I hope you’ve had your Monday-morning coffee, because this is going to be fun, fun, fun!

Why are pre-construction condominium prices so high? Is it because developers are greedy? Is it because land costs more these days? Is it because the city of Toronto is bleeding developers dry?

Or is it, as you would probably expect, a combination of everything above, and more?

I’ve spent some time speaking to industry contacts, and gathering tangible data on the costs involved with development. Let’s take a look…

12%.

Read it again.

12%.

That’s the answer to the question you all want to know.

“What is a developer’s profit margin, in this absolutely incredible real estate bull market?”

Twelve percent.

At this point, many of you are already shaking your heads.

You saw the number, you read the words ‘developer’s profit margin,’ and your brain quickly sent a signal to the rest of your body that made you squirm in your chair in discomfort, because I’m lying. The number can’t be that low.

You already have your minds made up, and some of you may even be thinking, “He’s finally done it; he’s sold out to the world of evil condominium developers!”

But surely you’re going to read onwards, right?

Surely you’ll give me a chance to explain?

Look, that 12% figure is more for effect than anything else, to start the blog off with a bang. I could have strung you all along, and done some big reveal, like this is a home renovation show, and the naive buyers finished their project under-budget, on time, and with no regrets.

The actual figure I was given was 12%-20%, and as will be a continuing theme in today’s blog, everything is estimated, subjective, and can change in an instant.

But where did this conversation start?

It started in the comments section, as many discussions usually do.

This is from Wednesday’s blog:

I had a feeling the “greed” comment was coming.

How can we not assume that greed is the main driver of just about any capitalistic venture in society today? The real estate market has been on fire for over a decade! Developers must be getting Sh!t-Rich off the backs of naive condo buyers!

But if you really sit down and think about it, successful, established companies are able to stay in business because they offer a product or service that meets the demands, and needs of buyers and users, at a price that they’re willing to pay.

I don’t think it’s reasonable to assume that when pre-construction condo prices were at $600/sqft, and developers’ costs were at, say, $300,/sqft, that today these developers are still paying $300/sqft in costs, and they’ve just decided to get rich or die tryin’, and charge $1,000/sqft.

In fact, I think it’s more reasonable to assume, and correct me if I’m wrong, that the reason for an increase in pre-construction condo prices is more likely to do with rising costs, than greed.

Please, tell me if you disagree.

And keep in mind, I say this even though I’ve been the most ardent opponent of pre-construction condominium purchases for the last decade. We won’t go down that road again; you’ve read my blogs for years. But what I want to do today, is hypothesize that the rise in prices is less to do with greed, and more to do with cost, and have you readers follow along, without making your minds up in advance that I’m in bed with developers.

As I told a reader who commented on Monday’s blog, I don’t know any developers. I’ve sold exactly ZERO pre-construction condos in the 14 years I have been licensed. I don’t hob-nob, or eat caviar with the principals of Tridel, Menkes, and Cresford. The only time I’ve ever interacted with developers is when their lawyers have sent me threatening letters because of things I’ve written on my blog.

So allow me to present to you my findings on the approximate cost of building new construction in downtown Toronto, and take it with a grain of salt, if you so choose.

I’ve solicited opinions from two people who work in the commercial and/or condo development space, both of whom I’ll quote, but leave anonymous.

The way we want to look at the construction cost is by breaking down the following:

- Land Cost

- Hard Costs

- Soft Costs

Let’s look at each one in detail.

LAND COST

One of my colleagues said the following:

“Fifteen years ago, surface-level parking lots were in abundance throughout the downtown core, and developers could have their pick of building sites, both those actually posted for sale, and those that could be solicited. Today, there are more developers, they are larger, and they have deeper pockets. But they’re all fighting for the same handful of building sites that are available each year. They’re suffering from the same lack of supply that your average 1-bedroom condo buyer or entry-level home-buyer is faced with, and they’re out-bidding each other, looking at smaller margins each and every time. Developers are getting more creative, and future-focused. They’re land-banking for a decade ahead. They’re buying existing commercial/office and trying to double or triple the denisty to make a condominium development work.”

