What a weekend it was, only a few short days ago!

Did I remember to mention Tiger Woods in my last blog post?

I spent Saturday afternoon touring Stouffville, which in all seriousness was an absolute treat.

As I explained to my clients, they were so lucky to be working in a market in an area that provides three things the Toronto market does not: choice, inventory, and a buyer’s market.

We toured a dozen homes on Saturday, and I think the last time I viewed a dozen homes in one tour with a buyer must have been a decade ago. Believe it or not, I do remember getting in the car on a Saturday and looking at ten or twelve houses in North Toronto. It was a long, long time ago, but once upon a time, you’d have that kind of inventory on the market, that kind of choice at your disposal, and while it wasn’t a true “buyer’s market,” it sure wasn’t what we see in the central core today.

I told my buyers, “It’s like shooting fish in a barrel up there,” and upon receiving feedback calls from listing agents on Sunday, Monday, and into Tuesday (something very few agents down here do), I realized just how much of a buyer’s market it is.

There was another BIG difference between the two markets, however, and it had nothing to do with inventory or price.

It had to do with sales tactics.

I’ve somewhat spoiled the surprise in today’s blog title, but just by way of introduction, do you remember this scene from The Simpsons?

So do you know where I’m going with this?

It’s a combination of pointing out the obvious and the idea of “over-selling” in real estate.

Folks, I honestly cannot believe what I saw the other day. Words cannot explain, so perhaps photos might.

But first, let me set the scene.

We’ve all watched Million Dollar Listing at one point or another, right?

You know how all the agents want to throw “smashing brokers’ opens” for their listings, right?

While I recognize that the show is scripted, and somewhat contrived, I do believe that one of the ways to sell $30,000,000 properties in Los Angeles is to throw a party, complete with ice-sculptures and DJ’s. But does this translate to all markets, for all houses and price points?

I don’t think so.

And yet on Saturday, I found myself in a home where I was told by one of the four agents in the property, “We’re having a party!”

The house was full of people, I’ll give it that. But the salesmanship was absolutely off the charts.

My buyers and I walked into the home and one of the agents followed us and launched into a massive pitch. My buyers rolled their eyes, and looked at me to save them, but somewhere in between not wanting to be rude and not wanting to have this guy continue his pitch, I simply said, “And we’ll know all of this once we’ve been through the house!” After all, we were barely inside for two seconds before we got a verbal feature sheet on the home.

My question to you folks, and I think this is rhetorical but I’ll ask anyways, is: does anybody actually appreciate an agent following them around at an open house and pumping up the home?

I’ve never understood this as a sales tactic. It rubs people the wrong way.

In any event, that was actually just the appetizer as far as the “over-selling” went.

