Define “Plan B” for me, if you can.

And no jokes about the emergency contraceptive pill, okay? We’re going to keep it clean here today!

Theoretically, a Plan-B should represent a contingency plan or a backup plan that’s implemented if and when the initial plan fails. That initial plan should represent the most desired course of action, both in terms of the plan and the desired outcome, and I would also think that a Plan-B is far less desirable.

But my question is this:

Should a Plan-B be forged along with a Plan-A? Or is a Plan-B something that is only enacted, let alone concocted, once Plan-A fails?

Real estate agents alike will relate to the negotiation “tactic” whereby a listing agent, flexing on behalf of the seller, will say something like, “We’re in no rush to sell, and in fact, we don’t even need to sell. If we don’t get our price, we’ll simply keep it and rent it out.”

This is a classic.

And more often than not, it’s complete nonsense.

If the seller of a $3,000,000 home says, “We’ll just keep it and rent it out,” you can be 99% certain that this is posturing. Nobody in their right mind keeps a $3,000,000 house as an investment property, with a brutal ROI, while risking the tenants damaging the home.

And when there’s a more entry-level home, say, a $1,400,000 semi-detached, where you know that the sellers have purchased their “move-up” home of $3,000,000, for them to suggest “If we don’t get our price, we’ll keep it and rent it out,” is also 99% nonsense, since you can almost guarantee that they need the equity from the sale of the starter home to buy the move-up home.

But what about the entry-level condo market?

Is this any different?

It all depends on the owner/seller of the property and why they want to move the condo in the first place.

When a condo owner purchases a house and needs the equity from the condo in order to close the purchase of the house, then, no, they’re not going to “keep the condo as an investment” in most cases. Sure, they could probably pull the equity from the condo in the form of a HELOC to use as a down payment for the house, but they don’t want to, and the bank doesn’t want them to either.

Now, when an investor is looking to exit the space and can’t get their price, it’s very possible that they will, in fact, keep the condo and rent it out.

I’ve had a few of these situations already this year.

In January, I listed a beautiful, new, never-lived-in unit that I thought we had priced attractively. In fact, the developer for the building, who still owned a handful of units, called me to ask, “Why are you priced so low?”

But we didn’t sell.

One price reduction later, a listing agent for a competing property called and told me, “You’re crazy for pricing that low, there’s no need for that! You’re giving it away!”

But we didn’t sell.

Two price reductions later, I wonder what the listing agent for the competing property was thinking?

In any event, these clients reached a point where they determined that keeping the condo and actively managing it as a short-term rental (by the book, via the City of Toronto’s shake-down for tax revenue and control over our lives…) made far more sense than another price reduction, in a condo market where nothing was selling.

Then last week, I had a candid conversation with another condo-seller about his plans.

When I told him in April that we needed to price his condo at $499,900, he was adamant that we at least “try” $525,000. I told him that this model hadn’t sold for over $500,000 since 2023, and it was pointless, and he eventually took my lead and we listed for $499,900.

But the property didn’t sell.

We reduced to $479,900, but we barely got any showings.

Call me a salesperson here if you want, but I literally thought about buying this condo myself. For $450,000, this thing would have been an absolute steal, but of course, I’m looking back at what prices were in 2022, and I’m looking forward at what I think will be another condo boom in 2029 after four years without pre-construction sales, but I digress.

Faced with a choice: reduce to $449,900 or put a tenant in the property and keep it for another 12-24 months (remember, a one-year lease goes month-to-month thereafter, and the average tenancy for a downtown Toronto condo is about 1.5 years), the owners decided to keep the condo and put a tenant in place.

We had six offers within 48 hours of listing the condo for lease, and then a lot of clueless agents who refuse to get off their ass and show the property, and instead, send me emails like this one:

Hello,

My client is interested in leasing a property and we would like to proceed efficiently.

Please have your client review the attached documents and advise whether they are willing to provide a pre-approval prior to scheduling a showing.

We are only pursuing serious opportunities, and this approach will help avoid any unnecessary efforts for all parties involved.

That email immediately went into “Deleted Items,” and I’m proud to admit this.

