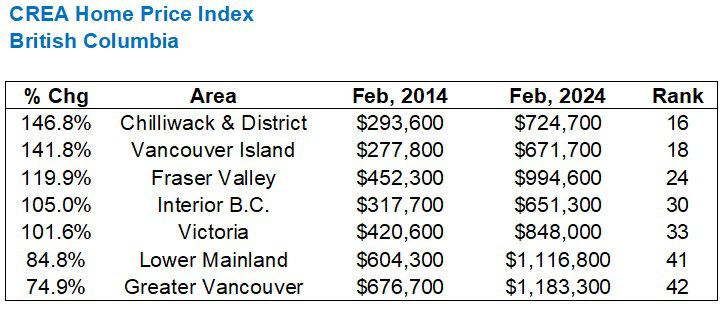

Alright, now we’re onto something!

The seven areas in British Columbia that the CREA HPI tracks have seen ten-year increases between 75% – 147%.

That’s a great floor at 74.9%. And amazingly, 74.9% ranks 42nd out of 51 cities!

But how is 146.8% only 16th on the list?

What in the world is happening?

What could possibly be in the first fifteen places on the list?

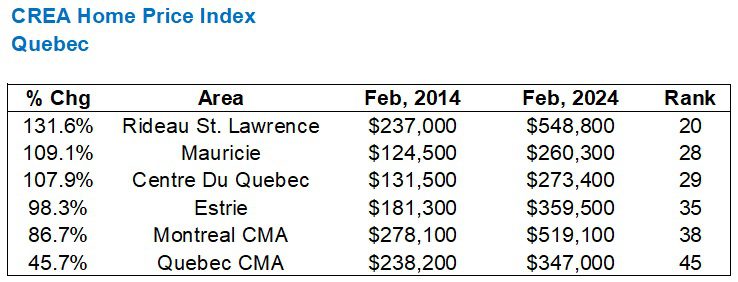

Wait…..is it Quebec?

Nope!

Although a “top-twenty” is nothing to sneeze at.

Interesting to see Montreal “only” up 86.7%, but while it’s not the number itself that’s surprising (since an 86.7% increase in ten years should be considered exceptional anywhere in the world) it’s the fact that Montreal is 38th out of 51 areas.

In case you haven’t noticed, we’ve left one province out thus far. But that’s not by design, I swear. I didn’t plan this out; it just sort of started with the cities in the midwest, then took a turn to the east coast, and before I knew it, I’d created this big “reveal” of sorts.

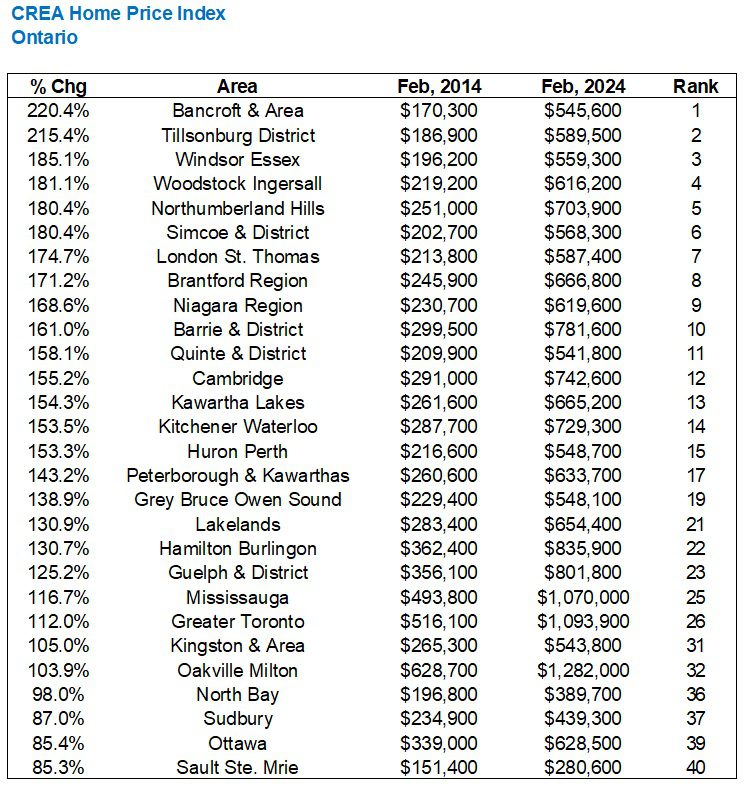

Yes, Ontario is the ticket.

In fact, the first fifteen cities out of fifty-one area ALL from Ontario:

Excuse the large chart, and apologies if this doesn’t display well on your phone.

But there are fifteen areas in Ontario that have seen a 150%+ increase in the CREA HPI in the last decade.

Not only that, 24/28 areas in Ontario have seen a 100%+ increase.