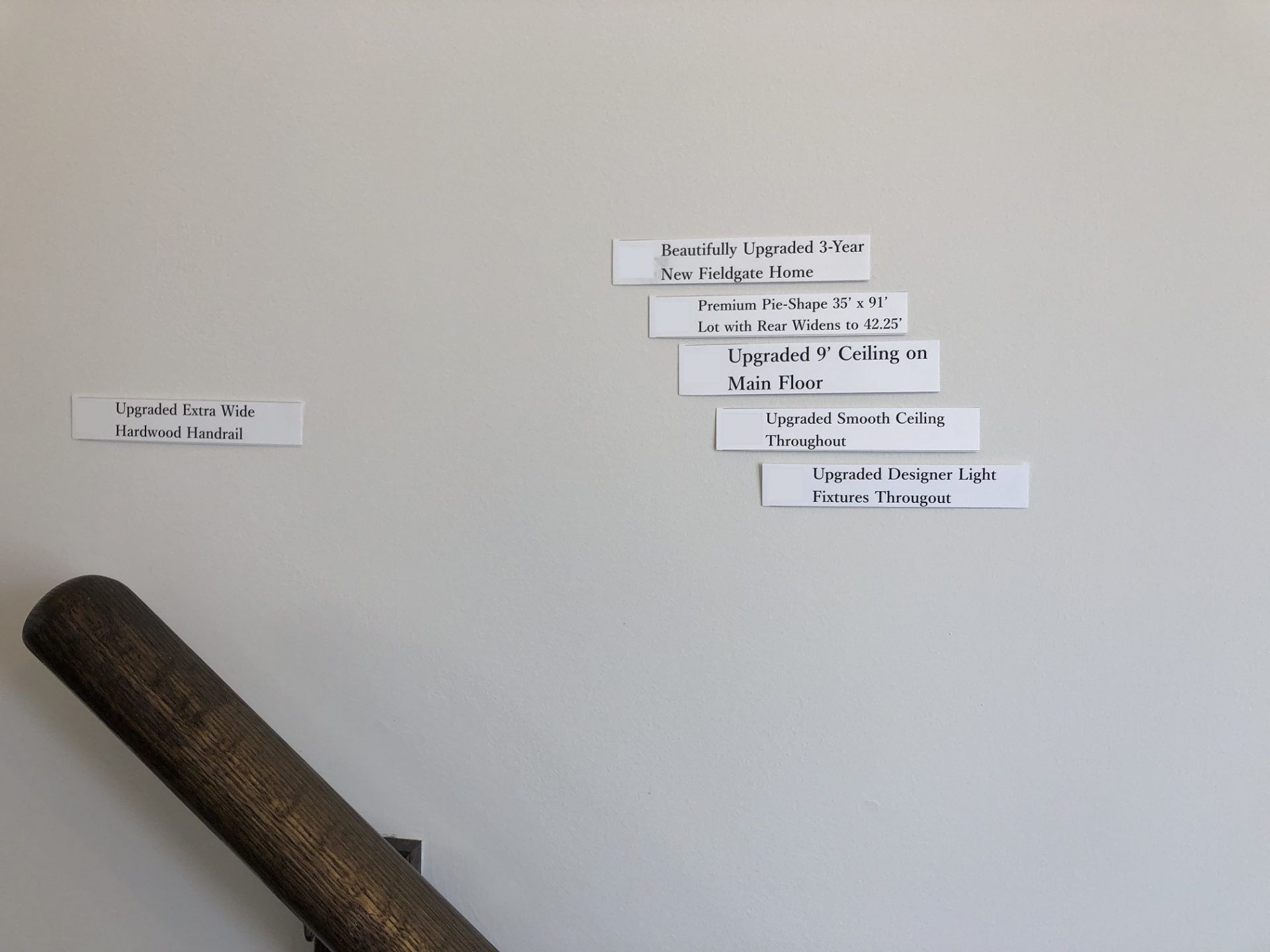

Consider the clip from The Simpsons above, and then look at this:

This was posted by the front door, and it’s the first thing we saw when we walked inside.

I turned my head slightly to the left, and I saw more of it.

Way more!

In fact, the entire goddam house was covered in labels.

It was just like The Simpsons episode

But the crazier thing about all these labels is the actual content, rather than just their mere presence.

These labels represented a combination of pointing out the obvious and overselling.

I mean, seriously, do you really need to “market” the upgraded extra-wide hardwood handrail? Is that really a “feature” that needs to be pointed out?

I think the soft-sell is a better touch, don’t you?

