Here’s a story that offers a microcosm of the 2025 real estate market thus far, but a story that by year’s end might provide answers to some of the largest questions as we look back and reflect.

Three months ago, I listed a small, 1-bedroom condo in King West for $499,900.

We were priced attractively, but not attractive enough as it would seem, considering the condominium market here in Toronto is in true “bear” territory.

After two months, we reduced the price to $479,900.

Still, no takers.

One month later, with our listing still sitting on the market for $479,900, an incredible thing happened! No, we didn’t receive an offer. That would have been incredible. What was truly incredible, or incredulous, was that the identical model to ours, two floors lower, came up for sale for $599,900.

Huh?

What gives, right?

It was actually my seller-client who first alerted me to the listing with an email that said, “David, what the heck is going on here?”

It wasn’t a typo. It wasn’t a mistake. It was, as I explained at the onset, a microcosm of the 2025 market – one that needs a little bit more explaining…

My client emailed me and said, “Are we under-priced? Are we giving this thing away?” It’s human nature, right? When you see a competitor at $599,900, and you’re listed for $479,900, your human nature drives you into protection mode and seeks to ensure you’re not being taken advantage of.

But consider that we had been on the market for three months already, unsold! If we were really “giving” the condo away, we’d have sold it the very first day to one of many lucky lottery winners.

So what was really going on here?

In a word: craziness. Or insanity. Is that better? How about stupidity? Or entitlement? Naivety? Inexperience?

I could go on and offer a dozen more words to explain the situation, but collectively, they offer an even better explanation.

In short: there was absolutely, positively, no reason for this competing condo to be listed for $599,900. Our unit was identical and wasn’t selling at $479,900, which means it’s probably “worth” $450,000. For another seller and listing agent to put the same model up for sale for $599,900 is tantamount to listing for $699,900, or $799,900, or ten billion dollars. This is to say that they simply shouldn’t bother.

All over the city of Toronto, properties are being listed for prices that make absolutely zero sense, and I’m not talking about a house that’s a bit over-priced, or another property with a built-in negotiating cushion. I’m talking about sellers and listing agents that are doing things that serve absolutely zero purpose.

Just think about it, for a moment: if our condo wasn’t selling at $479,900, for a seller to price at $489,900 might not make sense, and $499,900 surely doesn’t make any sense. But to price at $599,900 defies all logic, intelligence, and grasp of reality.

And yet, this is happening with regularity. I’ve seen it time and time again.

This time around, however, curiosity got the best of me, so I called the listing agent for the $599,900 condo and asked, “How did you come up with your price?”

He said, “Well, it’s the price my seller needs.”

I asked him, “Did you see that the same model is up for sale for $479,900?”

He didn’t realize I was the listing agent for that unit, and simply offered, “That listing has no bearing on our listing, our list price, or what we need in order to sell.”

And with that comment, he demonstrated that he misunderstood the very basics of how a market works.

What a seller “needs” is as relevant as what a seller “wants,” which is to say that both have absolutely relationship to value.

With sales nearing historic lows in this city, I continue to write on Toronto Realty Blog about the growing divergence between what buyers will pay and what sellers want, and how this is the biggest reason why more properties aren’t trading hands. It’s not about affordability, interest rates, the economy, or “Trump ‘n Tariffs,” but rather it’s about a real estate market that increased for two decades, and sellers who refuse to accept that prices have come down – even moderately, from that historic peak.

So without further ado, let’s get to the condo statistics.

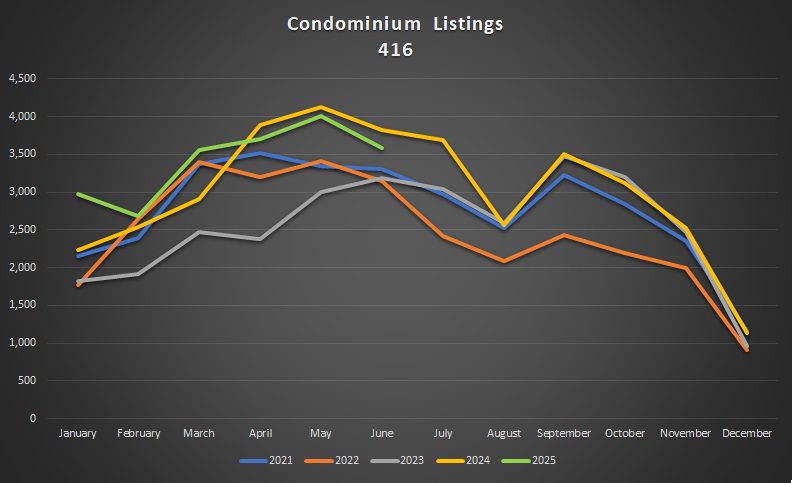

First, let’s look at total listings in the 416:

Listing activity has been picking up steadily through the spring, although it seems as though we might have peaked in May.

