Alright, so Wednesday’s blog was shorter than Monday’s, that’s good!

But Friday’s blog is longer than Wednesday’s, so we’re sort of back where we started.

A family member told me over the Christmas holidays, “I enjoy your blogs, but they’re really, really long.”

My response?

“Thank you.”

I mean, nobody tells Bono how to sing…

–

Discussion Point #6: First Time Home Buyer’s Plan

You’re a regular reader of my blog, right?

Yes, you, the person reading this. There’s a very good chance that this isn’t your first time reading, so I would suggest there’s also a very good chance that your knowledge of real estate is above average.

Now with that above average knowledge of real estate, let me ask you this: where are the sub-$500,000 properties in the central core of Toronto located?

Good for you! You got it! This is a trick question.

See, it doesn’t take more than an average amount of real estate knowledge to know that the days of the $500,000 properties are long gone.

In fact, a simple click on TREB’s Market Watch tells you that the average GTA home price was $843,637 in November, and the average Toronto home price was even higher at $910,419.

So, once again, where are the sub-$500,000 properties in the central core of Toronto located?

That time it wasn’t a trick question, but rather dripping sarcasm and cynicism.

And that accurately describes how I feel about the First-Time Home-Buyer’s Program that would see the federal government assist buyers of houses up to $500,000, by essentially loaning them the down-payments.

As I mentioned in Monday’s blog, I don’t feel that:

a) People that can not afford to be in the market, should be in the market

b) The government should be lending people who can’t afford to be in the market, money to get into said market

I don’t know whether I feel stronger about (a) or (b), but they’re both points that underscore how I feel about the First Time Home Buyer’s Plan.

Let’s not forget, this was a long time coming. 2019 was an election year, and in as early as January, Finance Minister, Bill Morneau, started to make noise about implementing programs to “help millennials.” Of course, this was more the result of a need for votes than an actual desire to help. Just look at the title of this Toronto Star article:

“Liberals Have Options To Help Millennials Buy Homes; Would Be A Vote Winner Too”

Then in March of last year, the government announced the plans to move forward with a form of shared-equity mortgages – something most of us in the industry never thought possible. In June, we caught our first glimpse of the “plan” itself, and now here we are, starting a new year, with no real understanding or expectation of how, or if, this will actually work.

Once again, I’m going to ask my mortgage broker to put together his thoughts on this and perhaps circle back next week with some more insight.

Discussion Point #7: What new taxes will be discussed in relation to the housing market?

Maybe you’ve heard enough from me on this front already, and maybe you’re ready to label me a Libertarian for my consistent rants about taxation.

But it’s not like I’m making this stuff up out of thin air.

Everywhere you look (that is, if you’re reading the newspaper instead of looking at pictures of your friends’ lunches on Instagram…), there’s tax of new taxes, and “sorely-needed” taxes at that.

I’ll try to make these points with as little political ramblings as possible, so here goes.

There are three taxes being bandied about that relate back to the housing market:

1) Vacancy Tax

2) Speculation Tax

3) Capital Gains Tax

Let’s start with the last one, simply because it’s the freshest in my mind, as I read a Letter to the Editor late last month…

From the Globe & Mail on December 30th, 2019:

CAPITAL IDEA

Re Hey Canada, Mind The New Generation Gap (Editorial, Dec. 27): Congratulations to The Globe for raising the idea of taxing capital gains on principal residences. To make a new tax more palatable to the majority of taxpayers, perhaps a lifetime exemption of $500,000 could be implemented. Undoubtedly, I believe such a tax would put the brakes to the rampant speculation in our major urban centres and end the practice of serial developers who build and own homes for a very short period of time, making what should be business income into tax-free capital gains.

Richard Austin Toronto

I find serious fault with the above comment for several reasons.

First of all, I believe that part of the reason why Canadians have come to accept being raked over the coals for their hard-earned dollars, year after year, and consistently being introduced to new taxes often concocted out of thin air is because we have the capital gains exemption on a primary residence. That is our one saving grace. If we own a family home, and we live in it, raise our kids, live our lives, work hard, pay taxes, and abide by the laws, then we get to keep what we earn when we go to sell our home later in life.

Fair is fair.

But to take this away from Canadians and continue to tax them to death just isn’t acceptable.

