Let’s start today’s discussion with an analogy, shall we?

I know, I know…..this is so unlike me…

Do you remember being back in grade seven and thinking that girl was really pretty, even though none of the other guys did?

You saw something; but only you. And you knew just how much prettier she was going to be one day.

Then in June, everybody went away for the summer.

And guess what?

In September, that girl came back and she was an absolute smoke show!

Now everybody thought she was pretty!

But what about you? You were the first one! You had a crush on her when nobody else did! She talked to you because nobody else talked to her!

And now all the girls wanted to be her friend, all the guys had crushes on her, and even the teachers said, “Wow, she is really striking!”

I know some of you can relate. I certainly can…

There’s something to be said for the “early-adopter” or the “first-mover advantage,” although perhaps my mistake was not actually making a move in grade seven, but I digress.

Now, at the risk of patting myself on the back here, I want to discuss three issues in real estate that I feel I was exceptionally early in identifying, only to have the late majority jump on the bandwagon much later:

1) Issues in the pre-construction industry.

2) Condo cancellations.

3) An issue to be named later…

Baseball fans will understand the third reference.

I started writing this blog in June 2007, and it wasn’t long before I began to openly opine on the issues in the pre-construction condominium industry.

Whether it was delays, deficiencies, material changes, closing costs, the occupancy period, or eventually – prices, I started writing about this in 2008 or 2009.

Years later, there was a ton of rage about the pre-construction industry, and reporters, politicians, real estate agents, and the like were all up in arms – but it was too little, too late.

Somewhere in the early-2010’s, I began to write about condo cancellations, and yet nobody else seemed to think it was a problem. People kept lining up to buy pre-construction condos, and the masses ignored my warnings.

My favourite was this:

February 2nd, 2015: “Did Urbancorp ‘Steal’ Their Condos Back?”

This was a post about the “King’s Club” development, that seemed to be about 90% completed when it was “cancelled” and the developer returned deposits to buyers, with minuscule interest, then completed the building, which became rentals.

Unfortunately, it would be until 2021 when politicians finally jumped on this particular bandwagon:

“Premier Slams Ontario Developer That Raised Condo Prices By $100K After Cancelling Sales Deals”

CBC News

November 22, 2021

Said Premier Doug Ford:

“You signed a contract. You better … build that damn house.”

Oh, if only!

Then the following year:

“Ontario To Boost Penalties On Developers Who Breach Ethics Rules”

CBC News

March 24, 2022

Yes, sure they will.

My point is this: many of the issues in our housing market have long been identified, and since I have been examining these issues and writing about them for almost twenty years, I’m always disappointed when stakeholders and difference-makers essentially jump on the bandwagon long after it’s too late to make a difference.

Now here we are, in 2024, with a bright light being directed toward what is possibly the biggest issue I have ever identified in our housing market, and one that I have been writing about for years:

3) Taxes driving up the price of new homes.

She’s the girl that I liked in grade seven when nobody else did, and she went away for the summer, got really pretty, and then came back and everybody was in love with her!

Last week, there was a ton of press on this subject.

But before we get to the article – because there’s a statistic in the headline that’s absolutely mind-blowing, and I want to save that for a moment – allow me to draw your attention to this blog post:

July 29th, 2013, I wrote: “Can City Council Kill The Condo Market?”

That was over eleven years ago.

And I still had the same shtick that I do today, as the blog post began:

Do any of you suffer from that constant affliction that makes you think you’re supremely smarter than certain people?

We all do it.

Yep, same bravado. Some people don’t change.

But this was the first time, from what I can gather, than I opined on the ridiculous amount of money that the government adds to the cost of new construction.

From the blog post:

Last week, it was announced that Toronto city council is considering DOUBLING current development charges for condominiums.

For those of you not familiar with the process, consider this: every single condo unit built in the city of Toronto comes with a fee, paid to the city of Toronto. Two-bedroom units have development fees in the $12,000 neighbourhood, and one-bedroom units are around $7,500.