New condo listings were up 4.0% from March to April, then 8.5% from April to May, before falling by 10.8% from May to June.

And while the 2025 trendline was above that of 2021, 2022, 2023, and 2024, it’s actually pulled below 2025 in Q2 as you can see from the chart below:

Less inventory is a good thing if sales are keeping pace.

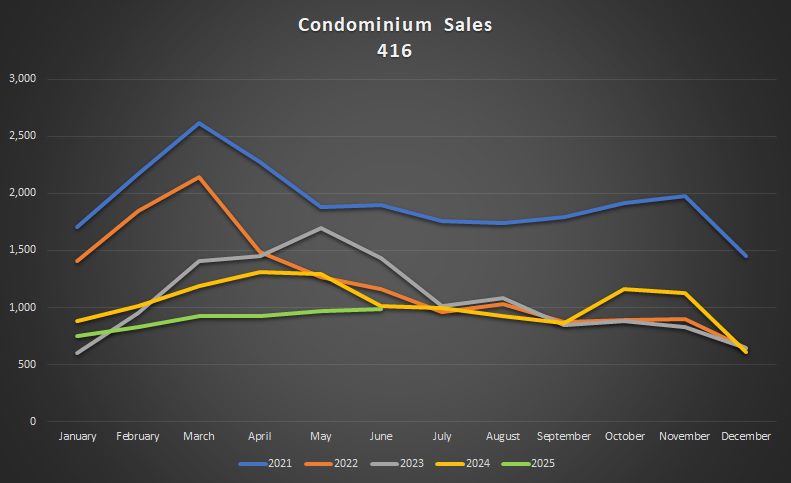

However, as you’ll see from the next chart, sales most certainly are not keeping up with 2024…

Not to put too rosy a spin on this, but consider how these sales looked on a year-over-year basis, from January through June:

January: down 15.4%

February: down 18.1%

March: down 21.8%

April: down 29.3%

May: down 25.0%

June: down 2.4%

As you can see from the graph below, sales typically taper off in June, but they increased this year:

The June sales data is in line with 2024 and 2022, while trailing 2021 and 2023 significantly.

But working backwards, we see that both April and May were nowhere close to the previous four years.

When it comes to the 905, the data is, in my opinion, far more shocking.

Here’s the listing data:

We saw record listing numbers in every single month, January through June, which was not the case in the 416.

We’re on pace for almost 22,000 new condo listings in the 905, which would obliterate last year’s total of 17,266.

Displayed on a chart, the above data becomes all the more eye-popping:

That green line is shocking!

It’s nowhere near the trend; not in any single month, nor does it seem like it’s ever going to fall in line.

Say what you want about the overall condominium market, and say what you want about the 416 or downtown, but I’m seeing real weakness in the 905. There’s just way too much inventory!

As for sales, the data isn’t great:

Interestingly enough, June sales data pulled in line with 2022 and 2024, as was the case in the 416.

This chart doesn’t look quite as bad:

This almost makes sales look like they’re starting to fall in line.

Almost.

But you have to take the massive number of new listings into consideration when looking at the overall health of the market.

To understand that level of health, or where we sit in terms of “buyers vs. sellers” market, we want to look at the absorption rate.

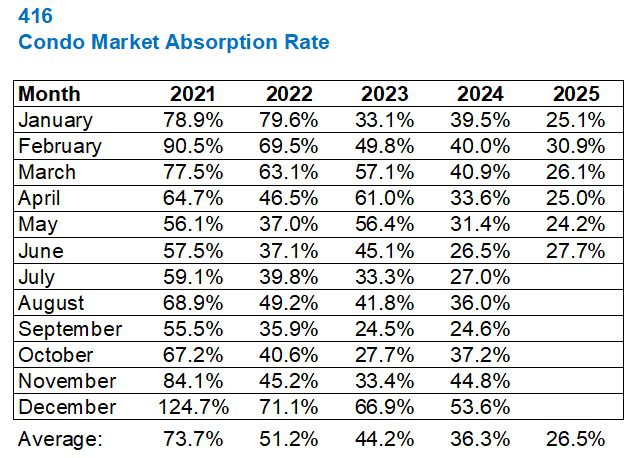

Looking at the ratio of sales to new listings, we’re coming out of Q1 where we saw the absorption rate drop below 30%, which is just wild.