The second issue that I have with this is the connection between “rampant speculation” and the tax-free status of a gain on a primary residence.

In fact, this is a complete oxymoron.

“Speculation” and “Primary Residence” are opposites.

People looking to speculatively purchase and flip are not the same as those people looking to purchase and reside long-term.

Am I the only one that believes Richard Austin from Toronto is missing something here?

The letter continues to connect “speculation” to “primary residence” and then to “serial developers,” which is asinine.

If a serial developer, posing as a primary residence owner, is avoiding capital gains tax, then that’s up to the C.R.A. to police. The solution to a handful of people dodging taxes is NOT to make everybody pay the tax.

Imagine.

Judy and Jim buy a house in 2009 and sell it in 2020 after raising two children there from grade-school age through university. But Mike the flipper buys a house in 2019 and flips it in 2020, paying no tax. So we’re going to make Judy and Jim pay tax on their capital gain to…..what? To ensure Mike pays? To make up for Mike’s lost revenue?

This conversation is ridiculous.

My biggest issue with taxation has always been that the tax itself is posed as something other than what it is.

A handful of developers dodging taxes does not necessitate removing the long-standing exemption for primary residences.

As for the idea of a “Vacancy Tax,” we discussed this in late-2019 with my post “The Friday Rant: Another Tax Is Not The Answer,” so I won’t go down that road once more, but rather I wanted to bring to your attention to how the tax can be abused by the municipality.

“Vancouver Homeowner Avoids Paying Empty Homes Tax After Winning Court Battle”

The oceanview property in West Point Grey was assessed last year at $26,789,000, but only $10,000 of that value was for the home itself.

Owner Yi Ju He, who purchased the property in 2015, had argued the city unfairly charged her the tax while she was waiting for permits to be approved to allow for redevelopment.

According to the court ruling, He was looking to replace the existing home with a new structure, and had run into issues with the removal, including the discovery of asbestos on the site.

He and her lawyers submitted various permit applications to the city in early 2017, before she submitted her empty home tax form for the 2017 tax year asking for an exemption. The ruling notes only some of the permits had been approved by summer 2018 — months past the tax filing deadline.

Some of you will ignore the problem here, simply because this is for a $27 Million home, or because the owner is likely from mainland China, or both.

But if you can put your bias aside, you’ll see this for what it is: a tax grab.

This isn’t a house but rather it’s a piece of land. The owner is looking to develop the land, and the city wants a quarter-million in tax.

I know, I know, I’ve lost some of you here. “Cry me a river,” you’ll tell me, as you refuse to lament the problems of a multi-millionaire.

But this underscores what municipalities can do with their power, and if you think this won’t happen to you, you’re kidding yourself.

Oh – and Vancouver has increased their tax by 25%, since it was such a cash cow.

As for the idea of a “Speculation Tax,” even though this overlaps with both the capital gains tax and the vacancy tax, I could see a cash-strapped government trying to score on all three.

No matter what happens, I do believe this: we will see Toronto City Council bring up the vacancy tax or speculation tax this year, and I think the Federal government will look at the capital gains tax as well.

Of course, we could have both the federal government, as well as the municipality and/or province, look at the vacancy tax. In the aforementioned mandate letter from Justin Trudeau to Bill Morneau, this little nugget spoke to the potential for a new tax:

Work with the Minister of Families, Children and Social Development who is the Minister responsible for the Canada Mortgage and Housing Corporation (CMHC) to limit housing speculation by developing a framework and introducing a 1 per cent annual vacancy and speculation tax on applicable residential properties owned by non-resident non-Canadians. This would involve working with provinces, territories, municipalities and law enforcement to track housing ownership and speculation.

Perfect.

So all three levels of government want the same tax.

I can only imagine how this plays out…

Discussion Point #8: What can we learn by watching other markets?

Here’s where half of you say, “Who cares? We’re not that other market,” and where the other half suggest that what goes around, comes around.

I just had a lengthy phone call with a prospective condo investor, and she had asked about areas in the Golden Horseshoe other than Toronto.

Buying properties in Hamilton is a sexy trend, but what’s the long-term viability of their hot market?

Other than perhaps interest rates, nothing affects a market more than supply and demand. Demand is more organic than supply, in my opinion, and it’s also my opinion that supply is far, far harder to create in Toronto than in other areas of the city.