Toronto city council, always on the lookout for new tax revenue, has determined that maybe the Golden Goose can, in fact, be platinum! And thus, their idea to simply DOUBLE fees.

Looking back at this now, it’s almost comical to consider the numbers being thrown around; $12,000 and $7,500.

That’s what city councilors use now to line the bottom of their hamster cages…

I continued to cover this topic over the years:

September 17th, 2021, I wrote: “Topics That I Do Not Want To Discuss!”

From the blog post:

In Toronto, 22 per cent of the cost of new condominiums goes to government charges, up from 18.7 per cent in 2013. In Brampton and Markham, these charges account for up to 30 per cent of the cost of a new home. At 16.3 per cent, Bradford represents the low end in Ontario.

What that means is that government charges constituted $164,500 of the purchase price of a $750,000 Toronto condo in 2019. The same amount is built into new home purchases in Markham, but on a lesser purchase price of $532,000.

See what I mean about the comical numbers from the 2013 blog post?

This is only eight years later and look at the numbers being thrown around!

Over the last two years, I’ve really ramped up my coverage of development charges and municipal, provincial, and federal fees and taxes added on to the cost of new construction.

This year, specifically, we have discussed this topic a lot!

February 5th, 2024: “How Can An Increase In Taxes Mean An Increase In Affordability?”

In this blog post, I discussed all of the taxes that affect real estate, including land transfer tax, municipal non-resident speculation tax, Ontario non-resident speculation tax, federal anti-flipping tax, Toronto vacancy tax, under-used housing tax, property tax, harmonized sales tax, and municipal development charges.

It wasn’t long before I rage-wrote another post about taxes, and this one might make my “Top Posts” list by year’s end:

May 27th, 2024: “Your Government(s) Are Lying To You About Housing!”

In this blog post, I noted:

In 2009, taxes accounted for about 12 per cent of the cost of an average condominium in Toronto. Now, taxes account for about 29 per cent for the same home.

I’ve been saying for the better part of two years now that, “Taxes make up 25-30% of the cost of new home construction,” but believe it or not, last week’s news has made those estimates look low.

Now you know why I wanted to hold off on showing you the headline from last week!

Trigger warning, folks: you might need sunglasses for this one…

“Blame Bureaucrats For Taxes That Comprise 35.6% Of The Price Of A New Home In Ontario”

The National Post

December 4th, 2024

See what I mean?

That number – 35.6%, is literally burning a hole in my retina right now.

Of course, if you don’t read the National Post, you might have missed the article, since I didn’t see this covered in any of the government mouthpiece media outlets.

35.6%.

There, I fixed it.

This article, and others written like it, are all referencing the following report by the Canadian Centre For Economic Analysis, which was published at the end of November:

“The Increasing Tax Burden On New Ontario Homes: 2024”

The report is twenty pages long but is a fascinating read.

The stated objective of the report:

The objective of this report is to quantify the total tax and fee burden on new homes in Ontario, incorporating data up to September 2024. Over the past decade, huge increases in this burden have occurred, particularly as the result of large development charge increases across many municipalities. This report examines the tax and fee burden and explores its implications on housing affordability, residential developer margins, market constraints and housing supply issues.

The objective makes an assumption: that the taxes are burdensome, but how could we believe anything to the contrary at this point?

The highlights are made known right at the onset of the report:

The average tax burden on new housing in Ontario is almost 36% of the purchase price.

Governments make almost 4 times more than a builder of a new home.

A new home in Ontario has a tax burden more than twice that of the rest of the economy

Yikes. How in the world did we get to this point?

