I suppose I could have titled this entry, “The Inevitable April Stats Blog,” but what fun would that be?

Plus, you all know that each and every month, I write a post about the TRREB stats and what they mean for the market, so pointing out the inevitability is moot.

Knowing that this blog post will arrive in short order, some readers are eagerly anticipating the entry, and some aren’t.

It depends on where you lay on the bullish-bearish spectrum.

Appraiser is licking his chops. I mean, an average home price of almost $1.1M? All of his comments are suddenly justified!

But the TRB market bears (and y’all know who you are…) aren’t going to want to read the following. It’s getting harder and harder to justify those “over-heated market” comments, the crash-talk, and the bums that are sore from sitting firmly on the sidelines when we look at the stats from the past month.

I’d be remiss if I didn’t point out, however, that not all of the market bears can be labeled as perennial-renters, or true sideline-sitters. In fact, many of the readers who are bearish on the market, critical of industry practices, or just downright sour on real estate in general are actually home-owners! So let’s not paint everyone with the same brush. It’s very easy, and very reasonable, to be critical of real estate while still owning your own home, or even if you own multiple investment properties.

There’s a lot more to being bullish than simply owning real estate. We’re talking about fiscal and monetary policy, government intervention in a free market, personal finances, city planning, and a host of other topics that go hand-in-hand with the real estate market.

So while I understand that many existing home-owners want the market to roll because the value of their largest asset is increasing, I also understand the existing home-owners that aren’t afraid to say, “This is nuts.” Whether or not those existing home-owners add, “This cannot continue” remains to be seen.

Where do you want to start this week?

How about with the average home price?

The average home price increased 5.0% month-over-month from February to March; from $1,045,488 in February to $1,097,565.

That’s a 21.6% increase, year-over-year.

Let’s take stock, once again, of the average 416 home price dating back a while:

I showed you this same chart last month, only without March’s price. At that time, the $1,045,488 average sale price from February looked monumental. It was the only seven-figure data point in the chart.

And now?

Well, now I suppose it’s up, up, and away, is it not?

Interestingly enough, if we looked specifically at the 416 last month, we would see that there was not a record price. In fact, the $995,201 average sale price in Toronto-416 in February was 3.5% lower than the peak of $1,031,721 in August of 2021.

That changed in March, however…

For those of you playing along at home, that’s an 8.9% increase, month-over-month.

Month-over-month data is not the most accurate measure of the market, so let’s not make this into something it isn’t. The February 416 average home price wasn’t in line with the GTA’s, and it seems like it’s caught up in the month of March.

All told, we’ve seen record prices in both the GTA and the 416 in March.

But those aren’t the only records.

The TRREB “Home Price Index” is supposed to be a smoother, less-volatile measure of pricing than any of the averages. Over time, this price is going to increase with the market, but at a much slower pace.

If you graph the TRREB HPI from the same time period as we’ve charted above, it looks exceptionally smooth – until 2021:

I know this is the most boring chart of all time, but humour me here. For an index that’s supposed to be “smooth,” it is, until we hit 2021.

See that tail on the right-hand side? I’d call that a spike as far as a moving-average goes.

But the most noteable increase when it comes to the bevy of price increases this month, in my opinion, has to be with respect to condos.

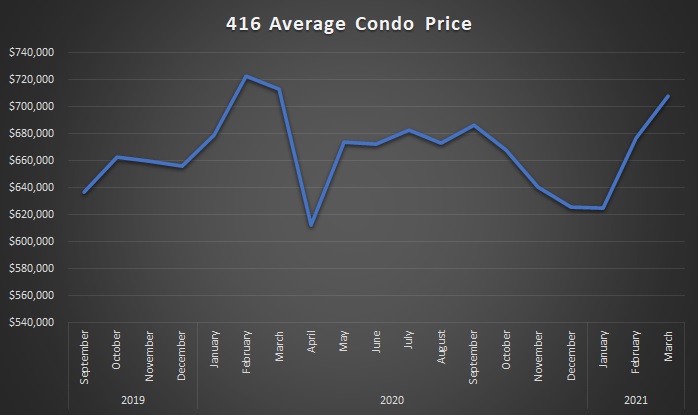

The average 416 condo price is up 4.6% month-over month, from $676,837 in February to $707,835 in March.

