Are you familiar with the laws of supply and demand?

I’m sure you are.

At least you’re familiar with the theory. But in practice, it doesn’t always work out the way that it should

Case in point: I made note of this in last month’s look at the May TRREB figures, whereby the sales-to-new-listings ratio of 37% clearly put us in a buyer’s market, and yet prices still increased.

So what would happen then, at least theoretically, if supply dropped massively over the next three years?

What would happen if no new condominiums were built? What then?

Because I have a theory and it goes like this:

There are virtually no new condo launches happening right now, and those developments that are being launched are failing. If we have no launches and no sales over a 12-24 month period, then inventory will plummet in 3-5 years.

Remember when I penned a previous edition of this feature?

April 8th, 2024: TRB Pre-Construction Review: “Freed Hotel & Residences”

I heard through the grapvevine, for whatever this is worth (and it’s complete hearsay so take it as you wish), that sales at this launch were almost non-existent.

It makes sense though, given the prices that were being asked. If you’re not familiar with this story – read the post!

But I’ve also heard through the grapevine that a particular condo project on Laird Drive in Leaside has sold three units. Three.

Real estate bears will use this as evidence that the market is cratering and/or that real estate is over-priced.

Maybe the latter is true, or more specifically, pre-construction real estate is over-priced.

But what happens if nobody buys pre-con?

Then new condominiums don’t get built.

Then new inventory is non-existent.

And with immigration in our country – and city, at all-time highs, this is a recipe for disaster in 3-5 years.

So with the preamble out of the way, I wanted to explore a new development today.

It’s called “REINE” and it’s located in Streetsville, Mississauga.

Neat logo, I guess:

And after reading through their seventy-nine page marketing package, I had a few thoughts…

This condo is to be built on the northeast corner of Britannia Road West and Queen Street South.

Currently, that corner is home to very little in the way of residential real estate. Google Maps shows a Home Hardware, Dairy Queen, a couple of auto body shops, a denture clinic, and essentially small plazas at a major intersection.

The project was launched by Lamb Development Corp.

The brochure shows some of Lamb’s other developments in TOronto such as The Brant Park, Glas, Park Lofts, Theatre Park, East Fifty-Five, The Harlowe, The King East and others.

Say what you want about Brad Lamb or Lamb Development Corp, but both have been quite successful over the years.

The building itself looks fantastic:

No doubt, right?

But all buildings look fantastic in artist’s renderings!

I’m sure there was a time when crap in Cityplace looked like the second-coming of Caesar’s Palace on those artist’s renderings.

What I want to know, what you want to know, and what the market wants to know is what the prices are like!

While I can’t speak to the entirety of the building, I can say what’s in the marketing package.

There are 24 different “standard” floor plans offered, then five in the “Patio Collection,” and five in the “Penthouse Collection.”

The floor plans provided conveniently show each individual unit number on the right-hand side of the page as follows:

So if you’re like me, you counted every single unit from the floor plans. This floor plan has fourteen units, for example.

What I concluded is that with respect to the standard units (not including the special “Patio Collection” and “Penthouse Collection”), the breakdown in units is as follows:

138 Studios

160 One-Bedroom-Plus-Den

45 Two-Bedrom

I see what’s going on here.

When you’ve got a whopping forty percent of units coming in the form of micro-condos, you’re clearly targeting investors, are you not?

Now, again, as I’ve mentioned before on TRB many, many times through the year, the following government initiatives are not helping with sales targeted at investors:

- Federal foreign buyer ban

- Provincial and municipal foreign buyer tax

- Increased capital gains tax

- Vacancy tax

- Speculation tax

Many people will say, “Who cares?” but my point remains: if nobody is buying pre-construction condos then no new condos will get built!

That’s it. It’s that simple.

Developers don’t build entire condominium towers and then sell the units. They pre-sell them. And if nobody is buying then they don’t get built. But we’ll come back to that.

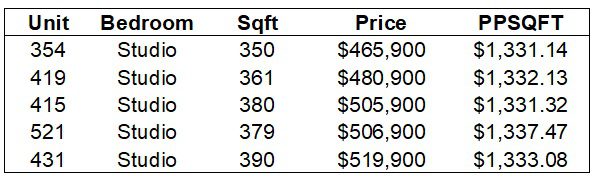

There are eleven floor plans for studio condos, as mentioned, constituting 138 total units from my count.

