September.

Labour Day.

Where do we begin?

Let me crack my knuckles, take a sip of my coffee, and lay my fingers on the “home row” of the keyboard.

What do you think, folks? Shall we dive right in, or do we need to dip our toes into the water first, submerge the ankles, get in past the calves, and then let out a scream when we pass waist-level?

Here’s an easy place to start. It’s with a really, really random question that has absolutely nothing to do with real estate, nor is it in any way seasonally appropriate:

At what age did your children stop believing in Santa Claus?

I told you it was random!

But for those of you who sent children back to school on Tuesday morning, you’ll probably understand. They’re only two months older than they were in June, and yet it feels like another year has passed us all by. It seems like only yesterday that we took the picture of them on the front porch, or at the doorway, or standing in front of the school.

My daughter just started grade four.

And for the life of me, I don’t know why or how she still believes in Santa Claus.

I wouldn’t change a thing, however. In fact, when the day comes that she no longer believes in Santa Claus, I’m going to cry. I’ve probably already cried just thinking about it.

It’s a blessing and a curse, of course.

On the one hand, the excitement, mystique, and belief associated with Santa Claus is a level of childhood innocence that doesn’t last forever, and it absolutely warms my heart.

On the other hand, I have to wonder how it’s possible that she hasn’t figured it out yet, and I might start to question her logic and reasoning skills.

If I dig deep into my childhood trauma bank, I can recall when I discovered there was no Santa Claus.

It was July of 1987. My father sent me to sleepover camp for a full month and insisted that I go one year earlier than the youngest children permitted at the camp. He dropped me off in the parking lot at Armour Heights P.S. where the buses met to pick up campers, and as I was 6-years-old, surrounded by what he described as “men who might as well have been shaving on the bus,” he told me that he feared I was actually too young and I might be bullied as a result.

So imagine my surprise when he blurted out, “Buddy, I gotta tell you – there is no Santa Claus.”

Then what? The bus drove off?

A therapist could spend hours on this, I swear.

Kids grow up fast, but they grow up even faster when you make them.

I was pretty emotional this morning looking at the video of my daughter from September of 2020 as she began Junior Kindergarten. Just a baby. And now?

I sent my son to Senior Kindergarten on Tuesday, and while he’s four grades behind my daughter, it feels like that time has flown by as well.

Many of you sent your kids to their first year of university over the weekend, and that’s a pain that I can’t comprehend, but you have my emotional sympathy. Others saw their kids head back to Concordia, or UBC, or Western, and hope to see them again before Christmas.

Well, if the pace of 2025 is any indication, Christmas will be here before you know it!

It seems like literally moments ago that we were in this space discussing what lay ahead for the 2025 spring real estate market, and now here we are, with summer in the rear-view mirror and the fall market ahead.

Last week, I put out the first episode of my podcast for the upcoming season, and as you might expect from people who frequent YouTube, my bullishness on the fall market was not well-received.

As you’ll read in the coming sections, I do believe that we’re going to see a robust fall market, and while it won’t be record-setting in any way, there are a few signs of strength in the market.

Don’t tell that to random YouTube viewers, however!

“Except prices to drop like a lead balloon,” said one person who spelled expect incorrectly.

“The market is on life support,” said another viewer.

I didn’t see a single positive or bullish comment, but maybe that’s just the way the world works?

For those who think that my job is to “pump up” the market and that my thoughts, opinions, and analysis are going to be biased as a result, just consider that in our line of work, we sell properties whether the market is up, down, or sideways. If you’re a long-time reader, I’m sure you’ll give me the benefit of the doubt in this regard, but if you’re a newer reader and you believe that this week’s blog posts are written with a slant of sorts, that’s your prerogative. Just be ready to explain why in the comments section below.

So without further ado, let’s look at the most important topics, burning questions, and favourable discussion points as I see them in the upcoming fall market…

1) What is happening with interest rates?

Are you tired of this question yet? How about the topic in general?

If I were to add the words “inflation” and “unemployment” to the sentence above, would that make you more or less likely to read this?

At the risk of being unoriginal, this is the same burning question that we asked last year at this time, but that’s not by design. I would call it “coincidence” except that’s not really the word for it.

“Necessity” is a better way to describe it.