One of the best resources for construction costs and industry trends that you’ll find available publicly is the Altus Group Construction Cost Guide.

The report states the following:

Altus Group’s annual Construction Cost Guide is the Canadian real estate industry’s leading guide to development project costing. It is trusted as a budgeting tool by public bodies, developers, lenders, contractors, consultants and various industry professionals.

Click HERE if you want to download, or read the 22-page report.

Market trends, sales figures for new construction, office leasing – this report has it all, in addition to the construction cost guide we’re interested in.

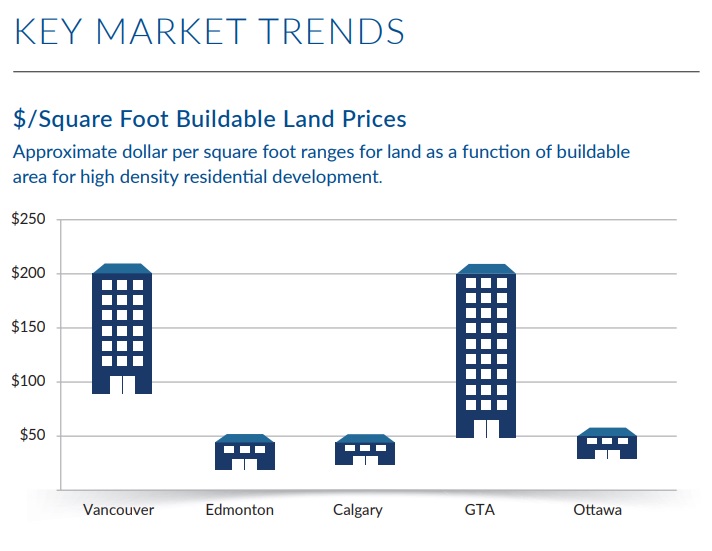

Within the construction cost guide is a reference to the cost per buildable square foot for land prices:

Toronto is on par with Vancouver at around $200/sqft.

But as far as that $200/sqft goes, we need to make two important notes:

1) This is a GTA cost. The value of land in Toronto’s downtown core is far greater.

2) This is buildable square footage, and not actual sellable square footage.

One of my contacts said the following regarding point #2:

“Buildings are typically about 85% efficient so when you sell, your sales are based on the square footage inside each unit but when you allocate the costs, it is on 100% of the building. Lobby, party room, gym, pool, fire escapes, elevators, hallways, stairwells – all common elements. So when you calculate costs, it is on 100% of the building but when calculate revenue, you can only charge on ~85% of what you have built.”

Taking into consideration both point #1 and point #2 above, that $200/sq ft estimate of cost per buildable square foot would likely head into the high-$200’s rather quickly for a downtown Toronto condo.

I was also told the following:

“The cost per square foot of buildable land is highly subjective for a condo. You might be looking at a land-banked dozen freehold homes, for which zoning is residential with a 3-storey height restriction. That site could be sold with the assumption that a 30-storey tower will be approved. It cuts both ways though. If you’re able to negotiate with the city and get approval for 40-storeys then you’re ahead of the game and your cost psqft is lowered. But if a downtown sight is sold as though 70-storeys is a slam dunk and you but heads with the city councillor and get 60-storeys approved, then your cost skyrockets.”

I would conclude here that we’re looking at a floor of $200 for the acquisition of one square foot of condominium space, and that cost, with the three points above considered, could double.

–

HARD COSTS

Altus Group’s proprietary database of project costs includes project data from over 1,400 properties in 2017.

For the Greater Toronto Area, I’ve taken a screen-shot of the following:

It’s fair to say that most new condos in Toronto are being built higher than 40-storeys, at least when we consider the downtown core.

These figures refer to the GTA, but for our purposes, we’re not really interested in what’s happening in Halton, Peel, York, or Durham. We want to know why pre-construction prices in the downtown core are now over $1,000 per square foot!

So I would likely use the higher number in the range, and again, I think that’s fair.

