Remember when the market was red-hot, there were 15-20 offers on every listing with an “offer date,” and listing agents got fed up with buyer agents calling and asking about the price expectations?

We started to see listing agents put disclaimers in their listings. Something like this:

**Listing Agent Is Not Able To Advise On Seller’s Price Expectations**

It was their way of saying, “Don’t call me.”

There was some debate here on TRB about whether or not this is a fair business practice.

On the one hand, listing on the MLS system means you are, by the very definition, cooperating. The RECO “Code of Ethics” specifies that you have to deal fairly with all other registrants.

But on the other hand, you have a fiduciary duty to your seller-client, and telling some deadbeat, know-nothing agent that the property, which is under listed by 20%, might actually sell (gasp!) over the list price.

It simply came down to agents saying, “It’s not my job to do your job.”

Buyer agents were saying, “This house is listed for $899,000 and I have no clue if it’s going to sell for $1,000,000, or $1,100,000, or $1,200,000. So I’m just calling the listing agent to ask what he or she thinks it’s going to sell for!”

But the listing agents were saying, “Do your job. Do a comparative market analysis. Research the area and the sales history. Network with colleagues and put your heads together. Do something other than just picking up the phone and calling to ask what the expected sale price is!”

And the crazy thing is: the expected sale price has no bearing on the acutal sales price. We could expect $1,100,000 but that doesn’t mean it’s not going to sell for $1,200,000.

In the rental market, there’s a similar practice happening, and we talked about this a lot last year.

We’ve had a bunch of rental listings so far in 2023 and every time an agent calls about a listing, it’s always the same…

“Can I run my client’s profile by you?”

That’s right; they want me to somehow “approve” their client on the phone, before they’ve made an offer, and before they’ve even booked a viewing.

And what do you do when the client profile is a disaster?

“My client is a young, single woman, currently working part-time downtown but receiving government assistance which should be able to cover the rent.”

Should?

“She has a lot of debt but that’s because an old partner of hers racked up huge bills under her name and then left and stuck her with it.”

Go on…

“She’s looking for a fresh start. She wants to reinvent herself.”

Okay.

And she wants to do that in my client’s upscale downtown Toronto condo?

I’m sympathetic about the state of our housing problem in this city. But only to a point.

What do you do when you receive this call:

“Hi David, my clients are newcomers and they’re amazing people, I personally vouch for them, it’s just that they have no credit history in Canada and neither has found a job yet but they’re out there every day, pounding the pavement!”

Again, I sympathize.

But I can’t advise my clients to rent an investment property to people that are unemployed.

Show this blog to some people that lean far “left of centre,” and they’ll call me a monster. But it’s not the job of the private sector, via individual property owners, to house these folks. And this probably leads back to the conversation about “where we’re going to house the 500,000 people that come to Canada every year,” but that’s a topic for another day.

Another topic might be why everybody assumes they can, should, or deserve to live in a downtown condo, but that too takes off far off point.

A regular feature here on TRB, written every quarter, is about the downtown condo rental market and how listings, leases, and absorption rate look on a relative basis.

When we ran this feature last October, we were looking at a rental market that saw both listings and leases down significantly from 2022, but the trend was toward a slightly softening market.

Let’s look at how things progressed into the fall.

First, the number of new lease listings:

We started 2022 with lease listings having plummeted, down by 30% in Jan/Feb, and that trend continued into the summer.

While Q4 still saw fewer lease listings in each of Sept, Oct, Nov, the year-over-year declines aren’t nearly as steep as in previous months.

Overall, you can see the trend – from a 30% drop in January, through an 11% drop in December, shows a market that saw inventory pick up as the year went on.

It’s so hard to look at the data and not compare to 2020, but the “pandemic year” makes just about everything look like an outlier.

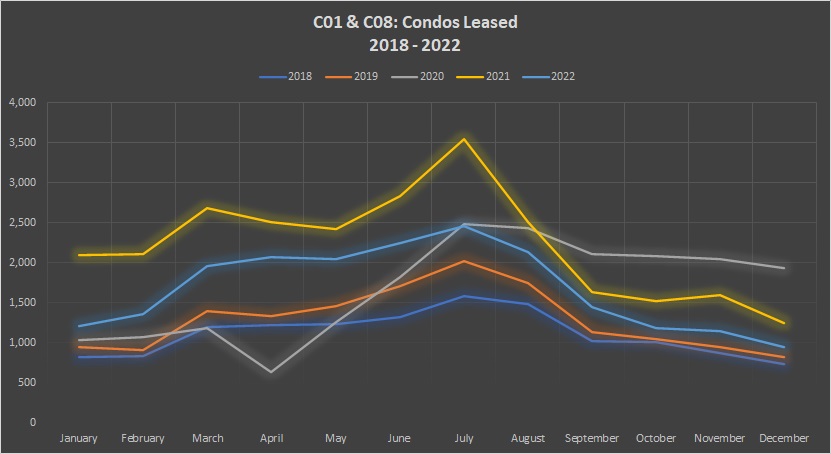

Viewing the data graphically, we can see that 2022 fell pretty much right in between the non-pandemic years of 2018, 2019, and 2021:

We’re almost splitting hairs by the time November and December roll around, and we know that December is a very slow month.

