My daughter told me the other day that the word “copying” is banned in her school.

As in, “Jimmy is copying me.”

Jimmy isn’t copying her answers on the test, aka cheating, but rather Jimmy is copying her.

“I was doing this exercise where we have to draw what we’re looking forward to on the weekend, and I was drawing my family at a picnic, and then Jimmy saw what I was doing, and he started drawing his family at a picnic too! He was copying me!”

They’re not allowed to say “copy” or “copying.”

They’re told instead to think, and to say, “Jimmy likes and appreciates my ideas.”

Remember when life was so simple that we didn’t need to regulate every single action, thought, or expression that our children had?

Then again, I’m old. I’m 43 going on 80.

My father told me that when he was at Camp Ponacka in 1955, he had a disagreement with another boy. They started to push, then shove, then clench their fists. Perhaps a punch was thrown, but the counselors soon broke it up. The boys were told to stop….

….then they were each given a set of boxing gloves and told to continue.

“We beat the snot out of each other,” my Dad told me. “Then we shook hands and that was the last of it.”

Interesting approach, to say the least.

Was that a better time?

Was that a better way of dealing with things?

Sorry, I was busy shaking my fist at a raincloud, I didn’t hear your answer…

While schools (and much of society…) have tried to do away with winners and losers, I still believe in the concept.

So I would like to remind everybody here that we are awaiting the TRB Interest Rate Prediction Game winner, to whom I believe I promised a $200 gift card to their choice of Starbucks or Tim Horton’s.

However, and this is a big “however,” we need to discuss the tiebreaker because this could get really, really complicated.

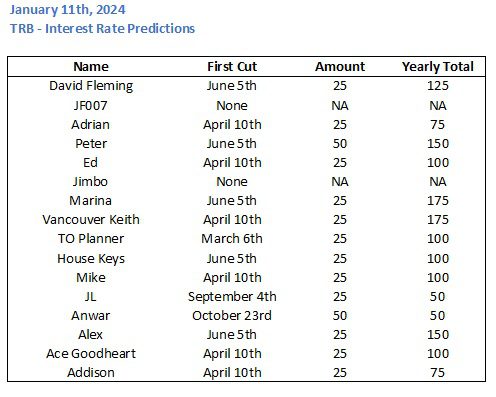

Here’s the table of predictions as you’ll recall?

JF007 and Jimbo are eliminated. Sorry, guys!

The following people got June 5th correct as the date of the first rate cut:

-David Fleming

-Peter

-Marina

-House Keys

-Alex

That’s a big one. But weren’t we awarding one point to each of the three predictions?

That means the following received a point for predicting the 25 basis points:

-David Fleming

-Adrian

-Ed

-Marina

-Vancouver Keith

-TO Planner

-House Keys

-Mike

-JL

-Alex

-Ace Goodheart

-Addison

But it’s clear that nobody is going 3/3.

David Fleming, House Keys, Marina, and Alex have respectively predicted 125, 175, 100, and 150 basis points will be cut in total in 2024, and it’s clear this isn’t going to happen. The only one that has a chance here is House Keys, as he or she has 100 basis points as the guess.

I’m doing the math here, and if we see one more rate cut of 25 points, for a total of 50 points, then JL and Anwar receive points. That gives JL two points, and he joins our list. If we see either one cut of 50-points or two cuts of twenty-five-points, then Addison and Adrian get a second point as well.

So should there be a tiebreaker?

Personally, I feel like House Keys should be declared the winner since he or she has 2/2 so far, but will also be closest in the third category – with a guess of 100 basis points, compared to 125, 175, and 105 for David Fleming, Marina, and Alex.

However, a deal’s a deal.

I don’t think I can change the rules now, can I? Or alter them?

I said:

Post your predictions below and you get one point for each correct prediction regarding:

1) Date of first interest rate cut

2) Number of basis points of first interest rate cut

3) Total cumulative basis point cut for 2024And just for fun, I’ll send the winner a $200 gift card to their choice of Starbucks or Tim Horton’s in December.

Looks like “one point for each correct prediction” stands alone.

So that’s a $200 gift card for everybody, even if it’s a six-way tie.

Geez, am I falling into the “participation ribbon” category now? 🙂

Alright, moving on…

So we had an interest rate cut last week. Did you hear?

Yeah, even my dog heard. And she doesn’t have a mortgage; just a line of credit.

But the question on my mind, and the minds of many, is very simple:

Now what?

