Do you want Alexander Ovechkin to break Wayne Gretzky’s record for most goals scored in the NHL?

I don’t.

It’s not because Ovechkin is Russian and Gretzky is Canadian. It’s not because Gretzky played for the Edmonton Oilers – a Canadian team, and Ovechkin played for the Washington Capitals. It’s not personal.

Or maybe it is.

Wait, it is. That’s exactly what it is. I simply like Wayne Gretzky more than Alexander Ovechkin, and “most goals” is probably the most coveted record in hockey.

Wayne Gretzky scored 50 goals in 39 games, led by that famous five-goal-game in Game #50 that season. That’s a record that will never be broken.

Wayne Gretzky scored 92 goals in 1981-82. That’s a record that will never be broken.

Wayne Gretzky recorded 163 assists in 1985-86. Only one other player in history has scored that many points in a single season. So, yeah, that record will never be broken.

Wayne Gretzky recorded 215 points in 1985-86, and that record will never be challenged, let alone broken.

Wayne Gretzky currently holds 61 records in the NHL, which is actually a record.

But his record of 894 career goals, which was once thought untouchable? That record is being challenged by Alexander Ovechkin, who currently has 749 goals at age thirty-six. At this pace, he could break the record if he plays until he’s 40-years-old. Now, to be fair, Wayne retired at age thirty-eight. But all-time records are about longevity! Pete Rose was forty-five years old when he broke Ty Cobb’s all-time record for most hits.

Records are made to be broken!

Ask most professional athletes who hold records and they’ll say: they would love to see somebody break it. Well, maybe not Rickey Henderson. But most respected, classy retired athletes will.

Some records are more unbreakable than others.

I remember watching Cal Ripken on TV in 1995 when he broke Lou Gehrig’s ridiculous record of 2,131 consecutive games played. They stopped the game in the 5th inning so Ripken could walk around the stadium shaking hands with hundreds of fans. Ripken’s streak eventually stretched to 2,632 consecutive games, and the way baseball is today, I’d be surprised if a player started his career today and strung together even 400 straight games. “Load management” and “rest days” are so 2021, right?

So can Alexander Ovechkin break Wayne Gretzky’s record for goals scored?

Probably.

But I still hope he doesn’t…

I’m a self-described stats nerd. I keep stats on things I don’t even care about.

Julia Louis-Dreyfus has the record for most consecutive Emmy awards, winning six straight from 2012 to 2017 for “Veep,” a show I have never seen.

Why do I know that?

I just love stats. I love records.

Some cheer for the underdog, but I cheer for legacies.

That’s probably why I love digging into these TRREB stats at the start of every month. There are just so many different numbers!

Price, sales, new listings, active listings.

Detached, semi-detached, rowhouse, condo.

Toronto, Halton, Peel, York, Durham.

HPI, average, seasonally-adjusted.

Month-over-month, year-over-year.

It goes on and on. And if you want to play with ratios, draw up some charts, and put labels on all of this, it can be a lot of fun!

When I look at the TRREB stats at the start of each month, I’m not really looking for anything in particular. The numbers will jump out at me, and if there’s a theme, or a trend, it will make itself apparent.

This past month, I couldn’t help but notice how many records were set. So many statistics, and yet so many all-time figures!

Now, one could argue, “If the market is at an all-time high, then all stats should be at all-time highs!”

Not exactly! A market is made up of many property types, geographic areas, and there are a multitude of stats. Not everything comes down to price.

Having said that, I want to go down the list of major statistics that I track and note if each is a “record” or if it’s close…

–

Average Home Price

The average home price in Toronto checked in at $1,163,323 this past month.

That’s, surprisingly, up from October by 0.7%. I remain surprised since the figure in November has not surpassed October since 2016. And what happened after that? Well, we saw this upward momentum in the fall lead to the most electric spring market of all time in 2017. Is this a sign of things to come? Topic for another day.

Year-over-year, that $1,163,323 average home price is up a ridiculous 21.7% over the $955,889 recorded in November of 2020.

Ridiculous.

Did we see a new record?

Yes, we did!

$1,163,323 is up 0.7% over the previous record set all the way back……………..in October.