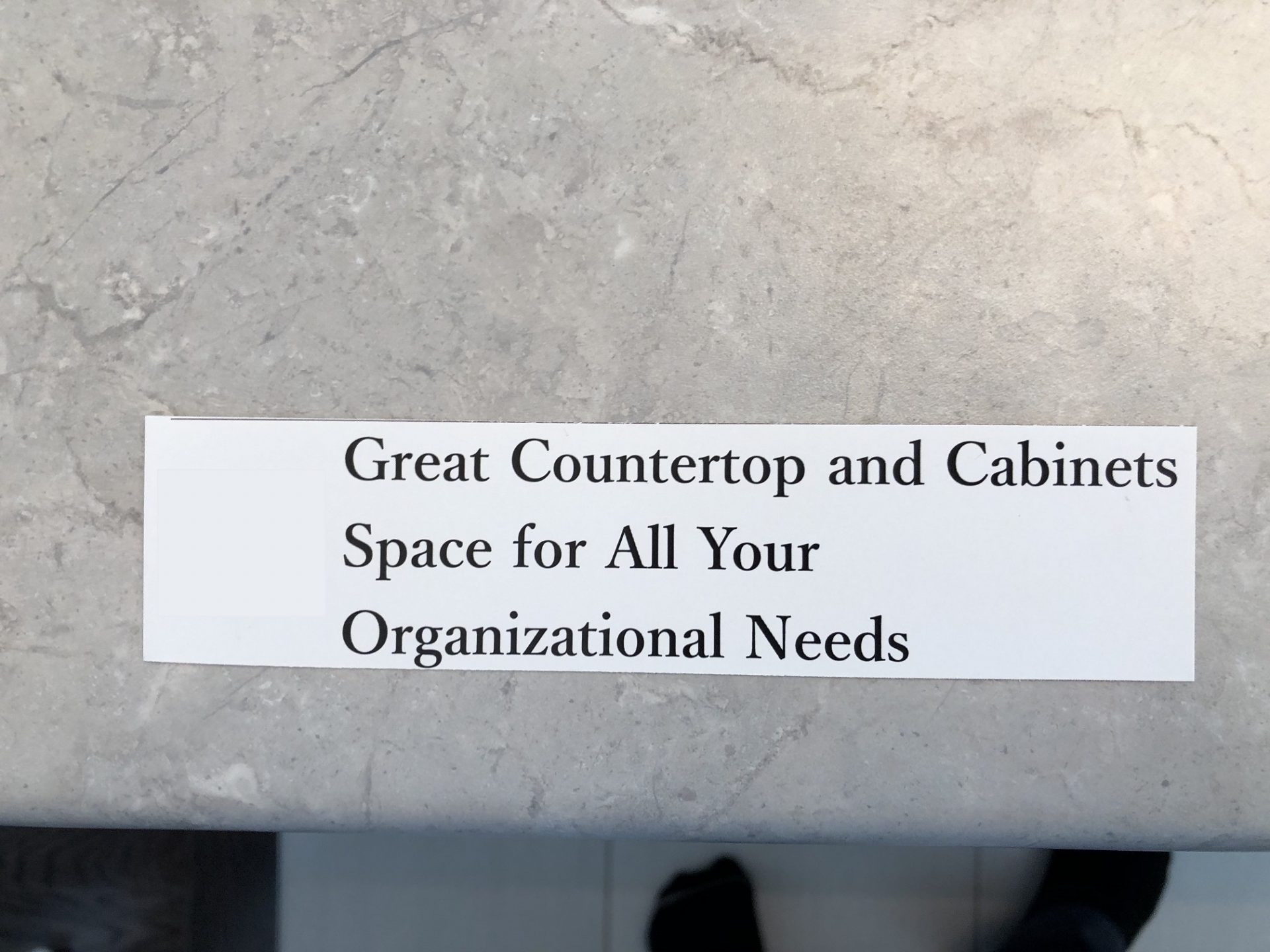

How about this note left in the kitchen:

“Great countertop.”

I mean, that’s not really marketing, is it? Can just throw “great” onto anything out there?

“Space for all your organizational needs?” You mean, “Place to put sh!t in yo kitchen!”

How about telling people how to use certain features, like this:

Why stop there?

Why gaze into the sky? Why not “get it on with your partner in the tub on every third Wednesday of the month?”

I mean, if you’re going to play, play to win, right?

How about just pointing out things that every house has, and then trying to claim they’re unique?

“Convenient” linen closet.

What is an inconvenient linen closet?

Or is this note trying to reinforce the general convenience of having a separate closet for linens? As opposed to slumming it like poor people who put their linens in the bedroom closet? Ewww. I shudder to think.

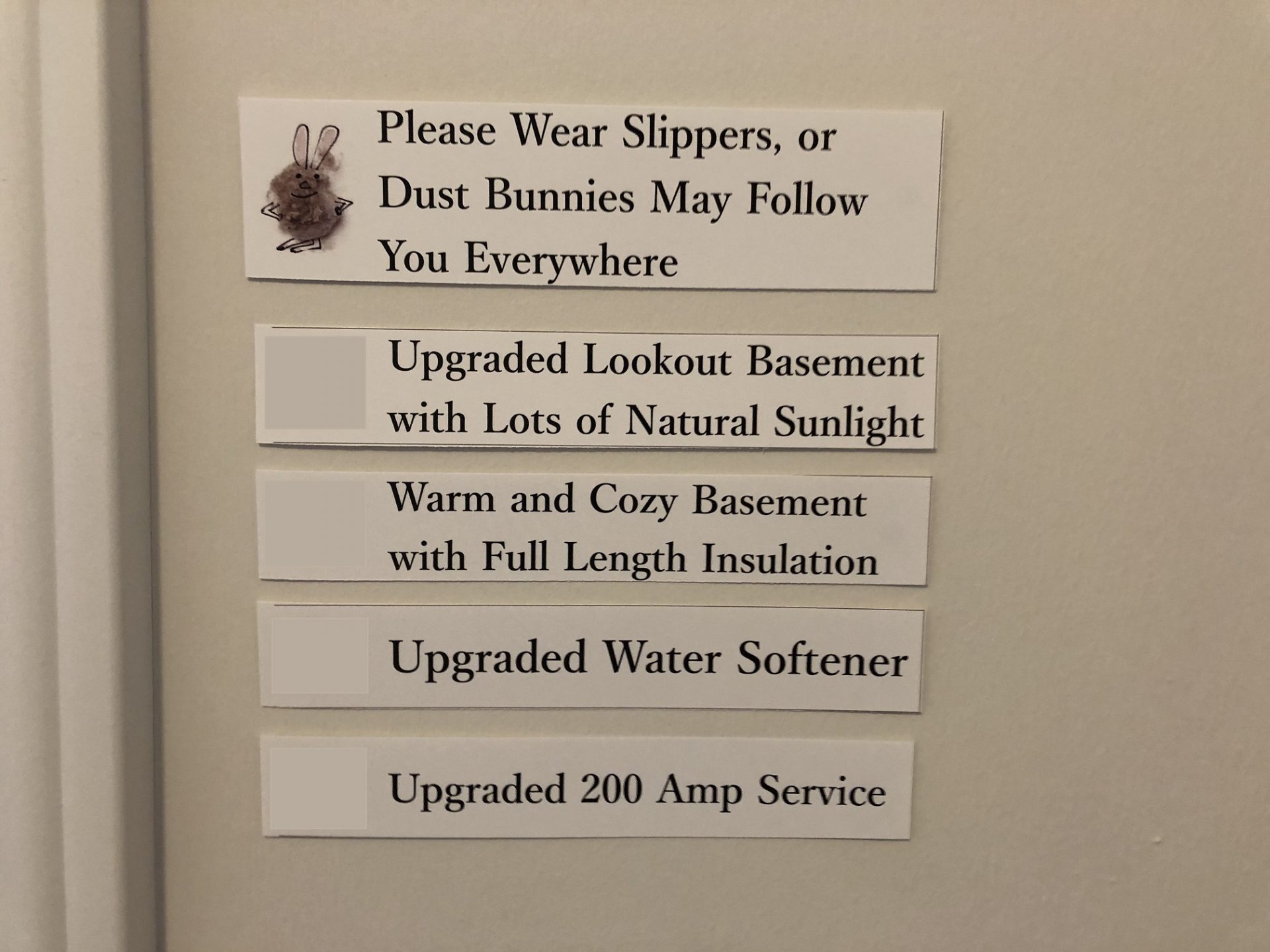

This was at the bottom of the stairs:

“Upgraded lookout basement.”

