Appraiser was right, I really do need to get out of the downtown core to paint a bigger picture of the overall Toronto real estate market and how it’s doing.

But just as I’m wearing the same “REPUBLIC OF IRELAND” t-shirt today that I’ve worn, at the very least, every other day for the past two weeks, we all have our “go-to.”

I examine the east side a lot when I talk about houses, because I find a lot of consistency in the housing stock, and the market in a combined look at E01, E02, and E03 will always be among the least volatile, with the fewest outliers.

When it comes to an overall snapshot of “the market,” I like to look at the downtown core.

I feel that when looking at any world-class city, you want to look at the downtown core as one of, if not the first, measure of the market.

So I’ll continue to monitor C01 and C08 as the weeks progress, for comparison purposes, but if I find time I will go back and look at the east and west sides.

Last week, I showed you how the market was faring in the downtown core, post-COVID.

We looked at all the listings that came onto MLS between Monday, March 16th and Sunday, March 23rd, and looked at the percentage of listings in each price bracket, the number of listings with offer dates, those that were re-listed, those that were terminated, and those that were sold.

We looked at a variety of metrics as a sort of “snapshot” of the market.

Today, we can look at the week of Monday, March 23rd to Sunday, March 29th, and compare this to the previous week.

This will allow us to see how the market is evolving as COVID evolves as well.

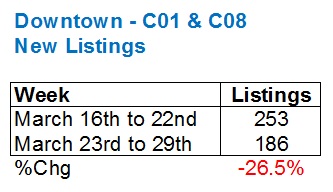

First and foremost, let’s look at activity:

It should come as no surprise that listings are down 26.5%.

Now this wasn’t in last week’s blog, but I wanted to look at the first week pre-COVID, which was the 9th to the 15th, to compare to the first week of COVID. There were 291 listings that week, which means that listings dropped by 13.1% from the second week of March to the third week, then a further 26.5% in the fourth week.

To be fair, our world didn’t change until Tuesday, March 17th when the Ford government announced a shutdown, so I think it was “business as usual” for a lot of people looking to list real estate on Mon/Tues/Wed of that week.

But bottom line: listings have dropped substantially as fewer sellers see a point in listing during a pandemic.

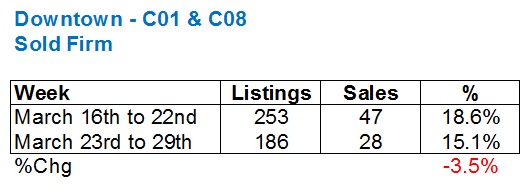

What about sales?

Firm sales are down modestly by 3.5%, which is a lot less than I would have expected!

Perhaps more interesting is the following:

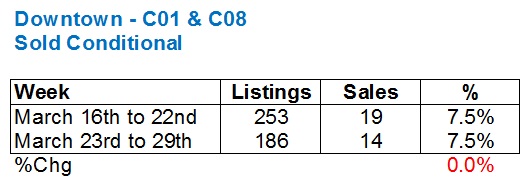

Conditional sales aren’t down at all.

As more and more properties are being listed with “showings upon receipt of conditional offer,” I would have expected this number to shoot up! But then again, if a property is sold conditionally for one day, then firms up, it will appear in the “Sold Firm” when I pull the data at the end of the week.

Total sales show the following:

This is on par with the decline in firm sales, so overall, we’re not seeing much of an effect yet.

Listings are down huge, but sales as a percentage of listings haven’t changed much.

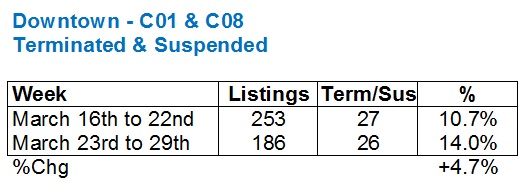

As for those listings that are coming off the market within seven days:

This is shocking to me.