–

416 Detached

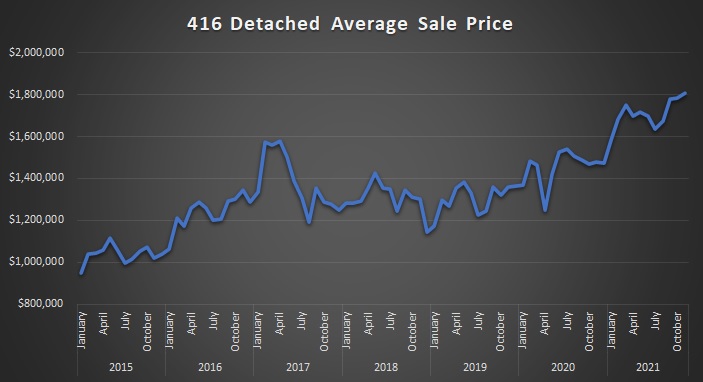

The detached market is by far the most volatile. Always has been, always will be. This segment incorporates the “luxury” market which is very seasonal.

When the market dropped off in April of 2017, it took the detached segment quite a while to recover! It wasn’t until February of 2021, if you can believe it, that the $1,578,542 record for average detached sale price was beaten by the new mark of $1,684,073. Of course, these are averages, and nobody in Toronto who bought a house in April of 2017 thought it was worth less in 2019 or 2020. The hardest-hit detached segment was in York Region, and that significantly skewed the data.

But if you look at a chart of the detached sale price over the last five years, while volatile, the trend is still up:

Did we see a new record?

Yes!

$1,807,983, which eeks out a 1.3% increase over October.

–

416 Semi-Detached

Last week, there were thirty offers on a semi-detached house on Boulton Avenue which sold for 150% of the list price.

Thirty offers. At this point in the season.

You can’t make this up.

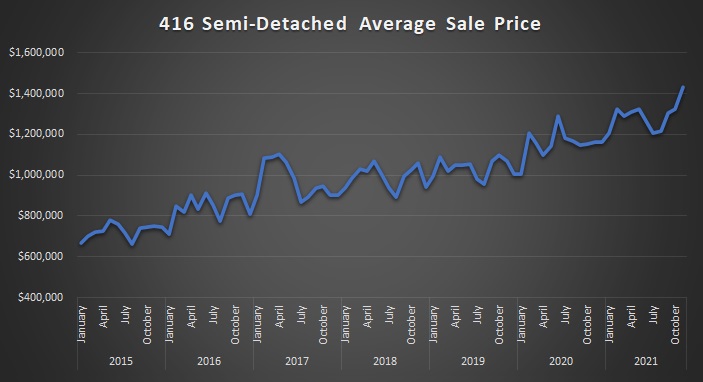

One could argue that the semi-detached market is always the hottest, no matter the time of year, or the market cycle that we’re in. That’s because the lower the price, the more people competing, and the more these houses can increase on a relative basis.

Note the chart for average 416 semi-detached is smoother

Note the chart experiences seasonal volatility, but is still smoother than its detached counter-part.

Did we see a new record?

Yes!

$1,431,988, which absolutely obliterates the previous record of $1,326,153 from May, and is up, on paper, 8.3% from October.

–

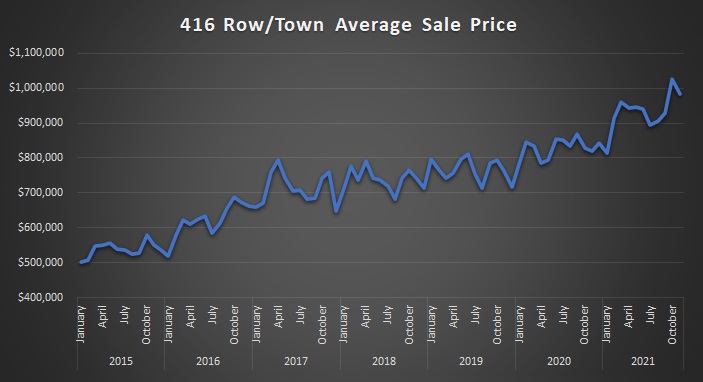

416 Row/Town

Here’s one of metrics we never discuss, and why would we? It’s an odd stat! What is a rowhouse? It’s a house attached at both sides, not just one, otherwise it would be a semi.

