I bet you thought after last week, we were done talking about mortgages! But how can we pass up a topic like THIS?

As real estate prices continue their unfathomable climb, and buyers watch as affordability slips away, we have another feature (along with 2.84% mortgages…) to further prop up the market.

Yes, folks, 100% financing is back!

It’s not as absolute as it was back in 2005, ie. you do need some money to qualify, but there are still lenders out there that have no problem giving mortgages to borrowers who have almost zero skin in the game.

There are pros and cons to this offering, so before you write it off completely, let’s examine…

Folks, I’d like to introduce you to something called “perspective.”

You see, when my mortgage broker told me last week, “You won’t believe this – 100% is back,” I was not on the same page as him.

You see, my mind immediately went elsewhere.

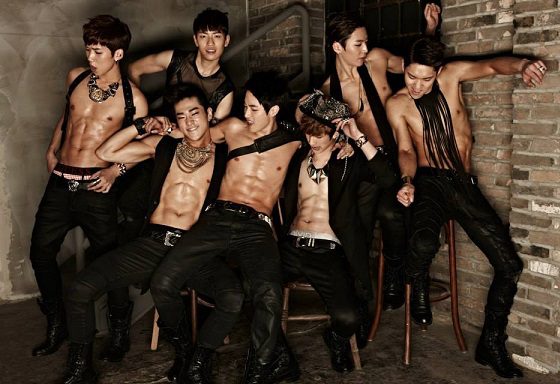

My mind went to a place where many, if not most of our minds would go……….South Korea!

Raise your hand if you don’t hear “100%” and immediately think of the hit Korean boy-band pictured below:

Seriously, it’s so hard to choose a favourite.

I always thought I liked Liam the most, but now it’s Bradley.

Or Jonas.

Nah, definitely Bradley…

Anyways…

How do I go from Korean boy-band-based sarcasm to a serious topic?

I guess we’ll find out…

Back in 2005, I had a client purchase a house with no money down, AND get money back.

His house cost an even $1,000,000, and with the 107% financing package that existed at the time, he closed on the house (paying legal fees and land transfer tax), and then was given a cheque for $70,000 by the lender to do with, as he pleased.

Times have changed since then…

We’ve seen the elimination of the 40-year amortization, the minimum 5% down payment for properties under $1,000,000, the minimum 20% down payment for properties over $1,000,000, and the minimum 20% down payment for secondary properties and/or investment properties.

These rules have helped tighten the mortgage market, and effectively caused consumers to take on less debt.

But as the lead-in to this blog suggested, it seems times are changing again. We seem to be reverting back to yesteryear, despite CMHC and Jim Flaherty’s attempts to rein in debt.

After BMO announced last week that a 2.99%, 5-year, fixed-rate mortgage was being offered to borrowers, other lenders followed with rates as low as 2.84%.

Later last week, some lenders started email blasting the entire province advertising the come-back of 100% financing.

That’s right – lenders will loan you the 5% you need to provide as a minimum down payment, so you can effectively purchase a property with no money down.

There are a few catches, however. Or maybe they’re not “catches,” per se, but rather points you might assume come with an offering like this:

1) You must have your own closing costs. Lenders are looking for 1.5% of the purchase price.

2) The interest rate is 4.85% over five years.

3) If you break the mortgage before the five years are up, you have to pay back the 5% loan on a pro-rated basis.

4) Owner-occupied properties only.

5) No rental income allowed to qualify.

6) Must have good credit and good income to qualify.

7) Cannot be used for Coops, student or rooming houses, B&B’s, Historical designations, commercial properties or mixed use, raw or leased land, seasonal access properties, mobile homes, prior grow ops or meth labs, life lease agreements, fractional interest, rental pools or hotel condos.

I don’t think anything on that list should come as a surprise.

Maybe, just maybe, you’re looking at the 4.85% interest rate and shaking your head.

But what do you expect?

Why else would a lender offer to loan you a down payment to purchase a property?

So I’m interested to know what the general public thinks of this offering.

On the one hand, you might suggest, “This is the last thing the market needs right now, as prices are skyrocketing, and lenders are helping to drive up the price. With consumer debt in Canada at an all-time high, this product is an absolute joke.”

