Do you know how I choose the top five real estate stories of the year?

It’s hardly an exact science, if I’m being honest.

It’s impossible to label something a “top story” without being subjective, and depending on whether you’re working inside the real estate market or standing on the outside looking in, you might have a completely different opinion of what’s important and what’s not.

But is “important” the right word?

What about impactful? Does that make something worthy of a “top story” billing?

How about controversial? Or sensational? We live in a world where there are always ten different versions of a blinking light, vying for our attention and interest, so perhaps something needs to be sensational in order for it to be important or noteworthy?

The truth is, in choosing the “top stories” for the year, I try to eliminate the subjectivity by not thinking about a list first.

The first thing I do is head to the Toronto Realty Blog archives and go through each blog post, one by one, from the start of the year, and categorize each of them.

Ignoring the regular features (monthly TRREB stats update, quarterly condo stats update, quarterly rental market update), I take the titles of the remaining blog posts and try to find commonalities or “categories” for them. When I’m done, I might have ten or fifteen categories, and some categories might have eight blog posts, whereas some categories might only have one.

Coming into every week, month, or year, I don’t plan what to write. I write what comes to me. I write what’s happening in the market.

So when I sit down to take stock of a year’s worth of blog posts, I never know which categories are going to have the most blog posts.

As a result, I’m essentially told by the spreadsheet in front of me what the “top stories” of the year were.

Of course, this often results in some of the same topics being repeated at year’s end…

Top Five: Real Estate Stories of 2024:

5) The Death Of Pre-Construction Condos

4) The Role Of Investors

3) Sales

2) The Government’s Impact On The Real Estate Market

1) Pricing And “Strategies” In A Changing Market

Top Five: Real Estate Stories Of 2023:

5) Condos, Development & Pre-Construction

4) Changing Business Practices Amid A Changing Market

3) Landlords & Tenants

2) Pricing

1) The Future Of Housing In Toronto

Top Five Real Estate Stories Of 2022:

5) The Rental Market & The Future Of Landlords’ Rights

4) Development: Yes or No?

3) The Market Shift

2) “Fixing” The Housing Market

1) Inflation & Interest Rates

Okay, so there’s definitely some overlap!

But many of the same topics are going to remain hot-button issues, right?

And if the same person is authoring the posts, surely there are themes that will be explored over and over. See #4 on today’s list as a great example! 😉

So in the spirit of brevity, and in the interest of time, let me get to the list!

5) Landlords, Tenants, & The Rental Market

Ah, yes, of course!

Call this one “Old Faithful” if you want to, but rest assured, this will always be a hot topic in the city of Toronto.

Having made the list, in one way or another, in both 2022 and 2023, this topic became a major theme here on TRB in 2025.

This seems to be one of those topics or issues in the world today where there are two “sides” and both sides believe, emphatically, passionately, and unequivocally, that they’re right.

Landlords believe that the system is completely screwed up and that tenants have all the power; so much power, in fact, that investors are leaving the rental space entirely!

Tenants believe that the system doesn’t protect them, their interests, and their rights, and that landlords have it so good that the government needs to further extend protections.

How can both sides be so far to the extreme?

Well, isn’t that a microcosm of the world we live in today?

We live in a “heads or tails” world, since it’s impossible to land a coin on its edge. There’s just zero compromise.

I always look at American politics for that “divide.” There are two parties, and they have opposite and contradictory views, but both sides vehemently believe they’re right, and the other side is bat-shit crazy.

I did an interview for the BBC last week, and one of the things I was talking about was this “divide” in our city. On the one hand, you’ve got people who argue we need more roads, highways, and solutions to gridlock, and on the other hand, you’ve got people advocating for tearing down the “unsightly” Gardiner Expressway so we can have street vendors selling ice cream on the side of the road.

You can extend this divide to the country as well, but I won’t get into politics (and pipelines…) today.

Nowhere in our real estate market do I see a larger divide than the sides taken by landlords and tenants, respectively. Both sides are clamouring for “more rights,” but in what is essentially a zero-sum game, if one side gets more, then the other side gets less.

I started the year by writing about the perils of pre-construction condominium buyers who are provided “occupancy” by their developer, but who might not be able to rent out their unit to help cover the occupancy fees.

