Don’t ask me how I found this because I honestly can’t remember.

For some reason, I was searching listings in this area (which shall remain nameless so I can claim that I never identified the address), and I saw the outside of the house and thought, “Huh, that’s not a bad price.”

Little did I know, this was a bad price, but not “bad” as in, the property isn’t worth it…

In our real estate market, sellers are free to enact any pricing strategy that they see fit.

If an individual owns a house that’s worth around $1,500,000, there’s nothing to stop that person from listing the house for sale for $2,000,000. Or $3,000,000. Or $2,222,222.22, if they want. It’s completely up to them.

By the same token, there’s nothing to stop that same individual from listing at $999,900 and setting an “offer date,” if that individual feels that the best way to get buyers through the door, and to maximize the price, is to “under-list” and hold back offers.

If neither strategy works, then the individual is free to change strategies.

At no point is that seller ever somehow “forced” to accept an offer of a certain price, nor should they be.

However, and here’s where I’ll delve into the grey area, there is a somewhat “acceptable” code of conduct in the real estate community, and from time to time, we see exceptions.

Actually, it’s not from time to time. It’s constant.

In our company meeting last week, we discussed some new leadership at TRREB and how certain individuals were being proactive and tackling long-standing issues.

I raised my hand and asked

“Back in the spring of 2017, we started to see agents listing properties for sale and noting ‘Seller Reserves The Right To Accept Pre-Emptive Offers With Zero Notice.’ Is that going to be addressed? It’s been seven years now.”

Time will tell.

But that’s an example of something that is blatantly against the rules of organized real estate and nothing is being done about it.

On the flip side, there’s nothing in the “rules” that says you can’t list your house over, and over, and over, and over, and over, at stupid prices, with stupid strategies, for years at a time.

Nope.

Stupid is as stupid does, and every day in this market, we see another example.

I have written many blog posts over the years with examples of ridiculous listings, ridiculous strategies, and properties being listed over-and-over. But in today’s blog, without exaggeration, I’m going to show you the single worst example.

There are three reasons why this listing takes the cake, through seventeen years of blogging on TRB, but I don’t want to play spoiler here, so I’ll detail those three reasons at the end.

Let’s start from the beginning.

March 15th, 2023, a house is listed for sale for $2,499,000.

Pretty innocent, right?

There is no offer date for this house, so it’s simply a $2,499,000 house. Right?

Except, well, it’s not.

Despite the lack of an offer date, this house isn’t worth $2,499,000. It’s worth much more, but the seller and the listing agent seem to have “strategized” and decided to list $1 Million below their target and not set an offer date.

That didn’t work.

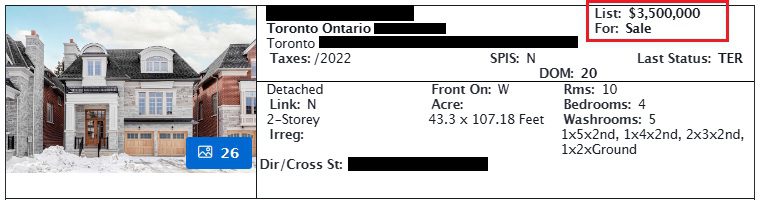

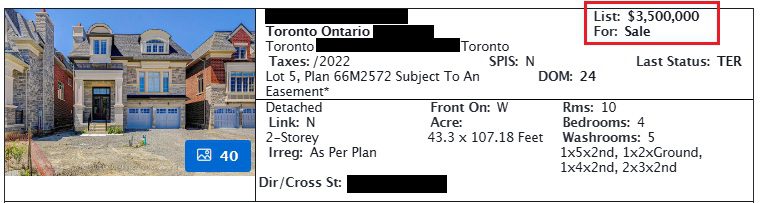

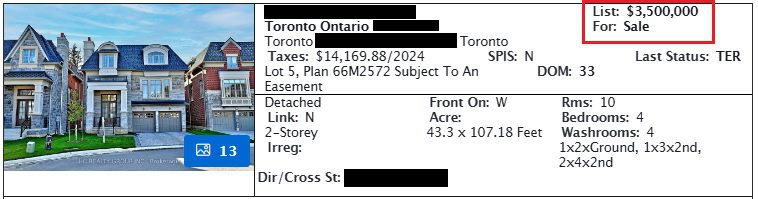

March 30th, 2023, the price was increased to $3,500,000:

That didn’t work.

