As I constantly complain to my wife, “There’s no time! Time is fleeting!”

So let’s spare the small talk and get right back into it, shall we?

4) What will sales volume look like, compared to the spring, and how will 2024 finish up?

If a tree falls in the woods and there’s nobody around to hear it, does it make a sound?

We’re still not sure.

But if a property is listed in a market where nobody is watching, and it’s reduced in price, does anybody care?

That is the question I asked many times this past spring when the market slowed to a crawl.

Again, consider that this isn’t across the board. This isn’t every property type, in every price point, in every area. But in some market segments, it was like nobody was paying attention. As I’ll explain in Question #6, it felt like nobody even wanted to lowball.

So is this a blip on the radar or is this the new reality of our market?

I think it’s the former, but that goes without saying.

And if I may be so bold, I’d like to replace “think” with “know.”

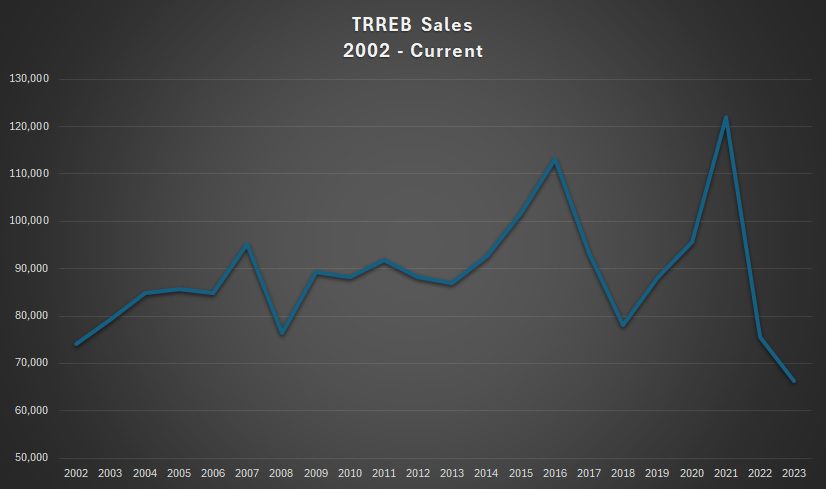

Here’s one of the blandest and simplest charts I’ll ever show you:

What is your takeaway?

Are we at the onset of a massive decline in sales that will see us on a march toward zero?

Or are we seeing a long-term uptrend as the city continues to grow, with a two-year decline during a period of increasing interest rates?

I think it’s quite apparent.

Nevertheless, it’s hard not to look at this chart and think, “Oh, Geez….”

I’ve mentioned this many times over the past eight months and I believe there are different ways to see this.

Pessimistic: “Sales are at an all-time low; this can’t mean anything other than the market is a disaster.”

Optimistic: “Interest rates increased ten times from 2022 through 2023 and sales plummeted, but interest rates are decreasing, and we are clearly in a market trough.”

You know where I stand on this.

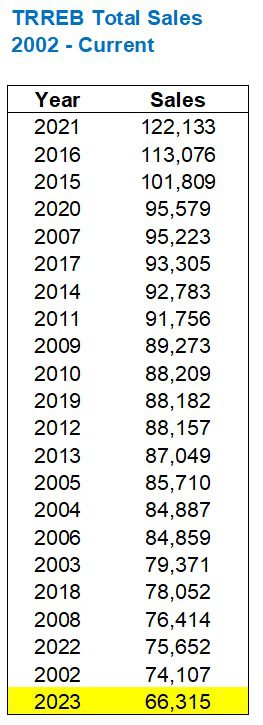

As for how 2024 will finish, I’m tracking this very closely:

Through July, we’re actually behind 2023’s total and on pace for the lowest sales since 2002, again!

Sure, the year started with a bang. At least, compared to 2023.

But the spring was historically slow.