Nope. Still have zero idea what that means.

And just how “warm and cozy” was this basement?

Let’s look a bit further…

Ah, right!

It was an unfinished “warm and cozy” basement.

Full-length insulation. Phew! And here I thought they’d just get lazy and stop halfway.

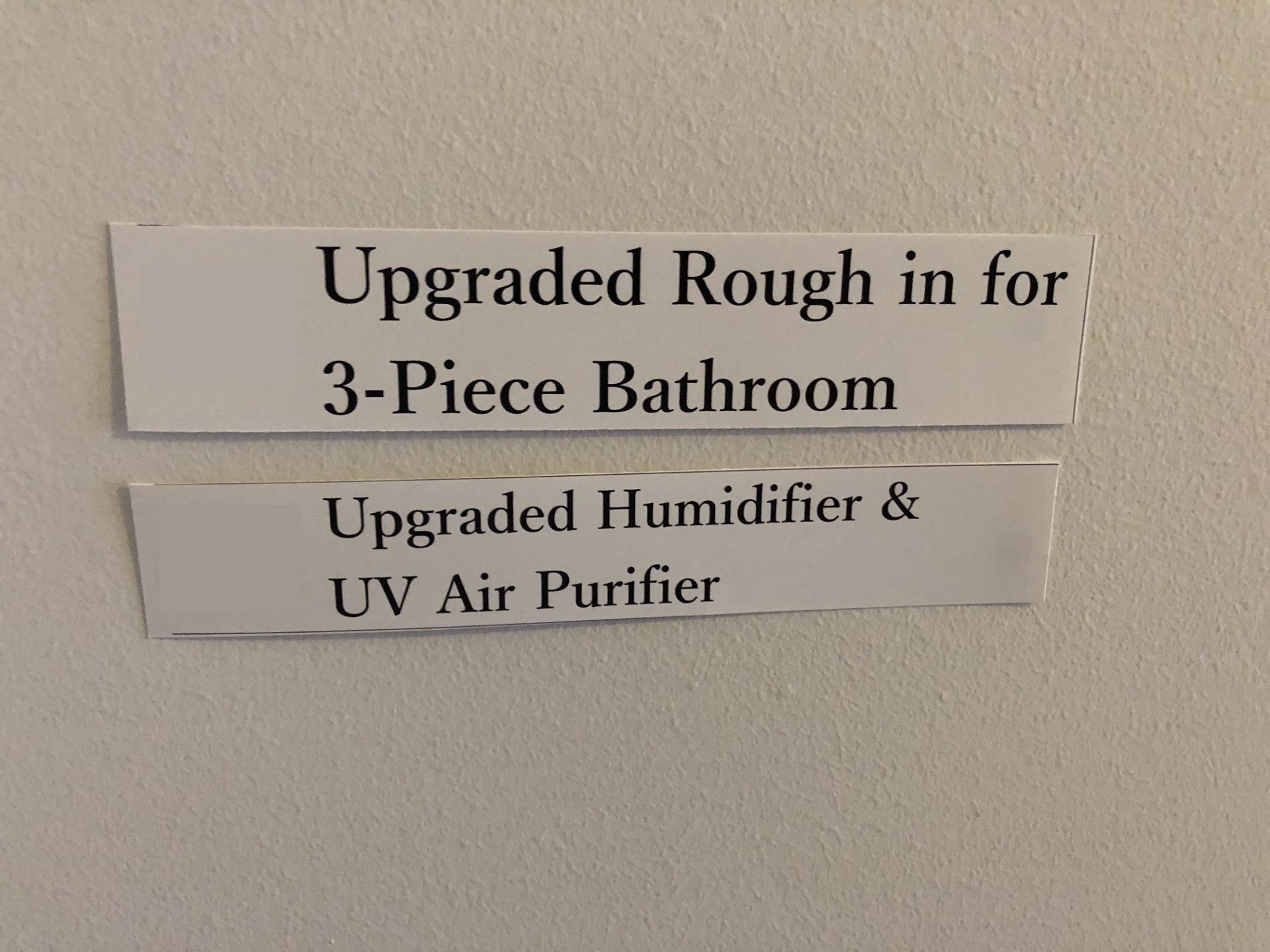

How about an oxymoron?

What’s an “upgraded rough-in?”

I mean, a rough-in bathroom is not as good as an actual bathroom. So the idea that it’s “upgraded” is a bit odd. I suppose that there’s a better………pipe? Um, than the rough-in next door?

