Perhaps you didn’t see that headline coming.

Or maybe you did. Maybe you’re in the rental market, getting beat out by higher offers, from people who haven’t even seen the unit, and you’re wondering why the heck all the fuss is about houses and condos for sale.

Well, sales are higher stakes, make bigger headlines, and thus are more talked about.

But let me fill you in on the downtown Toronto rental market, and how you can compete…

There are a lot of rookie agents in my office, as with any brokerage in the city.

I try to help the rooks where I can, given how much help I had years ago when I started.

This past spring, I started chatting with a new agent, who wanted to commiserate about how tough the spring market was.

“I lost again in multiple offers last night,” she said.

“Tell me about it, ” I replied. I had just lost in a 24-offer melee on the east side.

“How many offers were you up against?” I asked her.

“Four,” she said. “And I really thought I had it, but in the end, somebody just came in and blew us all away.”

This sounded quite familiar.

It was the busy spring market, and I was quite accustomed to seeing $799,000 houses, which you expect to sell for $950,000, end up selling for $1,050,000. You always fear that one person who just “blows everybody away.”

“How much over asking was the winning bid?” I asked.

“A hundred,” she said.

Hmm. A hundred. That didn’t seem like much. This was around the time that I was quoted in the Toronto Star as saying, “Two hundred is the new one hundred” in reference to the amount over-asking. Maybe the house on which she bid was only listed at $499,000?

“How much was it listed at,” I asked her.

“Seventeen-fifty,” she said.

Seventeen-fifty.

I was thinking “seventeen” and my mind wasn’t really reacting to the number.

It was like watching a car ever-so-slowly back up into a wall, until finally it hit me: she was talking about a lease.

$1,750 per month, there were five offers, and somebody paid $1,850 per month.

Even though the stakes seemed so small – we were talking about a hundred bucks, compared to the hundreds of thousands we talk about in the sale market, that $100 over asking goes a long way when you’re living month-to-month.

I got a call from a reporter at Metro News yesterday, who wanted to talk about the hot rental market.

I was actually quite surprised that the media was interested in the lowly rental market, but there is a story here.

The reporter told me that he had spoken to, I believe it was, an economics professor, who surmised that if the sale market is hot, the rental market should not be; that there should be an inverse relationship.

I told him that was great, in theory, and that any professor working in a vacuum might be correct.

But we have a housing problem in Toronto – there isn’t enough of it.

For rent, for sale – either way, there’s not enough product to satisfy the demand.

We have twice the new entrants into the city as we have housing completions, and we can’t keep up with the rapid expansion of the population.

So yes, the rental market is competitive.

And now so, it seems, more than ever.

Another new agent in my office sold an investment property back in June in the King West area.

His client bought it to hold long-term, and lease out.

The last two units in the building, identical to this one, were leased for $1,550.

He asked me if he could put it up for $1,600, and I said, “The market is nuts, what have you got to lose.”

The very day the property was leased, he came in the office, all excited: “I’m getting an offer on Brant,” he told me.

The next morning, I came in and asked him if he got that offer he was talking about.

He did a slow turn, eyes-wide, and said, “Nooooooo…..I got three offers.”

Within 36 hours of the listing, he had six offers, and leased the property for $1,700. It was listed for $1,600, and the previous high, one month earlier, was $1,550.

The rental market was, and still is, absolutely on fire.

So if you’re in the rental market, what do you do?

What can you do, in an insane market?

First and foremost, you need to come prepared.

There are three pieces of documentation that are essential in the leasing market, and all three need to accompany any offer to lease:

1) OREA Rental Application

This is a standard OREA form, just like the Agreement of Purchase & Sale, Amendment, Buyer Representation Agreement, Etc.

The irony here is – there’s a section for “Bank Account,” which is utterly bizarre, since nobody in their right mind would provide their banking account number in this day and age. OREA needs to update this form, but that’s an aside.

The form itself basically outlines the basic points – who the applicant is, where they work, where they’ve lived, personal references, etc.