Considering that more properties were listed with “holdbacks” on offers during the week of the 16th to 23rd (more on that in a moment), I would have expected a much larger percentage of properties being terminated/suspended during that week, as the strategy failed. And yet here we see the number of listings coming off the market is almost identical.

I honestly don’t know how to look at this.

Perhaps this is an outlier, and next week, we’ll see far fewer properties.

Or, perhaps more sellers are merely “trying” their listings on the market? But would that make sense, to just try it for a week?

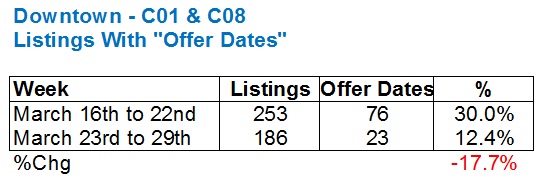

Because far, far fewer properties are being listed with “offer dates,” as mentioned. Here’s how that looks:

Recall that I suggested to list a property with an “offer date,” during a pandemic, was ridiculous.

76 listings with offer dates out of 253, although, again, some agents and some sellers already had their strategies carved in stone, so you can’t quite blame them all.

But to “under-list, hold-back” offers during the week of the 23rd to 29th, with offers reviewed in the first week of April? That’s nuts.

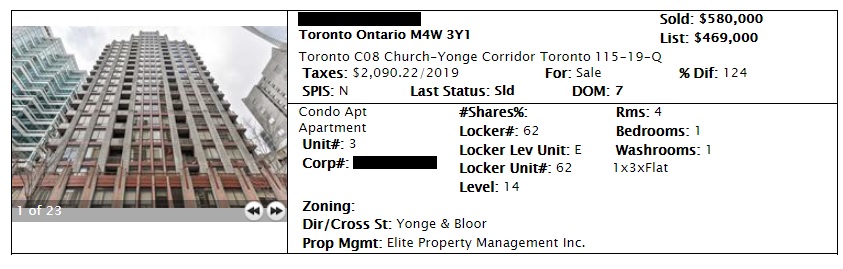

And yet 23 people still did it, with 9 of those properties selling, highlighted by this one:

Sorry, I know you all want to know the address. But maybe TRRRREB is still monitoring their archaic “do not give out sold data” policy during this pandemic?

This property, with offers reviewed on March 30th, received eleven offers.

And now the same model unit is up for sale, with offers on Tuesday night. It will, presumably, be sold by the time you read this on Wednesday, so I’ll update you.

Sales like the one above are rare, and I believe this will become an outlier as we move forward in April.

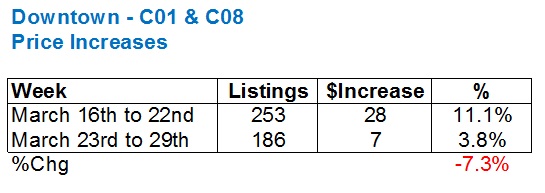

As listings with offer dates go down, so too should properties that are increased in price:

This is why I can’t quite understand the surge in listings that were terminated/suspended.

If the #1 reason why a listing would be either terminated/suspended in the same week in which it was listed, or, increased in price, is because the property was listed low with an “offer date,” but didn’t sell, then shouldn’t these numbers move in tandem?

In any event, nobody should be increasing a price right now, because nobody should be listing-low, holding-back. But 7 poor souls suffered this fate in the last week of March.

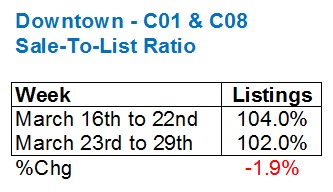

Last, but not least, how are the sales looking as a percentage of the list price?

That looks like a rounding error, but it’s not.

Two percent does have meaning in this market, and I think this points to the fact that fewer sales are going over list, and the ones that do, aren’t going quite as crazy.

So now let me give you a quick look at the volume of listings in more typical “family neighbourhoods,” and while these numbers include both houses and condos, I would estimate that almost all of these are, in fact, freehold.

