No, this is not a political announcement from Premier McGuinty.

This is a calling to all investors who should be looking at rental properties right next to a University campus…

One day before the Provincial election, and I’m still undecided as to which party will receive my coveted one vote.

Seeing as I’m working around the clock on renovating my new condo and still running a 24/7 business, I know deep down that I likely won’t have a chance to vote. So it brings me to the age-old cliche: “What good is one vote? What election has ever been decided by ONE vote?”

Well, the 2008 Hollywood blockbuster “Swing Vote,” with Waterworld & Postman star, Kevin Costner, clearly demonstrated that an election can be decided by one vote, so obviously if it’s happened in Hollywood, it can happen in Ontario.

I’m quite surprised that education hasn’t been more of an issue in this election. Are people really that concerned about HST on hydro and five-cent taxes on used batteries that they’re ignoring one of the top-three election issues in every election, ever held, everywhere?

Anyways…

Education has always had its place in real estate. No, I don’t mean real estate education, which is essentially an oxymoron, since anybody with a pulse can obtain their real estate licence through TREB, but rather I mean that when it comes to income producing properties, the investor always has to consider students.

Students make up a huge portion of the renter pool, and they’re difficult to ignore.

Sure, they’re not as quiet, clean, and neat as 75-year-old ladies, but they’re available in abundance, and quite often, missing a month’s revenue from a rental suite can throw your yearly return right out the window.

For some odd reason, I have been looking at investment properties near the University of Toronto Scarborough campus, and the return on investment is astounding.

We have to compare apples to apples here, since I’m sure investment properties in Ann Arbor, Michigan provide a higher return than those in Toronto, so let’s compare the return on an investment property in Scarborough to that of one in downtown Toronto.

Consider this: U of T Scarborough, versus Ryerson, George Brown, and U of T.

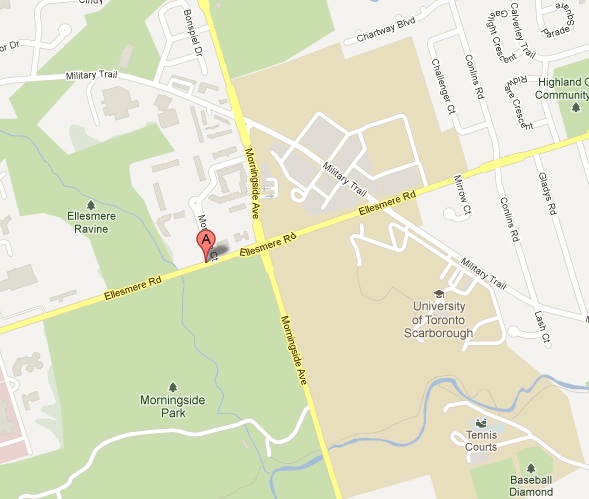

There is a condominium at 3050 Ellesmere Road which has several units for sale, all at unfathomable prices. Have a look:

How is this for location:

The building is literally a stone’s throw from the campus! I can throw a stone 200-feet, FYI…

So what does it cost for a standard 2-bedroom, 2-bathroom condo with parking and locker in this building?

Prices start at about $145,000.

Yes – really.

It’s not the nicest condo in the world, and it’s not downtown Toronto, but we’re looking at the return on investment here as it pertains to an income producing property.

So let’s look at the carrying cost.

For the purpose of this exercise, we’re going to assume a 20% downpayment on the unit, or $29,000.

A five-year, fixed-rate mortgage with a 3.29% interest rate will carry the $116,000 balance at a paltry $505.97 per month.

Maintenance fees are $438.21 per month, inclusive of utilities, and property taxes are $1,210.81 per year, or about $100 per month.

So all in, you’re looking at $1,044.18 per month in expenses.

What do these units rent for?

About $1,350 per month for two students. HERE is a current rental listing in the building.

So this property is cash-flow positive to the tune of $305.82 per month, or $3,669.84 per year. That’s a return on the original $29,000 of 13% per year.

Factor in the $192 per month of mortgage principal that you’re paying down, and the return on investment is 21%.

