For those of you who have commented in the past, “I usually skip the stats posts,” you’ll want to close Google Chrome right now.

Then again, if you want to sound informed when you talk real estate at the next box social, or wherever youngsters congregate these days, perhaps have a skim.

On Friday, my rather tame “rant” sought to dispel the myth-de-jour about “investors” being responsible for the increase in real estate prices in our country.

This time around, it wasn’t real estate agents who buy and sell like insiders, or the evil foreign buyer, or those damn flippers and speculators, but rather investors.

Every week, it’s another group of people who feel the wrath of those who can’t afford to buy what they want, or the wrath of politicians who can’t admit that their inability to put forth a true long-term housing strategy is really the cause.

I provided you with a good number of links and headlines in Friday’s blog, but a reader showed me that I missed a very important one:

“First-Time Home Buyers In Toronto Being Pushed Out By Investors”

This is a ridiculous headline.

There’s absolutely no data to support this, other than guesswork and anecdotes.

Not only that, are first-time buyers being “pushed out” or were they already out? How many people who would argue they’re being “pushed out” have a right to be in the market in the first place? A 26-year-old couple can’t buy a detached house in High Park and they’re sore about it. A lot of the readers hit on the same theme I’ve been pushing over the last few years: the combination of entitlement and naivety is a major reason why people claim they “can’t afford” a house in Toronto.

In the CBC article I referenced on Friday, a woman lamented that she and her husband can’t afford what they want in Toronto. But she says they moved from Edmonton. Just consider how tough it is to climb the property ladder here in Toronto while you’re on the Toronto-specific ladder; now consider how tough it is to do so when your starting point is Edmonton?

Despite the federal government enacting a slew of measures aimed at cooling the market in the last decade, all on the demand-side of the equation, the market has continued to run.

During that very same time, I’ve been stressing the importance of supply-side measures to help affordability in the long-term, but for whatever reason (and there are many…) the government has never got this off the ground.

Specifically what the government can do is a topic for another day.

Today, I want to show you just why our problem in Canada, more specifically here in Toronto, is a function of lack of supply.

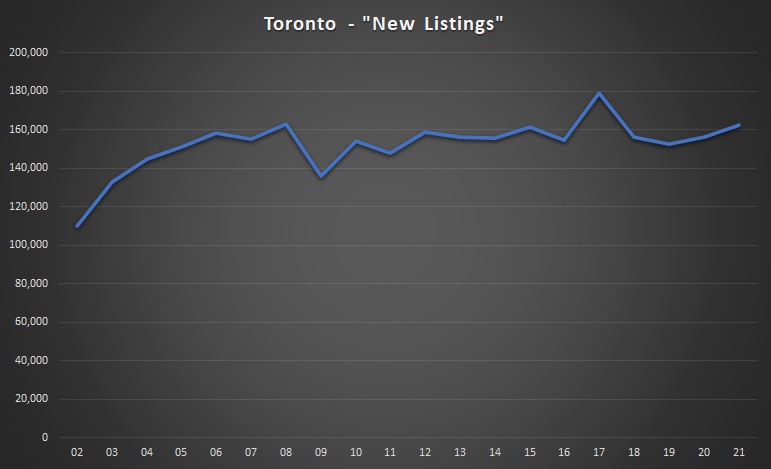

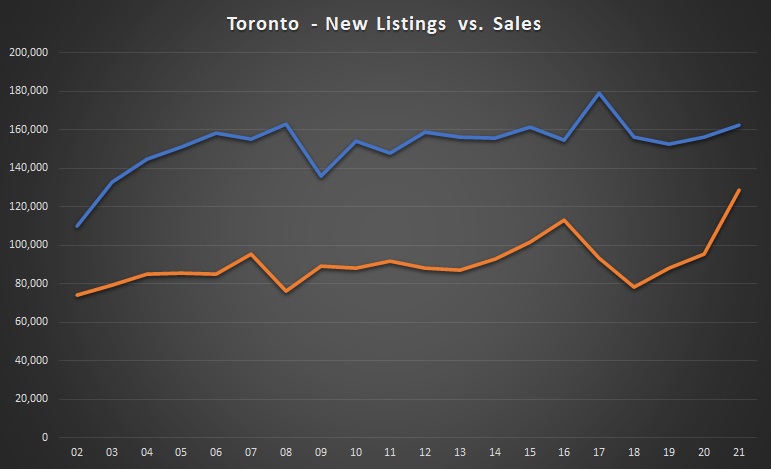

First, let’s look at “New Listings” in Toronto each and every year since 2002:

I have estimated 2021, with 151,359 new listings through ten months, I’ve extrapolated that figure to 163,446 for the year (built-in assumption that we see 65% of the new listings from November/December of 2020, since New Listings are down, on average, 35% per month over the last four months).

Note just how little New Listings are up from the pandemic-stricken 2020. That’s shocking! And that, combined with a surge in sales (more on this later) are reasons why we’re seeing a 20% annual increase in the overall market.

But if you look back twenty years, and then fast-forward to today, you have to wonder: Why aren’t MORE properties being listed?

As our city grows, there should be more houses! In twenty years, how much has the housing stock increased?

I can tell you almost exactly: 638,575 new units. New houses and condos, according to the data that I’ll be using for my charts to follow shortly.

But if we’ve got 638,575 more houses and condos in Toronto today than in 2002, then why doesn’t the New Listings chart point up?

Despite seeing an increased number of dwellings in Toronto, we are not seeing an increased number of dwellings up for sale! In fact, that number is declining.

This is the problem in Toronto.

The population is growing.

Immigration is growing.

The need and want for housing is growing, but fewer people are selling.

The CMHC has incredible data available for you, if you’re interested, and it’s free!

Here’s their interactive tool: https://www03.cmhc-schl.gc.ca/hmip-pimh/en#Profile/1/1/Canada

I’ve used their “Toronto Historical Completions By Intended Market” to analyze completions from 1990 through 2020 just to see how the number of completions and the type of completions has changed in three decades.

The results are shocking.

First, let’s look at “Homeowner,” as they define it, but we call that “Freehold”:

As you can imagine, not nearly enough homes are being built to satisfy demand.

In 2020, we saw only 8,479 “Homeowner” completions, down from 10,387 in 2019, and way down from 18,115 in 2018.