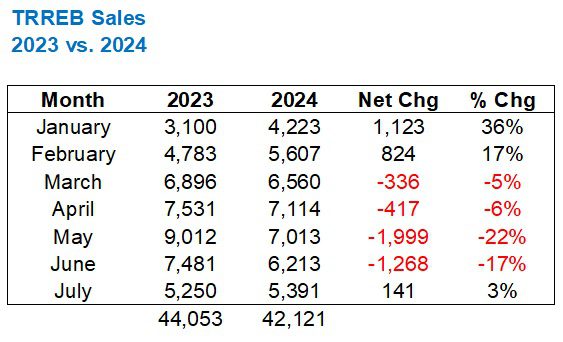

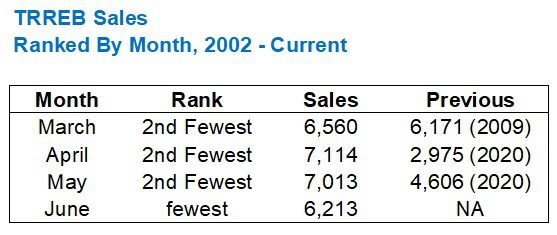

In our “prime” months, this is how the sales figures stacked up historically:

Consider that the only reason why April and May saw the second-fewest sales since 2002 was because the 2020 figures were depressed by the pandemic.

We’re only three days into the fall market and there’s already a lot of inventory out there.

Will sales follow?

5) What will inventory levels look like?

If the first three days of the market are any indication, I think we all know that a huge inventory dump is coming.

Yes, many of these “new” listings are actually re-lists from the spring or summer. I’m getting a headache looking at listings and asking myself, “Didn’t I see this two months ago?”

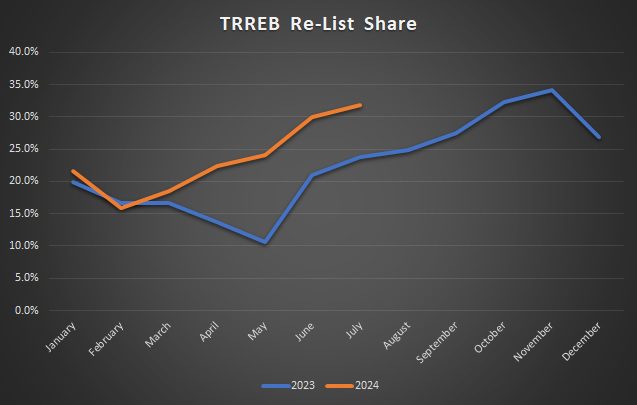

I shared this in a blog post last month, but it’s worth looking at again here:

I expect the “re-list share” to continue to increase into the fall, and we should have the August data by Thursday or Friday, so that will be quite telling. I’ll update the above graphic if/when we do.

But regardless of the re-list share, I do believe we’re going to see a huge surge in inventory.

There’s been a lot of talk this year about “high inventory” levels, but just how high are we talking?

Well, if we compare to previous years, it actually doesn’t look all that high:

(I've removed 2020 because of the pandemic data)

In fact, inventory was essentially higher in 2019, 2021, and 2022 from January through May, and that’s where the 2024 data starts to look like an “outlier.”

In June and July, the number of new listings is ahead of 2019, 2021, 2022, and 2023.

Of course, “high inventory” is only a concern if it isn’t matched with a high number of sales.

This leads perfectly to my next question…

6) Will there be “demand”?

While this might overlap with some of the points above, I believe this is a completely different question and one that serves to complement the discussion about sales and inventory.

After all, a month with 10,000 sales might seem like a better month, compared to one with 8,000 sales, but if those were 10,000 sales against 20,000 new listings, versus a month that saw 8,000 sales against 11,000 new listings, then the conversation is entirely different.

All-time high sales in a month with all-time high inventory is quite different from all-time high sales in a month with all-time low inventory, and that, of course, would lead to a shortage in the market, and increasing prices.

The relationship between sales and inventory is crucial for overall market context and over the last few years, I have continued to see the media and other online sources completely ignoring this context.

So it all comes down to this:

“You take the good, you take the bad, you take them both, and there you have…”

Ummm….Blair, Tootie, Jo, and Natalie?

Sure. But you also have context.

And examining the sales-to-new-listings ratio, or the “absorption rate,” is the way to acquire that market context.

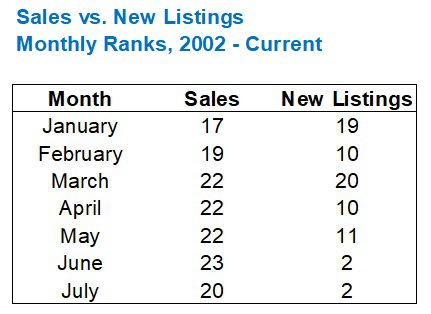

Here’s an exercise I’ve never done before: let’s look at the rank, from 2002 to current, of both sales and new listings, by month. We’ll compare them side-by-side:

See what I’m getting at?