Honestly, from 2018 through 2021, I don’t think I ever heard the words “interest rates.” Maybe I wasn’t listening hard enough, or maybe people just weren’t as concerned, but even when rates were super low, with the Bank of Canada rate set at 0.25%, I don’t think we talked much about it.

You would have expected newspapers to write articles about 5-year fixed-rates of 1.59% and how they’d affect the market, but it wasn’t until after prices had run up in 2022 and the Bank of Canada began raising interest rates that the subject became such a huge focus.

Last year at this time, we were discussing the current Bank of Canada rate, which was 4.50%, and whether or not we would see a cut on September 5th, 2024.

We did, in fact, but it wasn’t the “jumbo” cut of fifty basis points that many were hoping for.

No, those “jumbo” cuts came in October and December, respectively, but that might have proved to be too late to effect the fall market in 2024.

Some might say that we’re in a very different position this fall than last. The Bank of Canada rate was 4.50% on Labour Day and now we sit at 2.75%.

Then again, some might suggest that subsequent rate cuts have had no effect on the market. After all, prices are down, which we’ll discuss later in this blog post or the next.

This is what I wrote in our “Burning Questions” feature in September of 2024:

But if the story of Fall, 2024 is about interest rates, then there’s a chance the story in the spring or summer of 2025 could be “home prices.”

Bear in mind, what I meant by “discussing home prices” was that prices could be up.

But they are down.

How naive of me to believe that increased affordability would spur market activity! Then again, I felt buyers would get out ahead of interest rate cuts and not simply wait until cuts had been made and prices had rebounded, but as I have learned, buyers want to have their cake and eat it too. Nobody wants to catch a falling knife, right?

Here’s a chart from last year’s blog:

Predictions were that, by the summer of 2025, we would see the policy rate enter the “neutral range.”

By definition, this would mean a rate that is neither restrictive or stimulative.

Have we achieved that?

In April of 2025, the Bank of Canada defined the “neutral” range as 2.25% to 3.25%.

And here we sit at 2.75%.

It looks as though the economists surveyed by Bloomberg last August were correct, although as we have noted here on TRB many times, economists and banks alike will constantly revise their predictions or “forecasts.”