That figure is the lowest since this data set began in 1990, and I know that 2020 was ravaged by a worldwide-pandemic, but even if you round this up to match 2019’s figure, it’s still clear that we’re at all-time low levels.

There’s no way to look at this chart and conclude that supply isn’t the problem in our real estate market. Demand is there. It always has been, and always will be. And while some may argue that low interest rates are a major factor, I still don’t think that holds a candle to the lack of supply as a reason.

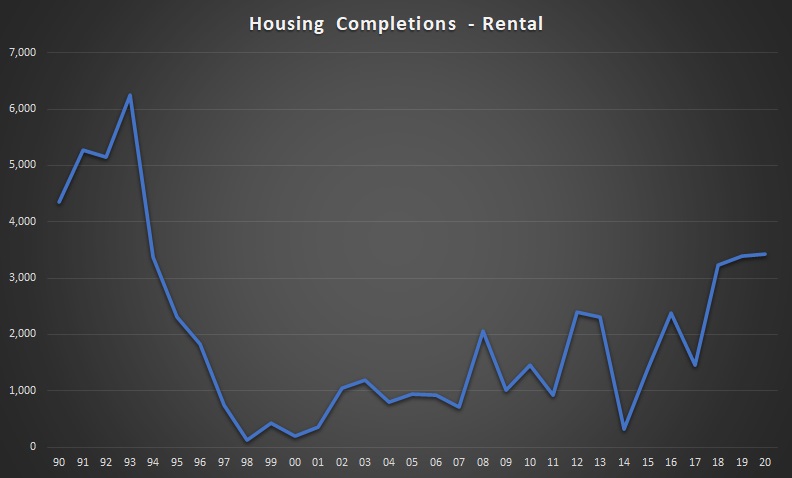

How about purpose-built rentals?

Who builds those anymore? Not when you can build condos and make more money, right?

Purpose-built rentals were a hot ticket back in the 1990’s, but when the condo boom happened in Toronto, the number of completions dropped off significantly:

Perhaps the one highlight in this chart is that pupose-built rentals have increased over the last few years. We’ve seen a few notable projects, some arriving with much fanfare, in a city dominated by condominium development.

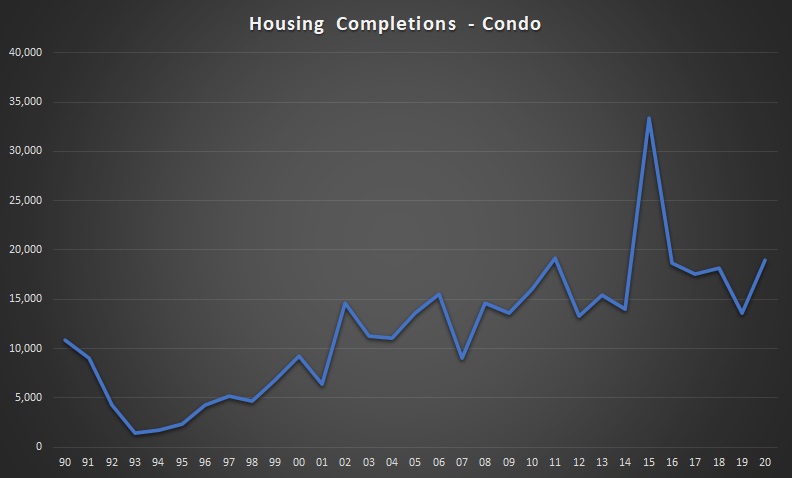

Now, what of the condo completions?

Have a look:

Condo completions have been steadily increasing, which is good, but not nearly at the rate that is required in order to satisfy both “demand” in terms of users/investors, but also necessity, as we’ll see in a moment when we look at immigration.

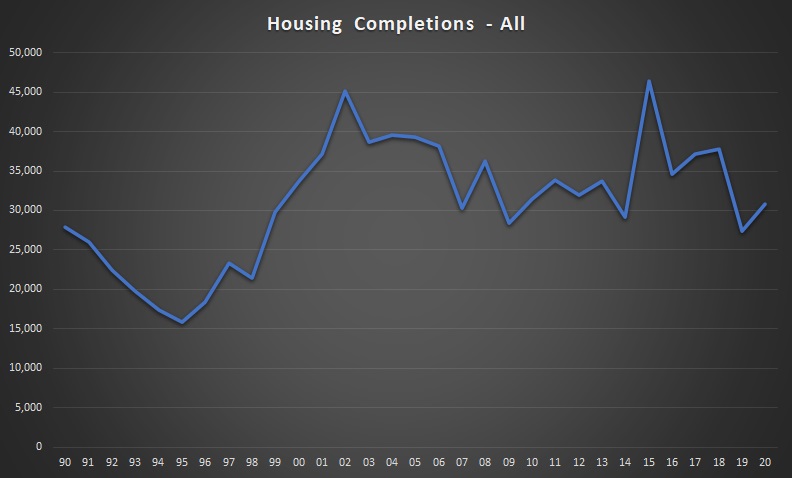

So how does total housing completions look, when we combined, homeowner, rental, condo, and co-op (the latter of which is a minuscule figure for which I didn’t include a chart)?

The “peak” in 2014-2015 coincides with the condo chart, but the lack of completions in recent years is disturbing.

Not only that, for a growing city, and one that’s starved for real estate, we’d like to see the blue line on this chart simply point up and to the right on a solid diagonal.

It’s highly concerning that in 2019, we produced the same number of new dwellings as we did in 1999.

The subject of immigration came up in the comments section of Friday’s blog, and I think while the topic can be sensitive, it’s an important one.

Some readers commented that immigration is necessary due to our aging population and shrinking workforce.

Some readers commented that to bring in 400,000 new residents every year, without a corresponding increase in housing completions, is a surefire way to decrease housing affordability.

Can I agree with both points?

Sure, we call can. And therein lies the problem!