Recall that condos were a really tough sell in the fall of 2020.

In fact, I gave interviews and told clients, “This is the worst condo market I have ever seen,” and I stand by that.

Consider this: I had a condo listed in early-December for $799,900 and I couldn’t even get a showing, let alone an offer. Not even a lowball! But then in February, we sold it for $850,000.

Here’s how the condo market has roller-coastered of late:

Wow, what a ride!

I haven’t been to Canada’s Wonderland since 2003, so forgive me if I don’t know any of the cool, new rides. But this kind of reminds me of The Bat. Remember when that was all the rage? For all I know, it’s been torn down or something. I got a season’s pass in 1992 with my buddies and we went there every P.A. day, but I digress…

Up, down, up, down, up…

Compare that chart with any other from the same time period, and it’s definitely the outlier.

Ask any Toronto real estate agent which market segment is usually the most volatile, and you’d typically be told it’s detached. It’s not uncommon to see the 416-detached prices bob-and-weave, even in red-hot markets.

But when we look at the average detached price on the same chart as above, and compare it to 416-condos, it may as well be a straight line!

In case it’s not obvious, the $1,750,518 average detached price in March of 2021 is also a new record, up 4.0% from the $1,684,073 in February, which served as the previous record.

So everything is up, right?

We’ve got record prices for GTA, 416, 416-Detached, and HPI in both TRREB and the 416.

The 416 average condo price is not a record, but on average, the price is up 13.3% from January to March, and is now within 2.1% of the peak in February of 2020.

So what is causing all this upward pressure on price?

I’ll give you a hint: it’s a good friend of mine.

It’s somebody I know, near and dear.

Somebody I talk about all the time, and somebody I’ve tried to introduce all of you to, even though some of you aren’t willing.

Yup, it’s our old friend, supply and demand.

It’s not interest rates, or immigration. It’s not evil real estate agents, or public policy. Sometimes, the truest answer is also the easiest, and there are simply way more people looking to buy real estate than are looking to sell.

March of 2020 was a “record month” in many ways, as noted above with respect to prices across the board.

But do you know what record stood out to me the most?

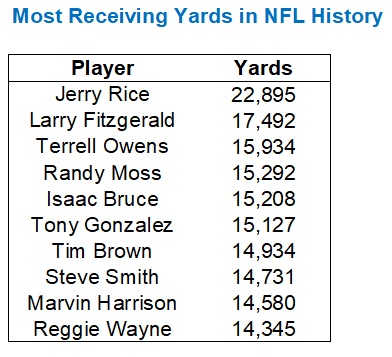

15,652 sales

Do you want to guess what the previous record was?

Was it 15,500?

Or, like, 14,900?

It had to be over 14,000, right? We can’t imagine a record being broken by like 1,500 – 1,600.

Except that it was!

And then some!

The most sales recorded in a single month, before March of 2020, was a mere 12,790 back in May of 2016.

If that statistic doesn’t shock you, then you’re probably decorating cookies while watching Texas Chainsaw Massacre.

This statistic is positively mind-blowing. The record wasn’t just broken, it was shattered! That’s a 22.4% increase, and if I had to look back at the previous records and what the increases were, it would look nothing like this. Case in point: we saw a record number of sales in May of 2015 at 11,706. That record was broken one month later with the 11,992 sales recorded in June. That’s an increase of 2.4%.

Do you grasp the sheer insanity of this figure now?

Here are the Top-10 biggest months in TRREB history:

We’ve seen a lot of outliers so far in 2021, but this might be the largest.