But what do you call the end-unit in a row of three? It’s attached at one side, right? So that makes it a semi?

Nope.

Still a “rowhouse” by definition, but sellers and agents have never agreed on this, so the data is skewed.

In any event, I didn’t want to leave this out for fear of being told I’m cherry-picking new records…

Did we see a new record?

No!

The record stands at $1,025,257, which was set in October.

The November figure dropped to $981,759.

–

416 Condominium

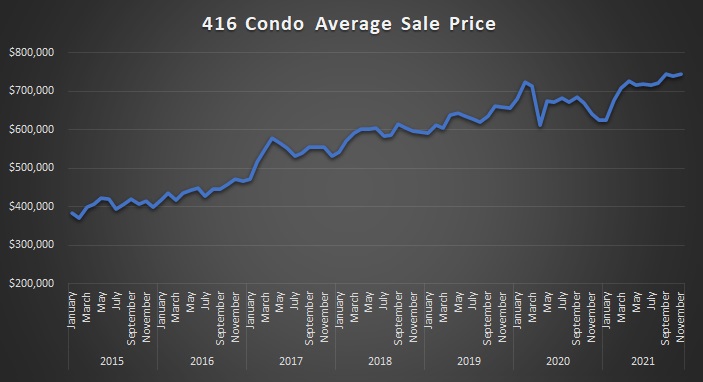

The condominium market has always been less cyclical than the freehold market.

As a result, these charts look far smoother and less volatile than semi-detached, let alone detached.

The condo market was hit really hard in the fall of 2020 and I told a lot of stories about how hard it was to move units. But as soon as the page turned to January, the market shot right back up:

Did we see a new record?

Yes!

The November figure checked in at $745,951, beating out the $744,730 recorded in September.

–

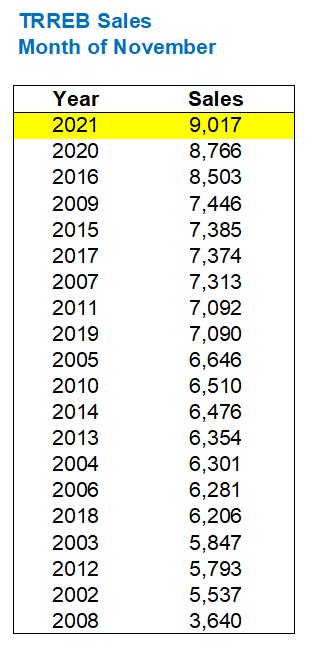

TRREB Sales

Sales declined from October to November; from 9,783 to 9,017.

However, sales almost always decline from October to November! So looking month-over-month doesn’t do November’s sales data any justice.

Did we see a new record?

Yes!

Here’s the November sales figures dating back to 2002:

–

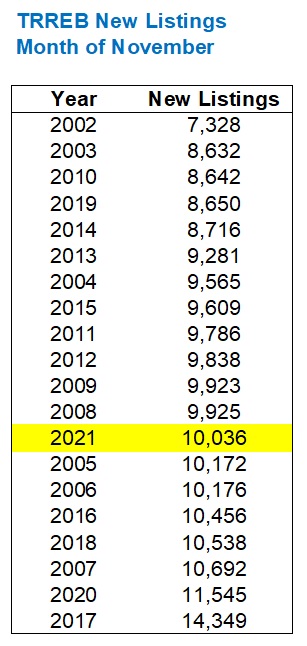

New Listings

New listings fell from 11,740 to 10,036, October to November.

And all the talk this past month has been about lack of inventory.

Was inventory low? Yes.

Did we set a new record?

No!

Not even close. No record for futility and no record for a dump of inventory either.