February 20th, 2025, I wrote: “Can Your Condo Developer Stop You From Leasing Your Unit?”

Yes, absolutely they can!

And before pre-construction buyers start to complain, I would advise them to get in a time machine and go back to when they bought the condo, and perhaps read the agreement that they signed.

Ignorance cannot be an excuse for everything in life, and while that is rather en vogue, I can’t sympathize with the folks who are being strong-armed by developers.

I don’t have statistics on this, but I would suggest that a lot of pre-construction buyers decide not to hire a lawyer to review their Agreement of Purchase & Sale during the mandatory “10-day cooling off period.” Why spend $3,000 on a lawyer when you can simply make assumptions about what’s in the contract, right? Then come up for air five years later and learn that the developer can stop you from leasing your condo during occupancy. Have fun eating those monthly fees for eight, twelve, or sixteen months!

As the year went on, I started to question whether the overall “quality” of today’s tenants is declining.

March 24th, 2025, I wrote: “Which Tenant “Qualifications” Are Realistic In 2025?”

This post was as sarcastic as it was cynical, but above all, it was true.

In the blog, I offered that today’s tenants should:

1) Have a job.

2) Have a credit history.

3) Have a reasonable number of occupants for the space.

4) Have identification.

5) Have a reasonable GDS ratio.

6) Not have their wages garnished, or have hired a debt consolidation company.

While this might seem like common sense to you, it’s anything but logical and reasonable to today’s tenant pool. In the blog post, I shared recent examples of tenants submitting offers to landlords when they aren’t adhering to items on that list.

The Toronto rental market was a wild ride in 2025!

It can’t get any worse, right?

Think again!

May 1st, 2025, I wrote: “Snookered: How A Toronto Tenant Can Get The Landlord Sued!”

This blog post got made the rounds in the landlord and legal communities, as I received close to a dozen emails from private individuals wanting to know more.

Imagine your tenant gives you legal notice to vacate, then you lease the condo to a new tenant, but the original tenant changes their mind?

You’re completely snookered! And worse is that the new tenant can sue you for breach of contract.

Speaking of “tenants behaving badly,” what if a tenant provides first-and-last month’s rent, but then refuses to take occupancy?

This happened to a client of mine in the summer!

August 11th, 2025, I wrote: “What Happens When A Tenant Refuses To Close?”

We bargained hard, and fortunately, came out ahead on this one. But I’m going to speculate that not everybody in this situation is able to break even, and the law is most certainly not on the landlords’ side.

In the fall, I put together an amalgamation of tales about the insanity of working with “leasing agents” in 2025.

October 16th, 2025, I wrote: “Tales From The Toronto Rental Market Trenches”

This is one of those blog posts that makes agents complain, “David, you’re not helping to change public opinion about real estate agents! Why are you putting all these stories in a public forum for all to read?”

Um, you should be asking, “Why not?”

Things don’t get better when you bury them under the rug, right?

But the point to this story is simply that the poor actions of real estate leasing agents are a symptom of the overall disease. Our rental market is an absolute mess, and tenants and landlords alike need to proceed with more caution than ever before.

Perhaps the most important part of the “Landlord & Tenant” story in 2025 was the Ontario government’s introduction of controversial Bill 60, which was withdrawn mere days after it was announced.

November 6th, 2025, I wrote: “Protecting Tenants & Supporting Landlords: The Impossible Contradiction”

In a true “zero-sum game,” there’s no way to help one side without hurting the other.

One of my biggest pet peeves is when people point out problems without offering any solutions, but I’m simply out of ideas on this one, folks. There’s no way to fix a system if people won’t admit it’s broken, and when you have two sides pulling so hard in other directions, there’s never going to be a middle ground.

I believe that investors will start entering the real estate market again in 2026, and as a result, that’s only going to add fuel to the fire for our #5 story in 2025, which will likely be on our list again in 2026…

4) How Public Policy Shapes The Housing Market

This will probably be on our list every year.

Forever.

Amen.

I suppose there are a lot of industries where you could suggest that public policy has, does, and always will have a massive impact on how that industry grows, but when it comes to the real estate market, the impact is only getting larger and larger.