Call me a stats nerd, but I looked at this and could immediately picture something similar in my mind’s eye.

Check this out:

I’m not wrong, am I?

You’ve got four guys in the 14,000’s, four guys in the 15,000’s, one guy up there at 17,000+, and then Jerry Rice in his own damn world!

I can’t possibly overstate how wild those 15,652 sales were last month.

And when you consider this was done in March, it’s even more impressive. Note that from the list above, we see April three times, May twice, and June twice. March and September had only made the list once previously. March is typically a busy month, but nothing compared to April, May, and June.

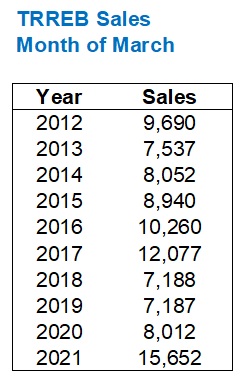

Looking back only at the month of March, we see that 2021 is even more of an outlier:

The talking heads will note that sales are up 97.0% in the month of March, year-over-year, but consider that the market came to a halt in the third week of March last year due to COVID, so we can’t really look at the 97.0% increase at face value. However, we can certainly look at the 7,187 sales from 2019, or the 7,188 sales from 2018, since those months weren’t affected by a worldwide pandemic. So all told, we’re seeing double the action of what the last three years delivered, and we’re actually 30% higher than the epic month of March in 2017 when the market was gangbusters.

Demand is at an all-time high, folks. There’s no mistaking that.

So just how tight is supply?

Oh, well, that’s interesting…

I think this is the part where most of you believe I was going to say, “Supply is at an all-time low.”

Right? It would have to be, in order for prices to be skyrocketing!

But what if I told you that supply was also at an all-time high, or pretty close to it?

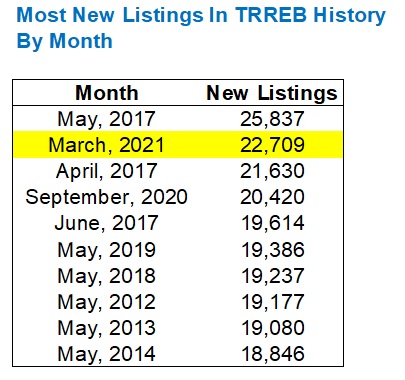

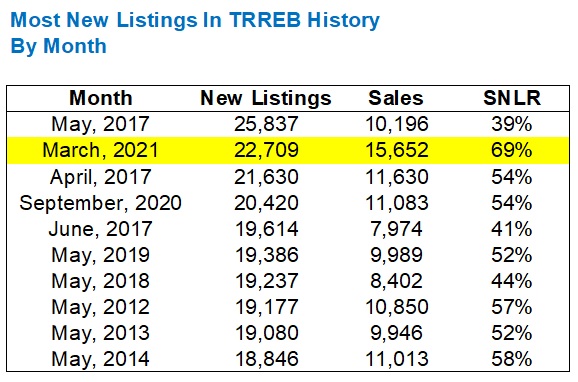

In March of 2021, we saw 22,709 new listings in Toronto, which is a 57.3% increase over the 14,434 new listings we saw in 2020. Sales were up 97.0%, and new listings were up only 57.3%, so that explains the 21.6% increase in prices.

But how do those 22,709 new listings stack up, historically?

As I said, pretty close to an all-time high.

We just experienced the second-most new listings in any month in the history of TRREB, and yet we complain that we have an “inventory problem.”

How can this be?

There were sixteen offers on a run-of-the-mill 1-bed, 1-bath condo listing I had last week.

I just lost a bid for a house on Whistle Post Street as I was writing this blog; there were seven offers!

So what’s pushing the prices up if we have near-record inventory?

It’s something we’ve already noted: supply and demand. In this case, it’s the interaction between supply and demand, and not just one versus the other.

Let’s look at those “Top Ten” months above one more time, but we’ll compare sales to each of these top months for new listings:

The “record” month of May, 2017, saw a mere 39% absorption rate.

