Was it Morgan Freeman?

The voice.

The one that you heard in your head.

In lieu of Ken Burns or David Attenborough, I don’t know how you might narrate a voice in your head, but personally, Morgan Freeman is my go-to.

Of course, the narration you hear in your head might differ depending on the subject matter, the scene, or the cast of characters involved.

You might hear a different narrator for something happy and a different narrator for something sad.

I wonder which narrator blog reader, Derek, was thinking of when he made his comment on last month’s “January TRREB Stats,” because personally, I heard Morgan Freeman.

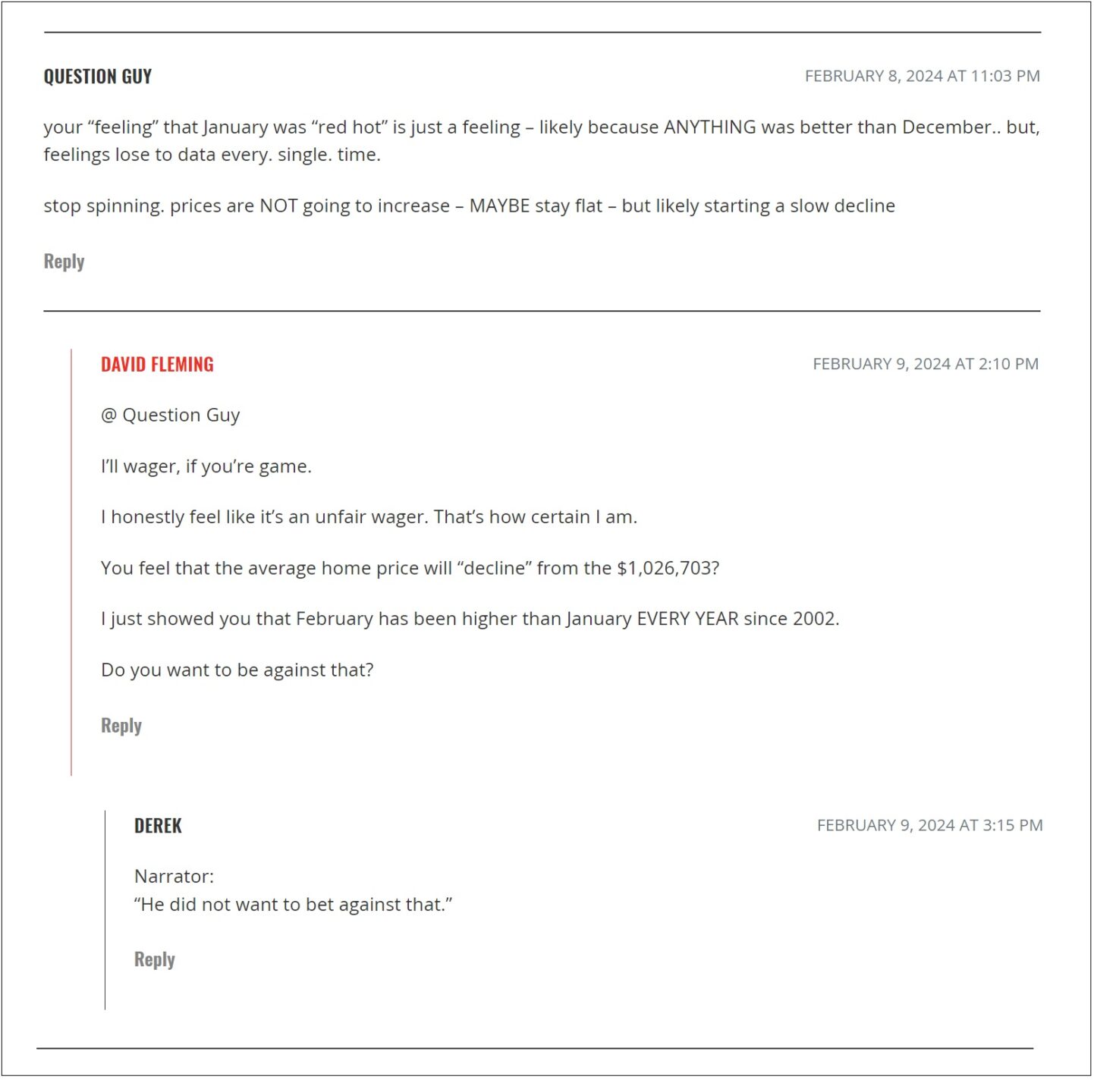

At the risk of looking like a bigger jerk than I was described as by a blog troll in Monday’s post, I want to reflect on a comment – and a couple of replies, from last month’s blog post on the TRREB stats:

Like I said: I heard Morgan Freeman.

I also laughed out loud when I saw this. I don’t know why, but sometimes a tiny dose of wit is funnier than just about anything else.

No, I don’t want this to be any sort of “I told you so,” but perhaps I’m past that already.

I just want to illustrate the dichotomy between real estate market realities and what many people want to “be.”

If you recall, I spent most of my time in this space last month arguing that the TRREB numbers “made no sense.” The average home price declined from December to January, when I fully expected and predicted an increase.

The TRREB average home price clocked in at $1,026,703, which was 5.3% lower than December’s price of $1,084,692.

Not only that, this $1,026,703 measure was lower than the previous trough – $1,038,668, set in January of 2023.

That’s a “double-whammy.”

We saw the average home price decrease substantially at a time when I expected it to increase, but we also set a new low.

It was just shocking!

My blog post reflected these sentiments and only one of the comments from the TRB readers disagreed with the logic.

That comment is posted above, and it referenced this chart, which I’ve updated to reflect 2024:

Betting against a price increase from January to February, after seeing the data above, would be like betting against the sun rising tomorrow morning.

But a large segment of society really wants to see home prices crumble and will often argue against reason.

So where does this leave us?

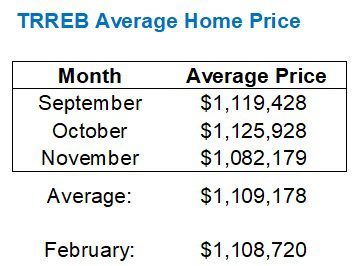

What does this $1,108,720 average home price mean, and what can it be compared to?

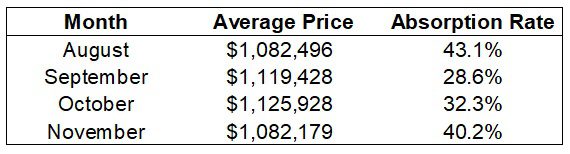

Ironically, or not, it’s essentially on par with the average home price last fall.

That is, an average of averages, seen here:

The average of September, October, and November’s average home prices is $1,109,178, which is on par with this past February.

Personally, I would still argue that the market in February was hotter than last fall.

The fall, if you recall correctly, was slow. Sales were down and it was a slog. I remarked on a few occasions that it was among the worst fall markets that I had ever seen.

So the fact that the February average home price is only on par with the fall is quite surprising.

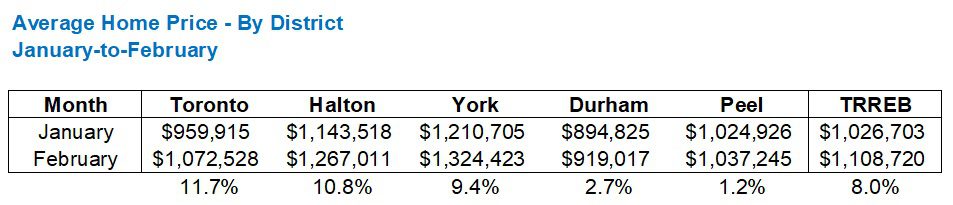

But once again, just to point out how depressed that January average home price was, let me show you how much prices have “risen” in the past month, in each of the five major TRREB districts:

I certainly don’t think the average house in the 416 is “worth” almost 12% more in February than in January, do you?

This is where I want to use numbers and apply them at face value, but I also don’t.