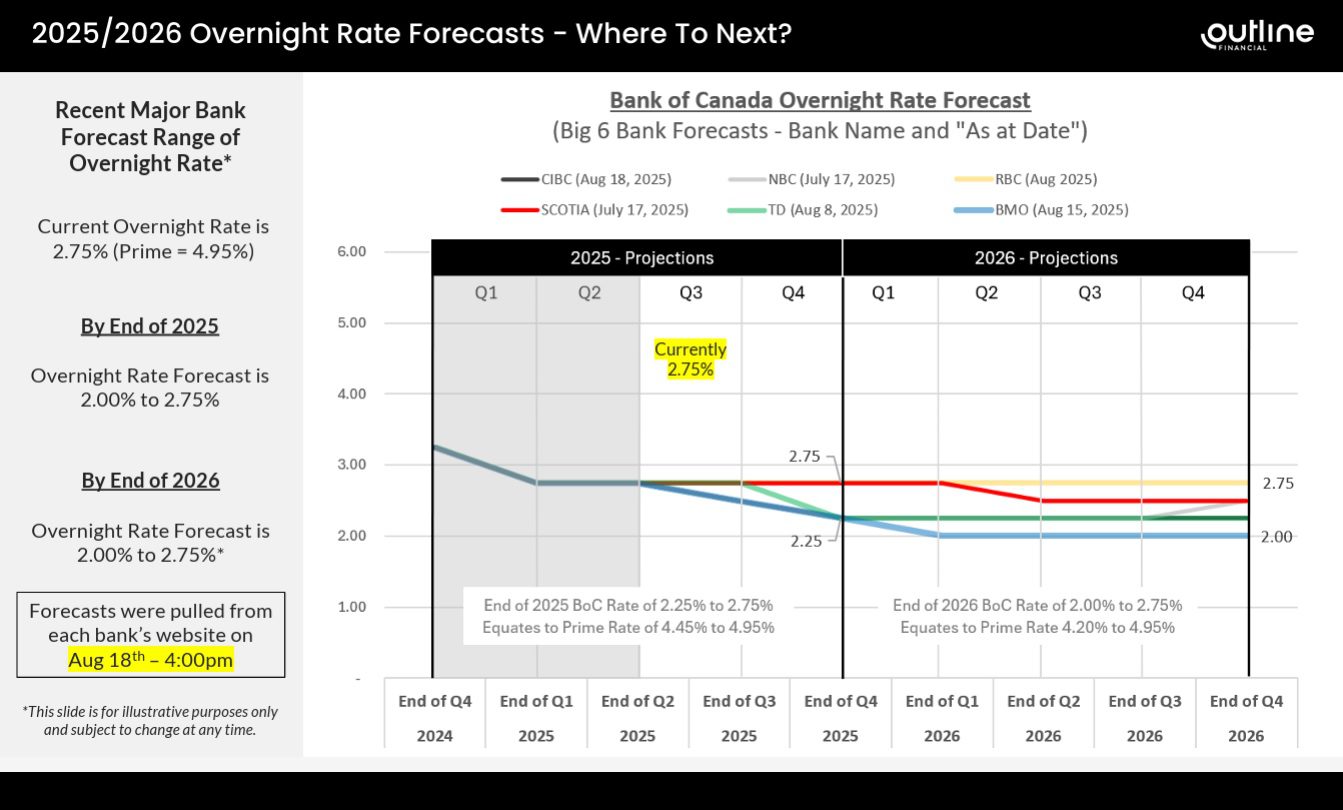

Case in point, the following chart, courtesy of our friends at Outline Financial:

Let’s ignore 2026 for a moment, since I’ve learned that the banks aren’t really making predictions here, on account of how many times they can revise them.

Scotia and RBC are the only banks predicting zero cuts by the Bank of Canada from now until the end of 2025.

TD, BMO, NBC, and CIBC are all predicting rates of 2.25%.

The next scheduled announcement is on Wednesday, September 17th.

Should we expect a rate cut?

Honestly, I would!

Inflation dropped to 1.7% last month.

Unemployment is pushing 7%.

