Am I the only one that’s bullish on the downtown condo market?

That wasn’t rhetorical. It also wasn’t sarcastic…

The downtown Toronto resale market is not very good right now, and by “not good” I suppose I mean “not hot,” but we’ve been so spoiled for so long that anything short of a hot market is often referred to as a “bad” market.

The stats that I will show you today are somewhat bleak.

Having said that, and at the risk of sounding like a cheerleader, this is exactly why I think now is the time for some first-time condo buyers or investors to get into the market.

Yup. I just lost some of you there. But come talk to me in a year and we’ll have this conversation again.

On Wednesday, we saw the second interest rate cut from the Bank of Canada in as many months, and whether there is a third cut on the way in September, the Bank of Canada has clearly signaled that we are entering a cycle of quantitative easing.

After seeing the Bank of Canada’s key lending rate increase from 0.25% in March of 2022 up to 5.00% in July of 2023, we’re now seeing the Bank of Canada unwind.

Canadian unemployment rose last month to 6.4%. The Bank of Canada can’t allow that figure to get any higher, especially as the U.S. unemployment rate is only 4.1%.

Inflation has declined from a peak of 8.1% in June of 2022 to 2.7% last month.

More interest rate cuts are coming.

And personally, I’m looking to add a third investment condo this year.

So tell me I’m full of crap and that I’m cheerleading the market – in the face of these bleak stats, but I think that the smart money buys ahead of the market turnaround; not after it.

I’ve used this example before, but here goes.

A product is trading for $100.

The value declines to $90. Then $80. Then $70.

At this point, most buyers naturally fear a decline to $65, then $60, and so on.

Smart money will buy in at $70, and if the product value does decline to $65 and then to $60 before the turnaround, then so be it.

But what does most money do?

It buys back in at $85 after it’s certain that the turnaround has begun.

Fear is a huge part of any market and there’s a lot of fear in the market right now.

But not every property in the city is “in trouble.” Literally only a handful, and most people who purchased their properties over the last few years are doing fine.

The exceptions to the rule are the opportunities, in my mind. And I have a whole list of them.

On Wednesday afternoon, Tara and I went to see an east-side condo that’s listed for $499,900. The current owners paid $575,000 for the unit in June of 2020, then got stuck without a tenant during the pandemic, then had to lease it for peanuts. They carried this unit – with the same tenant, for $1,400 per month when it was worth $2,200, for four years. The tenant finally left and then they tried to sell.

I think this condo could be had for less. Not everybody was meant to be a condo investor, and it’s clear that these folks “have to” sell.

Imagine getting that condo for $475,000? It’s a steal. And at $820 per square foot, I compare this to the pre-construction trash that sold four blocks away for a ridiculous $1,650/sqft pre-pandemic, and I wonder, “Ten years from now, won’t these gaps have shrunk?”

Anyways, that’s enough from me. But if you want to hear more, Friday’s podcast is on this subject, as is Thursday’s Pick5.

Now let’s dive into the condominium stats from Q2, starting with the sales.

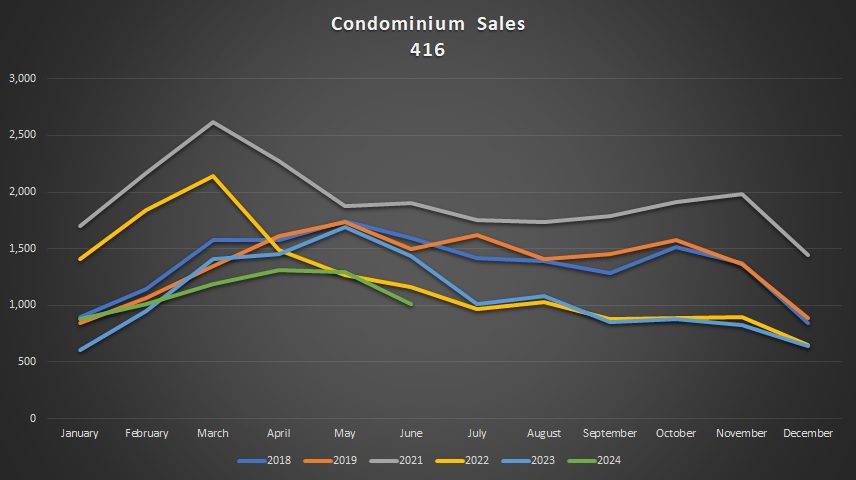

Here’s the 416:

As you can see, 2024 started out better than 2023, with a 46.2% year-over-year increase in January and a 6.5% year-over-year increase in February.