Very simple, indeed. Just two words. But “now what” has so many implications.

Now what for the Bank of Canada and their strategic policy?

Now what for direction of the interest rate environment?

Now what for future interest rate cuts?

Now what for banks?

Now what for the real estate market?

Now what for “affordability” in the housing market?

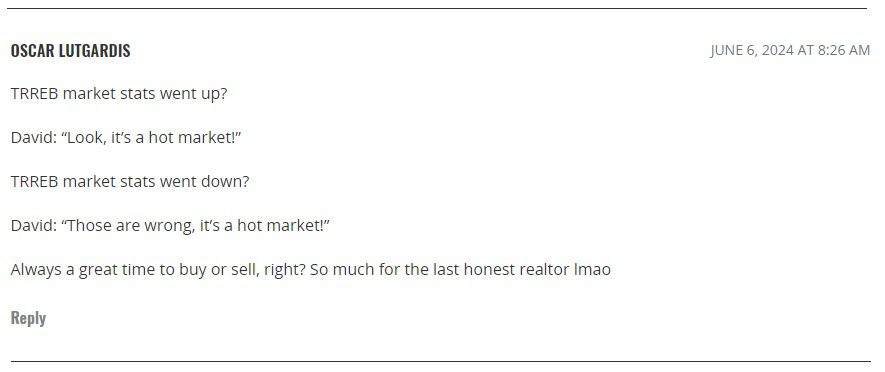

I took a little bit of heat for my blog post on Thursday.

This was my favourite comment, by far:

I mean, he’s not exactly off base.

The ‘last honest realtor’ quip was poignant and a few people on my team offered some you-know-what-eating grins when I mentioned it.

But that was me trying to be honest. It was me trying to explain what I’m seeing out there.

Despite high inventory and low sales, we’re not seeing a market implosion. We’re not seeing prices decline.

Yes, the year-over-year price is down 2.5%. That was pointed out by a reader and he or she is completely correct.

But the month-over-month prices are rising. Not only that, 2.5% is hardly worth sounding the alarm over. So a house purchased for $1,000,000, on average, is now worth $975,000, on average?

That’s not the expected result from all-time-low sales figures up against high inventory.

In any event, what’s done is done, what’s said is said, and it’s the “now what” that I want to explore.

Because, and this might not come as a shock to many of you, I suspect that future rate cuts are only going to cause prices to climb higher.

Just think of where we were at the end of 2023.

Think of what the sentiments were among industry onlookers, prognosticators, and economists alike.

Remember this article:

“Interest Rate Cuts Will Be The Story Of 2024 – What That Means For Mortgages And More”

Financial Post

December 27th, 2023

From the article:

The Bank of Canada overnight rate started 2023 at 4.25 per cent and will finish the year at five per cent, for a rise of 0.75 per cent after a rise of four per cent in 2022. I believe we will see a two per cent decline in rates by the end of 2024, back to an overnight rate of three per cent. The impacts of this decline will be the story of 2024.

This was a HUGE prediction!

And I noted this in my early-2024 blog.

The author further offered his own prediction of a rate cut schedule as follows:

January 24th: no rate change

March 6th: no rate change:

April 10th: 25 bps cut

June 5th: 50 bps cut

July 24th: 50 bps cut

Sept 4th: 25 bps cut

Oct 23rd: 25 bps cut

Dec 11th: 25 bps cut

Looking back, this is absurd!

He predicted six rate cuts? That’s crazy!

He predicted two hundred basis points in total cuts? That’s insane!

But we’re in June looking back at December. We have the benefit of hindsight, and many of us are quick to forget that the expectation for 2024 was a lot more than the 50 basis points we’ll likely see.

About two weeks before the Bank of Canada’s rate cut on June 5th, we saw this article hit the wire:

“CIBC’s Benjamin Tal Was One Of The Few To Correctly Predict The BOC’s Rate Moves This Year. Here’s What He’s Predicting Now”

The Globe & Mail

May 16th

Mr. Tal predicted 100 basis points of cuts this year, and further predicted 200-225 basis points will be cut by the end of 2025.

We could keep going.

We could keep finding articles with well-known economists talking about all the wonderful interest cuts that are on the horizon.

But the question becomes:

How are borrowers going to price in these impending rate cuts?

How will they respond?

There are many reasons why people borrow money, but for our purposes, we want to know how home-buyers are going to act now that the first rate cut is underway.

I’ve long maintained, “Smart money buys ahead of the rate cuts.”