Ah, but core inflation, you see! It’s all about core inflation now…

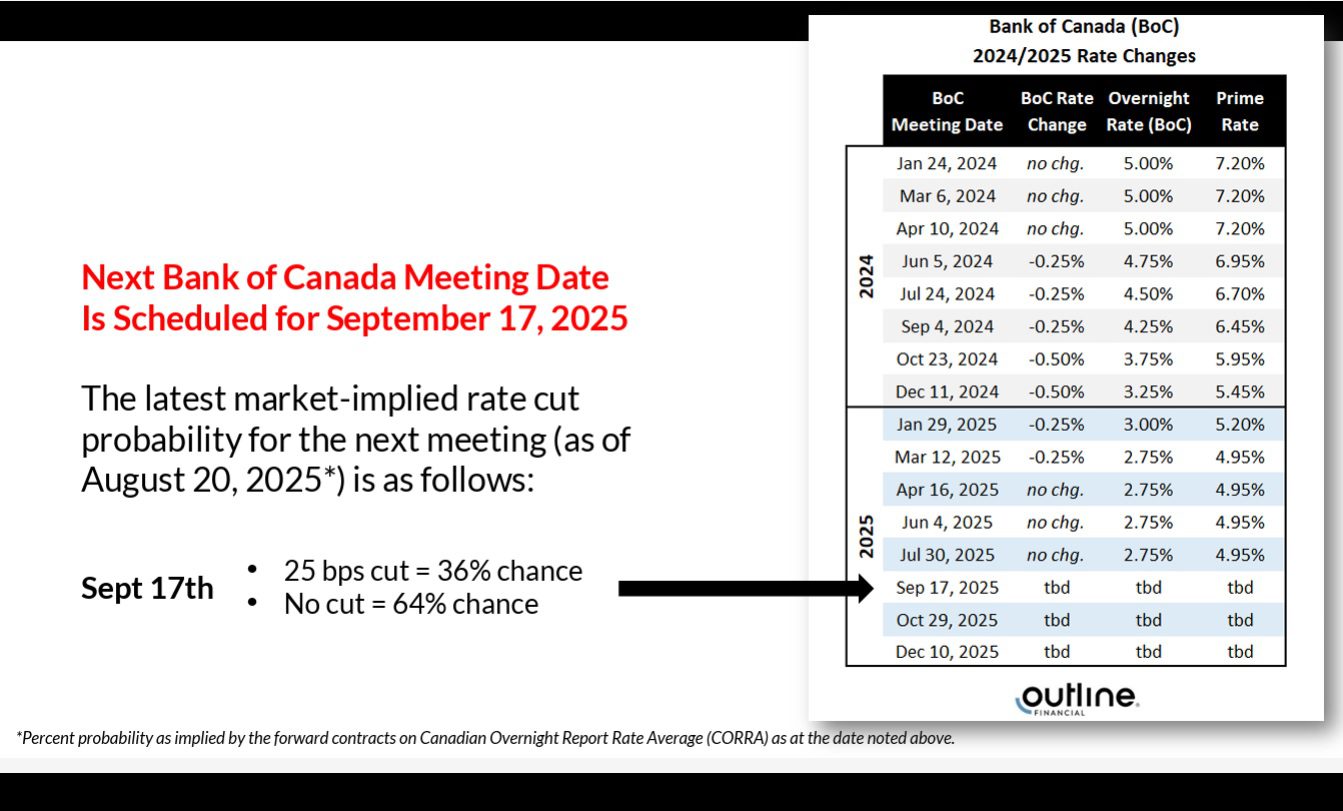

The latest market-implied rate cut probability data shows that there will NOT be a cut in September:

But predictions change, right?

All the time!

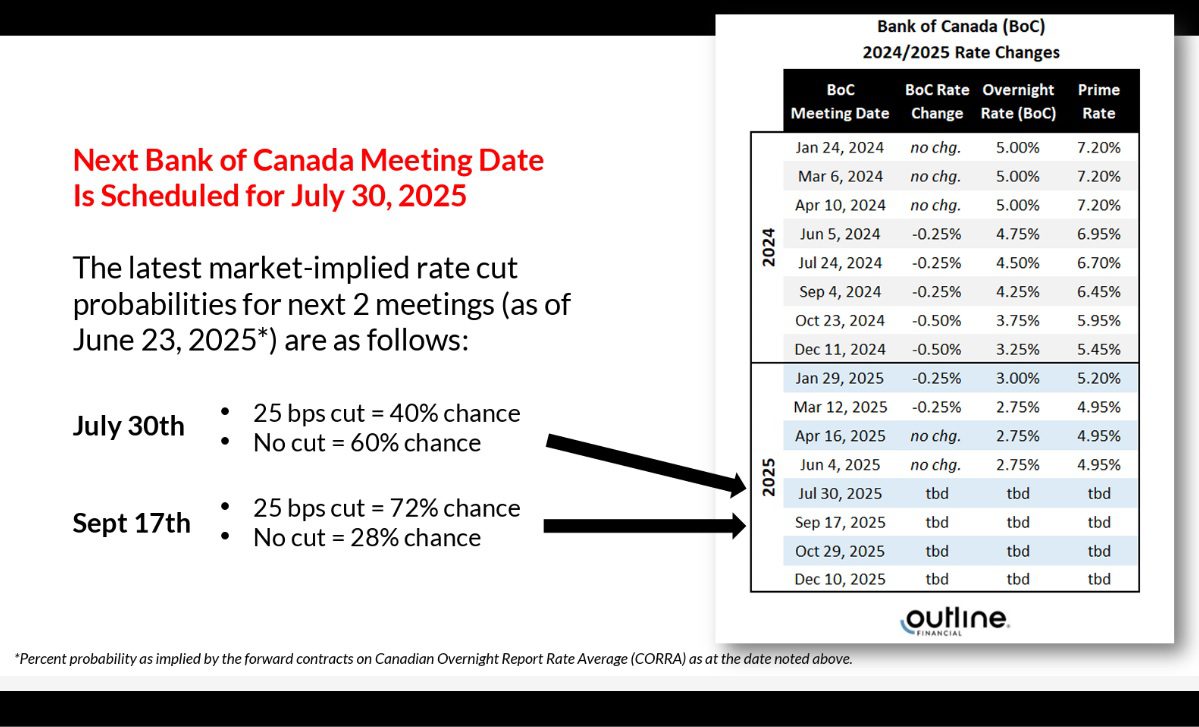

In fact, if we looked back only two months, the implied probabilities offered were completely different:

What’s changed since then?