The average of the other nine months on this list is 50%, so once again, we find ourselves staring down a market outlier in the month of March.

Yes, we saw the second-most new listings of all time. But we also saw the single-most sales in any month too.

So here’s what I think is going to happen: we’re going to see the April average home price come in around the same as March, and then we’ll see a modest pullback in May and June. When the average home price declines from $1,097,565, or whatever it comes in at in April, to, say, $1,040,000, the market bears will say, “See, the market is dropping!” while ignoring the massive gains made since the fall of last year.

An average home price declining like that does not mean homes are worth less, and I don’t think that you’ll pay less for a 3-bed, 2-bath semi either. In fact, I think you’ll pay more.

But the average home price fluctuates, month-to-month, from season to season, and this year will be no different.

It just remains to be seen if people will celebrate a 2-3 month decline after a twenty-year run as the bubble popping…

J G

at 8:32 am

416 condo still below 2020 Feb high, anyone who bought it for investment in last 3 years are not cash flowing.

Marty

at 9:14 am

But Jerry Rice played more games than any non-kicker in NFL history.

He played 303 games.

I forget where I’m going here.

Ed

at 9:15 am

So where does the market go from here?

Although this is by no means a bold prediction but I would be surprised or even shocked if there was another 10% to the upside in the next 12 months. I wouldn’t be surprised at all if the market was flat for a while.

JL

at 10:43 am

I and several others touched on this in comments last week; there has to be a limit to how high the (non-inflationary) increases can go, which is certainly the interesting question. At some point the (local) buyers’ funding will hit a ceiling, which presumably will place a limit on further price increases. If you’ve already got double income, are relying on near-zero interest rates and possibly COVID stay-at-home savings, and are getting help with your deposit from parents to make offers in the current market, how much more can you reasonably stretch your budget (and from what source would this funding come) before you get priced out?

Jimbo

at 9:02 pm

You can’t underestimate the number of buyers that will have houses that have appreciated and have been paying into it for 5-10 years.

Chris

at 9:18 am

“Appraiser is licking his chops… All of his comments are suddenly justified!”

Not quite. Let’s not forget that it was right around this time last year that stock markets were climbing out of their hole, and he warned about a pending “bull trap”.

From that comment one year ago to today:

TSX +40.55%

DJI +47.83%

S&P500 +53.09%

NASDAQ +73.20%

So what is causing all of this upward pressure in equity markets? Is it simply a product of good ol’ supply and demand as well? Is that also what is causing real estate prices to spike in bustling cities like Moncton and Ingersoll?

Or maybe, just maybe, we’re seeing across-the-board asset price inflation caused by extremely loose monetary and fiscal policy.

I know some people here mistakenly think the only stimulus that’s been provided has been in the form of CERB to unemployed baristas, but reality is the government has spent hundreds of billions of dollars on a plethora of support measures such as CEBA, CEWS, TWS, etc. Former TD CEO Ed Clark called on them the other day to scale it back and make their measures more targeted, while Yves Giroux, the Parliamentary Budget Officer warned that relief spending will plunge.

On the monetary policy side, Scotia’s Derek Holt has stated that the Bank of Canada’s promise of low interest rates for the longer term spurred household borrowing, and that they have seemingly overreached in this promise. Now, bond yields are climbing and as the global economy continues to recover, particularly if the US raises rates, Macklem will be under increasing pressure to do so as well.

And finally there’s the upcoming budget in just under two weeks. I’m not making any predictions on this one, but it wouldn’t shock me if Freeland trots out some measures to cool real estate markets across the country.

So, can we still expect no future crashes, drops or corrections, as you suggested a couple blog posts ago? I haven’t much changed my investments, but I’m not nearly as confident that equity markets won’t be roiled in the near future.

Joel

at 10:31 am

With 65% of Canadians being home owners, do you really think that the government is going to look to do anything to reduce their equity?