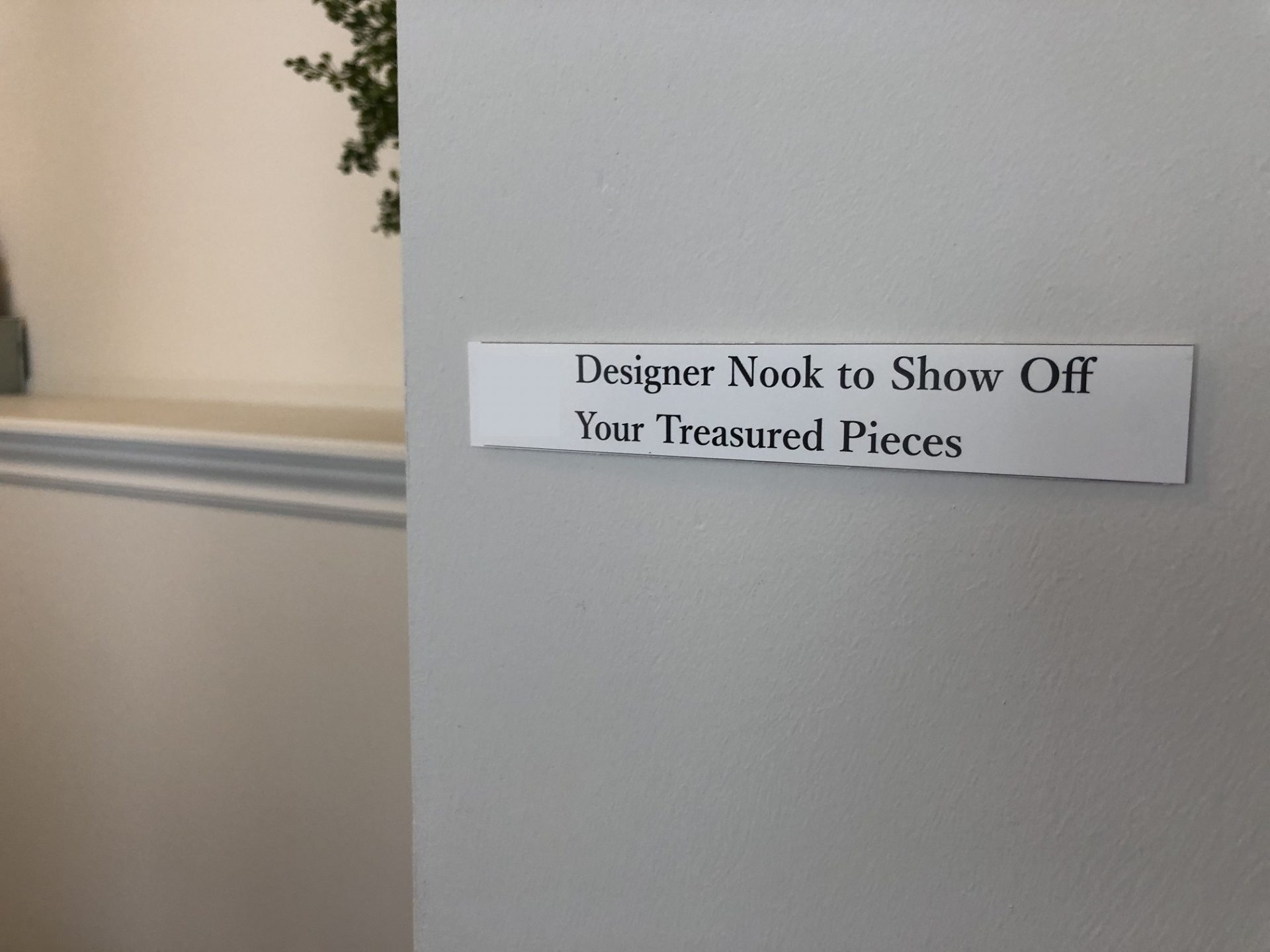

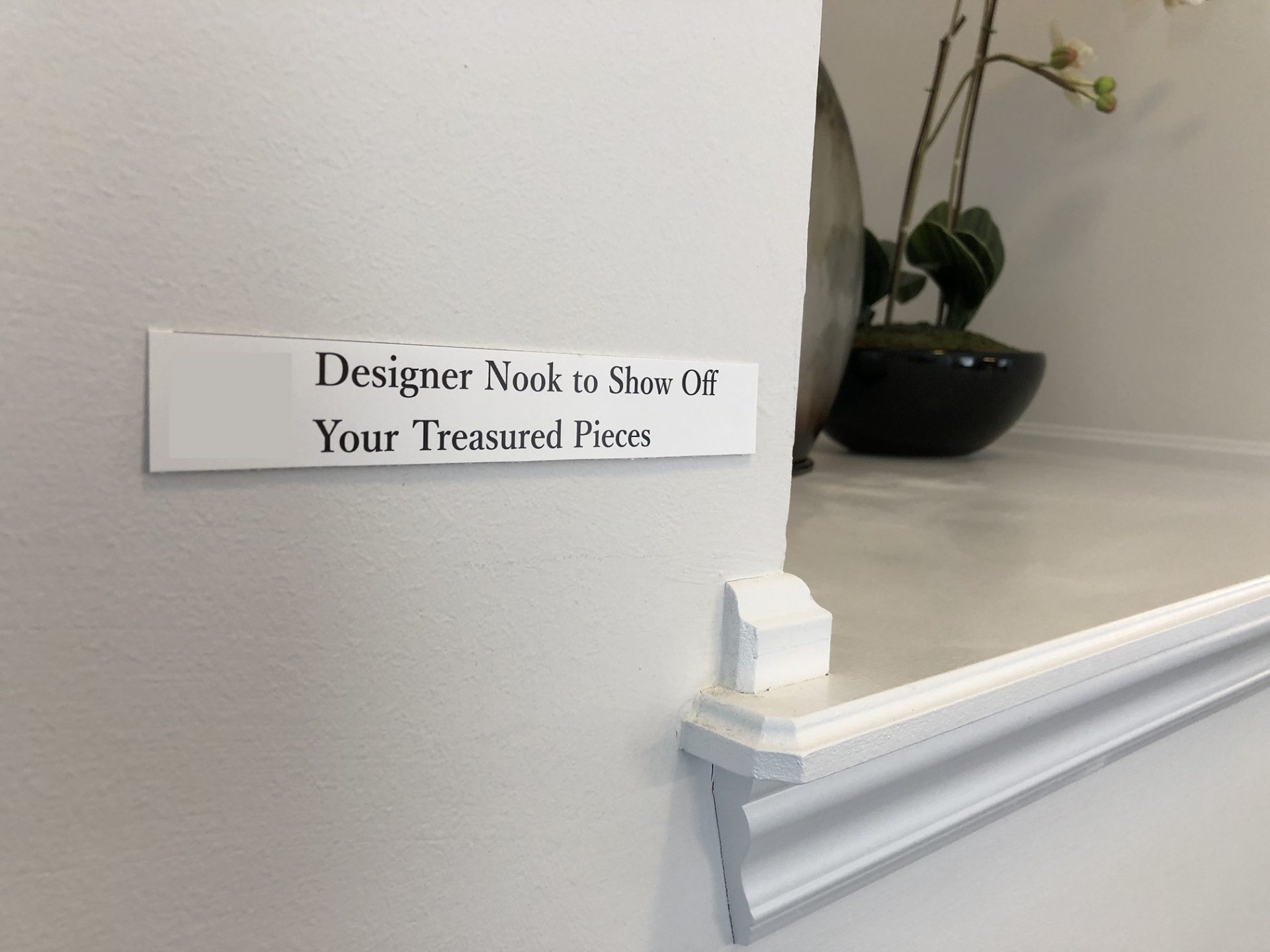

But my absolute favourite had to be this next one, which shows that whoever put these stupid notes all over the house was going to use each and every part of the home, no matter how innocuous:

Geez.

That’s just a goddam WALL!

It’s literally a wall. A “nook” as they note, that has zero importance whatsoever, but they’ve called it DESIGNER!!!

A DESIGNER NOOK!

Ah!

What the….

I can’t. Words, just cannot……describe.

Oh, and they did this multiple times, in multiple places:

So many designer nooks. So goddam many!

Folks, I just don’t understand who thinks this is a good idea, why, or how.

It was such a turn-off, I can’t even tell you.

My clients and I had no interest in the sales pitch, we laughed at the stupid notes, and we left without even considering the house.

My critics will say, “You’re a bad agent, you need to see past that,” etc, etc. But that’s not the point. That same model home is for sale on two other streets, if we’re interested, and my clients and I aren’t stupid. We know how to look past yellow paint in a house, because we know that people can buy a can, containing paint, and use a brush to apply it to the wall…

But for other buyers out there, will this really draw them in? Will this actually help them “learn” about the home?

Would it help you?

Verbal Kint

at 7:53 am

Who hires a downtown Toronto expert to represent them in Stouffville? Nobody who’s read this blog for the last few years! Is this even real?

Andrew

at 9:31 am

Yawn!

More trolling. Get a life!

Condodweller

at 9:50 am

Funny thing is when I read the name I just moved on without reading the comment. Remember, don’t feed the trolls. They are looking for attention. If they don’t get it they will go away after a while.

Mxyzptlk

at 9:54 am

Why do you care? Are you a “Stouffville expert” angry you missed out on the business? Petulance personified.

daniel b

at 9:28 am

i dunno, given how much time David spends griping about people using agents from afar to do a downtown condo, and given david’s expertise in the east side of toronto and downtown condos, it does seem a little ironic.

Katie

at 11:42 am

I see this differently.

If I were looking for a house in Markham, where it’s a buyer’s market and there there’s tons of inventory, I would want David to represent me over any person up there.

Why not have the best of the best, a cutthroat agent, “shooting fish in a barrel” as he says?

Central core agents (at least the top ones) are jut better at what they do. Up north is a different market with different attitudes and ways of doing business.

Appraiser

at 8:06 am

Time to re-visit the stress test?

“We need a more flexible benchmark, potentially a narrower spread over the contract rate when interest rates approach cyclical peak, and perhaps to establish a reasonable floor under which the qualifying rate will never drop below.”