Of course, if they have the advantage of buying in cash then the current interest rate environment doesn’t matter.

But who among us does not believe that prices will rise after cumulative cuts of two hundred basis points or more? So if we were to take it as a given, which many of us are, then wouldn’t that inspire and motivate any on-the-fence home-buyers to become active?

If you consider the metric “anticipated inflation,” which refers not to the actual increase in prices in the economy but rather the increase that consumers expect to see over a given time period, then we could almost create the same metric here in the housing market. I understand that there are people who really, truly don’t believe the real estate market (at least here in Toronto will increase) but in response to the Bank of Canada starting a period of quantitative easing, betting against higher prices would be a mistake.

Of course, we don’t know what the Bank of Canada is actually going to do.

There was a great article from the CBC last week:

“Cutting Interest Rates Was Easy. But The Bank Of Canada Still Has A Credibility Problem.”

CBC News

June 6th, 2024

From the article:

Bank of Canada governor Tiff Macklem says the central bank has to rebuild trust with Canadian households. After the last two years of interest rate hikes and messaging missteps, that’s not going to be an easy job.

The central bank cut rates this week for the first time since March 2022, when it embarked on one of the fastest and most aggressive hiking cycles in Canadian history, raising its key overnight lending rate 10 times in an attempt to get inflation back under control.

That meant Canadian households were hit by a double whammy of sorts. They were clobbered by rising prices and squeezed by increased borrowing costs.

That was exacerbated by the fact that none other than the central bank governor himself initially told Canadians that interest rates would remain low.

“If you’ve got a mortgage or if you’re considering making a major purchase, or you’re a business and you’re considering making an investment, you can be confident rates will be low for a long time,” Macklem said in July 2020.

When in doubt, blame the government!

While they’re responsible for getting us out of this mess, it seems they’re, apparently, also responsible for getting us into it?

Tiff Macklem has a tough job, I’ll give him that. But the comment about rates “being low for a long time” looks really, really bad right now.

If your cup is half-empty, perhaps you’d like to use this comment to suggest that there’s no guarantee the Bank of Canada will follow suit with more rate cuts, or that one cut is a surefire signal that two, four, or six more cuts are on the way.

But I think we can all agree that they are?

Blog readers JF007 and Jimbo both predicted, back in January, that we wouldn’t see any rate cuts in 2024 at all.

What do they say now? Now that one cut has already been made?

I do believe, and correct me if I’m wrong, that the folks who predicted that the Bank of Canada would not cut rates at all in 2024 weren’t suggesting that this period of quantitative tightening would never end, but rather that the unwinding wouldn’t start yet.

Well, here we are.

The first rate cut; now what?

I would love to hear from those who think this cut, and subsequent cuts, will not lead to higher real estate prices in the GTA. If I’m “pumping the tires,” then feel free to come by and slash them…

Appraiser

at 7:22 am

Low and slow is the way to go if they don’t want the market to explode again.

Good chance BoC will cut every other meeting and only 25 points at a time as it closely monitors the real estate market nationwide.

The BoC can’t stop prices from rising but they can try to blunt them.

JL

at 10:13 am

Prices will rise with cuts “all else being equal”, but there are other factors at play; maybe inventory continues to rise too, maybe the economy tanks, maybe unemployment rises, etc. And the cuts may have to reach a certain level before they have an actual effect on affordability that would get buyers to jump back in (rather than just an emotional one of seeing that first cut made).

I’m not taking positions on any of this, but I do believe there’s enough out there to muddy the waters in terms of predictions. In the end, rate cuts will push prices upwards, but I expect the extent to which they do will be at least partly offset by some of the headwinds noted above.

J

at 11:15 am

Also rate cuts do not equate to increased affordability for those refinancing. For fixed rate mortgages (75% of mortgages are fixed rate) renewals today mean a doubling of your interest rate. Even if rates drop by 200bp, mortgages will be renewed at higher rates over the next couple years.

Derek

at 10:29 am

Is that really what a change of -2.5% in gta average price means: “So a house purchased for $1,000,000, on average, is now worth $975,000, on average?” ??????

I don’t know what the future holds but I’ve seen charts on the twitter showing multi-year price declines as the cycle turns to rate cuts in a bunch of countries including ours. It’s not beyond the realm of possibilities. It’s not necessarily a slam dunk that the bottom is in this year even with more rate cuts.

Serg

at 11:48 am

What is missing in David’s (and every other realtor) statistics, it is buyers (and sellers) demographics, broken down per RE segments.