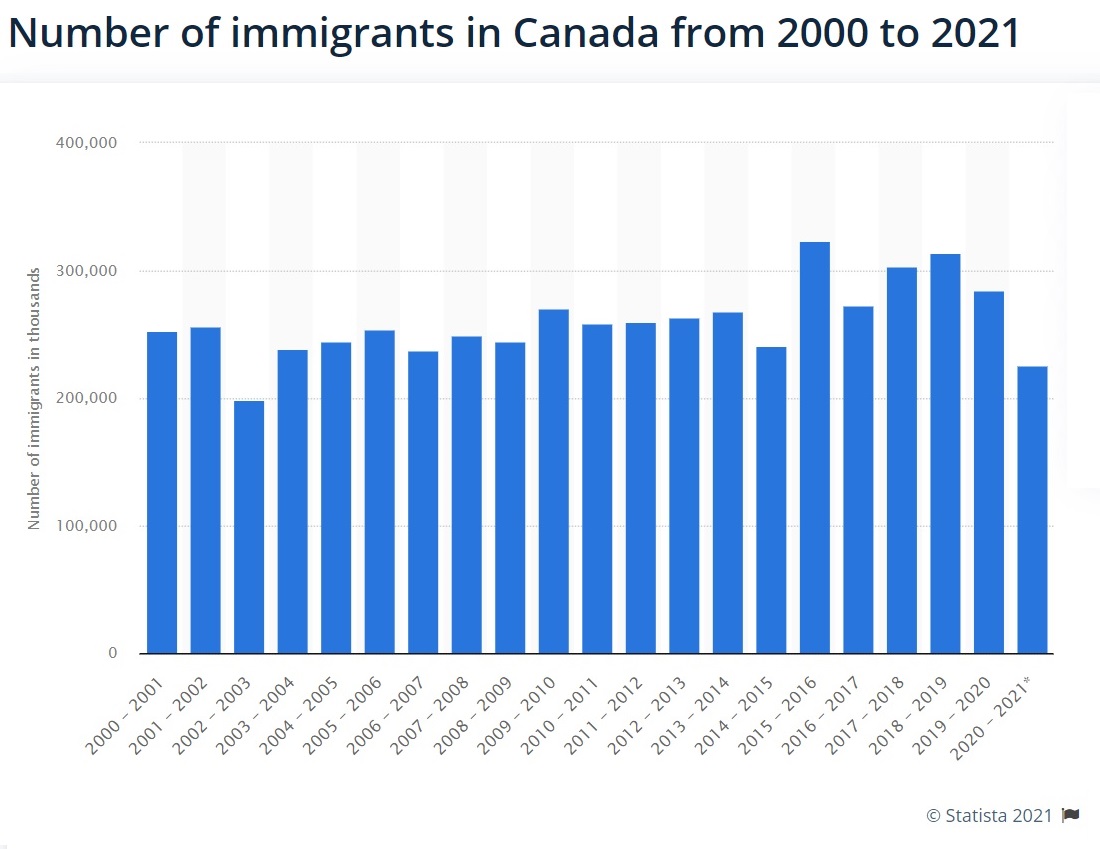

Let’s look at Canada’s immigration statistics from the turn of the millennium onwards:

Obviously, the pandemic caused immigration to decline, if not pause for a short while, but overall, we can see a trend toward 300,000+ immigrants every year. In fact, there’s been talk of 400,000 immigrants in 2022.

For a country with a population of around 38 Million people, this is “only” a 1.05% increase every year. On a relative basis, that’s low. On an absolute basis, it’s still 400,000 people.

Of these 400,000 people, how many would end up in Toronto?

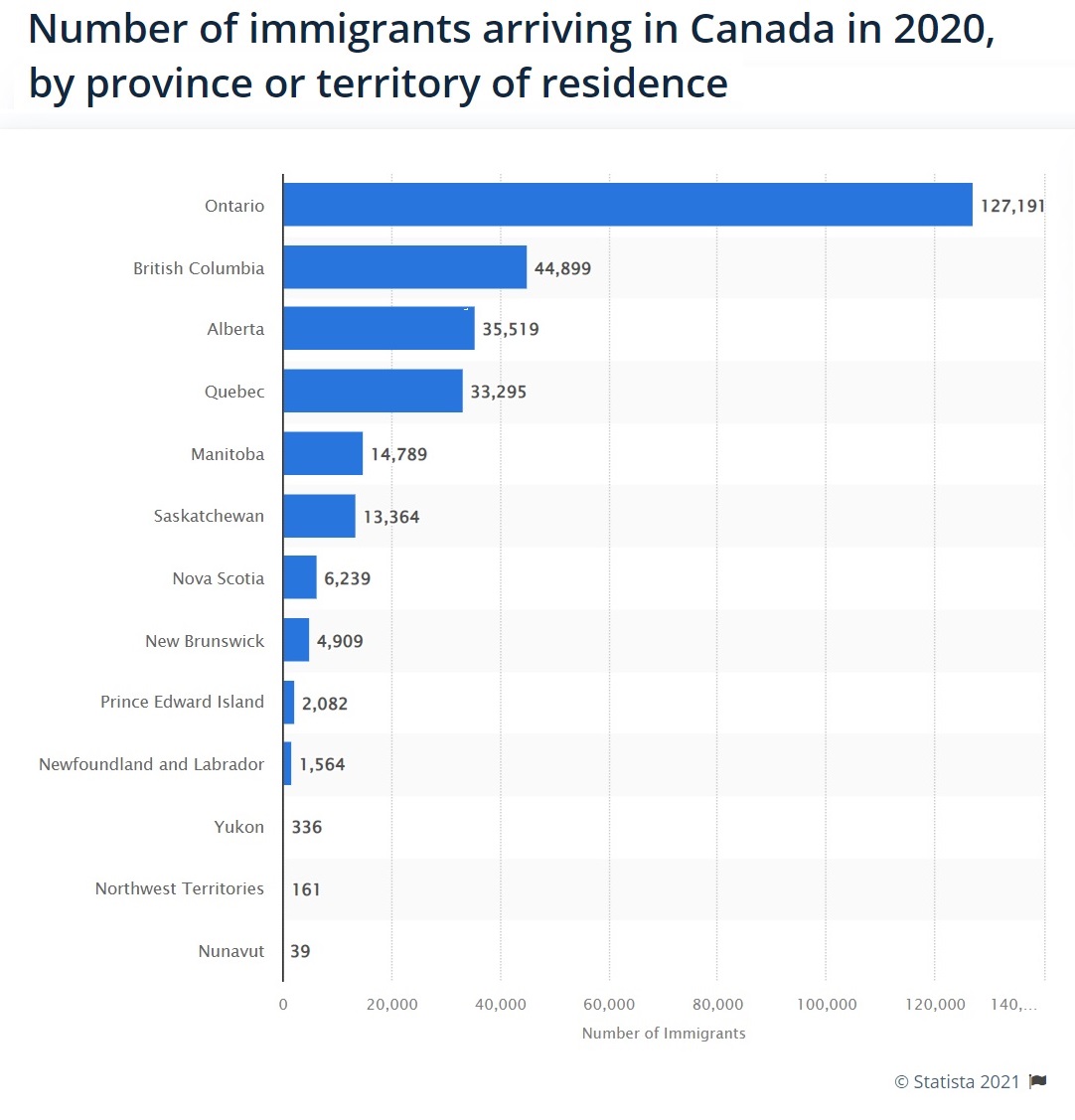

Here’s a great chart showing where the 284,387 immigrants in 2020 ended up residing:

Almost 45% of those immigrants ended up in Ontario.

