Did you read this article in the Globe & Mail last month?

“My Friends All Want To Buy Homes. Should I Stretch To Do The Same – Or Keep Renting?”

It’s a good question and one that is going to become more common as our city moves forward and prices continue to climb.

The problem is: folks like me believe that if you’re not on the property ladder, it’s going to make it exceptionally difficult to ever own property in the city.

As long as I’ve been in this business, there have always been people who argue, “It makes more sense to rent than to buy.” For a variety of reasons, whether the individual’s age or net worth, or the trajectory of the real estate market, there will always be proponents of renting. However, with continued appreciation over the course of two decades, renters have been left behind, and in my opinion, will continue to fall further behind thereafter.

I had a few TRB readers email me the above article and ask for my opinion.

I was going to write a blog post with my response, but with stats posts next week, and then year-end posts the following week, I wasn’t sure if I’d have time.

One of the TRB readers, who we’ll call “MVC,” emailed me a lengthy retort to the G&M article, complete with graphs! I asked him, “Can I post this? It would be an awesome blog, and more insightful than what I’d come up with.”

Sure, I might provide more comedic relief, cynicism, and snark, but in the context of an argument based on financial analysis, MVC has the background in finance as well as investing in real estate to offer a more scientific look.

A huge thanks to MVC for the following…

Rent vs. Buy Calculator: The Devil’s In The Details

By: MVC

There was an article in the Globe and Mail recently, which had a link to a spreadsheet by Benjamin Felix, who according to the article is a portfolio manager and head of research and

client education with PWL Capital in Ottawa.

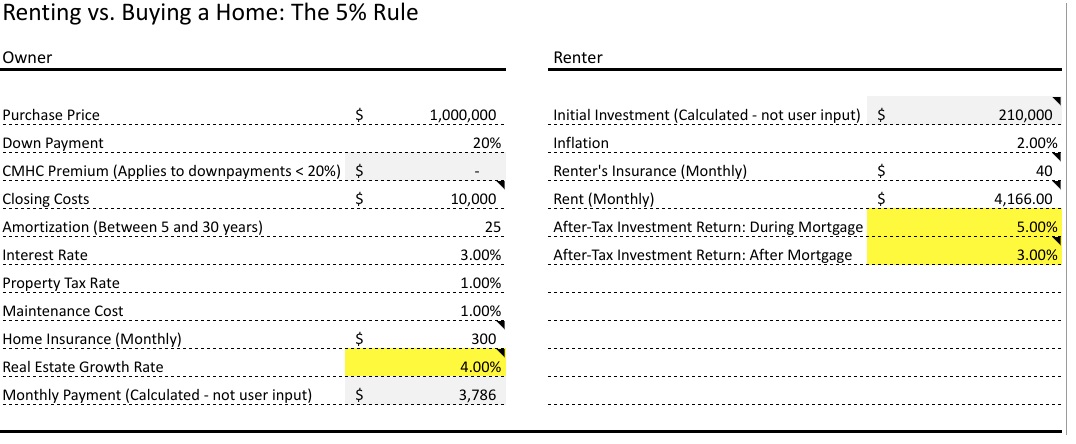

Felix’ claim is that renting is just as good as owning, as long as you spend no more than 5% of the purchase cost of the home in annual rent. I found this claim interesting and wanted to dig into the assumptions and numbers.

ASSUMPTIONS:

- We are assuming after-tax investment return rates, for apples to apples vs tax-free primary residence value growth.

- Both owner and renter have the same amount in cash available to them at the start (equal to the owner down payment amount).

- Renter invests the difference saved vs homeowner costs, consistently, until end of the 25 year mortgage (note the difference saved decreases over time due to ever-increasing rent costs).

- Both owner and renter will retire after year 25.

–

SCENARIO 1: Author Example

The base spreadsheet example is that by paying $4,166 monthly rent (5% of house cost, annually), you are better off compared to buying a $1M home. Let’s examine the author’s case first.