Gosh, maybe the “Three T’s” again?

Trump, Tariffs, Taxes?

The Bank of Canada has a very difficult decision to make in September. Many are demanding an interest rate cut and others are afraid of it.

I suppose it could be worse: we could have a Prime Minister (or President…) who wants to fire the head of the Bank of Canada (or U.S. Federal Reserve…) because he or she won’t cut interest rates on demand. There’s a battle that will undoubtedly end up in the Supreme Court.

For those of us on this side of the border, we have to assume that Tiff Macklem knows what he’s doing and has the best interests of the Canadian economy at heart.

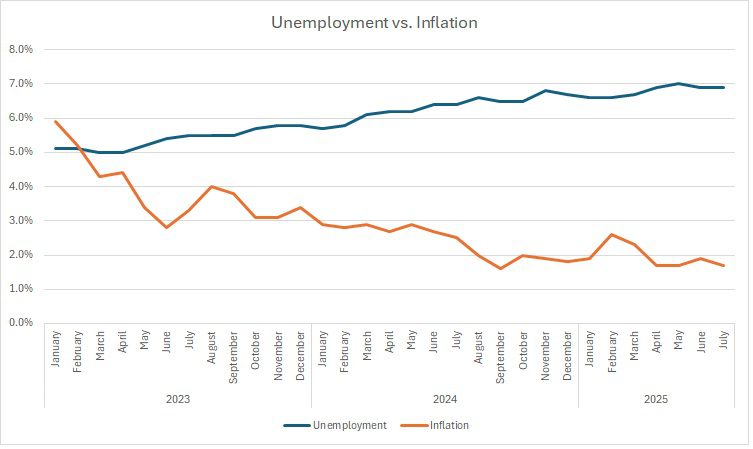

I’m a data nerd so I’m constantly updating my own charts and graphs, and I can’t help but bring this one to your attention:

The spread between unemployment and inflation is widening, and this is typically a sign that a central bank could or even should cut interest rates.

I know, I know, it’s all about core inflation now, which sits at 2.6%.

Maybe this is a moving of the goal posts, or maybe it’s a far more responsible way to track how Canada’s economic battle with the United States is affecting our own economy.

Say what you want about inflation, but unemployment is slowly becoming the elephant in the room.

Would you believe that Ontario is pushing 8% unemployment?

Have a look:

I’d be remiss if I didn’t make this political for a moment…

“Unemployment” is defined as the number of people who want to work but are unable to find a job. This says nothing of the people in our country who don’t want to work and are living off the massive social safety net that Canada has deployed. I don’t think this ends well for the country, long-term, but I was clearly on the wrong side of the last federal election, so it seems as though 40% of the country is okay with our current level of federal debt on a per capita basis, but I digress…

As much as I would relish the opportunity to set fiscal and monetary policy in this country, it’s not my job.

Sigh.

So I’ll be just like the rest of you on September 17th, waiting to hear Mr. Macklem’s crispy voice at a microphone, letting us all know if we can reduce our mortgage payments, borrowing costs on lines of credit, interest payments for our small business, and more.

I know it’s not a sexy topic, folks. But interest rates are going to be discussed ad nauseam this fall, and thus interest rates must be included in our first burning question on the list…

2) What in the world is happening with sales?

In case you were wondering, I did not catch any flak for what I said in last month’s blog post…

Then again, I sorta, kinda, maybe blamed somebody else.

Here’s what I wrote on August 6th:

On Wednesday, a colleague texted me the following:

“The Greater Toronto Area (GTA) experienced the best home sales result for the month of July since 2021.”

Question: Why am I paying hundreds of dollars per year for a marketing board that delivers sound bite size misinformation at a level that is borderline negligent, sandbagging me in front of my clients, instead of delivering real valuable insightful statistics based in reality?

His text message was referring to a press release from the Toronto Regional Real Estate Board that put a very positive spin on the July sales figures.

Sales were up by nearly 11%, year-over-year.

Huzzah!

Except that, as I wrote in the blog, these sales were up over near all-time low sales data.

The media at this up, as they always do. I couldn’t believe that nobody fact-checked this. I was amazed by the headlines about the market “finally shifting.”