I was always fascinated by the real estate boom in Dubai. Prices for condos skyrocketed, and yet, on the other side of that sexy new condo, or across the road, or down the street, is nothing but more desert. Constructing new condos is easy, compared to that of Toronto or, say, New York.

I filmed a video years ago down in Park City, Utah, where I showed a sub-division of about a thousand homes, all of which had risen and fallen in price dramatically. On the other side of that sub-division? On the other side of that very high fence? There were thousands of acres of vacant land.

The supply of resale properties coming onto the market is only part of the overall supply equation. How easy it is to create new supply is the other half.

How many truly “new” detached houses will be created in the central core? Zero? Is that right? Or is it two? Where’s the open land where new houses will be built?

So while I recognize that Hamilton has seen some pretty spectacular appreciation in the last half-decade, and while I’m not suggesting it’s going to end, I am suggesting that if and when the market in the GTA experiences a downturn, trendy areas like Niagara On The Lake, Grimsby, Milton, Hamilton, Burlington et al will be affected far sooner, and far greater, than Toronto.

Watching the activity in these markets is a good way of staying ahead of the curve here in Toronto.

With the assumption that Toronto is always going to be insulated from price change so long as the above areas are still chugging along, then consider the monitoring of price in these areas to be an early alarm.

As for other cities in Canada, and how we can compare, or at least learn from their markets, the only city I ever choose to look at is Vancouver.

“Toronto and Vancouver” are forever mentioned in unison, and always grouped together in real estate speak.

But does our market follow Vancouver? Are we actually correlated?

When the market in Vancouver began to trail off in late-2016, many pundits suggested that Toronto was next.

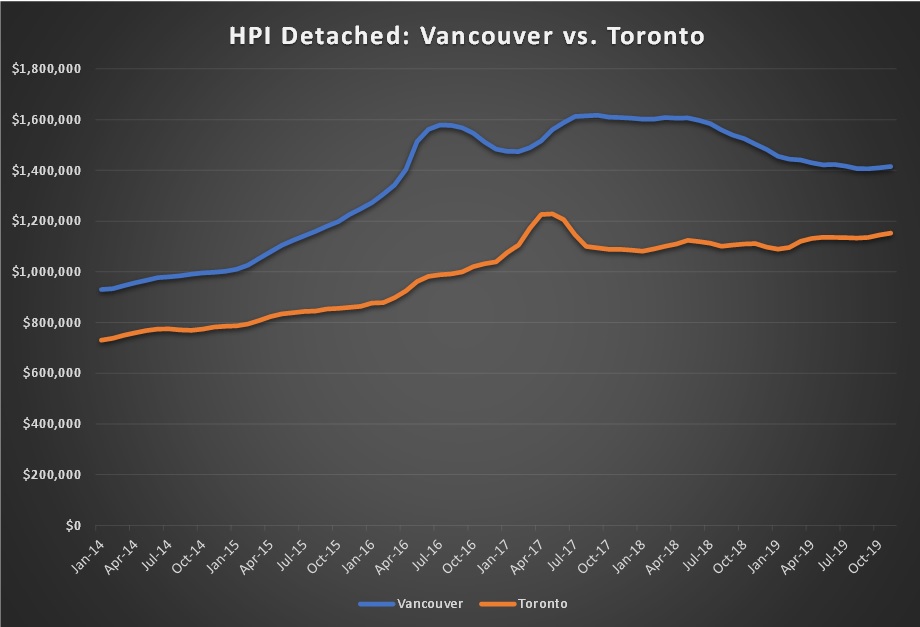

Those pundits were correct, to some extent, but only by coincidence in my opinion. The drop in prices in April of 2017 was a direct result of the Ontario government’s meddling in the market, and this had nothing to do with the drop in values in Vancouver. The timing, as you’ll see in the graph below, looks to be correlated, and it looks as though Toronto followed Vancouver little more than a half-year later, but what follows tells me otherwise. Let’s start with the graph:

Keep in mind that this is the Home Price Index, and not the average sale price. The HPI is a much smoother curve, less affected by seasonality, and as it’s a moving average, the figures somewhat lag behind the actual prices experienced.

The detached HPI peaks in Vancouver in July of 2016, at $1,578,300, and the Toronto HPI peaks ten months later in May of 2017 at $1,228,500.