We’re looking at upwards of $330 per square foot in hard costs, and note the “premium for high quality.” That could refer to Yorkville projects, but it could also refer to something as unassuming as a new Freed project in King West. Consider that Altus is using data from 1,400 condos, across Canada. And I don’t believe that the “average” features and finishes in a Calgary condo are the same as that of a downtown Toronto condo.

All three costs – land value, hard costs, and soft costs, have been increasing dramatically over the years. But with respect to the hard costs, one of my colleagues said this:

“Labour costs have never been higher. The unions feel as though after a decade of building, it’s time for them to get their ‘piece.'”

I have no hard data to support that.

But also consider that a developer must forecast increases in hard costs – labour, materials, what have you, as the project is future-based:

“When you are a developer and you sell all your units in one market, you have committed to delivering at that price. You have little control over costs of materials over the next 3-5 years of building, debt costs, delays etc.”

As we saw with the “LAND VALUE” portion, these costs can fluctuate dramatically. But if you want to be conservative, then use $330/sqft as the measure for your calculations.

–

SOFT COSTS

What are soft costs?

Basically anything outside of the cost to acquire the site, and the cost to build it.

Sales and marketing? Check. Building a sales centre, hiring a marketing firm, public relations, sales team, etc. Commissions payable to Realtors who sell units are 2.5%-5% of the price of a unit alone.

Architectural, legal, zoning, permitting, etc. This is a big one!

And that brings us to the City of Toronto’s part in all of this, which adds a substantial cost!

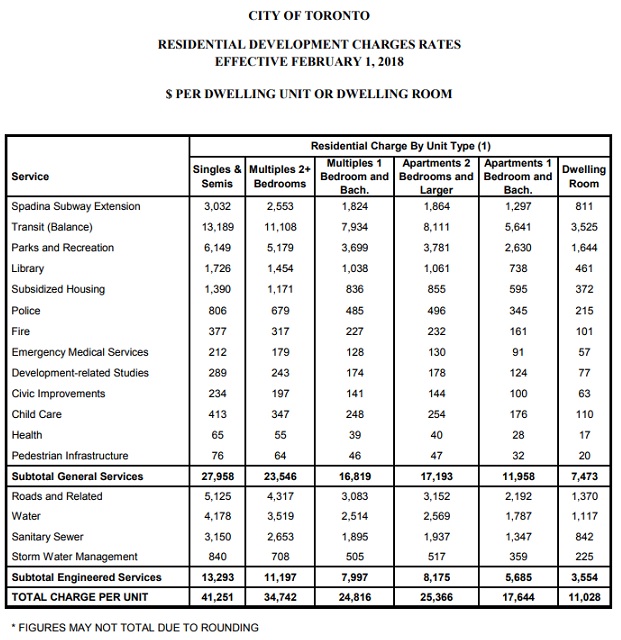

A lot has been made of “development fees” but that’s only a small part of the pie.

Much of what we want to know is made public by the City of Toronto, and is a set fee.

Click HERE if you want to see the City of Toronto’s residential development charge rates, effective February 1st, 2018.

Here’s a breakdown:

Note that for a 1-bedroom apartment, the development charge is $17,644.

In the context of a 450 square foot condo, selling for, say, $900/sqft (or $405,000), this represents 4.4% of that price.

4.4% might not sound like a lot, but it is. It’s a large chunk, and it’s passed directly on to the consumer.

But also consider that this is far from the only cost the developer incur from the City of Toronto.

A note on this from my colleague:

“In addition to those development charges, there are also education DC’s, cash in lieu of parkland (which can be 5-10% of the value of your land at the time of building permit), City permitting fees and many more. That is on top of Section 37 cost, which is arbitrarily negotiated with the city for “public improvements” which could be millions of dollars. You need to negotiate this in order to get final approvals to build. The conversation now is around DC’s going up by double in Toronto, and no one knows exactly when that will happen.”

The education charges are also available on the city’s website, check HERE.

They’re about $1,500 per unit, which, again, doesn’t sound like much. But trust me – this all adds up.

“Cash in lieu of parkland” is 5-10% of the value of the land at the time the building permit is issued, which is usually more than the amount which was paid for it. So you could conceivably add another 5-10% of that $200-$400/sqft from our first section on “LAND VALUE,” or another $10-$40/sqft.