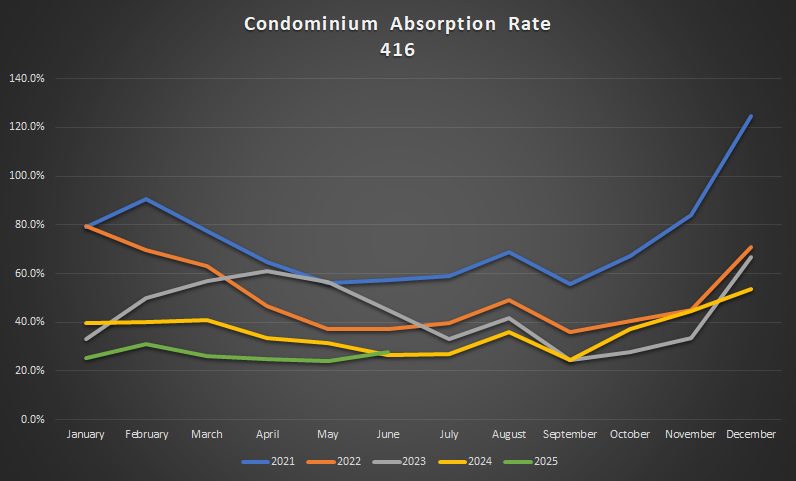

That trend continued in the 416:

We saw a slight uptick last month, as the absorption rate increased to 27.7%.

But to put this in context, that 24.2% absorption rate in May was the lowest I have ever seen. It narrowly beat out the 24.6% recorded in September of 2024.

Look at the average so far in 2025: it’s sitting at 26.5%.

The absorption rate has been steadily declining from 2021 to date, and while you might consider these, “famous last words,” I have to think 2025 will represent the bottom.

The graph demonstrates one positive takeaway from Q2, if you will…

That’s right: the June absorption rate surpassed that of the same month last year.

Not much to write home about, but if you really wanted to try, you could consider this the beginning of a trend.

In the 905, the data followed a similar path:

As with the 416 data, we saw the absorption rate increase from May to June.

But unlike the 416 data, we didn’t see the 2025 absorption rate surpass that of 2024.

Perhaps that’s completely insignificant, save for the “green line not passing the yellow line” in our graph:

The bottom line is: the absorption rate int he condo market has never been lower than it’s been for the past six months.

I can try as hard as humanly possible to find some difference between Q1 and Q2, but there really isn’t one.

When looking at the Q2 data, there are two major conclusions or areas of focus for me:

1) Listings in the 905 are out of control. The chart makes this absolutely clear.

2) Maybe, just maybe, condo inventory in the 416 is starting to be absorbed a little faster. The chart also makes this clear, but to be fair, it could only be one month.

Now, how does this affect the rental market?

That’s a topic for next week. Stay tuned!

Serge

at 8:45 am

Is it the first time the stats on condos presented without PRICE?

Derek

at 9:16 am

No, it’s the same format as usual, as far as I can tell.

Serge

at 11:20 am

Ah, ok.

JF007

at 9:46 am

Condos last 5 years or so are directly correlated to investors and immigration more so in 905 than 416 i think. With student immigrants down by more than 50% theses condos are now massively under water and hence the rush to sell from mom n pop investors who got advised by their cousin or their cousins newly minted realtor kid that this was the best investment out there. Overall i think next 3-5 years will be a rocky ride for the condo market till dearth of project starts will hit hard in GTA.

RICK MICHALSKI P.APP ACCI

at 9:57 am

Spot on insights as always David!!! Fully agreed with you The condo market just like the overall market continues to tighten and inventory remains very low once you account for all the listings that are just sellers testing the waters at beyond top top top dollar. Bank of Canada will keep dropping rates and market will only accelerate from here. Toronto prices proove resilient for the 25th year in a row!!!!

KM Realty Group LLC

at 7:56 am

Great update! The GTA condo market seems active in 2025. Do you think prices will go up more this year?

RICK MICHALSKI P.APP ACCI

at 11:56 am

Yes market is extremely active and real inventory very very low its obvious from Davids data that prices will go up even more this year and most likely very quickly!!!

Steve

at 9:57 am

I wouldn’t be so sure interest rates will be declining soon, or all that much.

Incredulous

at 11:36 am

A weird example of this is MLS® Number: C11904704.

This has been on and off the market for well over a year at various prices around 600,000 and was featured in the Toronto Star at least once. It’s a one bedroom and was relisted recently at $999,999.

The seller is also someone who “cannot afford to sell for less” than he paid for it. I can’t imagine what he thinks will happen.

Jesse

at 5:46 pm

Posted elsewhere in various forms but “investors” (speculators) were buying in the GTA a couple years back not looking at the sticker price in terms of value but looking at it in terms of greed of a 10% yearly increase in value and at least ability to rent it out to pay a slight income. Those days are gone.

Haroldcup

at 10:19 am

1xBet промокод что дает является эксклюзивный код, который дает игрокам возможность получить эксклюзивным предложениям при регистрации и использовании услуг букмекерской компании 1xBet. Этот промокод открывает доступ к широкому спектру предложений, таким как бонусы за регистрацию, бонусы на депозиты, free bets и другие специальные предложения.