I mean, The Soo? Really? I have clients who are from The Soo and they trash-talk it all the time, while simultaneously browsing real estate listings because they dream of moving back! But The Soo has increased by 85.3% in the last ten years. What does that tell you about real estate in Ontario, let alone in Canada?

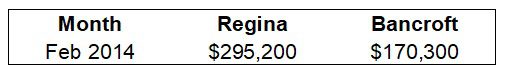

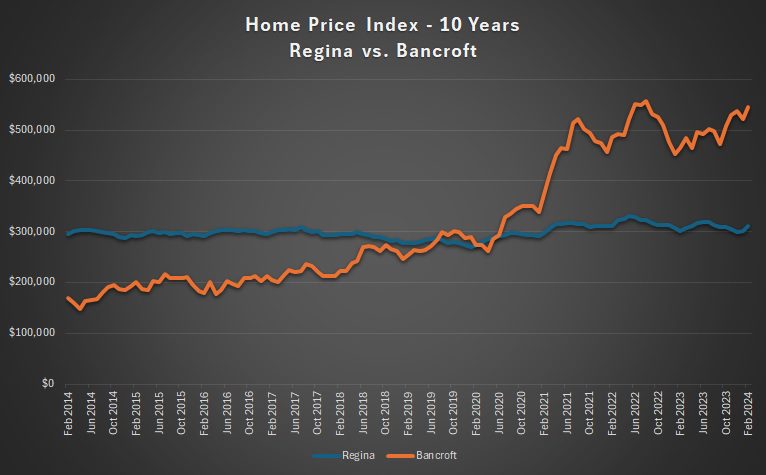

Now, just for fun, I want to compare #1 on the list to #51 on the list.

Bancroft versus Regina.

Look at where things started:

And look how things went over the next decade:

Much of the gain in the Bancroft & Area region seems to correspond with the 2020 COVID pandemic, and that’s a common theme with many of these areas in Southern Ontario.

There has to be a reason why the top fifteen areas on our list of fifty-one are all from Southern Ontario, and amazingly, Mississauga and the Greater Toronto Area rank 25th and 26th respectively.

In summary, I suppose rather than providing a conclusion or an opinion of my own, I want to ask the readers:

Is this normal?

I suppose we could spend days debating the definition of “normal.” B

But essentially what I’m asking is whether or not real estate prices doubling every decade is what you would expect to find in any other country in the world?

Is this sustainable?

Does this speak to where our country is headed?

Riddle me that, folks…

Graham (the real deal one with the name and so forth)

at 8:27 am

February 2014. I was planning my move down the 401 from Toronto to London. Bought a house in London for $220K. Good times.

Also, Eternal Sunshine of the Spotless Mind came out in March 2004. 20 years ago! I was planning my move from London to Toronto. lol.

Island Home Owner

at 8:57 am

As an PEI home owner since 2018, not the least surprised by that provincial chart …

David Fleming

at 1:01 pm

@ Island Home Owner

I still have not made it out there.

My wife asked me today at breakfast, “When are we going to travel out east?”

One of the darlings in our accounting department is from Newfoundland. She’s proud and sore at the same time. But she told me, “Don’t go there. Go to PEI. Or Halifax.”

It almost makes me want to go to rural Labrador…

Moonbeam!

at 4:08 pm

David – yes, visit PEI for 2 or 3 nites, I’ll babysit! I went a few years ago & loved it. Stayed in Charlottetown, loved the lobster rolls! A short painless flight on Porter, a very easy getaway

Jenn

at 11:48 pm

😍😍😍

David Fleming

at 7:15 pm

@ Mom

I’m allergic to shrimp, so I’m assuming I’m also allergic to lobster. Perhaps I should go for that thrice-cancelled appointment with the allergist? 🙂

But seriously, I would love to take you up on this!

I can go real estate shopping with Island Home Owner while I’m there!

Island Home Owner

at 7:57 am

Love to show you around the Island a bit if you’re ever here. Sadly, as your numbers show, not as many real estate deals here as there were a few years back though.

Island Home Owner

at 9:01 am

Also, pretty sure Rideau-St.Lawrence is in Ontario 😉

Francesca

at 9:38 am

In February 2014, we were looking to sell our house in Markham and move back to Toronto cause the suburbs were getting boring to us after five years of living there. I remember going to look at houses in the bloor west village area to be closer to my husband’s job at the time and balking at the 850-1 million range these small homes were selling for in comparison to our much larger house in Markham. Now in retrospect they were a steal to what they are worth now. We ended up staying until February 2021. Ironically while everyone was leaving the GTA during Covid we were the only crazy ones ( in our friends and neighbors eyes) to move back to the city and into a condo of all madness if you can imagine! We got way more for our house by waiting those extra six years to sell but by then any house in the GTA was way out reach so we decided to downsize into a condo. Here’s a tip to all of you with young kids: those kids will grow up and eventually you don’t need as much space as you think you do and location will then trump size of house. We are so happy we made this decision when we did. To speak to your point David it’s crazy to think how expensive it will be to buy anything in the GTA if prices double in another decade. Adult kids will never leave home or have no choice to rent with multiple roommates or to leave entirely. It’s a sad situation. This situation has been happening already for several decades in European cities. All my cousins in Rome either still live at home with their very elderly parents, rent or were lucky enough to have apartments funded or handed down by parents. Those who speak other languages move to more prosperous countries where salaries are higher like Germany or the UK.