The property remained on the market for another five days, and on April 4th, 2023, the listing was terminated.

Now here’s where things start to get ridiculous.

April 6th, 2023, the house is listed for sale at $2,589,900.

Huh?

What?

This house was just listed for $3,500,000 two days ago. Not only that, it was listed for $2,499,000 three weeks ago, so clearly the market has already seen this “under-pricing” strategy, right?

Yes.

So, surely there must be something different this time around, right?

No.

And the property remained listed for sale at $2,589,900.

On April 18th, 2023, the price was increased to $2,950,000.

But wait, are they planning to accept a price like this?

No, of course not, as you’ll see by the end of the story, and that’s yet another reason why this is the worst listing “strategy” I have ever seen.

On April 29th, 2023, the price was reduced to $2,888,000.

Again, there’s zero indication that the seller would have ever accepted a price like that, but away we go.

On May 24th, 2023, the price was increased to $3,500,000.

That’s a very familiar price, so get used to seeing that.

On May 25th, 2023, that listing was terminated.

Alright, so let’s regroup:

So far, we’ve seen two listings for this property at six different prices over the course of 70 days.

But that was only the beginning…

On May 26th, 2023 the house was listed for sale for $2,180,000.

That’s not a typo. They listed this house for $1,320,000 less than they were previously listed for, as crazy as that sounds.

This time, the listing description noted, “Priced To Sell. Motivated Seller. Bring Your Clients To Make A Deal.”

Uh-huh. Sure thing…

But this time, they tried something different! This time, instead of just under-pricing and hoping that buyers would, for some reason, flock to the property and throw dollar-dollar-bills at it, they enacted this thing called an “offer date.”

But it didn’t work. And why the hell would it? Who was going to “bid” $1,320,000 above the list price?

On June 10th, 2023, the price was increased to $2,880,000.

This was still $620,000 lower than what the seller presumably wanted, and the insanity of this listing continued.

The listing remained untouched for five days.

Then on June 15th, 2023, the price was increased to $3,500,000.

Crazy, right? What in the world was happening?

They didn’t sell at $2,180,000, they didn’t sell at $2,880,000, so they raised the price again, for the third time in this listing, representing the ninth price for this home since March.

June 16th, 2023, the listing was terminated.

June 16th, 2023, the house was listed for sale for $2,280,000.

What the actual eff?

They just did this three weeks earlier. They literally already did this.

But they set another offer date!

But it didn’t work.

June 23rd, 2023, the price was increased to $2,980,000.

Why, I don’t know.

Then the pattern continued…

June 30th, 2023, the price was increased to $3,500,000.

June 30th, 2023, the listing was terminated.

Here’s where I start to think that maybe, just maybe, these people sort of have a method to their madness. Don’t get me wrong – this whole thing is insane. But the fact that they increased the price to $3,500,000 right before they terminated the listing says that they are calculated….event though they’re totally lost.

Fair?

June 30th, 2023, which evidently was a very busy day, the house was listed for sale for $1,899,000.

That’s right. They listed $1,600,000 below the price they hoped to attain.

And yet again, they set an offer date:

At this point, we know this “strategy” isn’t going to work, so now it becomes a question of: “What would they increase the price to?”

July 10th, 2023, the price was increased to $3,300,000.

Ah, okay. So not $3,500,000? Maybe they actually would consider less than this magic number, now that they’d been on the market for four months, over five listings, at fourteen different prices?

Nope.

July 17th, 2023, the price was increased to $3,500,000.

July 17th, 2023, the listing was terminated.

Only this time, the listing would remain terminated.

And that was that…..

…until……2024! Hooray!

March 14th, 2024, the house is listed for sale for $2,389,000.

And an offer date is set, but the really, really odd thing is: the offer date is 29 days away!

They also say that thing that I hate – about how an offer can be accepted “any time without notice,” even though rules dictate that notice must be provided to interested parties.

Thankfully, in this case, nobody was interested in the house.

April 20th, 2024, the price is increased to $2,980,000.

April 25th, 2024, the price is decreased to $2,589,000.

Amazingly, another offer date is set, even though it’s the same listing:

This makes zero sense. But does anything in this make sense?

April 30th, 2024, the price is decreased to $2,489,000.

Why decrease the price of this listing now – before an offer date?

May 24th, 2024, the price is increased to $3,500,000.

May 29th, 2024, the listing is terminated.

