Maybe I’m just opening up another can of worms here, but I want to go back to last week’s epic discussion about the average Toronto home price, my predictions about the possibility of an increase in that statistic this fall, and an examination of where that number comes from.

Many will suggest that a Realtor trying to downplay the significance of a negative statistic is just more snake-oil selling, but I think my regular readers know that I write what I believe.

I really, truly believe that the $732,292 number representing the average sale price of a Toronto home this past August is misleading, so allow me to explain why…

The stakes have never been higher for bulls and bears.

The bears smell blood in the water, and they’re coming out of an epic hibernation.

The bulls believe in their position, and will defend it until the bitter end.

In a market of ups and downs, short and long term, I think it’s fair to say that both bears and bulls can be correct, at the same time.

But in the past week, I have never seen the kind of passion, and at times, animosity, coming from the mouths (and fingertips) of said bulls and bears.

Even politics doesn’t get this messy.

Last Tuesday’s blog post spawned a record near-200 comments, and while many of the comments were from a handful of loyal and passionate blog readers, engaging in a very rare – for the 2017 Internet, un-moderated debate, an incredible number of people weighed in with their opinions on the future of Toronto real estate.

I usually know when I’m about to light a fire, and walk away.

If you’ve been reading TRB for a decade, you know that sometimes I’ll post a blog because I know it’s going to result in debate.

But to be honest, I had no idea what a hurricane last Tuesday’s blog was about to cause.

My predictions were honest, and so I thought, reasonable.

Dare I say, in my mind, they were obvious.

The average sale price in Toronto fell to $732,292 this past August, from a peak of $920,791 in April. Everybody and their drunk mother know this number will be higher by the end of September.

Right?

So I thought, perhaps rather naively.

Perhaps I underestimated the number of market bears out there, and while some have suggested that the “bulls” and “bears” label are too form-fitting and restrictive, I really do think that there’s little room for an in-between.

A cynic would suggest that the bulls own real estate, and the bears do not.

I could easily create a fictional “bear” who passionately, and at times of late, aggressively, states his or her position on Internet forums. This is a would-be 2007 real estate buyer, who heard the market was going to tank, and held off on purchasing. The $1,000,000 house that he or she eyed in 2007, gained, and gained, and gained, hitting somewhere in the neighbourhood of $2,400,000 earlier this year. “Denial” isn’t a river in Egypt; it’s a character trait that we all possess, and many demonstrate in times of complete and utter dismay.

If I were a person who read the wrong article, took the wrong advice, or believed so hard in my own hope/dream/prayer that I cost myself a lifetime of tax-free capital gains I would never make back, then I might be angry too.

But reading the comments on many online newspaper articles, I just can’t get over the level of anger that exists.

Anger.

Real, true, anger.

It’s present in every comment section of every newspaper article about real estate this month.

I’m blessed to have a readership on TRB that is far more savvy, informed, and respectful, than what trolls around the Internet. TRB’s bulls and bears throw statistics like adults; not feces like monkeys.

But online – just, wow, I can’t get over it.

The Globe & Mail wrote just about the only positive article about the Toronto real estate market last week: “The Buyers Are Back In Toronto’s Housing Market.”

The comments, which have now been closed, were beyond angry.

Many readers took to calling this “fake news” and suggested that there was some sort of conspiracy between the Toronto Real Estate Board and the Globe & Mail to publish false information.

Here’s a sample of the comments:

“Yet another sponsored article by TREB/agents.”

“This article is FAKE NEWS! This market is about to plummet another 20-30%.”

“This is complete propaganda from the RE industry! G&M needs the cash (advertisement) and will print anything these guys will tell them to.”

“G&M you will go bankrupt if you continue to post realtor propaganda. Pathetic and laughable article.”

Where does all this anger come from?

And tell me if I’m wrong here, folks, but I believe that you are far, far more likely to predict a market crash if you want it to happen, then if you don’t.

I also think that the people that are the most angry, and screaming the loudest – throwing around “fake news” tags like those above, are far less likely to own real estate.

I’m not saying that all market bears are non-owners of real estate. But I’m saying that not owning real estate is a fantastic reason to have a bearish outlook, and delude yourself into thinking a 50% market crash is coming.

So with that out of the way, and keeping in mind that this was just supposed to be the lead-in for the actual meat of today’s blog, let me get back to the decline in average home price.

I made two statements last week that I think many people disagreed with:

1) The average sale price of a Toronto home will increase in September and October, over that of August.

