If the 2025 real estate market will be remembered for anything, it could be a little something that I call, “The great realization.”

Let me explain…

Back in January, we had a listing down in Leslieville, which was a fantastic “first-time freehold buyer” property, for which the target demographic was couples in their mid-to-late 20’s.

We hosted an open house on Saturday and Sunday, as is the custom, and we were absolutely slammed. Without exaggeration, I’d say we had fifty groups through the house in total.

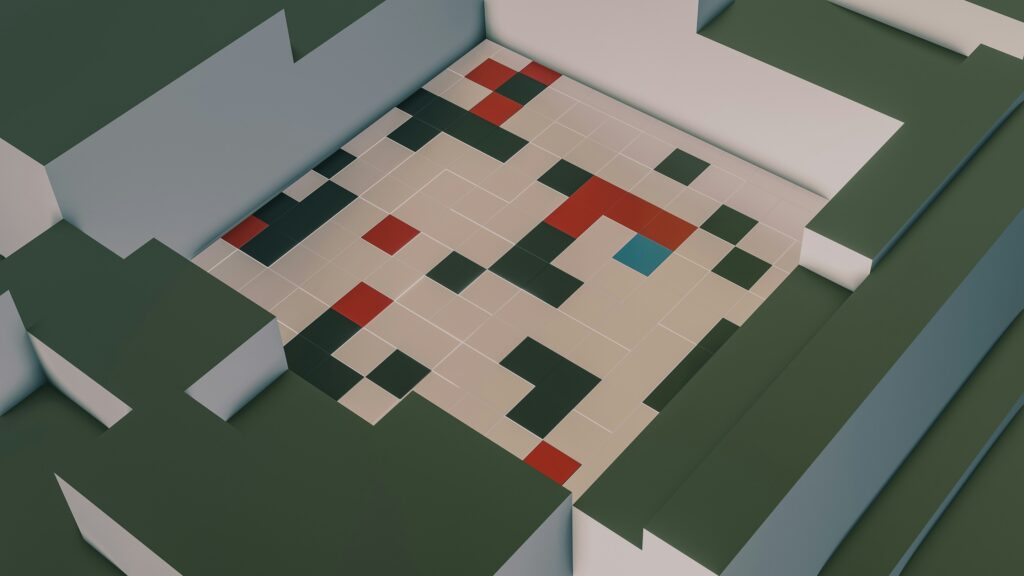

Tara worked the open house on Sunday and sent me a photo with the caption, “This pretty much sums it up.”

Here’s the photo:

I thought she meant, “This pretty much sums it up” in terms of the open house being slammed!

But what she meant was further clarified on Monday during our team meeting:

“Everyone who attended the open house was young, carefree, and unique. They were all unique. Except, well, they were all identical because they said the same things, acted the same way, and they ALL wore the same shoes.”

This photo was basically an advertisement for Blundstone’s.

The conversations among the young buyers were all the same: they were looking to buy an entry-level freehold in Leslieville and then sell their condos.

Both Tara and Chris, who worked the open house on Saturday, would engage the attendees and offer, “The condo market is pretty tough out there,” but the buyer pool continuously cut them off.

Why?

Because their condo was special.

“You’d have to see my place,” one person would say.

“My condo is different,” would be said by the next.

The view, the terrace, the kitchen, the building amenities – every young person who toured our Edwardian semi-detached in Leslieville regaled Tara and Chris with how their condo would have no problem selling because of how unique it was.

Fast-forward a few months, and I’ve listed an absolutely gorgeous hard loft in an iconic downtown Toronto building, and I’m having trouble getting showings. Not an offer, but rather showings in general.

It was at this point that I told my team, “If this were 2022, we’d have seventeen offers on this place. If we can’t get showings on this unit, then that speaks volumes about the 2025 condo market.”

What does this story have to do with the slap-happy youngsters and their Blundstones?

Well, it underscores just how difficult the condo market has been this year. If I can’t move an A++ condominium, then what chance do these young people have moving their unspectacular units on street names that are so new, you’ve never heard of them?

As the year progressed, these wishful combatants began to exit the market in droves.

What took place was something called “The great realization.”

They realized that they can’t go out and buy a house, then turn around and sell their condos.

This was the way it’s been for two decades.

Condos were easy to sell. Go search for a home, buy it firm, get a sixty-day closing date, and then sell your condo and line up the closing dates accordingly.

Et, voila!

