Folks, I’m going to let the cat out of the bag: this isn’t rocket science.

And yet all over the city, I see examples of absolutely ludicrous pricing.

It’s true that there is no fixed value of real estate, however that doesn’t mean that you can be wild with your pricing. If shares of Research In Motion were trading on the TSX for $8.20 – $8.30 all day long, would you put in a “sell” offer for $15?

Let’s take a look at a few examples of pricing that drove me nuts this week. And yes – this is just one week…

Imagine this scene….

You walk into Pharma Plus in search of a snack, and you check out the front counter.

Oh Henry, Mr. Big, Caramilk, Crispy Crunch – they’re all a $1.29 each.

Then right next to it, or even in between Oh Henry and Mr. Big, so you can’t miss it, is Aero, and it’s $3.89.

Would you have any reason whatsoever to buy an Aero?

I know, I know – it’s the only chocolate bar with bubbles, but that’s not the point.

The point is that similar products should be priced as such, and a consumer is going to notice the difference.

Real estate should be no different.

Here are three examples of things I’ve seen this week that makes me wonder if the people involved would pay $3.89 for that Aero bar, or whether they’d expect another consumer to…

1) Pricing Identical Products

This is the most common, and in my opinion, most egregious, of the pricing problems in our industry.

I see this all the time, and for the life of me, I don’t understand it.

A client of mine wanted to see a couple of units in a Front Street condo this week, and the same unit was up for sale, just at very different prices.

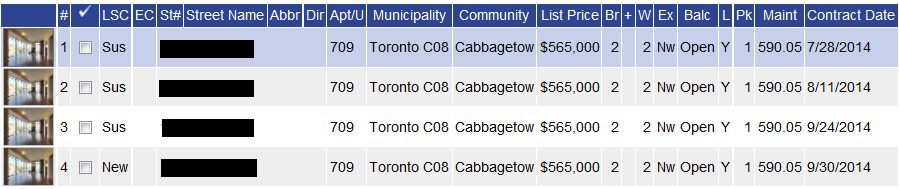

By the time we went to see the two units, one had sold firm, as shown below.

The other was still available – take a look:

So here you have the IDENTICAL unit listed for sale, only the listing prices are $31,000 apart.

That’s pretty odd, wouldn’t you say?

Only it gets better!

The unit that was priced $31,000 lower, also had a parking space! That’s worth about $35,000 in this market.

So all told, these two identical units are essentially priced $66,000 apart.

What the heck is the owner of the $599,000 unit thinking?

This isn’t about “upgrades” either. I was in these units, and the flooring, appliances, counters – they’re the same as far as I’m concerned. I know that one unit could have a “Porter & Charles” dishwasher and one could have an LG, but who really cares when you’re talking about $66,000? That would have to be SOME dishwasher!

It boggles my mind when I see things like this, but as I’ve said before many times, it’s not JUST the seller who is to blame

It’s the agent.

If the distributor of Areo bars told Pharma Plus, “Despite Oh Henry, Mr. Big, and all the other chocolate bars being offered for sale at $1.29, we’d like you to price Areo at $3.89,” do you think Pharma Plus would stock the shelves with Aero?

Agents in this city need to have some backbone, and have some v-a-l-u-e. Saying, “yes sir” is not your value; it’s pricing effectively. If a condo sells for $565,000 with parking, and a seller comes to you with the same condo without parking, tell him it’s worth $529,900, and price it as such. Don’t price it at $599,000. Or just don’t take the listing.

That unit will sit on the market forever, and ever, amen.

2) Pricing Like Products

You can argue that “if the product isn’t identical, then pricing is open for interpretation,” but to what extent?

In “Phase 3” of that absolute joke of a program that OREA calls the “education and licensing,” students and aspiring Realtors are taught how to conduct a proper Comparative Market Analysis (CMA), and add/subtract and make adjustments for features such as the view, outdoor space, parking, locker, upgrades, etc.

I understand that when two properties aren’t the same, sometimes you want to delve deeper than to just throw out your “gut feel” on pricing, even though an experienced agent’s gut feel is worth more than some rookie’s CMA.

But sometimes, you need merely glance at a condo listing to be able to say, “That thing is over-priced.”

Case in point: two units in a King Street East building that were sold, and listed, respectively in the past week.

The first unit looked as follows:

1-bed, den, 2-bath, 800 square feet, parking, locker, south view, Juliette balcony. Upgraded, great layout, excellent marketing of the listing.

That unit was listed at $449,000, and sold in multiple offers for $458,000.