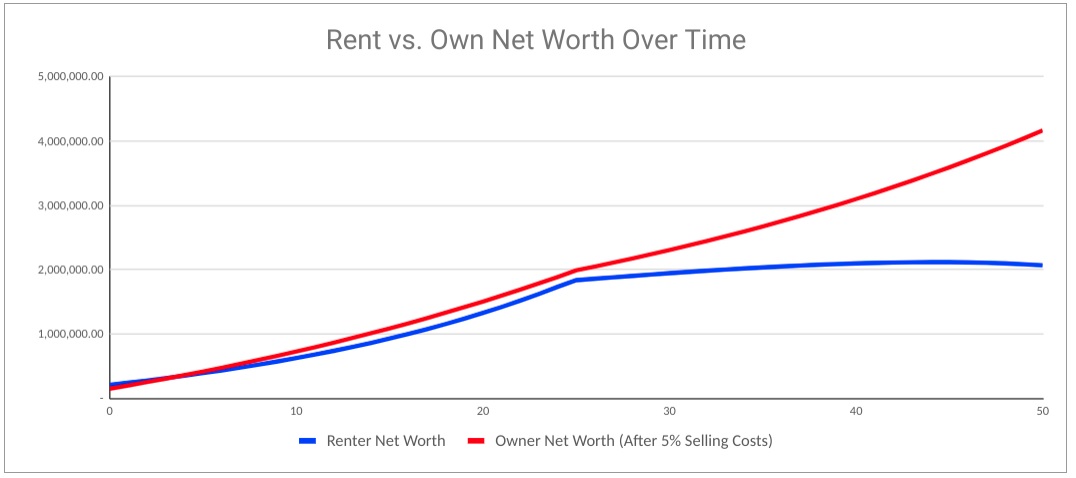

Well, this certainly looks good for both parties, renting almost as good as owning up to year 28 or so, and in fact better for the renter from year 30 or so onwards.

Owner at year 25: $2.0M (on the way to $4M+)

Renter at year 25: $1.8M (on the way to $8M)

Owner at year 35: $2.7M (on the way to $4M+)

Renter at year 35: $3.2M (on the way to $8M)

However, let’s dig into some details to fully understand what is going on here. Some things to consider:

1) Rent never ends

Ignored in this spreadsheet is one very key crucial fact: the renter’s rent costs never end (and never stop increasing). The spreadsheet author states that after year 25, when owner costs

drop since the mortgage is paid off, the renter is “able to absorb the higher cash flow costs with the portfolio growth while also seeing their net worth increase faster than the owner’s”.

However this “absorbing” is not factored into the model unless one simply assumes the renter works forever with increasing wages. The rent costs don’t magically get paid if/when the renter retires (or gets laid off, gets sick, goes down to part-time, etc). Where will that money come from? It will have to come from the renter’s savings/investments.

2) Model assumes the renter consistently invests the difference, versus owning

This model assumes the renter consistently invests the difference from the $1M homeowner into their portfolio for 24 years. This amount works out to $20k of after-tax dollars invested in year 1, and gradually works its way down to just over $12k in year 24, for a total of over $373k invested. Note the reason the difference declines annually is that the renter’s rent costs are going up faster than the owner’s costs, making the delta between the two smaller over time.

I understand this assumption from a model perspective, however in reality this is a big assumption, as the renter’s investment is discretionary, and not a “forced” investment like a mortgage payment. We must believe that the renter not only has this significant excess discretionary income (over and above the $4166 per month for rent), but additionally has the

discipline to invest this amount, in total, consistently while life happens (kids, that car purchase, the family trip, unexpected events, etc). I would argue this is not realistic in most cases.

3) 6% after-tax portfolio gains forever

6% after tax gain implies an 8% assumed before-tax return, and forever means there is no movement to a more conservative portfolio, and thus lower but more stable returns, over time. While 8% is not completely out of line, some would plan for a bit lower, and would assume a shift to a more conservative asset mix as they age, resulting in a lower (but more secure) rate of return.

4) 3% annual real-estate growth rate

This is a valid long-term assumption. However, as we all know, returns of the last couple of decades have exceeded this value locally in GTA, but will vary based on specific locations and

markets.

Let’s see what happens when we adjust for some of these inputs.

–

SCENARIO 2: Rent never ends

Let’s put reality into the rent never-ending. Once the renter retires, rent, unfortunately, doesn’t end for the renter. It still needs to be paid, and that money has to come from somewhere unless they work forever. We will take it from investment savings:

Owner at year 25: $2M (on the way to $4.1M)

Renter at year 25: $2M (now almost peaked)

Owner at year 35: $2.7M (still on the way to $4.1M)

Renter at year 35: still $2M (peaked and will eventually start dropping)

We now see a growing difference in net worth as of retirement, ending with a $2M+ larger net worth for the owner.

–

SCENARIO 3: Reality sets in

In addition for the reality that rent never ends, let’s now also adjust some other variables for what may be considered a more realistic scenario:

1) Investments: The renter invests $10k/year consistently, instead of starting at $20k, for a total of $240k over the 25 years.

2) Returns: After-tax investment returns set to 5%, then 3% after mortgage period and post-mortgage period respectively, assuming a more conservative asset mix in retirement (these are equal to ~7% and 4% respectively before tax)

3) Real-estate growth rate: Annual real-estate growth rate set to 4%. For highly in-demand markets this may be more realistic.

Owner at year 25: $2.5M (on the way to $6.7M)

Renter at year 25: $1.2M (on the way to $0/negative)

Owner at year 35: $3.5M (still on the way to $6.7M)

Renter at year 35: $550k (still on the way to $0/negative)

Whoa! What happened? Suddenly renting doesn’t look so good anymore. At year 25, the owner is over $1.25M wealthier, the mortgage is paid off, and fixed costs reduced. 10 years after that, the owner is $3M wealthier, and a total of $6.7M wealthier at the end. Meanwhile, after year 25 the renter sees their wealth dropping every year, knowing it will be $0 15 years later.