Then comes those pesky Section 37 fees, which I wrote about in a January blog you can read HERE.

That’s 1% of the “gross construction costs.”

When all is said and done, how much of the purchase price of a condominium – say that $405,000, 1-bedroom condo we used as an example above, goes to the city of Toronto in one form or another? 10%? 12%? 15%?

How much does that drive up the price?

I understand that the city needs money. And clearly, given the political climate we’re in now – with FREE STUFF FOR EVERYBODY, the city, province, and country all need to come up with creative taxation measures. But I think it’s prudent to identify how much of a hand the government has had in driving up the price.

As for the rest of the soft costs, use your imagination.

I don’t have any way of estimating the total soft costs, but my contact in commercial real estate has said these are roughly $150/sqft for your “typical” Toronto condo.

–

So where does that leave us?

Let’s recap:

Cost to acquire land: $200/sqft

Hard costs: $330/sqft

Soft costs: $150/sqft

That’s $680 per square foot.

And that’s using conservative numbers.

The cost to acquire the land, looking at downtown condos, and looking at actual sellable square footage, would probably be closer to $300/sqft.

The cost of building something with above-average finishes might be closer to $400/sqft.

That’s now $850/sqft.

And what are pre-construction condos selling for, on average, in downtown Toronto right now? About $1,000/sqft.

So what is the developer really making?

One of my colleagues sums it up nicely:

“I would suspect that on a typical project (if the market stays the same from when you buy it to when it is sold), developers are typically in a 12-20% profit margin range. Do you think it’s worth the risk??? This is of course increased by the ability to leverage their capital with land loans and construction financing, but that comes along with significant risk.”

–

This was a fun project to work on.

Keep in mind that I am a residential real estate agent, and this is an estimate; an exercise, if you will.

I wish I could find exact numbers on this, but I think it’s fair to say that Tridel, Menkes, Freed, et al aren’t going to let me publish their financial statements on Toronto Realty Blog.

I welcome your thoughts below.

Ralph Cramdown

at 7:39 am

1) The Altus land cost chart is attempting (poorly) to show a range for the GTA, of $50-$200 per square foot. Presumably the $200 end of the range would represent the highest priced land transactions in the region. Whether that figure is right or wrong, it would seem to represent the best guess of an enterprise which makes its money selling its best guesses to developers.

2) I take developer ‘greed’ as a given, and the reason we have zoning, building codes and inspectors, and that thing that replaced Tarion. The only organization building houses in Toronto for anything but the do-re-mi is Jimmy Carter’s. Which brings up the point: If you want to look at a lower bound for all-in costs to create housing, Habitat for Humanity projects might be a place to start.

Natrx

at 11:55 am

I guess the builders should think about the greater humanity aspect. And of course a little charity.

BJA

at 3:22 pm

Please leave the snark at home.

Carl

at 9:42 am

It would be interesting to know what portion of the “soft cost” is spent on getting zoning changes approved. Not that I expect a straightforward answer.

Neil

at 10:00 am

The land cost is overstated unless it is a 1-story condo! You should divide the cost per sq ft by the number of stories.

Daniel

at 10:48 am

Oh dear lord can’t you read?

This is buildable square footage. This was explained in great detail.

Bijan Soleymani

at 1:09 pm

So for a 70 story building you’re saying the land costs $14,000 a square foot?

Daniel

at 1:39 pm

The building never covers the entire site. These days you’re limited to an ~8,000 sf tower floorplate and typically need a 20,000 sf site to do it. Which puts you at 40% lot coverage. Multiplied by 70 stories would give you 28x density. At $200 psf buildable, that would make your land cost $5600 psf of land, or just under $250M an acre. Which is the right ballpark for a highrise site. NB, that sites above 20x density are very very rare in Toronto.