Landlord84

at 1:45 pm

Great story.

I agree. We are behind, and so following Europe in economy and culture shift. Politics will have to shift eventually as well. Allowing people to build 3 or 4 stories for their growing families, as they do overseas.

People will get used to living with an expanding family under one roof. And enjoy it.

Ed

at 9:52 am

Interesting to see on that list of Ontario cities/regions those that rank in the top 21 the prices in 2014 were all under 300,000.

Marina

at 10:50 am

In 2014, my daughter was 1 and I was pregnant with my son, so we were staying put in our house.

But I do remember that my mother’s close friends sold their house in Unionville for $1.4M and switched to renting. My parents were trying to convince themselves to sell their house and go renting too, and trying to convince us to do the same. Thankfully we talked her out of it.

That Unionville house is now worth 2.8 million easy, and the friends are still renting.

And my parents are finally looking at downsizing options, but only ones that involve ownership. Once those real estate prices get away from you, there’s no catching up.

Adrian

at 7:48 pm

I read today that Canada brought in 1.23 million newcomers in 2023 alone. Crazy numbers. That’s the only way price increases like this “are normal”. Demand easily outstrips supply when you’re growing your population at 3% per year.

Appraiser

at 8:12 am

There are three main reasons that Canada requires the current level of immigration, if not more:

1. Our population is aging rapidly and retiring in record numbers.

2. Our population is dying at an increasing rate.

3. Job vacancies in Canada are still over 700,000 (after declining from over 900,000 the previous year).

“RBC: Canada Needs a Lot More Immigrants, Almost Double the Current Rate in the Long Run” https://nationalpost.com/news/canada-needs-a-lot-more-immigrants-almost-double-the-current-rate-in-the-long-run-rbc

Appraiser

at 8:16 am

From the NP article:

“Even the current annual immigrant intake of 1.3 per cent of the population is not sufficient to stabilize the age structure, which would require about 2.1 per cent…”

Crofty

at 3:38 pm

For an historical perspective on our chronically under-populated country, and an intriguing look to the future, Globe & Mail columnist Doug Saunders’ 2017 book “Maximum Canada: Toward a Country of 100 Million” strongly echoes these sentiments.

Appraiser

at 7:28 am

Statistics Canada had this to say back in April 2022:

“In the midst of high job vacancies and historically low unemployment, Canada faces record retirements from an aging labour force: number of seniors aged 65 and older grows six times faster than children 0-14.” https://www150.statcan.gc.ca/n1/daily-quotidien/220427/dq220427a-eng.htm

Appraiser

at 7:38 am

Canada is not alone:

“More than 11,200 Americans will turn 65 every day — or over 4.1 million every year — from 2024 through 2027…” https://www.cnbc.com/2024/02/08/baby-boomers-hit-peak-65-in-2024-why-retirement-age-is-in-question.html#:~:text=More%20than%2011%2C200%20Americans%20will,thought%20of%20as%20retirement%20age.

cyber

at 9:00 am

StatsCan also had this to say:

– For jobs requiring a bachelor’s degre or higher, there were always more unemployed people than vacancies

– For lower skilled jobs, employers are simply choosing to keep wages low and accepting higher turnover

https://nationalpost.com/news/canada/statcan-report-casts-clouds-on-claims-of-a-widespread-labour-shortage-in-canada

So basically our record immigration is really suppressing wage growth across the board, for the benefit of big businesses in Canada, whether they’re grocery stores or the banks

Appraiser

at 12:06 am

Southern Ontario is the economic engine of Canada and that engine is accelerating. I don’t see that changing for decades.

Prices don’t have to double every ten years to make real estate a good long term bet.

Landlord84

at 2:27 pm

Well, I would say almost all investments calculate for a future value, close to, if not double your original amount. (7% compounded/yr) Bank mutual fund managers, financial analysts and advisors will use this as an average metric. Many factors contribute to this future value, (inflation, population, technology, etc.) Take the most general S&P 500. Was $1,923. March of 2014. Its now $5,234. Thats a %272 increase. Now the tsx did not do nearly as well. So I would conclude we generally invest in our housing, over large businesses we don’t own, in Canada.

Peggy Most

at 1:44 pm

I have been trying to determine a price to sell my recreational cabin/island in Ontario with no success. I found your article very interesting. My property is 70 miles east of Sault Ste Marie. I purchased the island and built the cottage in 2008. Could you give me your opinion of average % increase in value for this type of property in this area for last 16 years? Any insight would be appreciated!