But it declined from there, as we saw in this space three months ago, with a 15.9% year-over-year decline in March.

That decline in March led to 9.9%, 23.4%, and 29.4% declines in April, May, and June respectively.

While sales boomed in 2021 and for the first half of 2022, it’s worth noting that 2024 sales in the Q1 & Q2 lagged even 2018, and 2019. There were 6,703 sales in the first six months of 2024, compared to 8,523 in 2018 and 8,097 in 2019.

As you’ll see from the chart below, 2024 is lagging the previous half-decade in the 416 condo market:

The trend is always down from June to July, save for 2019, but how much lower will that light green line go?

This remains to be seen.

Sales typically decline in the second half of the year but maybe, just maybe, a third interest rate cut in September will help with affordability in the lower-end.

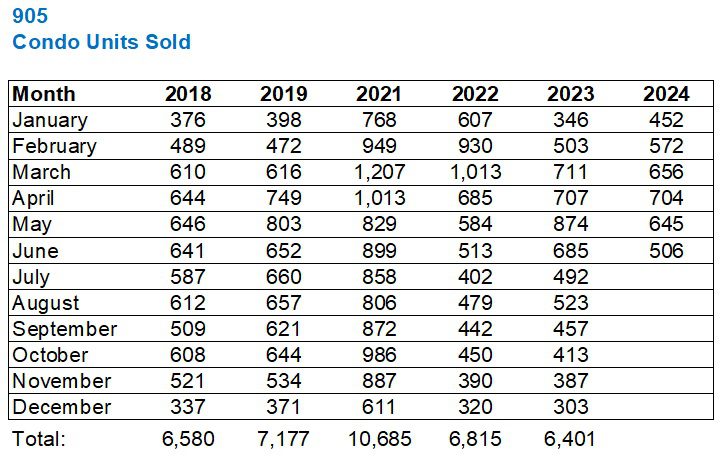

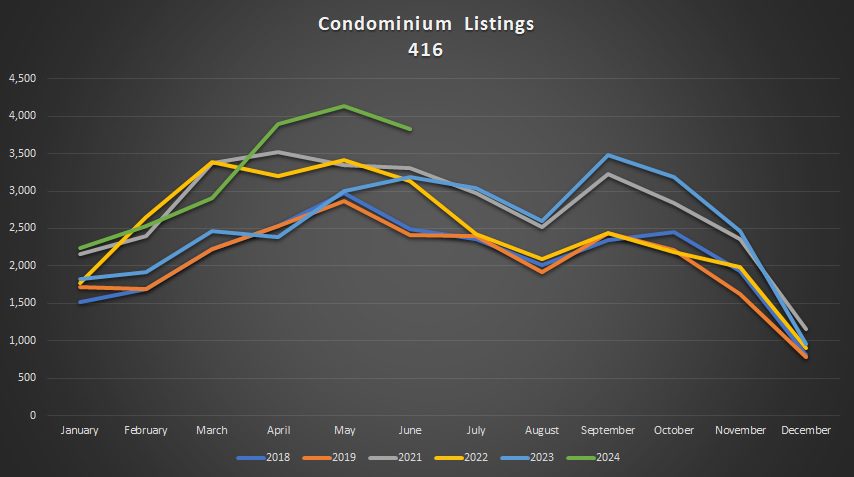

The 905 sales stats trace the 416:

As with the 416, sales in the 905 were higher in January and February but lower in March through June.

Year-over-year declines of 26.2% and 26.1% respectively in May and June line up with the corresponding 23.4% and 29.4% in the same months in the 416.

If these charts tell us anything, it might be that 2021 was simply a year on steroids:

Then again, they also tell us that 2024 is shaping up to be even slower than 2023.

Sales are down. We know this.

But what’s happening with listings?