It’s not just a direct impact, either, such as the Bank of Canada setting an interest rate policy, but rather even the subtle nuances of governing are going to have a ripple effect.

On the front cover of the Toronto Star on Saturday was a story about how the 2021 removal of the east section of the Gardiner Expressway has caused gridlock and mayhem across the city. When this was being discussed a decade ago, I said it was an awful idea, and that the absurd “studies” showing that commute times would only increase by 2-3 minutes would prove comical.

This is merely one example of how municipal public policy can shape the housing market, since it’s affecting the lives of everybody who lives on the east side of Toronto, with some deciding to move as a result.

These are policies that indirectly affect the housing market, and there are hundreds of them, if not thousands of them. When we get to policies that directly affect the housing market, it’s a whole other ball game…

Of all the stories that came out of 2025, here’s the one that got my blood boiling the most:

February 17th, 2025, I wrote: “Do “Speculation Taxes” Actually Target Speculators?”

For two decades, the government turned a blind eye to foreign money buying up Canadian real estate and using the country as a safety deposit box. As governments are never proactive, and always reactive, the federal government introduced a slew of measures aimed at “cooling the housing market” or “restoring affordability” that do nothing of the sort, and in fact, set our country’s economy back.

In the blog post noted above, I told the story of a family moving from the United States who had extremely sought-after skill sets that our country desperately needs, but who couldn’t buy a house here because they would be forced to pay the “Non-Resident Speculation Tax.”

It was absurd.

I remember my client saying to me, “How in the world can the government label me a ‘speculator?’ I’m moving here with my entire family, who are enrolled in school, and my husband and I were recruited by the very government that is now prohibiting us from buying a home?”

Canadian public policy: fails again!

This is how our government is run, folks. We constantly introduce legislation that sounds great when you announce it in front of a podium, but in reality, has unintended consequences that harm the economy.

I won’t say what industry my clients were a part of, but I will say that three other couples who were recruited to move to Canada decided not to because they couldn’t purchase a home.

“Speculators.”

What a joke.

Speaking of jokes…

April 28th, 2025, I wrote: “What Would Help Buyers More: Eliminating GST Or Land Transfer Tax?”

Who would have thought that only six months later, our esteemed Mayor, Olivia Chow, would decide to increase the land transfer tax yet again!

Don’t worry, it only affects 2% of Torontonians, and that’s just how politics work. This slow creep will continue until one day, somebody knocks on your front door and says, “Hello, I’m here from the government. We heard that you have two televisions, and there’s a family that doesn’t have any. So we’re here to take one of yours…”

Eliminating HST on new builds, or for first-time buyers, or both, would really help people get into the housing market. But eliminating the land transfer tax would help even more.

Halfway through the year, we started to see all this media about the government “helping home prices to fall.”

May 26th, 2025, I wrote: “Monday Morning Quarterback: Should The Government Make Home Prices Fall?”

Huh? What?

Now we’re entering a whole other level of insanity!

As I wrote on my blog:

When, in the history of modern civilization, has a country’s government deliberately tanked the value of existing homes by 30% and had this lead to economic prosperity?

Never.

But our government doesn’t seem interested in helping everybody in the country move upwards or onwards, but rather, bringing those higher up, down to the middle or the bottom, with everybody else.

It’s a recipe for disaster, but that’s what socialism is. Don’t waste time trying to help people do better. Spend your time telling them to tear others down.

We all know that the pre-construction condominium market has disappeared into the ether, and midway through the year, developers started to suggest that the government should get involved.

August 14th, 2025, I wrote: “Should The Government Intervene In The “New Home Sales” Market?”

No.

The short answer is “no.”

The government could get involved, perhaps by eliminating HST on new-builds, or removing land transfer tax, as we discussed above. But a market is a market. And a free market operates, in theory, as it should. I can’t see any real way that the government could “help” here, and while 35.6% of the cost of a new unit of housing is made up of some form of taxes, to reduce that amount would simply mean introducing an equal amount somewhere else.

I mean, we could cut spending, right?

(glass shatters as somebody throws a dish at David’s head)

Sorry. Bad suggestion.

Here’s another story that really got my blood boiling:

October 2nd, 2025, I wrote: “Australia Proposes “Spare Bedroom Tax”; Will Other Countries Follow?”