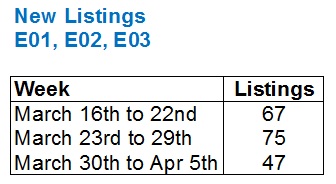

On the east side, we actually saw a spike in listings during the second week of COVID, followed by a drop:

I can’t quite explain the spike, but again, this is a little more than 10%, so perhaps an outlier, whereas the drop was 24% so maybe that’s a sign of things to come.

However, the same spike occurred in the Leaside/Rosedale/Bennington/Mount Pleasant area:

Again, maybe an outlier.

But interesting nonetheless is that 12 new listings in the first week of April essentially matches the 13 new listings in the first week of COVID.

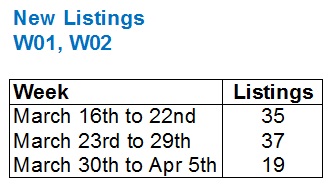

As for the west side:

Weird.

More listings in Week #2, albeit only two.

But a 46% drop in listings from Week #1 to Week #3 is what I would have expected for just about every area in the city.

So the overall drops from Week #1 to Week #3

East: -29.9%

Central: -7.7%

West:-45.7%

Not to stir the pot here, but a conversation about when all this “ends” is going to ultimately impact all of our views of the market.

A friend of mine works in a lab, and his job is to literally analyze slides with COVID-19 on them.

“Bet you would have loved to pick a different major in university, eh?” I asked him the other day. But he said he thrives on this. He loves it. Just as I’m fascinated by all things real estate, my friend is enamoured with the virus, the pathology, the biology, and everything else in between.

He said something the other day that really stuck with me: “This is never going to be ‘over.’ Change is incremental. Our lives going ‘back to normal’ doesn’t happen on a single date, or with a single announcement. When will people start going to movies again? Or even open-roof baseball stadiums? There is no one moment when we can say that this is behind us. It’s going to get better, slowly, and we will incrementally gain back our pre-COVID lives.”

So true.

What does that mean for the real estate market?

It means that, yes, eventually we will have in-person showings on properties again without restrictions, but even when that happens, some buyers will be hesitant.

It means that when prices recover, they will not do so overnight. Sellers can’t be thinking, “When COVID is over, I’ll get February’s price back,” because COVID will never be ‘over.’ It will fade away slowly over time, as fewer people are infected, vaccines are used with increasing levels of success, and fear, irrational or otherwise, subsides, and real estate prices will recover little by little.

I’ve maintained for several years now that, “Nothing can stop this real estate market. Nothing. Short of an act of God, nothing is going to stop it.”

Well, be careful what you wish for.

This market will recover, I have no doubt. Just as the DOW will be back above 29,000. But when? The DOW, I mean. September? January?

I will happily predict that the real estate market recovers first, and let’s acknowledge that the stock market has lost, what, triple that of the real estate market here in Toronto?

But for the time being, real estate listings will plummet, and so too will sales. We’re passed the “if” prices will drop, at this point. Many agents are saying otherwise, but they’re too busy chasing ambulances to give a truthful take on the market…

I think we have another month of tough market conditions ahead, but I do think things will revert to some semblance of “normal” sooner than most.

Am I being realistic? Or optimistic?

Varbal Kint

at 9:09 am

Area agent compares recent post-COVID listings to the always slow week of March break, sees a bit of a drop.

Derek

at 9:53 am

Local rabble rouser spells own handle wrong ????

Crofty

at 3:27 pm

Boom!

Appraiser

at 10:21 am

Realistic vs. optimistic – quite a conundrum.

The question to be answered here, is whether or not one believes that fundamental demand for housing in the GTA has been temporarily or permanently affected by the current health crisis.

Chris

at 12:52 pm

Depends what you mean when you fundamental demand.

People living in Toronto will still have a demand for housing. That’s not in doubt.

But speculative demand, such as was witnessed in 2017 for SFD, and 2019 for condos? That could absolutely be permanently impacted.

Demand from AirBnB hosts? I think we all agree that has suffered a permanent blow.