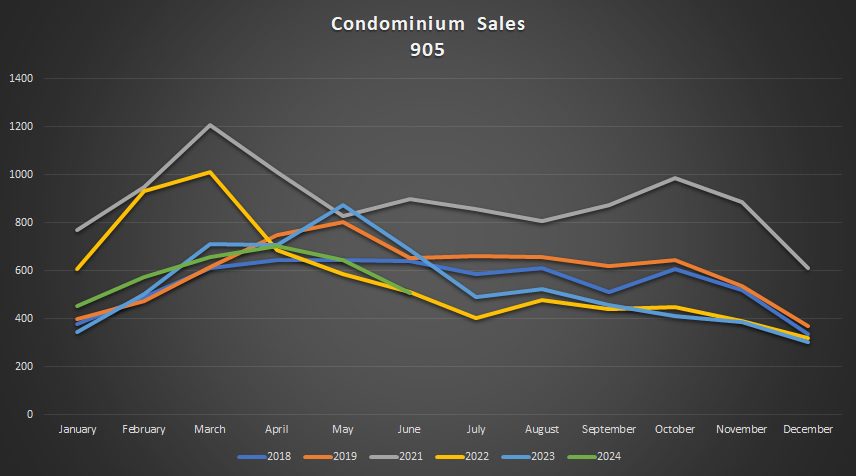

Here’s a chart that tells a tale:

New listings in the 416 were higher in each month of Q2 than any year in the previous five years.

Not only that, the average number of new listings in January through June, 2018 through 2023, was 2,577.

In 2024, it was 3,253.

That’s an increase of 26.2% per month.

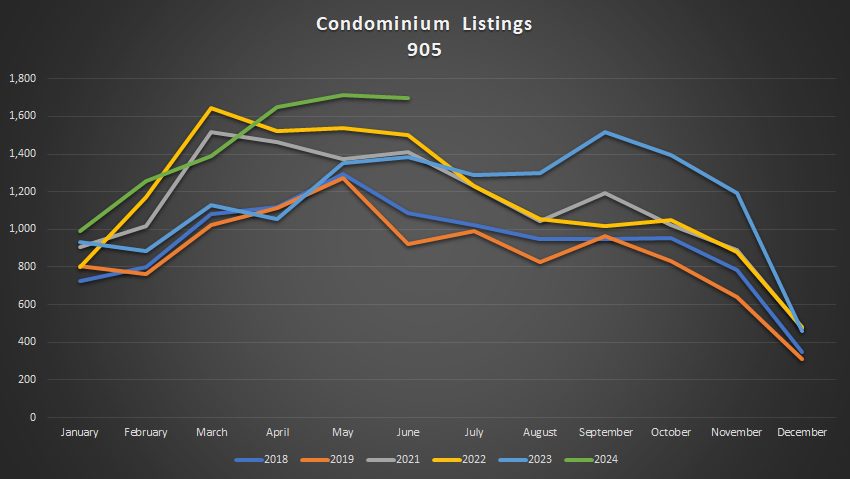

The 905 chart is quite similar:

The only real difference here is that new listings declined by only 0.9% from May to June in the 905, as opposed to 7.5% in the 416.

Interestingly enough, if we run the same exercise as we did above in the 416 – looking at the average number of new listings from January to June, 2018 to 2023, and compare that to the average in the first half of 2024, the number is almost the same: 25.6%.

That’s an average of 1,154 new listings, January-June, 2018-2023, versus an average of 1,450 in the first half of 2024.