I had one set of clients that closed on a house purchase in mid-December and subsequently listed their condo for lease four days before Christmas. We didn’t have a single showing booked until the New Year.

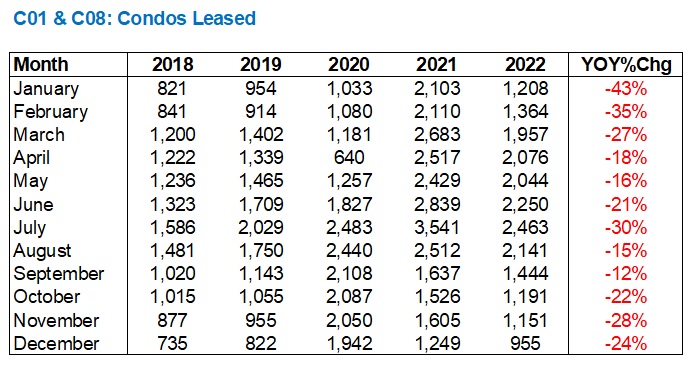

Looking at the condo lease data, we see a bit of a different pattern than that of listings.

Again, we started the year with a huge decline – January leases were down 43%, year-over-year, and that led to 35% in February and 27% in March.

But whereas with lease listings, the year-over-year percentages dropped as the year went on, we see with condos leased that the decline subsided in the summer and early fall, but then reverted back to a larger year-over-year decline in Q4:

Only down 15% and 12% in August and September, but down 22%, 28%, and 24% in October, November, and December respectively.

We had a lot of lease listings in Q4 and they all got leased, most with multiple offers. The only “tricky” ones were the freehold units, like a basement apartment or the second-floor of a house. The condos were easy to lease, so I’m surprised by the data above.

Graphically, you can clearly see the difference; that leases were higher than 2018, 2019, 2020, and 2021 in the first half of 2022, but then fell off substantially:

By December, we saw leases fall right into the middle of a five-year look at the downtown rental market.

What does that mean for 2023?

If the trend continues, we’re going to see a weak rental market moving forward. Through the first three weeks of 2023, I haven’t seen what I would call “weakness,” but it certainly hasn’t been strong.

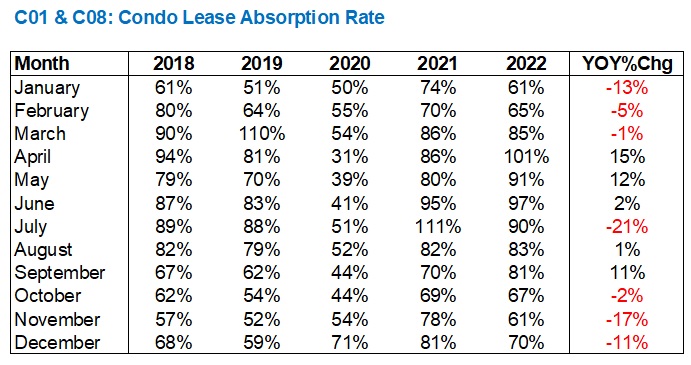

The intersection of leases/sales is where we really see how Q4 finished up.

July looks like a ridiculous outlier in this chart, otherwise, we see a year that started weak, picked up, and then finished even weaker:

The absorption rate throughout Q4 was down from 2021, albeit up from 2019, 2019, and 2020, but if we want to admit our recency bias and just compare to 2021, the market looks a bit weaker.

Seeing year-over-year weakness in Jan/Feb/March, then Oct/Nov/Dec tells us that if the first two months of the year are often weak, then based on what just happened in Q4, we should expect a very week January and February this year.

Graphically, we can see how 2022 had peaks and valleys compared to the previous years, with our light blue line moving up, over, and back again:

An early look at January’s data tells me I’m probably not off base.

To date, there have been 1,387 new listings for downtown condos and 670 leases.

That’s an absorption rate of only 48%.

If this trend continues through the end of the month, we’ll see the lowest absorption rate in January in the last five years. The rate would be 13% lower than 2022, which was 13% lower than 2021.

The crazy thing is: prices haven’t come down.