–

SCENARIO 4: What about those costs?

One may argue that the owner also still has fixed costs of property tax, maintenance, and insurance after the mortgage is paid off, and that money also has to come from somewhere. So let’s assume that the amount of those owner’s costs after year 25 is covered in both owner and renter cases, and renter only has to pay net-difference of that vs rent, from savings. The owner still comes out well ahead:

Owner is still ahead as of year 2, is $1.3M ahead at year 25, and $4.5M ahead at the end.

–

OTHER CONSIDERATIONS:

What if the owner also invested? Then the owner’s situation gets even better. The owner likely could invest at some point, as their mortgage cost obligation rises slower and looks smaller over time with inflation. They also in theory could invest the money saved once the mortgage is paid off, should they be in a position to do so.

What if the owner paid off the mortgage earlier? Owner situation gets better (less total interest paid, more time to invest).

What if the renter can not, or does not, invest the $10k annually, over and above paying their ever-increasing rent? Owner situation gets better.

On top of this, of course the owner gets to live in a home they own, and enjoy the benefits that this entails, can do what they want to it, and has no threat of being kicked out.

Some may consider liquidity. Certainly, non-real-estate investments are more liquid, however there are several ways to access home equity, including HELOCs, various secured loans, refinancing, second mortgages and so on. Moreover, the sell option is always there.

IN SUMMARY:

In a world where both owner and renter have the same amount available in cash for a down-payment, real estate gains average 3% per annum, and the renter invests the delta

amount vs an owner without fail for 24 years, gets consistent solid returns, never stops working, and has wage increases able to cover rent increases, the renter will have a larger net-worth than an owner starting after year 30 as per the model.

However, I believe in reality these assumptions often do not hold. While for some renting is a good option for the flexibility it affords, or the only option for financial reasons, we can see that with some different assumptions factored in, the homeowner net worth will almost always exceed that of the renter in the long term. The forced savings of a mortgage, the fact that a mortgage ends while rent does not, combined with the assumed investment amounts, real estate growth rates, and rates of return can all make a significant difference in potential owner vs renter net worth in the near term, and down the road.

Thanks so much to blog reader MVC for sharing!

I welcome your thoughts on the analysis, or even just your general, off-the-cuff intel about “renting versus buying,” a debate that is simply never going to go away.

Have a great weekend, everybody!

Chris

at 8:33 am

The rent vs. buy debate has been done to death. If I recall correctly, I think all of us here more or less agreed that if you’re planning on living somewhere for a long period of time you’re better off to buy.

However, I believe it was Will Dunning’s research that found that the average Canadian owns 4.5 to 5.5 homes in their lifetime. Assuming those moves come between the ages of 25 and 65, that’s one every seven to eight years.

And while changing the assumptions on investment return, the renter’s discipline to save, etc., will change the outcome, given the high transaction costs of real estate, adding a few moves for the homeowner will also materially alter the results.

Hence why you’re likely better off to rent if you plan on staying somewhere for a shorter period, and likely better off to buy if you plan to be there for the long haul.

The only other thing I would add is that, at least in the GTA, I’m not sure $4,200 rent for a $1M home is accurate. As an example, 134 St Clements recently sold for $1.75M and is now available for rent at $5,600. N=1, but this equates to a $1M home renting for $3,200.

Condodweller

at 1:45 pm

I thought we settled on this decision being highly personal in past debates. The first step is to use software or a spreadsheet and find a trustworthy non-biased person to run what-if scenarios who can identify most of the most relevant factors. Including the non-financial ones as mentioned by some like the comfort/satisfaction/safety of owning your own home and determining a proper weighting for them in the decision making process.

The two killer factors that always sway in ownership’s favour are leverage and forced savings. I mean how does it make any sense to have something with a 19 time leverage compared with something where the industry discourages even a 1 time leverage?

Another not insignificant factor is taxes. It takes quite a few years to earn $210,000 RRSP/TFSA room to evenly compete with a tax-free asset.

Chris

at 1:51 pm

Yep, we had pretty well laid this topic to rest I thought as well.

Forced savings is a big one for sure. Many Canadians are less than financially literate, and liable to skip a voluntary contribution to an RRSP/TFSA. They’re much less likely to skip a mortgage payment.

Leverage is relatively easily obtainable outside of real estate investing, but the same financial illiteracy mentioned above makes that incredibly daunting to most people.

A fair assessment of renting vs owning should try to consider tax sheltered investment accounts, but that’s tough in a general comparison. How old is the person, how much unused contribution space do they have, how much are they earning, etc., etc.

Appraiser

at 8:37 am

Excellent analysis MVC. Well done.

It is also good to remember that once the mortgage is paid off and the residence is still owner-occupied, the owner enjoys the generous benefit of imputed rent.