What’s more interesting is that if we re-run the “average of averages” with respect to each of the five major TRREB districts, and see how the February average home prices compare to the average of September, October, and November, the most depressed district is the least likely:

I sure didn’t expect to see that the 416 average home price lags the rest of the market.

But I also didn’t expect to see that the average 416 home price is lower in February than it was in the fall.

Once again, I feel that prices are higher.

I’ve seen it. I’ve lived it. I’ve sold it and I’ve evaluated it.

But for now, we’ll push forward and see how these pricing stats look through March and April.

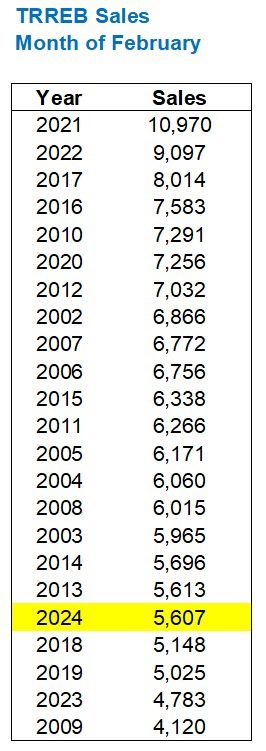

Now, just to show that I’m not picking data selectively to prove a point, let me demonstrate where I see indicators in the market that don’t necessarily shine the brightest of lights.

Sales in February were up 17.9% over sales in February, 2023, however, the 5,607 sales last month are still in the bottom third since 2002:

Again, you have to think that if we’re comparing February of 2024 to February of 2023, and thus our basis of comparison is the second-lowest number of sales in any February before, then obviously we’re going to expect an increase!

But we are only two months removed from 2023. This market is a continuation of the last one. So it’s not like we can expect to see sales double.

While year-over-year sales were up 17.9% in February, year-over-year new listings were up 33.5%.

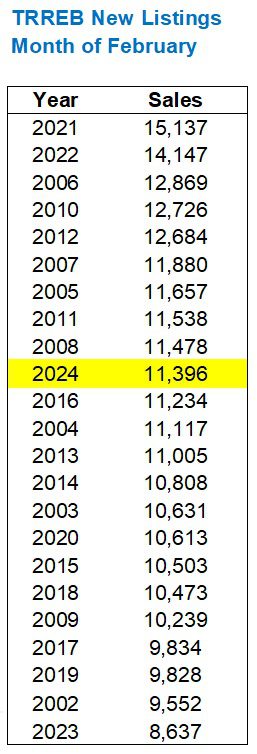

The result is a number of new listings that’s not in the bottom-third, like with sales, but rather right in the middle:

Without the increase in sales matching the increase in new listings, we’re going to see active listings increase.

We’re also going to see the absorption rate decline.

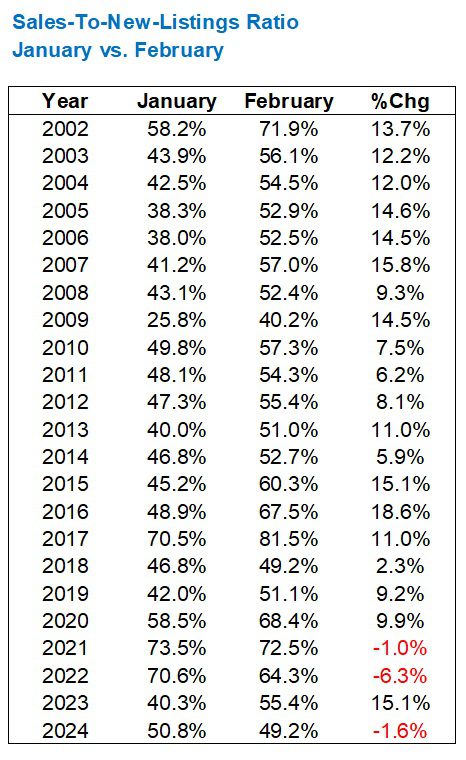

But shouldn’t the absorption rate increase at this time of year?

Doesn’t it always?

Let’s have a look…

Hmm….there’s a bet you’d never have made….until 2021, that is.

But this tells us that it is quite odd to see the absorption rate decrease from January to February.

