I was laying on my daughter’s bed the other night, as she found reason after reason for me to stay, talk, and avoid her having to go to sleep, and the topic of the “chicken and the egg” came up.

I thought it would be a nice little riddle to tire her out.

“Which came first? I asked her, knowing that whatever answer she provided, I’d have a retort ready.

“The chicken,” my daughter said. “The chicken came first.”

“But chickens come from eggs,” I told her. “So the chicken can’t have come first.”

“Then it’s the egg,” she told me. “The egg would have to have come first.”

“But eggs are laid by chickens,” I explained. “How could the egg have come first.”

She laughed and said, “You did this on purpose.”

She was right.

And then she said, “But I think the egg came first because even dinosaurs, which came way before chickens, laid eggs. So I think eggs came first.”

Now, I was a bit perplexed. She had taken this simple riddle offline and I could no longer assert my mental superiority over a 7-year-old.

“What does Google say?” she asked me.

“You know, in my day, when we didn’t have Google, I had to go to a library and….”

“…take out a book,” she finished for me. “I know, I know, Daddy. You tell me this about everything. I’m sorry you didn’t have Google when you were a kid but we do, so please see what Google says.”

So I did.

And highlighted in yellow for all to see, thanks to Google, was: the egg came first.

Every explanation that I saw was essentially a version of what my daughter had suggested: that eggs have been around for 340 million years and chickens only for 58 thousand years.

But what about a chicken egg, dammit!

I suppose we could chip away at this analogy all day, but I did promise to look at Toronto’s luxury real estate market, so we’ll shelve the biology lesson for another time.

The luxury market in 2024 has been sluggish.

There.

Maybe we just end the blog here and cut our early for the day?

But why has the market been sluggish? I think that’s like trying to answer, “What came first: the chicken or the egg?”

I have active buyer clients right now looking for a $3,000,000 house in a particular area of Toronto.

There are currently zero listings that fit their criteria.

There are a few houses around the $3.4M – $3.7M range, but those are over-priced and have been sitting on the market for as few as two and as many as five months.

My clients are not picky. They’re not unreasonable. They know what they want and it’s not unusual or uncommon.

There just aren’t any of those houses listed.

So are my clients unable to buy because there’s nothing for sale?

Are the sellers uninterested in selling?

What makes the owner of a $3,000,000 home want to sell in the first place?

When I ran this same feature back in August of 2022, the discussion back then was about whether a slower luxury market could drag down the market average. At the time, I looked at luxury sales in 2022 and 2021 to see if the market was experiencing fewer sales on a year-over-year or month-over-month basis and if this could “move the needle,” so to speak.

I do think that this thesis could apply to today’s data set as well, but the question I really want to answer is this:

Where are all the luxury listings?

A market bear will suggest that there are no luxury buyers out there.

“Buyers aren’t buying,” the bear will suggest. “They can’t afford to. The sky is falling.”

But how about this alternate take: sellers aren’t selling because they don’t ‘need’ to.

Where are all these mortgage defaults that have been predicted for the past two years? How many $4,000,000 home owners are walking away and handing over the keys?

One, for sure, that I know of. I wish I could write about it here, but I can’t. Imagine a financial self-help guru who writes books, holds seminars, and then loses his or her house to a private lender?

Topic for another day…

But what about everybody else?