And while I’m sure some ended up in North Bay or Sudbury, most ended up in the Golden Horseshoe, specifically the GTA.

So if we have 400,000 immigrants entering Canada every year, and 45% of them in Ontario, then that’s 180,000.

Let’s say that 150,000 of those 180,000 end up in the GTA.

Let’s also say that the average household is 3.0 individuals since we might have a lone immigrant and we might have a family of six. That means we need 60,000 new dwellings to accommodate these 180,000 new Torontonians.

As you can see from the chart above, “Housing Completions – All,” we have never completed 60,000 dwellings in a year in Toronto. According to that CMHC data, the most is 46,384 in 2015.

Even if we play around with these numbers, and assume 300,000 immigrants instead of 400,000, we’re still coming up way, way shy.

Immigration is not the problem in our market. Surely that’s not the conclusion that we’re coming to after looking at this data, so let me make that clear.

Every country needs immigration, especially Canada, with an aging population and a litany of jobs that Canadians don’t want to do. But with the bulk of immigrants arriving in Toronto, we’re going to see a massive deficit in housing each and every year. This comes as no surprise to you, me, and anybody reading this blog. So does it come as a surprise to a federal government who sets immigration and housing policy? Or have they just decided, internally, that there’s nothing they can do about it?

Simply put: we have too much demand, and not enough inventory.

The government has tried, basically since 2008, to bring “stability” to the market by attempting to decrease demand.

None of that has worked.

So the only rational conclusion now is that they must focus on supply, is it not?

At the onset, I showed you a chart with “New Listings” in Toronto dating back to 2002.

Let’s look at this chart again but also plot Sales just to see how the gap is narrowing:

Again, I’ve extrapolated 2021 sales to include an increase in November/December sales based on the increase in the first ten months thus far.

But look at how small that gap is! The lines have never been closer.

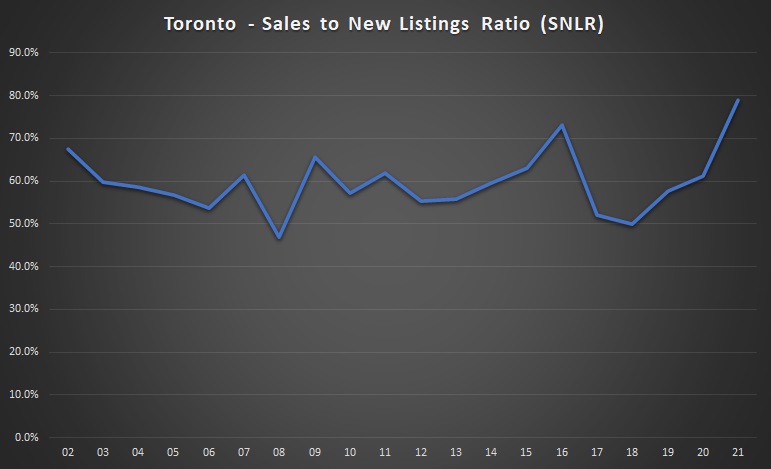

Not only are we going to see an all-time record for sales in 2021 – in a city starved for inventory, but we’re also seeing the “tighest” market ever in terms of the sales-to-new-listings ratio.

This chart should scare the pants off all of us:

The SNLR for 2021 is going to approach 80%.

That’s a factor of high demand and low supply.

New Listings in 2021 are at the same level they were in 2006. The expectation that a “growing, larger city, with more houses, will produce more listings” is flawed.

But sales aren’t just pacing 2006; they’re up by 50%.

Increasing demand with stagnant supply is a recipe for price increases, all day, every day.

So let’s watch the media, the government, and the real estate bears, and the envious all continue to blame foreign buyers, investors, flippers, speculators, real estate agents, and rich parents for the housing “problem” in this country. The rest of us can sleep well knowing we’ve actually done our homework…

Chris

at 9:24 am

On the topic of immigration, it’s worth remembering that in 2020 and 2021, the majority of so-called immigrants were actually non-permanent residents who became permanent residents. These were people who already lived in Canada, and have altered their legal status in the country, rather than new arrivals. The government has been pretty blatant in stating that, with international travel difficult, this would be their strategy. Immigration, Refugees and Citizenship Canada stated that, as at August 31st, 2021, over 70% of those granted permanent residency had been temporary residents.

Anyways, on the supply topic, David, I don’t see how this is substantially different than those you complained about on Friday trying to blame investors for all of the woes in the housing market?

Supply, or lack thereof, is certainly a contributor to price growth. But, as discussed last week, the issue is almost certainly multi-factorial, rather than attributable entirely to one cause.

Mr. Beaudry of the Bank of Canada discussed both supply and demand issues in his speech last week, looking at supply elasticity, investor activity, signs of exuberance, etc.

“…low borrowing costs supported demand and gave some people an incentive to buy a home earlier than planned. The surge in demand for housing wasn’t met with a similar increase in supply, though. And that pushed prices up sharply in several markets.”

And REAnon Grand Warlock John Pasalis’ Realosphy has discussed the supply demand balance multiple times over recent months:

“This jump in sales numbers suggests that notably strong demand has been the key driver of this current trend. Given the unprecedented impact of the Covid-19 pandemic, which saw many seeking more spacious living accommodations, coupled with the significant monetary and fiscal stimulus introduced to reduce economic fallout, it’s reasonable to think that these factors may have contributed to a sudden surge in demand for houses in the Greater Toronto Area.