This was a real suggestion, folks! I even included a video clip from the Australian parliament!

We’ve heard rumblings here in Canada about similar ideas, from those who believe it’s not “fair” that a 76-year-old is “allowed” to live in a four-bedroom house all alone. Never mind the fact that this individual worked, paid taxes, and that real property comes with “fee simple” ownership, which gives the owner absolute and indefinite rights.

Is 2026 the year that we start kicking old people out of their houses?

Of course not! We would never do that!

But we could just tax them to the point where they’re forced to sell…

Toward the end of the year, we started to hear a lot and talk even more about the role of government in building new homes.

November 3rd, 2025, I wrote: “Who’s Going To Build Homes: Home-Builders Or The Government?”

Um, home builders. Obviously.

Oh, wait, did Prime Minister Mark Carney just dedicate $13 Billion to building something like 4,000 factory-built homes?

I can’t wait to meet those lucky lottery-winners!

But then again, is there any guarantee that a “promise” made in front of a podium turns into anything in reality?

We explored that idea in yet another blog post.

November 24th, 2025, I wrote: “Did The Federal Government Change Course On Housing Promises?”

Our federal government promised to get Canada building 500,000 homes per year within a decade, which can only result in one thing going through your mind:

But thankfully, or regretably (because I honestly don’t know…), the government has started to walk that promise back.

It’s regrettable because politicians constantly fail to deliver on promises, but it’s thankful because it means they’re not going to lie to us anymore.

Pick your poison.

As with #5 on our list this year, there’s no doubt that #4 could remain on our list every year from here on out…

3) The Worst Condo Market Toronto Has Seen Since The 1990’s

Are you exhausted from reading points #5 and #4?

Shall I simply sum this one up quick-fast?

The Toronto condo market sucks.

(end scene)

Alright, on second thought, perhaps we can flesh this topic out a little bit?

But first and foremost, we need to make a very important distinction:

The “condominium market” needs to be divided into two extremely different categories:

1) pre-construction condominiums

2) resale condominiums

Don’t get me wrong, both segments of the condo market have been hit extremely hard, but the pre-construction condominium segment has been absolutely eviscerated, and yet throughout 2025, the mainstream media failed to distinguish between the two types.

We all saw the pre-construction collapse coming, right?

(everybody nods in agreement)

Except, all those real estate agents selling pre-con up until 2022 didn’t. Or they did, and they just didn’t care. And all those buyers; those “investors” who thought paying $1,700 per square foot for pre-construction, when resale next door was selling for $1,200 per square foot – where are they now?

We all know what happened with pre-con.

But the 2025 resale market was an absolute slog.

March 17th, 2025, I wrote: “2025’s Best Oxymoron: Condo Offer Dates”

I was in Florida on vacation with my family when I wrote this, and I remember spending hours and hours downloading data from our MLS system so I could analyze the “success rate” of condominiums being sold with “offer dates.”

Simply put, the idea of listing any Toronto condo at an artificially low price, and “holding back” offers for a set date, was absurd. This worked in 2022, but to think this was a good idea in 2025 was a fool’s errand.

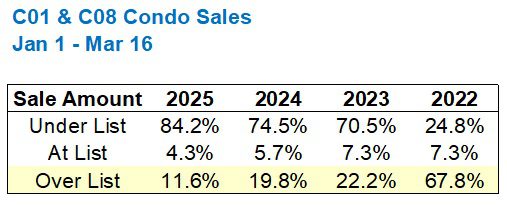

Here’s a summary of the stats on offer dates for condos:

And this was only up to March 16th, as that was when I started to download and analyze the data.

The Toronto condo market only got worse, and I would imagine that 11.6% figure is far lower now that we’re approaching the end of the year.

I didn’t extend this back to 2021 (my children probably wanted me to actually play with them on vacation…) but I would bet that the percentage of condos selling over the list price in 2021 was closer to 80%.

That was the market before we peaked.

But in 2025? What a silly notion to list a condo with an offer date!

By the spring, we started to feel the effects of the pre-construction fallout:

April 3rd, 2025, I wrote: “Developers Suing Pre-Construction Buyers: Who Is To Blame?”

Oh, what a headline!

Spoiler alert: I blame the buyers.