On the other hand, you might suggest, “This product allows people with good income and great credit to get into the market today, and not miss out on further property appreciations over the coming years where they would otherwise be saving for their down payment.”

I know I’ll get opinions from the general public, in the form of my readers, but I also wanted to know what the mortgage community thought about this product, so I asked Joe Sammut:

“I believe there is a place in the market for this type of product. Consider someone renting and paying market rent in Toronto and the GTA, trying to find a way to save for a 5% downpayment. Unable to save large amounts of money each month, yet affordability is not an issue as they are currently paying a high rate of rent. This can be the product that helps them make the leap to home ownership.

Another way to look at it is to consider that there is an element of “forced savings” when paying a mortgage. Each payment includes a portion that goes to the repayment of the principal amount borrowed for the mortgage. This can be looked at as the “savings” that renters are working hard to achieve. *A $400,000.00 mortgage at 4.85 requires a monthly payment of $2292.00. Of that amount, $691.00 goes to repay principal on the mortgage, the balance is interest. As the months go by, more of the monthly payment goes toward the principal repayment allowing the homeowner to build equity in their home. Add to that, a hope that the market will continue to rise and their home will increase in value as the years go by.

Yes the rate is higher, currently 1.76% higher than today’s 5 year fixed conventional (to 80% loan to value) and high ratio insured (to 95% loan to value) of 3.09%, but if cash flow and affordability allow for the monthly payment then this could be a great option. As always, I recommend that everyone review their options with an experienced Mortgage Broker. Read the fine print! Make sure the terms and conditions are clear and concise before selecting this or any other mortgage product.”

Joe Sammut,

Mortgage Broker

Mortgage Architects #10287

*oac and E.O.& E.

*Rates are subject to change

I don’t disagree with anything Joe is saying.

For the buyer who has no down payment, but has an amazing credit score, and a great job, this is an option to purchase.

The other option, of course, is to tap out your line of credit.

But you need to show that funds have been in your bank account for 90 days to qualify with most lenders. So if you took $20,000 off your LOC today, you’d be able to purchase in July with that money as a down payment. The issue, of course, is that you’re paying interest on that money, and you have to wait three months to make a move.

And then I would also wonder if a would-be buyer with no down payment has access to a $20,000 LOC anyways.

But I like the idea of “forced savings,” since many Canadians are terrible with their money (as evidenced by the 170% ratio of debt-to-income), and the example above shows that buyers using this product would be paying down principal on their mortgage.

And I honestly don’t think we’ve seen the last of “special products” like the stripped-down 2.84% mortgages, or the sneaky 100% financing.

The mortgage market is tight, and lenders are scrounging to find ways to make money. A lot of these products (notably the stripped-down mortgages) act as loss-leaders so that lenders can get your chequing accounts, savings accounts, credit cards, investments & RRSP’s, and other products that will make them far more money than a mortgage at rock-bottom rates.

In the end, like every product, every year, at every rate, and offered by every lender through the history of time – it’s up to YOU to decide what works best.

And for the rest of us, we’ll just sit around and debate the state of the Canadian economy, debt markets, et al….

joel

at 8:09 am

As Joe mentioned that this may be a great option for some and you mentioned that a line of credit may be a better option, I would have to say that saving money until you can afford it and not adding to the ridiculous market right now would be my suggested option.

I am not generally a real estate bear in the Toronto market, but this year seems to have some ridiculous prices and having a 100% mortgage could be devastating to someone if the market slows or drops over the next couple of years, leaving them owing more than the house is worth after 5 years of paying down their mortgage at a high (relative to current prices) rate.

If the market continues to grow by the rates it has over the last few years this could work out very well for someone that can’t afford to get into the market, but the potential downside is much higher than the potential upside.

MAXWELL LOAN

at 10:12 pm

Are you looking for a very genuine loan?

Do you want financial assistance in your business?

Do you want to buy your dream house and car?

Do you want to start up a business and you dont know where to start from?

Have you been turned down constantly by your banks and other financial institutions?

worry no more because we give out loan At an affordable interest rate of 2%? Processed within 24 hours.and a repayment

duration period of 1year to 10years to any part of the world.We give out loans within the range of 5,000 to 100,000,000 USD

Just for only one fee, which is the Registration fee while the company will be paying all other fees, Any loan company asking

for more than one fee is a scam and bewear of that company. Our loans are well insured and maximum security is our

priority.contact us today at(ma************@*****ok.com) where your needs are meet and your worries are over.

