It occurred to me today that I call this feature “Photos Of The Week,” but I only post it once a month. Would it be less appealing if it were called, “Photos Of The Month?” Or would it seem somehow more significant?

This week, er, month’s edition hits on all the emotions. It’s musical, colourful, it’ll make you laugh, and it’ll make you cry.

But I’m warning you in advance that the last photo, which is real, and which was found in a house, may be offensive to some people. Just saying…

Okay, raise your hand if you think you’re inventive.

Any hands raised?

Alright, so take a look at the following photo, do not cheat by looking ahead, and tell me if you see what this really inventive condo-owner did in the bathroom:

Did you see it?

She needed a place to put the cat’s litter box, and the middle of living room – while that works for some people, wasn’t on the docket for her.

So she used the space under the sink in the bathroom, and kept the kitty door well-hidden.

Good job!

Quick show of hands: is this the ugliest:

a) wallpaper

b) chair rail

c) wall-paper-chair-rail-flowery-swooshy medley

This photo appeared in an MLS listing for a unit in my building.

At first, I figured that God was angry and was about to throw a lightning bold.

Then I figured it was like what happened in Ghostbusters II before “Vigo” came through the painting.

In the end, it was just a really, really scary day to take a photo of the view:

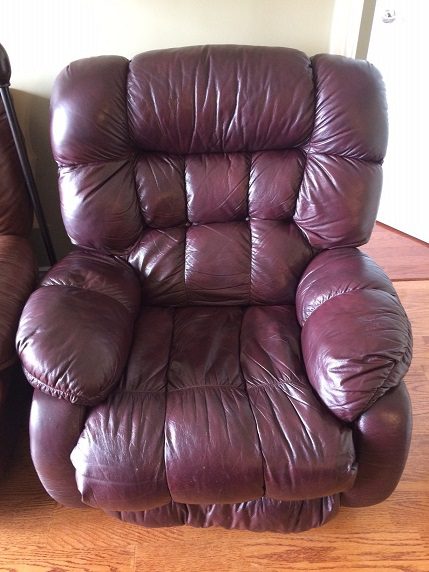

I’m a big proponent of staging, but whether you can’t afford it, don’t believe in it, or don’t have the time for it, you have to admit that some furniture sends the wrong “ideas” to the buyer.

The chair seen below was in a gorgeous 6-year-old condo, but clearly said “Old Man,” even though it was inhabited by some 30-somethings. Without a doubt, the ugliest chair I’ve ever seen in a condo for sale:

And let’s follow that up with possibly the ugliest chandelier I’ve ever seen, although, I’m sure some HGTV roadshow would take this and sell it for a grand…

This one is a beauty!

Clients of mine recently purchased a “total gut,” to use a modern real estate term.

The house hadn’t been touched in 50 years, and it was full of this miserable, awful, ugly vinyl flooring.

To their surprise (and cost savings!!!), they tore up the vinyl flooring to find gorgeous original hardwood underneath! They refinished it, and saved about $15K on floors for the reno:

And last but certainly not least, here is the panel in a house that was for sale recently.

It’s very diligently labelled, but I have to wonder about the accuracy and authenticity of those labels.

Don’t say I didn’t warn you…

Lee

at 8:03 am

RAPE ROOM?…

bo

at 8:41 am

Thats just where they keep the Parmesan cheese.

Domenica

at 10:45 am

Here is my two cents: looks it it might have been PIPE room and someone conveniently added a few strokes to change the words… the R from Room does not look the same like the R in the first word…just my theory!

jeff316

at 3:04 pm

That’s going to be one stinky-ass bathroom if you forget to do the litter once or twice

Chroscklh

at 3:27 pm

Purple chair look like corpse we pull from river in village

Chandlier look like robot designed by 75-yr old eastern european engineer

Paully

at 5:18 pm

We had tile almost like that in our first condo! Wasn’t long before it was changed.

I think the kitty litter box in the bathroom vanity is very clever and well-done. The whole family “goes” in the same room!

Long Time Realtor

at 9:13 pm

Want a good laugh? Read the most recent angry- echo-chamber blog post from Barf Turder (former MP?) and the goofy tweets from Ben Rabidoux, in response to the latest phenomenal July TREB stats. Hilarious!

Parsing decimals and making excuses. What a hoot!

P.S. Nothing New:

The ‘Tea Party’ faction of crazy real estate critics still toils in obscurity and shame.

Hash tag : desperate vindication seekers.

Joe Q.

at 10:20 pm

What’s the actual issue with Ben Rabidoux’s posts? He’s right about the “perpetual uplift” in stats that boosts the YOY sales figures.