In some countries imputed rent is recognized and taxed accordingly. https://www.businessinsider.com/imputed-rent-hidden-tax-break-homeowners-2016-9

Bryan

at 11:38 am

What a crazy thing to tax (IMO).

Imagine if that happened for other things people own. Paid off your car debt? Great, you get to pay yearly tax on whatever you would have to pay to lease it. Own a pair of skis? Well, you need to pay tax on what you would have had to pay to rent skis every weekend you hit the slopes! Bought that couch? Well I’m afraid sitting on it means that you need to pay tax on what it would have cost to rent the couch from a staging company….

The reality is that a person pays tax when they purchase something (and a plethora of extra tax when that something is real estate)… and they make that purchase with money that they have already paid tax on when they earned it. Adding an additional tax for using the thing they purchased(again, with money they paid tax on to earn) as though the ability to use it is a “generous benefit” seems absurd to me. Being able to live in a property you own is a “benefit” in the technical sense I suppose, but it isn’t a benefit offered out of generosity by the government, but one that is paid for by the owner… to both the seller and the government.

Appraiser

at 12:06 pm

“The absence of taxes on imputed rents is also referred to as Home-Ownership Bias.”

https://en.wikipedia.org/wiki/Imputed_rent

Bryan

at 12:15 pm

It being referred to as a bias does not make it, IMO, any less silly. It follows then that the absence of taxes on imputed ski rentals should be referred to as Ski-Ownership Bias?

From the exact same wiki article you sent “If imputed rent can be applied to housing, it can likewise apply to any good that can be rented, including automobiles and furniture”

Dan

at 8:39 am

I very much enjoyed the analysis but I think it’s going to be over the heads of some. The conclusion I drew was that MVC should be the portfolio manager at PWL capital and not Felix.

J

at 3:06 pm

PWL’s portfolio managers are sharp analytical minds, and Ben is no exception. Based on MVC’s egregious error of double counting rent, it doesn’t seem like he or she would cut it in that role (especially in scenarios involving fiduciary duty).

MVC

at 1:47 pm

There is no double counting of rent. Ben’s model is 100% accurate as a relative-cost model, which assumes the renter saves the difference when their costs are lower vs owner, and pays only the difference in years their costs are more. Once the owner’s mortgage is paid off, the model has the renter paying only the relative cost difference of $31k in year 25 (column C), and not the full renter cash needs of $81k (column B). However, if they are retired as of that year, which is our scenario here, then the full renter cash needs should be pulled from their portfolio from year 25 onwards, and this creates a very different net worth from that point forward.

MVC

at 2:15 pm

What I should have done for even compative absolute numbers is also take owner’s full costs out of their net worth for scenarios 2 and 3, but at the end of the day that only shifts owner line down a bit, doesn’t change anything for renter, and still same overall pattern.

Libertarian

at 9:44 am

I am a homeowner, so I am not one of those “renting is better” people. I agree with Chris about how it depends on how long you want to stay. The more fascinating debate for me is once you own your primary residence, do you then invest in buying more real estate or a diversified equity/fixed income portfolio.

Having said all that, why did MVC change all the inputs to say renters won’t invest consistently, and the rates of returns are too high, and real estate will outperform? Of course that changes the numbers. If you skew all the numbers to real estate, of course it wins.

Plus, as any homeowner will tell you, owning a home is way more expensive than 1%/yr. Renovations, repairs, new appliances, windows, furnaces, air conditioners, upkeep, etc. all add up over time. And with our governments all in debt, it is likely that property taxes will increase.

I’m not saying renting is better – I am saying it is impossible to know what will happen over the next 25 to 50 years. So if you think you’ll live somewhere long term, buy. If not, there is nothing wrong with renting as long as you save and invest. If saving and investing is too hard for you, then buy.

Mike Stevenson

at 2:36 pm

Definitely. And when you say it’s impossible to know “what will happen over the next 25 to 50 years”, that includes whether you’ll live somewhere long term! The whole ‘life’s what happens when you’re making other plans’ thing.

Potato

at 10:10 am

“Rent never ends” — that’s already accounted for in Ben’s base spreadsheet. See all those negative numbers in column C from year 26 on? That’s the rent continuing to be paid after the mortgage has been paid off — MVC’s adjustment is now double-counting rent. The reason the net wealth keeps growing is because those rent costs are less than the growth in the portfolio (and because Ben Felix already accounted for the ongoing non-mortgage costs of the owner and netted that out, which negates your 4th point too).

As for more conservative portfolios/what if the owner invested, this is looking at the difference between the choices. In both cases the person is likely saving more than just the shelter cost differences for retirement, so there’d be an additional portfolio on top of this that could be on a more conservative glidepath (and which also answers the “what if the owner also invested?” question — yes, that’s assumed, but isn’t a factor in the decision because it balances out on both sides).