We’re looking at twenty-three years here, so in January, we saw the 17th most sales in that 23-year period against the 19th most new listings.

That’s fine. That’s balanced.

But as the year goes on, the figures change dramatically.

By June, we see the 23rd most sales (ie. dead last) against the 2nd most new listings.

The trend continues into July

So here we have near-all-time-low sales with near-all-time-high inventory.

Not the best recipe for a balanced market, is it?

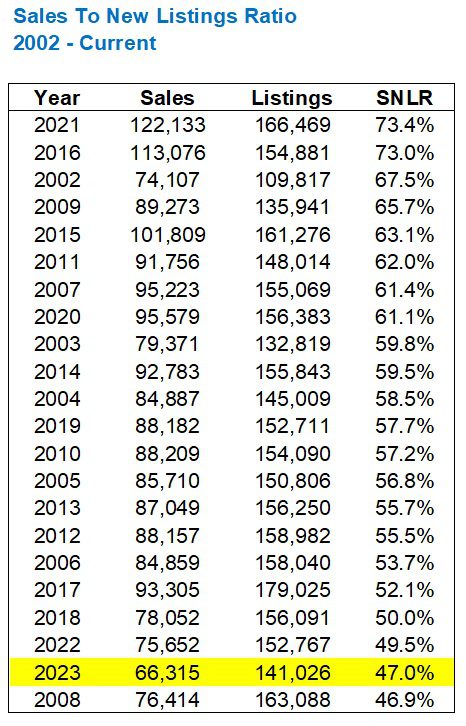

And if we look at the absorption rate for the entire year, from 2002 to 2023, we can see where we came from last year:

I find this absolutely fascinating.

Perhaps more fascinating is why home prices have remained stable in light of all-time high inventory, all-time low sales, and an all-time low absorption rate, but I’ll let you draw that conclusion.

With a third successive interest rate cut announced on Wednesday and a signal that a fourth is coming on October 26th, will demand finally return to the market?

7) Who wants to sell and who “needs” to sell?

We talked a lot about this earlier in the year, but to really drive home the point, let me tell two stories.

Earlier this year, I listed a condo for $899,900.

The property had been tenanted for four years and it showed some wear, so I worked with the sellers to showcase the property in the best light possible. I brought in a kitchen countertop contact that does timely and cost-effective work, and we replaced the early-2000’s black granite with a modern, sleek, white quartz. My painter revitalized the kitchen cabinets with a light colour, and painted every square inch of the walls, trim, and baseboards. We updated all the light fixtures, cleaned, staged, and put the property on the market.

But it was absolute crickets.

This gorgeous condo, shining in all its glory, didn’t attract a soul.

And would the sellers have taken, say, $875,000? Absolutely.

Would they have taken, maybe, $850,000? We’ll never know.

Because they never had to make that decision. No offer was ever presented.

“Nobody has even lowballed us,” they said. “Not that we would take $800,000 for the condo, but nobody has even taken a ‘shot’ at this.”

That’s just where the market was, for some properties, in some areas, earlier this year.

So the sellers switched gears and decided to rent the unit, as they didn’t really “need” to sell.

They wanted to sell; don’t get me wrong. They wanted to exit the real estate space and they weren’t exactly tickled by the idea of renewing their mortgage this fall and carrying the unit at an even larger loss, but if it costs $300 per month more than before to carry the unit, then what’s $3,600 per year, for two years, to keep the condo and sell for a price that makes sense in 2026?

Some sellers want to sell and others need to. These sellers were the former.

Over the Labour Day long weekend, a client of mine emailed me a listing for a home that had just been reduced in price.

It was odd. It was deja vu.

After all, the price of this house had already been reduced.

Listed in early July for $3,895,000, they reduced to $3,650,000 after only 26 days.

Now here we were, on the Friday before the long weekend – which is possibly the slowest time in the real estate calendar outside of Christmas, and the sellers had reduced again to $3,395,000.

In my honest and professional opinion, had this home been listed for sale for $3,895,000 in April, I believe it would have sold.