“New Listings” in November is very middle-of-the-road, comparing to previous years:

–

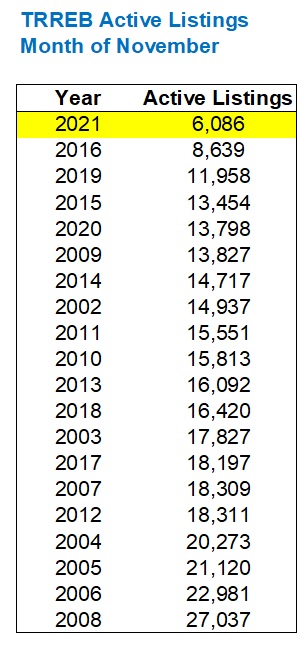

Active Listings

Some people think that “New Listings” are a more important measure of the market, and some feel “Active Listings” is a better snapshot as it incorporates the absorption rate.

I can make an argument either way.

“New Listings” tell us how much is coming onto the market.

“Active Listings” tell us how many months of inventory we’d have left, in theory, if there were no new listings. And of course, if Active Listings are declining at a faster rate than New Listings, then we know the market is absorbing units faster.

So as far as the low inventory in Toronto, when it comes to Active Listings…

Did we set a new record?

Yes! For fewest, that is…

And this chart tells you how dire our market looked in November:

–

Let’s go through the TRREB “districts” a little quicker…

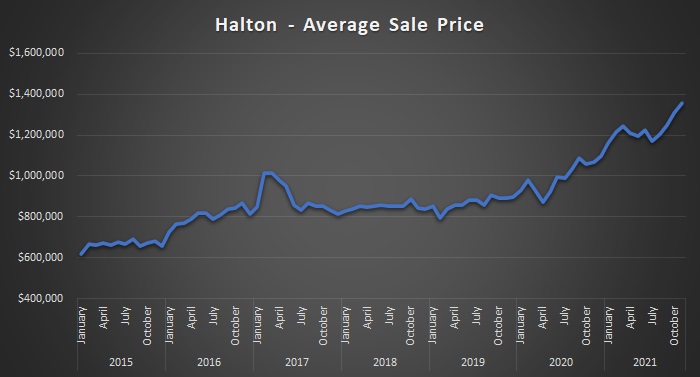

Halton Region Average Sale Price

Did we set a new record?

Yes!

$1,356,951 in November beat out the previous high of $1,305,714 set in October.

–

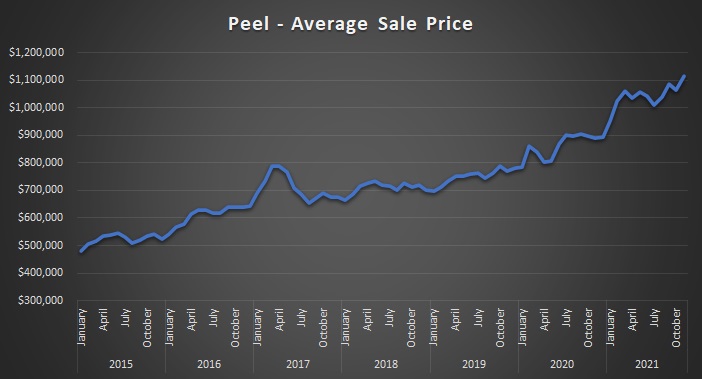

Peel Region Average Home Price

Did we set a new record?

Yes!

November saw a huge boost in sale prices in Peel Region, up 4.6% from October.

The $1,114,138 sale price recorded in November is a new record.

–

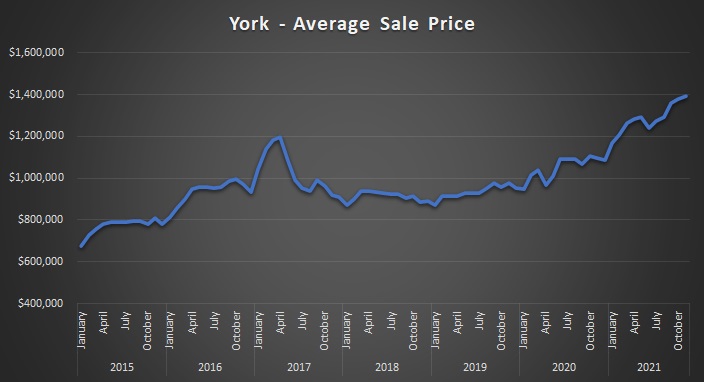

York Region Average Sale Price

Did we set a new record?

Yes!