You will hear cries from seniors who were banking on that money to survive, their children who want an inheritance and every new buyer in the last year, upset that the government has stepped in to reduce their net worth.

I think that would be enough to ensure they are not re-elected next term.

Realistically at most it will be a speculation tax, or some small gesture aimed at the very wealthy that won’t actually change anything in the market.

Chris

at 10:56 am

I have no idea what they’ll do.

You’re right that ~70% of Canadians own their homes, but that doesn’t mean >2/3 of the country is in favour of the current pace of appreciation.

While they’re less than scientific, BNN ran a few polls in recent weeks and found that 43% were in favour of a capital gains tax on principal residences, while 53% felt the budget should contain measures to improve housing affordability.

A more robust survey by Angus Reid in late 2018 found that only 31% of homeowners wanted prices in the GTA to continue to climb. 34% wanted them to remain stagnant, 22% hoped for a small decline of ~10%, and 13% hoped for a significant fall of 30% or more.

https://angusreid.org/greater-toronto-housing-prices-policy/

As Pragma points out below, the Liberals may opt to do nothing to cool the market, as it is the one bright spot in an otherwise not so great economy. Yet, at the same time, they’re being berated by big banks to address the increasing vulnerabilities that this run-up is causing.

And, let’s not forget that typically homeowners will come from the older and wealthier rungs of society, or reside in less dense areas. Young, lower income, more urban Canadians are less likely to own their home; they’re also more likely to vote for a left-leaning party. Liberals may make a political calculation that they can afford to alienate some voters on this topic, if it improves their standing with others, particularly in closely contested ridings.

Pragma

at 10:07 am

Prices went up so demand exceeded supply. That is not analysis, that is a tautology. The real analysis would be why has demand exploded over the last 4-5 months? Can we argue that household formation suddenly took off over the last few months? That would be a healthy driver but I don’t think anyone would argue that is happening at the moment. People are definitely rippling outwards from city cores looking for bigger homes. But these are not “new” households, they are leaving behind a home/condo/rental that will need to be backfilled. I think right now speculation/flipping/FOMO is a much larger part of the market that it has traditionally been. Extremely low(and temporary!) rates make it easier to lubricate that behaviour. It is admittedly anecdotal but I know two people who are currently in the “I need to buy anything anywhere” mindset. One of them has bought a home in St. Catharines, but are currently living and working in the GTA. The other couple is looking at Innisfil, and both of their jobs are in Toronto. I know another couple who have committed to a pre-build at least 18months out based on current interest rates and being able to sell their condo at current values. Incredibly risky! Pre-build sales are going nuts. Who are these people waiting in line to buy homes in Welland?!?

I’ve pointed this out before. Builders have stepped up and are pre-selling everything they can and building anywhere they can. Jan construction starts are running at an annualized pace of 250k, and increasing. Population growth, incorporating immigration, in a normal year would be ~600k, which suggests household formations of ~200k/year. We obviously won’t have that level of growth for 2020 or 2021. The data suggests we might be overbuilding at the moment. Plus interest rates can only go sideways or higher.

All that being said, the Liberals are absolutely shameless and know we are a one horse economy at the moment, and will do anything to keep the party going.

Bal

at 10:20 am

valid points Pragma

Joel

at 10:45 am

Yep, that all makes sense.

Values in bedroom communities are likely to take a large hit in 2-3 years when the new build are finished and everyone realizes that wfh isn’t in place forever.

Pragma

at 12:35 pm

I just looked up the most recent numbers. We are now at an annualized pace of 265k starts. Over the last few years we’ve averaged around 200k/year – in line with household formation as I guessed above, which kept the market balanced/tight. 265k would be too much in normal times, I’m not sure how that plays out at a time where population growth and household formation is on hold. It feels like people have made some very rash permanent decisions based on very temporary conditions.