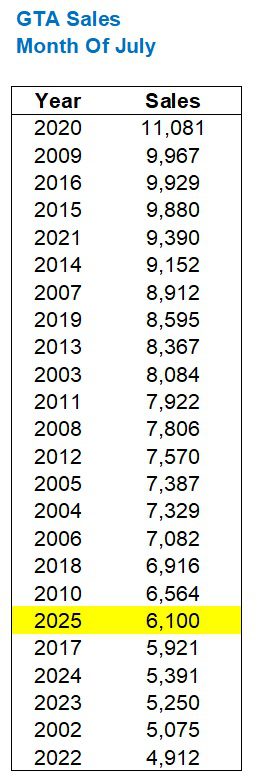

Here’s how sales should have really been viewed last month:

In a historical context, that’s how.

Sales did increase by 10.9% as TRREB described and as the media echoed. But outsiders weren’t exactly led to understand how to view these sales in an overall market context.

I’ve been ranting about this all year, of course.

To understand what’s happening in any market, with respect to any metric, I’ve always felt that it needs to be examined in a historical context.

We had this discussion in 2023.

We had this discussion in 2024.

And now we’re having it again in 2025.

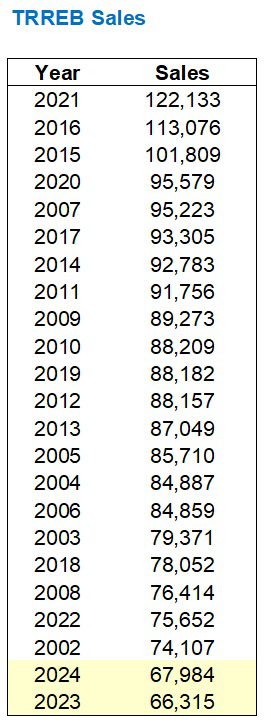

The market “peak” in terms of monthly home price came in February of 2022. But our peak year in terms of sales came in 2021 and it’s not even close.

In fact, the sales data for 2022 was quite poor. Upon the completion of 2022, sales were the second-lowest since 2002 when I began tracking this data. And just consider how much smaller the city was in 2002 than in 2022, and you would probably come to the conclusion, like I did, that adjusted sales were lower.

But 2023 showed us something even more noteworthy, and 2024 followed that up in tandem…

In 2023, we saw the fewest sales of all time in the GTA, and I mean “all time” because the city was half the size in 1999 and I refuse to compare to that data.

In 2024, we saw a slight uptick, but nothing to write home about.

Working backwards, we can see that the last three years, 2022, 2023, and 2024, hold three of the bottom four places on the list.

That represents our springboard for 2025!

There’s nowhere to go but up, right?

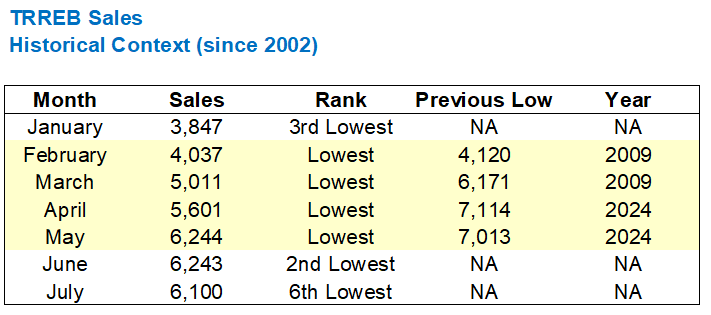

In January of 2025, we saw 3,847 sales, which were lower than the 4,223 sales recorded in January in 2024, but higher than the 3,100 sales recorded in January of 2023. This was statistically insignificant at the time, but as the spring market evolved, it would prove to be a marker, of sorts.

These sales represented the third-lowest of all time in January.

Why was that a “marker,” you ask?

Well, because we saw the lowest sales of all time in each of the next four months:

And it wasn’t even close!

March, April, and May didn’t just show the lowest number of sales of all time in those respective months, but rather they obliterated the records for previous lows!

Coming off the month of February, which saw the old record beaten by a modest 2.0%, the record-lows in the next three months were 18.%, 21.3%, and 11.0% lower than the previous lows.

Like I said: obliterated.