Recall I talked earlier about how hard York Region was hit in April of 2017. This chart certainly shows that!

Prices have recovered, and then some.

The $1,394,713 average sale price in November is, of course, a new record.

–

Durham Region Average Sale Price

Did we set a new record?

Yes!

Durham is absolutely on fire, up 52.3% from January of 2020 to November of 2021, more than any other TRREB district.

The $998,594 recorded in November is a new record.

–

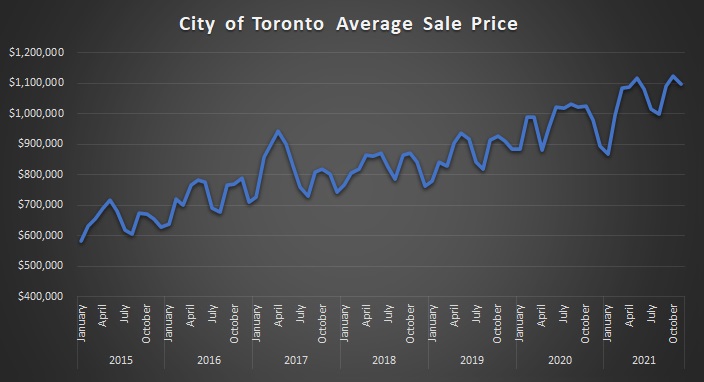

City of Toronto Average Sale Price

Did we set a new record?

No!

The November average sale price of $1,096,736 trails October, which checked in at $1,122,463.

So November isn’t a new record, but is the second-highest.

Should we draw any conclusions from the fact that Halton, Peel, York, and Durham were all new records, but the City of Toronto wasn’t?

Nah. I don’t think so.

I think the conclusion to draw here is that November was literally a month of new records. Everything except New Listings and the City of Toronto average sale price.

But back to Alexander Ovechkin.

He’s got 749 goals.

He has scored 19 goals in 24 games this year, which puts him on pace for 65 goals. Let’s say he slows down a little and “only” scores 52 goals.

That gives him 777 goals by the end of this season, and he’d be trailing Wayne Gretzky by 117 goals.

At age 37, 38, and 39, he needs to average exactly 39 goals per season to tie Wayne.

So, if he failed to average 39 goals over the next three seasons, he’d need a fourth season, which would be his 21st season at age 40.

Impossible?

Not really.

Records, after all, were made to be broken…

Appraiser

at 9:45 am

I blame the stress test.

As prices rise it creates an increasingly wealthier pool of market participants that can qualify for a mortgage at 5.25%. All the while, an ever larger group of homeowners can’t “afford” to move, so they don’t list.

It sure appears to be one demand-side measure that has completely backfired.

Average Joe

at 1:21 pm

Supply and demand says this would happen anyway, just a bit later. If noone sells their house because the value is skyrocketing and you need to buy before you consider selling, removing the stress test just moves up the price point at which the market starts failing again.

“Build-baby-build” is useless unless you’re building options that end-user buyers want, need and can afford. But us pesky homeowners don’t seem to want new housing options in competition with our properties. I don’t see that changing until the birth rate hits zero and even then there’s other ways to solve that. Our economy just gets less and less dynamic but nobody cares because their whole net worth is their house(s) anyway. One of the hottest shows around these days is about a family of NIMBYs physically attacking developers to protect ownership of their single detached house with a yard the size of Rhode Island.

Our standard of living has increased massively in terms of technology and connectivity, travel is ever faster and cheaper, cars are far safer and last longer. Modern commerce has largely been about democratization of innovations and products, but real estate has always been about cornering the market on desirable dirt and that’s all it ever will be.

Appraiser

at 1:55 pm

Attempts to control the market with artificial demand side policies have failed spectacularly for over a decade.

The unintended consequences are now all too apparent.

Bal

at 2:09 pm

if speculators or so called investors keep buying houses…i don’t think any amount of supply will be enough …in my neighbourhood once house is sold either going for rent or flipped within few months without any upgrades on hefty profit …my mortage broker told me other day that he owns six property and five are under construction …my jaw dropped …..lol … i believe in today market people are not buying house to live…it is a profit making machine ….If Govt bring 50% speculation tax and bank of Canada increase the interest rates….if i see house are selling like a hot cake then i will believe we have true supply issue otherwise this is more speculation and free money issue

Appraiser

at 2:52 pm

Investors and speculators are and have always been part of the market.