What about demand from immigration and population growth? That one is going to be interesting. Bloomberg published an interesting article today that touches on this:

“Attracting more migrants, foreign workers and students has been a pillar of Trudeau’s political agenda since he became prime minister in 2015, making his government an outlier at a time when openness to foreigners is waning in Europe and U.S. immigration has fallen to a decade low.

Yet, history shows economic downturns almost always lead to less migration into Canada, even without the unprecedented travel restrictions associated with the pandemic.

“We may be left with a legacy of higher unemployment through 2021 that could cause governments to rethink the near term immigration targets,” said Avery Shenfeld, chief economist at Canadian Imperial Bank of Commerce in Toronto.

Lower immigration may represent a third strike against Canada’s economy, on top of the widespread business shutdown due to the virus and collapsing prices for crude oil, a major export.

Newcomers have powered the country’s growth in recent years, providing a major source of new demand in cities like Toronto and Vancouver, where new arrivals tend to congregate. The surge has spurred a housing boom, driving up prices and fueling construction.

If social distancing measures and business closures last for a year, the reduced flow of foreigners will not only hit the real estate market. It could also have lingering impacts on demand for education and other industries that rely on population growth, Shenfeld said.”

https://www.bnnbloomberg.ca/faced-with-crisis-trudeau-forced-to-shift-on-immigration-1.1418867

Derek

at 6:23 pm

I’ve been wondering about the sentiment that if falling prices indeed materialize going forward, it might be explained by change in sales mix, i.e. a higher proportion of lower priced properties selling. Then, what is the ”correct” sales mix? If people are highlighting increasing prices, or rapidly increasing prices, is it ever commented that one should be careful about overstating the significance of same because its only due to a higher proportion of higher priced properties selling. Whats the baseline from which all other sales mixes should be measured? Know what I mean? I may need therapy.

Appraiser

at 6:32 pm

This may be helpul @Derek

“Average or median prices can change a lot from one month to the next and paint an inaccurate or even unhelpful picture of price values and trends. The MLS® HPI is based on the value home buyers assign to various housing attributes, which tend to evolve gradually over time. It therefore provides an “apples to apples” comparison of home prices across the entire country.”

https://www.crea.ca/housing-market-stats/mls-home-price-index/

Derek

at 6:37 pm

Thanks; I think LG mentioned waiting on that ,recently.

Chris

at 11:29 pm

Sales mix is always going to be shifting, so you’ll never have a perfect mix. HPI does help with that, though it seems to lag the market a little bit, e.g. in 2017 it took a few months for the slowdown to become apparent in HPI.

Derek

at 11:46 pm

There needs to be a “record price in the street index”. I remember when my neighbours demoed and sold a house across the street, the market was soft but they eventually got the record price on the street. In downtimes it can be how far off the rpots? In up times its a new rpots!

J G

at 1:22 pm

Agree with Chris. Demand for primary residence – no impact, people need place to live. Demand for investment properties – I think Covid is teaching some RE investors a lesson right now.

Chris

at 11:32 pm

Even beyond any lesson, credit seems to be tightening for investment properties. Ben Rabidoux sharing an Ontario Real Estate Investors Association post that Scotiabank will no longer allow HELOC funded down payments for investment properties.

https://twitter.com/benrabidoux/status/1247929999279247362?s=21

Pragma

at 2:55 pm

And what if the market clearing price has changed? Everyone could buy a $1m house with 2.5% mortgage rate, and that is where house prices converged. What if mortgage rates go up? You could have the same demand( I don’t agree with that), but now the max is $900k. That will be a factor as well, but personally I don’t think interest rates will play much of a factor in the direction of prices over the next few years.

Derek

at 10:24 am

Should we try to amuse ourselves with a game? I don’t know what metric would be best to use, i.e., avg price or HPI or freehold or condo or GTA or 416 etc., etc., (David or the other smart people can decide the goal posts) Do we take the Feb numbers as the top and work from there? Anyway, someone could define the parameters and we could post our guesses as to how much, if any, prices will change for the chosen metric(s) between top and bottom. Maybe even guess the month the bottom comes?