2) The average sale price of a Toronto home, reported in August, of $732,292, is misleading.

I stand by both of those statements, and today, I’m going to double down.

The reason why I ‘predicted’ that the average sale price in Toronto would increase in September and October isn’t because, as some commenters suggested, I was biased, or cheerleading, or pumping tires, or “trying to change the psychology of the buyer pool” (which was flattering, for somebody to think one blog post on the entirety of the Internet could have that effect), but rather because I figured that was a slam dunk.

The average sale price dropped 20% from April to August.

But the value of Toronto homes didn’t drop 20%, or anywhere near it.

This is what I mentioned last week, and have said in a number of media interviews – that the average home price decreasing 20% on paper has not translated in practice.

Not even close.

Yes, the average sale price reported by TREB has dropped from $920,791 in April to $732,292 this past August.

But I, or anybody else, nor you if you tried, can find a $1,000,000 house that’s selling for $800,000, or a $500,000 condo that’s selling for $400,000.

So ladies and gentlemen, get ready to throw the “fake news” tag at me when I suggest that the average sale price reported in July and August does not reflect the average value.

The two simply are not aligned.

Yes, I agree that values are down, the market has changed, the market has declined, the psychology has changed, and we’re in a far more balanced market. The spring conditions are long-gone.

But the numbers, on which the media, and the bears, want to focus, are exacerbating and exaggerating the decline.

Over the past month, I have offered two reasons for this:

1) Fewer houses are sold in the summer, as the housing market is more cyclical than the condo market.

2) Far fewer luxury houses are sold in the summer, because luxury homes are always marketed in the spring.

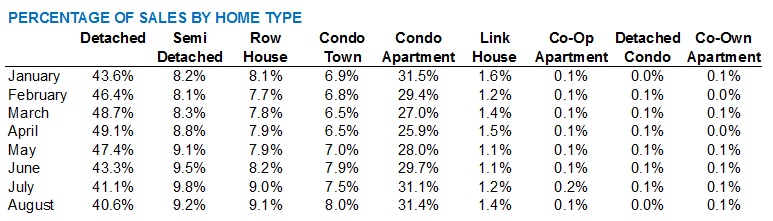

So let’s look back through the first eight months of 2017, and see how each of the nine home-types that TREB tracks represented all the home sales, on a percentage basis.

Many of you won’t be familiar with these home types, but I figured I’d show them all, as TREB does.

A “link” house is a freehold, which is linked underground via the foundation, but might not be linked above ground, like a semi or a row.

A “co-op” apartment and a “co-ownership” are essentially the same thing, as far as I’m concerned. Both fall under the “condo” umbrella.

A “detached condo” is something, to be quite honest, I have never seen and really don’t understand, and perhaps that’s why the numbers are so low.

In any event, you know what detached, semi-detached, and rowhouses are (the latter shows as att/row/twn on MLS for attached-rowhouse-townhouse, simply meaning it’s attached at both sides), and you know what condo apartments and condo townhouses are. The rest are such small percentages, that they’re not really important.

Here’s how the percentages break down:

I think it’s important to note, more than anything, how the percentage of detached homes, which are the holy-grail of houses, and clearly the most expensive, peaks in April at 49.1%, which of course, we know as the peak of the average home price, and valleys in August at 40.6%.

Coincidence?

Or correlation?

Those nine categories are confusing, and unnecessary, and I’ve really only included them to be exact.

Let’s add together the freeholds (detached, semi-detached, rowhouse, link house) and label them “Freehold,” and add together the condos (condo townhouse, condo apartment, co-ops, detached condo, and co-ownerships), and label them “Condo.”

Again, we see the trend continue.

The month of April saw 67.3% of all sales represented by freeholds.

That number dropped dramatically to 60.3% in August.

You might think 6% is insignificant; a ’rounding error’ you might say.

But if the average freehold price in Toronto was, say, $1,000,000 in August, and the average condo price was $500,000, then seeing 6% fewer freehold and 6% more condos in August, than in April, is clearly going to change the resulting average sale price.

If we saw the same 67.3% and 32.6% ratio of freehold to condos in August, as we saw in April, the $732,292 would be significantly higher.

If we’re truly going to compare apples to apples, and compare the average sale price in April to the average sale price in August, then we need to consider what the average is averaging.

In this case, we’re averaging a different set of data: far fewer houses, and far more condos.