It’s this sudden surge in demand that has resulted in a record low number of ‘active listings’ available. Even though the number of ‘new listings’ was in line with historical trends, the additional 12,366 sales this year, driven by this demand, has resulted in fewer homes being available for sale at any given point in time.”

https://www.movesmartly.com/monthly-report-october-2021

As you two seem to have differing opinions on the subject, it would be interesting to see another chat between you and John; assuming the two of you can find the time!

David Fleming

at 9:47 am

@ Chris

I’m not blaming immigration. In fact, I made that point clear mid-blog when I stopped to emphatically state that I was not blaming immigration. My biggest fear in this post was that people would skim and think I was blaming immigration.

We need immigration. I said that as well.

The point I was making today was that lack of inventory is driving prices. With 600,000+ more properties in Toronto since 2002, we’re not seeing a corresponding increase in properties listed for sale. The section on immigration is there to drive home the point that we need more housing, as if that wasn’t already clear.

What is the government going to do about all of this? That should be our next blog post. Suggestions on how they can drive supply?

Chris

at 9:58 am

David, I didn’t think you were blaming immigration.

My comments on the topic were more just a general follow-up to the discussion around immigration on Friday, as well as the numbers you shared.

Many people see “300,000 immigrants” in headlines and assume that these people all just arrived in Canada. The reality is, many of them have already been living, studying, and working here for years.

Government absolutely needs to align plans for population growth, on many aspects, be it housing, infrastructure, healthcare, you name it.

But, I think to state that “the problem with housing in Canada is lack of supply” is overly myopic. As with nearly all things, price is a function of both supply and demand, rather than of one alone.

Are we under building housing relative to population growth? Likely. Is there speculative demand driven by extrapolative expectations and monetary and fiscal policy? Also likely.

Condodweller

at 2:02 pm

There may be a delay between arrival and receiving citizenship but IMO the numbers can be taken at face value especially when one is looking at cumulative numbers for the past 20+ years.

I agree with the other points of government dealing with the knock-on effects of the increased population.

Chris

at 3:19 pm

“There may be a delay between arrival and receiving citizenship but IMO the numbers can be taken at face value especially when one is looking at cumulative numbers for the past 20+ years.”

Absolutely, that’s why in my initial comment I mentioned 2020 and 2021 specifically.

Over the past 20+ years, no sane person would suggest the population hasn’t grown. Over the past two years however, population growth has slowed, despite high levels of “immigration”.

“The focus on transitioning those within Canada explains why the country’s population growth remains historically low, amid a period of historically high immigration. In September, Statistics Canada reported the country’s population grew by just 0.5 per cent over the last year, which is the weakest growth since the First World War. Prior to the pandemic, Canada’s population grew by over one per cent annually for the better part of two decades with much of the growth being fueled by new permanent residents arriving from overseas.”

https://www.cicnews.com/2021/11/canada-welcomed-historic-45000-new-immigrants-in-september-1119536.html

Appraiser

at 10:28 am

Doug Ford is calling a housing summit: “Premier Doug Ford and Steve Clark, Minister of Municipal Affairs and Housing, will host a provincial-municipal housing summit on December 16 for Ontario’s Big City mayors and regional chairs.”

Says Doug: “It’s no secret that Ontario has a housing crisis, as demand has drastically outpaced supply over the past decade.” https://news.ontario.ca/en/release/1001229/ontario-to-host-a-provincial-municipal-housing-summit

Chris

at 10:38 am

Yep, when supply outstrips demand, price usually increases.

To slow appreciation, one can typically increase supply, decrease demand, or some combination of the two.

I don’t think many would argue against greater housing supply. But reducing demand is likely to also produce results, and faster than the time required to construct new homes.

The difficult part is finding the right mix of policies to accomplish this, while avoiding unintentional consequences. Reducing demand by slowing immigration may have broader economic repercussions. Building on protected wetlands may cause environmental damage. So maybe we seek to slow speculative demand while simultaneously allowing higher density in urban and suburban areas?

Appraiser

at 11:11 am

Canada’s housing market is dealing with a supply issue, not a price issue:

“Mike Moffatt, senior director of policy and innovation at the Smart Prosperity Institute, joins BNN Bloomberg to discuss how federal parties are dealing with Canada’s housing crisis in the upcoming election. Moffatt says policymakers are focusing too much on demand-side promises instead of finding ways to increase supply.” https://www.bnnbloomberg.ca/real-estate/video/canada-s-housing-market-is-dealing-with-a-supply-issue-not-a-price-issue-mike-moffatt~2278321

Chris

at 11:34 am

Mike Moffatt usually has good data and fair points. He does tend to lean towards supply as the answer more often.

It would be interesting to see Mike and JP discuss and debate, as John is leaning more towards demand side answers.

As I stated before, I don’t think we should ignore the demand side of the equation. There seems to be no compelling reason we wouldn’t address both demand and supply in curbing prices.

John

at 8:31 pm

So couple things, correct me politely if you see that I am wrong (and how I am wrong) but:

1) If, like the article argues, that the Government of Canada is bringing in more people into Canada *into a region of Canada* then there is new housing supply (from new builds/deaths/emmigration) then it is a Demand issue caused by governmental policy. Solutions could be increasing new housing supply builds, or make that area of Canada less desirable to move to for new immigrants, or better control your immigration levels, but the route cause would be a housing Demand issue.

This is especially true for “world desirable cities” like Toronto, Vancouver (NY, etc…).

2) Until Canada better controls its immigration rates, and where they can move/buy, there will always be a long-term housing issue since the World has more pent up demand for “world cities” then we could ever supply with new builds… and trying to address this long-term world demand issue by accelerating your new supply building rates will force current Canadian residents to have a reduced quality of life due to densification of already dense areas, reduced square-footage of new homes, and all the other issues cities like New York/San Fran/Tokyo have that Toronto/Vancouver/… don’t have.

Thanks.

J.

Tony

at 9:41 am

David how the heck do you have time for this???

Appraiser

at 9:43 am

Excellent data. Build Baby Build!

Re: immigration. Nine million Canadians will reach “retirement age” this decade. In addition, at current rates there will be least 3 million deaths during the same time period. https://www.statista.com/statistics/443061/number-of-deaths-in-canada/

Most advanced western nations display low birth rates and aging populations.