Craig Wilson

at 5:34 am

Good day everybody am Craig Wilson By name am from the United State Of America i want to give thanks and a great appreciation to Mr Larry Scott Loan Company for offering me loan for purchasing my house with a low interest rate. I want to give thanks to him for giving me this loan. My friends out there who needs loan for different purposes i advice you contact Mr Larry Scott Loan Company for loan instead of falling in to hands of Scammers online. Am happy today because of Mr Larry Scott Loan Company. So if you want to contact them for a loan you contact them on: (sc***********@***il.com)

Craig Wilson

Appraiser

at 8:30 am

Myth: “Canadians are terrible with their money.”

Correction: Some Canadians are terrible with money, regardless of interest rates. The smart ones are taking advantage of low rates to aggressively pay down debt.

Facts: The most recent data indicates that over 40% of Canadian homeowners have no mortgage (RBC). Approximately 36% of current mortgagors are on track to have their home loans retired within 10 years (CIBC). Over 600,000 Canadians that are mortgage free, have a HELOC with zero balance. (CAAMP).

frank le skank

at 9:02 am

Stats are fun. Here’s an example from our American friends which illustrates how a seemingly low rate of foreclosure correlates to a percent decrease in prices.

– More than 7 percent of Nevada housing units received at least one foreclosure notice in 2008

– Nevada led the nation in price declines between March 2008 and March 2009, with Nevada prices falling 31.1 percent.

It would be interesting to know if the 40% of Canadians who own their homes have money invested in other assets? Are they boomers who will sell to finance retirement? At first glance your stats are impressive, but if you dig deeper they provide an incomplete picture. Do RBC or CIBC hold all the mortgages in the country? I also find it funny when people use words like “facts” and “approximately” in the same sentence.

Kyle

at 10:22 am

Sorry but there is nothing “seemingly low” about Nevada’s 7% rate of foreclosure. As of Jan 2014 Canadian mortgages in arrears was at 0.55% (source below), the percent in actual foreclosure would be even less. So if you’re using Nevada as a measuring stick, things would have to get astronomically bad (an order of magnitude greater than 13x) here for house prices to drop an equivalent 31.1%

http://www.cba.ca/contents/files/statistics/stat_mortgage_db050_en.pdf

Appraiser

at 3:18 pm

I find it really funny when people are so pedantic and closed-minded that they try to parse every word to the nth degree. Would you like the stats illustrated to 17 decimal points?

Oh yeah, and pulling irrelevant red-herrings out of your ass regarding foreclosures in Nevada was really impressive.

The facts are cruel to those who don’t want to hear them.

Jonnathan

at 8:47 am

How would someone obtain mortgage insurance on a 100% mortgage? I thought CMHC does not provide insurance on this type of product.

Joe Q.

at 9:22 am

There is probably some kind of alternative (expensive) insurance arrangement here, which accounts for the very high interest rate.

In Canada, mortgage default rates are correlated with LTV. People with small down-payments are more likely to default on their mortgages than people with larger down-payments. I personally don’t have a big issue with 100% LTV mortgages as long as the lenders themselves bear all of the default risk.

Nick Bachusky

at 10:18 am

Typically CMHC would still only insure it at 95% LTV and the “downpayment” is still a loan or line of credit for the remaining 5% at the same 4.85% as the mortgage.

David Fleming

at 11:43 am

@ Jonnathan

This product isn’t being offered by the “Big Five” banks – just credit unions.

I believe Meridian is the largest proponent of this product.

IanC

at 9:14 am

Let’s say that you can get a good product that is not “stripped down” for under 3%.

(Details appended)

Now the zero down product – sure it helps people could not get in the game otherwise, but let’s look at the real costs from Joe’s example.

Joe’s interest rate would incur $90,540 in 5 years (60 payments). A competitive rate at 2.99% for 400K would incur $55,228.49 or a difference of $35,311.51 in interest.

$35K. Ouch!

Appended details:

==============

My five year fixed rate that I signed 7 days ago at TD was 2.99%. It included 15% annual prepay and up to doubling of each regular prepayment options, and is portable. Scotiabank was offering 2.94% for 5 years (extending their 4 year rate to 5 years) with some prepayment options as well.

