You know that I don’t like using summer market statistics to help explain the market, right?

Never have. Never will.

And yet for some reason, I feel compelled to continue the theme of posting a “TRREB Stats” blog every single month, even in July and August.

Perhaps it’s OCD. Perhaps it’s continuity. Or perhaps there’s a very small chance that we can use these stats to evaluate where the market is and where it’s headed. Right?

Or perhaps it’s all about interest rate cuts now.

Maybe we’re all simply sleeping until September 5th when there’s probably a 75-80% chance that we see another 25 basis-point rate cut by the Bank of Canada? If there’s a “Bay Street prediction” for this, let me know. But I would think it’s well above a 50/50.

In any event, I did have an epic two-part blog scheduled for this week, which I alluded to in the comments section on Thursday, but I’m going to shelve that in order to continue our monthly round-up of TRREB stats.

If you’re a market bear, you’ll thank me! After all, the average home price absolutely plummeted. Right?

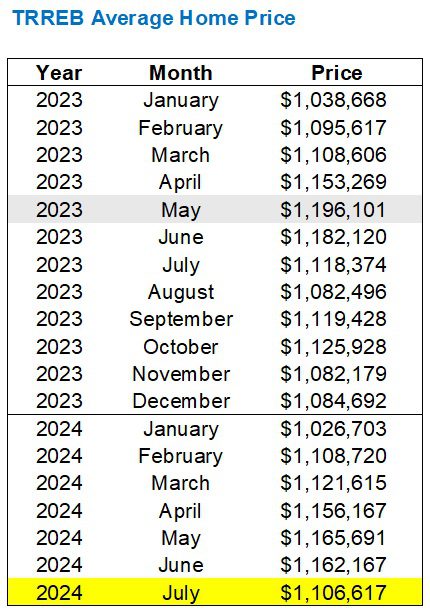

After checking in at $1,162,167 in the month of June, the TRREB average home price in the month of July was a modest $1,106,617.

That’s a decline of 4.8%.

Sound the alarm!

Prepare to abandon ship and then scuttle this perfectly good vessel.

Here’s an up-to-date look at the average home price in the GTA since 2023:

First, I’ll say this:

I talked a lot about whether April, May, or June of 2024 would see an average home price in excess of the $1,196,101 ‘peak’ recorded in May of 2023. But it never happened.

We fell 2.5% shy, as the $1,165,691 price recorded in May of 2024 was as close as we got.

I’m surprised. I honestly am.

But 2.5% isn’t exactly 7-10% so I won’t make too much more of this, other than to say I was more bullish on the market than what the market provided to us in the end.

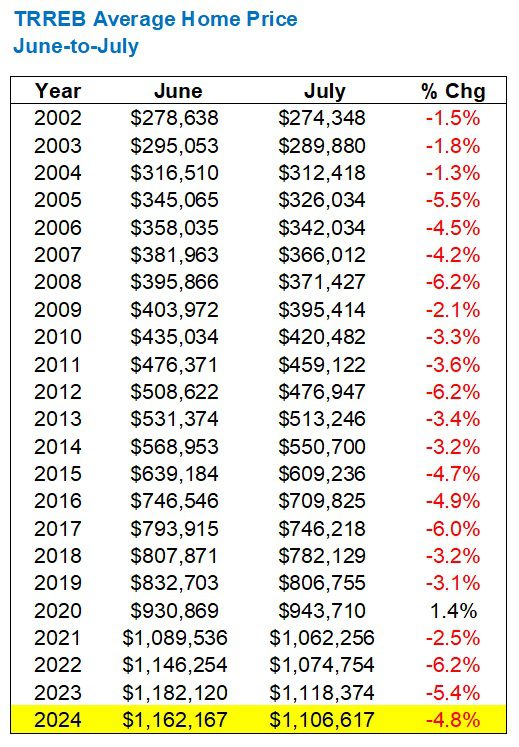

As for that drop from June to July, it’s a big number.

4.8%.

But does that mean your house or condo is worth 4.8% less today than it was one month ago?

Of course not!

The average home price declines every July.

Just look at the history since 2002:

Coming out of 2022 and 2023 which saw June-to-July declines of 6.2% and 5.4% respectively, you could conclude that this year’s 4.8% decline is lower than we could have expected.

Oh, and for those newer to the market and all things real estate, the reason that we saw an increase in 2020 (which stands out like a sore thumb on the table above) is because of the pandemic market recovery.

I have to wonder if, after seeing a 4.8% decline from June to July, we’ll see a decline in August? How low could the “average home price” go?

Again, considering this is just a paper figure, and not a true indication of home prices, it might not bear mentioning.

But there’s a “sticker shock to it.” And the sick side of me wants to look at the following…

Alright, I actually didn’t expect that.

In 2020, 2021, and 2022, the average home price increased modestly from July to August.

The 3.2% decline in 2023 was the highest in the entire data set from 2002 onward, so this is something to keep an eye on.

As much as I want to say, as I did at the onset, that summer statistics have little meaning if we saw an increase in the average home price next month, it might indicate that our fall market won’t be like 2023, which was brutal.