We all know that the real estate market is more cyclical for houses than it is for condos.

Who owns houses? Primarily families.

What do families do in the summer? They vacation. They send the kids to camp. They do not diligently and feverishly partake in the real estate market, as they do in the spring, and the fall.

That “average sale price” in August is skewed because of the sample being taken.

And it’s for this reason, going back to my blog from last Tuesday, that I figured I had a “slam dunk” prediction when I said the average sale price in September will be higher than August.

I still believe that.

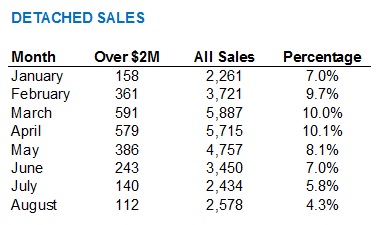

As to my second point, about the luxury home market, consider the following:

Now first and foremost, I don’t consider a $2,000,000 home to be “luxury” in Toronto any more, but TREB uses this as the highest price point tracked, so let’s work with what we’ve got.

Just as I suggested that there are more houses, as a percentage of sales, sold in the spring than in the summer, I am have suggested that the same is true with respect to the higher-end homes.

This chart proves that.

We saw another peak (a continuing theme) in April with 10.1% of all sales for detached houses topping $2,000,000.

in August, that number plummeted to 4.3%.

Once again, you have to figure this will have an affect on the average sale price.

Those $3 Million, $4 Million, and $5 Million homes that were listed in the spring, were not listed in the summer.

And while you might say, “If home prices decreased, then a $2,100,000 house that sold in April, and is included in those 579 sales, would sell for $1,990,000 in August, and wouldn’t be included in the 112 sales,” I would agree, but, I would suggest that we’re talking about a literal handful of properties that fit that description.

For the most part, we’re talking about 6% fewer luxury homes being sold in August, than in April.

–

Bottom line, folks: I’m telling you from experience in this market, that the 20% drop in average sale price, on paper, has not translated to an actual 20% drop in sale price, in practice.

I’m not seeing out there, and neither are my colleagues.

Ask your friend from work who is looking at houses every weekend – the drop isn’t there.

5%, 10%, whatever you want to call it, depending on the location, and property type.

But just as I “predicted” last Tuesday that many buyers would be caught off guard with respect to market dynamics, I also think they’ll be caught off guard by market price.

Just as they’ll be caught off guard if they’re not expecting to see “offer nights” on freehold houses, and houses selling quickly, they’ll be caught off guard if they’re looking at a block of houses worth $1,000,000 in the spring, thinking they’re going to pick one up for $800,000.

To answer a few commenters from last Tuesday’s blog – yes, if I’m wrong about the average sale price increasing in September, I will absolutely admit that I was wrong, and post a photo of myself on Instagram wearing a dunce cap.

So long as you understand and acknowledge that after ten years of blogging on TRB, I write what I believe to be true, not what I want to be true. The formula for many market bears, ironically, is the exact opposite…

Ralph Cramdown

at 7:27 am

When the average price advances by 20% or 30% in a year, the industry lets the numbers speak for themselves, while the public frantically tries to understand how and why it is happening.

When the bloom comes off the rose, the industry frantically talks about sales mix, but the public lets the numbers speak for themselves.

So how much of the price appreciation in recent years was real (i.e. actually happened to a typical property) and how much was an artifact of sales mix changes? I guess nobody is burning the midnight oil crunching those numbers.

Seller

at 8:35 am

I think David is right about homes not being down 20%. In fact I closed in the early spring on a tear down detached home then thought about flipping while going to get a permit to build.

I listed for 20% more than I paid and have already received 2 offers at 10% more than I paid which I have turned down. So much for a 20% drop.

If I get my price it will be sold – if not I will build. I do not NEED to sell as I suspect there are a lot of others like me who don’t NEED to sell.

iwill

at 10:55 am

2 houses sold in Moore Park in the spring for $3.5 – 3.6M; those houses are $3M houses today. close to 20% down. So yeah they have dropped. However they were $2.6M last year.

Greg

at 12:33 pm

It’s called an HPI (Home Price Index) and it is quite easy to come by. It is value based on a historical benchmark (typically 100) that allows one to gauge how house prices are changing over time by accounting for changes in housing composition.