Joe Q.

at 9:16 am

David writes: “But I like the idea of “forced savings,” since many Canadians are terrible with their money (as evidenced by the 170% ratio of debt-to-income)”

Doesn’t that 170% (I think it’s actually closer to 165%) include mortgage debt? In which case the argument becomes circular…

Schmidtz

at 1:24 pm

No.

Mortgage debt is DEBT. Reducing this debt via forced savings reduces the debt.

Your comment is invalid.

Joe Q.

at 4:29 pm

Re-read David’s comment. He points out that buying a home with 100% LTV at least forces a marginal buyer into “saving” his money, and that there are plenty of people who have problems saving their money, as evidenced by the high debt-to-income rate in Canada.

But since major housing debt is itself a huge part of that high debt-to-income ratio, the argument closes back in on itself.

Kyle

at 9:25 am

I think this is a really terrible idea. This type of mortgage targets 2 types of people:

1. Those who on paper SHOULD be able to afford a house, but HAVEN’T YET come up with the 5% down

2. Those who on paper SHOULD be able to afford a house, but CAN’T come up with 5% down.

Sure there are some in the first camp for whom this makes sense, like newly minted Doctors, Lawyers, Dentists and Investment Bankers, or more generally anyone whose financial situation has drastically improved, but does not want to wait until they saved up a down payment. But i think there are a lot more people who fall into the second camp. Those who are just plain bad with money, no matter what their income. If they can not save 5% when they’re renting, they have no hope in hell of making ends meet, with the additional cost of home ownership.

I’m sure the Quants did all sorts of fancy modeling to figure out that the additional 1.76% spread, covers the additional credit risk that not having 5%, BUT i think the Quanst are missing a very basic assumption about human nature. Anyone who SHOULD on paper be able to afford a house, SHOULD also be able to save up a down payment, since renting cost much less than owning. What their models don’t capture is that If the applicant CAN’T save a down payment, it usually has nothing to do with how much income that person makes and everything to do with how much that person spends.

ScottyP

at 10:15 pm

Well said.

Jason H

at 10:46 am

I would hardly say that debt levels have dropped in the mortgage market because they are still very high.

164% this quarter vs 164.3% this quarter last year.

The fact that 100% mortgages are back shows how bad the housing market is doing – even though prices are climbing. Banks need their profits.

I like Kyle’s points.

Neil

at 2:26 pm

Not having the 5% down payment costs a lot over the 5 years of the mortgage. Let’s say you want to buy a $300,000 condo. 5% down is $15,000. If you don’t have this, your monthly mortgage payment with a 30-year amortization is $1,574 and you pay $67,800 in interest over the 5 years. Your principal owing after 5 years is $273,000.

If you have the $15,000 down payment, the monthly mortgage payment is $1,212 (3.09% interest, 30 years amortization). You pay $40,900 interest over the 5 years, a saving of $27,000 over the 100% financing case. Your principal owing after 5 years is $253,000.

So not having a $15,000 down payment costs you an extra $27,000 interest over the 5 year mortgage period.

Alex

at 4:40 pm

But if the condo’s value increased 5% each year for all 5 years then you’ve gained ~$80000 in equity (assuming it takes you 5 years to save the downpayment). So this mortgage only makes sense if condo and house prices keep going up at record levels, and I’m sure that is how the bank is selling it. I wouldn’t take it, but I can see an investor who can handle some risk taking this.

ScottyP

at 10:20 pm

If it’d take 5 years for you to save $15,000 for a down payment, you should probably not be buying in the first place.

Stacey

at 5:01 pm

What is your profession? Are you qualified to declare such a strong opinion as though it is fact?

How many people can say they have encountered hefty expenses in a 5 year period, such as medical, travel, theft, spousal support or divorce, new business, job change, family in retirement homes, family in rehabilitation, …. There can be set-backs along the way.

I agree Alex. Unfortunately it is not as clear cut to segregate home buyers into 2 specific categories, to be on one side of the fence or the other. There are renters, divorcees, older adults, young families, immigrants, … everyone has a new scenario. That is why there are an abundance of mortgage products, purchase incentives, rebate offers available from lenders and our government. Created to cater to as many situations as possible.