Here’s a typical layout:

Do you want to live there?

They lost me at “Live/Sleep/Dine.”

I know that the measurements here refer to the entire condo – from the stove all the way to the balcony, but they wrote “Live/Sleep/Dine” and placed the measurements in the kitchen so it looks like you’re expected to sleep in your kitchen.

In any event, may we guess the price?

This is 356 square feet.

How much could this cost? What’s the going rate for a condo in Mississauga these days?

Well, this particular model can be all yours for the nominal cost of $465,900.

That’s $1331 per square foot.

In fact, there are four studio models being offered for sale in the marketing package that I received, and the price per square foot for each unit is as follows:

That’s only five units, as you can see. This is what the marketing brochure has provided us with.

But this is just a sample!

It’s simply to whet the appetite!

The average cost per square foot of those five units is $1,333.03.

For a studio.

In pre-construction.

In Mississauga.

O-kay….

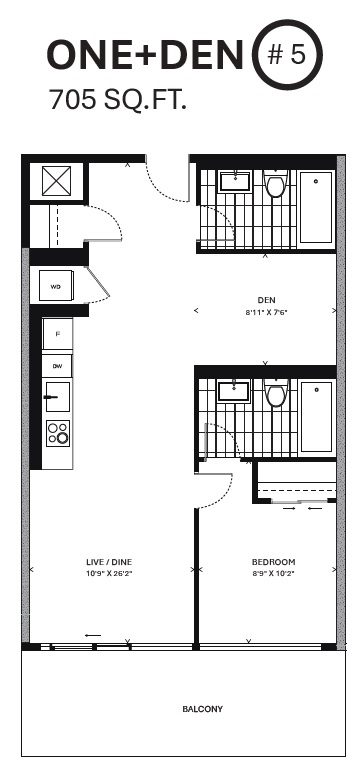

As for the one-bedroom-plus-den models, I’m surprised to see so many of these. Perhaps the pitch here is that a simple one-bedroom is too small for more than one person, but the “one-plus-den” is the new poor man’s two-bedroom?

I don’t know.

But I counted twenty different floor plans for one-plus-den units, with 160 total units.

The prices, on average, are lower than that of the studio units but still not exactly what I would call a “value play.”

Here’s an example:

Not a bad layout.

And not a bad little place to call “home” either!

But how much is this going for?

I mean, maybe I’m out-of-touch, but if this were in a 15-year-old resale building in downtown Toronto, say the St. Lawrence Market area, I might expect this little beauty to cost around $700,000 and including parking and locker.

Right?

Well, in Streetsville – in pre-construction, you can buy this for just under $900,000.

Oh, and that’s without parking and locker.

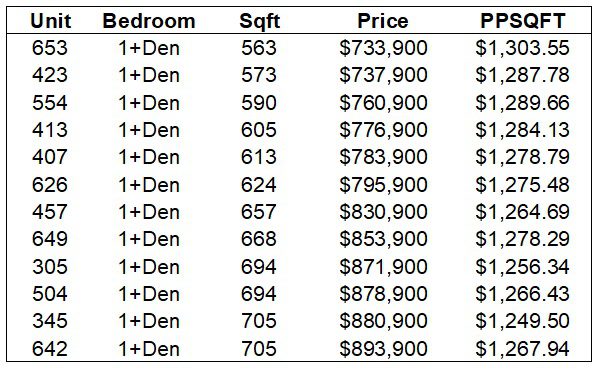

Here’s the price list for the one-plus-den units being offered in the marketing brochure:

This doesn’t make a whole lot of sense to me.

And while I would like to show you some comparable resale condominiums in the area, there aren’t any.

The nearest condo towers are at Glen Erin Drive and Britannia Way.

Perhaps that’s why the developers feel they can charge $1,300/sqft here – because there are no comparable sales to speak of?

Then again, if we looked at what else you can get in the area for the same price, it sheds some light on the value, or lack thereof…

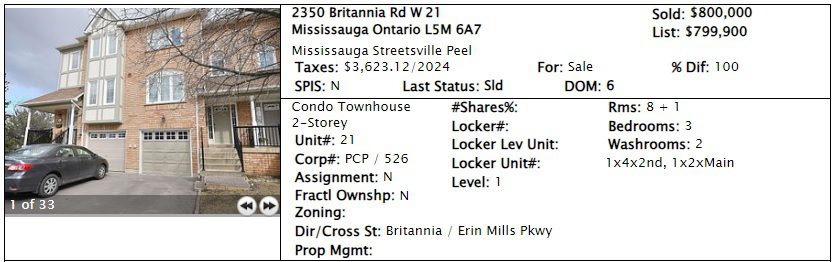

Check this out:

This is a condo townhouse that’s 900 meters from the site of “REINE,” down Britannia Road.