The rest is just what-ifs. What if the renter lacked financial discipline and didn’t save the cashflow difference? Surprise surprise, it doesn’t work out as well. What if the owner lacked financial discipline and kept refinancing their house to fund lifestyle expenses? Well then the mortgage never ends.

What if the starting annualized rent is actually much less than 5% of the purchase price? Say there was a city where you could rent a house for $3000/mo that costs $1.7M to buy today? What if the owner moved 5 times in 25 years and had to pay transaction costs (LTT & commissions)?

The rent-vs-buy decision is a surprisingly hard problem with a lot of scenarios to consider, and given that it’s one of the biggest financial decisions a person will make, deserves careful thought. There are scenarios where owning will come out better (see the last decade, though also please lend me your time machine as you do), but with prices so high relative to rents, it’s also not hard to get scenarios (such as a soft landing/Ben’s base case) where renting comes out ahead. And there are risks and trade-offs on both sides.

Libertarian

at 10:21 am

You said much better than I did!

Chris

at 10:23 am

Great catch on the double counting, Potato. That will pretty substantially change the outcome.

Good points all around from both you and Libertarian.

Condodweller

at 2:18 pm

That’s a good call on the rent. I didn’t look at the spreadsheet but as I was reading I was wondering how the author would have left out the biggest expense for a renter that we are comparing (rent vs mortgage).

This spreadsheet is a good start and it’s interesting that it uses a longer time horizon than the length of the mortgage. This is one of the biggest things most people don’t consider. To make it really interesting it should be extended to a lifetime. I guess this is close enough if we assume the purchase at age 30.

Another big one that jumps out at me is inflation. Very few people will include inflation in their financial projections (unless you work with a professional who does it for you) but why would one include it only on one side of the equation? Again, I haven’t seen the spreadsheet but I don’t see it on the ownership side. Do people think their home is impervious to inflation? I know some consider real estate prices to move in tandem with inflation on average in the long term so does the author consider the increase in house value to be inflation i.e. the value doesn’t increase?

At the end of the day, there are so many non-financial items that affect the outcome that it may be beneficial to do a psych evaluation on the person to determine how they can handle the two options emotionally and how likely they are to shoot themselves in the foot by either not following through or making bad decisions along the way.

As others have mentioned, transactional costs will take a bite out of an owner’s net worth. Even if we only assume one move from a starter home to a forever home will have a significant impact in favour of a renter never mind if they do it two, three or even more times.

At the end of the day, this is going to be a best-effort estimate unless someone does break out their time machine/crystal ball 🙂

J

at 3:02 pm

Great analysis, Potato. It seems that MVC’s entire analysis is incorrect (except for the first part that simply repeats Felix’s findings). So maybe David should publish a correction/retraction?

Kyle

at 10:02 am

MVC addresses the “double-counting” above. If we’re talking about what people can expect to have in Net worth under the various scenarios. Then MVCs graphs are correct and Ben Felix’s are wrong. This should be obvious when you look at Ben’s graph and don’t see even the slightest kink or disruption for the Renter when he retires. This logically makes no sense, unless the Renter has a magical money tree in his rented backyard that continues to fund his investment in his portfolio after retirement. In any real world situation, the Renter would need to shift from funding his portfolio to being funded by his portfolio.

MVC

at 9:33 pm

Exactly correct Kyle. Re Potato’s comment, if you looks at the original sheet, you will see that only the difference vs owner’s costs coming out of renter’s portfolio in year 25 on..for year 25 it’s $33k, instead of the full renter’s costs of $81k that year. Correct and fine for a relative cost model. But if we factor in retirement in year 25, which is our scenario here, then as of that year, the full renter’s costs has to be pulled from the portfolio from that year onwards, which changes the net worth trajectory. I should have pulled cumulative owner costs from year 25 on from their net worth also in scenarios 2 and 3, but that just shifts owner line down a bit, same overall trajectory, doesn’t change anything for renter.

London Agent

at 10:19 am

Great analysis here. While the numbers are definitely skewed to the owning real estate side, in practice, that is likely what will happen in the real world.

While MVC did mention it, and this is foremost a financial analysis, I don’t think it can be overstated how valuable actually owning your own home is. The security, control and comfort that a homeowner enjoys as opposed to a renter is massive.

Appraiser

at 2:37 pm

Ah yes…what price pride, freedom and security of tenure – massive indeed!

Dmitry

at 11:37 am

Also home owners have an option to do Smith Manoeuvre and start investment portfolio day one of ownership as well and will end up with HLOC that is the size of the mortgage and investment portfolio that is much larger and interest on the HLOC is tax deductible (rent payment are not). So think about interest portion of mortgage payment is your rent and principal portion goes to investment every month. After 15-25 years (depends on how fast mortgage is converted to full HLOC), homeowner end up with tax efficient HLOC and nice investment portfolio that is the same or bigger of the one renter has.

But the truth is no way to account for all these what ifs and other details that are very much personal to each other situations.