But this is a true “luxury” home in a neighbourhood where families empty out for summer, and the timing was odd, as was the presentation since not a single bit of effort went into the listing. Staging? Are you kidding? There were dirty dishes in the sink…

We bought the house for $3,300,000 and it was one of the best deals I’ve secured in years.

The only thing missing from the “need” to sell here was an MLS listing that read, “Sellers Are M-M-M-M-Motivated!”

When interest rates started to increase in 2022, I read a lot about how many sellers will “flood the market” with houses and condos in 2024 and 2025. I have yet to see it.

Will we see people who “need” to sell this fall? Will we see it in droves?

I doubt it.

But will the media stop writing about it?

I doubt that too…

8) Where is the resale condo market going?

When we talk about sales, inventory, and demand, we almost want to further divide this into freehold versus condos.

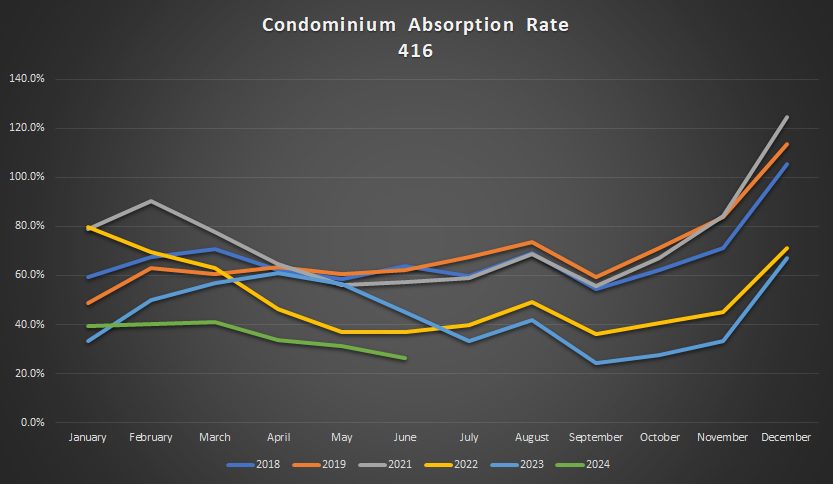

It’s no secret that the condo market has been slow this year, but I can’t tell you how many conversations I had with prospective condo sellers this summer where I had to break out this chart:

We covered this chart back in July in this post:

“How Is The GTA Condo Market Faring In 2024?”

I run this installment quarterly, and we look at sales, listings, and absorption rates in both the 416 and the 905.

With an absorption rate of 26.5% in June, we saw the lowest absorption rate in any month save for September of 2024 when that figure was a mere 24.5%.

Is that what lies in store for September? Can the absorption rate decline this fall?

Note that I used the word “resale” in the question posed above since I think we have finally started to see the media distinguish between pre-construction and resale, although as I lamented in a summer blog post, many still do not.

However, there is some overlap between the two market segments; pre-construction and resale.

There are tons of “assignments” on MLS which are essentially posted as resales, since MLS doesn’t distinguish between the two. These are essentially “dummy variables,” in my mind, since nobody is buying assignments right now.

Not only that, there are also lots of newly registered condos on the market, but those are dummies too since investors who paid through the nose in pre-construction four, five, or six years ago have now listed their units at astronomical prices with no hopes of achieving it.

Neither condominium assignments nor inflated-new-condo-garbage really “count” as true listings, in my mind. And yet they clog the MLS system like that fresh bar of Dove soap that my son smushed down the shower drain.

This fall, I do believe that the cream will rise to the top in the downtown condo market.

Units that are vacant, painted, cleaned, staged, extremely well-photographed, and marketed effectively will sell, and everything else will sit.

Perhaps that sounds like I’m not giving the condo buyer pool credit, assuming they will all buy “pretty things,” but I’ve seen this before.

With high inventory comes the paradox of choice. For many buyers, the ridiculous amount of choice leads to paralysis. For others, it leads to wanting to wait for what else is out there. But when all is said and done, the listings that look the best will get the eyes, and those are the ones that will sell.

If you’re trying to sell a tenanted property this fall, good luck, and Godspeed…

9) Will we see an increase in “affordability?”

I suppose first, we need to define the word “affordable,” but we’ve had this conversation before.

When you take “wants versus needs” into the equation, it shifts the conversation about “affordability” entirely.

Consider the conversations about “affordability” in New York, London, or Paris.