Condodweller

at 12:27 pm

There are a lot of numbers here and even I am not sure David has kept the same unit for all three components. The land cost as I read it is per sqft of land which needs to be converted to per sqft of a unit ($200xsize of lot divided by total sellable sqft) correct me if I misread this, however, in his conclusion he converts it to $330 using the 85% number. The hard cost is in per sqft of unit price as far as I can tell and the soft cost, while listed per unit for the city amounts, he provides a $150 figure provided by a builder which is per sqft of a unit.

Just for a sanity check a 300’x300′ lot at $200/sqft would come to 18 million which seems to jive with the total construction cost figure. However, that amount, using a 60 storey building with 8 units per floor at average 500sqft works out to only $75/sqft including the 15% “wasted” space. I mean it makes sense that the larger number of units decreases the per sqft cost for the land portion but that’s a big difference between $75 and $300, though $200 is 85% of $235. I am using a bit of assumption here and my math could be off as well. If I am correct, shouldn’t the per sqft cost of a unit be $550 which if it is a conservative number provides for a much higher profit margin.

I went back and re-read the part about the land cost and the title of the graph and this quote: “If you’re able to negotiate with the city and get approval for 40-storeys then you’re ahead of the game and your cost per sqft is lowered.” seems to indicate that I am right.

David, can you clarify?

daniel

at 12:13 am

whatever david intended, you can’t buy a 300×300 site for $18M anywhere in the 416. Downtown that would be hundreds of millions. Even contaminated employment land in etobicoke would get more than that.

Ana

at 10:41 pm

Thank you Daniel. I understand your calculation. Do you have any idea how much we can ask per sf for the land in Parkwoods area (ravine 60,000 sf, possible rezoning for 25 story tower)?

tommy

at 3:49 pm

Hey Daniel

you are super rude and know very little. Are you saying that a contaminated 2 acre lot in etobicoke would fetch 18 million??…. in what universe?…and that a 2 acre lot in downtown would fetch hundreds with an “s” of millions with an “s”

there are so many current examples of recent sales that this makes your info a joke. Please stop making assertive and ridiculous statements. The average cost of just pure land is for sure under 100 per square foot when you consider density even in the downtown core.

Downtowner

at 2:48 pm

I agree.I have done real world calcs for a potential development, and the number was under $100 per buildable sq ft. AND, the land purchase for a 20 storey condo was 12 mil, not hundreds of millions or even tens of millions

Mordy

at 10:19 am

There is another very large cost that is not mentioned here – the HST. For example on a $600,000 condo (after the HST rebate) the builder still pays $47,788 of HST to the government. A portion of that is covered by HST that the builder pays to his workers and agents etc… but its still a huge cost.

Jennifer

at 12:26 pm

There’s no HST cost to the builder. They get it all back. The buyer has to pay the HST on the purchase, and gets the rebate, but generally assigns it to the vendor (theoretically taking it into account when they set the purchase price).

Geoff

at 10:31 am

I think most non-business people are surprised to find how thin margins are on most products/services. The recent spotlight on the tough business that tim horton’s franchise owners are in was illuminating.

Andrew

at 11:52 am

This is probably the most impressive piece you’ve ever done.

Bravo!

Potato Chip

at 2:23 pm

Frightening the number and value of charges the city makes to developers. What happens when development slows down or even goes bust? The city’s budget will completely disintegrate.

KK

at 7:58 pm

Forget the city of Toronto. Worry more about the province of Ontario. Two of the three candidates are promising to basically give everything to everybody for free, how the hell are they going to pay for that? I’m glad to see David isn’t afraid to get political with that one quip in his blog. Too many people are afraid to say anything these days. This province is going to be bankrupt in a couple of years if this continues.

Peter

at 3:50 pm

thank you for pumping out quality articles on a weekly basis. I always enjoy reading them.

back to the question.

how about the cost of capital (ex: interest to pay to the bank) to build the condo?

I am wondering if it is included in your estimate of cost?

el jefe

at 5:52 pm

WACC – equity and debt

george politis

at 8:35 pm

Well said, I agree with you, this can be an extraordinary cost that had to be considered.