Christopher

at 6:22 pm

Your first point is spot on. It seems the general belief in the GTA today is that real estate only goes because government, which explains a lot of extra demand from buyers. Despite the general comments over the past few months about a lack of supply, February and March were both records for new listings. What is driving this record number of listings and which of these two forces will hold up longer? I’m sure we will find out in the next few months one way or the other.

Papa

at 12:20 pm

Do not forget that large corporations will take WFH to another level and move job to India or Phillipinnes. They make more money on WFH from these locations rather than Canadians doing the work.

Canadians need to be aware that Global corporations are not your friend long term and will move jobs even faster now that WFH kinks worked out.

Papa

at 12:22 pm

Any job that involves sitting at a desk at home is threatened by offshore move. Was told this by senior executive this year

J G

at 1:27 pm

I could have told you that 10 years ago 🙂

Condodweller

at 4:32 pm

Yes but this is different. Now that companies are forced to let their workers work from home, they can re evaluate and say, well, if we have someone working from a distance, it doesn’t matter if that distance is 50kms or 5000kms so why not do 5000 instead and pay them a quarter. There is already talk of reducing the wages of wfh staff because, you know, we can’t have employees benefit from the situation.

Anna

at 4:35 pm

Interested in dealing with taxes and employment standards in many different countries huh? Lol, looks like the lawyers gonna eat well the next few years.

Appraiser

at 4:34 pm

You know what’s more egregious than tautology? Dogma.

Here’s the bear maxim. Their article of faith if you will :

When the market is down, its going down forever.

When the market is up, it’s about to crash.

It’s their mantra.

Chris

at 5:06 pm

Sounds like you’re describing yourself and the stock market. Uncanny.

Kyle

at 7:54 pm

Good grief! I know you hate Appraiser and are super desperate to feel like you’ve got one over on him, but you’re past the point of embarrassing yourself now. Appraiser made a single bad call on the stock market, which he repeated a few times for about a month. Since then you’ve been regularly reminding him about it for the last year, basically 12x longer than he held his call. Hardly what anyone would call dogma. Meanwhile you’ve been dead wrong about the RE Market every single day for half a decade. And still keep trying to reaffirm your wrong position each day. Should we all remind you how incredibly garbage all your comments are for the next 60 years?

Chris

at 8:52 pm

Nope. Appraiser’s been bearish on the stock market for about as long as I’ve been around here, posting about every downturn and warning of others to come.

You’re free to remind me of the wrong calls I’ve made, most of which I believe I’ve admitted to missing the mark on!

And once again, it’s concerning that you think that arguing with someone means you hate them. Appraiser can be rude and childish, but he also regularly raises valid counter points, and I certainly don’t hate him.

If you’re finding yourself hating people here that you disagree or argue with, maybe take a step back.

Ed

at 9:38 am

I agree with Kyle.

Chris you are worse than a dog with a bone, time to let it go.

You are embarrassing yourself.

Chris

at 9:50 am

Ed, as I previously explained the last time you popped your head up whine and sling insults, I could not possibly care any less about your opinion.

Fearless Freep put it best when they asked, “Can we start calling him “Mr. Ed,” because he’s about as insightful/intelligent as a horse?”

Ed

at 9:57 am

OCD acting up again Chris?

Chris

at 10:11 am

You stay classy, Ed.

Ed

at 11:16 am

Made you look.

J G

at 1:56 pm

The real sheeple are the ones thinking RE is the only way investment.

Stocks esp. FAANG have killed Toronto RE over the past 15 years.

marmota

at 7:36 pm

Can I chime in and say this is half the fun of this blog?