Kyle

at 12:57 pm

This is really great work by MVC. Even Mr Felix, refers to renting as a “viable” option, not a better option. Anyone can play around with the numbers and change assumptions to make any theoretical scenario work, but MVC has really hit the nail on the head with his summary, that in REALITY AND NOT JUST ON A SPREADSHEET, you’re probably much better off owning over your lifetime.

If renting/investing was actually a better/easier way of accumulating wealth, then you should see many successful renters who have been able to pull it off, in fact they should outnumber successful homeowners. But i know i’m not alone in knowing zero millionaire lifelong renters, while millionaire home owners are a dime a dozen.

https://www150.statcan.gc.ca/n1/daily-quotidien/210611/dq210611a-eng.htm

“Homeowners account for majority of gains in household sector net worth

As intense real estate activity continued to raise average home prices, households that owned their homes recorded an increase of over $730 billion to their net worth, while renters saw their net worth rise by approximately $43 billion. On a per household basis, the average owner-occupied household increased their net worth by approximately $73,000, while the average renter household’s net worth rose by about $8,000.”

Chris

at 1:13 pm

Kyle, you’ve raised those StatsCan data points before, and each time someone mentions that, without controlling for things like age and income, the conclusions you can draw from it are a bit limited; homeowners tend to be an older and higher earning cohort.

It would be interesting to see, controlled for other variables such as age and income, and over a long run (eg. 25+ years) how household net worth differs between renters and owners. There seems to be some research into that in the USA but can’t find anything for Canada unfortunately.

Kyle

at 1:34 pm

I can’t find the link now, but i have posted data that showed homeowner vs renter net worth by income decile and in each and every single decile, the homeowners were worth significantly more, in most cases by multiples.

Chris

at 1:41 pm

If you can find that it would be interesting to read. But that helps controls for one variable only.

As an example, if we have two people, both earning $130k for instance, and one is 30 years old while the other is 55 years old, regardless of their homeownership status, I think we would widely expect the older individual to have a substantially higher net worth. Yet these two would be lumped into the same income deciles.

If we truly want to get to the causality on wealth of homeownership, we should seek to control for those confounding variables. And I’m not sure if that research has been done here in Canada.

Kyle

at 1:46 pm

Table 12 on Pg 25, eliminates any question on whether ownership results in higher net worth than renting in the real world. Spoiler alert: It isn’t even close.

https://mortgageproscan.ca/docs/default-source/government-relations/owning-vs-renting-2018.pdf

Chris

at 2:34 pm

Thanks for the link, Kyle. Technically, I think it should be table 10 on page 23, which actually bolsters your case!

It’s a bit disappointing that Will’s research has a few areas where the data has been suppressed, but I understand why this is the case. It would have been really interesting to see how, for example, the higher quintiles of income compare on renting vs. buying.

I do also wonder about some of the lower quintiles as well, for example, how many in the 2nd quintile aged 20-29 who own homes have had their net worth bolstered by parental assistance for a down-payment, etc.?

Will touches on some of these confounding variables by stating:

“It is possible that owners are more motivated to save than renters, and therefore these differences in net worth may be the result of different behaviours between the groups rather than any inherent financial advantage of homeownership. However, this comment does not disprove that owning is financially beneficial”

And I suspect he’s right. Homeownership has been a great investment in much of Canada for the last few decades.

Two 30-year retrospectives from the USA show a bit of a different result:

“Instead, this study hypothesizes that crowding toward homeownership raises the price of homes above their fundamental value resulting in the purchase of a home becoming a contra-indicative action. After setting the holding period to the average American’s tenure in a residence, renting (not buying) proves to be the superior investment strategy over most of the study period.”

– Lessons from Over 30 Years of Buy versus Rent Decisions: Is the American Dream Always Wise? by Beracha and Johnson

“This paper presents long-term, historical scenarios for six metropolitan areas that compare accumulated ending wealth for the rent-versus-buy decision. The scenarios incorporate the major costs of home ownership and renting over a 30-year time horizon. These historical scenarios, which reflect year-to-year changes in such factors as mortgage rates and investment returns, show that home ownership has not always been the best financial decision for a family.”

– To Rent or Buy? A 30-Year Perspective by Cox and Followill

Obviously, a different country and different markets. Will’s Canadian research is more relevant up here, but interesting to other perspectives.

Anyways, I’m not sure if it will be possible to control for every confounding variable, from behavioural differences, to parental help, to age, to income, etc.

I think most people commenting here have advanced pretty reasonable opinions – in the rent vs. buy debate, go through the math, go through your own personal preferences and projections, and make a decision based on those.

Kyle

at 3:31 pm

The area of the chart that i see as being the most important to think about is that you’ll notice there is a relatively large jump in Renters’ net worth after the age of 60. This is almost certainly due to previous homeowners downsizing and now having their net worth skew up this segment’s.