Interesting to note two separate articles dated 5 years apart wherein at first the Liberals are ridiculed in 2016 for wanting to expand the population of Canada to 100 million by the end of the century https://ipolitics.ca/2016/10/27/a-canada-of-100-million-are-they-insane/

Followed in April of 2021 at a conference attended by former Prime Minister Brian Mulroney : “Mulroney, who is remembered for tripling immigration over his term as prime minister, called for Canada to grow its population to 100 million by 2100.” https://www.cicnews.com/2021/04/former-prime-minister-wants-canadas-population-to-grow-to-100-million-0417708.html#gs.hdmsrh

Libertarian

at 10:32 am

Toronto is growing in terms of population, but its borders are not expanding. So where are we supposed to build all of this new housing?

On top of that, David, you wrote last week how you hate 300 sq ft condos and 3 bedroom condos that are 750 sq ft.

We don’t have room for new subdivisions of freeholds, condos are too small, everyone’s complaining about something, so the government should just announce that they can’t do anything to solve these problems.

Bryan

at 11:18 am

Not to mention how much hate all of those 70 story towers get from people living close to them….

cyber

at 1:25 pm

It’s not nearly as hard as it seems…

(0) Adjust the expectations. Yes, most of us will not be able to afford the size/type/location of dwelling that our parents had, or will need to be significantly wealthier than them in order to be able to afford the same. Toronto used to be more like Pittsburgh, and is now approaching New York – and “no one has a driveway in Manhattan”. Even celebrities in NYC live in multi-million rowhouses with no parking in Brooklyn that were originally built as housing for the working poor way back in the day. It’s just what happens in the evolution of cities as population grows over time driven by few cities truly being the source of economic opportunity.

(1) Up-zone the ‘yellowbelt’: Currently, ~2/3 of land designated for residential use only allows single family dwellings [https://www.toronto.ca/legdocs/mmis/2020/ph/bgrd/backgroundfile-148582.pdf#page=18)] There’s simply too much political weakness at the local level that, along with NIMBYism, prevents even moderate ‘missing middle’ projects like multiplexes from being built/redeveloped. California looks to be leading the way with state forcing the cities to get out of their own way on the topic of supply – proposed bill SB9 allows homeowners to build duplexes and fourplexes on most residential lots that would have previously been zoned for just one home, while SB10 would make it much easier for cities to rezone land for small multi-family projects near public transit and jobs [https://www.bloomberg.com/news/articles/2021-09-15/newsom-win-clears-the-way-for-california-zoning-reform], while New Zealand in a rare show of tri-partisanship announced new Medium Density Residential Standards (MDRS) granting as-of-right development to three storeys across the entirety of New Zealand’s five largest cities while removing height limits in CBDs [https://thefifthestate.com.au/columns/spinifex/new-zealand-rushes-in-on-upzoning-where-australia-fears-to-tread/]

(2) Better and faster public transit: Most people have a ‘radius’ of home search set based on commute time to work, whether by car or transit. Anyone delusional about ‘building more roads’ being a solution just needs to take a look at Texas [https://www.cntraveler.com/story/the-worlds-widest-highway-spans-a-whopping-26-lanes] New free lanes create ‘induced demand’ as areas further out become accessible within certain number of commuting minutes, then enough people move into bigger homes further out while continuing to drive into work, until traffic becomes same or worse than before capacity expansion. We need fast and affordable local and regional public transit – provincial and/or federal financial support for these is both necessary and warranted, given the outsized role major cities play in the GDP and the tax base.

(3) Decentralization. In the long term, getting attractive jobs to be more broadly distributed geographically would be of great help to reduce demand pressure from the ‘hottest’ markets, but accomplishing something like this is likely too complex and long dated that no government would seriously try it (except maybe in China…). However, one positive out of COVID is probably a 10+ year jump in number of fully remote, well paid ‘creative’ job opportunities and this trend will naturally continue based on demands of knowledge sector workers. Ironically, the knowledge center workers are pushing for remote in many cases due to lack of housing affordability in the tech hub cities.

perpetually agitated

at 5:43 pm

K you’re the only that is making sense here in the comments. Are you a city planner by any chance? I actually agree with all that you have written. You should submit your ideas through another platform as well.

Bryan

at 11:17 am

I don’t envy the government on this one. From an economic standpoint, as this article makes abundantly clear, the only real solution to the housing crisis is to build more places to live than there are people to move into them. Fewer new homes than new people is a recipe for price increases…. no matter who or how they tax. All taxing or interest rate adjustments will do is change the distribution of the cost (my guess is it would land mostly on renters).

The trouble is that developing the remaining land in and around the city is generally hurtful to the environment and almost always politically unpopular. How many ads have you seen/heard about “Doug Ford’s developer buddies” building on the greenbelt(probably a lot of the criticism is fair, but that’s sort of beside the point)? Paved paradise and put up a parking lot and all that….

Kind of a tough position to be in. I blame it on an uneducated population when it comes to real estate and economics in general. There is always a tradeoff when it comes to solving economic problems. Either immigration needs to decrease which would lead to a bunch of horrible things in our society, or we need to build more places for people to live…. which will invariably have an impact on the environment/traffic/transit etc. You can’t have it both ways. There needs to be a rational and informed discussion on how to move forward, and a plan created to do so.

Libertarian

at 12:09 pm

Well said, especially your last paragraph.

Condodweller

at 1:58 pm

You have some good points. Governments should definitely be looking at both sides of the equation when making changes to factors that affect housing and affordability. If you’re going to bring in x number of immigrants, you also need to ensure there is sufficient housing available.

I wonder how the opinion on the environment might change going forward as we run out of space for housing. It’s not unlike rainforests where environmentalists cry foul about deforestation yet there is a significant need for farmland by locals on top of the income the harvested lumber provides (I’m just using this as an analogy, I don’t want to start a discussion on it). If you have a short term need, other issues tend to fall by the wayside. If housing becomes dire enough, I fully expect the government to relax on the environmental restrictions. What if it’s the environmentalists who need housing? This is going to test their convictions. Just like the immediate threat of death changes the conviction of many anti vaxers.

Bryan

at 2:53 pm

I think your analogy is a good one….and honestly not that far off what we are seeing specifically north of the city.