This is a 1,300 square foot, 3-bed, 2-bath townhouse with parking.

Are these different property types?

Absolutely!

But despite “REINE” being brand-new (or at least it would be in the year 2030) and having the conveniences of a condominium, not to mention “state of the art” amenities, is there any question here which is the better value?

Option A: a pre-construction condo, 1-bed-plus-den, 705 square feet, no parking, no locker, priced at just less than $900,000

Option B: a condo-townhouse, 3-beds, 2-baths, 1,300 square feet, parking (garage), sold for $800,000

There’s absolutely no contest.

Not only that, you can find a very nice, relatively-new unit in downtown Toronto for less.

Toronto > Mississauga

Or did I miss something?

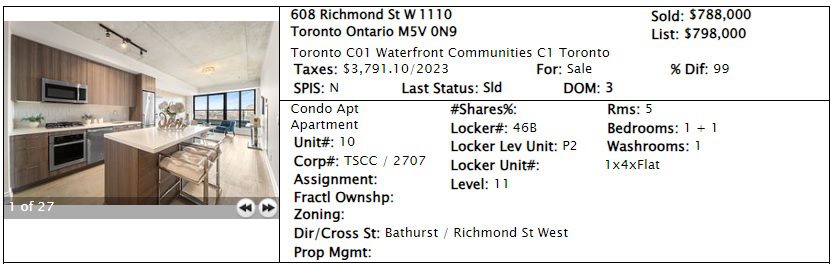

Check this out:

This is a 1-bed-plus-den unit, just like the ones being pre-sold at “REINE.”

But this is $100,000 less.

And it has an owned parking space.

And it’s in Toronto, not Mississauga.

It’s also in the heart of the downtown core, in prime King West, and not at a busy intersection with a Home Hardware, denture clinic, and Dairy Queen.

I don’t really need to belabour this point, right?

I’m sure that the counter-argument would go something like this:

“You can’t compare a 6-year old condo to a brand-new one, and you haven’t considered the incredibly superior amenities at REINE.”

Sure, there’s a counter-argument. And it’s a weak one.

And it’s exactly how pre-construction has been sold for the longest time.

“This is new!”

Who cares?

Why is that infinitely better?

Why should that cost substantially more than comparable resale, even if it’s in a different city?

I’m not sure if the launch of “REINE” is exploratory in nature, like some of the other projects that have been launched in the GTA so far in 2024, or if the developer really expects to sell out and break ground.

But there’s nothing that makes sense about these prices.

And the fact that 40% of units are studios and 87% of units are 1-bedroom (plus den) or smaller makes me think this development is geared toward investors, and I don’t love the prospects of this becoming anything other than a glorified rental building.

Would you line up for the big “launch party” for REINE?

Or do you think that, like I do, maybe $1,330/sqft is a bit rich?

Appraiser

at 6:59 am

As the inventory of resale condos continue to expand, it is difficult to believe that this project will ever get off the ground. Not at these prices.

Derek

at 10:26 am

Is there any available data for the past 20 years showing the percentage of condo closings upon completion by the actual original pre-con buyer? Versus the percentage of closings after some number of assignment flips? Versus the percentage of completed condos sold before any original or assigned buyer moves in? Does this information exist?

JF007

at 11:07 am

When i moved to Canada more than a decade back someone shared a piece of info not sure how true was the same but it went like this—that years back condos were sold at a cost that was in line with the current market cost of a similar one and then the builders realized that they were missing out on profits that could be made if they were sold at a price they would command in 3-4 years time when they would be ready to be occupied and that’s when the builders started pricing condos at a price that they might command in 3-4 years and started pocketing tremendous profits on the way…not sure how true was that anecdote but would be really interested to understand what is the profit margin a builder currently takes home on these type of condos..also keeping in mind the commissions paid to the agents some packages mention up to 10% in commissions…so the profits have to be eye watering for the builders to be able to afford that…maybe time for some reduction in profit margins… 😀