If you backed out these previous homeowners, the actual net worth of the lifetime renters would likely be considerably less. It’s debatable how much less, but either way under half a million isn’t that much to retire on when you still have to continue to pay rent for the rest of your life.

These is real world data, not lines on a graph. Anyone thinking renting is viable should understand the consequences when their mileage varies.

Kyle

at 3:52 pm

In fact the real world data, actually looks a lot like what MVC describes in Scenario #3: Reality Sets In. Which those pondering this should take as an important PSA from MVC.

My advice to those pondering rent vs buy is if anyone tells you renting for life is a better way to grow your net worth, i would ask them to first show you someone who has done it successfully. And when they can’t (because the data clearly shows those people don’t exist-like i’ve been saying all along), be glad you didn’t fall for the grift.

Chris

at 4:40 pm

“The area of the chart that i see as being the most important to think about is that you’ll notice there is a relatively large jump in Renters’ net worth after the age of 60. This is almost certainly due to previous homeowners downsizing and now having their net worth skew up this segment’s.”

Definitely! That would be another interesting aspect to control for, that I don’t think Will’s research would be able to account for. Lots of confounding variables to consider in all directions.

“My advice to those pondering rent vs buy is if anyone tells you renting for life is a better way to grow your net worth…”

I don’t think anyone here has advocated that. Rather, most are suggesting considering personal situation (e.g., how long you’re planning on living in a spot, propensity to save outside of a mortgage, etc.), as well as the math, and basing the decision on all of the factors. As Potato said, there are lots of scenarios to consider, and no one-size-fits-all answer.

Kyle

at 4:51 pm

Ben Felix is totally talking about a lifelong renting…

“Despite the tighter rental market, Mr. Felix believes renting long-term is still financially viable. For people looking at it as a lifelong option, he says a rule of thumb is for yearly rent to cost no more than 5 per cent of the price of a home you would consider buying.”

The point is we should be very clear, as MVC has shown, as the REAL WORLD data shows, lifelong renting is a recipe for retiring on food stamps. So by all means consider how long you’re going to stay in a place, etc. But just know that there is pretty much zero chance that you’re going to end up ahead by renting for life.

Chris

at 5:14 pm

I’ll admit to not having read the article, hence why I said that nobody here was advocating that. Though, the statement “Mr. Felix believes renting long-term is still financially viable” is not equivalent to “renting for life is a better way to grow your net worth”.

As many here have correctly brought up, there are myriad factors to consider. A renter who doesn’t save and invest will be in a worse position. A homeowner who moves every 2-3 years will be as well. And then there are those that are beyond the financial considerations.

I would suggest MVC re-run their assessment, correcting for the double-counting that Potato identified, and including a few other alternative scenarios, particularly the impact that moving every 7-8 years, as is the Canadian average, would have on the projected outcome.

Anyways, I think at this point, we’ve exhausted the topic. Thanks for the chat, and have a nice evening, Kyle!

Appraiser

at 2:44 pm

Spoiler alert re latest TRREB sales data:

“GTA home sales reached a new record for the month of November, and the average selling price hit a new all-time high.”

All these buyers and sellers must be so financially illiterate. On top of that, the homeownership rate in Canada recently hit 70%!

So many dummies.

… ‘Coulda rented.

Mxyzptlk

at 3:21 pm

In his December eNewsletter, David comments on the November YOY average price increase in the GTA being higher than that in October (“…so we’re now increasing at an increasing rate!”).

But it’s not just this past month, it’s been happening since the summer:

July 2021 prices increased by 12.57% vs. July 2020

August 2021 prices increased by 12.58% vs. August 2020

September 2021 increased by 18.29% vs. September 2020

October 2021 prices increased by 19.29% vs. October 2020

November 2021 prices increased by 21.70% vs. November 2020

So the December average can drop by as much as $28,000 from November’s average and still represent a YOY increase greater than November’s 21.70%. I’m not predicting that this will happen, but I certainly wouldn’t bet against it.

Appraiser

at 5:05 am

And what about the latest employment data from Friday:

“The Canadian labour market took an extraordinary leap in November with employment gains seen across most industries and provinces. Even total hours worked, which had been a laggard through much of the recovery is now back at its pre-pandemic level. Truly, a gangbuster report.” ~TD Economics

I blame Trudeau.

Chris

at 9:37 am

The next paragraph in the report you’re citing:

“A possible, and perhaps likely, driver of employment in November was the expiry of key fiscal measures like the Canada Recovery Benefit. Without income support, job search intensity likely picked up.”

Wasn’t an end to the broad fiscal stimulus what the opposition were asking for?

Another interesting section:

“November’s job report will be impossible to ignore for the Bank of Canada. Throughout the pandemic, the Bank had stressed that it would keep the overnight rate low until the labour market recovery was complete. With last month’s release, it safe to say we’re nearly there. The unemployment rate is almost back to where it was in February 2020, the employment-to-population ratio is only a touch below its pre-pandemic rate, and even total hours worked showed a major improvement in November. Given tighter labour market conditions, stronger price pressures, and hot housing market activity, we can’t discount the possibility the Bank may choose to hike as early as January. Next week we’ll hear more from the Bank of Canada, expect more hawkishness in their statement.”

