Perhaps by the time you sit down to read this on Monday morning, we’ll already have the October TRREB stats in hand.

But as I write this blog post (over the weekend), I can only guess as to how October sales will look.

In my monthly “TRREB Stats” blog post, I always examine three essential statistics in our real estate market: price, sales, and new listings.

We can hone in on any one of the three and get far more specific, ie. prices in particular locations, prices in particular market segments, or analyzed by a group of different price points.

But on the whole, a great measure of the market is simply looking from the top down in any one of the categories.

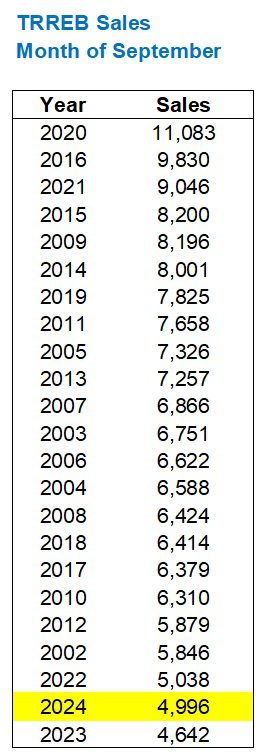

Last month, I offered this chart:

That’s right; sales in September were the second-lowest ever. And by “ever,” as the regular readers know, I mean post-2000 when I began tracking this data, since the city was half the size in the late-1990’s…

Now why are sales so low?

If you looked at any product in any market, you’d come to one of two general conclusions:

1) Low demand

2) Low supply

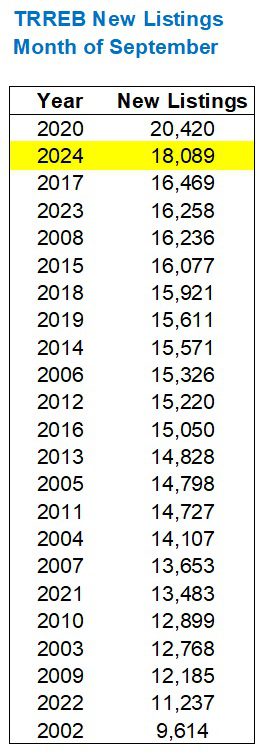

But the latter simply isn’t the case, as evidenced by this chart, also offered last month:

As an aside, I would argue that the level of “quality listings” is low, but there’s simply no metric to track this.

Ask any active real estate agent or any active buyer and they will tell you that there’s just “nothing out there” right now. I’m feeling this with all of my buyer clients, and although the level of “New Listings” is near an all-time high, we feel like what we’re looking for isn’t represented in that statistic.

Nevertheless, there is a third reason why sales could be sluggish, and it can be applied to many markets for products and services, aside from just real estate:

Sellers do not accept current market prices.

That, in my opinion, is the number-one reason why sales are slow right now.

There is demand, no doubt about it. Sure, there will be more demand in the spring of 2025 when interest rates are even lower, and you’ve heard me question why people are waiting until next year, when they can purchase today, close on a variable rate mortgage, and experience lower payments in a few short months. Regardless, we have demand in this market. We also have inventory.

What we don’t have, it seems, is a host of sellers who are willing to sell today at today’s price.

And nobody is forcing them to, of course. If a seller has the luxury of waiting a month, or two, or ten, and if the seller has a crystal ball that he or she can look into with certainty, then who could blame them for not accepting today’s price?

Having said that, part of the reason why sellers aren’t willing to accept today’s price, in my opinion, is yet another classic issue in a lukewarm market:

Agents aren’t willing to have difficult conversations with their sellers.

Let me run through a few recent examples of what I’ve witnessed in the market trenches…

Last month, I was showing downtown condos to a client of mine who is ready to buy tomorrow, and essentially close the next day.

Suffice it to say, he’s the buyer that sellers want. He’s got cash, a pre-approval, and an itchy trigger-finger.

We went out to look at four units in and around his price range, but I knew the one he’d like the most. Sure enough, we saw that one last (by coincidence), and he was ready to make a play for it.

This unit was listed for sale at $769,900 but it had an asterisk:

There was an “offer date.”