Kyle

at 9:41 am

There are indeed a few issues with him harping on the pointless fact that Sales figures are revised (as is COMPLETELY NORMAL with any data that comes in with a lag. e.g. gdp, inflation, employment). The biggest issue is that it is pointless – So What if they’re revised? Does the conclusion that sales are rising change – ABOSULTELY NOT! But beyond that my issue is this, and i apologize in advance for being long winded:

1. He is trying to argue that Sales are technically not rising as much as the release shows, because bears like this message. They don’t like seeing # of Sales rise, because that makes them feel that there are still a lot of people demanding and succeeding to board the shipped that for many of them has already sailed.

2. Much like all the other bear talking points, when you look at what he is saying with even an ounce of objectivity, even a dummy like me can see that the # of Sales in Toronto are being constrained by LACK OF SUPPLY. So a lower # of sales means lower supply, which is not supportive to his bear religion. So one might ask why is he making a big deal about something that isn’t supportive of his position? I can only conclude that his cheerleading for lower # of Sales has more to do with selling a soothing message to the bears than it does with providing any worthwhile analysis.

3. Like all the other cornerstones of the bear religion, where the rubber meets the road the arguments fall flat on their face. Real Estate prices are influenced by three things: Supply, Demand and Affordability – FULL STOP. Not historic lines on a graph, not spurious relationships mined from past data, and certainly not ratios and levels that some flake has decreed to be “correct”. So if whatever mined data set or ridiculous theory the bears come up with doesn’t directly impact the current and future Supply, Demand or Affordability of active market participants then it has very limited predictive power. And # of Sales does not directly impact current or future Supply, Demand or Affordability, it’s just data, nothing more.

Joe Q.

at 12:13 pm

I understand all the points you are making, Kyle, and clearly the revisions to the stats don’t change the fact that sales are rising, for this month’s YOY at least. But the way TREB presents the data results in them always portraying the RE market as more vigorous than it is. YOY sales increases get boosted, YOY sales declines get reduced. It’s basically cheer-leading the market, even if it has no effect on the facts on the ground.

I don’t see this as sending “a soothing message”, so much as sounding a note of caution about taking statistics at face value.

It always pays to dig in deeper to stats like these to see what is really being measured. I’m reminded of the discussion here a few months ago about the economic impact of the Land Transfer Tax — a study concluded that it was costing Toronto’s economy billions of dollars, but the assumptions made in the study were nonsensical. Similarly, there is a report out today from CMHC claiming a surprisingly low number for investor ownership of Toronto condos — turns out that there are very unrealistic assumptions there too.

In any case, we’re probably talking past each other, as you see a lot more “doom and gloom” in Rabidoux’s writing than I can discern, and you have pointed out multiple times that you are not really interested in using analysis to try to get at how the market came to be the way it is, unless that analysis also makes a prediction about prices. I am interested in that kind of thing, which is why I find Rabidoux’ writing to be valuable.

Joe Q.

at 12:16 pm

By “interested in that kind of thing” I mean in detailed analysis, including reference to historical trends, in an attempt to understand what is different now and how things might change in the future.

Kyle

at 1:01 pm

Exhibit A: Here’s an example of logical well thought out analysis that takes data and ties it directly to those things i mentioned before – Supply, Demand and Affordability, to come up with a very solid (and consistently correct) conclusion.

“Strong demand for ownership housing will underpin robust average price increases

for the remainder of 2014. In fact, the pace of price growth that we have

experienced over the past year will continue until growth in listings outpaces

growth in sales for a sustained period of time,” said Jason Mercer, TREB’s Senior

Manager of Market Analysis.

Exhibit B: Here’s an example of a grown man pretending to be an Analyst, but acting like a baby by taking pot shots at data in an attempt to discredit and dismiss it whenever the data once again proves him to be consistently wrong yet again

Ben Rabidoux @BenRabidoux · Aug 5

Amazing how much press coverage that lame BMO report on debt levels got. There’s no way those results are accurate.

See the difference? Jason Mercer looks at the data and forms an opinion. Ben Rabidoux has a very stubbornly formed opinion and then goes and tries to find data to support it and when presented with data that doesn’t support it, he goes and attacks the data. Does the fact that Rabidoux only ever calls into question (or as you say “digs in deeper to stats”) when it opposes his view not seem a bit skewed to you? And then instead of providing analysis or elaborating (you know like what an Analyst is actually suppose to do), he simply take a dismissive pot shot at the data.

Don’t forget there was a time you used to defend Garth Turner, i clearly recall debating his ethicacy with you a few years back before you changed your tune.

Long Time Realtor

at 2:15 pm

I get a kick out of Rabidoux calling himself an analyst and president of North Cove Advisors. Chief cook and bottle-washer of a one-man company is more like it. As far as I can tell, he has no formal training in economics and was previously a part-time psychology instructor at a community college. His “company” is nothing more than he and a lap- top computer working from his kitchen table in a rented house in Owen Sound.