I lived on the Oak Ridges Moraine for a number of years when I was younger and watched with great interest as the Ontario government brought in laws that restricted building there….. basically in order to appease the people who were already living in houses built on the moraine in the 80s and 90s. The sad thing now is that the children of those same people are the ones complaining that they can’t afford to buy a house to have a family anywhere south of Keswick. It’s all because for the last 15 years you “couldn’t” (and I put that in quotes on purpose as there has certainly still been building) build anything between the 407 and the north edge of Newmarket.

Was that the “right” decision? I am not really sure, and can see both sides. On the one hand, its such an environmentally sensitive area that it should probably be protected…. but on the other hand, there is a generation of 20 and 30 somethings that can no longer do what their parents did when they couldn’t afford to live in Toronto and “move to Newmarket” (or Aurora, or Oak Ridges or whatever) because huge swaths of that region never got developed. Its a tough commute from Sutton….

Condodweller

at 5:20 pm

There may be valid reasons for not wanting to build in “green” areas. There is a reason some are called “wetlands”. I would not be shocked to find out that these would be prone to flooding if we built there. If we built there it may even cause flooding elsewhere.

But I would take a hard look at places where the reason is not truly environmental but more of a “tree-hugging” type. We are fortunate to have wast green spaces and perhaps with careful planning where subdivisions can be built by building around existing trees vs plowing the entire lot may be a workable compromise.

I’m surprised that people complain about saving trees where they don’t seem to mind farmlands being developed which IMHO has a more direct impact on us.

Mike Stevenson

at 12:55 pm

I don’t understand the whole “that’s not the reason, *this* is the reason”. If I have one message for today’s young people, it’s this: more than one thing can be true at the same time.

Obviously investment demand crowds out people who want to buy a home to live in it.

Chris

at 1:57 pm

Succinct, and well said, Mike.

It’s almost certainly a multi-factorial issue. Not just investors, or just supply, but a combination of them and many other causes.

Appraiser

at 3:23 pm

The causes / solutions may well be multifactorial but they are not evenly weighted, not even close.

Chris

at 3:48 pm

I don’t recall anyone stating that all causes are evenly weighted?

Clearly, some will be more impactful than others. Personally, I would estimate that supply, or lack thereof, is a substantial factor. I would also place a good amount of weight on extremely lose monetary and fiscal policy.

I don’t know how one could hope to accurately quantify all of the causes and their weight, so it’s likely to remain a bit of a guessing game. Feel free to share your weightings, if you’re so inclined.

Condodweller

at 5:03 pm

A significant factor on the supply side is cost(s) of moving. This is probably close behind no new build.

Chris

at 5:16 pm

I can’t perfectly recall, but I think I’ve stated here before that I’d be strongly in favour of getting rid of land transfer taxes, for exactly this reason.

I don’t think we should be forcing those who are overhoused to downsize, but we shouldn’t be adding anymore friction to it either.

Murasaki

at 4:34 pm

I’d be extremely reluctant to look at eliminating land transfer taxes, for the simple reason that doing so would possibly (likely?) result in home prices rising rather quickly by the amount saved on LTT. If this were to happen in Ontario and/or Toronto, both the province and (especially) the city would lose a large chunk of revenue, likely necessitating increases in other taxes, almost definitely including property taxes.

Chris

at 4:54 pm

Yes, most likely. But that seems like it would be beneficial:

“By one estimate for cheaper houses, a 1% increase in stamp duty reduces annual churn in property ownership by 3.5%. When fewer moves mean fewer job switches, the labour market becomes less efficient. Productivity growth may slow. Thankfully, transaction taxes tend to bite hardest only for expensive homes. But gumming up the top of the housing market has knock-on effects. Those who would occupy mansions stay in cheaper homes instead.

The taxes also discourage downsizing, a particularly unwelcome effect in ageing societies. More than two-fifths of British housing equity is owned by over-65s, many of whom are sitting on large, empty nests. More than a third of Britain’s owner-occupied houses have two or more spare bedrooms. People are entitled to hold on to their houses if they wish. But the tax system should not encourage them to do so—especially when high prices have left many families wanting more space.

There is an obvious replacement for transaction taxes: higher annual levies on property values or, ideally, on land values. Such taxes target wealth, and can be just as progressive as stamp duty, but they do not distort markets much.”

– “The case for scrapping stamp duty”, The Economist

https://www.economist.com/leaders/2018/11/24/the-case-for-scrapping-stamp-duty

Kyle

at 2:39 pm

@ MIke Stevenson

You’re right, in that both supply and demand can contribute to the reason for prices to rise, but when we talk the bigger question of solutions and addressing prices, there’s a big difference. Solutions that restrict demand from the various “villains”, is always about favouring one over another. For example: restricting foreigners in favour of locals, restricting immigrants in favour of Canadian born, restricting investors in favour of end users. These are all fraught with unintended consequences and unresolved questions about why we should be favouring anybody, instead of just letting the market do its thing.

Increasing supply addresses the cause and the symptoms, and unlike demand-side restrictions isn’t just about squeezing the balloon in one area so that it bulges somewhere else.

Chris

at 3:16 pm

“Solutions that restrict demand from the various “villains”, is always about favouring one over another.”

Going to have to disagree with you again, Kyle.

Certainly some measures are ‘us vs. them’, such as restricting immigrant numbers (though I haven’t seen too many people advance this, and polls consistently show Canadians widely supportive of immigration).

However, there are other measures that could temper demand that I don’t believe necessarily boil down into favouring one group over another, or at least are detrimental to a group not worth protecting the interests of.

For example, enforcing rules around money-laundering and implementing a beneficial ownership registry. Or enforcing short-term rental laws that many municipalities have enacted.

You might say that pits us against criminals using Canada to launder their ill-gotten gains, or those who want to run ghost hotels against prevailing regulations? In which case I say, great!

As another example, tapering monetary and fiscal stimulus will likely slow demand. But this isn’t so much about prioritizing one group over another, as it is a response to a recovering economy and accelerating inflation.

Also, maybe tone down the hyperbole like “villains” and “QAnon Shamans”… it’s a discussion about economics and real estate, not a comic book battle or a civil war. Remember, reasonable people can disagree on topics without hating each other!