Perhaps that 3.2% decline in 2023 was a “sign of things to come?” For those who don’t remember, last fall was the worst fall market I’ve seen in recent memory. This past June and July weren’t great, so are things going to turn around in September, or will it remain like it has been – and follow in the footsteps of 2023?

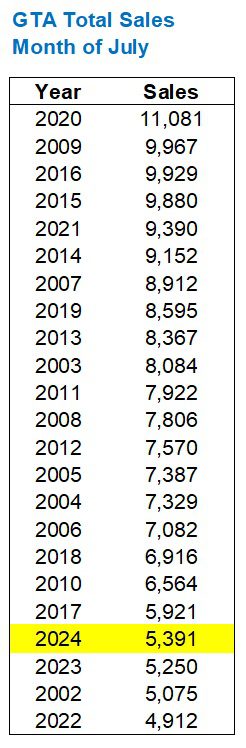

As for sales, recall that the previous few months gave us:

April – fewest sales in any month of Apri, 2002 onward

May – fewest sales in any month of May, 2002 onward

June – fewest sales in any month of June, 2002 onward

So did July continue the trend?

Nope.

Call this hair-splitting if you want to, but it’s not the fewest!

In fact, it’s a modest 3.3% gain over July of 2023.

For whatever that’s worth, and I believe it’s worth very little. But those 5,391 sales are still well below the 2002 – 2023 average of 7,868.

Then again, if we wanted to paint a more positive picture, then we’d look at how sales usually decline from June to July, as follows:

“Only” a 13.2% decline from June to July.

Coming off previous cycles that showed 24.1% and 29.8% declines respectively.

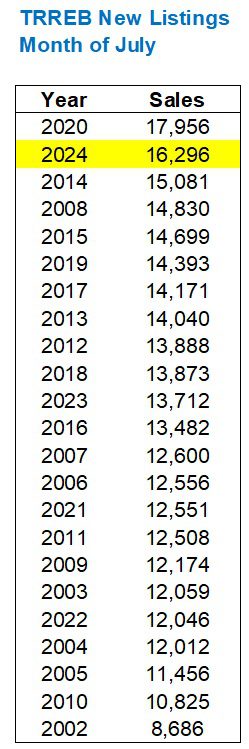

Alright, so sales are not declining as usual, but what about listings?

Surely we’re seeing a ton of inventory, right?

I would say……yes.

That’s the second-highest number of new listings in any month of July, 2002 onward.

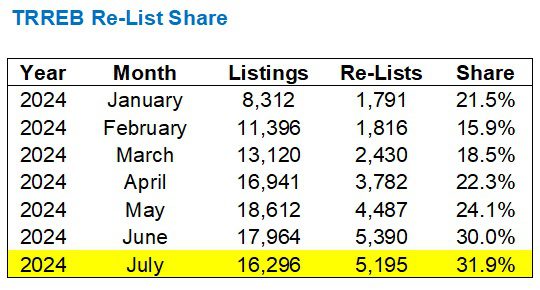

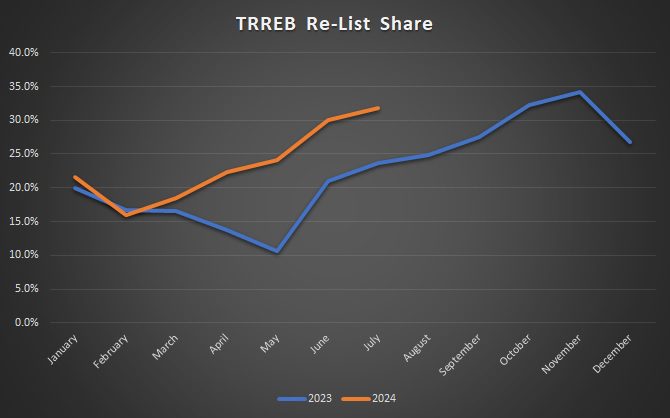

However, the “re-list share” increased again last month:

The re-list share is up nearly 2% from June, and I would expect this trend to continue as we move into August.

Remember, the fall of 2023 was really, really sluggish. And in that fall market, we saw a record number of re-lists, so my big question in today’s post is: are we going to repeat the fall of 2023, or are some of the more positive data points from today an indication that this year’s market will buck the trend?

Here’s a look at how the re-list share played out last fall:

As I said, we saw a much higher re-list share in March, April, May, June, and July of this year, and it looks as though August will follow.

But can we expect to top the record 34.1% re-list share from November of 2023?

I’m going to call it now: no, we won’t.

I was speaking to a colleague today who told me, “I don’t know what to expect this fall, but my 2025 is shaping up to be great!”

I asked her what she meant by that, and she said, “There’s a lot on the market right now but it’s all trash. I have sixteen buyers under contract, all ready to pull the trigger, but what they want just isn’t out there!”

Having pre-written most of today’s blog post, I was armed with the statistics noted above. I told her, “We just saw the second-most number of new listings in any month of July from 2002 onwards, and you’re telling me that ‘there’s nothing out there’ right now?”

She spat out my statistic and reiterated her position.

“It’s re-list city out there. And most of the inventory is leftovers from May and June. Shit has been picked through like your scalp during a 1980’s lice-check by that weird school nurse!”

