I love my mother.

Have I ever told you that?

My mom, just like your mom, is amazing. She’s a lot of things.

But one thing she isn’t: a Trudeau fan.

She’s the one who broke the news to me this week that January’s inflation data came in at a “surprising” 2.9%. Yes, although I work in real estate and live and breathe economic indicators, it was my mother who told me the news.

Her reaction was priceless, however.

“Oh wow, would you look at that; January inflation came in at 2.9%!” she said.

But before I could even muster a response, she added, “I can’t wait to see Trudeau’s victory tour with this number. He’s gonna take it and RUN WITH IT!”

So yeah, how about that, eh?

2.9%?

Damn, Gina!

I’ve never known a “Gina” but I sure know which 1990’s sitcom that comes from…

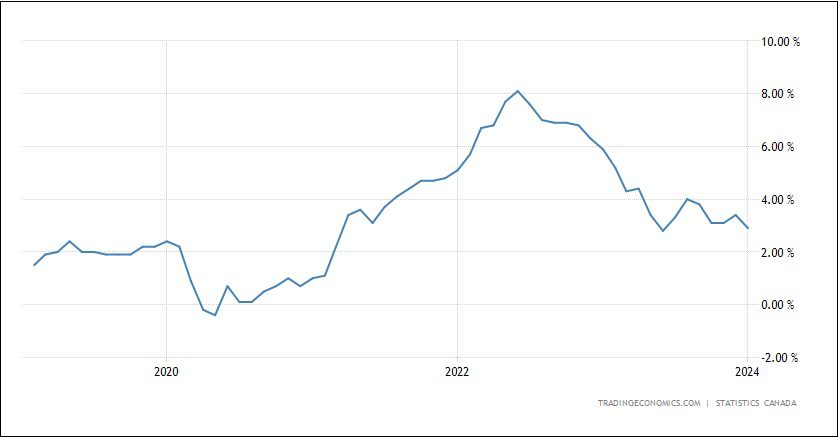

Here’s an up-to-date five-year chart of the Canadian inflation rate:

Wow. Almost back to the pre-pandemic pace, eh?

With the inflation rate back below 3%, surely we must be closer to quantitative easing by the Bank of Canada, no?

The “bets” are already being placed:

“Canada’s Inflation Rate Slows And Bolsters Bets On Early Rate Cut”

Reuters

February 20th, 2024

From the article:

It was the first time in seven months that headline inflation has dipped below 3%. That prompted money markets to hike bets for a rate cut in April to as much as a 58% chance from a 33% chance before the figures were published.

The January inflation figure “will certainly raise the odds on an April rate cut,” said Karl Schamotta, chief market strategist at Corpay.

We’re going to see a rate cut this year, despite what TRB readers, Jimbo and JF007 predicted earlier this year.

A 58% chance of a cut in April?

Oh, that’s something!

And when the second or third rate cut comes, look out, real estate market…

…sorry. I forgot, I’m not supposed to “hype.” Even though I’m right, er, that sounds conceited, so even though I’m not wrong, I don’t want to seem like I’m cheerleading this real estate market (which is on the upswing and will get even more of a boost when we see interest rate cuts and restored affordability in the market……..)

But like I said, I’m not going to go down that road.

The point I wanted to make today was that this conversation about inflation will lead to conversations about interest rates and all things mortgages, and for that, I want to bring my in-house mortgage broker, Tony Della Sciucca into the fold.

We are going to see a lot of mortgage renewals this year, as discussed on this blog already in 2024, and we’re seeing a lot of buyers in the marketplace struggling with the decision of whether to take a short-term hit on a variable-rate mortgage and lock into a fixed-rate mortgage in 12-18 months, or whether to take a 3-year or 5-year fixed.

There’s so much to discuss.

So please feel free to pose your questions to Tony in the comments section below.

I’ll sit down with Tony on Sunday for an interview and we’ll get his answers posted for a video blog on Monday.

Marina

at 8:32 am

Nobody is a Trudeau fan these days. And I don’t care what the inflation rate is, he can’t run anywhere. I genuinely believe that no matter what happens over the next year, good or bad, the Libs are out and the Cons are in.