This was felt throughout the market for the first six months of the year as the resale condominium sector stagnated, our 905 districts stalled, and even some segments of the 416 freehold market were slower than expected.

When you look at the pace of sales so far in 2025 and compare it to 2023 and 2024, the projections for end-of-year sales data are abysmal.

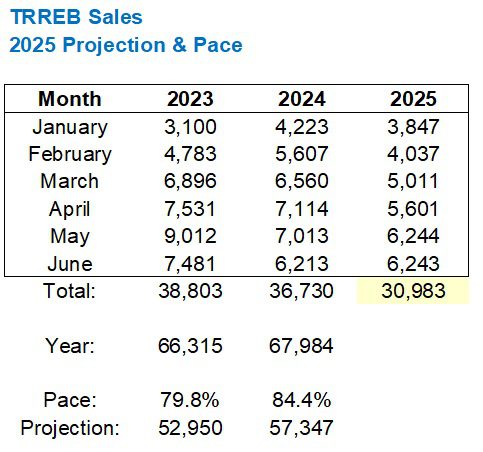

Coming into July, this is how the projections looked:

On a face-value basis, you can clearly see that 30,983 sales in the first six months of 2025 is well behind the 38,803 and 36,730 respectively, in the same period in 2023 and 2024.

If you use the yearly totals in 2023 and 2024, you can extrapolate the data to show approximiately how many sales would be expected through year-end based on the pace in each of 2023 and 2024.

Those figures show as 52,950 and 57,347 respectively.

If you’re wondering why the 2023 data projects a lower number, it’s because the fall of 2023 was much slower than the fall of 2024.

Now, consider all the hoopla about that 10.9% increase in July sales for a moment. If the pace were to change, then the projections could as well.

In fact, consider that we saw the third-lowest sales ever in February, the lowest in each of February, March, April, and May, with the second-lowest in June, only to witness an “improvement” in July via the sixth-lowest total for that month, and we would expect the above data set to improve if we add in July.

So that’s what we did here:

This is an improvement.

The “pace” goes from between 52,950 – 57,347 sales to between 55,823 – 59,853 sales.

That’s what the strength of one month can do.

Of course, whether we’re looking at projections as of June or projections as of July, these numbers are still way below the record-low number of sales set in 2023.

Unless we see a massive increase in sales this fall, the year 2025 will go down as the lowest sales year this millennium.

I can already see the headlines over at BlogTO.

“NOT A SINGLE PERSON BOUGHT REAL ESTATE THIS YEAR,” or something to that effect. But the amazing part about these record-low sales numbers is that prices have only nominally moved.

We’ll come back to that, however.

First, we need to talk about inventory.

And given my monumental word count so far, I think we’ll hold this over to Thursday or I’ll risk losing those of you who have made it this far…

(TO BE CONTINUED)

Francesca

at 8:04 am

We told our only daughter the truth about Santa, Easter bunny and tooth fairy the summer between Grade four and five at age 10 because she still believed in all of them and I was worried she would find out the truth at school from a friend instead. She was devastated and angry that I told her and made me promise that she would still get to enjoy the benefits of all three despite knowing the truth! She just left for her first day of university at u of t this morning and I look back and wonder how did time go by so fast?

As for sales, I literally feel like nothing happened this summer: all the for sale signs are still there or have been taken down. I get emails from Housesigma for watched properties, and this year most have been “terminated” emails and very few sold. Seems like buyers are still too nervous too jump in even though there are some great deals out there to be had. I read an article this past weekend about how condos are no longer the safe retirement bet for seniors they once were for downsizing because they aren’t appreciating and there are too many of them on the market both resale and pre construction. This could be an interesting topic for a future blog David!

Marina

at 11:42 am

Our kids kinda figured it out between grade 3 and 4. It started with the tooth fairy, but they took it as an opportunity to ask for stuff. The Santa thing we discussed and explained that no, there is no fat bearded guy who lives at the North Pole, but it’s OK to believe in Santa as an idea, like a group delusion that makes everyone a little nicer and more generous at Christmas. They seem happy with that.

For the market, I think so much depends on what Orange Voldemort is going to do. But that’s true for pretty much the whole economy. I’m stocked up on coffee and ready to watch.

Derek

at 1:22 pm

“What mortgage rate can I get?” is the only question.