Here’s what the president of Urbanation, Shaun Hildebrand, had to say:

“The Canadian rental market had one of its strongest years ever in 2022, more than reversing any weakness experienced during the pandemic. Rental demand is primarily being driven by a quickly growing population that is finding it increasingly more difficult to afford homeownership or find suitable rental housing. Looking ahead for 2023, rents are expected to continue rising, but less heated growth can be expected as the economy slows and new rental supply rises to multi-decade highs.”

And here’s what Paul Danison at Rentals.ca had to say:

Year over year, average monthly rent in December for a one-bedroom in Toronto was up 21.3% and up 18.1% for a two-bedroom. But month over month, average rent was down in Toronto in December for a one-bedroom home by 3% and down 3.9% for a two-bedroom.

In Toronto, average rents were up 22.7% year over year in December to $2,775.

Ontario average annual rents were up 15.5% for purpose-built and condominium apartments in December.

So we’re seeing the absorption rate of condo rentals falling, and yet prices are still going up.

I would hate to think what happens when the absorption rates start increasing again!

Let’s see how things look when we revisit this feature three months from now…

Ace Goodheart

at 9:43 am

“Show this blog to some people that lean far “left of centre,” and they’ll call me a monster.”

Toxic socialism seems to be showing its cracks more lately .

Also it is just completely nuts. Went to see where Ford actually authorized all the new houses to be built, on the greenbelt. Well, folks, it is not a paradise. There are no flamingos there. No waterfalls or stunning scenery. It’s a field. Across the street from a massive urban area. Looks like it has already been mostly cleared. It may be green in the summer, but that would just be the weeds. No towering oaks or majestic maples.

The thing to remember about socialism is, it thrives on crisis. There must be a continuous state of emergency. If a government, listening to the socialists, says “OK, we need more houses, then we can build them on the other side of the street, all the services are already there, schools, stores, doctors’ offices” then the socialists reply “no, that is protected green belt land!” The socialists now have a new “crisis”.

Housing crisis – solved. Just build more houses.

But now we have a greenbelt crisis. Get out your protest signs……

I think people are just getting tired of it. A lot of people are like “this is just dumb, these people complain about everything…”

Appraiser

at 8:03 am

Ford knows his audience. Buck-a beer. Weed shop on every corner. Gamble till you drop.

That’s Ontario – that’s who voted him in.

Geoff

at 12:29 pm

That to me seems simplistic – PC’s won with 40% of the vote, almost what the liberals and NDP got combined. I drink imported beer, don’t smoke weed and don’t gamble. But yet I voted for him and I think a lot of other people like me did too.

JF007

at 10:03 am

Rents keep going up cuz immigration keeps going up..younger generation as well as immigrants want to live in toronto..additionally as interest rates are high carrying costs are high and anything built after 2018 i think is anyway not under rent control so there you have it an ever increasing rent cost which ultimately would mean that “house” will be inherited in future Vs being able to buy your own and people wither will be afford to live in a condo or just rent for all their lives..again which isn’t a bad thing as we have seen in lot of the developed world where people tend to buy house either much later in their lives or live in a condo their whole lives. My folks built their first home just as they were about to retire that too cuz they were able to score a land lottery..meanign they did pay market price for the land but were luck to get a call up for that plot out of hundreds others..but beside that when my grandfather passed away he left inheritance for all the kids to divvy up which included a house

Marina

at 10:05 am

I’m a huge proponent of social housing. But “social” means it’s done on the back of the government, NOT on the back of individuals.

All the examples you gave should be housed – maybe in government housing , maybe through some kind of rent guarantee program, subsidy, what have you. But making it a single landlord’s problem is not socialist. It’s a cop out.

KB

at 3:02 pm

As someone who bought a house in Toronto this winter, the “what does your seller expect” question is actually totally reasonable. Look at the sales rate – the *majority* of houses listed this fall and winter never ended up selling. That is, the sellers were not actually willing to sell their house at the market-clearing price. *I* had a good read on where the market was and what comparable houses were selling for. It was (some of) the sellers who were deluding themselves into thinking their house would sell for 20% above comparables.

I had many discussions with seller’s agents where, privately, they confided that they were having a tough time convincing their clients to look at decent offers. In those cases, it’s useful both for me and for the seller to make clear that the seller is actually trying to sell their house, and not just listing at the February price, wasting everyone’s time for two months, then pulling the listing.

(Lastly, on rent: inflation-adjusted average rent in Toronto is exactly where it was in 2018, and not far off where it was ten years ago. The big change was a massive drop in 2020, and then an equally massive runup last spring/summer. Since we got “back to trend” in July, rent prices have been roughly constant.)

Appraiser

at 7:57 am

“back to trend” in Toronto means expensive. Very expensive.