The Clash is awesome!

But I’m not referring to the 80’s Brit band that brought us “London Calling.”

I’m talking about all those renters whose leases are coming up for renewal in the Spring.

Do you stay and keep renting? Or do you buy somewhere else…

When I was a child of five years old in the mid-80’s, I recall the milk crates full of LP’s next to the old record-player in my living room.

I loved the song “Macho Man,” but I wasn’t sure what band sang it. Since I couldn’t read yet, and I thus I couldn’t identify the correct album, I would pull out every single record and look for the silly-dressed men on the front cover that looked like they were throwing a Halloween party. Who’d have ever guessed they would actually become the inspiration for many, many Halloween costumes down the road…

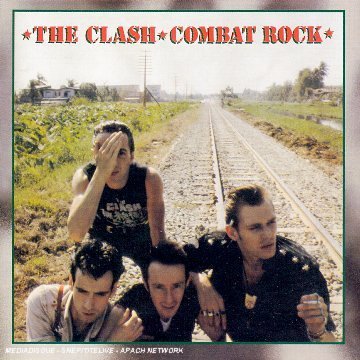

My other favorite album was Combat Rock by The Clash, which featured “Should I Stay Or Should I Go.” I remember we had this silly dance that took the song lyrics far, far to literally, whereby we would mimic the actions of staying or going while constantly ducking back and forth behind a wall. Silly, silly kids…

My point to all this? Well, I don’t really have one. I just thought it was a dynamite lead-in to this blog post, and I get a ton of emails from people that enjoy my occasional reminiscing…

As we approach the spring season, many people’s leases will be set to expire all over the city. For some reason, May 1st and September 1st seem to be the most common lease start dates, and in my recent experience, May 1st tops the list.

Some people are lessees for life, and others consider it a short-term stop-gap towards the ultimate goal.

But how do you make that decision?

And when you think about it, perhaps there is more than one decision to make.

First of all, do you renew your lease or not?

Do you like living where you are now? Is the space big enough? Do you like the building and the area? Is the rent too high, or on the flip-side—can you afford to pay more?

Secondly, if you decide to move out, are you going to find another place to lease or are you going to buy?

Maybe that second question comes before the first, as many renters ask themselves, “Am I ready to buy” before they consider whether to stay in their current residence with their current lease.

It takes all kinds…

So let’s say you are a current renter, and you’re weighing the pros and cons of purchasing a property. What are some of the factors to consider?

1. Money. Of course this is at the top of everybody’s list, but it goes beyond the simple monthly payment mathematics. If you’re renting for $1600/month, can you afford to pay a $1600 mortgage? That’s a silly question, but consider that you’ll also be paying property taxes and monthly maintenance fees as well.

2. Timing. What is going on in your life right now? Are you ready for home ownership? Do you work 80 hours a week, and are you happy with the status-quo in your living situation? What happens if you wait a year? Will you be in a better/worse position down the road?

3. Living Arrangements. Do you have a roommate in your rental unit? Is he/she coming with you when you purchase? Do you see an engagement or marriage in the near future, meaning your plans could soon change?

4. Market. This is the big question for most people these days, since the media seems to be predicting an eventual change in the tide (although they’ve done this every year for three years running…). Do you think the market is going to decrease, providing a better opportunity to purchase down the road? If the market continues its upward trend, will you kick yourself for not buying sooner?

5. Moving. Okay seriously, if you’re concerned about putting a few boxes and pieces of furniture in a van, then you’re just being a lazy bastard!

There are a whole slew of other factors but these ones stick out from the rest.

The most well-known lyric in The Clash’s song “Should I Stay Or Should I Go” is the following:

“If I go there will be trouble.

And if I stay there will be double.”

Now I’m not calling Joe Strummer a clairvoyant, but I will say that he’s got this correct. A lot of people think “its just easier” to stay where they currently are, but in the long you’re better off searching for greener pastures.

My life changed when I moved into my new condo, both because I purchased instead of continuing to rent and because I moved from one neighborhood and one situation into a completely different one.

There is a subtle difference between finding a place where you are “comfortable” and simply getting stuck in a rut.

Part of it depends on your age, and I can honestly say that if you’re in your 20’s or 30’s and you’ve been renting at the same place for a few years straight, you’ve got to eventually ask yourself “What is my plan?” If you don’t have one, then perhaps that is your first step.

From a personal standpoint, and putting real estate aside for a moment, even if you’re a renter and you don’t want to buy, you should still consider renting someplace else. Change is a good thing, and living in a different building and in a different neighborhood might expand your horizons a little bit.

I talked to two girls the other day who inherited their parents house in Davisville Village, and they told me that at 27-years-old they are tired of seeing yuppies pushing baby-strollers, and that they want to live downtown where they can act their own age. They feel as if staying where they are will hold them back in life; in their development as adults.

I couldn’t possibly agree more.