How does this compare with a “typical” downtown Toronto student rental?

I’m going to use 21-25 Carlton Street for this example, because I know how many renters there are in the building, and how many are students at University of Toronto or Ryerson!

There were two sales for 2-bedroom, 2-bathroom condos earlier this spring, however neither unit had an owned parking space! The sale prices averaged $440,000, but let’s add about $30,000 for parking to compare ‘apples to apples.’

These units rent for about $2,200.

Using the same parameters, let’s look at the numbers:

20% downpayment on $470,000 = $94,000

Monthly mortgage payment = $1,640.03 ($622 of mortgage principal)

Monthly maintenance fees = $524.36 (plus $60 for hydro)

Monthly taxes = $176 (total is $2,112 for the year)

Overall, you’re looking at $2,400.39 in monthly expenses.

This unit is cash flow negative by about $200 per month.

When you add in the mortgage principal that is paid down, you’re return on investment is 5%.

And just to throw a final wrench into this – the unit at Carlton is about 100 square feet smaller than the unit on Ellesmere.

3050 Ellesmere Road earns 21% per year.

21-25 Carlton Street earns 5% per year.

Lesson learned?

Well, clearly we need to be concerned with the potential for future appreciation!

A classic investor is only concerned with the yield, but investors in the past decade have been more concerned with the tens or hundreds of thousands of dollars in appreciation! If condo prices in Toronto have increased, say, 40% over the past six years, how much do you think condos have appreciated on Ellesmere? Maybe half as much? If that? How about 15%?

If you bought a condo for $200,000 in Toronto six years ago and made a modest 5% return but combined that with a 40% appreciation, the $80,000 in appreciation would far outweigh the importance of the 5% dividend.

Again – it depends on the type of investor.

Benjamin Graham taught us that we should buy stock in companies that pay large dividends and hold them long term. But when people were making 90% returns in a single day during the dot-com boom, they threw years of sound investment advice out the window!

So how can you possibly convince an investor to chase a 21% return on investment on Ellesmere when condos in downtown Toronto have appreciated so rapidly in the past decade?

Well, if you think that growth in the Toronto real estate market is stagnant, then maybe it’s time to take a page from Benjamin Graham and Warren Buffet and go after the steady return.

I’m not going to be actively selling condos in Scarborough any time soon, but it’s not the worst idea…

Nick

at 8:26 am

Good analysis. Though I bet there is more money to be made if you go beyond condos… You should consider investing in student housing in Halifax, where I went to school recently. Many students live in houses that are broken into 3-4 flats of 4-5 people, which are under 10 minute walks to campus. If you assume that people pay 550-600/mo in rent, the landlords are pulling in ~10k/mo. I don’t know how much these houses cost, but you have to figure that the landlords are banking some serious coin, even after repairs etc…

I would imagine there are similar situations in University towns/areas across the country.

Ralph Cramdown

at 9:03 am

So your vacancy rate is 0% and your maintenance allowance is 0%?

Serena

at 12:06 pm

Interesting post. I went to U of T Scarborough. One of my classmate’s parents purchased a condo in the area as an investment property. I always wondered why. Now I know lol!

As a side note re: not having time to vote. You can always vote early in the advance polls which are open for a good week before voting day. There are quite a few in everyone’s area, check your voter registration card. I had 3 advance polls within a 10 minute drive from me, all were open for at least 5 days till 8 PM.

WEB

at 10:54 pm

Awesome to hear you quote Benjamin Graham and Warren Buffett! Now that is my kind of real estate agent!

Geoff

at 8:22 am

Have to agree with Serena above re: “I know deep down that I likely won’t have a chance to vote.”

Sure you will, you have the same amount of time to vote as to not vote. Just you chose to do other things instead of voting. Which is fine, but it’s a choice, not a chance…

David Fleming

at 10:49 am

@ Geoff

If there’s voting in my building, I’ll vote tonight…

Geoff

at 4:30 pm

No one said participating in a democracy would be convenient, David.

Or to quote Austin Powes: I’d love a solid gold toilet but it’s just not in the cards, baby.