But the rise prices was far more dramatic!

Let’s look at one year prior for each:

Vancouver:

July, 2015: $1,141,800

July 2016: $1,578,300

+38.2%

Toronto:

May, 2016: $961,300

May, 2017: $1,228,500

+27.8%

Again, keeping in mind that these are not prices, but rather another measure of the market, we can see that the Vancouver market for detached homes moved far quicker than that of Toronto.

What happened after these two peaks was completely different, however.

Vancouver’s market actually did recover quickly, and then some. While the $1,578,300 peak in July of 2016 gave way to a drop down as far as $1,474,200 in February, the HPI actually rose above $1.6M, and stayed there from July of 2017 through May of 2018, never really moving much.

But thereafter, it’s been a freefall.

Since May of 2018, the Vancouver HPI is down 12.0%, currently sitting at $1,415,400.

Toronto’s detached HPI also fell, only it didn’t experience the same dead-cat bounce 6-8 months later like Vancouver.

Since the respective “peaks,” Toronto’s detached HPI is down 6.2%, and Vancouver’s is down 10.3%.

But it’s the last twelve months that I find fascinating.

Since December of 2018, Vancouver’s detached HPI is down 4.5%, and Toronto’s is up 5.0%.

This is clearly two markets moving in opposite directions.

Can we learn from this?

Yes, I do believe we can.

I believe that we should stop looking at Vancouver for indications of what might happen, since the last half-decade’s data has shown us, in multiple periods, that these two markets aren’t correlated, nor can any of their movements serve as indicators of future events.

Now as for New York City….

Discussion Point #9: Who else do you know that will leave the city this year?

I read today that there are 100,000 people moving to the city every year.

But how many move out of the city?

I’m guessing that “net migration” is a statistic that would differ from the numbers we see thrown about in the newspapers, but there are obviously far, far more people moving into the city than out.

Over the last few years, I’ve written more and more about clients moving out of the city, as it’s something that’s happened with increasing regularity. Some merely move out of their downtown Toronto, 1-bed, 1-bath, and into a detached, 3-bedroom home in Mississauga. But others move out of the GTA altogether.

One of my wife’s best friends just did that. She picked up her family and relocated to Manitoba.

Originally from Manitoba, her husband is from Toronto, and both of them were gainfully employed here in Toronto, and had two small children both in school.

But you know what?

$400,000 buys an absolute mansion in Manitoba!

And when you sell your fixer-upper in Toronto for triple that amount, and buy in cash, it begs the question, “Why don’t more people do this?”

My wife is sad to lose a close friend, but happy for her friend’s fresh start and new lifestyle.

You all know somebody who made the same move, but what you don’t know is that somebody else – be it a family member, friend, or colleague, will also be moving in the next couple of years.

If it’s not the frenetic, fast-paced way of life that often drives us out of the city, it’s the high cost of living, which I believe is now a separate category unto its own, as the high cost of housing is a whole other issue.

Not only that, you can’t swing a cat without reading an article about how cheap it is to buy real estate in other cities.

I came into the office after Christmas and found a copy of the Financial Post, with this article face-up:

“Want To Buy A Mansion? Meet The Small Town With The Hottest Real Estate Deals In Canada”

Aside from noting that Dwayne “The Rock” Johnson’s father lived in Amherst, the article teases us with a photo of this house, offered for sale at a mere: $579,000:

That gorgeous, sandstone house, likely from the Victorian era, is something you’d expect to find in Rosedale or The Annex here in Toronto.

If that house was for sale in Rosedale, even if it were in original condition, it would be $4,000,000

That house, done?

Maybe $7-8 Million?

The article also notes that the asking price of this house is “less than the price of an average downtown Toronto condo.”

Yup.

And that is why the topic of people moving out of the city will remain a discussion point in 2020.

That’s it, you ask?

Yes it is, at least for now. Three days and nine solid discussion points, much of which we will refer back to as the year goes on, and much of which will likely make our “year-end” posts as well.

Is anybody else waiting for new listings to hit the market?

It’s like a drug. And it’s not that I need it. It’s just that I can’t go on without it…

Marina

at 9:51 am

The last topic was really hot for us this holiday season – so many of our friends are moving to the suburbs,or further out (Port Perry, Bowmanville, Barrie, Guelph). We got excited that a friend is moving to Paris, but it turned out to be Paris, Ontario. For $600K she’s getting a stunning bungalow that wouldn’t even be built in Toronto because of the land cost.