~Benjamin Tal

https://business.financialpost.com/news/fp-street/mortgage-stress-test-is-helping-fuel-alternative-lending-boom-cibc-economist-warns#comments-area

Housing Bear

at 11:27 am

Sales apparently doing pretty well so far this month in GTA. If supply is so limited relative to demand in the GTA, why do we need to increase demand? What’s your issue with the stress test?

Appraiser

at 6:47 pm

In a nutshell the test is too harsh to the point of being punitive, given the prevailing and long-term interest rate environment. I agree with the growing chorus of voices calling for the rule to be re-visited, not necessarily eliminated.

Housing Bear

at 1:42 pm

I agree that 2% is an arbitrary number. Could rates get that high? Short of a big collapse in our dollar and or a huge increase in commodity prices probably not at this point. Deflation is looking like more of a reality in the short term anyway.

Here’s a great article from CBC yesterday about Ben Bernanke, the global response to the GFC and its unintended consequences for countries that had to take the same medicine even though they did not have the same disease.

https://www.cbc.ca/news/business/housing-mortgage-canada-1.5099900?fbclid=IwAR0QVLQ5HRWdHwStrQum30RvIqEstB1YOaPCI9tXsXRH9HGORofHh5ozuTk

Basically, if countries like Australia and Canada did not follow the FED in cutting rates to zero, our currencies would have become too strong and it would have killed our export companies, who were already under pressure from slowing sales, BUT, because our households did not have to deleverage like those in the US, Europe, etc. these low rates just encouraged us to leverage up to the extreme.

Low rates were needed to support quite a few areas of our economy, but made our household sector extremely vulnerable. The stress test is actually a great way to raise rates for mortgages and household debt without having to raise them for the rest of the economy. My biggest issue is that I think it should have been done years ago, the horse was mostly out of the barn when they pulled the trigger. The crazy growth rates had already been subdued by foreign buyers tax I believe.

So do you cut it or remove it today? Debatable. If you did remove it today I think it would create a short term bump, but would then just put more vulnerable borrows into the system which could cause greater issues when a recession hits. The GTA seems to be pretty steady from a price perspective right now. I think it would be better to let it ride as is for the time being, allow more people to continue paying off existing debt while trying to discourage new debt and keep the riskiest borrowers out of the main financial system. When the next recession hits, then remove b-20 as a stimulus to help turn the economy around.

Appraiser

at 1:35 pm

You keep predicting a recession – for how many years now?

Just keep on ‘dancin till it rains’, I guess.

Remember that recession of 2015?

…yeah me either.

Batalha

at 10:27 pm

One underreported factor, highlighted in a new report by Benjamin Tal of CIBC World Markets, is that the stress test may be at least “in part behind the strong rise in alternative lending.”

https://business.financialpost.com/news/fp-street/mortgage-stress-test-is-helping-fuel-alternative-lending-boom-cibc-economist-warns

Housing Bear

at 1:58 pm

Alternative lenders are more likely to foreclose in a bigger downturn, which could push more supply and a further drops in prices, which then would further impact the assets and collateral held by all lenders and owners. But unless those alt lenders are mostly funded via HELOC debt and therefor tied back to the big banks, I don’t see why this is worse from a systemic perspective. Even if they are mostly funded from HELOCs, LTVs are usually lower than new mortgage holders, so in the event of a loss, those investors would be on the hook and have more home equity to absorb a decline.

My opinion, keep the riskiest new borrowers out of the taxpayer backed and very systemically important sectors. Also allow some existing risky borrowers to move from traditional lenders to the alternative space and now in the event of a bigger downturn more of the losses will be privatized.

Appraiser

at 2:10 pm

Oh, and there are the unintended consequences spilling over from the stress test, like sharp increases in rents.

“Many experts say the jump in rents over the past two years has to do with the slowdown in the owner-occupied housing market. Many would-be homebuyers have been priced out of the housing market due to the new mortgage stress test or rising interest rates, forcing people to stay in rental housing longer.”

https://www.huffingtonpost.ca/2019/03/03/canadian-rental-rates-statcan_a_23682881/

Housing Bear

at 3:22 pm

Not a 1:1 ratio but agree 100% that things that reduce demand for ownership will somewhat increase demand for rental. Have talked about that before on here. Rental demand starts to spike towards the end of a boom (as people get priced out) and continues through the earlier stages of the correction (people don’t want to catch a falling knife). Usually recession that include or are caused by the deleveraging of the household sector are the most severe. Rents start to flatten out and fall in real terms during recession.

Clifford

at 11:13 pm

“may be”? It is. The stress test is utterly ridiculous when you consider all the other policies that make it so difficult to buy a decent home.

JG

at 1:24 pm

Hey Appraiser,

Back in February, I posted stocks/financial markets have recovered from their December lows while housing market will take a while. You arrogantly replied “most people sell into the storm” and “it’s still well below the peak”.

Well guess what? It’s at the all time high again. I will enjoy my dividend growth stocks while you debate about mortgage stress test.

Derek

at 9:41 am

You sold me! I’m moving to Stouffville!