Derek

at 5:04 pm

Yeah Derek, fun idea, why not!

[positive murmuring noises]

COVID Home Buyer

at 9:31 pm

We just sold our Toronto Condo right before the lock down. We took the lower offer on no conditions because we knew any conditions would mean a no sell with the COVID looming (it was about 50k lower). Especially since a few units in the building had that happen at the same time as we sold.

Now we are slowly trying to buy (condition free) in this COVID world, and I think owners and maybe the realtors just don’t realize their neighbour’s much nicer house that sold last year is no longer a good example of a comparative listing in this market, especially if their listing has been on the market for over 30 days at this point with 0 offers. We are in no rush we have a place to move to interim, and will wait until the right home is available or a realtor calls us back about our previous offers.

J G

at 12:45 am

Good! In a buyers market, have financing ready, go in with no condition, big deposit, but low ball. Someone will bite and you will get a great deal!

Chris

at 11:34 pm

Do you want to lead us off, Derek 1 or Derek 2?

Derek

at 12:01 am

Yeah Chris,I can go first. I’m not proud. It’s been all OG Derek since that one traumatic day btw lol. I think someone other than me needs to define the goal posts first. If its assumed prices are softening, are we going average, HPi, GTA, T.O. etc etc?? Maybe this is in poor taste though?

Chris

at 12:07 am

I’d vote GTA average sales price, as that is the conspicuous headline TRREB number usually cited when discussing “price”.

I’m honestly not even sure what I would predict. So much depends on how long the pandemic impacts us, and thus how much damage is done to our economy. As none of us have any insight on that front, the best we can do is blind guessing. Good for fun but not much else!

David Fleming

at 11:21 am

@ Derek

Agreed, I’d use GTA average sales price.

Sales volume will plummet, but that’s becasue listings are down too.

The March average sale price was $902,680, compared to February’s $910,290, both of which were astonishing (the former because it was back over $900K, the latter because prices acutally held).

I suspect the April figure will drop to the mid-$800’s and it will remain there through the summer.

No luxury homes are going to sell in this market, and 1-bedr condos still reign supreme, so the data will be a bit skewed.

A very simple measure of the market on which to vote: in what month will TREB average sale price rise above the $910,290 we saw in February? I’ll go on record with October of 2020.

Condodweller

at 1:34 pm

Crickets. What happened to all the bulls?

It’s a total crapshoot so why not. I agree the GTA average would be the easiest too use however the number I watch is the 2017 high which I believe was around 970k.

Since I’m labeled as a bear I am going to use the most pessimistic numbers of my range.

The most interesting number to me is how low we’ll go. Will it be a short shallow dip or a more severe drop before things turn around, or will we Infact turn around. I mean this could go a number of ways. If inflation kicks in and interest rate start to move up we may not see the 2017 highs for a very long time. I.e. 15-20 years.

So I’m going to go with 700k Aug 2021. The Feb high of 810k I’m going to say Feb 2022.

Chris

at 2:39 pm

Small point – 2017’s high for average price was $921k, not $970k.

Trebber

at 3:21 pm

Small point? $49K is “small”? A five percent discrepancy is “small”? I beg to differ.

Condodweller

at 3:25 pm

Thanks for the correction, perhaps I was remembering a different number like SFH.

Chris

at 3:42 pm

I actually wasn’t exactly right either.

Average price hit $920,791 in April 2017. However, that was later revised down to $918,138.

Derek

at 4:18 pm

A very simple measure of the market on which to vote: in what month will TREB average sale price rise above the $910,290 we saw in February?

April 2022 (with the caveat that I hope things turn around much quicker);

Chris

at 4:36 pm

Ok so let us recap quickly; guess is for when GTA Average Sales Price will re-attain $910,290 hit in Feb 2019.

David’s guess is Oct 2020

Condo’s guess is Feb 2022

Derek’s guess is April 2022

Well, I’ve been vocally bearish since early 2017. This is shaping up to be a huge shock to our already vulnerable economy. May as well make a heavily bearish guess.