The offer date was quite silly, however, since this property had already been listed seven times and there had already been one previous offer date.

But as I’ve written on my blog lately, this is an unfortunate reality of our market. Many sellers and agents have to try and/or experience different “strategies,” whether success was ever a possibility or not, in order to eventually get in line with market reality.

This property had just been listed for $860,000 three days prior. The listing was up for 42 days and the property didn’t sell, so now it seemed that the seller and the agent were going back to the well, once again, to try a “strategy” that likely wouldn’t pay off.

I told my client, “The list price and the presence of the offer date are meaningless. Pretend they don’t exist. Look at the property and decide on your own if and how you’d like to proceed.”

That’s exactly what we did.

We decided to put together an offer for $800,000 even, which was obviously less than the seller was “hoping for,” but far more in line with market reality.

Consider that when the property was listed for $860,000, it didn’t sell. It didn’t sell for $860,000, but it also didn’t sell for $850,000, $840,000, or $830,000.

What this property was “worth” depended on what a willing buyer in today’s market would pay for it, and we figured that this was somewhere in the low-$800’s.

The listing agent was kind, courteous, and grateful to have the offer. She didn’t seem all that optimistic about the prospects of coming to a deal however, and that’s when I tried to speak to her from experience.

“You have an offer,” I told her. “That’s good. That’s the first thing you need to get a deal done for your client,” I explained.

She told me that the sellers “Really wanted $860,000 for the property,” and I explained that the property was already listed for $860,000 – for 42 days, and it didn’t sell, so the sellers needed to come to terms with the fact that their expectations weren’t in line with the market.”

She talked about what a “great property” it was and how it was “so undervalued,” and I reiterated that her job was to present the offer to the seller and present market reality.

I’ll be honest; I was optimistic. Despite the nonsense that’s going on out there right now, this unit has been listed since February and surely it was time for the sellers to pull the trigger.

I was in North York showing houses on a Sunday morning when I received an email from the listing agent that contained her client’s counter-offer.

Her email was full of positivity, but it was directed in the wrong place.

Lots of fodder about the “rare opportunity” it was to get into this unit, even though there were fourteen other units listed for sale in the building.

Some sales-speak about the high ceilings, loft-esque features, and descriptions of parts of the unit that I wasn’t exactly unaware of, even though I was now on the receiving end of a tutorial.

Call this “sales” if you want, and tell me that she was “doing her job,” but I already knew where this was going.

I knew I was going to receive a terrible sign-back.

What I didn’t know, however, was that the sign-back would be worse than you could possibly expect.

What I didn’t know was that this was a listing agent and a seller who seemed to look outside at the hot summer sun and think now was the opportune time to build a snowman, if you will.

That’s right.

They signed back at $888,000.

They signed back higher than their previous listing price.

This made absolutely zero sense, and while you might try to rationalize this, just to play Devil’s Advocate, there’s no substance to that argument.

This unit had been listed for sale for $860,000 for 42 days and didn’t sell.

It was now listed for sale at $769,900 with an offer date, which wasn’t going to work.

We provided them with an offer of $800,000 and they chose to sign it back at $888,000.

It really didn’t make any sense, but this is what’s happening in the market right now and this is part of the reason why sales are so slow.

I called the agent and asked her, “What’s the logic here?”

She spoke in euphemisms and said, “We’re ready to make a deal that works for both parties!”

I asked her for just a bit of humility and perhaps some honesty, but she went on about the “rare opportunity to get into such a fantastic space,” and continued talking up the unit.

At the risk of coming off as a jerk, I decided to be blunt.

I said, “I noticed that you have ‘CNE’ in your email signature; that’s the ‘Certified Negotiation Expert’ designation.”

She offered an “Uh-huh.”

I said, “In what part of that course did they teach you to sign back higher than your previously unsuccessful listing price?”

Silence.

I let the void continue and offered her an opportunity to fill it, and eventually, she said, “Well, I mean, we’re just looking to get what’s fair.”

The problem in our market right now is that sellers don’t understand “fair market value,” since their own definition of “fair” is what’s fair to them. Fair, by definition, is the intersection of what’s fair for the seller, what’s fair for the buyer, and what results in an accepted agreement.