Condodweller

at 9:48 am

I found an example of why people dislike lawyers so much while reading a company’s financial report:

“Although the main action has been resolved, there are a few smaller lawsuits involving a

substantially lower volume of commerce that remain outstanding. As a result, during the third quarter of 2018, we increased our litigation reserve by $35 million. This is in addition to the $65 million reserve established during the second quarter of 2018. This reserve is to cover, in aggregate, legal fees related to these matters, the settlement amount for the main action and our estimate of amounts necessary to resolve the lawsuits that remain outstanding. Obviously, this is a distasteful result, but we are happy to get this behind us, so we can continue to focus on our improving businesses.”

“Turning now to our businesses and their markets, third quarter EBITDA was over $88 million”

EBITDA is their earnings. So they expect to spend $100 million on legal fees while earning $88 million.

To stay on topic: “What is an inconvenient linen closet?” Perhaps one in a bathroom behind an opened bathroom door next to the sink?

“My critics will say, “You’re a bad agent, you need to see past that,””

I wouldn’t critcize but it’s worth noting that if other agents make irrational decisions like this to avoid an otherwise perfectly fine home, why wouldn’t I make an offer on this one? I mean while agents are busy making offers on the other two identical houses in a competitive situation, I can make the sole offer on this one. The only downside is if they leave the notes up and I have to remove them before moving in.

Definitely not Verbal Kint, lest you ignore me

at 10:49 am

To summarize:

– the main action has been resolved

– we’re increasing our litigation reserves by 50%

– and we’re SO happy to have this behind us.

Dude, reading comprehension. Maybe it’s the lawyers’ fault. Maybe they deserved to get sued. As an investor, why should you care? Sell, and buy a company that gushes cash and doesn’t lose it all to plaintiffs and lawyers.

Disclosure: Not a lawyer. Not legal advice. Not investment advice. Former Chemtrade investor.

Condodweller

at 11:37 am

Company/merit is irrelevant. I’m simply highlighting an example of why lawyers may be getting a bad wrap when one might have to spend all their earnings to cover legal fees.

Not looking for legal/investment advice, thanks.

Jennifer

at 11:35 am

The reserve is for the settlement amount too, not just legal fees.

Condodweller

at 11:50 am

You are correct. I was looking at it from the high level point of view of losing an entire quarter earnings to cover these costs of which a significant chunk is legal fees still.

I’m just saying that in a high stress situation, like a divorce for example, one tends to lose a significant amount and people tend to attribute the loss to the lawyer as I did in this case.

P.S. Technically the costs aren’t from one quarter eihter, again it just struck me the amount was more than a quarter’s earnings.

Jenny

at 9:50 am

The word you’re looking for is “tacky.” Their signs are tacky.

Whaaa?

at 10:38 am

But isn’t it now tacky to use the word “tacky”? Just kidding.

Peggy

at 2:29 pm

Your comment of how “tacky” being a tacky word reminds me of the word “trendy”, which is anything but trendy!

Kyle

at 11:09 am

Upgraded? That handrail looks like a dirty baguette.

Ed

at 11:34 am

Insulation only halfway down a basement wall is a thing.

I’m kinda disappointed you didn’t include a picture of the view from the soaker tub.

IanC

at 12:56 pm

Oops, I read this too fast.

I thought “Show off your treasured pieces” was in the bathroom / shower.

Derek

at 4:02 pm

I like the honesty of the agent who likes transparency for his buyer clients, but not for his seller clients:

https://www.thestar.com/business/real_estate/2019/04/17/realtors-oppose-mandatory-sharing-of-offers-among-competing-home-buyers.html

Can’t there be some recognition that the market includes buyers and sellers? And are the barriers raised to transparency, such as “private information”, real barriers or made-up barriers to prevent change towards more transparency. Would transparent disclosure of the offered sum, for example, actually require disclosure of “private information”.

Condodweller

at 4:35 pm

My question would then be, how do you reconcile allowing double ending if you can’t treat both parties fairly?

I think this protection of private information is a cop-out. I suggested in the past that all offers should be uploaded to a system owned by an independent party which all buyers should be able to access to generate a report. It would have to be a simple report with a listing of offers with the prices. It would not have to disclose any information about the buyer whatsoever other than the offer price.

This would address my biggest issue about being sent back with the highest offer. My agent would look at the report and see our offer at the top of the list. If the seller agent wants to do a second round let him/her send every one else back. The seller agent would still be able to control the process as to who is sent back i.e. 2nd, 3rd best offers to avoid turning it into a silent auction.

It would also protect the seller in case the agent wants to hide a high offer in order to go with a lower one he/she is double ending.

Noel

at 11:12 am

This is one of the most hilarious posts you have ever done. (Yes I’m back!), not because of the notes but because of your commentary on them. “Place to put sh!t in yo kitchen!” – hilarious!

One of the worst things is they didn’t even use a paper cutter to at least cut the notes square, lol

Joel

at 4:43 pm

Had they have done several notes throughout the house highlighting thing people may have missed I think it could have been a great idea.

The volume and quality of the notes are the problem.