The CREA/TREB maintains one and updates it monthly. (see http://www.trebhome.com/MARKET_NEWS/home_price_index/index.htm). As does Statistics Canada which updates theirs annually (see http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/manuf12-eng.htm)

I am surprised that David did not mention it in this article especially when spending so much time talking about composition of sales. The CREA calculation is limited however because it is such a lagging indicator due to their methodology. In particular this part (from http://www.crea.ca/wp-content/uploads/2016/02/HPI_Methodology.pdf)

“To mitigate volatility, a moving three-year sample period is used, since the use of a shorter

sample horizon may result in an insufficient number of sales over the period and cause index

inaccuracies. ”

Personally I think that is a little bogus. They should also provide a one month sample horizon along with he volume numbers and let the reader decide if the number of samples is too small to make a valid comparison. More info, not less is a good thing. It does nothing to CREA/TREB’s reputation when they are not more transparent with their data.

Francesca

at 7:41 am

Very good article David defending your point of view. I tend to agree with what you are saying as I’m definitively not seeing houses selling for less money over the summer. If anything sellers were taking their houses off the market in my area if they really didn’t need to sell. Only those that had bought already were forced to reduce prices to sell. To your point about detached family home sales being cyclical I agree with you wholeheartedly. Most people who have a family with school aged kids prefer to list in the spring to move out in the summer so they can be in their new home for the start of the school year in September. Most people will prefer to not move their kids out of school mid year unless they are just moving from one house to another in the same school district. As for your comment about detached condos..there may not be many examples in the city but I can give you an example here in Markham where I live. There is a gated community of adults lifestyle called Swan lake here that compromises of condo apartments, condo townhouses and 10-12 detached condo homes. These are fully detached bungalows with their own garage and yard but because they are within the gated community and they too pay maintenance fees and get to share all the amenities. Condo detached are also common in the USA. My sister lives in the suburbs of Philadelphia in such a house in a gated community. In Toronto where land is so valuable such a form of housing would be a rarity for sure.

ed

at 8:39 am

It is very interesting that within the city of Toronto we can see different areas reacting so differently. Where I was living in central Etobicoke I have seen bungalows that in March (which appeared to be peak craziness in this area) crack a million and now selling in the $800,000 range. I don’t think it is typical of all areas of the city but I do think that in certain neighbourhoods and at certain price points we have seen a 20% drop. Certainly not across the board though.

John

at 7:45 am

Why not use the median home price instead of the mean (average)?

Kramer

at 11:11 am

Using the median won’t correct this particular ‘flaw’ in the data. Median will be impacted by the change in composition same as the mean.

When the market was increasing, the same flaw in average price would have existed… people didn’t argue it though because it was obvious by comparable sales in everyone’s neighbourhood that prices were increasing. That’s the only thing you can do today as well… look at your own neighbourhood and comparable sales… the consensus of all these observations would be that prices have softened some since the peak, but not by the amount of the average.

Professional Shanker

at 2:19 pm

Kramer is correctly reading between the lines of this post, the increases weren’t as high as some would have believed in April and not as low as reported since then. What I don’t understand is that TREB provides average and mean prices for each segment of the market (detached, condo, etc.) by city or area in Toronto, so really you can figure out exactly what a detached house as increased/decreased by – don’t need to hypothesize via the mix between segments. Now, the luxury sales point of detached homes selling greater than $2m, I guess you can chalk this up to true mix change.

Kramer, what is your take on renovation dollars influencing average price growth. Anecdotally, I believe that a very large % of price growth over the past few years should and can be attributed to this. Why isn’t this discussed and further this could have been a driver for the massive increases over the past 2 to 3 years.

Kramer

at 4:32 pm

Good question. My first reaction was ‘yes, this must be part of it’. But I’m not completely sure of the exact effect it has on “market price” per house.

By renovating you would be increasing the total value of the entire market. You’re making some of the houses worth more by pumping cash/resources into them. So now the total $ value of all houses combined is worth more. This is 100% certain.

But would you be growing the “market price per house” necessarily?

If my neighbor and I have the EXACT same house, and then they invest $250K into his house… all else equal, is my house worth more? Not really, aside from some indirect impact (neighborhood maybe looks nicer, etc).

At the other end of the spectrum, if the entire market was made up of only 10 houses, and you renovated all 10 of them (pumped in cash/resources), and one of them sold, then yes, the market price per house has gone up as well. But what if only 5 of the 10 were renovated… would the 5 that were NOT renovated have gone up because you renovated the other 5? I don’t see why they would.