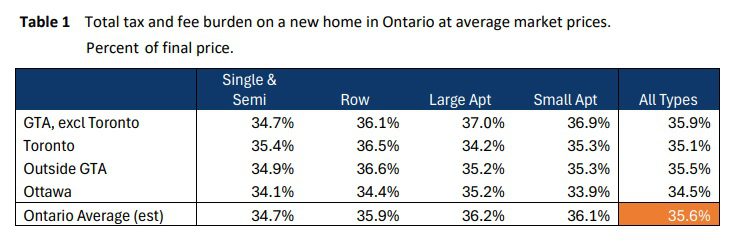

Here’s the breakdown of the 35.6% figure and how the tax burden differs by property type and geographic location:

Since a similar report was authored in April of 2023, the tax burden has increased from 31% to almost 36%.

Just think about that, for a moment. We’re talking about last year. The tax burden has increased from 31% to almost 36% since last year.

The “housing crisis” has been upon us for, what – a decade? We’ve been hearing politicians at all three levels of government talk about housing affordability almost daily for that same amount of time, and yet the tax burden continues to increase at an unimaginable rate.

But even worse still is that the tax burden increases when builders attempt to deliver a more affordable product.

If you thought that 35.6% figure was ghastly, you ain’t seen nothing yet:

The affordability problem in Ontario’s housing market is starkly highlighted by the gap between what is considered an “affordable” new home price, at around $450,000, and the actual average price of a new home, which is roughly $1,070,000 (averaged across all housing types). The high tax burden—35.6% on an average-priced home—further exacerbates this issue, but it becomes particularly problematic for lower-priced, “affordable” units. For homes priced at $450,000, an amount which aligns with what many households could afford based on median pre-tax household incomes, the average tax burden rises sharply to 45.2%. This regressive effect means that a significant portion of the price of an “affordable” home is made up of taxes, fees and charges, leaving limited room for construction and development costs. The tax burden does vary by dwelling type.

That’s absolutely disgusting, in my opinion.

And it’s the result of governments that have grown, spent, and acted uncontrollably over the last decade.

The governments can clamour all they want about “affordable housing,” but if the cost to build a statistically-affordable home in Ontario consists of 45.2% taxes, then who could we possibly blame other than the people who are supposed to be in a position of power to help?

The governments are making almost four times as much as the developers who build the product in the first place:

Our analysis shows that governments collectively benefit significantly more than builders from new home construction, earning over 3.9 times the revenue that builders realize from a single unit. This is especially problematic given that the tax and fee burden on new homes is now more than double that of the general economy. Ontario’s new housing tax regime risks placing significant pressure on prospective homebuyers.

The incentive for a developer to actually put a shovel in the ground is disappearing rapidly, and a decline in housing starts is only going to exacerbate this issue down the line.

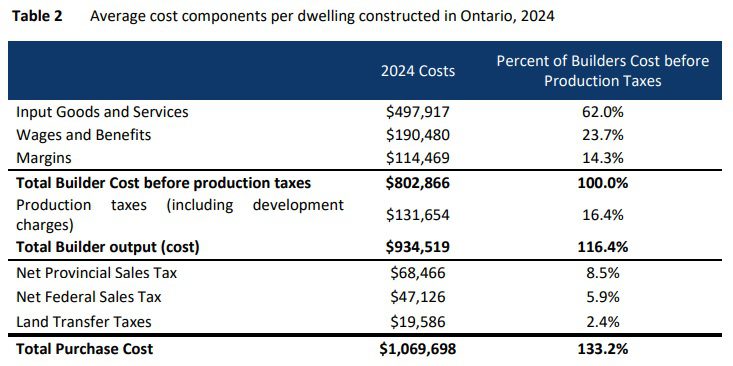

Here’s a breakdown of the cost of an “average” new home in Ontario:

As the report notes, the average price paid for a new home in Ontario is almost $1.1 million before real estate and legal fees. This is over 14 times the Ontario median household after-tax income.

But more importantly, production, sales taxes, and transfer taxes alone are over 3 times he Ontario median after-tax income household income.