Steve

at 8:18 pm

Land values expressed on a buildable basis are concluded through market sales evidence or a residual basis ( residual meaning what can I as a developer pay for any given site)

In fact most market land sales are for un-zoned, raw sites where it may take at least 1 to 2 years or longer to achieve the applied for density as OMB hearings usually are required for many condo apartment projects. It is rare that the OMB is not involved.

Land values are said to have hit low to mid $ 200 p.s.f. buildable in Yorkville, but the Yonge corridor through to Lawrence Avenue is below $ 200 p.s.f. for sure. In 2015, Yonge-Eglinton sites were being acquired for $ 50 to $75 p.s.f. buildable based on hoped for densities at 10 to 15 x site area, that is for expected final density.

Alexander

at 11:52 pm

Very interesting input, it changes the perspective. Thanks.

Daniel

at 9:53 am

if you have any $50-75 a buildable land i’ll buy it

high water mark for yorkville is $360 psf buildable. nothing has sold below $200 buildable in that ‘hood in at least 3 years.

Melissa Goldstein

at 12:23 am

Wow, TWELVE PER CENT?!

You mean that on a 400 unit condo with an average price of $500,000/unit, developers only make $24 million in profits?! Oh, those poor developers, how on earth do these poor souls survive?! My heart breaks for them…

Daniel

at 9:39 am

Another naive, immature comment.

12% is 12% no matter the stakes.

Twelve cents on a dollar investment is the same return as $24 Million in the childish example you provided above.

Ignoring the fact that a dynamic shift in the market could bankrupt any one of these companies on a single project, I suppose you feel as though they should aim for 8%, and let the city make a far higher return in fees and levies?

Professional Shanker

at 11:27 am

What do you mean bankrupt a company on a single project – they sell certain % of units before they fully construct do they not?

And yes for a 12% return levels of risk should be assumed, major market shifts do not typically happen overnight. If the market corrects, then construction costs & land fees, etc. would re base themselves on future projects – every industry operates in a similar fashion, developers will still get an adequate risk based premium on their capital deployed.

What the other side is articulating is that 12% is an adequate return so do not feel sorry for developers – they are making good money.

D Bull

at 2:54 pm

12% profit is a lot for a large company. It’s more than Walmart, Exxon, Toyota, Berkshire Hathaway, etc. made in 2016. Developers aren’t that big of course, but millions in profit is millions in profit, regardless of the percentage. If it’s more profitable to simply sell the land and invest it somewhere else, why don’t they?

https://www.forbes.com/pictures/5759834fa7ea43396db2842c/13-berkshire-hathaway/#2c06a5ec14e3

sal

at 1:41 am

I think bKR has very high profit margins and ppl forget. That developers get rich of leveraged returns not relative returns.

Ralph Cramdown

at 8:39 am

Another place to look for hard numbers on real projects is in the entrails of Urbancorp. Google urbancorp trustee for a trove of information.

Condodweller

at 11:29 am

Great post David! These are the topics not covered anywhere else. Thanks for doing the heavy lifting.

I was following Tom’s lead but perhaps the word greed is a bit excessive in these case although I am sure developers want to squeeze out every possible dollar for profit.

“In fact, I think it’s more reasonable to assume, and correct me if I’m wrong, that the reason for an increase in pre-construction condo prices is more likely to do with rising costs, than greed.”

On the surface I would agree with that, however, the devil is in the details. 12% return is certainly not greedy if one considers the range of returns possible elsewhere. Heck, I would certainly not go through the uncertainty and amount of risk involved in a multi-year project for 12%. Although, given that the actual return is millions perhaps it’s not so bad. It is probably a very high risk for anyone entering the business today but for those who have been around for a decade or more who have banked land are probably doing just fine. These are the companies that are making huge profits while delivering products that are mostly inferior quality. I know there are a few good builders out there so I don’t want to paint everyone with the same brush, but unfortunately, the norm is poor quality. For a company who planned ahead well and is making multiples of 12% in profit, I’d say it is greed that prevents them from stepping up and increasing quality above the required bare minimum. They should at the very least correct all the identified deficiencies without hiding behind Tarion and putting up barriers for owners to pursue them. Never mind all the time bombs they left behind for us consumers have no way to go after the builder like the kitec plumbing replacements sweeping through the city costing thousands of dollars for owners because the builder chose the cheap alternative to save hundreds of thousands if not millions. Then there is the matter of “upgrades”. This is where a builder makes a good chunk of their profit with inflated pricing. The irony of it is that many of these “upgrades” should have been included in the original price such as a reasonable amount of electrical receptacles, ceiling lights, proper paint etc.