If this goes back to the whole sales mix behind the average, you would have to assume that as more houses are renovated into being “luxury” houses, that the number of houses sold in all segments stays the same as well… it’s not obvious to me here either.

Technically it could have the opposite effect. If you have 10 houses that are various price ranges and the market bears them, and you renovate all of them to the highest price range, if the buyers available cannot afford a market filled with the best houses, then wouldn’t the market price decrease? I don’t know. Theoretically?

Maybe this is why this aspect has not been widely discussed… not so cut and dry. I agree that it must play into it, but it would require some deep diving, some pretty complex analysis to break out the portion of market price increase that is attributable to renos being done… you would also have to break out the portion attributable to neighborhood getting better, to gentrification, to new Starbucks openings, etc. Personally, if I own a house, I would rather have a new Starbucks open nearby than have my neighbor renovate… unless my neighbor’s house is actually deteriorating property values.

So maybe the answer is that renos grow the “total value of the market”, but only “indirectly impact the market price for houses”. ?

Doug ford

at 7:48 am

David,, you are so adorable! You have worked in an industry that has only seen the bright side of the equation, never having seen or been through a recession or a serious real estate crash. They happen. Will happen. But, as an agent who gets paid either way, why do you care?

John

at 7:56 am

Straw man argument.

Geoff

at 4:25 pm

Was there something of value in that posting there?

BJA

at 4:07 pm

Something of value? From a guy with such an a**hole handle? Hardly!

Appraiser

at 8:09 am

It is true that the last five months in a row saw an increase in listings, year over year in relation to those same months a year ago, however the trend slowly decelerated each of those months and was finally negative again in August. The supply train is once again in reverse.

What’s that law they have in first year economics?

Oh yeah, on averages. H.L. Menken wrote:

“It is even harder for the average ape to believe that he has descended from man.”

JCM

at 4:22 pm

Listings are up again year over year in the first week on September. I expect that to continue as houses that didn’t sell in the Spring/Summer are re-listed.

https://twitter.com/JohnPasalis/status/907217107951263744

Real estate millennial

at 8:36 am

I agree with most of what you’ve said the only caviot I’d wait for is the OFSI ruling on uninsured mortgages if the stress test is applied across all borrowers I could see prices continue to stagnate and sales decrease. The CEO of RBC seems to believe that should be implemented given his interview on BNN last week (RE industry is pushing back which personally I think is stupid. I have my real estate licence and appraisal designation and refuse to fight that change with TREB). You’re right about prices decreasing I appraise 15-20 homes a week and there is no 20% dip but to be fair most appraiser valuations were never near the sold price during the peak of April. In 90 days we’ll see what happens it should be an interesting fall market.

kd

at 8:54 am

Thanks for the explanation. Let me add a few things.

First: while you may be right that mix will drive up September’s average price a bit, in the slightly longer term it will pull things down as the market share of detached homes continues to shrink. The GTA looks to be going in the same basic direction as Vancouver (i.e. their detached share in Aug 2014 – 41.8%; in Aug 2017 – 29.6%).

Second: the downturn is mostly about low rise homes, especially detached houses. Condo apartment price in August in Toronto, Markham and Mississauga (i.e. the main markets), are either slightly negative (i.e. in the low to mid single digits) or barely positive from a year ago. Not good but not exactly a catastrophe.

Third: place really matters. Median detached prices in Newmarket, Richmond Hill, Markham and Pickering are down not only from the March peak, but also from much earlier. August 2017 prices are barely above those of August 2016 (i.e. 0.5% to 1.2%). In real terms they are actually under water. While almost all markets are down from the March madness, most are doing much better than the fatal four. Detached homes in Milton, Brampton, Burlington, Barrie, Georgina, Innisfil and Burlington are still showing gains of 8% to 12% on the year. Nowhere near the March increase, but still pretty respectable.

Fourth: the new home market is going nuts with obscene record high prices in both the low and high rise spaces. In July BILD reported the average condo apartment sold for 40% more than a year before and 27% higher than in March. So …. at least some people, really, really want to buy and aren’t concerned about annoyances like rent controls, foreign buyer taxes and the downturn on the resale side. I don’t pretend to understand what is going on there, but it’s hard for me to believe the new buy frenzy won’t impact resales, probably in ways most of us won’t like.

