What would you say if I told you that there aren’t enough million-dollar condos in the city of Toronto?

Would you cry me a river, or maybe direct me to the world’s smallest violin?

I’ve spent some time examining the number of million-dollar condo sales over the past ten years, and honestly, what I’m seeing is that there just aren’t enough of them!

Let’s take a look…

Tell me if I’m foolish for saying the following, but while many interested Torontonians will ask, “Where is everybody going to live in twenty years,” I feel like a follow-up question should be, “Where are all the well-off people going to live?”

I’m not kidding.

I mean, I’m not feeling bad for the millionaires out there, but rather I’m saying that as our city continues to expand, and developers continue to build condominiums seeking to sell to investors rather than users, the proportion of 1-bedroom condos being built and sold massively outstrips the “luxury” market, or even the market for $1M and up.

Where there is demand, we need supply.

And just as we need affordable housing in the city, we need whatever else is in demand.

Otherwise, prices skyrocket, and we’re all familiar with how that works.

I read an interview the other day – with either the finance minister, or somebody from CMHC – can’t quite recall who, but a policy-maker who said that there haven’t been any “unintended consequences” with all the mortgage changes over the past eight years.

Really?

Come on. Dig deep, and surely you’ll see…

Remember a few years ago, when the geniuses in charge decided that all properties over $1,000,000 will from then forward require a 20% minimum down payment?

But you could still purchase for $999,999 with a mere 5% down?

This made every $800,000 house worth $900,000 overnight.

The amount of demand for sub-$1M houses skyrocketed, and the pressure under $1M was so fierce that the entire market just about burst.

If you want to put a face, a name, a price, and a full set of stories to this “unintended consequence,” then go back and read Sue Pigg’s piece in The Toronto Star from 2 1/2 years ago – “The Race To Rhodes Avenue.” One of the best real estate pieces I have ever read, and this was around the time that buyers under $1M started to fight tooth and nail, and every house, be it $800,000 or $600,000, seemed to gain 10%.

My point to all this is simply that it is demand that pushes prices, but it’s also lack of supply.

And over the past few years, the demand for condos over $1,000,000 has spiked, and the development hasn’t kept pace.

Who’s buying a condo for $1,000,000, you ask?

I see four main groups of buyers:

1) Playboys.

Playgirls too, but playboy has the original ring to it.

Mid-to-late 20’s, single, with a lot of money.

Hard-working, many of them are, then there are those (as you’ll see below) that are not.

Professionals who live and work downtown, some from home, all of whom want you to see every meal they eat on Instagram, plus whatever shirt they’re wearing, plus whatever they did last night, and this night, and tomorrow night…

2) Rich Millennials

Maybe this overlaps with the above, but not entirely.

I listed a King West penthouse earlier this year and sold it for $1.3M.

Do you know who bought it?

Some young 20-something girl, who’s daddy bought for her……in cash.

She probably made about $40,000 per year at her entry-level job, and now she’s living for free in one of the nicest condos in the downtown core.

3) Professional Couples

Late-20’s, 30’s, or even early 40’s.

The childless couple, who may or may not eventually bear offspring, work hard and want to live a carefree lifestyle.

They can afford a house. Maybe they could afford two.

But they want to live in a condo as it affords them the zero-minute commute to work, the walkable daily conveniences, and virtually no maintenance on their primary residence, not to mention all the perks that an upscale condo can offer.

4) Retirees

Similar to the above, these folks have owned houses, but now want carefree, maintenance free, and easy.

Oh – and they have a ton of money.

–

So now let’s get to the meat and potatoes here; let’s look at the number of condos that have sold downtown in the past ten years, over $1,000,000.

As you’ll see from the charts, I’ve included 2016 to date, and then extrapolated the number to reflect a yearly total.

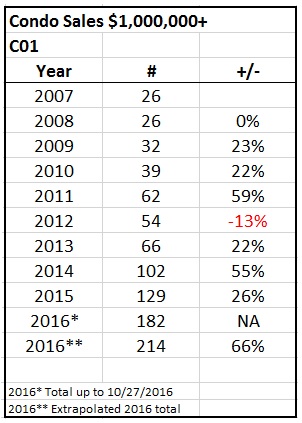

Here’s C01:

So save for 2011 to 2012, the number of sales over $1M has increased every year, and is on pace to jump massively this year.

Consider that with the overall Toronto home price increasing in the 15% neighbourhood, perhaps condos lag behind at 5-8%, and perhaps those over $1M lag even further, but you can still argue that a $960,000 condo in 2015 is a $1,000,000 condo in 2016, and thus these numbers SHOULD be increasing.

No doubt.

But at what rate?