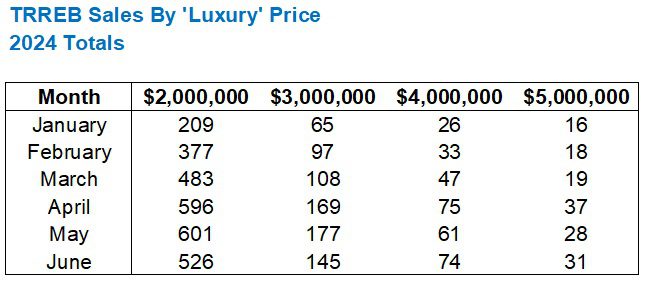

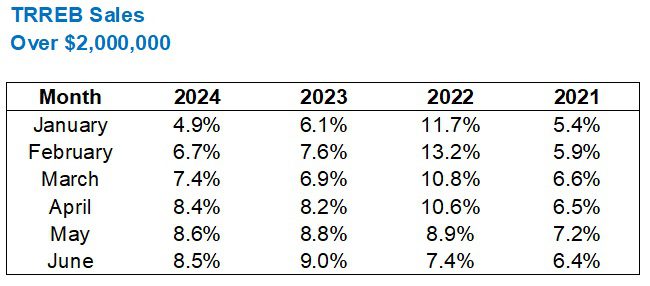

Let’s look at the luxury market so far in 2024, and we’ll define “luxury” as starting at $2,000,000, which is odd, since the average GTA home price is just shy of $1.2M, but I digress…

This seems to reason, right?

That the luxury market would “peak,” at least in terms of sales, in May?

By the way, this is houses and condos, although there really aren’t all that many $5M+ condos trading hands, but this is the complete data set in the GTA.

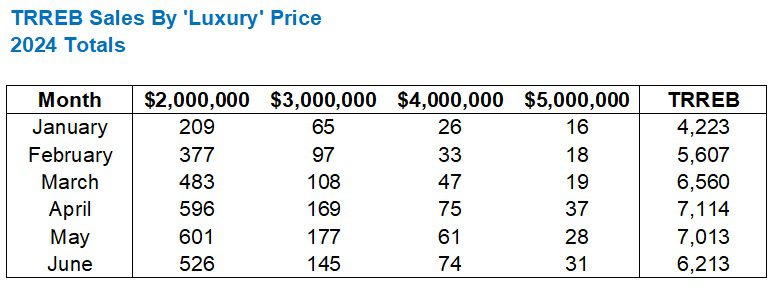

These sales, perhaps, lack context without being expressed as a percentage of the overall sales data

Now, this makes more sense.

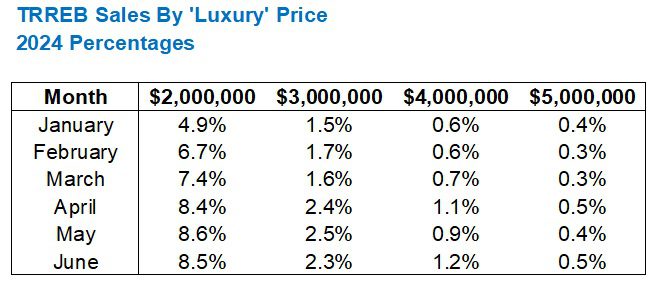

It seems to reason that the sale of luxury properties will increase as total sales increase, but let’s see this as a percentage:

I’m actually surprised to see such a similar data set for April, May, and June in the $2M+ segment.

8.4%, 8.6%, and 8.5% respectively. Basically identical.

And with the average home price increasing from April to May, then decreasing from May to June, it seems to be moving with the market. Or, it’s just a coincidence.

But on its own, this still needs more context.

What should we expect to see in the market? What do other years look like comparatively?

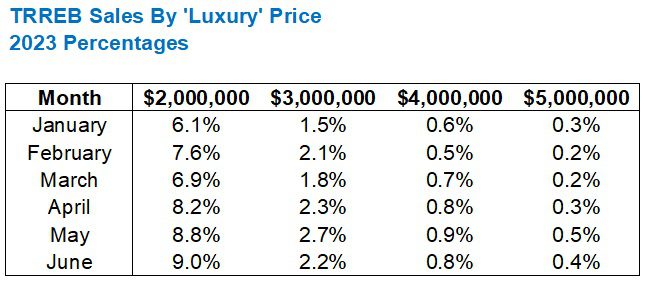

Here’s the same data set from 2023:

Upon first glance, it looks like January and February of 2024 were slower than 2023, but overall, these years seemed to line up relatively well.

Let me break these down further:

I would suggest that 8% of total sales is a “large” chunk, but this should, or at least could be enough to move the needle on the average home price.

But how much of an impact could it have?

If we saw 8% of sales over $2,000,000 in 2024 compared to, say, 14% in 2023, then I think it plays a role.