She actually said that.

Analogy aside, she’s not exactly wrong. Statistics would disagree with her, but I too am feeling that there’s not a lot of quality product out there for my buyers right now, and several of them have been with me since the early-spring.

Expect the month of August to follow July quite closely, and then when we get to Labour Day, it’ll be a battle royale between the bulls and the bears, both claiming victory over the market.

September 5th is the next Bank of Canada announcement.

So when I say “battle royale,” I mean it. If you think there are market haters out there right now, just watch them double-down after a rate cut…

…or two…

JF007

at 9:34 am

@DavidF can dig up the re-list shares from previous years for a true comparison and it would also give an idea what are the actual number of new listings when compared to previous years and where do things stand year wise.

As for market absolute crickets in my area of Peel..homes between 10 years to less than 5 year old listed for months now at prices people would have killed for these past few years and have been languishing leading to either terminations suspensions or re-lists..even new developments from GGulf in the area languishing where as just 2-3 years ago you would ahve people lined up around the street in front of their office a day or two before opening of sale.

Derek

at 9:49 am

https://www.newswire.ca/news-releases/history-suggests-stressful-times-for-the-canadian-housing-market-880614911.html

I don’t understand it. Why, historically, did house prices drop while interest rates were lowering? Is this “fake news”?

Nick

at 12:11 pm

No, that would be the reality that interest rates are not an immediate on off switch. It takes time for their affect to occur.

As an example when rates were increasing this time, prices still went up for a few months because the rates hadn’t gone up so much that people couldn’t afford it and also individual buyers still had pre approvals they could use.

Additionally, rates generally get forcibly decreased when the economy is not at its strongest point meaning less people will be able to immediately take advantage. Again it takes months and multiple cuts to start creating upward pressure on prices as it all works through.

Derek

at 2:11 pm

Wait, what? I mean, not this time though, right?

Ace Goodheart

at 12:35 pm

The difference this year is there was no spring market.

Usually stuff slows down in July and August, after a heated spring. This year, there was no such thing. Spring buying season simply did not happen.

It looks like condos are faring the worst. There is a six month supply of inventory out there. No one is making money on condos right now. If you have one to sell, best advice is to wait. If you are buying, it is like being in a candy shop after it closed for the day. No other customers.

There is still roughly a 30-40% difference in what people can afford, and what stuff is being sold for.

Everyone is saying, well, interest rates will go down to the point where people can afford houses and condos again and then when that happens, look out!

That is just market timing. What do they tell you about market timing, in every investment course, every economics class, every lesson on buying and selling commodities?

Don’t try to time the market.

Why would it be different this time?

JF007

at 4:44 pm

Back in 2012 when I came to Toronto after spending 6-7 years down south for work used to share a condo with a friend who had been in Canada for a bit and he shared an anecdote that how for a time the builders would sell condos based on the current market prices of condos but then some genius (greedy) builder figured that why to leave the profit on the table that a buyer would see on appreciation of prices from the time they purchase to when they get occupancy, and started selling condos at prices that they figured would be in future at the time of occupancy and rest followed suit..so now we are a position where over a period of time entire supply chain in the condo building process wants their pound of flesh and we are stuck with land that is exorbitantly priced to begin with and everything else follows suit leaving with condos having to be built ever smaller to be sold to investors for renting out to students/bachelors etc…when we say downward pressure on prices yes on single bed/studio type condos that were sold in last 2-3 years for rest it is some small pain for next 2-3 years but investors in former would take more than a hair cut to survive.

Ace Goodheart

at 7:19 pm

It won’t be possible to make money in Toronto real estate for likely around 10 years.

The party is unfortunately over.

It was, though, a very good party, and those of us who profited from it will look back fondly at the gold rush that was.

Ten years from now the next upward cycle will start and it’ll all happen all over again.

Alex

at 4:25 pm

I think there’s a 90% chance of a .25 bps cut in September and a 50% chance of a .50 bps cut in September. Still bullish on my gift card 🙂

Appraiser

at 8:52 pm

“We finally have the first Big 6 bank (Scotia eHOME) with an advertised uninsured fixed rate under 5%. First time that’s happened in over two years (last time: June 2022).”

“Despite the bounce in yields the last few days, mortgage spreads are still wide enough to support more fixed-rate cutting. And that’s exactly what we’re seeing. 3 of the Big 6 trimmed fixed rates in the last 36 hrs.” https://x.com/RobMcLister

Derek

at 11:48 pm

What is a “market hater” per the last paragraph?

Ace Goodheart

at 8:24 am

This seems to be a person who understands real estate market cycles and the role inflation plays in setting home prices.

Derek

at 11:27 am

Can someone be a market observer? Do you have to choose sides?

Ace Goodheart

at 1:22 pm

I think you just see what you see.

I guess if you don’t want to make known what you are seeing, you become an observer

Steve

at 9:26 pm

I’m not a housing bear, but I have never seen properties linger this long, or being re-listed every few months, before now. Despite prices, sales seem to be very slow. Can’t help but think we are in a stand-off situation, with buyers and sellers awaiting the other’s capitulation.