Not because I side with developers, but because when it’s the law to put on your seatbelt, and you get hurt in a car accident because you didn’t put on a seatbelt, you have nobody to blame but yourself.

While this was the first time we heard about developers suing buyers who refused to close on their pre-construction condos, I suspect it won’t be the last! This will be an interesting story as we plow through 2026 and those condos that were sold from 2018 – 2022 approach completion.

For those condos that were built, I had a fun time analyzing the “assignments” that were up for sale in 2025.

April 21st, 2025, I wrote: “The Toronto Condo Assignment Market Is Shocking!”

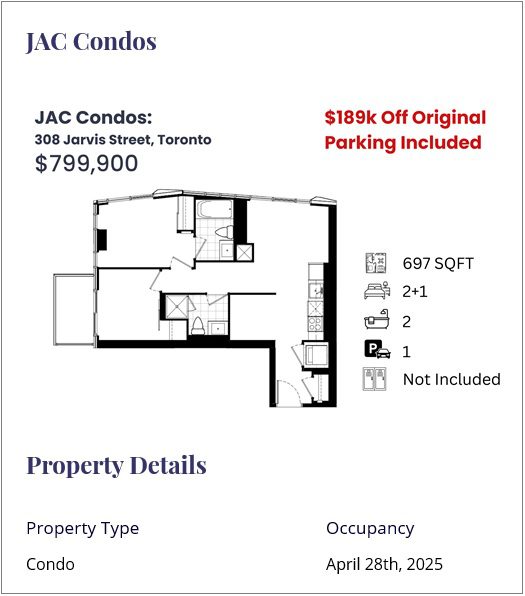

I also had fun with this marketing strategy:

Way to put a positive on a negative, right?

“HOT distress!”

But this is what the assignment market has devolved into:

These pre-construction condo “investors” are offering $189,000 off the price they paid!

Except, $799,900 for 697 square feet is still way too much, as I wrote in the blog post.

May 12th, 2025: I wrote: “The Condo Market Strategy That Is NOT Going To Work In 2025”

This was only two months after I wrote the first blog about condo “offer dates,” which meant one thing for certain:

Clueless listing agents and gleefully ignorant condo sellers were not reading my blog.

How else can you explain it?

And if we wanted to tie a nice, pretty, red bow on the topic of “all things condos,” there is a reason why our condominium market has experienced an untimely demise.

September 20th, 2025, I wrote: “The Cost To Build A Home In Canada Is Up 58% Since 2020”

Wow, what a headline!

Refer to point #2 in today’s blog if you want to know why, but I digress…

But despite all this talk of the “worst condo market we’ve seen since the 1990’s,” how much is the average 416 condominium down in price, on average?

14.7%

What? That’s it?

Well, the average 416 condo in February of 2022 was $822,090, and in November of 2025, it was $701,259.

That’s 14.7%.

You would think that with all this “worst condo market” talk, prices would be down 20%, 30%, or 40%.

Nope.

Just a “wee bit.”

Raise your hand if you think the average condo price in November of 2025 will be higher than $701,259?

Raise your hand if you think it won’t…

2) Working With Agents In 2025

One of the most difficult parts of navigating the real estate industry in 2025 was simply working with my “colleagues” on the other side of the transaction.

Any industry has its better and worse participants, and whether you want to talk about lawyers, accountants, financial advisors, or auto mechanics, there are bound to be individuals therein who are more qualified, experienced, knowledgeable, and professional, and there are most certainly individuals who will be less.

I’ve written about this on TRB essentially since the blog’s inception in 2007.

But 2025 felt like something altogether different.

It was like years previous, with similar issues and challenges, but it was just more intense.

In my opinion, the source of these difficulties can be linked back to three major pillars:

1) Agent inexperience.

2) Agent indifference or desperation.

3) Seller pricing expectations.

Notice how two of the three have to do with agents?

We’re in a declining market, and an overwhelming percentage of real estate agents have never seen anything like this. As a result, they have no idea what to do.

Many agents are simply indifferent. Indifferent toward the market, indifferent toward their clients, indifferent toward rules and regulations, and that often leads to a certain type of desperation. A desperate real estate agent is dangerous, and yet buyers and sellers continue to hire these individuals at will.