It’s a form email; it didn’t even start with “Hello, David,” but rather it’s a copy-and-paste that an agent sends to dozens of listing agents before ever taking the tenant-client out for viewings.

Instead, we leased the property to a tenant who was well-qualified, who actually viewed the condo, and who was well-represented.

Well-represented? What does this mean?

This was a young agent working on a team under a very established agent who has a familiar name and a trustworthy track record. I told this young man, “The moment I saw her name in your email signature, it gave you instant credibility.”

That is what experience and reputation do in this business. I was eager to work with him and his tenant because of who they were and the connections they had. This big-name agent wasn’t going to employ a team-member who was running rental scams with fake tenants. No way.

In any event, my client went from “Seller” back to “Landlord” in a matter of days.

So as we prepare to look at the Q2 downtown rental statistics, keep in mind just how many would-be sellers have jumped back into the rental pool…

Here’s an update on new condo lease listings in the downtown core in Q2:

There wasn’t really a “trend” in Q1, per se, as we went from a 2% increase year-over-year to a 1% decrease the following month. But you could probably combine Q1 and Q2 and consider the prevailing trend to be an increase in new listings as the year has gone on.

Every month this year, save for February, has represented a high as far as our five-year chart goes.

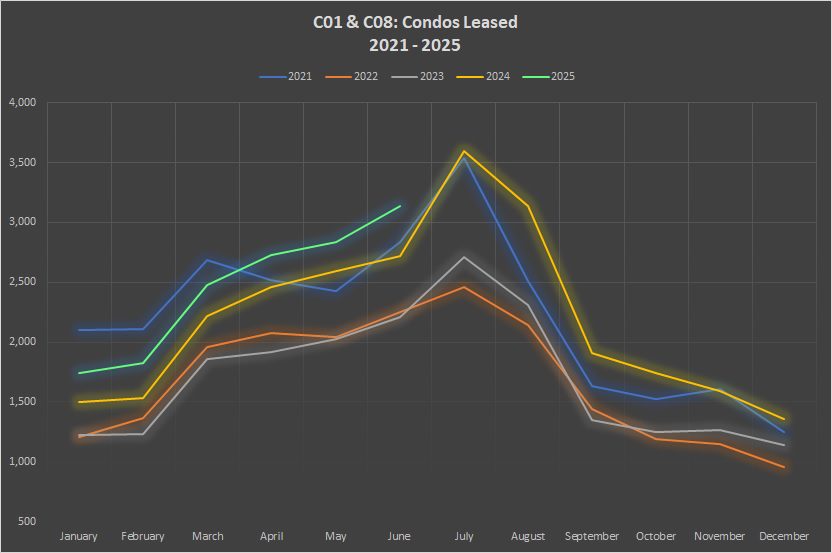

Inventory typically does increase every summer, as the following graph shows:

We saw a pretty wicked spike in July of 2024, but even without that spike, you’d note that there was, at the very least, a “peak” in July in 2021, 2022, and 2023.

Consider that most students look for a possession date of September 1st.

As a result, many of them who vacate will be doing so in June or July the following year, as they look to turn the condo over for September when their year is up.

This is why we see such incredible activity in the summer months, but it remains to be seen if we’ll see a similar spike this July.

With inventory up on a year-over-year basis throughout Q2, the question now becomes: did leasing activity follow suit:

It certainly did!