Kyle

at 3:47 pm

My word choices are intentional and accurately portray exactly how the narrative has been cast in the media. In the articles David shares, there are always the “victims” who aren’t able to have the house they “should be” able to afford, because of….[insert “other” group].

It isn’t the Supply-side proponents who try to portray Foreigners, Landlords, Developers Realtors and Investors in a negative light. Anyhow reasonable people can acknowledge and accept this reality without having to convince themselves that the unflattering bias they’ve bought into exists only in comic books.

Chris

at 3:57 pm

Ah, I see, I misread your comment.

I thought you were implying that the solutions proposed to restrict demand were ideas coming from various villains.

I now realize you were referring to solutions, which would restrict demand that stems from the villains (as they’re portrayed in media), such as investors, etc.

My mistake.

Anyways, it shouldn’t come as a surprise to anyone that the media uses emotionally charged language. It get clicks.

Appraiser

at 3:24 pm

Very well put Kyle.

Mike Stevenson

at 7:59 pm

In normal times I’d agree, Kyle. But the market is already distorted and pools of investment money pouring into residential real estate is itself an unintended consequence.

Time to redirect that money back into Litecoin and electric vehicle companies that have only produced a sketch of a car. Give a chance of home ownership back to people whose only contribution to the city is that they work jobs that we need done. This does not preclude supply side initiatives.

Condodweller

at 2:08 pm

David some additional things to keep in mind regarding immigration. The regional break down is misleading as people are free to move once they land in Canada. My parents landed elsewhere when they arrived many decades ago and we ended up in Toronto within a year and they had friends who landed all over the country, including Vancouver, who are here now.

Then of course there is the natural migration within Canada which can be added to this. When oil prices plummeted a few years ago, lots of people moved to the GTA. Alberta license plates were a common sight in the city.

Pile In Johny

at 4:57 pm

Move in with your ugly in-laws and become a farm hand.

Average Joe

at 10:47 pm

Supply is a huge part of the issue, probably the main part. But it would be less of an issue without investor activity. I suspect a lot of those investors are the same ones who show up to complain to their councillors about how there shouldn’t be any new supply in their area.

Where is the supply supposed to come from, and who is going to be willing or able to buy it? More leaky towers rammed full of micro condos? More particle board McMansions at the edge of the greenbelt? Lots of moaning around here about buyers wanting a detached property while ignoring that detached is the only legal form in most of the city.

If we are saying all demand is good demand, then all supply should be good supply. Build whatever you want anywhere, because free market. But if we can’t agree on loosening the rules for building, time to tighten up rules for buying. If idiots are going to keep voting for land shortages, we’re going to get land rationing.

CommanderCB

at 8:01 pm

Hiya.

Yeah so . There actually is no shortage.

It is all a big fat lie

Oiooops we are liars.

Proof.

You want… Demand proof .

Fine.

If you see a homeless person sitting beside a “vacancy” sign… Then you do not have a shortage

There is no shortage..

Liars.

Liar liar pants on fire ????

Bal

at 9:09 pm

something is seriously wrong….I saw semi sold in Brampton today ( northwest ) close to Mayfield and Mississauga rd. for 1.4 million. only 20 feet wide. can you imagine just ordinary small lot semi……..This is insane. Investors in the Brampton are driving the market to insanity. everyone want investment property.

The new builder opened the new phase at Mayfield and Dixie for 1.7 million on Saturday . when builder saw the line up , they increased the price from 1.7 to 1.9 and still all the houses sold within 30 minutes don’t think this will end ever. I think next year we will see semi selling for 2 million in Brampton….I have no idea how people are even able to afford…I understand that mortgage rates are low but with the price…low mortgage rates are damn tough to afford

Mardig Bidanian

at 1:11 am

I definately agree with the supply issue. Not enough houses are being built. Therefore, more incentives are needed to bring up supply.

However, building new houses are easier said than done. Raw materials are getting more expensive and there appears to be a labour shortage. Albeit I don’t have much sympathy with employers complaining about labour shortages.

On immigration, Canada should actually limit immigration. The standards of living will eventually start to fall when our population reaches 50 million. That will be the time when people realize that hell there is a lot of poverty in Canada.

On investors, this is more tricky. Housing is an investment vehicle. Look at the Evergrand crisis in China. Families use real estate to increase their assets. In my opinion and the evaluation of others housing is more of a liability but that’s another issue. I mean COVID definately increased inequality in Canada. In a free housing market a family will need to possibly compete against real estate companies for housing. Just because it may not be happening now does not discount the fact that it may happen in the future.

DT

at 4:40 pm

Nice use of graphs! I expect the situation is actually a bit worse than what your data is showing because: (1) you only included immigration to Canada, and not inter-provincial migration, and (2) your data doesn’t include all the housing units lost when multi-tenant homes downtown have been renovated to be single family.

We have lots of room (and demand) to build within city limits. Our achilles heel is single family residential zoning covering most of the city. Toronto is unfortunately turning into a dichotomy between towers and single family detached homes. If we allowed multiplexes and low rise apartments everywhere in the city, we could add scale relatively quickly, while keeping human scale neighborhoods, and while making use of our existing infrastructure.

*And* we need the government to get back in the business of investing in affordable housing for those on the bottom rungs.

j

at 1:01 pm

Hi, I think there may be an error in your calculations. In the 400,000 immigrant scenario, you settle on 150,000 arriving to GTA but then apply the 3 person/household assumption to the 180,000, instead of the 150,000 to (incorrectly) yield a 60,000 unit demand. Using the correct 150,000 GTA figure yields a 50,000 unit demand. If we apply a more reasonable 300,000 historical immigrant scenario, the same assumptions yield a 37,500 unit demand. Looking at the unit supply curve (recent years excluding Covid) we see a supply of around 37,000 units – essentially meeting demand closely. As such, based on the charts provided (and your reasonable assumptions), it seems like historical GTA stock has roughly been keeping up with historical new immigrant demand.

sprayfoam kings

at 7:06 am

hi

For the first time ever, I’m reading a blog on this website, and I’d want to congratulate you on the excellent writing and high quality of the content. I really appreciate you taking the time to write this, and I’ll read your blogs from now on. I appreciate how much you value both your audience and your staff. Regard

Wall Spray Foam Insulation

umair ali

at 2:43 am

Its really good information for me and those people who takes interest in this field. Thank you very much for share this amazing blog. Svarna Immigration Services