Lastly, in a market that has declined since our 2022 peak, many real estate agents don’t know how to explain this to their seller clients, and as a result, they expect the market to rescue them.

Let’s say that a house in the 905 was selling for $600,000 in 2018. By 2022, that same house was selling for $1,200,000.

Now, let’s say that this house is worth $900,000 today.

A listing agent who is inexperienced, indifferent, and desperate will happily take that listing at $1,149,000 and simply think, “I’ve got a listing. That’s the first step toward making a sale!”

But it’s not.

The first step is education. Pricing, analysis, market knowledge, and market reality.

That listing agent hopes/wishes/expects a buyer agent to come along and rescue him, by providing an offer that’s 125% of fair market value.

April 14th, 2025, I wrote: “How Not To Sell Real Estate In 2025”

This post was extra sarcastic (for a change), and I offered the following points for discussion:

1) Define “market value.”

2) What year is it?

3) You can’t spell “misrepresentation” without “representation.”

The first two points speak to the theme about pricing and real estate agents not being able to deal with seller expectations.

By spring, I was starting to notice that listing agents and sellers were shooting themselves in the foot by trying to sell in a difficult market but making it even more difficult with their actions when it comes to property viewings.

May 15th, 2025, I wrote: “Maximum Exposure Is Essential In Today’s Market!”

I offered the following examples of listing agents, for some reason, making it much harder to show properties in 2025:

1) Delaying the commencement of showings.

2) Showings on tenanted properties.

3) Restrictions on showings at all, any time, in a down market.

4) “Seller/Agent” to confirm all showings.”

5) No “double bookings.”

6) “Listing agent to be present for all viewings.”

Two weeks later, I told the first of many stories about an absolutely clueless listing agent who was greedy, stupid, and ultimately unsuccessful:

May 29th, 2025, I wrote: “Dear Listing Agents: Will You Bite The Hand That Feeds You?”

There were so many stories like this one in 2025!

It’s like winning the lottery and then telling OLG, “This isn’t enough.”

Here’s another one:

June 12th, 2025, I wrote: “Here’s Why Sales Are Being Lost In 2025!”

This is a fantastic example of sellers not understanding leverage.

In a market segment, whether it’s geographic, price point, or property type, where there is exceedingly more supply than demand, the seller needs to understand that he or she has no leverage. The seller needs to be gracious, cooperative, and collaborative with the buyer and the buyer agent in order to get a deal done.

But that’s not what happened in 2025.

More often than not, deals were lost because of seller ignorance, arrogance, greed, or poor advice from the “professional” whom they hired.

Listing agents were so afraid to tell their seller clients what was actually happening in the market for fear of the sellers reacting poorly, and the agent losing the listing.

June 23rd, 2025, I wrote: “Rookie Mistake!”

This is a very sad story.

It’s sad because the buyer agent in the tale is completely inexperienced, clueless, and useless, which I would expect from an agent who works part-time for a discount firm. But it’s even more sad because the agent in the story completely screwed his or her buyer client.

July 24th, 2025, I wrote: “What Does “Buying The Listing” Mean?”

Speaking of over-pricing!

Some listing agents do it as a strategy!

Think about it: your business model is to tell every seller who interviews you that the house is worth more than it actually is, thereby winning some sort of unofficial auction held by a seller who’s going to list with the agent who promises the highest price. Then, you simply sit on all these listings like aged cheddar. List, wait, reduce, wait, reduce, reduce, wait, wait, and eleven months later, maybe you get a sale!

This is the business model of many real estate agents out there. Their budget for every listing is approximately $0.00.

I’ve talked to agents like this before. It blows my mind!

And the incredible thing is: many of the sellers who hire these agents don’t realize who they’re hiring, and maybe never do.

Interactions with agents in 2025 were tough, to say the least. Some agents just “don’t get it,” if you know what I mean.

September 11th, 2025, I wrote: “Reading The Room: A Forgotten Skill”

The agent in this story might have been experienced, might have had high-end clientele, and might have been a rocket scientist, but she just didn’t get it. There was no tact, no diplomacy, no discretion, and dare I say, no class.

In a story like this one, where a buyer agent tries to bulldoze two young sellers who inherited their late parents’ house, you really get a feel for just how clueless some people can be out there.