Scarcity attracts them.

Bal

at 4:53 pm

i understand that the Investors and Speculators are always a part of the market …but we all know that the house prices doubled within 12 months and we also know that something is not making sense . I know that RE always go up in value,,, 8% or 10% yearly increase make sense but not 50%….when i talk to my mortgage broker or my family friends….they all have many properties but they are willing to grab more…,,how is this demand issue? ..if more houses will open tomorrow. They will be first one to buy more……:).. All i am saying they are creating fake demand and Govt must control that kinda demand.

Condodweller

at 1:40 pm

“Investors and speculators are and have always been part of the market.

Scarcity attracts them.”

What’s attracting investors is past performance and the belief that past performance is an indication of future performance.

Sirgruper

at 7:15 pm

Why do people think it’s so easy to buy and flip. Between land transfer tax, commissions, legal fees carrying cost, it take some skill and improvement. Then they create homes for the end user. So you still have a homeowner at the end of the day, fees to government and jobs. Or you could also say upgrading a home is illegal or taxed at 50% and property values will drop. People hate high prices but like nice things. Move to Detroit, KC, etc and you will get cheap housing but at a different cost.

Bal

at 7:34 pm

if you are making hefty profit after selling ….you will buy and flip …please check house sigma and you will see within few months people made 200,000 to 600,000 and some made million also ….it is easy for people who already have equity on their homes …they are one buying second or third house and flipping ….everything is easy when you have money

Bal

at 7:36 pm

yes it is very bad for the end users …in may this year …brand new detach was selling for 1.5 and now semi…so end users are suffering bcz instead of detach now they gonna ended up with semi

Sirgruper

at 12:43 am

Bal

With all due respect try it. Try finding an undervalued house, pay for it or carry it and all associated costs and then flip it. Try to make a profit. Everything is easy until you do it. I know many examples of people who bought and sold and lost money. Try being a developer. Believe it or not many fail; even sometimes the big boys. And yes, many people want modern move in ready and don’t have the time, skill and patience to do it. Why is that a bad thing? It’s a marketplace like it or not. I agree people should have housing. I agree that government needed to help though who truly need decent shelter and believe they are failing on this. But homeownership in major cities in the best areas cost. Try living in Manhattan and complaining why you can’t afford a family home. It’s just reality.

And as for government intervention, I learned long ago that governments generally don’t care about actually doing good for society but care about being viewed as doing good. It’s perception that counts.

David, maybe you could discuss your clients’ experiences on how easy it is to buy and flip. I’d bet it would be illuminating.

Bal

at 2:48 am

Hello- please wake up and smell the roses …you are still living in 1947….please check out the current market ….everything is overvalued ….nothing is undervalued these days…lol…..i understand that the location matter….townhouse in Oakville will sell higher than townhouse in Brampton …all i am saying prices are increasing so fast every month …that people are flipping without any upgrades . more and more people jumping in the market due the insane price increase or maybe prices are increasing bcz more people are jumping in ….i do agree with your one point that everyone cannot take the risk… but now i am seeing those people jumping in the market also who used to be so afraid …only one thing on people’s mind …market will only go up…….up….up…lollol…i am saying what i am seeing around me….i am not an expert but just explaining the ground reality

Sirgruper

at 12:44 am

1947? Sorry a lot younger than that. So to do nothing and flip after costs would cost you about 10-12 % of the cost. If it overpriced why would someone pay 20% more than they could have a month ago. No stats are showing a 20 % per month appreciation. Are you going with the greater fool theory? There might be but in your example it’s 1989 again and that would I presume make you vet happy. Steep price decreases, people losing their homes, steep recession, unemployment etc.

You are trying to oversimplify a complex market with a multitude of factors that are hard to see. But these no value added flippers (if there are more than a few) are betting red or black on the roulette tables and will eventually be burned badly. So no point in whining and blaming; just do your best in the situations as they present.