I’ll go with April 2024. Why not.

condodweller

at 5:27 pm

@Chris I actually meant to write 2023, so Feb 2023

Chris

at 7:16 pm

Noted – Feb 2023 for Condo.

Anyone else want to wade in?

David Fleming

at 11:39 pm

@ Chris

April of 2024?

Come on, you can’t be serious. Four years is an eternity.

Forget $910,290. I will further bet you that the average home price is above $1M by April 2024.

Potato

at 3:52 am

Chris, April 2024 to re-attain the recent highs is supposed to be heavily bearish?

I’ve been bearish for a long time. But I’ll stay true to form and come growling in here to say that 2024 will more likely be when the market is trying to find its bottom than finding new highs, and the peak won’t been seen again until the 2030s, at least if the bearish case plays out.

We could have all the ways the market kept finding to make new highs unraveling at once: AirBnB, the strong job market, easy access to credit, and high immigration, which when they reverse might finally kill the FOMO.

And if it does happen that way there would be a touch of irony, as we’d still have low rates, the one factor I previously thought would be most likely be the one to watch.

Of course, Condodweller has it right in calling it a crapshoot — forecasting is hard at the best of times, and I never have complete confidence in a particular call. But the main thing to consider is not that it will crash, but that the worst-case bearish scenario could be significantly more bearish.

Chris

at 9:33 am

Well, David, if you thought my guess was too bearish, now you’ve got Potato’s!

Using history as a rough guide, it certainly doesn’t seem impossible. Prices declined from 1989 to 1996, before finding a bottom and starting back upwards.

If we’re making the case that Toronto real estate has been a bubble, our economy is susceptible due to widespread over leverage, and the pandemic is the shock our central bank has been warning about for years, well, 2024 could be overly optimistic.

But who knows.

Anyways, let’s put potato down for Jan 2030!

David Fleming

at 10:08 am

Potato?

It’s been years! Where have you been?

Condodweller

at 10:33 am

I bet you weren’t expecting to be called too optimistic.

Derek

at 1:07 pm

It is definitely scary to think that all or nearly all of the risk factors for RE might be rearing their ugly heads for the covid catalyst. I’ve never understood what happened in the GTA RE market from 89 to 96 as it was before my time and googling it doesn’t seem to find any authoritative commentary. Hopefully, if things are going to get bad, it will not be as long of a decline to bottom or recovery to top.

Not too many people have thrown a guess at this exercise….????

Chris

at 4:48 pm

I wasn’t expecting to be called too optimistic, but I can see Potato’s points, if the entire bear case plays out.

Let’s get some more predictions here. Bal, Kyle, Appraiser, Kramer, Francesca, etc., get in on this!

Potato

at 1:12 am

Oh, you know, mostly in my bear cave, hibernating, taking care of sick people, and occasionally growling at the kids about leverage and liquidity.

Jeremy

at 10:51 am

Total Sales the first week were 66, which dropped to 42 the second week, so I would argue that total sales were down 37% week over week.

Jimbo

at 11:51 am

Just like real estate the losses are not real until you sell….. The only people that are hurting are the ones that flinched or the ones that retired with most of their net worth in stocks Vs less volatile bonds or annuities. There is a reason you divest into safer options as you get closer to retirement. 2008 should have taught people that

Pragma

at 1:37 pm

So it’s just COVID and that’s it? We lead the world in leverage and there is going to be no de-leveraging event? Are we going to add to our lead? We weren’t already heading into a recession? Our data wasn’t already weak and slowing before this happened? Our debt levels don’t match or exceed the US in 2008? We aren’t going into a recession starting at essentially zero rates?

Jimbo

at 5:06 pm

Easy yogi

Chris

at 11:37 pm

I don’t know that we were heading into a recession before this, but it’s no secret that our elevated household debt levels make Canada more susceptible to these kind of shocks. Our central bank has been warning us for years.