Their offer date failed, by the way, in case it wasn’t obvious.

The property was re-listed for $860,000 again, and I wondered how in the world the seller and the agent thought their sign-back of $888,000 was ever in the realm of “good ideas.”

Don’t get me wrong; I understand the concept of “negotiating.” Just as I didn’t expect the seller to accept our offer of $800,000 even, with no questions asked, the seller certainly didn’t expect the buyer to accept the sign-back of $888,000.

But as far as I’m concerned, a seller signing back at $888,000 when the property sat for 42 days on the market at $860,000, is basically telling us to go away. Or worse.

Our next example will feel similar to the first, but this one will draw on some of the themes from last week.

A small freehold property in the west end was listed for $899,900.

I mean, it still is. Don’t misunderstand – this property will never sell, as the following story will explain! But my story takes place in the past, hence the past tense… 🙂

This house was listed for sale in the spring for $1,099,000. It sat for quite some time.

The house was re-listed for sale in the summer for $999,900. It continued to sit on the market.

By the time my client and I got to it, the house was listed for $899,900 and had been on the market for 18 days.

It seemed like exceptional value, but the fact that it was sitting for almost three weeks offered us the opportunity to try an offer below the list price and see what would happen.

My spidey-sense was already tingling here. I just didn’t trust this offering. Whether it was the listing agent, the listing brokerage, or the way the house was presented (vacant, no staging, no marketing, misrepresentations in the listing), I just didn’t expect to offer $875,000 and have the listing agent smile, thank us, and send a copy of an accepted APS.

I mean, $875,000 on an $899,900 listing. Not bad, right?

Not bad for the seller and not bad for the buyer. In fact, some of you might offer, “David, you’re not negotiating hard enough!”

But I just had a feeling.

And when the seller signed back to us at an absolutely ridiculous $1,060,000, I felt like my feeling was justified.

I don’t know why but I just knew this was coming.

There was zero reason for it and zero indication that it would happen.

But on a long enough time horizon, you just learn to sniff these things out.

I asked the agent for a little bit of context on the sign-back, and he said, “Well I’m sure you ran the property history here. They paid $1,050,000 for the house in 2022.”

He was right. I did run the listing history.

Not only did I see that they paid $1,050,000 for the house in 2022 (which was a massive overpay back then, and perhaps why they were now using a discount 905 agent), but I also saw that they were listed for $1,099,000 for four months without a sale, and then $999,900 for three months, also without a sale.

“They don’t deserve to lose on this,” the listing agent explained.

“Deserve ain’t got nuthin to do with it,” said Clint Eastwood in Unforgiven.

I didn’t tell him that, by the way. I’m just going with my stream of consciousness here…

The concept of what is “deserved” in any market is a moving target but there’s been this expectation in the Toronto real estate market that nobody can ever lose.

In this case, the seller simply wasn’t willing to acknowledge the true fair market value of the property, and when the listing agent admitted to me (accidentally?) that our offer of $875,000 represented the first offer they had received on the property, it should have been like a flashing neon light in front of their eyes.

But it wasn’t.

Whether they didn’t know what “fair market value” meant or whether they just didn’t care, they refused to consider our offer. The listing agent even pushed as further out the door as we walked away, saying, “If you do sign our offer back, make sure it has a ‘1’ in it, or we won’t even look at it.”

If you read last Monday’s blog, you might ask me, “David, isn’t this false advertising? The property is listed for $899,900 but they won’t actually sell for this price, and there’s no offer date here.”

You would be correct.

At least, this is my definition of false advertising, as I outlined in last Monday’s blog. But in the Toronto real estate market, sellers are making up their own rules as they go.

I’ll offer a third story today, and this one involves a friend of mine from another brokerage.

Farrah showed the same west-end house to her buyer-clients that I showed to mine, only mine were a “pass” and hers were a “maybe.”

She and I both agreed that the house, listed at $1,899,000, was over-priced even though there was an “offer date” set for it.

The listing agent gave me a hard sell, even when I told him, “My clients aren’t interested.”

Farrah told me, “This guy’s been all over me; all week long.”