Speaking of clueless…

September 18th, 2025, I wrote: “Is This Your Absolute Best And Final Offer?”

For those parents out there, I’m sure you could read this story and wonder, “Were these adults or were they children?”

It’s like asking a child with chocolate around his mouth and crumbs on his hands, “Did you take the cookie from the cookie jar?” The child looks at you with a straight face and says, “Of course not!”

In this story, I lamented a sale where I was working with two competing buyer agents, and after explicitly explaining that we would take the highest offer, no matter what, no second chances, one of the agents came back with a, “Hey, that’s not fair!”

Last, but not least, I put most of my fall “pet peeves” into one single blog post a couple of weeks ago.

November 27th, 2025, I wrote: “Recent Real Estate Pet Peeves: Fall 2025 Edition”

This was more of a “quantity over quality,” but it still drove the point home.

In fact, all of these above blog posts drove the point home!

2025 was an absolute nightmare year when it came to dealing with other licensed real estate agents, and I’m of the firm opinion that this had a huge effect on sales, or rather, the lack thereof…

1) Navigating A Changing Market

Well, this is pretty darn close to the #1 real estate story of 2024, isn’t it?

The titles sound the same, and perhaps the context is as well. But whereas in 2024, we were talking a lot more about pricing in a changing market, as well as listing strategies, in 2025, there were a lot more discussions about market participants and business practices.

Some of the topics we explored were exceptionally timely, or dare I say, more important now than ever before.

February 24th, 2025, I wrote: “Mission Impossible: Accepting Less Than You Had Previously Turned Down!”

See what I mean by, “more important now than ever before?”

I can’t tell you how big a topic this was in 2025.

I will admit: this happened to our clients twice this year.

We listed a condo for sale in April for $899,900, and we received an offer of $820,000. We signed it back for $875,000, and the buyer walked away.

Whether that buyer was serious or not, we’ll never know.

But after reducing to $874,900, then reducing to $849,900, we ended up with an offer of $770,000 after five months on the market.

We worked with that offer, got the buyer up to $810,000, and sold the unit.

That was $10,000 less than the offer we had previously received, but alas, that was five months prior!

Hindsight is 20/20, and while you can easily say, “David, you guys should have taken the $820,000 offer,” you can’t ignore that this offer was submitted when we were priced at $899,900, and we had only been on the market for two weeks. We signed the offer back, and the buyer walked away.

In the other case, my clients sold a house for $2,000,000, but they had received a much higher offer previously.

They listed with another broker in early 2023 for $2,595,000. By the summer of 2023, they received an offer of $2,200,000, and appalled by the “lowball,” they took the property off the market.

I listed the property for sale in 2025, and the market had declined since it was listed in 2023.

They knew this, and they were okay with it. When we sold for $2,200,000 in the summer of 2025, they said, “Well, you win some, you lose some. We should have taken the offer in 2023, but woulda, coulda, shoulda.”

They’re moving to an area of the Golden Horseshoe where prices have declined substantially, so ironically, they’re going to come out ahead.

Back to the condo market for a moment…

March 10th, 2025, I wrote: “What Is A “Blanket Appraisal” And Why Is This Problematic?”

Oh, it’s problematic! Let’s work through a hypothetical example to explain what’s going on.

Let’s say that pre-construction condos are being sold in 2019 for $700,000. These condos wouldn’t actually be worth $700,000 in 2019, of course, since pre-construction condos have always been sold at a premium.

Now, let’s say a major bank like RBC provides a “blanket appraisal” on the condos and magically pre-approves every buyer, even though the bank has no clue if these buyers will be gainfully employed in 2025 when the condos are ready.

Then the market declines!

In 2025, these condos are probably worth around $580,000.

So does RBC appraise the condos at $580,000 when it comes time for buyers to close?

Nope.

RBC appraises them at the $700,000 that was contracted back in 2019.

How this is legal, I have no idea. And in the blog post above, I described how these actions seem to circumvent the Bank Act.

There was no shortage of conversations about market value in 2025.

Case in point…

March 20th, 2025, I wrote: “Defining “Market Value: All The Rage In 2025!”