June 8th, 2024, the house is listed for sale for $2,995,000.

There is no “offer date” this time around, so perhaps the new and improved price of $2,995,000, with a new and improved real estate agent representing the sale, truly is what the seller would consider selling for?

Maybe. Watch this…

June 15th, 2024, the price was decreased to $2,899,000.

June 21st, 2024, the price was decreased to $2,799,000.

Maybe they finally want to sell?

Nope.

This was merely the start of the most ridiculous use and manipulation of the MLS system that I have ever seen.

Watch this…

June 25th, 2024, the price was increased to $2,995,000.

June 26th, 2024, the price was decreased to $2,799,000.

June 20th, 2024, the price was decreased to $2,699,000.

July 14th, 2024, the price was decreased to $2,599,000.

July 20th, 2024, the price was increased to $3,500,000.

What an absolute joke this had become.

July 20th, the listing is suspended. But interestingly enough, the listing wouldn’t be terminated until two weeks into the next listing. That’s right; they effectively had the house listed twice at this point…

July 27th, 2024, the house was listed for sale for $2,689,900.

Once again, no offer date.

August 2nd, 2024, the price is decreased to $2,499,900.

August 3rd, 2024, the price is increased to $2,689,900.

August 4th, 2024, the price is increased to $3,500,000.

August 5th, 2024, the listing is terminated.

Are you getting angry yet? Because I am.

Maybe you don’t agree, but I consider real estate to be a profession filled with professionals.

Behaviour like this gives us all a bad name.

It’s unprofessional. It’s wrong. And it’s pathetic.

August 6th, 2024, the house is listed for sale for $2,698,800.

September 18th, 2024, the price is increased to $3,500,000.

September 18th, 2024, the listing is terminated.

September 18th, 2024, the property is listed for sale for $2,398,800.

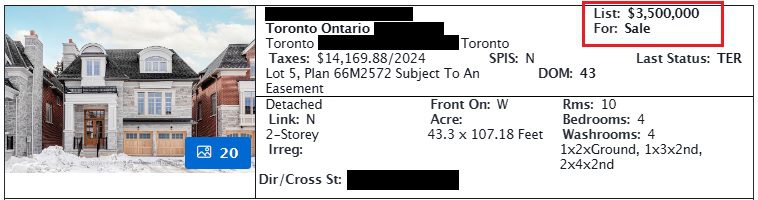

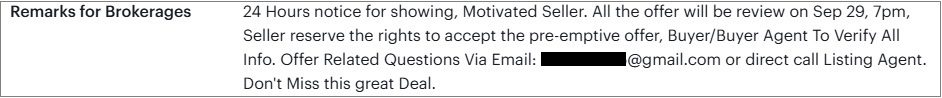

This time, an offer date is set:

Uh-Huh.

“All the offer,” you say? As in all of them? Like so many?

Because this property is so in-demand? Because you’re going to be flooded with offers?

Oh, and you’re also specifying you have the right to accept pre-emptive offers. Got it.

September 23rd, 2024, the price is increased to $3,500,000.

September 28th, 2024, the price is decreased to $2,398,000.

October 21st, 2024, the price is increased to $3,500,000.

October 21st, 2024, the listing is terminated.

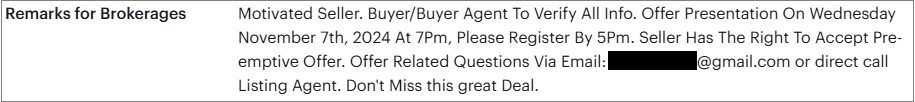

October 21st, 2024, the property is listed for sale for $2,398,000.

And guess what?

There’s an offer date.

Sigh.

I’m not sure what bothers me about this the most.

Is it the cluelessness?

Is it the stupidity?

Is it the steady line of real estate agents (four and counting…) who are willing to play this game, and who won’t stand up to a seller’s ridiculous demands?

Is it the manipulation of the MLS system?

Or is it the fact that I hold myself and those around me to a higher standard, and I can’t make sense of something like this when it happens?

I suppose it’s a combination of all of the above, but there’s another part about this that bothers me:

There aren’t any rules that prohibit this behaviour.

As a listing agent, you have a fiduciary duty to your seller. If your seller instructs you to enact this “strategy,” you can’t exactly say no.

And as for the rules that govern the MLS system, I have long maintained that it should be considered “false advertising” to list a property for a price that you’re not willing to accept – unless you have an offer date set, that indicates this is essentially a ‘starting bid.’