I told her in advance of the offer date that this one had a bit of an “odour” to it, just like the story I told previously. The more the listing agent tried to sell the shit out of us both on how amazing the house was, the more I began to think that he and his clients were massively overvaluing it.

As I said at the onset, many listing agents just aren’t willing to have difficult conversations with their clients.

This felt like a case of the clients saying, “We’ll only sell for this price,” and the listing agent taking the listing when he knows that the home isn’t worth it.

The offer date came along, and guess what?

Zero offers.

Farrah put together an offer for her buyer clients who liked the house but didn’t love it, and thus the offer was for $1,850,000.

The listing agent jumped right down her throat.

He emailed her “comparable sales” and ranted and raved about “value.”

She told me the whole story and I was actually mad at her for sitting there and listening to his nonsense.

“The more you let him talk, the more he thinks he’s making a point.”

This is the problem in our market right now.

Ego.

Combine the ego of a listing agent with the fear that agent has of the seller-client, and it results in all kinds of over-priced listings that won’t move, and bonafide offers of fair market value that are turned away.

The listing agent provided Farrah with a sign-back of $2,100,000 and her buyers instantly walked away.

That property was probably “worth” somewhere between $1,800,000 and $1,900,000.

Ultimately, it’ll prove to be “worth” what somebody pays for it, but the property might not ever sell.

Or maybe it sells in December. Maybe it sells in February.

Who knows.

But it seems as though many sellers out there in this fall market don’t “need” to sell and thus they don’t feel the need to consider what fair market value for their home actually might be.

Then on the flip side, many sellers do “need” to sell, but still won’t accept fair market value, and they create a massive mess for themselves.

The real estate equation out there this fall is quite simple:

Willing Buyer + Willing Seller = Sale

Yes, it’s simple, and yet the market doesn’t seem to be working in lock-step.

It takes two to tango, as the saying goes.

The buyers are out there on the dance floor looking for a partner.

But the sellers are waiting off the side of the floor, thinking they’re too good to dance, even though most of them have two left feet…

RICK MICHALSKI P.APP ACCI

at 7:28 am

Bang on David just like I said Once you make adjustments for the very very large majority number of listings that are just sellers testing waters at 50%+ above peak price, actual inventory number are very very very low.

With Bank of Canada interest rate dropping like a stone now as I predicted demand will stay white hot and prices shoot up glad you agree David ! Very smart!!

Francesca

at 7:57 am

I think a big part of the problem is this sense of entitlement that you always need to make money or at minimum break even to sell something you bought at peak price a few years ago and that for whatever reason you need to unload now. These people obviously need to sell or they wouldn’t not be listing their house for sale so shortly after buying. They should be grateful to get a fair market offer and get on with it. People in this city see real estate too much as an ever appreciating asset and always seem to overvalue their homes compared to the competition and in a declining market just don’t want to accept reality. Doesn’t help that real estate agents aren’t willing to have a difficult discussion with them for fear of losing the listing. The stale mate this is creating for both buyers and sellers is silly. Buyers always seem to be dealing with something: either having to overbid on properties in a sellers market or dealing with sellers’ unrealistic expectations in a buyers market. Sellers seem to always have the upper hand which doesn’t make sense and if you are lucky to find a seller who is reasonable it’s often not the house you truly want to buy!

Marina

at 9:17 am

Given Toronto market history, there are a LOT of home owners and investors who have never really seen a down market or a sluggish market. Maybe short term ones, but not really anything sustained. So in their minds, there is another equation:

Buy Real Estate + a few years = $$$

The idea that the market might be lower than when you bought just does not compute. Plus the FOMO of what if you sell today, but the market jumps up in a year? Maybe the buyer should just buy your excellent property now for prices from next year, because you shouldn’t be penalized for selling now. Which is insane logic, but there you have it.

I have a young coworker who bought a condo in 2022. It’s actually a nice condo, and his family are contractors so they revamped floors, bathroom, kitchen, etc. It’s a lovely condo. It is still, however, only going to sell for about 50K less today than he bought at. He tried selling it, and of course it didn’t work. He was genuinely puzzled. The following wisdom actually came out of his mouth: “You won’t find a better renovated condo in the city. In three years it will be worth another 150K. So why wouldn’t the buyer pay 75K more today? It’ll double his money – maybe more!”