If I didn’t have to commute, I’d seriously consider it too, but adding an hour or more a day to my time away from family is a non-starter.

GinaTO

at 11:43 am

Same here Marina. Moving further and commuting into the city is a no-go, so we’re seriously thinking of just moving everything – new city, new jobs, new house, new school, etc.

Libertarian

at 9:57 am

“I’ll try to make these points with as little political ramblings as possible, so here goes.”

David, I’ll do the political ramblings for you. This country and the 3 levels of government are having a competition to see which one can get to full-blown socialism the fastest!

It’s ridiculous!

Matt

at 10:05 am

Hey Dave,

One tax that you missed- property tax increases. John Tory has finally conceded the necessity of increasing property taxes, and given the limited taxing powers of the city, there’s not many alternatives (although if the province hadn’t nixed road tolls, they would’ve likely made sense too). There’s a pretty obvious infrastructure problem in Toronto; repairing the roads, improving public transit, making infrastructure more resilient to extreme weather events, all need to be done. Not to mention the pathetic state of public spaces in Toronto compared to even Chicago: will there ever be a build of the Rail Deck park? I doubt it… Given the division of powers in Canada, the only way to provide the basic public goods that make the city livable, is through spending by the city itself, which has a pretty limited ability to run deficits. Property taxes need to go up, and by a lot, or the city will continue to crumble. As an aside, the property taxes in Toronto are really low compared to NY, for example. The corollary of higher property taxes should be at least some moderation in real estate appreciation, as the property tax hikes get capitalized into real estate values.

Also- I’ve benefited from the tax free status of gains on principal residences, but think it’s a little absurd that a benefit that so obviously stokes excess demand for real estate persists in a country where there is so much excess demand for real estate. Why tax capital gains on a principal residence? To me it’s obvious. 1. Phase in a capital gains tax and you’ll get a bunch of old geezers living in too much space to finally sell to younger families that need it 2. It will relieve some of the narrative that creates excess demand for real estate (I’m being paternalistic here, but real estate is a bit like a drug, and people want more of it than is good for them already, so why stoke the habit) 3. It can potentially allow government to lessen the tax burden on earned income. Cause there’s a reasonable argument, in my view, that the windfall gains from changes in real estate values deserve to be taxed more than earned income

condodweller

at 10:26 am

If you think that the government is going to give you a tax break on your earned income after taxing your principal residence you are delusional. The number one magic trick in the tool box of a politician is the slight of hand of giving with the left hand and taking away with the right. The problem is they always take more than they give.

If you are ok with your government forcing “old geezers” out of their homes simply because you feel they take up too much space perhaps you should move to China instead (or any other country where the government does whatever it wants. I’m not picking on China here)

Appraiser

at 2:05 pm

Property taxes in T.O. have to go up substantially for many years in a row to simply take care of the backlog of deferred maintenance on the books, let alone any infrastructure projects of the future. You go John Tory!

As for capital gains on principal residences being taxed, I have no problem with a modest sum and a high floor for exemption. For example, no tax on capital gains under $500,000. A reasonable tax could then be collected on perhaps a graduated scale that rises with the amount of capital gains realized.

As for the non-resident, non-citizen vacant house tax scheme currently being devised by our masters – it’s a 90% done deal. Mainly because there is almost zero political fall-out attached. Non-resident, non-citizens don’t vote.

Alex

at 6:21 pm

I do not think that government is going to give me back the taxes that I’ve paid purchasing my house. They’ve spent it right away. Now they are increasing annual municipal taxes and thinking about waving the capital gains on principal residences. If they think that private entities are going to pick up the tap to house all renters and get kicked in the groin while doing it, they should think twice.

Taxes are taxes and if you think government is going to spend carbon tax – or extra taxes on principal residences capital gains somehow different to save planet , then you live in your own world. Wake up.

condodweller

at 10:14 am

You have hit the nail on the head with point #7 David:

“If a serial developer, posing as a primary residence owner, is avoiding capital gains tax, then that’s up to the C.R.A. to police. The solution to a handful of people dodging taxes is NOT to make everybody pay the tax.”