Fifth: the scale of new buys is pretty astounding – 24,411 new condo apartments were sold in the first seven months – double the average of the last decade; 11 thousand of these were bought after the Province introduced their new rules. Also as a reference point TREB reported 17,282 resale condo apartment sales over the same period. So this is a big deal. And yes, the new apartments aren’t built yet and to an extent I’m comparing apples and oranges, but for better or worse, this will effect us all.

Sixth: GTA builders have pretty well give up on the low rise market, at least until after the next election. In July some 137 new low rise homes were sold or about one for every 47 thousand GTA residents. With new low rise homes nearly extinct in the GTA is it any wonder there’s a housing crisis?

Francesca

at 9:15 am

KD you are correct in saying that certain 905 markets are barely at August 2016 prices. I have seen that first hand here in Markham where buyers were being stubborn waiting for March-April prices and then taking houses off the market after 4 months for sale and only reducing their prices to sell if they absolutely needed to sell. This to me is a clear indication that certain pockets of the 905 was definitively inflated by foreign investors. Almost every single house in my area of east Markham sold to Asian buyers in the last year. Nobody local could afford to trade up and move with these inflated prices. To your point that new builds are still selling at record prices: also correct. There are new builds being built constantly where I live from condos, towns, semis and detached and the builders have not decreased their prices. Why anyone would buy brand new when they could buy resale at a lower price and then make any cosmetic changes is beyond me especially when we are talking about buying resale homes that are less than a decade old so not needing any major repairs yet like roofs etc.

Chris

at 9:00 am

David,

As Kyle, Kramer, etc., and I discussed last week, many of us agree with the crux of this post; the decline in average sales price is a mixture of composition change and value change. The statistics you have presented clearly demonstrate that.

You may also be correct in your assertion that average price will climb in September and October (although, again, we will be left questioning how much of this is composition vs. underlying value changing).

However, I reiterate my concerns regarding the headwinds I brought up last week:

– Interest rates climbing last week, with more rate hikes predicted for 2017-2018

– OSFI stress test, widely predicted to be implemented

– Record levels of household indebtedness

– The impact of speculative investors, particularly in 905 neighborhoods (who may stop buying/begin offloading properties without continued appreciation on cash flow negative properties)

– Reduced foreign demand both due to foreign buyer’s tax as well as China’s capital controls

– Toronto real estate at it’s least affordable since 1990 (RBC affordability report)

Given all of these facts, I just can’t be optimistic about the short to medium term propsects for Toronto real estate. Sure, price may tick upwards in the coming two months (the very very short term), but what about over the next 2-5 years? (that’s a rhetorical question, as none of us, unfortunately, can predict the future!)

Kramer

at 11:51 am

Chris,

A good list of headwinds. Certainly a mighty breeze being blown from many sources.

What tailwinds would you see over the long run for Toronto real estate market?

Chris

at 12:34 pm

Kramer,

Good question!

I am actually relatively optimistic about Toronto real estate over the longer term.

Some tailwinds I perceive:

– Although population growth has slowed recently, Toronto does still continue to grow, increase in density, and is a vibrant, global city with a high quality of life

– The City of Toronto (416 area) has limited room to grow (note that this same argument does not apply to the GTA as a whole; many areas in the 905 have space to grow, with huge swaths of land left to develop before they are constrained by the Green Belt)

– Lack of financial literacy in this country; very few people I know understand how to invest in stocks, bonds, ETFs, etc., whereas almost everyone understands how to invest in real estate at a basic level (buy house, live in house, sell house for more money later); until people become more comfortable with other investment vehicles, real estate will continue to be attractive

– Real estate has a long history of appreciation; usually closer to the rate of inflation, but even at this rate, when coupled with the Principal Residence Capital Gains Exemption, as well as the leverage you can employ through real estate, the potential for long term gains is pretty good

If I were asked by someone moving to Toronto if they should rent or buy, it would depend on how long they’re planning on living in the same home (longer is better for buying), how financially disciplined they are (if they rent rather than buy, will they save the difference and invest it, or just spend it), how much flexibility they need (easier to move to another city for work if you rent rather than buy), etc.

I would also strongly urge them to buy a home within their means, that they can afford (the total carrying cost, not just the mortgage, need to consider insurance, taxes, maintenance, etc.), and one that they can afford even if interest rates were to climb.

While I’m bearish on real estate in the short term, I’m also not one to advocate trying to time the market. If you need a home, plan on being there a long time, buy within your means, and can incorporate real estate as part (not the entirety) of your portfolio/net worth, then by all means, buy a place, even at today’s historically high valuations. Chances are, it’ll end up fine in 10, 15, 20, 25 years.