Finally, while it doesn’t seem like greed when you look at the numbers for the projects taking into consideration land/construction/city etc costs given the apparent returns, unfortunately, from the end user experience, it’s a completely different optics. As they say in Survivor perception is reality.

Carl

at 1:54 pm

“In fact, I think it’s more reasonable to assume, and correct me if I’m wrong, that the reason for an increase in pre-construction condo prices is more likely to do with rising costs, than greed.”

Actually, it’s neither. Construction costs determine the floor for condo prices, but not the ceiling. Pre-construction condo prices are what the buyers are willing to pay. If the development charges disappear tomorrow, the condo prices will not drop as a result. If demand for condos increases, prices will go up even if construction costs stay the same.

And if the demand softens, prices will go down. We had a concrete example of that recently in Whitby:

https://torontorealtyblog.com/archives/20390

There the developer said: “When (the market) is moving upwards, we obviously raise our prices and when it’s moving downwards, in order to continue to sell and to build and complete the communities, we have to lower our prices to a price point the market will bear.”

Professional Shanker

at 2:37 pm

To your point, although it is great David conducted this analysis, there is no way Mattamy just pissed away their profit through this price reduction (assuming 12% margin) the price reduction was 10%.

Developer’s bank land and in a bull market likely make more than 12%……

Excerpt from article:

She says she paid $955,000 for a 2,749-sq.-ft. detached house. Last month Mattamy began selling the same model on a similar lot for about $859,000 in Queen’s Common Phase 2.

J.L.

at 3:57 pm

Great article, I think the land costs are a bit high though and do not take into consideration that a lot of the projects launching now are on sites that were purchased in the last 3-5 years, if not more, for much less than they might be worth now. Developers will obviously not give a discount if they got land for less than it is worth today.

realinfo.realnet.ca has a database of transactions with breakdowns per square foot buildable, this info could easily be matched with selling prices of new projects to give a real clear pictures of how much land was purchased for and what the developers selling price and profits are.

Kyle

at 4:59 pm

The City’s DC structure really incentivizes the building of 1 Bds and bachelors over 2 bd+ units.

Blanche

at 1:57 pm

The “Cash in lieu of parkland 5-10%” is the most depressing part of this whole post. It costs that much and we don’t actually get any NEW parkland… hence cash in lieu. With the thousands of new units being built downtown every year and basically zero new parkland, where are these condo dwellers going to go to get outside and get a reprieve from the concrete? And how will the remaining parks not all turn into dog urinals? All the other infrastructure constraints can be fixed with enough money, no new parkland downtown is basically irreversible.

nick

at 9:03 pm

You might want to take a look at the planning act here – Parkland Dedication is capped at 5% (of current land value) for residental and 2% for commercial/industeral uses

ken

at 10:12 pm

Yes, it’s worth the risk. 10% for eons was considered a very fair return on ANY capital investment. I appreciate the article can’t address every nuance of what’s at hand but if you consider that the 12-20% return isn’t on peanuts but on substantial sums overall, then, YES, it’s worth the risk. Capital doesn’t accumulate without risk and there hasn’t been unduly great risk for capitalized players in the Toronto condo scene for many years

Real Investor

at 2:30 pm

Excellent article David.

I work with developers and commercial real estate owners to help fund the projects. Why are developers still putting up so many condos? Use of leverage. If you are a large pension then you might not use leverage, but 99.9% of developers use leverage to build a project. Below is a sample structure.