The amount of leverage in this country will almost certainly deepen the impact of this pandemic, and slow the recovery on the other side of it.

Jimbo

at 9:43 am

HELOC as a percentage of our GDP is insane so it will be interesting to see how our market responds.

FWIW

at 2:44 pm

For those who are too gleeful with current stock market gains……

https://business.financialpost.com/investing/investing-pro/david-rosenberg-im-less-bearish-but-far-from-bullish-as-markets-head-into-a-new-chapter-in-this-crisis/amp?__twitter_impression=true

Derek

at 5:10 pm

No glee here ????. Any recovery has not been complete nor stable.

Condodweller

at 1:47 pm

I think the unemployment numbers are very misleading as these jobs weren’t lost due to a change in the economy and because they are no longer required. They were lost because the government forced businesses to shut down temporarily. Most of them should be regained as the restrictions easy and eventually disappear.

Looking at day to day changes in the stock market is almost as useless as looking at the daily changes in the RE market.

Chris

at 2:36 pm

Condo, I’m being pedantic, but the jobs were lost because of the pandemic. If government hadn’t shut things down, the economy still would have taken a hit because of people voluntarily reducing spending and staying home (to protect themselves and their family), plus the tens of thousands of deaths the virus would have caused without mitigating efforts.

I’m also becoming less confident that we’ll have a quick rebound to normal. Many experts think this virus will be with us for quite awhile, thus government restrictions are likely to remain in place, at least in some fashion, for a prolonged period. And the longer this goes on, the less likely we see a robust rebound, as more businesses and individuals go bankrupt.

Trebber

at 3:25 pm

@Condodweller

How does your relatively bullish (IMHO) outlook on the job market jibe with your extremely bearish (IMHO) outlook on Toronto RE stated above? Just curious (really, I’m not trying to “call you out” here).

condodweller

at 5:13 pm

I responded to both your comments but things went haywire on me and my response ended up at the bottom of the thread instead of as a response here….

Derek

at 8:23 pm

if RE sales stay sluggish will there be any discussion about the LTT?

Appraiser

at 9:21 pm

Yeah, it might be tripled to make up for lost revenue 🙂

Bal

at 8:33 am

I read sales tripled in China in the month of March…i guess anything is possible… let’s see

Chris

at 10:47 am

Bal, be cautious with statistics coming out of the Communist Party of China. For years, people have doubted the accuracy of their GDP figures. There’s increasing evidence that their Covid-19 data is questionable:

“But there is growing suspicion that China’s official statistics on the covid-19 pandemic cannot be trusted. On March 24th China’s prime minister, Li Keqiang, came close to admitting that the numbers had been miscounted when he warned officials that “there must be no concealing or under-reporting.” Classified reports to Congress from American intelligence agencies have concluded that the numbers of both cases and deaths from the disease in China are much higher than the official government figures would suggest.”

https://www.economist.com/graphic-detail/2020/04/07/chinas-data-reveal-a-puzzling-link-between-covid-19-cases-and-political-events

Wouldn’t shock me in the least to find other related figures (e.g. real estate sales, inter-provincial travel, etc.) have been fudged, for the party to paint a rosier picture.

Bal

at 12:45 pm

Chris- I hear you but then why our trusted realtors are trying to present China numbers? Maybe they are trying to put a positive spin in our real estate market using China number

Chris

at 1:41 pm

“Real estate sales in China triple in March vs February – something tells me our recovery will be a bit more sluggish”

– John Pasalis

https://twitter.com/JohnPasalis/status/1248088770232147972

Chris

at 10:34 am

Today’s labor force survey printed double the number of jobs lost compared to the forecast estimate:

“Canada’s labour market sustained a historic drubbing in March as the nation reels from the widespread devastation of the coronavirus pandemic.

Employment plunged by 1.01 million from the prior month, the largest decline in records dating back to 1976, Statistics Canada said Thursday in Ottawa. The jobless rate surged to 7.8 per cent, up from 5.6 per cent in February.