In this blog post, I showed how “you can make numbers say anything you want,” but only to a point. You could use a variety of different market indexes or averages, such as the Home Price Index, the GTA average, the 416 average, the detached or condominium average, etc. But at some point, you run out of numbers to try to justify the price you want, and this is what so many sellers are missing these days.

Now, back to new business practices!

Or should I say, back to old business practices?

July 10th, 2025, I wrote: “Buying A Home That’s Sold Conditionally – With An Escape Clause!”

There’s a generation of agents out there who have no clue what an “escape clause” is.

This is certainly more prevalent outside the 416, but even when the market was ripping, you would never see somebody look to buy a home that’s already sold conditionally and intentionally trigger that escape clause.

But in 2025?

Sure, why not?

As the blog post detailed, we used this to our advantage and basically stole a house right out from under another buyer!

October 9th, 2025, I wrote: “What Is A “Reverse Offer?””

This is yet another example of “what’s old is new again,” and in this blog post, I detailed the story of one of our sellers who finally “bit the bullet” and sent a reverse offer (seller to buyer), which was accepted.

It was genius!

In fact, I’m convinced that had our seller not taken this aggressive approach, his condo would still be listed for sale.

Last, but not least, we had discussions about how the market has changed across the country, and not just in Toronto.

October 27th, 2025, I wrote: “Canadian Real Estate Landscape: A Year-Over-Year Look”

Would it surprise you to know that Ontario has been hit harder than any other province over the last twelve months?

In fact, everything in Atlantic Canada and Quebec is up in price, while everything in Alberta, Saskatchewan, and Manitoba is up, save for Calgary.

Ontario has been absolutely hammered!

So when we talk about “navigating a changing market,” don’t underestimate just how hard it is for property sellers here in Toronto to acknowledge that their home is worth less today than it was one year ago, but somebody in Quebec City, Moncton, or St. John’s has seen their property value rise significantly.

This year was very, very tough on all market participants, but I feel that those who were able to persevere will be stronger down the line.

There were many casualties along the way – sellers, investors, agents, and brokerages.

I expect 2026 to be tough as well, but not quite like 2025.

Alright, that’s a wrap!

My apologies for hitting 6K+ on the word count today, but how else am I supposed to explain the “Top Five Real Estate Stories of 2025?”

If you want bullet points, you’re in the wrong place!

If you have any ideas for stories that should have been included on this list, I’m all ears!

Derek

at 9:41 am

Ipro Realty was otherwise a pretty big story, but I guess not by your metrics for this list.

David Fleming

at 9:42 am

@ Derek

You’re totally right, I probably should have included this.

Serge

at 11:55 am

Thanks for publishing it, David. There has been a lot of fun and illuminating information. Happy… say, safely, New Year and other holidays!

hoob

at 8:53 am

I’m curious if David has loaded his entire back catalog of blog posts into NotebookLM and is able to ask his catalog questions for this sort of thing.

Serge

at 9:15 am

Huh. Why not directly to ChatGPT?

hoob

at 1:59 pm

Whatever the notebookLM equivalent is with chatgpt is would likely work as well (contextualized deep research grounded with a specific curated data set) but in this space most people are most familiar with NotebookLM.

David Fleming

at 9:43 am

I have never heard of notebookLM.

HOWEVER, did I ever tell you guys that I was downloading MP3’s on Napster in September of 1998?

Freakin’ tech genius over here!

Graham (the real deal one)

at 3:11 pm

You’re probably still downloading MP3s on Napster in 2025. But were you on Usenet and IRC in the 90s. The real Friday night lights. Modem lights.

David Fleming

at 9:45 pm

@ Graham

Actually, I only moved from MP3’s on iTunes over to Spotify in like 2021.

I was obsessed with “collecting” MP3’s.

I didn’t want to listen to “somebody else’s” music, and I wanted all my songs, and my playlists.

Then I realized I was absolutely insane, and that I was out of date by at least a decade. That was a real wake-up call.

But back to the 1990’s…

Before Napster was invented, I used a program called “Scour.” That was the first platform I ever used to download MP3’s.

I played them on “Winamp.”

The first MP3 I ever downloaded?

Any guesses?

Ghetto Superstar.

It took 33 minutes to download a 3.5 MB song on my 28.8kb modem…