But the figures above don’t speak to that big a difference between the markets in 2023 and 204.

The same can be said for sales over $3,000,000:

However, it’s interesting to note that, comparatively, 2023 was a stronger market for $3M+ homes.

Then when we get to the houses selling for over $4,000,000, the pendulum swings back to 2024:

Again, I don’t think there are any “outliers” here.

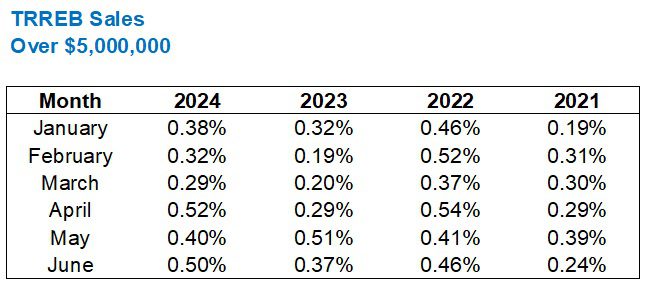

In fact, the only place that I really see a major variance in the numbers is with $5M homes:

Here you have a 0.52% share in 2024 versus a 0.29% share in 2023, and that’s significant.

But with the sample size so low, you could chalk this up to happenstance.

There’s no metric for “quality” here. And for buyers looking to purchase a $6 Million home or an $8 Million home, I would think that it has to be absolutely perfect or they wouldn’t pull the trigger.

As I asked at the beginning, “Where are all the luxury listings?”

I don’t think there’s a lack of desire for buyers to buy, but rather I think there’s a lack of need for sellers to sell.

In fact, if you trace the data back even further – to 2022 and 2021, you can see that luxury sales in 2024, at least as a percentage of overall sales, aren’t down that far from 2022.

This time, I just want to look at the low-end and the high-end.

We’ll start with the high-end:

The first thing that I notice is that 2021 seems to lag the rest, save for February and March, which actually exceed 2023.

April, May, and June are fairly even between 2024 and 2022, although early-2022 was heads and tails above the rest.

As for the $2,000,000+ range, we already saw the data from 2024 and 2023, but here’s how it looks if we add 2022 and 2021:

The market share for $2,000,000 sales in 2022, versus 2024, is quite striking.

In February alone, we saw double the sales in 2022 versus 2024.

Now, I suppose you could argue that a $2,000,000 house in February of 2022 is a sub-$2M house in February of 2024, but how many properties sit right on that thin line?

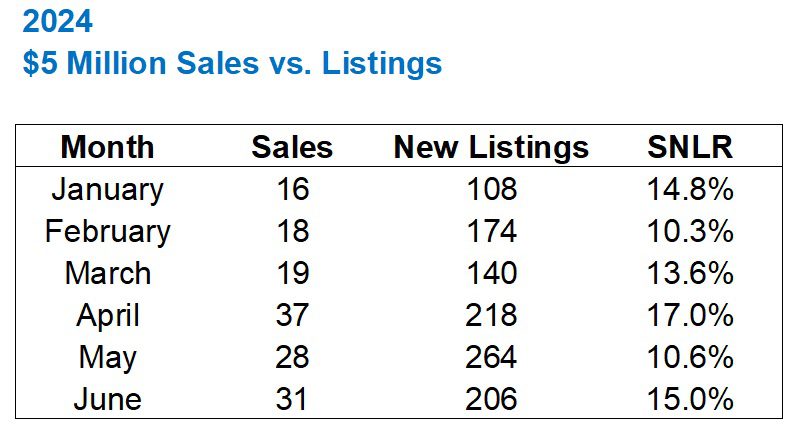

The one thing we have yet to talk about in all this is the absorption rate of luxury homes.

This was an interesting exercise and a surprising one. Check out 2024 for the highest-end at $5,000,000 and up:

Keep in mind, many of the $5,000,000+ listings in the GTA are farms or larger rural properties, but once again, I think the comparison to other years is going to tell us whether the luxury market in 2024 is moving, or not.