Joe Q.

at 4:33 pm

Kyle, if you looked at Rabidoux’s post in its context, rather than cherry-picking one, you might see things differently. Did you simply not see the posts surrounding the one you quoted, where he (very sensibly IMO) points out what he sees are major red flags in the BMO survey? Like the fact that it reports a 13% YOY increase in the number of Canadians who have mortgage debt — or its findings on household debt levels in different regions of the country. Both of these tweets appear right next to the one you quoted.

Rabidoux (IMO) very correctly points out that the changes reported for average household debt — a 40% YOY increase in average household debt in AB, a 20% YOY decrease in average household debt in MB / SK — are unreasonable (for YOY those numbers are too enormous to be believed).

This is the kind of analysis I like to see. In this case I don’t think his argument skews pro- or anti-RE in any real way. He is pointing out issues with the credibility of the data presented by RBC (which, it turns out, comes from a relatively small online poll).

In contrast, I find Mercer’s comments to be boilerplate. To me, they sound like “Here’s the data, there is high demand, this will push prices up until supply increases.” It is the exact same comment every month.

As for Turner — you can go back through David’s archives and see what I’ve written about him. I’ve consistently said that he is repetitive and thrives on bombast. I’ve also said that his comments about savings needed for retirement, seniors in denial about their savings, people too heavily weighted in RE as they head toward retirement etc. were all sensible, which they were (I haven’t read his blog in years, I don’t know if he covers those topics anymore).

Kyle

at 4:59 pm

Look ‘m not defending the BMO data. What i’m saying is perhaps he should apply the same level of scrutiny to the data he uses to support his own shoddy conclusions and then maybe he wouldn’t be wrong ALL THE FREAKIN’ TIME.

Mercer’s comments seem boiler plate, because he is analyzing the same set of stats every month and he provides the exact same comment every month because that’s what is actually happening in the market, and with each month’s release the market once again shows him to be correct. Unlike the bears who need to mine for new data and create a new story line each and every time one of their previous explanations gets old, because nothing they come up with actually ever happens in the market. I think what you consider to be valuable analysis, i consider to be nothing more than fodder for bear fiction. And like it or not, the market is the score keeper and the bears are getting skunked.

Kyle

at 5:51 pm

“This is the kind of analysis I like to see. In this case I don’t think his argument skews pro- or anti-RE in any real way. ”

Don’t kid yourself, everything he does skews anti real estate. One of the cornerstones of the bear religion that he preaches is that prices are rising unsustainably, particularly in hot markets like Toronto. Based on nothing more than an historically high Debt to Income ratio across the country. Like i’ve pointed out before this is hardly the type of data where one should draw concrete conclusions, but nonetheless bears including him will happily put all the weight in the world behind this theory without ever challenging whether the data warrants such certainty.

The BMO data however shows Ontarians’ average debt levels dropping by 9K, which pretty much debunks yet another bear myth. A reasonable person would question whether they maybe put to much stock into what is a very imprecise, agglomerated data element, but nope not him. What does he do, he attacks the BMO data.

Kyle

at 12:41 pm

Here’s another fine example where Rabidoux feels the need to once again attack data in an attempt to dismiss it, because (as is pretty much always the case) it clearly shows that his assertions are unfounded in the real world.

Ben Rabidoux @BenRabidoux · Aug 8

That CMHC condo report is pretty close to the most useless survey ever.

If you like analyzing historic patterns, try analyzing the behaviour pattern of the whole bear religion:

– create a bad inference from imprecise data to support your view

– when precise data gets released that disproves your inferences vigourously attack the data or its source.

– repeat

ScottyP

at 9:15 am

Defend Garth Turner? Thems fightin’ words!

(For what it’s worth, while I agree with just about everything Kyle is saying in this thread, I can’t agree with that. I’ve been reading this blog almost since its inception, and don’t remember nor can’t conceive of Joe Q. saying one positive thing about Garth Turner. And even if he did? Hey, we all make mistakes. Let’s just set the record straight that Joe Q. is NOT a Turner apologist. *Shiver*)

Appraiser

at 2:34 pm

Yes, I see that Barf Turder is spreading manure once again. After previously dicrediting him here, regarding his false assertion that homes in the $1M category were falling due to the new CMHC cap, when in fact they have risen substantially; I now have to embarrass him again.

He now fibs that sales in the $1.5M range are languishing. Naturally, he provides zero data to back up his horeshit claim.

Here are the TREB stats year to date for sales in excess of $1.5M:

Freehold (2013) = 1193 sales. (2014) = 1549. An increase of 23%.

Condo: (2013) = 49 sales. (2014) = 77. An increase of 36%.

Empty theory #2 – DEBUNKED!

How does his flock of angry renters fall for this crap?

Waqas Ali

at 1:49 am

looking to save cash in real estate transaction? visit http://www.waqashomes.com

ScottyP

at 9:20 am

I’m going to flood your website with false registrations, Waqas Ali.

Frances

at 12:25 am

Don’t have a lot in the way of ethics, do you? You’re poaching on somebody else’s site.