Except to do that in 2025 would be nightmareish, as there’s no guarantee that you can sell your condo, and in actual fact, I would offer a high probability that you don’t.

By April or May, I started to receive offers on our freehold listings from young people who had sold their condos first.

Smart as hell.

But only some people were doing this. Many others were continuing to bop around the city, in and out of open houses, thinking they could search for a move-up freehold first.

It’s a recipe for disaster, and I can’t imagine the stomach ulcer that these individuals will develop as they stare at the clock, watching it run out, trying to sell their condo as the closing date of the freehold they purchased fast approaches.

I’m not sure if any of this will be reflected in the updated condominium statistics, but let’s keep that in mind as we move through them.

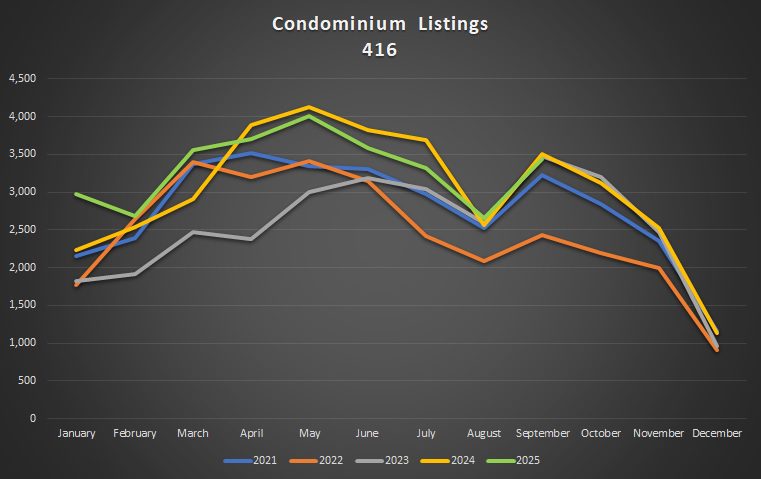

First, let’s look at new listings in the 416:

Through the first half of the year, we saw record listing activity in each of January, February, and March, while April, May, and June all trailed that of 2024.

In Q3, we saw July and September trail 2024, but August surpass the numbers set in the same period last year.

We’ve come a long way from January, as the graph below clearly shows:

New listings in January were up a whopping 32.9% over January of 2024.

That was a massive concern, and I specifically recall having this conversation on TRB.

This trend continued through the rest of Q1, but believe it not, that trend has since reversed:

For the record, we saw 29,274 new listings from January through September in 2024, and 29,907 in the same period in 2025.

That’s a 2.2% increase.

Ask the proverbial man on the street and I think he would believe that inventory in Toronto has skyrocketed!

But maybe that’s where the 416 and the 905 diverge?

Let’s have a look…

Right off the bat, I see a major difference: listings are higher in 2025 versus 2024 in January, February, March, April, May, June, July, and August.

Not September.

But suffice it to say, there’s a pronounced difference between new listings in the 416 and the 905.

The following graph illustrates this exceptionally well:

New listings are way up in the 905!

How much are they up?

Let’s run the same chart as we did for the 416:

Yikes!

Whereas we only saw a 2.6% increase in new listings, from January through September, in the 416, we saw a whopping 17.8% in new listings in the 905.

Things have cooled off since Q1, but we’re still on pace to see the year finish with record listing numbers.

As for sales, let’s start again in the 416:

Sales were down year-over-year in January, February, March, April, May, and June, then up in July, but then back down in August and September.

All told, we’ve seen 8,250 sales so far this year compared to 9,483 during the same period in 2024.

That’s a 13.0% decline.

When we look at the graph, the one conclusion I’ll draw here is that while sales are down, so too is volatility:

Yes, that’s a very flat line indeed!

Now, here’s where things get more interesting!

We saw a massive divergence between the 416 and the 905 when looking at new listings. As noted, new listings in the 416 are up 2.6% in the first nine months of the year, whereas new listings in the 905 are up 17.8%.

Should we assume that we’ll see the same divergence with respect to sales?

Here’s our chart:

We’ve seen 4,344 sales in the 905 so far this year, against 4,966 during the same period in 2024.

That’s a 12.5% decline.

That’s a smaller decline than the 13.0% we saw in the 416.

Wild!

As a result, the graph looks similar in terms of the less volatile green line:

Conclusion?

Sales in the 416 and the 905 are down from last year at the same rate, despite the fact that listings have increased more dramatically in the 905 than the 416.