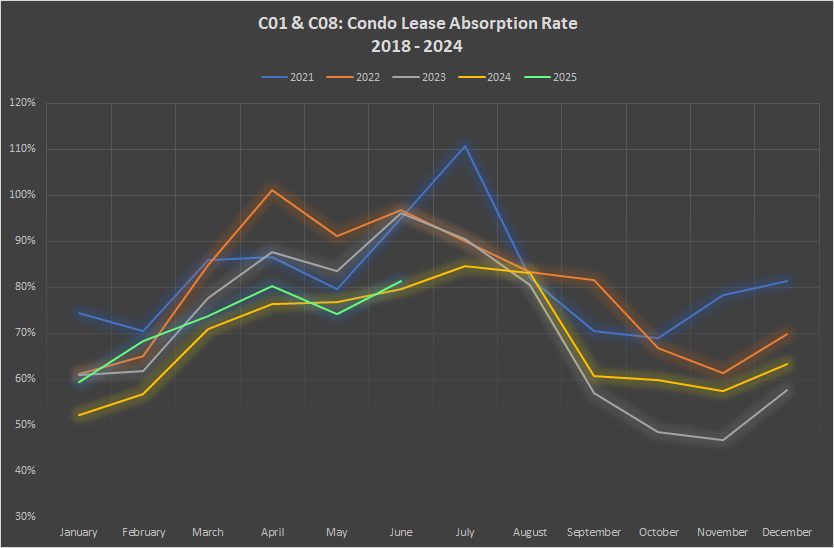

Compare the year-over-year increase in listings to leases for Q2:

April: Listings up 5%, Leases up 11%

May: Listings up 13%, Leases up 9%

June: Listings up 13%, Leases up 16%

In two of the three months in Q2, we actually saw the rental market tighten.

Our graph for leased units looks quite similar to that of new listings:

Save for 2021, the other trendlines look identical from January to June, don’t they?

In fact, the trendlines from 2024 and 2025 look absolutely identical from January to May.

All told, the most important question becomes the following:

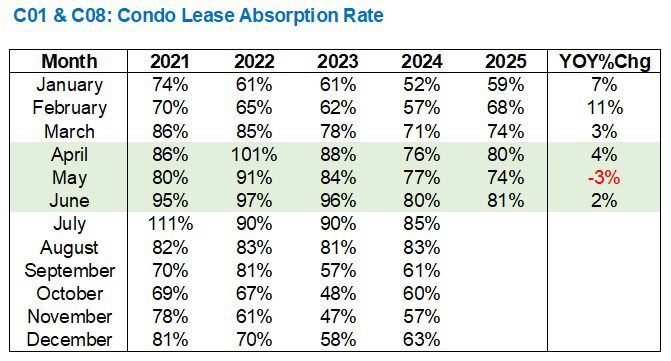

With all these would-be sellers putting their properties back on the market for lease, are we going to see a massive decline in the absorption rate?

Theoretically, if listings spike and lease activity remains the same, or does increase but not at the same pace, then our absorption rate could plumment.

Except, well, that didn’t happen…

I don’t know what the absorption rate is in Tallahassee, Florida, nor do I know what it looks like in Prince George, British Columbia. But I do think that an 81% absorption rate is high, at least on a relative basis if we compared to other areas around North America.

Now, if we only compared apples-to-apples, which is probably the most prudent thing, then we see the 81% absorption rate in June is well below 2021, 2022, and 2023.

It will be interesting to see how the absorption rate moves in July and August…

The 2025 lease market has been much stronger than 2024, and say what you want about rents, but I haven’t had any pushback with my own listings this year.

Urbanation & Rentals.ca show us that the average rent in Toronto, in the month of June, is down 5.1%. Link HERE.

But I’m not seeing that.

Every property that I’ve listed for lease in 2025 that was also leased in 2024 has achieved the same rent amount, or more.

Whether this continues into the fall will depend on just how many more condo-sellers become condo-renters…

Serge

at 8:40 am

It looks true that this market segment has been supported by students. 2022-2024 were peak student years. It is interesting that 2025 supports the numbers. Having data for 2019 would have given a better picture, I reckon…

“how many more condo-sellers become condo-renters…” – that sounds ominous…

vishal

at 7:54 am

This is really insightful—declining rents and rising incentives reflect a shifting real estate landscape in Toronto. As a mortgage advisor, I’m seeing how these rental trends can signal upcoming changes in buyer demand and interest rates. For those weighing renting versus buying, now may be a prime time to explore homeownership options. Understanding these rental shifts helps both investors and first-time buyers make more strategic mortgage decisions. Great analysis—thanks for sharing!

Patrick

at 8:00 am

Hi David – I think a really interesting topic for a future post would be comparing the economics of purpose built rental, retail investor condo long term rental, and retail investor short term rental. I assume purpose built rental benefits from longer amortization but would be interested in the difference in management vs condo fees etc.