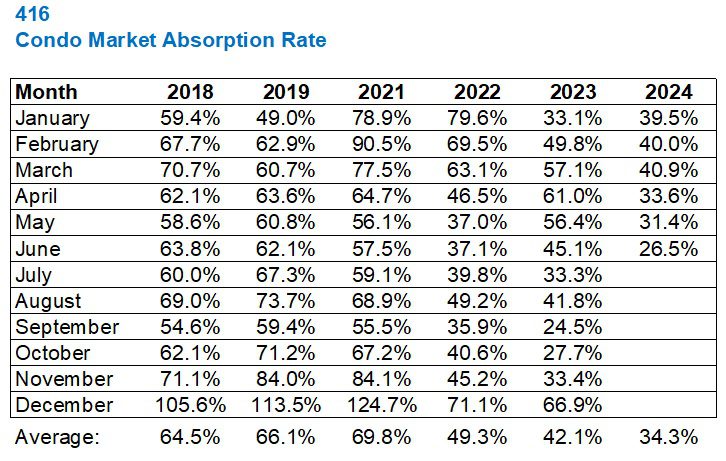

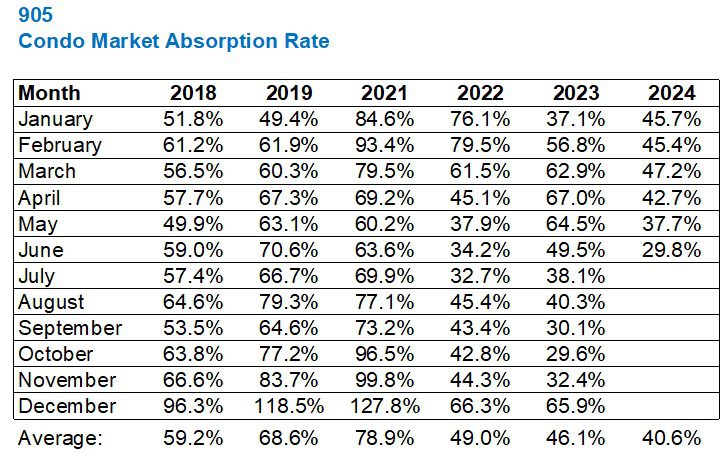

But I’ve saved the most startling statistic for last: the absorption rate.

In this space three months ago, we marveled at the approximately 40% absorption rate in the 416 in Q1, which was the lowest in our data set from 2018 onward.

Fewer sales and more listings meant that figure was going to decline:

Yep, 26.5%.

That’s a figure that jumps off the page to me!

The only month in the previous five years that saw a lower figure was 24.5% in September of 2023.

In theory, anything below 50% signals a “buyer’s market,” as we have discussed.

But 24.5% should, in theory, mean a firesale.

As noted in many of the mainstream media articles, most sellers are simply holding firm on their price. But as noted in my opening of today’s blog, there are a handful of sellers showing their pain!

This chart doesn’t inspire confidence:

This chart also might not inspire people to call me and say, “David, can you please list my condo for sale tomorrow?”

But I’m not telling anybody to list tomorrow. In fact, I have suspended three listings in the past ten days with plans to re-list in September.

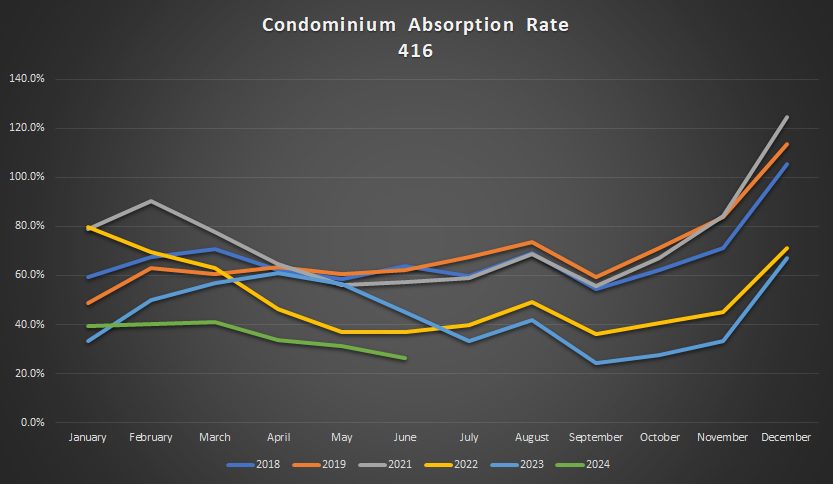

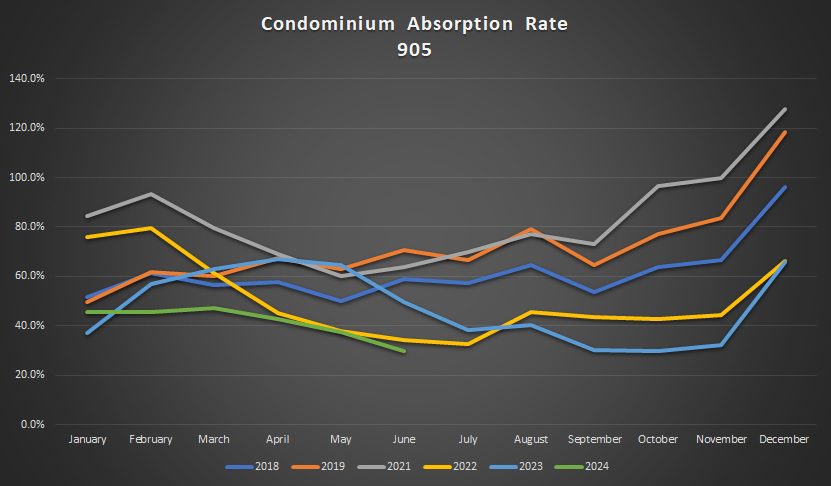

In the 905, the data isn’t quite as poor:

With an average absorption rate of 40.6% through the first half of 2024, the 905 is well ahead of the corresponding 34.3% figure in the 416.