Over the years, real estate broker-owners have disagreed with me, and many TRB readers have argued that simply “setting an offer date” doesn’t significantly alter the implications of under-pricing.

But it does.

If you list a house for $999,900 and write in the MLS listing, “Offers Reviewed On Monday, October 27th,” then we know the format of this listing; the property is, at least potentially, under-listed and the seller is going to consider offers at that date.

If you list a house for $999,900, with no offer date specified, and the property has been on the market for 88 days, then the public is led to believe that this $999,900 list price is acceptable to the seller.

So when it’s not acceptable to the seller, in that case, I believe we have blatant false advertising.

In the case of the property we’re analyzing today, the were multiple listings, at multiple times, for months where this property was listed at a price that the seller wouldn’t accept.

The price was moved up-and-down like a yo-yo, sometimes 4-5 times per week.

And yet nothing about these collective listings seem to be problematic, otherwise, I would think that TRREB or RECO would have done something about it.

So why is this the worst example of a ridiculous listing strategy that I’ve ever seen?

- 11 listings

- 39 prices

- 8 offer dates

- 4 listing brokerages

- 592 days and counting

If you can find a better (ie. worse) example, you where to find me.

Happy Monday, folks!

Vancouver Keith

at 2:10 pm

Back in the mists of time, you wrote a story about a condo listing with a price of $1.00. When I read the headline, I thought maybe there was 99 cent or lower listing.

As for the multiple listings, if the seller trusts neither the agent or the market, this is the result. Hopefully they are saved next year by falling interest rates, and a professional agent.

Derek

at 4:54 pm

Looks like maybe a developer built a whole cul-de-sac there. Can get $4 M for them next year so all’s well that ends well.

Derek

at 12:35 pm

It also looks like 4 of the similar and neighbouring homes sold in 2021, in the ballpark of $3M . Are these homes “worth” more now? [Again, obviously they are getting over $4M in the new year]

J

at 10:38 pm

A nearly identical home across the street sold for $2.9M in Feb. 2024.

David Fleming

at 10:31 pm

@ Derek

😂😂😂

At least $4M. Should be $5M by summer though…

Derek

at 11:10 pm

Too far! You’ve taken it too far! 😝

On a serious note I am super excited as a decent looking home in my area, just listed by one of the prominent neighbourhood brokerages, is holding offers for next week!! Must bode well for the current situation. How the turntables.

poy

at 11:54 am

curious to see what the FINAL sale price will be on this one. keep us posted.

lol

Sirgruper

at 9:01 am

David. Was always curious why you can’t identify the property by address but you can give the legal description that clearly identifies the property on a plan that anyone can see. And you can show the picture. Just seems like a strange rule. Can you describe a property as between 2 and 6 Maple Street?

David Fleming

at 10:30 pm

@ Sigruper

It’s not a hard and fast rule.

As you can see from my blog topics, there’s a lot of awful behaviour in our industry.

But I am trying to avoid breaking three RECO rules:

1) Disparaging a competitor.

2) Disparaging a competitor’s listing.

3) Unauthorized advertising.

By blacking out addresses and contact information, and often changing “he” to “she” in my stories, or “west” to “east,” I have plausible deniability.

You are correct though – anybody can spend ten minutes investigating and find the address. But I would argue (where, when, why, and in front of whom??) that if somebody has to jump through hoops to find out what property I’m talking about then, I’m not DIRECTLY advertising that property, or disparaging that property.

Every day, the bar in our industry is raised by many, and lowered by many more. There are egregious rules being broken every day, but “two wrongs don’t make a right.”

Sirgruper

at 11:41 pm

Good points. Thanks.

Peter Dewar

at 6:56 pm

David, why would an agent take this on? They can see the history and would know that it isn’t gonna sell…so why accept the listing? Doesn’t listing cost you money???

Marie

at 4:36 pm

Love this example of a ridiculous MLS price ride! All those listing agents should be embarrassed to be Realtors.

You are quite right that BS like this should be stifled by TRREB.

LucasJ

at 10:41 am

Looks like this listing finally sold.. For 2.45M!

ECK

at 10:14 am

This is really bizarro. It smells like there is something nefarious behind this… some want to be real estate agent playing around? A bet or a weird article in the making. Skill testing question – how many ‘docusigned signatures’ did the seller have to make?