And if there’s not enough supply, how much pressure will be put on prices via the demand?

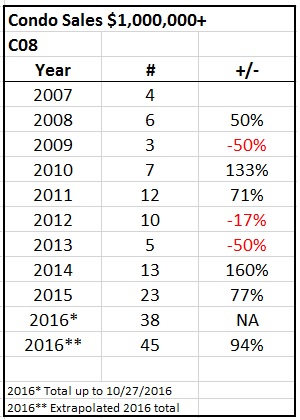

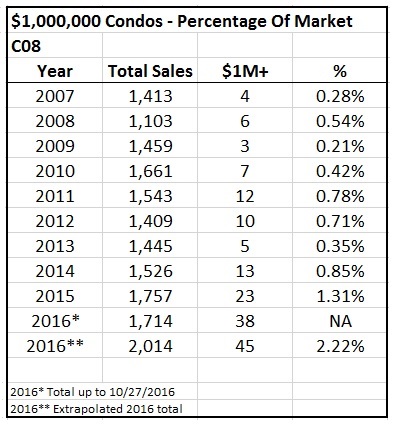

As for C08 (east of Yonge), the number of $1M+ condos ten years ago was so few and far between, that it’s tough to draw any conclusions:

Then again, to go from 23 sales in 2015 to 45 in 2016 certainly tells you what’s happening to prices, and how demand is holding up.

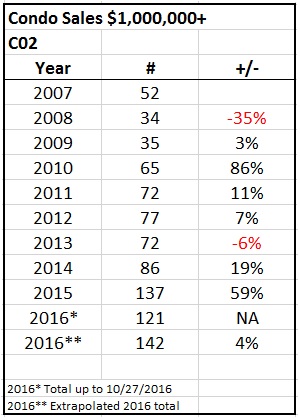

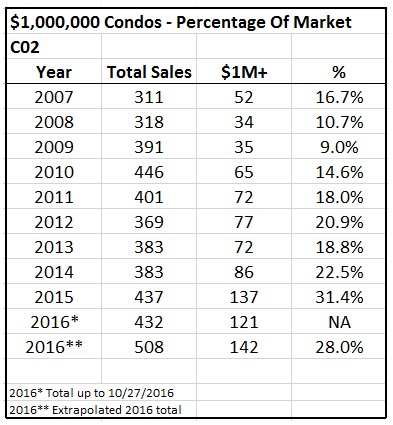

Now let’s look at C02, which is home to The Annex, Yorkville, and a host of “luxury” buildings:0

This is amazing to me.

To see 137 sales in 2015 and only on pace for 142 in 2016, it shows me perhaps prices aren’t rapidly appreciating here like they are downtown, and I might think that all the luxury developments that were finished in the past few years, like Four Seasons, have been absorbed by the market, and the demand has been satisfied.

Those numbers are interesting, but are they helpful?

What kind of story do they tell?

What percentage of the overall market, do those $1,000,000 condos represent?

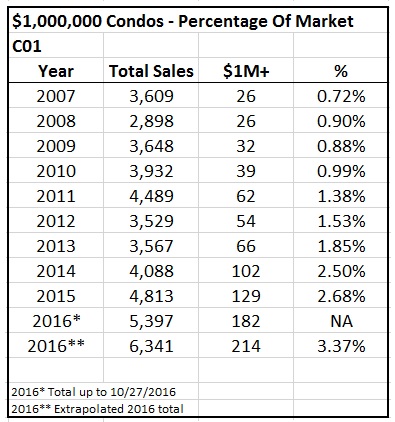

Let me now show you exactly that – the number of overall sales in the area, with the number of $1,000,000 sales expressed as an overall percentage:

That’s wild.

Only 26 sales in both 2007 and 2008, and on pace for over 200 this year.

Naturally, as overall sales have almost doubled, you might expect those sales over $1,000,000 to follow suit.

But I would have expected more.

Much more.

A paltry 2.68% last year?

Only 2.68% of condos in C01 are selling over $1M?

And the average price of a home in Toronto is $755,755 as of October, 2016?

Shouldn’t this number be a lot higher than 2.68%?

Developers today don’t care about the city and its future, and they don’t care about what people want and need.

They care about selling condos, and they build for what sells. Investment condos sell the best, and that’s why so many new towers have 70% 1-bedroom units.

With that being the new theme in Toronto, what’s going to happen when people actually want a liveable space, and not a tiny 400 sqft box in the sky to rent for $1,700/month?

The stats in C08 show an even bleaker picture:

Four sales over $1,000,000 in 2007?

FOUR?

And what the heck happened in 2013? Talk about outliers…

As for C02, most of that product is expensive to begin with, so nothing really shocking here:

In the end, you could surely argue the opposite.