Please do not stop bickering over these topics 🙂

Homeowner

at 10:26 pm

Confession of a homeowner: I do feel richer knowing the value of the very space that I occupy is increasing over time; I do feel greedy because I do hope that it will sell at a handsome price when I am ready to do so; I do feel guilty in participating in the bidding wars and helped push the price to the next high; I do feel lucky that we bought years ago at the time when second viewing and offering lower than asking was totally normal, even between two or three bidders. And yes bidding wars were existed in the early 2000s where I am. Those are the very reasons I have a wishful thinking, that the hopeful homebuyers especially for the homegrown younger generations, to not be in such tight spots when they decide to own. Price growth is favourable but not at such pace that makes closing a deal only to the lucky few. Perhaps a staggering taxation system for sellers ie 5 years full flipping tax, 10 years smaller percentage of flipping tax, no tax only after X number of years? No system is perfect but a system in which majority of the public has a chance may be possible if we try harder.

JL

at 2:52 pm

Very sensible. I have a feeling there may be a large number of people out there coming to similar views, especially if they have a younger generation they are worried about. Growth of your investment is great and all, especially early after buying, but after a while (and at this crazy pace) you start worrying about what awaits the ones coming behind you.

Average Joe

at 10:43 pm

Hopefully we have regulators, policymakers and economists who are doing more at the moment than just saying “oh well, it’s just supply and demand”. I’d have to imagine most people in the market for things understand that there is both a supply for things and demand for things, and that imbalances influence the price of things. I’d also imagine the vast majority of people would understand that markets don’t happen in a vacuum and many factors – especially government policies – play a role. There is really no analysis here without exploring why this might be happening or asking questions about it. Anyone can read a number.

I’ve always been led to believe that real estate is a local business. Location, location, location. But not only has the GTA and GGH area skyrocketed, but the rest of Canada is also red hot. This includes Newfoundland, which has long been known as a large exporter of people. Yorkton, SK is apparently reporting high demand; 200-300 km away from Saskatoon or Regina. China is surging, as is the US, as is Australia, New Zealand, Singapore, Warsaw, Munich…

What else has surged? Tesla went beyond 1500x earnings and Elon Musk is the first first or second richest man, depending on the day, by selling a few hundred thousand cars and barely turning a profit. Junk stocks like Hertz and Gamestop exploded to the point that the US congress and the SEC are investigating. Sham companies like SPACs caught fire, bitcoin is having a massive run and now NFTs (digital blockchain art) is exploding.

I know, you can’t live in stocks like a house – but what about wearing your assets? If you want a green(!) Rolex Submariner they were trading for 80% over retail not long ago.

Toronto real estate is definitely way up. Everything is. But it’s all just totally normal and sustainable supply and demand, nothing worth looking into folks. Here come the roaring 20’s.

Chris

at 11:06 pm

Very well put, Joe.

David is taking a bit of a victory lap here and touting supply and demand as the cause, while conveniently ignoring that pretty well every asset class is surging these days. Are we to believe that it’s normal supply and demand for all of them?

Compared to many other alternative investment options, Toronto real estate’s appreciation has lagged; a fact the resident bulls don’t seem to enjoy being reminded of.

It all feels quite speculative, and I don’t see it is sustainable. As I’ve said, I’m not at all confident that we won’t see equity markets crash, correct or drop in the near future.

Joel

at 10:11 am

Are you all cash right now, or are you riding this up?

Money is cheap, those with money have less things to spend it on and we have seen a shift. Are the increases for anything you mentioned above sustainable? Of course not, but that doesn’t mean a big crash, it can mean a softening, a level off.

That submariner was very high when it came out, as those who needed one for social media, got one at inflated prices and now they are down a bit. Still over retail and over previous years. Don’t know why we won’t see the same with housing.

Average Joe

at 2:26 pm

Still riding it up, but not rushing in to buy the dips anymore. The central banks are crushing anyone holding cash – at this point it’s almost rational to buy toys if you’re out of quality opportunities. And that’s exactly what’s happening because exotic cars are up big time and commuter vehicles are in decline.

The problem I see is we’re through the pent-up demand and now we’re into the pull-forward demand on durables. I dont think there will be a crash either, things will just dip a bit or trade sideways for a long time. So for people spending money they don’t really have assuming this party never ends, I think there could be some tears.