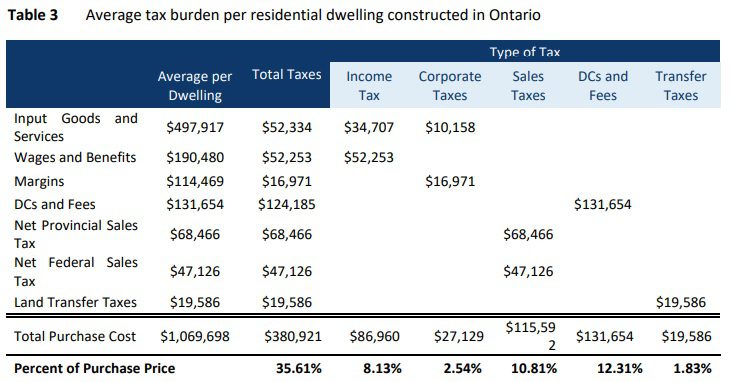

As bad as all this sounds, and as bad as the figure 35.6% sounds, nothing will shock you as much as the actual dollar figure that, on average, represents the total tax burden on new homes in Ontario.

Note the following:

Do you see it?

$380,921

That’s the amount that, on average, consumers are paying in taxes for every new home.

When it comes to new home construction, the government is, by far, the largest beneficiary:

There’s something seriously wrong with this picture.

Thankfully, I’m not the only one to notice this.

Here’s a great read on the matter:

“Why A Conversation Fees The Municipalities Add To New Homes Is Necessary Now More Than Ever”

The National Post

December 5th, 2024

But will people dismiss this article and its contents because it was written by the President and CEO of the Building Industry & Land Development Association?

Does that change the fact that development charges on a single-family home in Toronto have increased 993% since 2010?

People seem to have forgotten that development charges were originally intended to offset the cost incurred by the public sector. Nowadays, development charges are simply another real estate-related revenue generation tool for the City of Toronto, as though the Municipal Land Transfer Tax isn’t enough already.

Mark this date on your calendar: May 1st, 2025.

That’s the next scheduled adjustment to the City of Toronto’s development charge rates.

If you had a dollar to wager, would you wager that:

a) The City of Toronto, knowing how expensive and unattainable housing has become, will lower development charges, not only to increase affordability but to increase the chances that developers will actually put a shovel in the ground at a time when pre-sale activity is non-existent.

b) The City of Toronto will increase development charges because it’s run by a group of people with absolutely no understanding of finance and economics, who possess zero common sense, and who continue to spend money that doesn’t exist.

Sadly, I know which outcome I would bet on.

And sadly still is the fact that this 35.6% figure, which should be etched in all our brains by now, will continue to grow higher, even as politicians and other stakeholders clamour about it…

Alright, folks!

See you back here on Thursday for our “Top Five: Blog Posts Of 2024.”

Steve

at 9:45 am

Great post! Some will say that this is the inevitable socialist/redistributive creep faced by our society. That downloading fiscal responsibilities from federal, to provincial, and now finally to municipal governments has brought us here … taxing everything that moves so as to keep the society we’ve become accustomed to barely functioning. Yes, governments are lying to us. But perhaps it’s because we can’t handle the truth … we are expecting a quality of life that reaches beyond our means?

Mike

at 10:23 am

Who ever thought that your 25-30% “estimate” would end up being low in the end??

Serge

at 9:44 pm

The total value of new residential building permits in 2023 in Ontario was about 130 billions. Is that what they are going to sell it for (more or less)? Then 30% will be 39 billions. The money that goverment gets should be in this range, anyways. About third goes to the Fed. Ontario gets about 66% of it. Let’s say 20 billions. And according to the goverment, all income from corporate taxes is 24 billions in 2023 (with total income 200 billions). So… the developers and real estate single-handedly feed all Ontario.

Steve M.

at 10:44 am

Excellent analysis and reality check concerning the real pricing i.e. development charges breakdown of new housing in the GTA and other areas. The pre construction apartment condominium market in the next two or three years is due for serious downward pricing re-set. But where will the adjustment come from? Land values?, reduced development charges? etc. The provincial government should have brought in a heavy speculation tax on urban readily serviceable development sites either site plan approved, nominally zoned for housing or even raw sites, many years ago. At least that offsetting tax revenue shared with the municipalities and province would help offset ever increasing development charges. It is fair to state however that the land cost of a project is proportionally less than the cost of project hard and soft costs and builder profit. So the net benefit of spec tax on land may only have made a modest impact on new home pricing.