As a broker, every file crossing my desk is different. Every product for these clients is tailored to their needs. That is the point of brokering. That is the point of the 100% financing. It is back because there is a need for it.

Home ownership is wealth, and without owning those buyers may never increase their financial worth. Let the buyers that are able, incur higher payments for the 5 years, and earn a discounted rate for their next term. The stipulations should keep out those that simply CAN’T as you have described.

G___

at 3:20 pm

Concur with Kyle, supra.

This will help move starter condos to those of us with enough school debt that 2 years of that repayment = down payment yet we can still carry a 1.3-1.7k monthly rent.

Run the numbers, Caveat emptor, and YMMV.

Anton

at 7:15 pm

The 167% ratio of debt-to-income does NOT include mortgage debt.

Otherwise that number would be staggering – in the 500% range.

It’s funny (maybe the wrong choice of word) but most people see that 167% number and think “That’s so high, how is that possible?” Maybe the readers of this blog are more affluent and responsible, but somewhere out there is somebody making $30,000 per year who has $50,000 in debt.

I think student loans play a huge factor, specifically doctors, lawyers, dentists, MBA’ers, and those who take out $100K in loans and pay it back with inteterest as they hope and prey their salaries slowly increase throughout their 30’s. It would be ignorant to suggest that most of the debt is held by poor people living off credit cards, when in fact many professionals are carrying 6-figure debt-loads.

Appraiser

at 6:25 am

“The 167% ratio of debt-to-income does NOT include mortgage debt.” ~Anton

WRONG! Anton needs to do more research before hitting send .

ScottyP

at 7:45 pm

Yeah, you gotta love it when people can pull comments such as “it’s not 167%, it’s like 500%!” out of their ass and not even blink.

JP

at 9:24 am

I don’t disagree that 100% financing can be useful for certain customers, but it scares the heck out of me.

I used to work for a builder not too long ago and we were selling houses in the upper 200k lower 300k range just outside the GTA.

I don’t know how many people came in asking about the deposits and didn’t even have the initial $5000 payment. Back then, the on-site bank rep was only too happy to swing 100% financing for them in one form or another. I’m more of the opinion that if you don’t have a 5k deposit for a house, maybe you shouldn’t be buying a house.

Then there was a tiny house in Corktown this week that sold for 70K over asking. Just shy of 700K for what is essentially a 1 bedroom home (one of those “currently 1 bedroom but easily converted back to 2 bedroom jobs) …. “but it has a basement rental!” Cute yes, 700K? Crazy.

Kyle

at 11:38 am

I’m totally with you. This idea scares the crap out of me. I think whomever came up with this idea, only went so far as plugging numbers into a risk formula and stopped there. Sure, from a credit risk perspective a measly 5% down payment represents a rather small reduction in the potential loss – nothing more, but anyone who has saved for a down payment knows it represents much more than that. It represents an ability to prioritize and allocate a finite amount of income wisely, it represents an ability to defer consumption over immediate gratification, it represents financial discipline. Traits not everyone has. There are lots of people who want EVERYTHING and they want it NOW. They find ways to spend every penny of disposable income and then some: on rent, clothes, vacations, meals, entertainment, cars or whatever. There is no discerning between “needs” and “wants”, to them they’re all “needs”. So when you replace rent, with the higher costs of home ownership, i think it is unrealistic to expect that these people who never had the financial discipline to save 5%, will suddenly discover the financial discipline to reduce spending on all the other items in their life. And i think this type of mortgage is like a big giant beacon calling to people like that.

AndrewB

at 8:27 pm

^ This.

Many people could afford if given 100% financing, but like you said, do they have the financial discipline to follow through on the day to day costs of home ownership. I’ve heard many say that owning is cheaper than renting its equivalent, but they fail to see all the other associated costs with home ownership.

Paully

at 5:03 pm

Yep, giving huge mortgages to people who do not have the means or ability to save a minimum 5% down is a great idea. It worked out so well in the USA.