Kyle

at 10:11 am

Great number crunching and insights, David!

Here’s hoping you don’t need to do that instagram pic.

JCM

at 12:54 pm

Personally, I’d bet on another monthly drop despite the typical September increase for the simple reason that listings are up again. In the first week of September, listings were up 6% year over and sales were down 33%. https://twitter.com/JohnPasalis/status/907217107951263744

That said, who really cares. Interest rates, the new OSFI stress test and different market sentiment (no FOMO, no speculation) will likely hold prices down for years to come, regardless of what happens in September

Kyle

at 1:24 pm

I think you might be confusing his tweet. New Listings are up 6% Y/Y for the beginning of September, not active listings. Also remember that last year was a record low for supply.

JCM

at 4:19 pm

Yes, I understand the difference between new listings and active listings. Active listings were up 65% in August year over year.

I would note that the year over year increase in active listings has presumably increased further in the first week of September, as new listings are up year over year and sales are way down.

Jack

at 3:01 pm

David, a good piece of research, thank you.

You did another good numbers-based post on June 19.

https://torontorealtyblog.com/archives/18171

It was kind of open-ended, with a number of properties that were listed, then re-listed and still unsold on the day of your post. So what happened to them? Did they sell for more, for less? Were they re-listed again later?

Joel

at 3:10 pm

From tracking properties in my area I have noticed a maximum of 10% dip in market values. Prices are still up over last year though, just without the frenzy.

The anger that people have about a real estate prediction is hilarious. Anyone who uses the term “fake news’ I immediately dismiss as an idiot and do not put any weight on their argument. It would be nice if others debated your points with actual figures and stats and not just “Garth Turner said” or “Conspiracy Theory”

As others have mentioned if OFSI changes how mortgages are qualified for we will see a massive impact on real estate prices. There are so many people that refinance consumer debt into their mortgages. If they are not able to qualify for this we will start to see a lot of people desperate to sell in the next few years. I am a mortgage broker and would suggest 5-10% of my clients would either need to add second mortgage or sell their homes in this scenario. If this comes into affect we will start to see more inventory in a couple of years.

Jack

at 3:13 pm

This post is about two questions: What will happen to RE prices in Toronto in the next few months? Why are some people such passionate believers that the prices will rise or fall? There is an easy way to answer the first question — just wait a few months. The second question is more difficult. It could be a good topic for psychologists and sociologists out there. But the claim that it’s mostly non-owners who believe that prices will fall is just too simplistic. In fact, the scramble to buy over the last several years was driven by FOMO (fear of missing out), non-owners believing that prices will keep going up and leave them home-less.

blowing Sunshine

at 3:34 pm

Jack- I agree. The psychological factor cannot be overstated. People made decisions in terms of real estate over the past few years that were divorced from financial prudence or logic because they believed that if they didn’t they would never own a house. And the same can be true on the other side; yes there is a demand to live in Toronto- it’s a highly desirable city, but do not underestimate herd thinking. If people think a house will be worth less next year than today, they may very well stay on the sidelines. I guess we will know at the end of the year…

Max2

at 4:29 pm

I think it will come down to the rental market. People need to live somewhere. When enough people want to rent, condo prices will go up. Condo owners will move up. Rent will go up for every new rental that becomes available. At some point buying will be cheaper than renting. Even if house prices fall, they will never fall below condos, so it would self-stabilize. Inflation will support house prices to a degree because wages and materials will cost more. We all get screwed just the same.. but for those with a family with kids, they would take the risk to move up for the sake of their kids, avoiding marijuana in their condo, etc. Don’t underestimate the happy wife happy life effect. The market is what your wife thinks it is.

Max

at 4:53 pm

Down to the core… Most buy for personal needs. There’s timing but you can’t wait forever to get into the market. You can’t time the market. Investors have been buying real estate for decades. Everyone thinks the investors will be the ones to dump inventory.. but most are more calculated than the average Joe and probably didn’t buy in impulse. You’ll always have your bandwagon investors, but even the dumb ones that got in earlier, even if it was due to Fomo, would be way ahead with the low rates they’ve had and years of principal paid off. You’re looking at besides maybe the last year of buyers pool, anyone that bought in the decade earlier can easily handle mortgage payments with minimum wage increases.

