Chris just looked over my shoulder as I was writing the title for today’s blog.

He said, “Shocking? The assignment market is ‘shocking?’ Dave, I’d be shocked to hear there is a market out there…”

Good point.

And he’s not exactly wrong, and if a tree falls in the woods but doesn’t make a sound in doing so, then maybe would-be assignment sellers don’t actually represent a market if there’s nobody looking to buy?

I was on CTV’s “Your Morning” two weeks ago talking about the state of the condo market and was so happy to discuss pre-construction condominiums in a forum with such a vast reach.

Sure, I’ve been touting the dangers of pre-construction condominium “investing” for fifteen years here on Toronto Realty Blog, but it was nice to be able to say the following, on air, in front of tens of thousands of live viewers, as well as 100,000+ viewers on YouTube since then:

“Pre-construction condominium investing; it’s gambling. It’s always been gambling. You don’t walk into a casino, put all your money on the roulette wheel, lose, then turnto the pit boss and say, ‘I’ve changed my mind.'”

The host, Anne-Marie, pointed out, “Real estate is a market, and markets go through cycles.”

Sadly, it seems as though most pre-construction buyers never understood this.

Here’s the video:

In any event, the “house of cards,” as I described it during Your Morning, has caved in, as we know, and the stories we’re hearing out there are like something out of The Big Short.

I’ve told a few stories so far this year about random phone calls I’ve received, related to pre-construction condos, but here’s a new one that’s relatively recent.

A young man called me two weeks ago and asked for help with his condominium assignment.

I asked him where he found me, and he said, “Through your podcast.”

I asked him to recall which episode, because I wondered why in the world he would call a guy like me, who has nothing positive to say about pre-construction, who has never listed an assignment, and who is realistic about the tire-fire that is the assignment market in 2025.

He said, “I know you hate pre-construction condos, and so do I. I mean, now I do, but not when I bought. That’s why I need you to help me.”

The following is shocking, so hold on to your hats.

In 2021, he purchased a pre-construction condominium for a $689,000 sticker price, but after $15,000 for a locker and $18,000 in “upgraded finishes,” he was in for $722,000.

The condo is a studio, and it’s 471 square feet.

He’s made the structured deposit payments per the Agreement, which is 20%, or $144,400, but he doesn’t want to own this condo.

“My occupancy is scheduled for May,” he told me.

But the surprising part was when he said, “They moved it up from July.”

Wow, who ever heard of a developer moving the occupancy date up?

The problem that he had was one that I hadn’t heard of before:

The Agreement stipulates that while assignments are permitted (without any public advertising, of course), they are permitted only up to the point of occupancy.

With buildings taking around a year to go from occupancy to registration, that meant he would be forced to keep this unit for a year or more.

“I basically have to find a buyer for the assignment in the next couple of months or I’m screwed.”

He was right…..in part.

I explained to him, in no uncertain terms, that he was screwed either way.

“Nobody is buying assignments right now,” I told him. “And you paid an insane price for the condo in the first place, so unless you’d take $500,000 for that property now, why would anybody buy it from you?”

To his credit, he didn’t scream, didn’t cry, and didn’t seem all that surprised.

“I paid, like, almost $1,600 per square foot,” he told me. “What the fuck?”

I was wondering the same thing, I just didn’t say it.

I asked him, “Do you mind if I satisfy a curiosity of mine and inquire as to why you bought this and what the goal was?”

He laughed and said, “I was like two years out of undergrad, and one of my friends from school just got into real estate. We had a tight group in university, and we always said, no matter what we all did for a living, we’d support each other. So when he came to me with this ‘unbelievable investment opportunity,’ I trusted him and I went for it.”

I asked him how long this friend of his had been in real estate for and he said, “About six months.”

That made sense.

He added, “But the messed-up part was that he works in Durham and I live in London and we’re looking at investments in Toronto like we know what we’re doing…”

I told him that he was far more self-aware than anybody else in his position, and he laughed and said, “Unfortunately, that doesn’t help me.”

He said that he was willing to take a loss on the condo to get out from under it, but how big a loss was the question.

I said, “Look, I don’t sell assignments, never have, never will, but I’m happy to chat with you for a bit. Let me ask you this: can you afford to close on this condo and keep it?”

He said that he could.

I continued, “Then do it. You’re not going to find a buyer for this unless you give it away. Close, put a tenant in there, and come back to this in three years.”