Lior, Mortgage Edge

at 12:17 pm

We’ve done a few of these 100% financing deals. It is definitely a niche product. For those of you who are asking about the lender, it’s Meridian and they can offer 100% financing because as a credit union they are not a federally regulated financial institution. This type of financing is a good option for consumers who have steady income, very strong credit, and little debt. Instead of waiting to accumulate a sizable down payment, especially with where home prices are in Toronto, this products allows these clients to get into the home ownership market with covering just the closing costs. The interest rate is quite higher than a conventional 5-year fixed based on today’s rates but for those who are qualified and are looking to get into the market with no saved down payment, this is the only choice they have. For the right person, it can work, and as Joe said, it requires taking into account different scenarios that may impact the client’s ability to pay a substantial mortgage payment. Another item that was absent from the original post is that this product is available for properties that are in the vicinity to a Meridian branch (20 minutes drive to an urban branch).

USA LOAN INT.

at 5:47 pm

DO YOU NEED URGENT LOAN?

USA LOAN ORG. IS CURRENTLY GIVING OUT LOAN OFFER TO INDIVIDUAL AND ORGANISATION IN THIS 2015 FOR EXPANSION OF BUSINESS OR OTHER. IF INTEREST KINDLY RESPOND NOW

Hyland

at 9:01 pm

WELCOME TO CREDIT UNION LOAN FOUNDATION! 2%

Do You Need a Loan? Do you need Money to start your own business,

How much do you need ? Have you been turn down

by the bank, worry no more we are here to help you

We can make your dreams come through today

for more details you can CONTACT US TODAY:

EMAIL: cr*******************@***il.com

lilian scott

at 11:42 pm

Hello Beloved People,

I am Mrs lilian scott, I am writing this letter because am very grateful for what Mrs carolina bruce did for me and my family, when I thought there was no hope she came and make my family feel alive again by leading us loan of low interest rate of 3% I never thought that there are still genuine loan lenders in the Internet but to my greatest surprise i got my loan without wasting much time, so if you are out there looking for a loan for any financial reasons at all then i will advice you to email Mrs carolina bruce at VIA (ca*************@***oo.com) for more Info

I WISH YOU ALL THE BEST

Best Regards

Mrs lilian scott

cletus morgan

at 11:00 am

you are welcome to Cletus Morgan loan firm, do you an urgent loan to pay off bills, to set up business or need a personal loan you can contact us today on ub****************@***il.com

Grace Dennis

at 5:24 pm

I’m Grace Dennis by name. I live in Canada,i want to use this medium to alert all loan seekers to be very careful because there are scammers everywhere.few weeks ago I was financially strained, and due to my desperation I was scammed by several online lenders. I had almost lost hope until a friend of mine referred me to a very reliable lender called Mr Chris S. Melvin who lend me an unsecured loan of $25,000.00 under 12hours without any stress. If you are in need of any kind of loan just contact him now via Email:em***************@***il.com I‘m using this medium to alert all loan seekers because of the hell I passed through in the hands of those fraudulent lenders. And I don’t wish even my enemy to pass through such hell that I passed through in the hands of those fraudulent online lenders,i will also want you to help me pass this information to others who are also in need of a loan once you have also receive your loan from Mr Chris S. Melvin,i pray that God should give you long life.

Grace Dennis

Richard Farmer

at 11:50 pm

Are You Financially down ? Do you need a loan to pay off bills or buy a home Or Increase your Business ? Apply for a loan now and get approved. We offer all kinds of loan at a reduced interest rate of 2%. Our loan program is direct and flexible and your financial aim is our success. IF INTERESTED, contact us now via Email: cr******************@*****ok.com

Sara Blakely

at 6:19 pm

Hello Every Body, Information to you all!!!

My name is Sara Blakely a citizen of U.S.A, founder and C.E.O OF

SPANX, I want to testify of the lender who showed light to me when I

was in need of funds to rescue my business from falling down. I never

knew that there would still be genuine loan lenders of funds until I

came across Mr James John the Managing Director of James John

Loan Firm, he is indeed a genuine loan lender of funds. Well when I

emailed him, he gave me the details of his transaction and I was

afraid to follow him up and he said he want me to worry no more so I

should trust him which I tried to do, I was surprised that I received

my Loan amount of $700,000 from him and I promised him that I will go

and share this great testimony to the world that there are still

genuine lenders of funds. So if you know that you need a loan and you

don’t want to involve your selves with scammed lenders, then I will

advise you to email him on his Email address:

Jamesjohn_loanfirm@outlookcom

Email him now and get your loan.