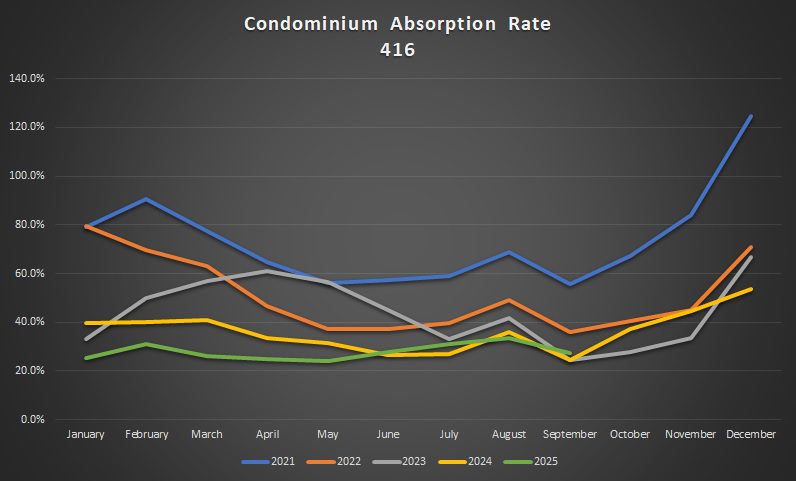

As a result, the absorption rates in the 416 are higher than the 905.

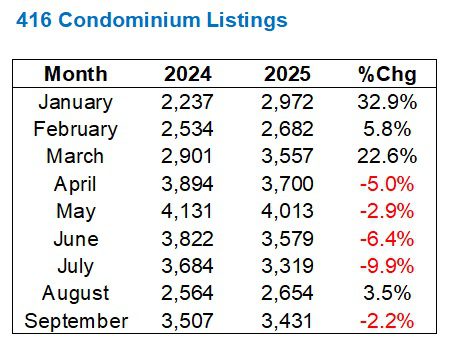

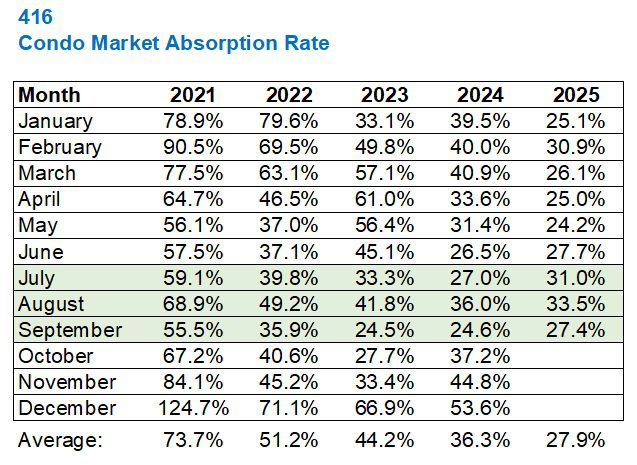

Here’s an update on the 416:

We saw an increase in the absorption rate in July and September, but not in August.

Overall, as you can see, the yearly absorption rate of 27.9% in 2025 is setting a new low.

Look at the numbers flow left-to-right: 73.7% in 2021, down to 51.2% in 2022, down further to 44.2% in 2023, down to an abysmal 36.3% in 2024, and finally plummeting to 27.9% in 2025.

If there’s any positive to take away here, it’s shown in the graph where the Q3 absorption rate draws closer to 2023 and 2024:

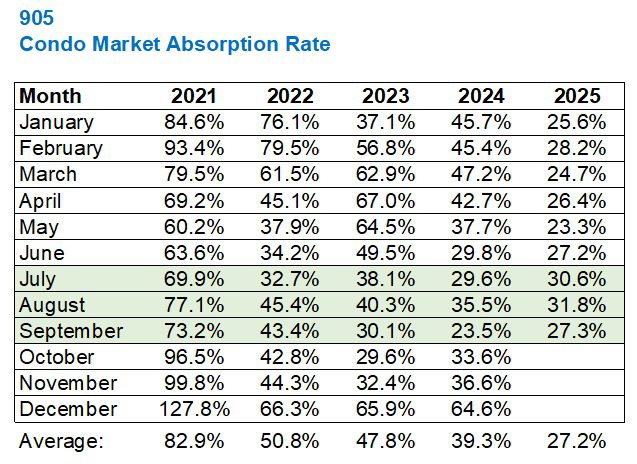

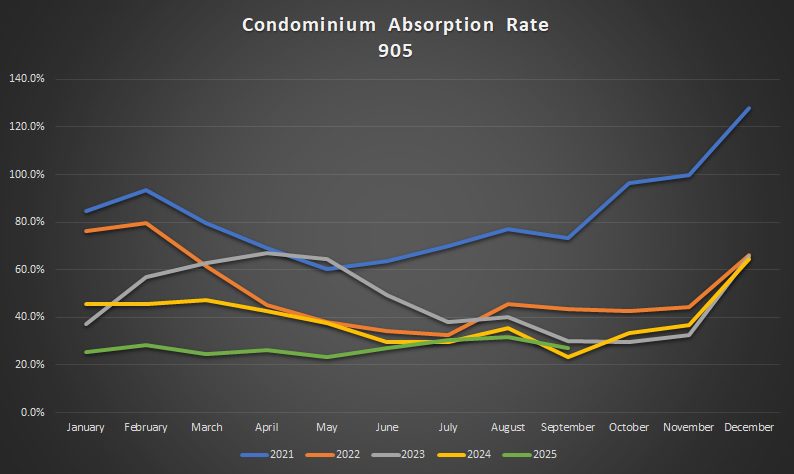

For reference, here’s the 905 data set:

And while you might be tired of numbers, charts, and graphs at this point, here’s the 905 absorption rate over the last five years in a graph:

While we might see a parallel between the decline in sales in the 416 and the 905, the increase in inventory in the 905 is a concern, nonetheless.

As for how this translates with respect to price, the September average condo price in the 416 is down 3.8%, year-over-year, and the average condo price in the 905 is down 4.3%.

Call it a wash, if you’d like.

But my two cents, for what it’s worth, is that 416 is still performing better than the 905. Or, if you’d like, the 905 is performing worse than the 416.

Either way, this has been a down year for condos, and I don’t see it changing.

Sure, there are instances of positivity and reasons for optimism. We’ve all heard about or seen that condo that sold quickly, or received multiple offers, or finally sold after a lengthy amount of time on the market. But those stories don’t represent the norm.

The new norm is what we have out there today, and it will continue through the end of the year.

By the time we revisit this feature, it will be mid-January, 2026. I welcome your predictions…

Serge

at 9:33 am

As far as the young men in 416 (the shoes look masculine) are still moving up on the property ladder en masse, there is no bubble.

Graham (the real deal prawns on the barbie)

at 9:36 am

If you’re going to buy Australian boots, may as well go for R.M. Williams Chelsea boots. Stand out, like an Australian politician at your local boozer.

Ace Goodheart

at 10:15 am

Interesting

At least whomever did the reno on that house took the time to put actual tiles in the entrance way (many houses I have seen, they just run the hardwood right up to the door). Vent location isn’t ideal (you have to dig the salt, mud and sand out of it every few months and you get this wonderful water stain on the ceiling in the basement when someone leaves their winter boots over top of it and all the snow and ice melts into the vent).

Someone also actually took the time to do a proper level transition, with a hardwood floor piece turned the opposite direction, right up against and level with the tile floor. Many of these I have seen, they simply cannot be bothered to ensure that the wood floor and the tile floor are at the same level, and instead just run some idiotic trim piece between the two, so it looks like something a preschooler did in creative play lessons.

cyber

at 8:00 am

Ah, to be in mid-20s and be able to shop for a SECOND TIME “upgrade to freehold” property – in Leslieville no less… must be nice to be bankrolled by “bank of mom and dad” and have generouls “old stock” Boomer parents who bought their own home for a busher of raspberries and a handshake!!! (The first-time condo would have still been a minimum of a cool half a mill, assuming it wasn’t bought and fully gifted by Mom and Dad >10 years ago as “student residence” alternative before these 20 year olds were even in the workforce)

It’s pretty nuts to think that while average first time homebuyer age in Ontario is 40, and still more than 1/3 of those receive financial gifts for a downpayment, there’s 20-somethings shopping for a second time property with no maintenance fee.

Don’t be surprised if the young ones finally mobilize at the polls and vote in populists that promise no immigration, capital gains tax for primary residence, permanent ban / closed loopholes on foreign ownership, no corporate ownership of single family homes, “spare room tax”, US Medicare style “means test” for government old folks home spots (ie must basically be bankrupt and own nothing in order to get), etc. It’s already kind of happened with both Liberals and Conservatives doing a hard 180 on immigration (something they both supported/increased for decades regardless of who was PM)