A few days later, we got the infamous Toronto Star article about the developers suing pre-construction buyers who can’t close.

The young man emailed me, referencing the article, and said, “Yeah, I’m just gonna close. I don’t need to invite this into my life.”

Despite the fact that there seemingly aren’t any assignment buyers out there right now, I continue to receive emails with “opportunities” and field calls from agents who are trying to beat the bushes, fruitlessly or otherwise.

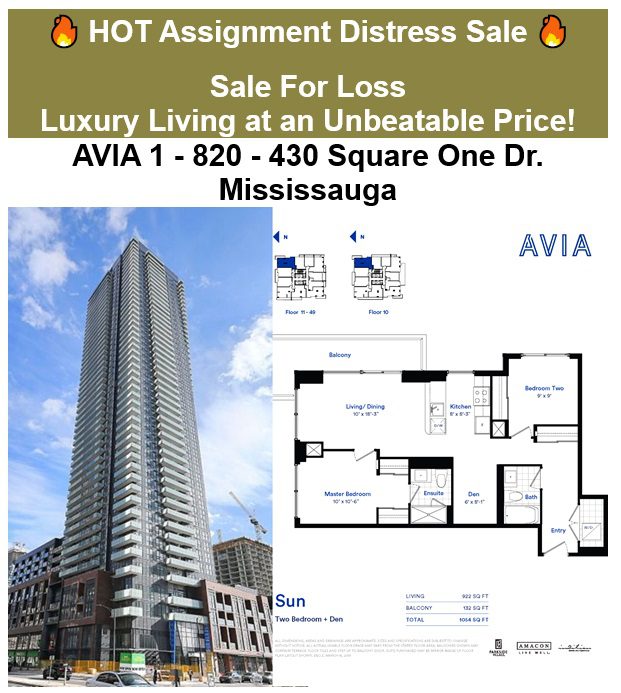

What really made me chuckle last week was the masthead on this email blast that seems like the best (or worst?) oxymoron I’ve ever heard:

Really?

“Hot assignment distress sale”?

Is that like, “Delicious rotten chicken”?

How in the world does one pair something amazing with something exceptionally awful?

The FIRE icons are the icing on the cake.

I was reviewing offers on one of our listings last Tuesday night, irritable and hangry, and that email came up in my inbox.

“Matt! Tara! Get in here, you have to see this!”

Hot assignment distress sale. Wow. I just can’t get over it.

In any event, some of these distress sales just weren’t distressed enough, nor were the offers all that “hot.”

I also don’t know about the marketing here, because it’s one thing to suggest that rotten chicken is delicious, but it’s another thing to suggest that eating out of a dumpster is five-star dining…

430 Square One Drive.

“Luxury Living.”

I mean, my five-star dining analogy wasn’t that off-side, was it?

Ask me how many units are available for lease in this building right now, just on MLS alone?

76.

That doesn’t include the units owned by people who want to save listing fees and are posting on Facebook Marketplace or Kijiji.

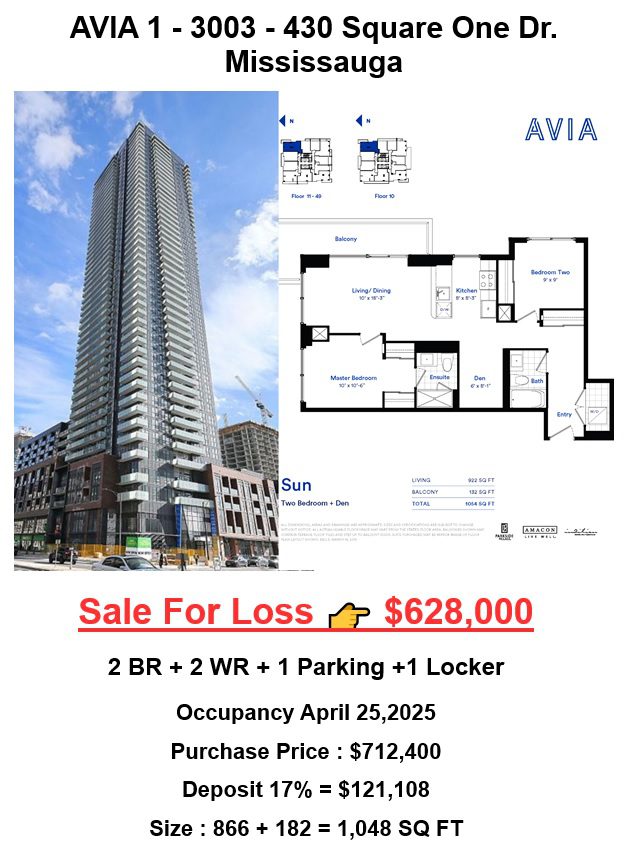

Now, what’s the offer?