Bal

at 7:52 pm

lol@ they create homes for the end user….who they? Flippers ….lollol…Funny……

Bal

at 7:58 pm

houses are flipped without any upgrade…Zero upgrade….lollol….no we no need to live in the shitty areas ……if Govt control these speculators …we can have nice house in nice location with reasonable price …..My brother bought house in May pre construction in May for $1,470,000…closing is within two years…but same kind of house is now selling for $1,800,000……330,000 increase within 7 months…..lollol…whoohoo!!!….

Appraiser

at 9:33 am

Flippers, speculators, investors, specuvestors or what have you, they are a function not the cause.

JK007

at 9:37 am

Sorry with due respect are you saying that your brother making a decent profit is bad for everyone else…just hope your brother doesn’t read these comments :D:D:D:D. Jokes aside..it’s easy to say govt should control this or that..but what is that control..should govt not let investors purchase or say tax specific investments at a much higher rate what is that specificity or what is that tax %..and would such a increase stand scrutiny of the courts? Govt makes a ton of money on real estate transactions and noone will kill a golden goose especially if the same one pays 10-20K every other year in LTT etc. I think the issue is that in canada everyone wants to be a homeowner and the stats prove it i believe in the developed world canada has the highest home ownership somewhere north of 70% and that is causing a huge demand/supply gap…throw in new immigrants flush with cash coming to canada and ready to buy a home/condo/town whatever u have a big demand/supply issue…I have couple of rental properties yes they have appreciated in value but then i put my hard earned money into purchasing and then carrying the risk.. dealing with tenant issues so i am well within my right to expect the appreciation that comes with it. Whoever is flipping is similarly taking risks on his own or borrowed money so how is it different to playing equity markets we don’t ask stock purchasers why they are in for say day trading and hold the stock for 2,3,4,5 years..so why real estate…end of the day for these folks RE is also an investment to make money from plain and simple so if the markets rise they reap the reward and if they fall they lose their money. Thais a Capitalism..otherwise there is always Cuban socialism…

Bal

at 10:06 am

lol@ my brother comments …. he also telling me what the heck…lol….i am happy for my brother and he works hard…but you all missing my point ..all i am saying the way prices are increasing is not healthy ….houses are doubled in price within 12 months ….

Condodweller

at 2:46 pm

David if you like records you must love Tennis and F1. One has to be very careful about saying a record will never be broken. People said Sampras’s 14 grand slam titles will not be broken until Federer broke it and now sits with 20 and Nadal has 13 French Open titles alone! Then they said no one will beat Federer’s 20 and now it’s a three-way tie between still active players. On the women’s side you have Serena Williams with 23 titles. Will that be beaten? Not unless you count pre open era titles. Raise your hand if you are a tennis fan and know who Margaret Court is. She won 24 titles however only 11 of those were during the open era. However, she’s still in the top 5 with 11 oe titles.

F1 is an even better example. Fangio’s 5 titles took nearly 50 years for Schumacher to break and people said his 7 will never be beaten. Well if Hamilton manages to finish ahead of Verstappen at the final race on Sunday he will have 8. He should already have 8 if only he managed to keep his car between the white lines in the pit lane his first season. Will he get it? Tune in on Sunday to find out.

Murasaki

at 7:57 pm

But the very next season, the luck went Hamilton’s way in the final race of the season, when Felipe Massa was a lap or two away from winning the drivers’ championship, until a late rain shower allowed Hamilton (who had switched to intermediate tires) to pass Timo Glock (who had stuck with slicks) thereby finishing one point ahead of Massa to capture the title.

Condodweller

at 11:09 pm

Massa was world champion for a few seconds when he crossed the finish line that year. Glock spun off on the last lap a few turns away from the finish that allowed Hamilton to pass him to collect the extra point he needed to win. Mind you Hamilton also made a rookie mistake at the start of that race I believe where he qualified at the front but pushed a wrong button on his steeringwheel which allowed half the field to pass him on the first lap.

He was also lucky this year at least on three occasions two of which Verstappen didn’t finish but would have won the race. Roseberg also could have easily won a second title the previous year and Vettel also could have easily taken one off of him a few years ago if Ferrari could get their act together. Last year was a joke with COVID so realistically he should really only have 4 or 5 titles. Even this year Verstappen should already be champion.

.