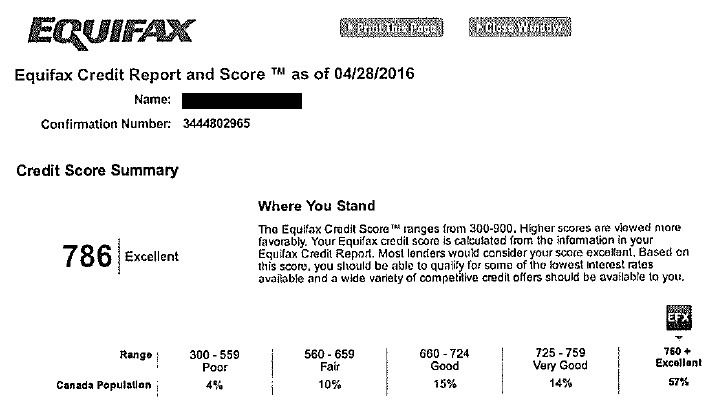

2) Credit Check

Very simple – go to www.equifax.ca, spend $23.95 on the “Credit Score,” and download it.

You get an “Equifax Credit Score” which is like a FICO score or Beacon score.

You’re not entirely judged on this by the landlord, but having a score over 725 is important.

Here’s a sample, with the breakdown of where the Canadian population ranks:

3) Employment Letter

This comes from the human resources department where you work.

It should have your job title, tenure, salary, and bonus.

If you’re in the probation period at your work, that’s an issue.

If you’re self-employed, that’s an issue too.

–

Now those are the three standard items that should accompany a lease, but amazingly, not every agent submits them.

I’m shocked at how many times I get an offer to lease on one of my clients’ rental properties, and it’s just the lease – no supporting documentation.

“Can I get a credit check,” I’ll ask, almost rhetorically.

“Take a look at the offer,” I’ll be told. “If it looks good to you, we’ll take the next step.”

That’s moronic, in this market.

The offer is almost standard in September of 2016; for a 1-bed, 1-bath condo in the downtown core, it’s the listing price, with all the particulars filled in.

What you’re actually considering as a landlord, is the tenant him or herself.

You’re looking at them as candidates, and you’re weighing the merits of their income, job security, debt load, and credit score.

You’re also weighing them on the merits of their age, gender, and a whole other list of items which are NOT allowed under the Canadian Charter of Rights & Freedom, and other acts, but let’s face it – landlords might, just might not want to rent to a couple of 19-year-old frat boys who are living off-campus as they attend U of T in their second year.

We can debate that another time…

So assuming you have those three documents – the rental application, credit check, and employment letter, you’re submitting a clean offer to lease, and you find yourself in competition, what else can you do?

How can you differentiate yourself from the pack?

Here are some ideas:

1) Bio

This sounds cheezy, but it’s not.

Think of it like a cover letter to a resume!

You’re submitting an offer to lease, meaning you and the person to whom you’re submitting the offer, are entering a working relationship.

When somebody sells a property, they really don’t care who’s buying it, since they’ll move on with their life.

But for a lease, you’re going to interact with the tenant, and thus you want to know who they are.

For a tenant to submit a brief bio, it allows the landlord to learn a bit more about them, and perhaps establish a personal connection – just like you try to do with the person reading your resume when you apply for a job.

2) LinkedIn Profile

Somebody once told me, “LinkedIn is basically Facebook for adults.”

Good call.

As with the bio, if you want the seller to know how you are, and in a professional capacity, then share your updated LinkedIn profile.

Perhaps a photo of you in a suit will differentiate you from all the other faceless applicants you’re up against.

3) Higher Deposit

Often with sales, a higher deposit breaks the tie.

If two identical offers are submitted for $950,000, one with a $25,000 deposit, and one with a $100,000 deposit, the offer with the higher deposit might make the sellers feel a little better about the buyers’ commitment to the purchase, as well as their ability to close.

Tenants usually provide “first and last month’s rent” as a deposit.