This:

“Sale For Loss” is another catchy marketing tag, and I do enjoy the pointing-finger emoji that somebody used while typing this up on their iPhone.

Including the outdoor square footage in the overall square footage is a time-tested technique, although at least these folks broke it down.

So overall, we’re looking at a $725,900 purchase price that’s now available for $638,000. Or less.

But what really pops out at me:

Occupancy April 25, 2025

I received this email on April 14th.

Does this person have nine days in order to sell the unit? If that’s the case, maybe add “HOT” again in the marketing, and then put the word “SUPER” in front of the word “distressed.”

Here’s another one:

Hmmm….

The first unit was offered for $691 per square foot after being bought for $787 per square foot.

This unit is being offered for $725 per square foot after being bought for $823 per square foot.

It seems as though the pricing is identical here: these units are being offered for 88% of the original list price.

This next one, however, is not:

Bought for $698,400 and being offered for $670,000?

Not good enough!

Another real estate agent blasts my inbox with other “hot” assignment sales.

“HOT DEALS ON THE MARKET”

That’s what the tagline in the email says.

Here’s one such deal being offered:

Do the math on this: $799,900 + $189,000 = $988,900 original purchase price.

That’s $1,419 per square foot.

A 20% deposit on $988,900 would have been $197,780, so this “investor” is looking at losing almost the entire deposit.

Something tells me there’s a ways to go here, however.

This assignment is being offered for $1,148 per square foot, but we don’t know anything about the occupancy fees and closing costs, which could drive the price higher.

The problem, as I have been saying for the last fifteen years, is that you could buy a competing property that’s:

-Finished, without any more construction

-Not in occupancy

-Not half-empty

-Not with 90% renters

-Better location

-Better building

Oh, and for less money.

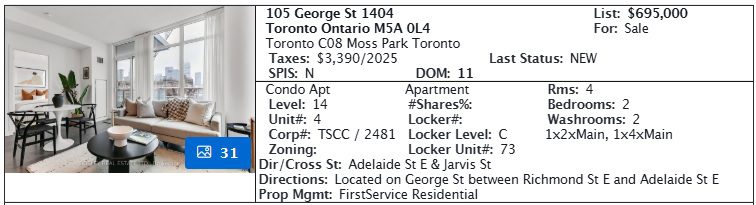

Here’s one such listing that a colleague of mine has:

This is a 725 square foot unit, or $959 per square foot.

It’s resale, so no hidden closing costs and no occupancy fees.

George Street / King Street is an infinitely better location than……….Jarvis and Carlton. Directly across from a park synonymous with homeless encampments and one block north of a very famous Toronto landmark, located on the northwest corner. Can anybody name this icon – and provide the correct moniker?

In any event, with resale properties like this one on George Street available, I have no idea who’s paying 20% more for an assignment.

But I have never understood who’s paying 20% more for pre-construction! Or 30% more. Or 40% more.

For the record, while I now have the opportunity to say “I told you so,” it doesn’t make me feel any better. This never should have happened. Pre-construction prices should never have settled at a 30-40% premium over resale. I said this for years. Nobody listened.

And now look at the mess.

I have absolutely no idea who is going to buy these assignments, no matter how “HOT” they are or how 🔥 distressed 🔥.

Fire icons.

Seriously. This is what the assignment “market” has devolved into.

Emojis in marketing.

Le Sigh.

Oh, and one more thing:

The assignment above notes an occupancy date of April 25th.

Gosh, if only there were an emoji to help describe this.

Wait, I think I know of one…

…ah, here:

😱 😱 😱

DM

at 7:26 am

I haven’t thought about Hooker Harvey’s in a very, very, long time.

Different David

at 1:12 pm

I see both sides of the argument. Completely agree with David that why would someone, in April 2025, pay 20% more for a non-finished assignment with unknown future costs (and deficiencies), when they can buy in a similar location, without half-finished fixtures, knowing what they are getting, with functioning amenities.

However, put yourself in a builder’s shoes. They have to forecast what the cost of all the trades, supplies, and interest rates will be in 3-4 years, when setting the sale price of the units at their glamourous overdone sales center with artist’s rendering of what the units would look like.