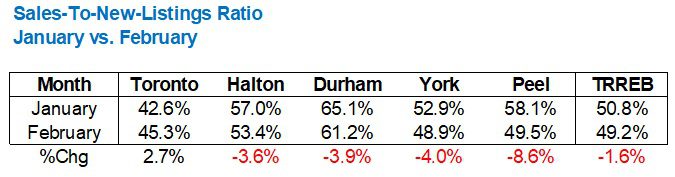

For what it’s worth, the absorption rate didn’t decline in every TRREB district. One district saw an increase:

As I said: for what it’s worth.

So far, we’ve seen that the average GTA home price has increased by 8.0% on a month-over-month basis, however, sales are sluggish, new listings are outpacing sales, and the absorption rate is dropping.

So then, for what it’s worth, we can come to one of two conclusions:

1) The increase in average home price is a mirage. Indicators such as SNLR are showing a weakening market, and while sales are increasing, they’re doing so at a rate that’s far lower than the number of new listings.

2) The increase in average home price came despite other negative indicators, and this resiliency points to a market that’s about to explode.

Is there an in between?

A lot of people have told me before that I’m too binary, and always looking at the extreme ends of the spectrum.

I suppose those two “conclusions” above are a good indication of that.

But how else can you look at this?

I see an average home price that is up 8%, albeit from a very depressed January figure, and even though we have an SNLR below 50%, we’re seeing a seller’s market and price appreciation.

If we saw 15,000 new listings in March and only 5,000 sales, then yes, we could see downward pressure on price. But there’s no indication that we’re going to see a massive increase in inventory or a massive decline in sales.

And let’s not forget what happened last fall…

Last fall, we saw the lowest absorption rates in years.

That 28.6% absorption rate in September was the second-lowest in any month since I started tracking data in 2002.

And yet, the average home price held steady.

This was the theme last fall. Despite never-seen-before absorption rates, prices held up.

So with a 1.6% decline in the absorption rate from January to February, I’m not fussed.

The average home price is up 8.0%.

Put this together with the evidence from last fall, and I’m no longer convinced that the sub-50% absorption rate means it’s anywhere even close to a buyer’s market. Sub-40%? Not according to last fall.

So call me bullish on this market.

I just don’t see any other way…

Graham (aka, the real deal Ron Howard)

at 8:16 am

I heard Ron Howard as the narrator. I don’t want to be the one to say it, but I hate that guy. He’s just another Hollywood liberal big shot.

Marina

at 8:49 am

David, what’s your prediction, high level, for the rest of the spring and early summer?

I’m still slightly bearish on overall price, but I’m also not seeing quality inventory. Basically anything good that comes up gets sold. Not sure where that leaves me, but I’d love your perspective on the mid-term. Do you think we are on a real upswing?

David Fleming

at 9:36 am

@ Marina

I do think we’re on a real upswing. I think there’s a real chance that the average GTA home prices touches $1.2M in April or May. That’s another $100K, or 9%, but the luxury market doesn’t usually begin to move until spring, so that’s going to push the price point.

There were some surprising stats last month – like the absorption rate declining. But prices still went up, so as I wrote above, maybe the SNLR doesn’t matter anymore? Maybe just bow down to the holy price gods?

Your Favourite Tenant

at 9:10 am

Maybe this isn’t a bear market or a bull market, but perhaps… a historically normal market where prices are neither skyrocketing nor cratering, but just plodding along at something kind of close to normal inflation? Wasn’t there a time when that was the standard expectation for housing?

What animal represents a normal, boring, steady state? Maybe a sloth?

Or am I just in wishful thinking mode, hoping my down payment can catch up to prices, without the scary risk of finally pulling the trigger right at the top of the market?

Appraiser

at 8:51 pm

I think there are a great many of us who would gladly take a slow and steady real estate market going forward.

However, it will take a monumental increase in housing supply to make that happen.

Derek

at 4:26 pm

Narrator in my head is the adult Kevin Arnold aka one half of the wet bandits!

RPG

at 7:53 pm

Sam Elliott.

Best voice in Hollywood.

Ever.