But if you have the ability to provide a third month’s rent up front, it might differentiate you from the other candidates.

I remember “back in the day” when I was doing rentals, and I had a client who fell in love with a loft at Candy Factory.

There were nine offers.

She was very well off.

She provided six month’s rent up front.

We beat the other eight offers.

I know, I know – you think that’s nuts, and it’s unnecessary, and some of you think it’s “unfair.”

But it’s a competitive market, and guess what? It is necessary.

4) Guarantor

This is a big deal when you have young tenants.

Again, I know – you’re not supposed to discriminate against people for age.

But you’re also not supposed to J-walk. Or drive over 100 KM/H on the highway. And if you win $100 in your office Superbowl pool, you’re supposed to declare that as income on your tax return…

When young tenants are looking to secure a lease, many landlords simply scoff at the idea of letting two 22-year-olds, making $32,000 per year, rent a $2,500/month condo. It’s not just the finances – it’s also the idea of young people living in your investment, given how they live, how they party, and where their priorities lay.

Oh, young people!

If only they were accountable for their actions.

Wait!

They can be!

And by that, I mean somebody can be on the hook: their parents.

If a parent is willing to sign as a “guarantor,” it makes that parent accountable for everything.

And it might make the parent teach their kid a thing or two about life while they’re at it.

–

It’s tough out there, folks!

We’re about two weeks into the fall market, and already I can say it’s the craziest market I’ve seen in my twelve years in the business.

Next week, I’ll tell you a few stories about the condo market, for sale, and just how absolutely, utterly insane things are getting…

Ed

at 8:04 am

Adding to the shortage of rentals are landlords who are using Air B&B instead of going for a lease.

Kyle

at 10:44 am

Also in the core, more and more duplexes and triplexes are being converted back to single family homes. There are a bunch of new purpose built rental towers under construction now that will come on stream in the next six years, but they are targeted towards professionals and will not be cheap.

jeff316

at 2:11 pm

^^^ This. Partial and full house rentals are disappearing right now. Still decent deals in some older apartment buildings, e.g. long term rental building, not condos, but many don’t have a/c and are outside of the core.

Mike

at 11:13 am

Alex Avery, one of the smartest real estate minds in the country, has just come out with a book on why renting makes more sense than buying.

jeff

at 2:15 pm

I am a big believer in Linked in. I have 2 investments in Toronto and doing it for years. You are just looking for honesty/good people. Also as a landlord I like pulling Equifax, I know many landlord who have received fake ones. Apparently there is a program that lets you run a fake one.

It is also different once you leave Toronto. Me and my 2 sisters inherited a duplex in Hamilton, the girl didn’t pay rent for 3 months because…..she bought a hoarse and couldn’t afford to pay for both. We ended up having her leave with us taking a hit on rent, no idea what happened to the hoarse.

Darnell

at 6:11 pm

I thankfully own but have tried to help rent a condo in the core and its ridiculous how difficult yhe listing agents were making it to rent. He makes well over 200k a year for a megacorp and they still wanted a letter of reference pay slips the whole nine yards. He ended up going with a private renter. Not sure what is going on but doesn’t seem kosher when you have the creds and the cash and the agents put up so many obstacles.

crazyegg

at 10:01 pm

Hi All,

As a Realtor, don’t even list list on MLS anymore for my my rentals. I go straight to Kijiji and Craigslist. Way less paperwork and more importantly, way more quality leads. In this crazy market, I just hold 1-2 open house nights and it’s rented to a person of my choosing.

Regards,

ed…

ahh that rental life

at 7:55 am

10 years ago we competed for rentals near U of T – short commute to uni was very important and it was common to have open nights and everyone had their parents with them ready guarantee the rent for 4 college kids to live in a rundown house run by a slumlord.

the first time my parter and i rented out a property we used a realtor, i think it was nerves and we wanted to feel more secure..since then we only use kijiji – i have several friends that also own rental properties and only use kijiji – never had any issues