He was so sincere in his ignorance, that I just had to walk away. I mean, where do you even start with this? And I do think there are a LOT of sellers out there that think like that. The market will go back up. Guaranteed. So why should I lose out today?

Derek

at 11:36 am

When exactly did my home become worth less than it was previously? And why is this the first I’m hearing about it?

Jennifer

at 12:52 pm

Funny enough this is exactly the logic agents were using on their buyers to overbid a few years ago, “It’s not worth that today, but it will be in x time so buy the future value today.” Again, logic made no sense and it all made it to be a bit of a house of cards. I am not shocked to see that logic now on the other side, except it is even more egregious.

your_favourite_tenant

at 1:36 pm

This is also the logic of pre-construction – buy this condo that doesn’t exist yet, for more $/sq. ft. then existing condos – its be worth more by the time it actually exists!

And it works, until it doesn’t. Looks like we might be at the time when it doesn’t.

I’m a buyer, all gussied up and ready to dance, but the options are fundamentally unappealing.

Vancouver Keith

at 4:52 pm

Exactly. And sellers need to be schooled. I remember an HGTV show on the selling process, in a good but not overheated sellers market. At one point a seller told the camera, I accept what the agent says about the market value of my house but it’s his job to bring me a client that’s willing to pay the price I want.

Interest rate impact lags. It will be a buyers market for a while, sellers will not wise up quickly. Reality is painful.

Sanh

at 3:13 pm

That seller would be right.

RICK MICHALSKI P.APP ACCI

at 8:55 am

Very very savvy young man. He is 110 % right and will be laughing all the way to the bank when he makes a massive ROI on his shrewd investment!

Appraiser

at 5:48 pm

“Metro Vancouver home sales jump 32% in October amid lower mortgage rates” https://www.canadianmortgagetrends.com/2024/11/metro-vancouver-home-sales-jump-32-in-october-amid-lower-mortgage-rates/

According to John Pasalis: “Toronto area home sales were up roughly 40% in October over last year”

https://x.com/JohnPasalis/status/1852316010193309780

House sales ⬆️ 45%

Condo sales ⬆️ 32%

Derek

at 11:56 pm

Woot woot! Looking forward to seeing the immediate rise in prices!

RICK MICHALSKI P.APP ACCI

at 8:57 am

Trreb stats out this morning CONFIRMED price rise! Dont say I didnt tell you

Ace Goodheart

at 9:04 am

Should be eye opening to see what happens in Decembet when the 999,999.00 peanut gallery folks can suddenly purchase 1,500,000 houses with 5% down and 30 year amortization.

The flood gates open?

Appraiser

at 2:55 pm

Flood gates open – why not ?

Canada enjoys one of the lowest mortgage default rates in the developed world. Year after year. No matter the economy or interest rates.

Ace Goodheart

at 8:14 am

I guess you don’t see the humor in being able to purchase a 1.5 million dollar house for $75,000 down?

Appraiser

at 9:57 am

As long as the buyer qualifies there is no issue, especially with the MQR still in place.

What one might consider to be an oversized mortgage is irrelevant.

5% down payment has been around for a long time.

Ace Goodheart

at 11:48 am

Fair points

RICK MICHALSKI P.APP ACCI

at 8:54 am

With Trump back in people from US and beyond will be flocking to Toronto. Already a world class gem demand and price for real estate is going to scream higher with everyone flooding here! Trudeau will win the next election and guide Canadas inclusive and progressive agenda making us even more desirable. You heard it here first!!!

Sanh

at 3:01 pm

There is no such thing as a “realistic price” or a “delusional seller”. There is only prices that have varying degrees of likelihood of selling within a set period of time.

Real estate is just a multitude of micro transactions and decisions. A seller setting a higher than expected price for a property is simply participating in the market and influencing it in a micro way.

I for one sure as hell do NOT hire an agent to pressure me. I hire him to give recommendations, and for him to try his best to achieve my wishes should i not follow his recommendations.