Project Summary:

Cost: $100,000,000

Revenue / Value: $115,000,000

Profit: $15,000,000

Return on Cost: 15%

Time to Complete: 60 months

Sources of Capital:

Cash Equity: $10,000,000

Land Equity: $ 5,000,000

Insured Deposits $10,000,000

Senior Debt: $75,000,000

Total: $100,000,000

Return Summary:

Developer 30% per year

Now, often times the developer will not use $10mm of his own money and use 3rd party investors and split the profits. Developers share of profits will be higher than the % of cash he put into the deal and so return goes even higher.

Sam

at 11:36 am

Hard Costs Wrong: It Cannot be more than $235 PSF in CanadianDollars Considering the quality builders are giving(USA it is $168in US Dollars)

Sofft Costs Agreable.

LandCost For Downtown Vs Other Fringe Areas Are Completely Different.

Under any circumstances Average total cost cannot exceed $500 total.

$1000 PSF is price fixing or gouging. Trying to contact Govt Dept.

Tony Linardi

at 12:02 pm

$150.00 a sq.ft. profit on a 600 sq.ft condo is a $90,000.00 profit. Multiply that by say 10 condos per floor $900,000.00 x 40 stories that works out to 36 million. not bad for a couple of years work.

Kurt

at 10:13 pm

Wow. I’m living now at vertis and I never realize that it takes too much to build one.

Brian

at 11:47 pm

Despite the article being a bit dated by now, it is still a good reference. Thanks. I am involved in real estate development and investment and have a quantity surveying background, and I could confirm that while development projects may offer very good returns at times, they are also very risky endeavors in particular when leverage is taken into account. Also, what prices real estate can be sold for has little or no relationship to what costs it has incurred. A developer naturally doesn’t want to sell his real estate for less than his costs yet prices are determined by the purchasers whose purchasing power and willingness to buy are in turn determined by his financial clout and perception of the market which in turn are affected by the state of economy, finance, interest rate, business sentiment, social environment, politics and governmental issues, geopolitics, and so on…

mary

at 4:23 pm

I have studied many industries and many companies and the average profit margin across all is around 6%. 12% to 20% is very high. Very few industries or companies can consistently earn that type of margin and of course you must adjust for risk when talking about profit margins but I am just saying that it is high.

Zac

at 11:22 am

They liked your article so much they copied it

https://precondo.ca/how-much-does-it-cost-to-build-a-condo

Red Tape

at 6:26 pm

Commenting on an old post but here’s some recent info.

Firstly, reading the comments has brightened my covid 19 day. Very entertaining. Opinions, guesses, derision but not many facts. The comment about large profits by putting up a building in 2 years. Hilarious! Thanks! I call it the “magic wand” syndrome invoked by the obviously clueless.

Read the list of required items on the City Of Toronto Planning Application Checklist, then guess again. While you’re reading through the items, consider that at the moment, work on this file has stopped but the money clock is still ticking. For how long, no one knows.

The following is a recent example of a zoning change application made in November 2019 in Toronto. The application fee paid to the city was $67,000! Could be much higher but it’s only a 6 story/60 unit building. We’ll have the opportunity to observe the timeline to get city approval. If it has to go to LPAT (former OMB), add at least 12 to 18 months.

Especially eye opening is the mountain of red tape. Studies, reports and hoops that need jumping. The pile of paper required is going to be about the same as the height of the proposed building. The documents can be found at the link below.

Link to website of the developer:

https://3353lakeshore.com/#documents

Harold Chan

at 12:58 pm

very helpful for a real estate professional trying to sell condo land

Dani

at 8:34 am

I do not agree with these numbers and logic either. No one is mentioning the condo fees that each unit has to pay for the rest of the violins, where are those profits going?

Plus you are telling me that builders would risk investing millions for a 4% return. They can do better by investing on Tesla.

So this is a load of bull waste and do not buy the analysis.

Winning369

at 3:59 am

The online casinos offer free bonus game slot machines that enable the gamblers to win real cash bonus. You have to understand that there are a number of casinos that offer this service on the internet. To know more about it you can read the blogs and reviews written by the casino’s customers or check with the casino’s online casinos that are associated with the slot machine business. A good online casino should be well known for providing the best casinos and bonus games. You should also read the bonus news that is provided to you by the online casinos so that you will be aware with any new update in the bonus game slot machines.