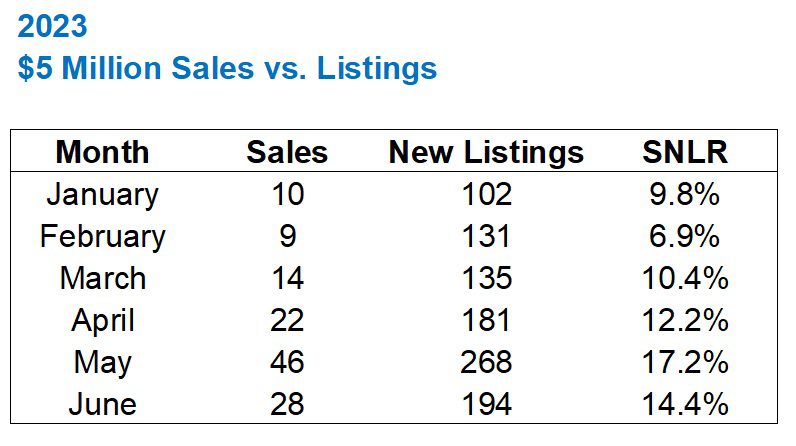

Here’s the data from 2023:

Fewer sales, fewer listings, but overall, a much lower absorption rate.

2024 saw a higher absorption rate in every month except May.

Perhaps talking about the $5,000,000+ price range isn’t exciting for some folks as it’s not relatable. Still, just as I like to look at the rental market, the condo market, and other market segments that we discuss with regularity on TRB, I think looking at the “luxury” market gives us another data point to reference as we compare year-to-year.

I still maintain that there’s a lack of quality listings in the $3,000,000+ range right now, but I know just as little about the market for $12,000,000 houses as I do for farms, acreage, and McMansions on massive estates in the middle of nowhere. I can’t imagine the market for those properties is strong.

Well, folks, it’s August. I can’t believe what the calendar is telling me.

We have one month left in summer.

Fall is my least-favourite season and while I’m trying to “live in the present,” I’m having dreams of apple-picking and pumpkin-carving and this tells me that my subconscious is really concerned.

Wishing everybody a happy and safe Civic Holiday long weekend, and hoping you all soak in the next four weeks of summer!

Derek

at 11:35 am

In the interesting (to me at least) anecdote files, the open house I went to last weekend (was listed at 2.495) has now terminated and relisted at 2.9. hmmmmm

David Fleming

at 2:04 pm

@ Derek

That’s my most hated pricing “strategy.” 🙂

Nobody

at 2:00 pm

Huge issue in the 3+MM market is the lack of motivation.

There are houses on the market for 60+ days that were also listed for 60+ days in November. Owners (they ain’t sellers) simply refusing to accept the judgment of the market.

Most of the product is owned free and clear so there are many options besides taking a price you dislike.

There are some obvious distress sales where demolition has happened and funding ran out partway but you need to be very brave to pick something like that up.

Many spec renos are on market at crazy prices but will need months if not more than a year before they get to an actual distress point where people take a much lower price. Likely requires insolvency lawyers to get involved.

Mike Moffat put out numbers today showing the market is far, far past the levels of overextension seen in 88/89 aka the peak of the last real estate bubble in Toronto. Recipe for things getting ugly ugly despite rate cuts. As the Margin Call quote goes “the music is starting to slow”. We’ll see if it’s just some lentissimo or we get full stop.

Rick Michalski P.App ACCI

at 9:33 am

Shut the fvck up you idiot

Rates are going down and prices are going up

Milk Man

at 9:53 am

Someone is a spicy little carrot this morning

Walter Pen

at 9:49 am

I’m in the market for a three mil. home. My wife and I are retired and want an updated, upgraded home. The only problem is that we require to sell two of our two acres treed lots. These two are nestled in a lovely and growing tiny community, next to the Trent River. Recently I’ve shown these to potential buyers who also would love to build their dream home. By selling these two lots is where it would meet our financial goals, to move forward in purchasing our dream home. Please let me know if you have any potential buyers. Thanks from a retired couple.

genxestate

at 1:56 am

I just wanted to say thank you for sharing this valuable information. Your post was really helpful and informative. I learned a lot!

Thank you