More than 4 million people — or one in five workers — have already applied for emergency income support since the government imposed social-distancing measures and ordered the closure of non-essential businesses to slow the spread of COVID-19.

The numbers are worse than economists had been expecting. Job losses had been forecast at 500,000 in March, with the unemployment rate seen rising to 7.5 per cent.”

https://www.bnnbloomberg.ca/canada-sheds-record-1-01-million-jobs-in-march-1.1419622

condodweller

at 5:11 pm

First my disclaimer: I’m no economist and anything I write is simply my own opinion. I do like to inform myself and my opinions are based on a mix of opinions of others that I agree with, critical thinking on my part, and my own experiences based on previous situations which can be applied to current events.

Clearly the job losses are due to the pandemic, having said that, the severity is due to the lock down. I think most will be regained once we are back to normal. Yes, back to normal may take two years, hence my 2023 prediction.

Regarding my pessimism on RE it’s simply the low end of my range. The main reasons I think may go as low as that is that if people like the commenter above gain numbers where people will just sit and wait for lower prices where sellers may need to sell will push prices down eventually. The reason I’m divergent on my two outlooks is that the hardship may wake people up to the fact that their credit level may be too high and unmanageable when things go pear shaped and even those who were thinking of buying homes might rethink how much debt they are wiling to take on.

condodweller

at 5:23 pm

This was meant as a response to Chris/Trebber above. I accidentally hit back which reloaded my last page and lost most of my comments. I thought I hit reply on that post but it ended up at the bottom here.

Chris

at 7:15 pm

Wait, are you saying that you don’t have a PhD in economics, like the rest of us here?

The lock down is absolutely causing economic harm, but it isn’t as if the government had decided not to lockdown the nation, the economy would be humming along as if nothing had happened. Even in Ontario, they projected 100,000 deaths had they taken no mitigating efforts. Between the dead, and those who would willingly stay home, the economy was always going to get hit hard.

I align more with your view that it is going to take quite awhile for any semblance of normal to return. But even then, I think “normal” after this will not be near the same as normal before.

You touch on this in the latter part of your post; for a long time, many people acted as though risk was just a four letter word. They’ve had rude awakening lately, and I don’t expect their behaviour will revert to pre-pandemic patterns afterwards.

Even RBC’s CEO yesterday said that trade, globalization, etc., won’t return to normal after Covid-19 abates.

https://www.bnnbloomberg.ca/trade-globalization-won-t-return-to-normal-after-pandemic-rbc-ceo-says-1.1419046

condodweller

at 11:33 pm

If the Canadian government hadn’t taken the steps we would have been in the same boat as the UK. They would have been forced to take the steps once they realized that our hospitals would be overwhelmed and people would have died needlessly.

It looks like in Canada most of the deaths are similar as China i.e. mostly the elderly or people with underlying medical issues are effected. Intuitively, I don’t think the elderly on fixed income are the driving force behind spending and the economy in general.

The reason I don’t think things will be back to normal is that restaurants might see reduced business as people may pull back on spending as they get aggressive on paying down debt by redirecting discretionary spending.

For things to return to 100% “normal” we either need a vaccine or have the virus not become seasonal like SARS. As long as there is a chance for the virus to be circulating there will need to be restrictions of some sort. But even then, if the blood test can identify everyone who had it and can go back to work, we should be able to get back close to normal.

Bottom line is even the experts don’t know how it’s going to play out. There is no way to know if the virus is going to become seasonal.

Chris

at 9:40 am

You’re definitely correct that nobody knows how this will end.

I’m skeptical of a return to “normal” anytime soon because it’s sounding more and more like this lockdown, or some form of it, is going to be our reality for at least another couple months.

While the government is doing what they can to keep people fed and sheltered, those businesses and individuals who over leveraged themselves are likely to suffer big losses.

I think you and I are mostly on the same page, Condo. You talk of people finding their credit levels unmanageable, and I definitely agree. I suspect that will be one big lasting change coming out of this – waking up to risk.

Crofty

at 10:34 am

Let’s hope so.