I’m definitely a “visual person” and this chart isn’t as bleak as the one above for the 416:

Nevertheless, both charts are showing all-time low absorption rates, or close to it, as in the case of the 416.

Part of the reason that sales are down is because many sellers are holding on.

I had two clients list their condos for sale in Q2 and decide to rent them instead.

Not everybody has that option, and there’s certainly no guarantee for next year, but many are looking at the risk/reward scenario and deciding to hang tight.

While I know that many market bears are laughing when they hear, “It can’t get any worse,” I do believe that we are at the trough of the weakness in the condo market. We have long surpassed the trough on price, since condo prices are higher than they were in late-2023 and early-2024, but I think we’re at the trough of the absorption rate, which impacts the ability for a buyer to secure a “deal” out there.

There are deals, if you look hard enough.

No, I don’t mean the pre-construction condo assignment for $1,500/sqft from the lunatic who paid $1,650/sqft in 2019.

I mean deals in the resale market, where we are currently seeing a massive disparity in price declines from building to building.

As for the update on our Bank of Canada Interest Rate Game, let me get back to you on Monday! 🙂

Derek

at 3:15 pm

Re: your plans to invest, I wouldn’t bet against you.

—

What do you mean when you say, “Part of the reason that sales are down is because many sellers are holding on”? Isn’t there literally a record number of condo listings on the market?

JF007

at 4:34 pm

Would like to unpack the statement as well..i wonder if splitting the numbers by type of condo and age would tell us something e.g. is the number of new listings being driven by more “investor” type condos studio, 1 beds under 500 sq ft or thereabouts hitting the market..especially ones bought at peak and now are under the water and hence in the market..or are these older larger size ones…

Derek

at 5:52 pm

Per Urbanation July 2024, very few larger (3BR condos) are held by investors:

“The bigger the unit, the larger the negative cash flow position. Studio units were effectively cash flow neutral on average for condos completed in 2023, compared to negative cash flow averaging $523 for one-bedroom units, $734 for two bedroom units, and $866 for three-bedroom units (Chart 13). This provides some insight as to why investors favour smaller units, and the scarcity of rental options in the market for larger units. Only 3% of condos completed in 2023 that were held as rental investments were three-bedroom units.”

David Fleming

at 5:20 pm

@ Derek

Holding on – in terms of their price.

A lot of listings are 90+ days on the market with no price change.

Derek

at 7:17 pm

Ahh I see ty

Ace Goodheart

at 9:16 pm

As the great one once said, be fearful when others are greedy, and greedy when others are fearful.

This is setting up to be a really good time to buy a condo.

Lousy time to sell one. But hey, if you’re buying and they’re selling, it sucks to be them, right?

Derek

at 11:08 pm

I wish columnists would focus exclusively on the well healed buyers during down markets and then the wind-falling sellers during rocketing markets. Not the losers, yuck.

Vancouver Keith

at 11:38 pm

David, any tracker on the “relisting rate” for properties. I can see on Zolo in Vancouver it’s rising from nothing to commonplace.

RICK MICHALSKI P.APP ACCI

at 7:38 am

Once you make adjustments for the very very large number of listings that are sellers testing waters at peak price, actual listing numbers are very low.

With Bank of Canada interest rate dropping like a stone now as I predicted demand will go from high to white hot and we will see prices shoot up

Now is the time to buy if you dont want to miss the boat!! Great decision to invest!

johnnychase

at 1:48 pm

Interesting post Dave. Now I notice there are 12 condos listed on the downtown east side for $499K. I wonder if at some point you could explain how you, as an investor would assess these options and your view on which ones are better investments than the others and why.

David Fleming

at 5:24 pm

@ Johnnychase

My offer is live right now – Friday afternoon.

If this goes through, I’ll tell the whole story in a week or two.

In terms of the evaluation criteria, price per square foot is important to me if for no other reason than the absurd pre-construction prices out there right now.

But there are a host of other factors which I’ll explain. Actually, looking at all twelve of the $499,900 listings would be a great blog post! I can’t “advertise” other listings but it could be a cool idea. Let me mull that one…

David Fleming

at 3:53 pm

@ Johnnychase

Update – I’m in the office on Saturday afternoon going over these twelve properties and this is REALLY fun! I’ll be a blog post in the next couple of weeks.

Thx!