A couple of questions on mortgages:

1. Can we get a more realistic view on buying with cmhc insurance vs without? Do you really get a lower rate with the insurance? Is there and “optimal” downpayment? I’ve read some crazy takes and I’d like a balanced one please.

2. What are you seeing with refinancing these days? Not just what people are doing in terms of fixed vs var, but what’s their reasoning? Whats the fear level?

3. If you were to buy an investment property today, let’s say in the 750-900 k range, what rate would you take and why?

Appraiser

at 8:52 am

In Canada we don’t vote for Prime Minister.

The over reliance on charismatic politics is a weakness of our political and societal structure.

Mortgage question: Would you recommend going variable upon renewal or is it too obvious?

Steve

at 2:22 pm

We don’t vote them in but we sure vote them out…

Mike

at 10:45 am

I guess I like horror stories. So what is the highest five-year fixed rate you saw somebody take in the last couple years?

Anwar

at 11:34 am

Shouldn’t we ask Tony to join the interest rate prediction game?

He has a huge advantage since we made our picks at the start of the year but I would like to know his thoughts. Maybe we consider it a more educated and more informed viewpoint?

Derek

at 5:19 pm

How’s business?

Ratio of new buyers versus those refinancing is “normal”?

Lenders cautious about purchase price or not really (APS number getting lent without issue)?

What normally happens with prices after a rate hike cycle reverses to rates lowering? Prices rocket, obviously?

Peter

at 8:55 pm

Two questions about the mortgage stress test:

1) Did it “work?” I mean as intended? The point of the stress test was to make sure people could afford payments when rates skyrocketed and nobody thought that would happen but then it did!

2) Any changes to the mortgage stress test on the horizon? Anything rumored or anything lobbied in broker circle?

Sarah

at 7:15 am

Hi Tony!

First time commenting on here.

My question might ask you to predict the future so I’m sorry in advance, but let’s say that a home buyer isn’t concerned with monthly cash flow and servicing the monthly payments. Would it be prudent to take a variable rate today of like 6.5% and make those payments until a point in the future? What point is that and how long? What would be the signal to lock into a 5-year fixed?

Thank you!

Sarah.

Graham (the real deal G-Money)

at 9:43 am

Tony Della Sciucca vs. Ron Butler – Hell in a Cell cage match. Who wins?

Appraiser

at 9:55 am

We could reach 2% inflation by this summer: National Bank

“To get 2% inflation, one doesn’t need to assume inflation decelerates at all from the recent run-rate,” he writes. “Indeed, simply plugging in the average monthly increase from the past six months (+0.2%) brings you right to target in Q3.”

https://www.canadianmortgagetrends.com/2024/02/we-could-reach-2-inflation-by-this-summer-national-bank/

Perry

at 1:20 pm

How do you see the US Fed decisions affecting the timing of the BOC cuts and the number of cuts?

Jonathan C

at 8:23 am

Headline CPI was only “down” to 2.9% annualized due to a drop in gas prices, which has now reversed. Core numbers are still rising unabated, and governments still continue to spend beyond what they collect in taxes (fiscal stimulus). Markets have been and are likely still too optimistic about potential rate cuts.

Anonymous Realtor

at 2:27 pm

Would love to know how many clients of Tony’s have used the first time home buyer incentive in the last three years.

I’m thinking maybe one?

Jason

at 4:49 pm

What I wanted to ask was covered in an FP article last week:

https://financialpost.com/news/canadian-homebuyers-jump-into-variable-mortgages

Is this what everybody’s doing?

QuietBard

at 11:00 pm

Hope Im not too late.

Tony can you comment on your experience with how the investor class is doing. In particular the folks who already own investment properties and what their outlook is in the market. As well, can you comment on if people are looking to buy new investment properties. I would assume that with the higher rates maybe the numbers don’t make sense or getting financing through an existing property isn’t feasible. Or just any other insights on alternative investments like cottages etc… you may have.

George

at 11:40 am

I’m old enough to remember when financing condos under 600 square feet was difficult.

Then condos got so much smaller.

My daughter purchased a 450 sqft condo about fifteen years ago and she had to put 25% down.

Where does the bank set the benchmark today?

Are banks financing the purchase of 280 square foot condos with 5% down or are there strict rules like there once was?