Once they set the price, they have no idea what the market will be – just some way to ensure that they make enough money to pay their investors and tuck away a small profit.

Although at some point, basic investment calculations should have dawned on the investor to realize how ridiculous wages (and property values) would have to inflate for this property to make money

CS

at 6:21 pm

Hooker Harvey’s is a Toronto landmark!

However, I will say that as someone who bought in an older building near Jarvis and Carlton (and recently sold within a couple weeks of listing in February), we play with our kids in the western playground in Allan Gardens and it’s great. Right across the street from JAC, always packed with families, and the western park has been nicely renovated and cleaned up in the last year or two.

Seeing the preconstruction mess and struggles selling in newer buildings, I’m extremely glad we went for an older building when we bought and were realistic about our selling price this spring.

Dave

at 6:24 am

Part of the reason for the housing market mania is that we were all told by the media that there was a severe housing shortage and if you didn’t get into the market immediately you would be locked out of the market forever. Well, the housing inventory is now piling up all over and the condo inventory is the size of a mountain. Where is the housing shortage now?! Every investor needs to eat their losses just like someone would in the stock market or a casino.

Marty

at 9:08 am

I think about Hooker Harvey’s almost daily.

All kidding aside, best line(s):

“I paid, like, almost $1,600 per square foot,” he told me. “What the fuck?”

I was wondering the same thing, I just didn’t say it.

Zulfi Malik

at 10:58 am

The real killers are occupancy charges, hidden fees, and brutal management companies engaged by the builders without the input of the unit holders, who have no say in the selection of those management companies. I am a realtor and have become the deadliest critic of condo builders. They have no sympathy or respect for their purchasers.

Derek

at 11:04 am

The good news is that with resale condo sales nosediving, we will soon get to beat the drum and blow the horns about average sale price. Woot! Woot!

Ace Goodheart

at 12:49 pm

I have talked to a number of young couples with very young children (preschoolers and grade school kids) looking for housing in Toronto. Our kids are young, but we are old, so we come in contact with parents who are 20 or more years’ younger than us all the time.

This weekend was another round of playdates, and various young couples coming over to our house.

The reception is always similar. First, shock at how we live (it’s quite a large semi detached house). When I tell them I just bought it a few years’ back in 2021 and didn’t need a mortgage because I had several other houses that I sold for rather large profits, the shock kind of deepens.

You get comfortable living like this and you kind of tune out how things are for everyone else.

I met one couple who manged to purchase a two bedroom condo, because they qualified for a mortgage. The rest of them were all renting condos. It is like a different world for these people. They don’t seem to be able to save, as monthly expenses eclipse income. They have no “dream” of ever owing a house. They seem to realize that this is impossible for them. Many of them have given up on owning entirely.

The ones who are looking, are looking at older condos, stuff from the 1990s or early 2000s. The reason is always the same – the newer condos, and especially the ones being built right now, simply do not work for a family of four. The bedrooms, when they actually exist (many times, there is no bedroom at all) are too small to fit beds. The kitchen is part of the living room, which doesn’t work when someone is watching TV with the kids and someone else is making noise cooking something. There is no “private space” at all. There are no doors on the rooms. The rooms aren’t big enough for a child’s bed, let alone an adult bed. The layout is horrible. Often a child’s bedroom is directly off the living room/kitchen and right next to the front door. How do you function as an adult, when you cannot open the front door, watch TV or do something in the kitchen, without waking your child up?

The consensus seems to be, find an older condo. You get an actual kitchen, two or three real bedrooms, and a sensible layout. You also get a parking spot (often more than one). The locker is huge (the new ones, you can barely fit anything in what goes for a locker).

There are so many frustrated young couples with kids out there right now, it is something you have to experience to understand. We have had many of them in our living room (which is by itself larger than many of their apartments). You get a sense of the futility of things when you talk to these people. They are resigned to living their lives in a state of compression and lack of space, which they see no way out of.

I think you have to come to the conclusion that the price of a regular, good sized piece of real estate in Toronto is simply completely detached from people’s earning fundamentals. There is no way, if these folks lived to be 100 and saved for all of their lives, that they could actually, after factoring in cost of living, purchase a house in their own city.

Pragmatic Jane

at 9:19 pm

In addition to hooker Harvey’s, there’s also Spa Excess right next door to JAC where you can watch 60 gay grandpas playing pool naked.

JAC is not for everybody, but maybe it is for somebody?