Oh, wait, there aren’t any conversations about affordability. People simply accept what is.

This fall, I believe that the word “affordability” will be over-used to the point of absolute frustration, and often it will be used in the wrong way.

“As Interest Rates Trend Down, Could Housing Get More Affordable?”

CTV News

August 31st, 2024

This isn’t speaking to “affordability” at all.

It’s simply connecting the most basic math possible: that if something costs less, it is, by definition, “more affordable.”

If a loaf of bread costs $3.99 but is now being sold for $3.79, then yes, it’s “more affordable.”

Newspaper articles about how declining interest rates result in “more affordability” are going to get really, really tiring.

The conversation about “affordability” should pertain to the ability of an average Torontonian to afford an average place to live, and about the growth in wages versus the growth in real estate prices. Of course, a conversation about the growth in population relative to the growth in new homes would likely then follow, and that should likely lead to a conversation about the ratio of owners versus renters in the city and how that ratio will continue to change over time.

As I have mentioned more times than I care to count, “affordability” must also take into consideration the significant shift in societal norms, the outlook and attitudes of future successive generations, and the expectations – realistic or unrealistic, of Torontonians, as they consider what forms of living are “acceptable.”

But I’m using “should” and “must,” so my cynical side knows this is all well-wishing on my part.

No, Toronto will not become more affordable any time soon. But no, we won’t hear any less about that this fall or into 2025…

10) Will I purchase another condo this fall?

Alright, so I really only had nine questions, so this is just filler.

But there’s a unit at King George Square that amazingly is still available for $500,000 and I cannot believe it. What would the seller accept for this condo that’s been on the market at this price for three months now?

The unit looks like crap. That’s a good thing if you’re an investor.

The long-term tenant leaves at the end of September.

Paint the kitchen cabinets, install some new laminate flooring, paint the whole condo, and add an inexpensive Home Depot bathroom vanity, and voila!

Manage this yourself and the renovation is less than $10,000.

I appraised the same unit for another seller for $625,000 in the spring. Sure, it would seem that I was off on the price, but this remains the best “deal” out there…

This was fun. We should do it more often.

Or so I said on my first date…

With TRREB stats being released on Thursday or Friday, I’ll be writing my eNewsletter to follow.

If you feel the need for even more market analysis, for some unknown reason, feel free to sign up at the bottom of the page HERE.

Otherwise, have a great weekend!

Serge

at 11:45 am

There is a cliche in RE literature: “buyers are sitting on sidelines”. I have never seen any statistical estimates of how many. There are polls of tenants, or youth, “how many of you see buying RE in next 5 years?” Not realistic.

Number of people who were preapproved for mortgage, but never bought, could be one guideline. Number of households younger than 50 and with income above 150K, having no RE, would be another.

May be David has his own measures.

Derek

at 1:41 pm

11. Will TRREB avg. sale price see a new bottom b/t here and 2025?

Derek

at 1:46 pm

**the end of 2025?

12. Will the annual 2024 TRREB avg. sale price be higher or lower than that for 2023?

Rick Michalski P.App ACCI

at 1:56 pm

11. No

12. Higher

Youre welcome

Ed

at 6:21 pm

Luxury vinyl is much better than laminate.

Steve

at 10:49 am

Does anyone remember the decade after the 1989 “crash”? Yup, it was a long drawn out decade of virtually no price appreciation. I have a builder friend who put it this way …. we have been enjoying price increases for 20 years, now the market is taking a breather. It takes time for sellers to realize and accept that yesterdays prices are yesterday’s prices and that going forward they will have to sell for less. And buyers? Well, they are aware that mortgage rates are dropping, so, what’s the hurry. It will be a while yet before real estate becomes exciting again for the average person.

Rick Michalski P.App ACCI

at 1:57 pm

Stfu bear

Milk Man

at 4:45 pm

Who sneezed in your cereal, again? 🤭

Ace Goodheart

at 6:25 pm

It takes roughly ten years from a major correction, to the next price run up. We are just at the beginning. The situation is mostly psychological. It doesn’t matter what the house is worth.

On the lighter side of things, over on Quebec Ave, a house just listed claims beautiful sunset views from an east facing back yard patio.

Maybe you can see through the house?

Or does the sun set in the East now?

Derek

at 8:41 pm

It does for Rick