DonaldQuack

at 4:55 pm

Count me in the group looking for this elusive 20% discount. Where is it?

I’ve been looking to spend 1.1 mil to buy a freehold that was 1.35 in March but I don’t see such a deal downtown.

David is right. The headlines spouting average selling price are meaningless without context. The mix of what is selling and where it is selling has changed. In downtown (Trinity Bellwoods, Annex, Dufferin Grove) there have been barely any new listings over the past few months.

REPerspective

at 10:39 pm

So by the same methodology in 2016:

In April 2016, the average price was $739,082, reflecting a freehold sales percentage of 69.4% (50.2+9.4+8.1+1.7=69.4). In August 2016 the average price was $710,410, reflecting a freehold sales percentage of 63.6% (45.3+8.8+7.7+1.8=63.6). The percentage of freeholds sold dropped by 5.8% (vs 7% in 2017) but the average price dropped by only 3.9% (vs 20.5% drop in 2017).

Please explain why this methodology explains the big drop in average price from April to August 2017 but does not explain or show a similar drop in 2016.

Kramer

at 11:28 pm

I think you need to keep going more granular into each segment, and the same argument applies, mix/composition.

In 2017, the number of sales of higher priced homes dropped much bigger than the less expensive ones.

In 2016, the decrease was much more consistent through the price segments.

Just focusing on the $2MM+ detached houses below…

In 2016 it was 333 sales down to 219.

In 2017 it was 579 sales down to 112.

2016

Detached Houses

# of Sales by Price Range

Price Range Apr ’16 Aug ’16 % change

————————————————————–

Less than $700,000 2185 1611 -26%

700000 to 799999 815 576 -29%

800000 to 899999 661 533 -19%

900000 to 999999 453 337 -26%

1000000 to 1249999 682 495 -27%

1250000 to 1499999 501 376 -25%

1500000 to 1749999 293 209 -29%

1750000 to 1999999 139 93 -33%

$2,000,000+ 333 219 -34%

2017

Detached Houses

# of Sales by Price Range

Price Range Apr ’17 Aug ’17 % change

————————————————————–

Less than $700,000 914 851 -7%

700000 to 799999 650 370 -43%

800000 to 899999 707 332 -53%

900000 to 999999 584 227 -61%

1000000 to 1249999 940 323 -66%

1250000 to 1499999 665 205 -69%

1500000 to 1749999 431 99 -77%

1750000 to 1999999 245 59 -76%

Greater than $2,000,000 579 112 -81%

Looks like in April 2017 a ridiculous number of $2MM+ detached houses were selling… driving the overall average price up so high.

Maybe for 2017 it actually went from a record high # of $2MM sales in April to a record low # in August (579 vs 112). I don’t know for sure.

Maybe usually it is much more balanced between April and August (i.e. 333 vs 219 in 2016)

It wouldn’t surprise me if the -81% was a record % change.

Anyways, this is at least part of the answer you’re looking for.

Mortgagejake

at 12:56 am

You are going to be dead wrong simply because of the impending doom of mortgage rule changes.

Ricky

at 7:24 am

Well it will be dead funny if it works out that way.

Slow down the foreign investors with a 15% tax and then dump the market 30% so that the foreign investors (who don’t care about getting mortgages) can buy up two houses instead of one for cheaper.

Way to go!!!!

Ricky

at 7:26 am

I didn’t mean two for cheaper than one, just they’ll buy two and each will be cheaper despite their personal tax.

Juan

at 7:09 pm

Why haven’t we gotten a release of Foreign Buyer Data recently? I strongly believe they are still having a large effect on prices in certain areas of the City.

John Hutchinson

at 6:40 pm

To predict that fall house prices will be higher than summer prices is almost like predicting that the sun will rise tomorrow. I doubt that there are more than 1 or 2 occasions when the seasonal spring/fall peak cycles didn’t materialize since I followed this stuff back the mid-80s. Saying that, it is in comparing month-to-month changes over multiple years that makes me suggest that it will be a weak recovery of prices, at best. The various Cdn governments are determined to crush a speculative binge, which led to deep recessions in America, Ireland, Spain and other countries in 2008/9. The debt-induced economy in North America is starting to show signs of picking up – therefore more interest rate hikes. But the biggest problem is the house price to family income ratios. This simply cannot be sustained over an intermediate term. At best, housing as an investment is not worth it (re. reward / risk). In saying that, there should be a greater drop off of those type of buyers.