This week, a unit came out onto the market for the same price – $449,000.

Only this unit was a 1-bed, den, 1-bath, 700 square feet, parking, locker, west view, balcony. Ugly as hell, minimal upgrades, terrible marketing and blurry photos by a discount brokerage.

The fact that these two properties are listed at the same price is a joke.

On a per square foot basis, the first unit sold for $573. The second unit is listed at $641.

The first unit had a second bathroom, and the unit belonged to a designer who changed the layout of the unit, and decorated it herself.

The second unit looks awful from the six blurry photos that are on MLS.

Now one point to mention, just to be fair – the second unit does overlook St. James Park, and it has a very small balcony (the kind you step out on to smoke, or remove a dead bird…), whereas the first unit faced south with just a Juliette.

But even if you gave a nice premium to that park view, these two units are still far, far from equal.

In my mind, the second unit should be priced at $389,900, in its current state.

And again, to be fair, I think the first unit was actually above 800 square feet (the listing doesn’t give exact square footage, and I’m erring on the side of caution), and thus the discrepancy is even larger.

Based on the fact that the new $449,000 listing is on the market with a discount brokerage, dare I be so bold as to suggest that the seller is a bit out of touch, and the unit was priced in the same way a child says what he wants to be when he grows up.

All this means is that the unit will sit on the market, not unlike the one in example #1 above, until the agent gives up on the listing, the seller comes to his or her senses or POOF! Magic happens….

3) Pricing The Same, And Expecting Different Results…

That is the true definition of insanity.

“Doing the same thing over and over, and expecting a different outcome.”

I love that line. I don’t know where it came from, but it’s awesome.

I always thought insanity involved a straight jacket, padded walls, and food in liquid form. But who knew that it was actually the sellers of many downtown Toronto condos!

My colleague who sits behind me and talks to the back of my head all day, asked me on Monday, “Did you see the new listing at XX Street?”

I said, “What new listing,” and then began to search on MLS.

As luck would have it, this wasn’t a new listing, but rather the same listing, just re-listed six goddam days later.

Oh, and as you might guess, it was listed at the same price!

Have a look at this one. She’s a ‘beaut:

This is a favourite “strategy” by listing agents who don’t know how to say “no” to their sellers.

They just re-list the same damn thing, over and over, at the same inflated price.

The funny thing about this one, is that the length of each “listing,” and I use that word in quotation marks because this barely qualifies as one, is incredibly short!

14 days, 44 days, and 6 days.

What the heck?

WHY would somebody list a property, and then six days later, terminate that listing and bring it out at the SAME price?

This isn’t even a long time to be on the market – 66 days in total. I mean, that’s about 5-6 times as long as my average condo listing, and about 2 1/2 times as much as the average condo listing in Toronto, but what I mean is that of all the insane listings on the market that will never sell and just rot like your green bin, 66 days isn’t even in the conversation. No, if you wanna play with the big boys, you have to be over 100 days to be considered “insane.”

Nevertheless, I can’t figure out why somebody would list the same property four times, at the same price, after it didn’t sell the first three times.

–

There’s one constant in this crazy real estate market: if you can think it, it’s probably happened.

Today’s blog is just one example of how things that make no sense, happen constantly.

It makes for a daunting property search if you’re a buyer, since you have to sort through hundreds of listings for properties you’d never buy, but hopefully you have some guidance, and some patience too.

Kyle

at 12:41 pm

#3 reminds me of a certain flipper house in Swansea that has been on and off the market for what feels like well over a decade.

Andrea

at 4:51 pm

Without disputing your point, ’cause I agree with you completely… Can you please explain Starbucks to me?

Carl

at 5:51 pm

The “insanity” quote is generally attributed to Albert Einstein, although there’s not a shred of evidence that he ever actually said it (or anything like it). But speaking of (attributable) quotes, those who subscribe to the argument that “the (fill in the blank) market is overpriced and it’s gonna go down now now now!” would be well advised to heed the words of John Maynard Keynes: “Markets can remain irrational a lot longer than you and I can remain solvent.” I wonder if Alan Greenspan, who bemoaned the “irrational exuberance” of stock markets more than three years before markets peaked (at more than double their level when he spoke), wishes he’d read more Keynes (he obviously read, or at least believed, very little – more’s the pity).

Carl

at 5:54 pm

David, a question. Is the Toronto rental market as much a minefield as the ownership market (i.e. misrepresentation, hyperbole, outright falsehoods, etc.)?