You could say that, for example, condos in C01 have gone from 0.72% over $1,000,000 in 2007, to 3.37% in 2016.

But condo prices have appreciated every year since then, substantially, might I add. So I consider that a natural progression.

And with the average prices where they are, I’m just shocked to see a number like 1.31% – for the number of condos over $1,000,000 in C08 last year. That’s a massive area – everything between Yonge and DVP, south of Bloor. And a little more than one out of one-hundred is over a million bucks?

We know that houses are in extremely low-supply, but who ever thought that expensive condos might represent the next major real estate shortfall?

Feel free to draw your own conclusions…

downtown

at 8:19 am

No thought to families with kids, who want to live downtown but not deal with home maintenance? Why is it always assumed that everyone with kids wants to live in a house?

Real estate millennial

at 10:26 am

I haven’t looked at the data but how quickly are these condos selling (days on market)? And is it possible that because of that price point those condos don’t turn over as often because mls is only re-sale and doesn’t account for new construction. With all the development over the last couple of years it would be nice to see how many new construction condos were sold for over 1 million. The million dollar plus condo market appears to be for end users and thus less turnover. I think that could be a possibility but I don’t know for sure.

Joel

at 6:13 pm

I would agree that there have been a lot of $1 million plus condos built recently and those buying are looking to live in them. I would think many are downsizers who intend for those condos to be their last homes.

Millenial Couple

at 10:41 am

We are in category 3 and would definitely agree. When we were condo shopping the selection was slim enough that we could view almost everything that popped up in our criteria (obviously impossible for 1BRs). It’s amazing how many odd layouts still exist at that price point.

(Late 20s, married, dual income (finance + medicine), no children, married to the downtown lifestyle)

Ralph Cramdown

at 11:48 am

People who want to live in the units they buy are so PICKY! Who’d want to market to them? Urbanation says the share of sales to foreign+investors is 57% across the whole GTA, higher downtown. Buyers who want large, liveable units are going to have to get them the old-fashioned way: Buy adjacent units and combine them.

Kyle

at 2:24 pm

My gut tells me the $1M condo concentration goes up once you get outside of downtown, where there are a lot less “Jr 1-bedrooms” and investor units to dilute the averages. C01, 02 and 08 are dominated by mega towers, and i think $1M+ condo buyers, prefer smaller buildings where there aren’t as many plebes and renters. I feel like there would be far higher concentrations around St Clair, York Mills, The Beaches, High Park, BWV, Old Mill, Kingsway, Leaside, Summerhill, Bayview, etc.

Joel

at 6:10 pm

Do the numbers for condos over $1 million include condo towns? If so I am very surprised at how low of a percentage that is.

That Rhodes article was very good, thanks for posting that!

Steve

at 7:53 am

It makes no sense to only look at sales figures and say that there is a shortage of $1m condos. Why don’t you take the number of $2m condos sales figures and then argue that there is a shortage of $2m condos as well?

if you look at days on market, I’m sure the average $1m condo likely takes quite a long time to sell compared to other properties.

crazyegg

at 10:35 am

Hi All,

Agreed. The above data and information (although very enlightening) does not reasonably conclude that there is a shortage of luxury condos in Toronto.

That being said, builders generally want to maximize their return in the least amount of time. This translates to building smaller and more mainstream units. So perhaps David is onto something here…

Build it and they will come. Who is willing to take that (probably very lucrative) gamble?

Regards,

ed…

Gilly

at 4:45 pm

While our price point is not quite at $1 million, I have been online looking at 2-bdrm condos downtown with the 2nd bedroom being a decent 10 x 12 ft size, not a windowless den without a door. The other issue is the monthly costs which really jump from 1 bdrm to 2 bdrm (I do realize that these are based on unit size, but they seem oddly higher than the 1 bdrms). So here we stay, in a centrally-located detached midtown house with a nice yard and parking, with our kids grown up, because our monthly utilities and property taxes are cheaper than if we moved to a condo. I don’t get it. Why are there so few 2+ bdrm condos out there?

Jack

at 7:06 am

$millions come and go, but the real question is about size: Where are all the 1200 (or 1500 if you prefer) sqft condos? Where are developers willing to build some?

Weed

at 4:30 am

It takes a long time for $1+ millon condos to sell in Toronto.

Look at inventory of said condos over the past few years. They remain on the market for months, sometimes years.

MartinHoockly

at 2:53 am

Great information, till know I didn’t find any data about the number of condos selling in a year?. Thanks for sharing such an informative blog. Keep sharing such posts.

MortgageJake

at 10:17 am

As your readers have pointed out please add days on market analysis to this post.