When realtors say, “the buyers are going to jump back”, it is never specified, who do they expect to jump back?

Young people 25-35, first time buyers, with income 200K/year? Equity buyers? Investors? Immigrant cash buyers?

How many people of these categories could be “waiting on the sidelines”?

Will they jump back to pre-con, condos or houses?

Or, all together, to everything?

BNK

at 2:05 pm

The extent to which borrowing costs make housing unaffordable is obvious – the anemic sales numbers tell the story…very few people (relative to historical numbers) can afford to move! I do feel for those who are bearish, because we know what it feels like to want to see Toronto housing prices decline. We were looking at a relocation to Toronto and stepped back because housing costs led us to conclude we’d suffer a decline in our quality of life should we move to Toronto. The near-term headwinds in Canada are clear: unemployment rate at 6.2%, anemic economy (relative to the U.S.), and borrowing rates that are punitive relative to recent history. But the structural outlook remains bullish: lots of people moving in (many/most of whom want to be around the GTA), and little policy action to really meaningfully boost supply of new homes. So the structural tailwinds for housing in Canada remain supportive for continued price stability and growth in Canadian dollar terms. Our hope is we see continued weakness in the Canadian dollar, such that a $4M CAD house (with the CADUSD at .65) costs $2.65M USD, at which point we’d be open to relocating from the U.S.

Alex

at 4:33 pm

“the buyers are going to jump back” is a general statement that realtors make. They are made by the realtors who do enough business and have a good piulse of what’s happening in the market – almost like a gut feeling. To be able to filter down to the specifics you mentioned is hard to do, I mean where do you think realtors would get that kind of financial demographic information from?

Serge

at 8:40 am

That is true that 99.9% of 80K realtors in Toronto fly by gut feeling. But it is not David. His forte is analytics. That is why we are here. That information exists, and may RE analytics demonstrate they do have access to it (e.g., Wong in BetterDwelling). I would appreciate if David expanded his analysis to this aspect. Well, but… it is up to him.

Alex

at 4:34 pm

@David,

Is it not 2 points for guessing the date of the cut and by how many basis points?

Rules are rules and you can’t change them now!

David Fleming

at 4:39 pm

@ Alex

Were those two linked? I considered that.

But then I read it again.

“You get one point for each correct prediction.”

Trust me, I’d rather give out one $200 gift card than six! 🙂

Cool Koshur

at 8:32 pm

I predict no further rate cut in July. On lower end atleast another 25 bps likely by end of year. On higher end it is 50bps for rest of the year.

House market is likely to rebound in fall. Condo market will continue to bleed. Demand for freehold townhouses and detached will cause prices to go up.

Ace Goodheart

at 6:44 pm

We got where we are with Toronto prices, with the BoC policy rate at 0.25%, and a five year mortgage available at under 2%.

We now have a policy rate of 4.75% and mortgages available for a hair under 6%.

From what I understand of math, that doesn’t mean a rapid rise in house prices in the GTA.

That means current pricing is still largely set where it was, back when you could get a 1.5% mortgage and our BoC governor had promised to hold things at that level for “a long time”.

We also have a lot of government debt being dumped on the bond markets, meaning the interest rates being offered for mortgage bonds by banks will have to be higher, for those bonds to find buyers ( government debt is always preferable to bank mortgage bundles, if you can get it).

We also have the current situation where significant bundles of mortgage debt are becoming un-repayable and it is becoming clear that banks were a little too loose in their approval processes.

I just can’t see prices going up overall.

The detached Toronto house will remain something that is desired by most people and for the most part unattainable by all but the most well heeled among us.

But the market in general is not going up.

How many unsold condos are there right now?

How does the condo assignment sale market look?

How are new builds?

I thought so.

Derek

at 8:47 pm

Bah! You’re ignoring that prices haven’t even dropped from this morning to this afternoon. That’s bullish. And, there are just no “good” condo assignments or condo listings out there though. When zero condos sell its uberbullish for our avg sale price too!

JF007

at 12:20 am

Well David I stand corrected on the rate cut…as for what I believe right now on what’s next..well still feel that BoC will follow the once bitten twice shy mantra and take its own sweet time to cut rates going forward. They would want to ensure that the cuts stick and don’t lead to inflation increasing so I suspect we are in for a long haul to come back to 3% or lower levels…

Alaa younan

at 9:44 am

I do think the first cut is only a trap to home buyers, there is not trust on what the BOC is announcing