Anwar

at 8:38 am

Your suggestion is another tax?

Tax can’t land and force developers to build, even if it’s not economically feasible?

Changing governments is the only solution. Governments who spend less money and require less tax revenue.

Vancouver Keith

at 3:33 pm

Declining real wages for decades, understating the true inflation rate is the dripping of a tap – annoying but it can be borne for a long time. Until society reaches a tipping point.

We are sadly reaping a rich harvest of developing a low wage low salary society, while adding more and more liquidity to and taxation on the real estate market.

The latest round courtesy of Garth Turner’s blog:

Thirty-year mortgage amortizations available to first-time buyers of any real estate.

At the same time all buyers of new housing (first timers or repeaters) will be eligible for 30-year loans.

The price cap for CMHC insurance soars to $1.5 million, meaning cheaper loan rates for buyers of more expensive homes using leverage of up to 20x.

The cap change also brings a 60% drop in minimum downpayments (and a corresponding increase in mortgage debt).

The stress test for renewers has been eliminated, so homeowners facing big interest rate increases don’t have to prove they can actually pay them.

The amortization changes alone, says Scotiabank Economics, are equal to a 1% drop in mortgage rates in terms of market stimulation.

Plus the crazy-generous tax-dodging, house-feeding HFSA and the enhanced taxless downpayment-ciphering from RRSPs are with us.

The moronic reality of the government creating a real estate market too big and too important to fail, while failing sadly to take care of the rest of the economy and the people that work in it, has led to the sad reality of today. People don’t make any money. Where do you get government revenue from? Where the money is, which is in the government pumped up real estate market.

Cities are buried under costs of the failures of senior levels of government. Roughly 60% of us pay the taxes for the 40% who don’t make enough money to pay for anything. Voting for free money will continue, on all sides. It’s a mess. I expect a decades of property tax increases over inflation.

TOPlanner

at 10:53 am

The government is not ‘making money’ – it is charging money to pay for infrastructure (speaking for municipal government).

Taxes on new development / development charges pay for infrastructure needed to service new developments. The saying in planning is ‘growth pays for growth’. If you reduce taxes / development charges, how are you going to pay for that infrastructure (pipes, sewers, roads, transit, etc.)? What other revenue tools are available to municipalities? Who else is going to pay for pipes, sewers, roads, transit, which are already massively underfunded as most Torontonians can tell you?

I challenge you to get involved in the City of Toronto budget process, which is happening right now, and propose some better ideas:

https://www.toronto.ca/city-government/budget-finances/city-budget/how-to-get-involved-in-the-budget/

Perhaps we should remove the primary residence capital gains exemption, and use that money instead? Or all move to an incorporated township where everyone digs and maintains their own well and pays $200 in property tax annually? (:

Angry Birds

at 6:30 pm

Development charges and taxes pay for roads, utilities, and transit.

But tax revenue is routinely wasted by selfish, entitled bureaucrats with social agendas.

Rename Dundas Street, and it will cost $12.7 Million

Or how about the $11 Million city hall spent on unused software licenses:

https://www.taxpayer.com/newsroom/taxpayers-call-for-top-to-bottom-city-of-toronto-spending-review

Merely two fun examples.

Spending is out of control at all levels of government.

Combine this with Liberal give aways. Yecch. Trudeau is giving hundreds of millions of dollars to Haiti to help with law and order.

If the three levels of government were responsive, efficient, and were able to leave social politics and causes out of the equation, they wouldn’t have the need to generate so much revenue.

Toronto doesn’t need all those development charges to build sewers. They just want the funds to pay for all their needless causes. More safe injection sites, please. And near my grandchildren’s school, thanks.