Regards

Sara Blakely

Ibrahimy

at 12:01 am

Are you in search of a legitimate loan? Tired of Seeking Loans and Mortgages?Have you been turned down by your banks ? Do you need a loan to clear your debts/bills? Then your financial trauma is over. We Offer Loans from $5,000.00 to $100,000,000.00 with 3% interest rate. We are certified and trust worthy. we can help you with financial assistance. If interested do get back to us via Email: ib***********@***oo.com

Thanks

Sir Ibrahimy Idi.

Stupid Arab

at 6:31 pm

All the above is scam!!!

Tim Reid

at 8:38 am

Applying for a funds was simple and easy and what they actually

advertise about Mr. James Carl is true. I received my money in my bank

the very next day. I was really in need of extra cash I was in a bind

and James Carl Loan Firm Credit helped me a lot so thanks JCLF Credit

for your help and flexible payments, i recommend anyone in need of

financing to contact through email (ja*******@**ho.com) or Text: +1

267-884-0582

Mr Richard

at 8:56 am

Do you need an urgent loan (Funds)? If yes contact us for more information via our email: ri************@***il.com

DAVID MICHAEL

at 4:45 am

Christmas Is Almost Here!

Merry Christmas and a Happy New Year. Christmas 2015 is on its way. its time to get your finances in order so that you can afford to buy presents and pay your bills. Apply online today.

@

gl*****************@***il.com

James Robert

at 11:38 pm

Hello Loan Seekers,

Do you need an urgent loan to start up business,Xmas loan, debt loan? buy a car or a house? If yes worry no more, For we offer all kinds of loan at a low and affordable interest rate of 4%, without collateral and without credit check. Get back to us if you need a loan with the below information.

(1) Name:

(2) Loan Amount Needed:

(3) Loan Duration:

(4) Phone Number:

(5) Country:

(6) State:

Contact us now via Email today: ( r.***************@***il.com )

Best Wishes,

James Robert.

Rosario Christiana

at 12:31 pm

Loan Application

================

Hello

We welcome you to Happiness Loan Company and we would be very glad to

give you a loan of your desire provided you can be trusted and can be

relied on. We offer loans to individuals at just 2% interest rate. So

feel free in doing business with us.

I want you to know that our transaction does not take time but it

depends on how serious you are to get your loan from us because we

love doing business with serious people who will be ready to pay us

back at the stipulated time. ( genuine people only).

Qualifications On Our Transaction:

==========================

1)The Borrower must be trusted with good faith and unlimited grace

2)Even with Bad credit, we still Guarantee the Borrower the Loan with

unlimited grace in this company.

3)The Loan Can Be Granted Even With low credit.

4) Fixed Rate Of The Loan interest is 2%.Feel free to write us on our mail (ro***************@*****ok.com)

mrs rabecca

at 1:59 am

Hello sir/ ma, our company is located in USA, we offer all kinds of loan at a very interest rate 2%, Mr James from London got his loan of $450,000, Mrs

Cynthia from UAE also came to us that she was scammed two good times, she applied on our company and we offer her loan of $70,0000 so my dear Friends

we have come out here to render you all kinds of loan without no delay or stress, please do not allow your self to be scammed again by any other company,

apply now and we shall never disappoint you, our company email address is su********************@***il.com

Godsent Pablo

at 5:51 am

Thanks to Mr Larry Buknor, I can finally smile again and he gave me a loan to invest in business. loan funds of $250,000,000.00 has been awarded to two of my colleagues, we also received a loan without any difficulty with an interest rate of 2% per year. I advise you no longer on the wrong people, if you want a loan for a project or another need. I’m making this announcement because Mr Larry Buknor, with this loan has helped a lot. Through a friend I met this honest and generous gentleman. You can write to him and he will work to your satisfaction. you can contact Mr Larry Buknor by via E-Mail: La********************@***oo.com,Thank you.

Teri Cary

at 7:02 pm

Hey,

I saw a comment and i applied for a loan to my greatest suprise i received my Loan. So fast and easy. If you are in need of a loan you can contact them via email and please let them know you were refered to them by Teri McCary

E_mail: liberoloans@gmail. com

Darin Bloye

at 12:05 am

Thank you for sharing this.