“If a serial developer, posing as a primary residence owner, is avoiding capital gains tax, then that’s up to the C.R.A. to police. The solution to a handful of people dodging taxes is NOT to make everybody pay the tax.”

I truly believe people calling for the elimination of the principal residence exemption is just a case of sour grapes. As you say it’s the last saving grace we have after all the taxes we pay. I think it would be political suicide to eliminate it, especially now after the run up and the huge capital gains people are sitting on. That would be a blatant tax grab of epic proportions.

Izzy Bedibida

at 10:27 am

I agree. Mom and her friends in the “widows club” are in the same position and worried about the proposed changes. They are living in modest homes that have been paid off decades ago.

They have all read the “paper” that was circulated by Conservative candidates during the last election. Technically they are sitting on a gold mine.

They fear that CRA will pick on them because they are seniors with poor language skills who do not know how to to properly fight an assessment from CRA, fill out paperwork etc.

Izzy Bedibida

at 11:06 am

“it’s the high cost of living, which I believe is now a separate category unto its own” is a point that is rarely discussed-especially how it relates to the high cost of housing.

There have been several articles recently about long standing restaurants being forced to close because of rent increases. I think this goes hand in hand with the high cost of housing, and how it’s affecting life in the city.

Kate

at 1:26 pm

Great series this week!!

Verbal Kint

at 2:22 pm

Local pundit chalks up correctness of other pundits’ calls to coincidence.

Osmosis Jones

at 3:18 pm

In regards to #9, my family waved goodbye to Toronto last year and have no regrets. We got a 3 bedroom, 3.5 bath house with a finished basement and 2 car garage for $390,000. The trade-off is that we have to live in New Brunswick. The lifestyle here is actually pretty good though, if you like snow. No waitlists for daycare, short commute, flexible work hours, and a small but nice downtown with a variety of local businesses.

While we were in Toronto, we saw many of our friends move to the suburbs and spend 3 hours a day or more commuting. I’ve even known people who bought in Etobicoke end up renting out their home and getting a rental in the city to avoid commuting. It’s a personal choice whether someone feels they can live without the amenities of Toronto (and it is an amazing city!), but I’m honestly surprised more people don’t do it.

Max

at 12:11 am

Businesses go where rich customers are. People go where good jobs are. Stability exists in these places. Money follows where risks are lowest. And it repeats itself and grows itself in the GTA… Look at the once “booming” Fort McMurray, people are forced to move away. Nowhere in Canada is the risk lowest than in the GTA.

Appraiser

at 3:19 pm

“Canada added 35,000 jobs in December, capping strong 2019 for employment”

Unemployment rate drops to 5.6% in Canada.

Over 300,00 jobs added for the year.

“In Ontario, employment increased by 25,000 (+0.3%) in December, the result of gains in full-time work…The unemployment rate in the province decreased 0.3 percentage points to 5.3%.”

https://www150.statcan.gc.ca/n1/daily-quotidien/200110/dq200110a-eng.htm

I blame it all on Trudeau and the other socialists.

balwinder bal

at 8:08 pm

Healthy job market is a healthy news…no?

Appraiser

at 11:37 am

Yes!

And by the way, 243,000 of the 320,000 jobs created last year were in Ontario.

Phenomenal performance.

Appraiser

at 4:56 pm

P.S.

Approximately 150,000 of those jobs were created in the Toronto Census Metropolitan Area.

Wow!

I wonder what affect a fast-growing, dynamic population creating thousands of new jobs has on housing demand ?

Kyle

at 11:58 am

Point #9 is a very interesting one to me. In the last decade, prices have been driven up by urbanization, with people pouring into large cities to find work. When you think of many of the newer jobs (Tech, Finance, Corporate Legal, Research, etc), those are in areas that really only exist in large cities. Obviously there are many other benefits to big city living besides jobs, like amenities, arts, convenience, services, parks, public infrastructure, parks, libraries, etc. But i think there are a lot of people who would choose to live elsewhere if work didn’t require them to be here.

I have long wondered if we will see people who can do their work remotely migrating out, causing a de-urbanization trend. Maybe it begins with certain demographs like families seeking more housing value, but longer run, i see a lot of the jobs that are attracting these people to the City becoming more virtual, and less location dependent.