Bal

at 4:56 pm

Hey Chris lets stop making predictions….lollol…….Semi in Brampton are now selling for 1.4 million….lollol…..house prices are doubled since we started making predictions……lolol…Problem is market is drive by investors and now even regular people started to worry about their kids..one of my cousin is a chill dude but today he was talking about investing in the townhouse as now he realizes his kid will never be able to afford the house in near future….

Chris

at 5:29 pm

I didn’t make a prediction there. TD did.

https://economics.td.com/ca-employment

As for doubling, GTA HPI as reported by CREA is at 369.4, or roughly double (+99.89%) the 184.8 it was in June 2015.

To put things in perspective, over the same time frame:

S&P500 +117.19%

DJI +92.33%

NASDAQ +203.38%

TSX +37.43%

Let’s not pretend asset price inflation has been limited to only one class.

Bal

at 5:57 pm

Sorry i did-not mean to offend you ..Actually no one knows anything …all these so called pundits and. bankers all are blah blah ….lol….yes i know everything went skyrocketing but houses have more impact on our lives as this is place to live ….Same like Grocery and prices of Gas….Other assert classed people are not that much familiar …like crypto or stocks …we know more than before but still learning

Chris

at 6:00 pm

No problem Bal, I wasn’t offended! Tone is hard to interpret through a message board.

Anyways, it’s looking more and more likely that interest rates will begin to climb in the not too distant future. As the monetary and fiscal stimulus wanes, it will be interesting to see how all asset classes respond.

Appraiser

at 9:26 am

There is a big a difference between fiscal stimulus and emergency income support.

P.S. The Conservatives voted for every measure proposed by the Libs.

Chris

at 11:40 am

Emergency income support was a fiscal policy meant to stimulate the economy. So no, not a big difference between that and fiscal stimulus.

And as far as I can tell, the conservatives have been advocating for a tapering of these policies for awhile now.

When we’re 22 months into a pandemic, and there’s a plethora of examples of stimulus going to inappropriate recipients (e.g., profitable companies reviewing CEWS then bolstering dividends), it’s probably time to narrow the scope of those “emergency income supports”.

Bal

at 4:03 pm

Check out the forecast for next year …lol. … A Large Canadian Real Estate Brokerage Has Forecast Prices Will Rise Up To 20% over the next 12 months.

Chris

at 5:40 pm

Is that the Remax one you’re referring to? It’s curious, if they’re expecting prices to rise 20% in the next 12 months, why are so many encouraging listing and selling now rather than waiting until spring?

http://moneywise.ca/a/ch-pms/dont-wait-for-spring-to-sell-your-house

Bal

at 6:15 pm

As of today all real estate firms are forecasting 9% to 20% increase within 12 months ….i am sure they know more than us….or they know something what we don’t …:) …only time will tell ….

Mr.Audi

at 1:40 pm

This comparison cannot be made,there are not two scenarios alike.

I am a homeowner and investor and I believe both are great vehicles for building wealth.

You can definitely can earn more money on the stock market or crypto market.

The assumption in the given scenario is that the renter will only buy mutual funds or put his money in whatever his bank told him.

How about the scenario where the renter bought $200000 AAPL 25 years ago?What kind of property in the GTA or Canada would be even close to that return?

Also from investing perspective,the returns are far better and easyer to manage if one puts their money in a REIT rather than buying a home.

On the other hand there are many benefits from ownng a home,better borrowing power being one of them.

This debate about rent vs own showld really not exist as every single scenario is different and cannot be compared.

Both can be quite beneficial and everyone should decide for themselves how to proceed.

clark

at 6:51 pm

I can’t believe you didn’t even address the grossly inflated assumption of 5% for interest, property tax, maintenance combined. It’s more like 1.5% in my case.

Susie

at 11:25 am

There are a lot of assumptions negatively about renting while assuming home ownership will never decrease from the 4% increases we have been seeing.

What if you buy a home, value drops, interest rates increase, you accumulate more debt because you are already stressed to the max. Buying in 2022, with interest rates increasing (I don’t think it’s fair to assume that they won’t ever increase), based on economic forecasts and with inflation so high… It would be safe to say your 1 million dollar home may not continue to increase in value.

Bob McDonald

at 4:17 pm

Of course, what about if you live in, say, Fort McMurray, which is chock full of underwater mortgages that are never going to recover and house prices values continue to slide even in 2022? Do you ever bother to rent? No, right? But then what if the rents are considerably more than mortgage, even if the value of homes still will slide?

Bob McDonald

at 4:18 pm

“Do you ever bother to rent?” should be “Do you ever bother to buy”